Abstract

Online banking is a method of conducting transactions between businesses or individuals. Online banking has grown in popularity in recent years, particularly since the Covid-19 pandemic. The primary goal of this study was to examine the effects of perceived complexity of online banking, Internet accessibility, perceived risk, and perceived usefulness of using online banking on users' intentions to use online banking. A literature review was presented to define online banking and the determinants studied in order to provide a better understanding. The hypothesis addressed all items in the independent and dependent variables. A questionnaire form is also distributed to 350 young Malaysians to participate in this survey. A 5-point Likert scale was used to collect the data. Using the SmartPLS 4 programme, the measurement items' convergent validity, discriminant validity, and internal consistency of independent variables will be analysed. Furthermore, SPSS software will be used to test the hypothesis by examining the ANOVA as well as the Multiple Regression Analysis coefficient. In essence, perceived complexity, Internet accessibility, perceived risk, and perceived usefulness have all been shown to have a significant impact on the non-adoption of online banking. As a conclusion, it shows that factors such as perceived complexity, internet accessibility, perceived risk, and perceived usefulness have a significant impact on whether or not online banking is adopted.

Keywords: Internet Accessibility, Online Banking, Perceived Usefulness, Perceived Complexity, Young Malaysian

Introduction

The advancement of technology has significantly improved our lives in the dynamic new era of globalisation in terms of education, industry, medicine, transportation, and so forth. Information and communication technology (ICT) has increased the world's quality of life, social progress, and economic growth in recent decades (Doong & Ho, 2012). A broad category of technologies and services involved in computing, data management, telecommunications, and the internet are included under the umbrella term "ICT" (Pawlak, 2020). According to the earlier study, ICT is crucial to a nation's development, economic expansion, and national e-commerce growth (Govinnage & Sachitra, 2019). ICT has undoubtedly given the world a lot of advantages and conveniences. ICT development also reduces distances between nations in a variety of ways. In addition to improving performance across a variety of industries, Malaysia's Digital. The country is being transformed in order to become a regional digital hub. Malaysia concentrates its efforts on connectivity based on smart automation, digital infrastructure for buildings, and satellite broadband (Ismail & Masud, 2020; Loh et al., 2021).

According to the report from Global Data Market Opportunity Forecasts, Malaysia will spend about $25.2 billion on ICT by 2023 (Mohd Rafi et al., 2022). Many companies spend millions on technology in order to compete with one another and avoid obsolescence (Afolabi et al., 2022). The process of converting a business model to a digital one is known as "digitalization" (Menchini et al., 2022). Digitalization is on its way to transforming how people conduct business on a daily basis. Businesses and enterprises today that are following the trend of digitization face challenges from a variety of industries (Schmidt et al., 2017). However, people around the world are changing the banking industry as both the supply and demand of digital-based services grow (Moşteanu et al., 2020). When compared to conventional banking institutions, online banking is more popular (Lu et al., 2003). Poon's (2007) earlier research indicates that online banking offers a higher level of convenience that encourages users to access banking online anywhere and at any time.

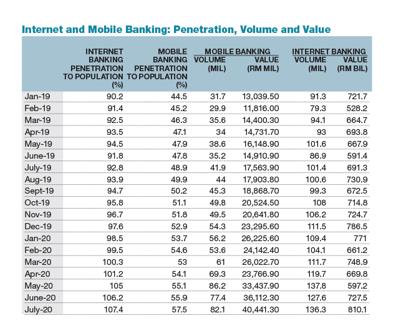

According to a statistic from Malaysia, there was a significant value increase between January 2019 and July 2020. As shown in Figure 1, the population's penetration of both internet and mobile banking has grown steadily. It increased from RM 13,039.50 million to RM 40,441.30 million for mobile banking, and from RM 721.70 million to RM 810.10 million for internet banking (Goh, 2020).

In fact, the Covid-19 pandemic outbreak has increased the use of online banking. According to Baicu et al. (2020), when compared to the time before the Covid-19 pandemic, the use of online banking services has increased during the pandemic. COVID-19 has also significantly accelerated the digitalization of online banking in Switzerland (Wade & Shan, 2020). Residents are only permitted to stay inside their homes during the movement control order (MCO) period in 2020 if it's necessary to buy necessities, essentials, or in case of an emergency. The majority of people were more likely to buy online and schedule a contactless delivery date. Thus, online banking, including online transactions, has been widely used since the period (Cheah et al., 2023).

According to the volume and value of online banking adoption, Malaysians are still less likely to use online banking than other countries (Foo-Wah et al., 2019). In order to compete, Malaysia's government is frantically adopting the new trend of online banking. However, a global survey of 1501 respondents in 2022 revealed that only 13% of them have a digital bank account, a low percentage when compared to Brazil's 43%. Aside from that, Generation Z, those born between 1999 and 2010, and now aged 20 to 30, have mostly grown up with the Internet (Kim et al., 2020). Many Malaysian youths still do not use online banking. As a result, the factors influencing young Malaysians' non-adoption of online banking will be examined in this research.

Literature Review

Definition of online banking

Online banking, also referred to as internet banking, is a type of financial system that gives users online access to their bank accounts. Bank Negara Malaysia essentially oversees all banking and financial services in Malaysia (BNM). Internet banking first became accessible in Malaysia in June 2000. 23 banks offered online banking services as of January 2008 (Suki, 2010).

Customers who use online banking cannot interact with bankers in person, but they can use a device to access the Internet instead. Users only need to access a few items of information, such as the payee's account password and the recipient's account number, when performing online banking for the recipient. Online banking is being used by more financial institutions to reduce labour costs associated with providing in-person customer service, speed transaction processing, increase the flexibility of business transactions, and generally provide better service (Hanafizadeh & Zare Ravasan, 2018). Online banking aims to carry out as many tasks as conventional banks (Hua, 2008). Users gain from online banking, because it makes it easier to pay bills, transfer money, apply for loans, confirm transactions, and check account balances. Users can complete their tasks without going to a bank branch, which saves a lot of time. As long as a user has access to the internet, a device for browsing the internet, and an online bank account, they can conduct online banking anytime, anywhere. In essentially, the Covid-19 pandemic increased the use of online banking because during Movement Control Orders (MCO), people are not permitted to leave their homes. To reduce contact and the risk of contracting the coronavirus, most people are also more likely to make cashless payments. Based on Loke (2022), the Touch'n Go (TNG) e-Wallet is the country's first electronic wallet that can be used for online banking.

Definition of traditional banking

Traditional banking serves as the foundation for the majority of banks. It was the first type of banking (Blanco-Oliver, 2021). If a customer wishes to make deposits and withdrawals, they must traditionally keep a passbook. All transactions, including those that are credited and debited, are recorded in the bank passbook. Everything is focused on the passbook. When customers visit banks without their bank passbook, they are unable to conduct transactions or receive services (Laplante & Kshetri, 2021).

A traditional bank is a bank with a physical presence and a domestic banking licence, in contrast to online banking services. In every nation where they operate, they always have a bank branch. A few own-branded automated teller machines (ATMs) are located in each bank branch to allow customers to check account balances, deposit or withdraw cash, print statements of transactions or account activity, and perform other functions. If customers use an ATM that is not owned by their banks, they will be assessed an additional fee. Thus, the absence of an ATM owned by your bank may be inconvenient (Gangadwala & Goyani, 2019). The interest from the loans to borrowers, which is how traditional banks conduct business, brings in profits.

In addition, although some conventional banks allow customers to open accounts online, they still need to physically visit the bank branch to submit paperwork or provide identification (Soetan et al., 2021). Some customers will benefit from this mode while others will suffer. Traditional banking services are limited because customers must visit the bank branch to resolve their issues one-on-one and in person with the staff. Consequently, some customers favour conventional banking. However, given that they must wait there to speak with knowledgeable and helpful bank employees, some clients believe it to be an inconvenience and a waste of time (Galazova & Magomaeva, 2019). The time lost while waiting there could be used for a variety of activities. When providing traditional banking services, bank employees had to establish a strong rapport with the client. Many customers still use traditional banking services despite the availability of modern banking or online banking because they lack confidence in digital models with regard to security and safety issues (Chaimaa et al., 2021). Online banking may outperform traditional banking if there is no trust and good services are offered (Ghani et al., 2022).

Perceived complexity on using online banking

Perceived complexity is the degree to which new technology or innovation is regarded as being relatively challenging to understand, accept, and use by consumers (Cheung et al., 2000). The complexity of online banking refers to the challenges that users face when implementing the service. Users face a variety of challenges or difficulties. For instance, users who are not familiar with these technologies perceive online banking as being difficult and complicated. It's also possible that they lack the knowledge or training needed to adopt new technologies. Thus, even though their perception may not match their actual experience, the complexity of adopting online banking will give potential users the impression that it is difficult or inconvenient to use. As a result, it might discourage potential users from implementing it (Machogu & Okiko, 2015). Chauhan et al. (2019) came to the conclusion that perceptions of ease of use have a positive influence on attitudes towards the adoption of the online banking system.

The perceived ease of use will also influence how valuable people think using online banking is (Chauhan et al., 2019). According to Rahi et al. (2020) study, the adoption of online banking has a significant and strongly positive relationship with perceived ease of use. This is because banking customers will prefer to manage their accounts online rather than in person. Customers will also use online banking if the interface is user-friendly and straightforward. Kasilingam (2020) stated that, the intention of customers to use online banking is directly influenced by perceived ease of use.

Poon's (2007) earlier research indicates that users' adoption of internet banking is positively impacted by their perceptions of convenience and usability. According to Cheung et al., the perception of complexity has had a significant impact on the adoption of Internet banking (2000). Reviewing earlier studies and the references Hua (2008) cited leads one to the conclusion that online banking is easier to use the more popular it is. With more effort required to adopt an online banking system, the importance of not doing so increases.

Accessibility of the internet of using online banking

One of the tools that is crucial to online banking is mobile technology. The existence of the Internet, the ability to use it, and the equipment needed to access it are all components of accessibility. The process of connecting to the Internet using computers, laptops, or mobile devices is known as internet access. Every internet service as well as other web-based services are available to anyone with an internet connection (Praful Bharadiya, 2023). Online banking can be done once users have a device and are able to browse the internet. However, a variety of metrics can have an impact on how accessible the Internet is. Internet service providers have used a variety of network design strategies. However, there still seems to be a difference between different areas' network accessibility and population density (Wulandari & Wirawan, 2022).

The accessibility of the Internet is supported by access technology and assistive devices, according to Rajšp et al. (2019) study. Accessibility to the Internet is one of the major factors influencing the adoption of online banking (Abdurrahaman et al., 2021). Furthermore, Poon's (2007) research found that in order to keep customers from being inconvenienced, banks must offer immediate, round-the-clock online support for internet services. Some customers are very interested in and willing to use online banking, but for them, Internet accessibility is a major issue, according to a study by Abdurrahaman et al. (2021) in Nigeria. It's because many people in Nigeria, a developing nation, continue to live in poverty.

In addition to the Internet's accessibility, knowledge of the Internet is crucial. Elhajjar and Ouaida (2019), Nasri (2011) demonstrates how consumer adoption of online banking is directly influenced by their level of internet literacy. Online banking is positively correlated with internet usage, according to research done in Turkey (Tekin & Guleryuz, 2020). Customers will use online banking if Internet accessibility is generally good, as demonstrated by Abbasi et al. (2017). Yeşildağ (2019) mentioned that the ease of access to the Internet has a favourable impact on the uptake of online banking. It is regarded as one of the most significant factors influencing the use of online banking.

Perceived risk of using online banking

Users' decisions and intentions to adopt online banking can be affected by perceived risk (Hong & Yi, 2012). Perceived risk is defined by Zscheischler et al. (2022) as the users' perception of some ambiguity regarding the results and losses that may result from using particular products or services. Suki (2010) further defined perceived risk as the subjective belief of the consumer that they will lose something while pursuing expected results. A subset of numerous perceived risks make up the multidimensional concept of perceived risk (Suki, 2010). There are numerous dimensions into which the perceived risks can be divided, including privacy risk, financial risk, social risk, and so forth (Hong et al., 2020).

Poon (2007) reports that about 56% of survey participants believe that online banking issuers don't always deliver customers' privacy and confidential information securely and safely. Thus, the study by Chauhan et al. (2019) revealed that all aspects of the perceived risk of online banking have a negative impact on the users' intention to use it. Suki (2010) found in her earlier research that there was no significant link between perceived risk and the uptake of online banking. In other words, perceived risk was a factor that Malaysian consumers' use of online banking would not be impacted by (Suki, 2010).

According to Abbasi et al. (2017), if banks tighten security and privacy policies to lower users' perceived risk, more people will be inclined to use online banking. It demonstrates that the adoption of online banking and perceived risk are significantly related. However, Nasri (2011) demonstrated that the idea that a lower perceived risk of using online banking will lead to a greater likelihood of adoption is unfounded. It has also been demonstrated that perceived technology risk has little impact on people using internet banking (Alkafagi et al., 2019). The perceived risk has been identified in previous studies as a deterrent to using online banking. Users will decide against using online banking if the perceived risk is high, according to studies by Liao et al. (2016) and Martins et al. (2014). Tan and Teo (2000) also suggested that the acceptance of online banking is negatively impacted by perceived risk. In this study, consumers' perceptions of risk will be examined to see if they have a significant impact on young Malaysians' reluctance to use online banking.

Perceived usefulness of using online banking

The degree to which a person thinks that implementing an innovation or technology will facilitate the accomplishment of his or her professional goals is known as perceived usefulness (Davis, 1989). On the other hand, perceived usefulness has been defined by Taylor and Todd (1995) as a reflection of one's belief that using the innovation or technology will improve his or her job performance. Perceived usefulness, according to Arora (2022), gauges how highly a user values a piece of hardware or software in terms of performance. The degree to which a person believes that using an online banking system can enhance and improve its performance is how Dwitama (2014) defined the perceived usefulness of using online banking. The perceived usefulness of using online banking is used to determine how useful it is for them to conduct online banking operations, according to Novitasari and Baridwan (2014). Additionally, according to Li et al. (2021), people who use online banking are more likely to recognise its benefits, such as its usability, accessibility, and informational resources. While those who don't use online banking are more likely to notice the relative drawbacks, such as privacy and security worries.

Users' perceptions of the convenience that online banking can offer them are one factor in the perceived usefulness of the service. The effectiveness of online transactions is increased, for instance, by the adoption of online banking. It also helped people and banks carry out daily tasks during the Covid-19 pandemic. Perceived usefulness, according to numerous earlier studies, is the main barrier to online banking adoption. A direct predictor of users' intention to use internet banking is perceived usefulness, according to studies by Zandhessami and Geranmayeh (2014). Users will most likely switch to online banking if they think it is superior to traditional banking. The TAM model, which contends that consumers will adopt a technology if they believe it is useful, is consistent with the perceived usefulness. Once consumers are aware of the advantages of online banking over traditional banking, they are more likely to use it (Nguyen et al., 2020). Perceived usefulness is one of the concepts that is most frequently used in the literature on online banking. Perceived usefulness has been linked to online banking adoption in a significant and positive way, according to research by Safeena et al. (2013). This relationship has been found to exist. It has been demonstrated and established that perceived usefulness has a favourable impact on the intention to use internet banking. Online banking is functionally and usefully similar to traditional banking, according to research conducted by Hua (2008). The intention to use Internet banking is directly positively impacted by perceived usefulness, according to Ramayah et al. (2003). Additionally, their research demonstrated that perceived usefulness has a greater influence on the intention to adopt online banking than perceived ease of use.

According to Anouze and Alamro (2019) study, perceived utility has a positive impact on users' intentions to use online banking. Similar to the study conducted by Nguyen-Viet and Ngoc Huynh (2021), perceived usefulness influences whether or not people will use online banking. The evidence is consistent with the study by Sharma et al. (2020), which found that adoption of online banking is positively impacted by how useful people perceive it to be. Additionally, according to the research, perceived utility can have a direct impact on users' intentions to use internet banking, as the Technology Acceptance Model (TAM) explained. Perceived utility has been identified as the key factor influencing customers' adoption of online banking in prior research (Almansour & Elkrghli, 2023). As a result, this research postulates that consumers' intentions to adopt online banking will be significantly impacted by perceived usefulness.

Based on the previous study discussed in this section, hypotheses for this study:

H1: Perceived complexity significantly impacts the non-adoption of online banking among young Malaysians.

H2: Accessibility of the Internet significantly impacts the non-adoption of online banking among young Malaysians.

H3: Perceived risk significantly impacts the non-adoption of online banking among young Malaysians.

H4: Perceived usefulness significantly impacts the non-adoption of online banking among young Malaysians.

Method

A random sampling approach will be used in this study. The target respondents 350 Malaysian youth. Young Malaysians were chosen because, when compared to older people, they are more likely to use and adopt online banking. Age groups 0 to 14 years, 15 to 64 years, and 65 or older will make up 7.6 million, 22.7 million, and 2.4 million of Malaysia's population in 2022, respectively.

SmartPLS 4 software will be used to conduct data analysis for this study. In order to assess the internal consistency of independent variables, convergent validity, and discriminant validity, the PLS-SEM system is run in the SmartPLS 4 software. The PLS-SEM model used in this study is created using 31 indicator variables on four constructs.

Cronbach's alpha and composite reliability (CR), which assess the interrelatedness of the variables, will be used to gauge the internal consistency of the independent variables. Tavakol and Dennick (2011) state that Cronbach's alpha values should be between 0.70 and 0.95. According to Tavakol and Dennick (2011), Cronbach's alpha values that are too high or too low indicate the presence of questions that are similar but presented in a different way, and vice versa. Meanwhile, independent variables with internal consistency are represented by the composite reliability (CR) of at least 0.7.

This research will also look at convergent validity. How well a variable or measure correlates with other variables or measures of the same construct is known as convergent validity 2017 (Krabbe). The model will show convergent validity, factor loading from each construct, and composite reliability (CR). The average variance extracted (AVE) values can be used to extract convergent validity. The recommended value of AVE, according to Anderson and Gerbing (1988), should be greater than 0.4. All items should have factor loadings greater than 0.5, and any item with a factor loading below 0.5 should be removed from the measurement model.

Additionally, the square root of the AVE and the correlation between the variables will be compared to see if the square root of the AVE is higher. A heterotrait-monotrait (HTMT) analysis of discriminant validity is also conducted in this study. The HTMT calculates how similar the variables are to one another. Henseler et al. (2015) state that an HTMT value of less than 0.85 is preferred.

In the data analysis process, multiple regression analysis will be used to examine the relationship between independent and dependent variables. According to Mark and Goldberg (1988), there are a number of statistical techniques that can be used to deal with multiple independent variables in an equation. One of these techniques is multiple regression analysis (MRA). It can be used to evaluate a variable's significance at different levels of significance. The equation below serves as a representation of the multiple regression model.

The dependent variable in the equation is the rejection of young Malaysians to use online banking, and the independent variables are, in that order, perceived complexity, Internet accessibility, perceived risk, and perceived usefulness. The variable xn stands in for any additional independent variables. The coefficients of B0, B1, B2, B3, B4, and Bn are all constant terms. After the PSPP software has been used, the data can be seen in the table of analysis of variance (ANOVA), allowing us to abstract the data. We can determine from an ANOVA whether the independent variables are important to the lack of adoption of online banking. The strength of the relationship can also be determined by a R Square value between 0 and 1. The correlation is stronger the higher the value (Akossou & Palm, 2013).

Result

The demographic information of the 350 respondents was summarised in Table 1. The majority of respondents (66.3%) are female. The majority of respondents are students between the ages of 18 and 20 (44.30%) and 21 and 23 (51.70%).

Table 2 summarises the statistics for the measurement variables. ITU and PR were the two statements that received the most support from respondents, while AOTI, PU, and PC received less support. In Table 2, the average scale for ITU is between 4.29 and 4.41, whereas the average scale for the other variables is between 1.4 and 3.61. The variable factor loadings are higher than the 0.5 ranging from 0.523 to 0.919. Table 2 variables have Cronbach's alpha (CA) values that fall between 0.881 and 0.904, which is within the recommended range of 0.70 and 0.95 Tavakol and Dennick (2011). This illustrates the high reliability of the measurement items. Additionally, the average variance extracted (AVE) from the variables in Table 2 is greater than the reference value of 0.4 and ranges from 0.562 to 0.81. 1988 (Anderson and Gerbing).

The values of HTMT are all satisfied with the suggested value of less than 0.85, as shown in Table 3. These findings demonstrated that all constructs have good discriminant validity.

According to Table 4, Adjusted R Square, which is 0.18, the four independent variables perceived complexity, Internet accessibility, perceived risk, and perceived usefulness account for 18% of the variation in intention to use online banking. While the four independent variables cannot account for 82% of the variables. The findings also show that the four variables can significantly predict the dependent variable when sig. is less than 0.05 and F is greater than 1.0. However, R Square only has a value of 0.11, indicating that the influence of the independent variables on the dependent variable is minimal. Additionally, Table 5 includes the following formula:

ITU = 4.91 – 0.08 PC – 0.03 AOTI + 0.11 PR – 0.04 PU

The equation can be written as follows: while holding other variables constant, a 1% increase in perceived risk will result in a 0.08% decrease in intention to use online banking. Ceteris paribus, despite an increase in Internet accessibility of 1%, there will be a 0.03% decline in the intention to use online banking. A 1% increase in perceived risk will result in a 0.11% increase in intention to use online banking while holding other factors constant. Ceteris paribus, a 1% change in perceived usefulness will have an adverse impact of 0.04% on the intention to use online banking.

Discussion and Recommendation

To summarise, perceived complexity (PC), Internet accessibility (AOTI), perceived risk (PR), and perceived usefulness (PU) all have a significant impact on both the intention to use and the non-adoption of online banking. As a result, all four hypotheses are supported: H1, H2, H3, and H4. The purpose of this study was to investigate the factors that influence young Malaysians' non-adoption of online banking. The PC, AOTI, PR, and PU hypotheses (H1, H2, H3, and H4) have been shown to have a significant influence on the intention to use online banking. The proposed hypothesis and responses from 350 young Malaysians indicate an inverse relationship between perceived complexity and intention to use online banking. In other words, potential online banking users are less likely to use the service the more complicated they perceive it to be. As a result, there will be a higher level of non-adoption of online banking because of the low intention. As a result of the results in this paper correlating with those from the earlier study by Safeena et al. (2013), the H1 is also supported.

The perceived difficulty of potential users adopting online banking must be decreased in order to increase adoption. As was previously mentioned, users' perceptions of the difficulty of adopting online banking were a result of their ignorance of technology and the system itself. As a suggestion, current users of online banking can encourage and promote the use of the service among their friends. They should also let their peers know that using online banking is simpler than they think. Potential customers can accept it as a result and learn about the convenience of online banking. Even though the AOTI results indicate that it has the smallest percentage impact on the ITO—0.03%—it still has a sizable impact on both users' intentions to adopt online banking and users' decisions not to. It is consistent with Nasri (2011) study, which discovered that having a basic understanding of the internet can increase one's access to the web and, as a result, can directly affect a consumer's decision to use online banking. Additionally, the results of this study and Machogu and Okiko's (2015) study are in agreement. Knowledge of the internet, Internet access tools, and Wi-Fi connection to the Internet are some of the factors that affect Internet access (Moyle et al., 2018).

We suggest that the government make sure that Internet access is available in every part of Malaysia in order to lower the rate of non-adoption of online banking. Using Singapore as an example, the entire city-state has free public Wi-Fi access .Singaporeans don't mind using a Wi-Fi connection for online banking as a result. Furthermore, we think that knowledge of how to access the Internet, not the Internet access devices, is what matters mostOur recommendation suggests streamlining the procedures for logging into the online banking platform and carrying out online transactions. To increase the adoption of online banking, young Malaysians should be encouraged to use online e-wallets like Touch'n Go (TNG) e-wallet and DuitNow. Some of them choose not to create accounts because they are unable to install it. Therefore, by giving cashback or gifts to new registrants, the government can promote the use of e-wallets.

The aforementioned findings show a significant correlation between perceived risk and both the intention to use online banking and the lack of adoption of online banking. Online banking non-adoption is correlated with perceived risk, according to research by Liao et al. (2016), Martins et al. (2014), and Tan and Teo (2000). The adoption of online banking may increase as a result of improved bank regulations regarding security and privacy issues, claim Abbasi et al. (2017).

Even though the government has tightened regulations on financial institutions to improve security standards, particularly the privacy of customers' personal information, fraud cases are still common, and we frequently hear new reports about new scams or fraud schemes. In my opinion, the reason scammers can get away with their crimes is because their victims are avaricious. Enhancing consumer awareness and vigilance while engaging in online transactions is advised as a way to reduce the perceived risk or actual risk associated with using online banking. Additionally, since online banking makes it simple for people to conduct online transactions, the victims were duped by simply clicking a button. People become more cautious and perceive online banking as having a higher risk as there are more reports of crimes involving it. Once more, consumers must refrain from being overly greedy for benefits that unknown people are offering.

The fundamental idea of the Technology Acceptance Model (TAM) states that perceived usefulness affects consumers' acceptance of and intention to use online banking (Davis, 1989). The findings of this study are consistent with those of the TAM research. Consumers benefit greatly from the convenience that online banking offers. For instance, the use of cashless payment means that people no longer need to carry cash with them at all times. Online banking makes it easier to transfer money from one person to another, so people can do so without actually meeting the other person. As some users do not actually experience the usefulness, there are times when the perceived usefulness of online banking users does not match up well with the actual use of online banking. I think the government should encourage young Malaysians to experiment with various online banking features. When given the opportunity to use it, they might decide against the perceived usefulness and instead view the actual use of online banking as being simple, as TAM explained.

Conclusion

This study examines four independent variables to see if they have an impact on the non-adoption of online banking. After creating a questionnaire with 31 constructs and distributing it to 350 young Malaysians, the information was gathered in four weeks. This study confirms that all four variables—perceived complexity (PC), perceived risk (PR), perceived usefulness (PU), and Internet accessibility (AOTI)—have a significant impact on the non-adoption of online banking. The TAM theory is further supported and illustrated by the fact that consumers' intentions to use online banking were influenced by their perceptions of its perceived complexity and usefulness. In addition, the SmartPLS 4 software was used to test the interrelationship of the measurement items. As a result, it is possible to show the validity and consistency of the discriminant. The results of this study are in line with earlier findings, to put it briefly. The four hypotheses are supported, as shown by the multiple regression analysis that SPSS software also extracts. The study's conclusions shed light on the possible factors that may prevent widespread adoption of online banking. In addition, the perceived risk was not sufficiently described to be divided into various categories of risk. Future studies should use the survey on consumer attitudes towards online banking and concentrate on various types of perceived risk.

Acknowledgements

The research was funded by Pembiayaan Yuran Prosiding Berindeks (PYPB), Tabung Dana Kecemerlangan Pendidikan (DKP), Universiti Teknologi MARA (UiTM), Malaysia.

References

Abbasi, S., Kamran, S., & Akhtar, C. (2017). Factors affecting customers' adoption of internet banking in Pakistan. Pakistan Administrative Review, 1(2), 115-129.

Abdurrahaman, D. T., Sharubutu, M. S., Sabiu, T. T., Adam, S. B., Ibrahim, M. G., & Udu, A. A. (2021). Examining the determinants of eBanking adoption: evidence from Nigeria. Technium Soc. Sci. J., 22, 463.

Afolabi, A., Ibem, E., Aduwo, E., Tunji-Olayeni, P., Oluwunmi, O., & Ayo-Vaughan, E. (2022). Gauging parameters for e-procurement acquisition in construction businesses in Nigeria. International Journal of Construction Management, 22(3), 426-435. DOI:

Akossou, A. Y. J., & Palm, R. (2013). Impact of data structure on the estimators R-square and adjusted R-square in linear regression. Int. J. Math. Comput, 20(3), 84-93.

Alkafagi, A., Salameh, A. A. M., & Abu-AlSondos, I. A. (2019). The importance of individual technology factors for adoption of internet banking. European Journal of Business and Management, 11(36), 1-8.

Almansour, B., & Elkrghli, S. (2023). Factors Influencing Customer Satisfaction on E-Banking Services: A Study of Libyan Banks. International Journal of Technology, Innovation and Management (IJTIM), 3(1), 34-42. DOI:

Anderson, J. C., & Gerbing, D. W. (1988). Structural equation modeling in practice: A review and recommended two-step approach. Psychological Bulletin, 103(3), 411-423. DOI:

Anouze, A. L. M., & Alamro, A. S. (2019). Factors affecting intention to use e-banking in Jordan. International Journal of Bank Marketing, 38(1), 86-112. DOI:

Arora, R. (2022). Perceived Usefulness, Perceived Trust And Ease Of Use In Adoption Of Online Banking Services. Journal of Pharmaceutical Negative Results, 1-7.

Baicu, C. G., Gârdan, I. P., Gârdan, D. A., & Epuran, G. (2020). The impact of COVID-19 on consumer behavior in retail banking. Evidence from Romania. Management & Marketing. Challenges for the Knowledge Society, 15(s1), 534-556. DOI:

Blanco-Oliver, A. (2021). Banking reforms and bank efficiency: Evidence for the collapse of Spanish savings banks. International Review of Economics & Finance, 74, 334-347. DOI:

Chaimaa, B., Najib, E., & Rachid, H. (2021). E-banking Overview: Concepts, Challenges and Solutions. Wireless Personal Communications, 117(2), 1059-1078. DOI:

Chauhan, V., Yadav, R., & Choudhary, V. (2019). Analyzing the impact of consumer innovativeness and perceived risk in internet banking adoption: A study of Indian consumers. International Journal of Bank Marketing, 37(1), 323-339. DOI:

Cheah, P. K., Jalloh, M. B., Cheah, P.-K., Ongkili, D., Schneiders, M. L., Osterrieder, A., Peerawaranun, P., Waithira, N., Davies, A., Mukaka, M., & Cheah, P. Y. (2023). Experiences, coping strategies and perspectives of people in Malaysia during the COVID-19 pandemic. BMC Public Health, 23(1). DOI:

Cheung, W., Chang, M. K., & Lai, V. S. (2000). Prediction of Internet and World Wide Web usage at work: a test of an extended Triandis model. Decision Support Systems, 30(1), 83-100. DOI:

Davis, F. D. (1989). Perceived Usefulness, Perceived Ease of Use, and User Acceptance of Information Technology. MIS Quarterly, 13(3), 319. DOI:

Doong, S. H., & Ho, S.-C. (2012). The impact of ICT development on the global digital divide. Electronic Commerce Research and Applications, 11(5), 518-533. DOI:

Dwitama, F. (2014). Faktor-faktor yang Mempengaruhi Minat Nasabah Menggunakan Internet Banking dengan Menggunakan [Factors that Influence Customer Interest in Using Internet Banking by Using Technology Acceptance Model] (TAM) Pada Bank Mandiri. Jurnal Ilmiah Informatika Komputer, 19(3).

Elhajjar, S., & Ouaida, F. (2019). An analysis of factors affecting mobile banking adoption. International Journal of Bank Marketing, 38(2), 352-367. DOI:

Foo-Wah, L., Fakhrorazi, A., & Islam, R. (2019). Consumers' parsimony of mobile internet banking usage in Malaysia. Humanities & Social Sciences Reviews, 7(1), 239-248. DOI:

Galazova, S. S., & Magomaeva, L. R. (2019). The Transformation of Traditional Banking Activity in Digital. International Journal of Economics and Business Administration, VII(Special Issue 2), 41-51. DOI:

Gangadwala, D. R., & Goyani, M. R. (2019). A study of issue of e-banking from the customers perception. Emerging Trends in Global Management and Information Technology, 73.

Ghani, E. K., Ali, M. M., Musa, M. N. R., & Omonov, A. A. (2022). The Effect of Perceived Usefulness, Reliability, and COVID-19 Pandemic on Digital Banking Effectiveness: Analysis Using Technology Acceptance Model. Sustainability, 14(18), 11248. DOI:

Goh, J. (2020). Noticeable rise in mobile banking, internet banking subscribers. The Edge Markets (Malaysia Edition).

Govinnage, D. Y., & Sachitra, K. M. V. (2019). Factors Affecting E-commerce Adoption of Small and Medium Enterprises in Sri Lanka: Evidence from Retail Sector. Asian Journal of Advanced Research and Reports, 1-10. DOI:

Hanafizadeh, P., & Zare Ravasan, A. (2018). An empirical analysis on outsourcing decision: the case of e-banking services. Journal of Enterprise Information Management, 31(1), 146-172. DOI:

Henseler, J., Ringle, C. M., & Sarstedt, M. (2015). A new criterion for assessing discriminant validity in variance-based structural equation modeling. Journal of the Academy of Marketing Science, 43(1), 115-135. DOI:

Hong, A., Nam, C., & Kim, S. (2020). What will be the possible barriers to consumers' adoption of smart home services? Telecommunications Policy, 44(2), 101867. DOI:

Hong, Z., & Yi, L. (2012). Research on the Influence of Perceived Risk in Consumer On-line Purchasing Decision. Physics Procedia, 24, 1304-1310. DOI:

Hua, G. (2008). An experimental investigation of online banking adoption in China.

Ismail, N. A., & Masud, M. M. (2020). Prospects and challenges in improving e-commerce connectivity in Malaysia. E-commerce Connectivity in ASEAN, 78.

Kasilingam, D. L. (2020). Understanding the attitude and intention to use smartphone chatbots for shopping. Technology in Society, 62, 101280. DOI:

Kim, A., McInerney, P., Smith, T. R., & Yamakawa, N. (2020). What makes Asia–Pacific’s generation Z different. McKinsey & Company, 1-10.

Laplante, P., & Kshetri, N. (2021). Open Banking: Definition and Description. Computer, 54(10), 122-128. DOI:

Li, F., Lu, H., Hou, M., Cui, K., & Darbandi, M. (2021). Customer satisfaction with bank services: The role of cloud services, security, e-learning and service quality. Technology in Society, 64, 101487. DOI:

Liao, C., Huang, Y.-J., & Hsieh, T.-H. (2016). Factors Influencing Internet Banking Adoption. Social Behavior and Personality: an international journal, 44(9), 1443-1455. DOI:

Loh, Y. X., Hamid, N. A. A., Seah, C. S., Yo, J. J., Law, Y. C., Tan, S. Y., Chung, H. L., Liew, Y. L., & Chong, C. (2021, April). The Factors and Challenges affecting Digital Economy in Malaysia. In CoMBInES-Conference on Management, Business, Innovation, Education and Social Sciences, 1(1), 1843-1849.

Loke, M. Q. (2022). Case Study of Touch 'n Go in Malaysia: Are You a User of E-Wallet? International Journal of Accounting Finance in Asia Pasific, 5(3), 97-106. DOI:

Lu, J., Yu, C.-S., Liu, C., & Yao, J. E. (2003). Technology acceptance model for wireless Internet. Internet Research, 13(3), 206-222. DOI:

Machogu, A. M., & Okiko, L. (2015). E-banking complexities and the perpetual effect on customer satisfaction in rwandan commercial banking industry: Gender as a moderating. Journal of Internet Banking and Commerce, 20(3), 1.

Mark, J., & Goldberg, M. A. (1988). Multiple regression analysis and mass assessment: A review of the issues. Appraisal Journal, 56(1).

Martins, C., Oliveira, T., & Popovič, A. (2014). Understanding the Internet banking adoption: A unified theory of acceptance and use of technology and perceived risk application. International Journal of Information Management, 34(1), 1-13. DOI:

Menchini, F., Russo, P. T., Slavov, T. N. B., & Souza, R. P. (2022). Strategic capabilities for business model digitalization. Revista de Gestão, 29(1), 2-16. DOI:

Mohd Rafi, A. I., Laser, J., Mohd Fadzilla, N. S., Ramli, N. A. A. N., & Mohd Adaha, S. S. (2022). JANNS. co.

Moşteanu, D. N. R., Faccia, D. A., Cavaliere, L. P. L., & Bhatia, S. (2020). Digital technologies’ implementation within financial and banking system during socio distancing restrictions–back to the future. International Journal of Advanced Research in Engineering and Technology, 11(6).

Moyle, W., Jones, C., Murfield, J., Dwan, T., & Ownsworth, T. (2018). 'We don't even have Wi-Fi': a descriptive study exploring current use and availability of communication technologies in residential aged care. Contemporary Nurse, 54(1), 35-43. DOI:

Nasri, W. (2011). Factors Influencing the Adoption of Internet Banking in Tunisia. International Journal of Business and Management, 6(8). DOI:

Nguyen, D. T., Pham, V. T., Tran, D. M., & Pham, D. B. T. (2020). Impact of Service Quality, Customer Satisfaction and Switching Costs on Customer Loyalty. The Journal of Asian Finance, Economics and Business, 7(8), 395-405. DOI:

Nguyen-Viet, B., & Ngoc Huynh, K. (2021). Empirical analysis of internet banking adoption in Vietnam. Cogent Economics & Finance, 9(1). DOI:

Novitasari, S., & Baridwan, Z. (2014). Pengaruh Kepercayaan, Persepsi Resiko, Persepsi Manfaat, dan Persepsi Kontrol Perilaku Terhadap Niat Penggunaan Sistem E-Commerce [The Effect of Trust, Risk Perception, Benefit Perception, and Behavioral Control Perception on the Intention to Use the E-Commerce System]. Jurnal Ilmiah Mahasiswa FEB, 3(1).

Pawlak, J. (2020). Travel-based multitasking: review of the role of digital activities and connectivity. Transport Reviews, 40(4), 429-456. DOI:

Poon, W.-C. (2007). Users' adoption of e-banking services: the Malaysian perspective. Journal of Business & Industrial Marketing, 23(1), 59-69. DOI:

Praful Bharadiya, J. (2023). A Comparative Study of Business Intelligence and Artificial Intelligence with Big Data Analytics. American Journal of Artificial Intelligence. DOI:

Rahi, S., Ghani, M. A., & Ngah, A. H. (2020). Factors propelling the adoption of internet banking: the role of e-customer service, website design, brand image and customer satisfaction. International Journal of Business Information Systems, 33(4), 549. DOI:

Rajšp, A., Kous, K., Kuhar, S., Šumak, B., & Šorgo, A. (2019). Preliminary review of jobs, skills and competencies for implementation of Digital Accessibility. In Central European Conference on Information and Intelligent Systems (pp. 93-99). Faculty of Organization and Informatics Varazdin.

Ramayah, T., Jantan, M., Mohd Noor, M. N., Razak, R. C., & Koay, P. L. (2003). Receptiveness of internet banking by Malaysian consumers: The case of Penang. Asian Academy of Management Journal, 8(2), 1-29.

Safeena, R., Date, H., Hundewale, N., & Kammani, A. (2013). Combination of TAM and TPB in Internet Banking Adoption. International Journal of Computer Theory and Engineering, 5(1), 146-150. DOI:

Schmidt, J., Drews, P., & Schirmer, I. (2017). Digitalization of the banking industry: A multiple stakeholder analysis on strategic alignment.

Sharma, R., Singh, G., & Sharma, S. (2020). Modelling internet banking adoption in Fiji: A developing country perspective. International Journal of Information Management, 53, 102116. DOI:

Soetan, T. O., Mogaji, E., & Nguyen, N. P. (2021). Financial services experience and consumption in Nigeria. Journal of Services Marketing, 35(7), 947-961. DOI:

Suki, N. M. (2010). An empirical study of factors affecting the Internet banking adoption among Malaysian consumers'. Journal of Internet banking and Commerce, 15(2), 1.

Tan, M., & Teo, T. (2000). Factors Influencing the Adoption of Internet Banking. Journal of the Association for Information Systems, 1(1), 1-44. DOI:

Tavakol, M., & Dennick, R. (2011). Making sense of Cronbach's alpha. International Journal of Medical Education, 2, 53-55. DOI:

Taylor, S., & Todd, P. (1995). Decomposition and crossover effects in the theory of planned behavior: A study of consumer adoption intentions. International Journal of Research in Marketing, 12(2), 137-155. DOI:

Tekin, K. O. S. E., & Guleryuz, E. H. (2020). Determinants of internet banking adoption in Turkey. Yaşar Üniversitesi E-Dergisi, 15(58), 167-176.

Wade, M., & Shan, J. (2020). Covid-19 Has accelerated digital transformation, but may have made it harder not easier. MIS Quarterly Executive, 19(3).

Wulandari, T. A., & Wirawan, E. (2022). Communication Strategy of the First Digital Internet Service Provider Company in Indonesia to Increase Brand Awareness among the Internet Service Users. Proceeding of International Conference on Business, Economics, Social Sciences, and Humanities, 3, 98-113. DOI:

Yeşildağ, E. (2019). Factors affecting internet banking preferences and their relation to demographic characteristics. In Contemporary Issues in Behavioral Finance (pp. 187-203). Emerald Publishing Limited.

Zandhessami, H., & Geranmayeh, P. (2014). Determinants of user acceptance of internet banking: An empirical study. Management Science Letters, 4(7), 1369-1374. DOI:

Zscheischler, J., Brunsch, R., Rogga, S., & Scholz, R. W. (2022). Perceived risks and vulnerabilities of employing digitalization and digital data in agriculture - Socially robust orientations from a transdisciplinary process. Journal of Cleaner Production, 358, 132034. DOI:

Copyright information

This work is licensed under a Creative Commons Attribution-NonCommercial-NoDerivatives 4.0 International License.

About this article

Publication Date

29 November 2023

Article Doi

eBook ISBN

978-1-80296-131-7

Publisher

European Publisher

Volume

132

Print ISBN (optional)

-

Edition Number

1st Edition

Pages

1-816

Subjects

Accounting and finance, business and management, communication, law and governance

Cite this article as:

Xuan, L. Z., Roslan, S. N. M., Ismail, M. K., & Tajudin, A. H. (2023). Factors Affecting Young Malaysia Non- Adoption of Online Banking. In N. M. Suki, A. R. Mazlan, R. Azmi, N. A. Abdul Rahman, Z. Adnan, N. Hanafi, & R. Truell (Eds.), Strengthening Governance, Enhancing Integrity and Navigating Communication for Future Resilient Growth, vol 132. European Proceedings of Social and Behavioural Sciences (pp. 361-377). European Publisher. https://doi.org/10.15405/epsbs.2023.11.02.27