Abstract

The increase in export earnings allows agricultural producers and industrial enterprises to implement investment projects, upgrade existing sites and open new lines. The article explores the trends in the development of agricultural exports in the Russian Federation on the example of the Volgograd region and the Chechen Republic. The statistical indicators of product exports for 2019–2021 given in the article in the context of industries and product groups confirm its expanding potential. Additionally, the highest growth in export earnings for such positions as the meat and dairy industry (+ 44 % per annum), grain (+ 32 %), and oil and fat products (+ 25 %) is argued. Realizing the importance of leadership in agricultural exports, the state provides financial support, the list of methods and instruments of which is given in the article. One of the conductors of financial support measures (credit guarantee and insurance) to agricultural organizations is the Russian Export Center Joint-Stock Company. This institute offers consulting and information services. The promotion of agricultural products is a component of export support. The concepts of promoting agricultural products to foreign markets have been adopted and are being implemented. It was recommended to strengthen the existing measures for state support of the dairy industry, to continue to increase the potential of financial measures: expanding the credit line, preferential insurance, providing tax benefits, guarantees, and developing grant support.

Keywords: Concepts, competitiveness, export, financial support methods

Introduction

The export of agricultural products in the Russian Federation is one of the main promising areas that contribute to the development of the industry. The currently implemented Federal project “Export of agricultural products”, the key objective of which is to increase the volume of agricultural exports to 45 billion dollars a year by 2024, contributes to the development and growth of export potential (Babaeva et al., 2017).

Problem Statement

Despite the positive trends in the development of agricultural exports, there are enough problems that hinder the expansion of export potential. Such problems are the competitiveness of agricultural exports; inadequate experience in providing state support at all stages of the life cycle, from the creation of the new products to their promotion, registration, and certification. The elimination of these problems will ensure the formation of favorable conditions for the further development of agricultural exports.

Research Questions

The availability, accessibility, and transparency of obtaining state support will contribute to the growth of the agro-industrial complex, reflecting the modern features of the country related to ensuring competitiveness and food security. Consideration of the key statistical indicators of product exports from the point of view of industries and some commodity groups, as well as areas of their state support, will allow determining the scale of the problems and possible solutions in case of their development.

Purpose of the Study

The paper aims to explore trends in the development of exports of agricultural products, methods and tools for its state support, and opportunities for their expansion.

Research Methods

The article is based on the systematization of materials on the economic interests of subjects of economic relations using the methods of comparative analysis, induction, and deduction; and is also supported by tables with data illustrations.

Findings

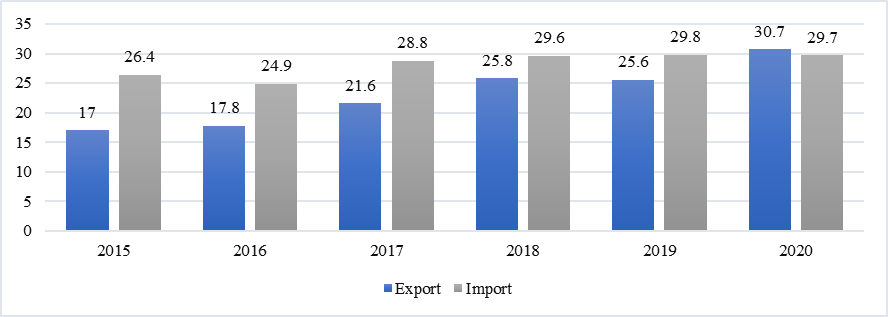

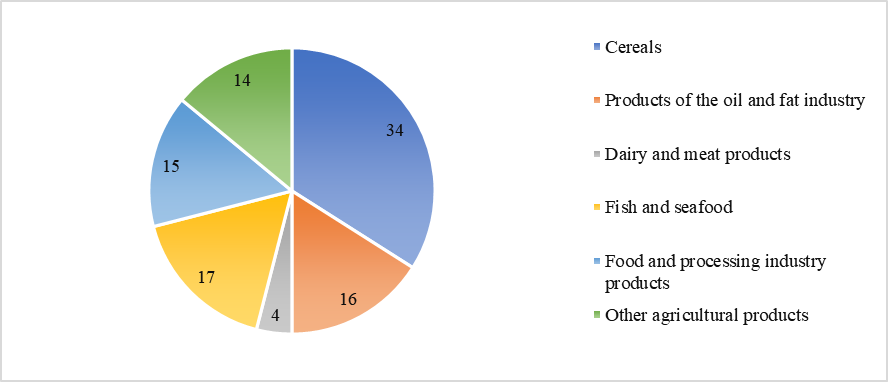

In 2020, Russian agricultural exports are dominated by imports for the first time (Figure 01). According to the Federal Center for the Development of Product Exports, the Russian Federation ranks 17th among the world's major food exporters. The proceeds of the export of agricultural products amounted to more than 30.5 billion dollars. Compared to 2010, deliveries to foreign markets increased by almost 4 times. Figure 2 shows the structure of exports of agricultural products from Russia in 2020 (Federal Center, 2021; MCS Government, 2021).

Dynamics of export and import of agricultural products, % (Federal Center, 2021)

The leading positions in the agricultural exports are given to the grain industry, fish and seafood, and products of the oil and fat industry. The peculiarities of storage and transportation of dairy and meat products, as well as the impact of the pandemic, predetermined the low rate of these industries in the structure of exports of agricultural products in 2020. Agricultural exports in 2020 were represented by more than 164 destinations. China was the leader in terms of buyers of agricultural products. It is assigned the 1st place with the volume of imported products of 4 021 million dollars, followed by the EU (3 343 million dollars), and Turkey (3 138 million dollars). The 4th place in the top 10 leaders was taken by Kazakhstan (2 087 million dollars) and the 5th place by Egypt (1 956 million dollars) (Federal Center, 2021).

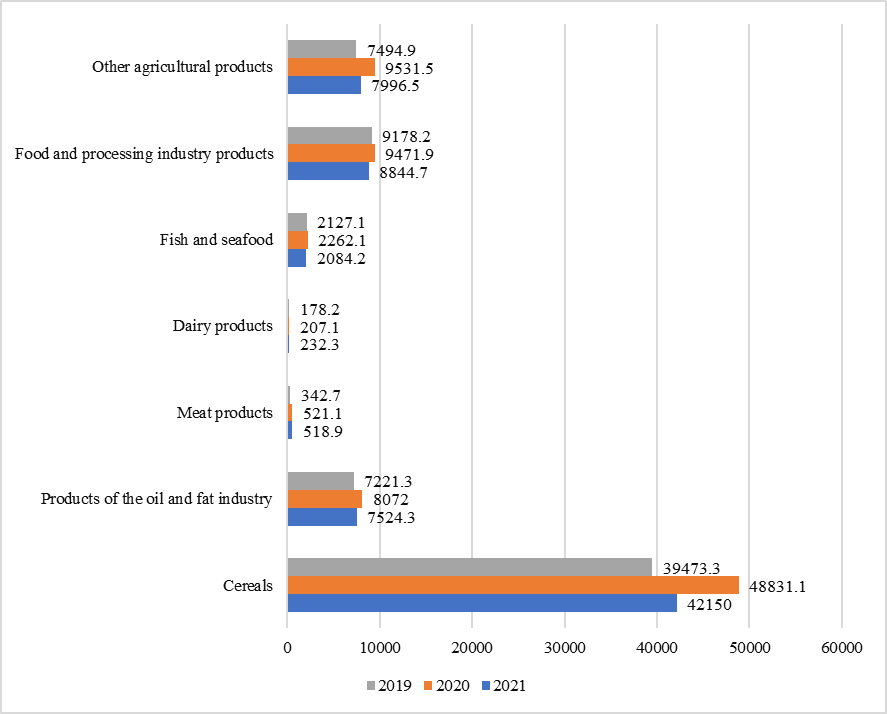

Statistical data on the export of agricultural products for 2019–2021 emphasize that 2020 is recognized as a record year in terms of exports. This is the result of a large-scale modernization of agriculture, the introduction of modern methods of land use, and animal husbandry (Figure 03). A noticeable increase in the export volume in the dairy industry (compared to 2019, the export volume increased by almost 200 thousand tons) and meat industries (compared to 2019, the export volume increased by almost 300 thousand tons). In the grain industry, the export volume amounted to 48831.1 thousand tons, which is 9357.8 tons more (compared to 2019). The largest growth in export revenue is observed in meat and dairy products (+ 44 %), other agricultural products (+36 %), grain (+32 %), and oil and fat products (+25 %). A decrease in the value, compared to 2019, was observed for fish products (–2 %).

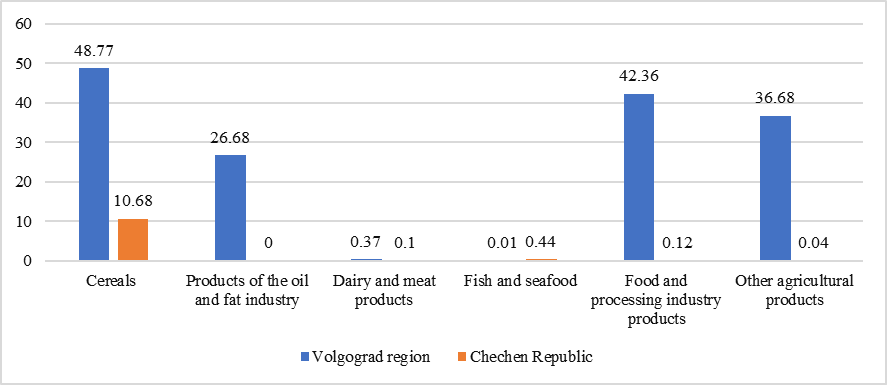

According to statistics, the Chechen Republic entered the regions with the highest average annual growth rate of exports of agricultural products for the period 2015–2020. Thus, in 2020, the Chechen Republic increased the supply of wheat by almost 4.5 times compared to the level of 2019 (Dokholyan et al., 2019), significantly increased the export of dried and salted fish and adjusted the supply of beef (53 thousand dollars in 2020) (Figure 04, Table 01).

Next, consider the dynamics of exports of the Volgograd region and the Chechen Republic for 2018–2021 (Table 02).

According to statistics, the Volgograd region provided the maximum growth in the context of cereals: corn (5 times), barley (6 times), buckwheat, and millet (17.5 %). The negative growth dynamics for the specified period are observed for rice (–36 %). In the dairy industry, a positive trend is observed in whey (4 times). Oil and fat products provided a 4-fold increase in sunflower oil and a 3-fold increase in mayonnaise. In the food and processing industry, there is an increase in sausages (2 times) and in products of deep processing of cereals (7 times). An increase of 37.9 % was achieved in drinks and 35.1 % in confectionery. An increase of 7.1 % over the period under review in commodity groups (fish and seafood) was provided by fish, dried, and salted.

For other products of the agro-industrial complex of the Volgograd region, the increase from 2021 to 2020 was 14.1 %. Thus, processed fruits, vegetables, and nuts increased by 23.2 %, the growth of pasta increased by 8 times, and the export of oilseeds increased by 34.3 %. There is also an increase in growth in animal feed by 12.3 %. Negative growth is observed for legumes (–60.8 %) and sunflower seeds (–98.3 %).

The competitiveness and high quality of the products of the Volgograd region are ensured through the technological re-equipment of the industry and targeted support for export-oriented projects. The expansion of the export potential of the region was facilitated by the work of the NewBio plant for the deep processing of corn grain in the Alekseevsky district (Mitrofanova & Chernova, 2018). An example of a successful organizational and managerial component of the import-substituting potential was also the commissioned Oil Extraction Plant of Cargill Novoanninsky LLC, the launch of which contributes to ensuring 100 % processing of sunflower seeds in the Volgograd region. The increase in oil production fully covers the needs of the country's domestic market in vegetable oil but makes it possible to produce it for export to neighboring countries.

More than 35 times, the Chechen Republic provided an increase in barley. The products of the food and processing industry at the expense of drinks ensured an increase in the Chechen Republic by five times, and for other products of the agro-industrial complex by seven times. The growth of meat and dairy products in the Chechen Republic is not observed. Information on commodity groups, however, is not provided. There is a negative value of exports of fish and seafood (–16.2 %). The concentration of grain exports of the Volgograd region by macro-regions of the world in the context of enlarged commodity groups is represented by: Transcaucasia and the Middle East, North Africa, Central, and South Africa; Chechen Republic: Transcaucasia and the Middle East, Southern Europe.

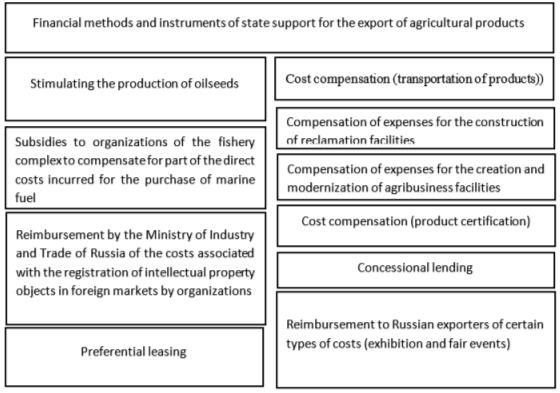

The Russian Federation is implementing a set of state support measures for agricultural producers aimed at improving the efficiency and competitiveness of Russian food products (Figure 05).

One of the conductors of providing financial support measures (credit and guarantee support and insurance) to agricultural organizations is the Russian Export Center. Also, this institute offers consulting, informational and organizational services. The competitiveness of exported agricultural products is a fundamental factor in the export development until 2030. Thus, understanding the strengths of the agro-industrial complex and systematic work with the “failing” factors of competitiveness will contribute to the development of exports. The fundamental factors of competitiveness are: in the target market, integration into the value chain, high recognition of products, consumer loyalty, high adaptability to the market landscape; at the border, infrastructure that contributes to the efficiency of the passage of goods, preferential regimes when crossing customs borders; within the country, competitiveness and production efficiency, quality methods for product certification, veterinary phytosanitary control, corresponding to the world level.

Conclusion

Coordination of the activities of federal and regional authorities with the participation of agricultural producers, veterinary and phytosanitary services, etc., and state support measures are the key to expanding the export potential and increasing the competitiveness of agricultural products of the Russian Federation. One of the components of export support is the promotion of the products. Thus, the concepts of promoting agricultural products to foreign markets have been adopted and are being implemented at the federal level. Considering that in 2020 the dairy industry turned out to be at a low level in the structure of product exports, it is necessary to strengthen the following measures: the introduction of advanced breeding technologies to increase the productivity of livestock, the harmonization of the technical requirements of the Russian Federation and China for dairy products (labeling products, increasing shelf life), development of an industry program for the promotion of Russian dairy products to foreign markets, compensation for the costs of certification of products in the target market and part of the capital costs for the construction and modernization of dry milk formula production, and participation of Russian representatives in key international industry associations. Financial, credit, and institutional infrastructure support should become the main ones in promoting agricultural products to foreign markets. It is advisable to continue building up the potential of financial measures aimed at creating conditions conducive to the development of exports of agricultural products. Of particular relevance is the expansion of the range of credit products in the context of short-term and investment lending, as well as the provision of subsidies for these purposes. The likelihood of political and commercial risks predetermine the need to develop export insurance to protect Russian exporters of agricultural products, as well as the banks that finance them from non-payment by a foreign counterparty. It is appropriate to increase financial support for the exhibition and fair activities in the context of the implementation of state programs, the provision of export guarantees, the strengthening of grant support and tax incentives (Mitrofanova et al., 2021).

References

Babaeva, Z. S., Postnova, M. V., Yalmaev, R. A., Kasimova, Z. N., & Isbagieva, G. S. (2017). Agricultural lease as a form of financial support for the expanded reproduction of the agro-industrial complex. Espacios, 38(62), 7–14. http://www.revistaespacios.com/a17v38n62/a17v38n62p07.pdf

Dokholyan, S. V., Yalmaev, R. A., Postnova, M. V., Dolgova, I. M., & Nabiyev, R. A. (2019). Prospects for implementing innovative technology in enterprises within the agro-industrial complex. Scientific Papers. Series: Management, Economic Engineering, and Rural Development, 19(3), 189–195. https://managementjournal.usamv.ro/pdf/vol.19_3/Art25.pdf

Federal Center (2021). Agroexport 2030. Trends and prospects. https://mcx.gov.ru/upload/iblock/186/186a255a5aefae001e3d6f1e7a93089d.pdf

Federal Development Center (2021). Federal Center for the Development of Exports of Agricultural Products of the Ministry of Agriculture of Russia. https://aemcx.ru/

MCS Government (2021). National report on the progress and results of the implementation in 2020 of the State Program for the Development of Agriculture and the Regulation of Agricultural Products, Raw Materials and Food Markets.

Mitrofanova, I. V., & Chernova, O. A. (2018). Assessment of the import substitution potential of the agro-industrial complex of the Southern Federal District. Bulletin VolGU. Ser. 3. Economics. Ecology, 20(1), 40–54. DOI:

Mitrofanova, I. V., Shkarupa, E. A., & Batova, V. N. (2021). Export of agricultural products: trends and directions of state support in modern conditions. Regional economy. South of Russia, 9(2), 1731–1140.

Shkarupa, E. A., Yalmaev, R. A., & Perekhodov, P. P. (2021). The Russian practice of applying instruments of financial support to agribusiness. International Scientific Conference “Social and Cultural Transformations in the Context of Modern Globalism” (pp. 1702–1708). (November 2021).

Copyright information

This work is licensed under a Creative Commons Attribution-NonCommercial-NoDerivatives 4.0 International License.

About this article

Publication Date

23 December 2022

Article Doi

eBook ISBN

978-1-80296-128-7

Publisher

European Publisher

Volume

129

Print ISBN (optional)

-

Edition Number

1st Edition

Pages

1-1335

Subjects

Science, philosophy, academic community, scientific progress, education, methodology of science, academic communication

Cite this article as:

Yalmaev, R. A., Shkarupa, E. A., & Vatyukova, O. Y. (2022). Development Of Exports Of Agricultural Products: The Experience Of The Regions. In D. K. Bataev, S. A. Gapurov, A. D. Osmaev, V. K. Akaev, L. M. Idigova, M. R. Ovhadov, A. R. Salgiriev, & M. M. Betilmerzaeva (Eds.), Knowledge, Man and Civilization- ISCKMC 2022, vol 129. European Proceedings of Social and Behavioural Sciences (pp. 1247-1254). European Publisher. https://doi.org/10.15405/epsbs.2022.12.159