Abstract

The article presents the methodological aspects of the complex rating assessment of enterprises. It results in the development of a system of indicators to evaluate, on the one hand, the performance of the economic entity, and on the other hand, the consumers' opinion of the evaluated products. The authors propose a methodology for the multidimensional comprehensive comparative rating of enterprises, based on a system of indicators for two vectors: evaluation of consumer preferences and assessment of economic performance and financial stability of facilities. The research employed questionnaire survey methods, rationing and summary of results, statistical methods and a ranking method. The methodology has been tested on the example of meat processing enterprises - participants of the "Real Vologda Product" brand; a comprehensive analysis of the economic and financial potential of meat processing industry representatives in the Vologda Oblast has been carried out. The analysis allowed rating producers - participants of the brand in the product group "Meat Products" according to the value of obtained integrated levels of their comparative assessments, as well as identifying a number of structural features of producers of this product group according to their influence on the strength of the brand "Real Vologda Product". The study identifies solutions to the problems identified for different groups of meat processing enterprises in the Vologda region, highlighting the drivers of growth in their economic potential.

Keywords: Brand, consumer assessment, economic potential, indicators, meat processing plants, rating

Introduction

The development of regional production and the spread of unique brands contributes to the development of rural areas, increases the region's investment appeal and creates a positive image of the region. "Real Vologda Product" is one of the promising projects of the Vologda region, which unites producers producing agricultural products of different commodity groups. Their quality is confirmed by a special System of Voluntary Certification and provides a solution to the problem of food security.

The trademark "Real Vologda Product" is a kind of guarantee that these goods are produced in the Vologda region and are of a quality that meets the highest international requirements (Burgomistrova, 2018).

The purpose of this trademark is to motivate consumers to purchase quality products made from agricultural raw materials, because permission to use the mark is granted to food products and industrial raw materials with proven quality and safety (Selina et al., 2020). On the other hand, it is important for trademark management to competently manage brand development, maintain consumer loyalty of brand products and the level of their availability, and to solve these problems it is necessary to consider the financial and economic aspects of the development of product manufacturers - participants of the brand "Real Vologda Product".

Problem Statement

One of the main problems of humanity in the modern world is the management of food security (Shikhova et al., 2020). There are two ways to ensure food security for the population - either to produce raw materials and foodstuffs in-house, controlling the quality of all production processes (from the farm to the shop shelf), or to strictly monitor the quality of imported products. The first way is feasible for the Vologda region, due to the successful operation of the Voluntary Certification System, as the region is able to be almost self-sufficient in terms of agricultural production volumes. Local processors of agricultural products must be covered by the quality management system as widely as possible. The strength of the brand will also depend on the financial and economic health of the brand participants. Today, for medium, small and micro-enterprises engaged in processing agricultural products and producing beverages and foodstuffs, participation in the Voluntary Certification System is around 33% (Shikhova et al., 2020).

Research Questions

The key focus of the study was to analyse the economic potential of the meat processing industry in the Vologda Region in terms of a comparative assessment of the economic efficiency and financial sustainability of enterprises participating in the "Real Vologda Product" brand, considering the level of demand for their products among consumers. Within this line of research, the authors considered the following questions.

3.1.They developed a system of indicators for analysing meat processing enterprises in two areas: consumer assessment and assessment of economic efficiency and financial sustainability.

3.2.The research includes a methodology and tools for a sociological survey of consumers of the products manufactured by the enterprises in this sector.

3.3.There is a methodology developed to quantify the results of respondents' answers to the questionnaire, to aggregate their values and calculate the indicators of consumer evaluation.

3.4.The article develops a methodology for a comprehensive comparative ranking of enterprises based on a system of indicators.

3.5.Researchers identified the potential of meat processing companies participating in the "Real Vologda Product" brand on the basis of the results of the ranking.

3.6.They derive a general characteristic of the economic potential of the meat processing industry in the Vologda region and outline ways of solving the identified problems.

Purpose of the Study

The purpose of this study is a comparative assessment and rating construction of the Vologda meat products processors included in the trademark "Real Vologda Product" on the basis of the original methodology of comparative complex evaluation of producers - participants of the brand.

Since the rating process always involves comparing the characteristics of the compared entities, in our case brand members producing and selling specific products, it only makes sense to carry out this procedure within relatively homogeneous product groups.

Research Methods

The information basis for the comparative assessment of brand actors is a system of indicators that includes two problematic blocks:

I. Economic indicators - indicators of the financial health, business activity and performance of the brand member. The source of information for calculating the values of this block's indicators is the accounting and financial statements of enterprises published by the Federal State Statistics Service of the Russian Federation. The method of information collection is traditional document analysis (desk research). This block calculates the following indicators:

1. Financial sustainability indicators.

2. liquidity and solvency indicators.

3. Business activity indicators.

4. Financial performance indicators.

II. Consumer evaluation indicators are indicators calculated from a summary of a consumer questionnaire survey. The source of information for calculating the values of the indicators in this block is a consumer survey. The method for collecting information was qualitative (determining the proportion of respondents who gave a particular answer) and quantitative (using the scale method) (Solovyova & Afanasyeva, 2013).

The system of indicators for this block included the following eight evaluation indicators:

- indicator for assessing the level of consumer loyalty to a brand member (an indicator of commitment to the producer, "heart share", "Product patriotism");

- indicator for assessing the level of perceived quality of a brand member's products (a measure of the perceived quality of the manufacturer's products;

- indicator for assessing the level of market share (market share, sales share) of a brand member;

- indicator to assess the level of perception and recognition of the manufacturer's image as a brand participant;

- indicator for assessing the level of accessibility of a brand member's products (an indicator of physical accessibility of products);

- indicator for assessing the level of price satisfaction with a brand member's products;

- indicator for assessing the level of territorial prevalence of a brand member's products (breadth of the sales market);

- indicator for assessing the level of awareness of a participant's brand advertising.

Consumer opinion research used a questionnaire survey.

The list of 13 main questions in the questionnaire includes four types of questions and different ways of converting the results of respondents' answers into a quantitative form. We aggregated and rationed them to obtain a quantitative quotient of the overall result of the respondents for each question for each of the brand participants included in the set of compared objects to build their ranking.

In the next step, the resulting coefficient estimates of the respondents' overall response to each question were aggregated for two indicators: brand member loyalty (a measure of commitment to the manufacturer, "heart share") and brand member product availability (a measure of physical product availability), for which the respondent answered several questions in the questionnaire. For the other indicators, which only one question corresponded to in the questionnaire, aggregation of the results of the respondents ' answers was not required.

Since the aggregates are coefficients, the geometric mean methodology applied in such cases was used to summarize and determine essentially their mean.

Based on the system of indicators discussed, represented by the indicators of the economic block and the consumer evaluation block, it was possible to provide an in-depth and detailed comparative analysis of brand member producers by applying the methodology of multidimensional comparative comprehensive evaluation.

The methodology for the comparative composite assessment of brand member producers relies on a multidimensional comparison algorithm with respect to the indicator system discussed and includes the following steps:

- standardising indicator values;

- constructing a square matrix for each indicator with the values of private comparative levels between each pair of brand participants in the study population;

- summarising the derived matrices with partial levels into a final comparative evaluation matrix with summary levels by determining the sum of the values of the partial levels according to the place in the matrices for the whole indicator system for each brand member;

- constructing a final evaluation matrix by calculating the values of the levels of summary comparative scores for each brand member;

- transforming the derived summative assessment levels of brand members to produce an integrated assessment level value by converting the summative assessment level value to a non-negative form, comparing the non-negative summative assessment levels to the maximum value in their aggregate and presenting the result as an integrated summative comparative assessment level (ICA);

- analysing and comparing the integrated assessment levels of the participating brand producers;

- determining the participation degree of the levels of indicators for each block in forming an integrated assessment level by calculating the block relative assessment levels of brand participants according to the above described methodology, based on the previously calculated private levels of comparative assessments of the indicators for the selected blocks;

- qualitative characteristics of the level of evaluation received by each brand member according to the blocks of indicators based on an interval scale of values of the received integrated levels, construction of the rating and typological grouping of brand member producers.

The level of integrated comparative assessment of a brand member against one or another of the four domains outlined characterises its economic potential, consumer demand and the degree of attribute manifestation according to the highlighted blocks of indicators.

Findings

A questionnaire survey "Real Vologda Product - Meat Products" conducted online via Google Form reached 163 respondents.

The questionnaire investigated consumer opinion on the products of producers participating in the "Real Vologda Product" brand, specialising in the production and processing of meat and meat products from farm animals. The list of manufacturers included 16 brand participants from this product group.

The processing of the responses according to the methodology described above has resulted in forming a system of indicators of consumer assessment to apply in practice a multidimensional comprehensive comparative assessment of producers - participants of the brand "Real Vologda Product" and the construction of their rating for the product group "Meat Products".

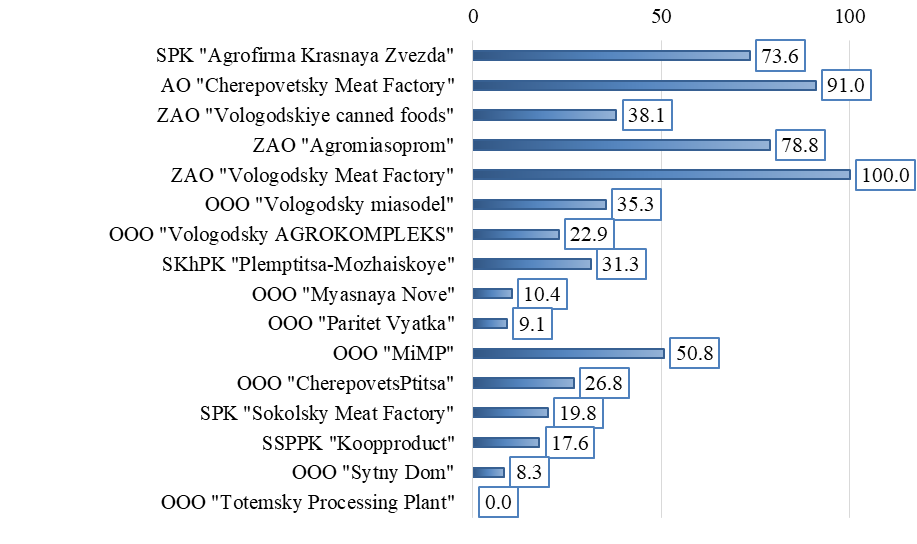

The results of the study show that the leader of this product group in the brand "Real Vologda Product" by the aggregate value of the integrated comparative assessment is ZAO "Vologda Meat Factory" (ICA is 100%), which is shown in Figure 1.

Source: compiled by the authors based on market research

This indicator can be characterised as high according to an interval scale of values for the integrated level of comparative assessment. The same scale interval also includes the integral score of AO "Cherepovetsky Meat Factory" (ICA is 91.0%, 2nd place in the participants' rating), ZAO "Agromiasoprom" (ICA is 78.8%, 3rd place in the rating) and SPK "Agrofirma Krasnaya Zvezda" (ICA is 73.6%, 4th place in the rating). This high level of the aggregate score for these four branded manufacturers is due to the relatively high scores in both problematic blocks.

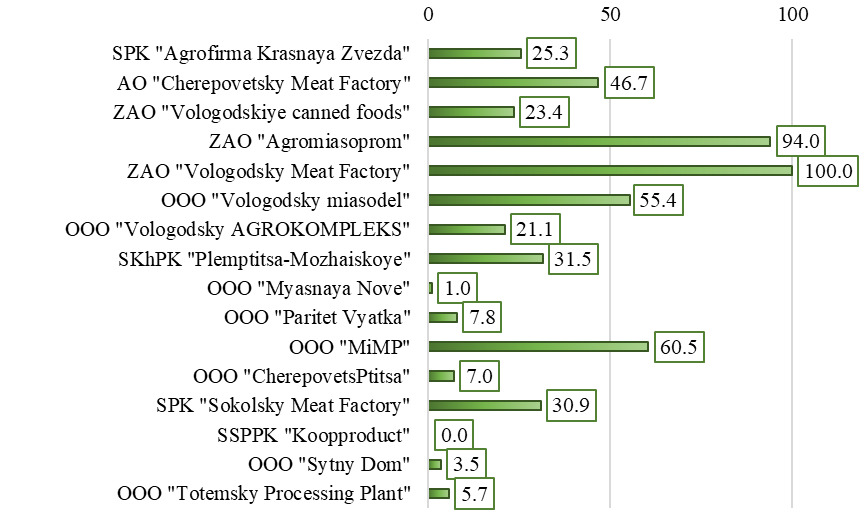

According to the generalization of respondents' opinions, ZAO "Vologda Meat Factory" is also the leader in the consumer evaluation rating, ranking first by such indicators as customer loyalty level, market share, perceived and recognizable image, level of product availability and territorial distribution; and second by the perceived quality indicator (89.3%), product price satisfaction (81.6%) and advertising awareness (95.9%) (Figure 2).

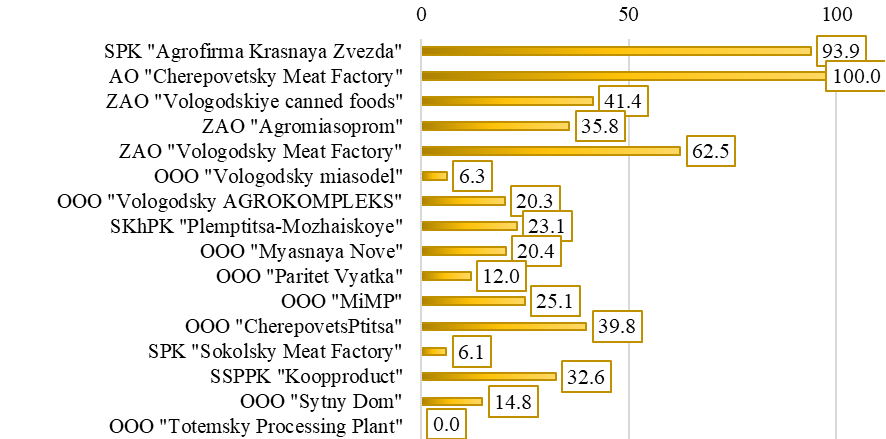

According to the economic block of indicators the level of integrated comparative assessment of ZAO "Vologda Meat Processing Plant" is above average (62.5%) and, despite the 3rd position in the rating for this problematic block, the enterprise is significantly behind such brand participants as AO "Cherepovetsky Meat Factory" (1st place, score 100.0%) and SPK "Agrofirma Krasnaya Zvezda" by its economic potential (2nd place, rating level 93.9%) (Figure 3).

Source: compiled by the authors based on market research.

Source: compiled by the authors based on market research

Analyzing assessment levels by groups of indicators of this block, it becomes clear the problem moments in the efficiency of economic activity of ZAO "Vologodsky Meat Factory" in comparison with other leaders of the rating: at a rather high level of assessment by groups of indicators of financial stability (87.0%) and profitability (74.7%) the complex assessment of liquidity and solvency is below average (40.3%), business activity is low (11.7%, 11th place from 16 in the rating by this indicator).

Cherepovetsky meat factory is ranked second in the aggregate assessment rating, primarily due to its leading position in the economic indicator block, but it is significantly behind Vologodsky Meat Factory in the consumer assessment indicator block. The consumer research shows an existing but underused potential in the development of the company's marketing policy: with the level of the integrated consumer evaluation being just below the average (46.7%) and the 5th position in the rating. The company scored high only in the product availability indicator (70.8%); above average in the price satisfaction indicator (57.9%); below average in the loyalty indicator (47.5%), perceived quality (48.5%), territorial coverage (47.1%), advertising renown and recognizability (45.8%), market share (32.6%) (the enterprise should develop its marketing and sales policy regarding these indicators). The consumer's perception and recognition of the company's image is low (21.9%).

ZAO "Agromiasoprom" is also in the lead, taking the 3rd position in the aggregate assessment rating (ICA is 78.8%, high level of assessment) and the 2nd position in the consumer opinion rating (94.0%, which corresponds to a high level of assessment). According to the consumer, this manufacturer was the leader in terms of the perceived quality and price satisfaction indicator of the products offered, as well as the level of awareness and prevalence of advertising. The respondents demonstrated a fairly high level of brand loyalty to this participant (99.7%, which is not significantly lower than that of the leader ZAO "Vologdsky Meat Factory"), market share reflecting demand for its products (87.5%), level of perception and recognition of its image (76.6%), territorial spread (86.8%), and degree of product availability to the consumer (71.6%). Given the high level of customer loyalty and satisfaction with the company's products, the prominence and prevalence of sales, a sound pricing and assortment policy will enable the company to raise its competitive level with the ranking leaders in terms of economic performance.

We should note that according to the results of the consumer survey OOO "MiMP" is on the 3rd position in the rating (assessment level 60.5%, above average), while respondents highly enough evaluated the level of availability of this producer (84.9% and 2nd place in the rating for this indicator), and also showed a high level of product quality (73%) and availability of advertising (81.6%), above average level of loyalty (52.7%) and slightly below average territorial distribution of products (47.1%).

The group of brand participants with the level of aggregated comparative assessment below the average included 3 enterprises - ZAO "Vologodskiye canned foods" (38.1%, 6th place), OOO "Vologodsky miasodel" (35.3%, 7th place) and SKhPK "Plemptitsa-Mozhaiskoye" (31.3%, 8th place). For these companies, there are relatively weak estimates for most economic indicators, especially for the groups of indicators of financial stability, liquidity and solvency, and business activity. In terms of consumer opinion, the best position out of these enterprises has only OOO "Vologodsky miasodel" (55.4%, 4th place in the consumer assessment rating). The respondents demonstrated their loyalty quite well, satisfactorily evaluated the level of advertising availability, product quality and availability, price satisfaction with it. Enterprises in this group need a thorough approach to adjusting their marketing and sales policies, aimed at expanding their product range and increasing their market coverage both regionally and beyond the Vologda region, which will naturally become a driving factor for the growth of their economic potential.

The group of brand participants with a low level of comparative assessment in the overall rating includes 8 enterprises - OOO "CherepovetsPtitsa" (26.8%), OOO "Vologodsky AGROKOMPLEKS" (22.9%), SPK "Sokolsky Meat Factory" (19.8%), SSPPK "Koopproduct" (17.6%), OOO "Myasnaya Nove" (10.4%), OOO "Paritet Vyatka" (9.1%), OOO "Sytny Dom" (8.3%), OOO "Totemsky Processing Plant" (0.0%). Both their level of economic potential and the level of consumer demand for their products are significantly lower compared to the levels of the leaders in this product group ranking. For the most part, these enterprises aim at a narrow market coverage, with a low range of products purchased mainly by the population living in the enterprise's area of operation. It is important to take a more active approach to introduce products to consumers, not only through participation in trade fairs and exhibitions, but also through advertising and by expanding the territorial spread of sales on at least an intra-regional market.

Conclusion

The analysis of meat processors participating in the "Real Vologda Product" brand, carried out on the basis of a comprehensive approach, has made it possible to identify the strengths and weaknesses of these enterprises, which in general suggests that the economic potential of the meat processing industry in the Vologda region is quite high and that there are opportunities to expand the sales market both within and outside the region, including more intensive expansion of the geography of exports. Products of agricultural origin produced from certified organic raw materials have undeniable competitive advantages over products imported from neighbouring regions and imported products (Moronova & Dorogovtsev, 2010).

Acknowledgments

The article is completed with the financial support of the Government of the Vologda region within the state scientific grant “The approaches to the evaluation of the brand power and rating of commodity producers of the Vologda region, Russia as viewed by consumers”.

References

Burgomistrova, O. N. (2018). Regional brands "Vologodskoe butter", "Real Vologda Product". Agricultural and Lifestock Technology, 1(4), 1-4.

Moronova, O. G., & Dorogovtsev, A. P. (2010). The study of food supply in the Vologda region. Economic and social changes: facts, trends, forecast, 1, 99-107.

Selina, M. N., Shikhova, O. A., & Barinova, O. I. (2020). The role of branding in regional food security. Marketing in Russia and abroad, 3(137), 57-64.

Shikhova, O., Selina, M., & Barinova, O. (2020). Experience in branding producers-processors of agricultural products to ensure food security in the region. In BIO Web of Conferences (Vol. 27). EDP Sciences.

Solovyova, D. V., & Afanasyeva, S. V. (2013). Marketing analysis of brand position in the market: an integrated method. Bulletin of St. Petersburg University, 1, 31-68.

Copyright information

This work is licensed under a Creative Commons Attribution-NonCommercial-NoDerivatives 4.0 International License.

About this article

Publication Date

01 February 2022

Article Doi

eBook ISBN

978-1-80296-123-2

Publisher

European Publisher

Volume

124

Print ISBN (optional)

-

Edition Number

1st Edition

Pages

1-886

Subjects

Land economy, land planning, rural development, resource management, real estates, agricultural policies

Cite this article as:

Shikhova, O. A., Selina, M. N., & Barinova, O. I. (2022). The Economic Potential Of The Meat Processing Industry In The Vologda Region. In D. S. Nardin, O. V. Stepanova, & E. V. Demchuk (Eds.), Land Economy and Rural Studies Essentials, vol 124. European Proceedings of Social and Behavioural Sciences (pp. 63-71). European Publisher. https://doi.org/10.15405/epsbs.2022.02.9