Abstract

The key link in the assurance of the reliability of accounting information is audit. It is its results that allow making informed management decisions. The main problem of audit organizations is the lack of time, since the cost audit is one of many audit segments that an auditor needs to check. In this regard, the authors propose the creation of a case study of working documentation “Audit of the costs of production of crop (livestock) products”, which will save the time of an auditor by the use of the list of documentation that an auditor requests from the agricultural organization and generated working documentation recording the collected audit evidence. The collection of regulatory and legal literature and working documentation are formed by cost elements and present the continuation of the audit after receiving documentation on accounting for production costs. The construction of working documentation and their use allows evaluating the verified operations for economic feasibility, the correctness of the correspondence of invoices, the assessment of the formation of costs and their attribution to the cost of production. The use of this case with working documentation will allow audit firms to make the audit process less time-consuming, transparent and also provide the opportunity to redistribute the saved time directly to audit costs.

Keywords: Agricultural organizations, cost audit, working documentation

Introduction

Today the market forces agricultural enterprises to increase the level of control in order to improve management efficiency. Costs play an important role in this context. The assessment and measurement of production costs is one of the most important aspects in the improvement of the economic instruments of enterprises. The solution of this issue allows timely identification of reserves for cost reduction, which in turn allows increasing the level of profitability of an agricultural enterprise (Shumakova et al., 2018). The processes taking place in the modern world make it necessary to control and monitor changes in the value of costs, which are influenced by inflationary processes, the constant rise in prices for raw materials and the need to replace some materials with others in order to save money. All this makes the production cost a movable indicator and the process of calculating it is one of the most important accounting procedures. As a rule, great attention is paid to the assessment of the legality of including certain costs in the cost of agricultural products and not the accuracy of its calculation. In the process of auditing costs, the compliance of the applied methods and methods of accounting with regulatory legal acts and the accounting policy of an agricultural organization are often verified. Nevertheless, the issues of cost accounting and costing are currently unclear. Therefore the methodological aspects of cost auditing are not fully covered and need further improvement (Meltonyan, 2009).

Many Russian scientists have studied cost audit: Alborov R.A., Amanzholova B.A., Babaev Yu.A., Bakaev A.S., Belobzhetskiy I.A., Bogataya I.N., Bychkova S.M., Vakhrushina M.A., Gadzhiev N.G., Gilyarovskaya L.T., Gutsait E.M., Danilevsky Yu.A., Ivashkevich V.B., Kochetkova A.I., Mizikovsky E A., Novodvorskiy V.D., Ovanesyan S.S., Paliy V.F., Pizengolts M.Z., Podolskiy V.I., Skobara V.V., Sokolov Ya.V., Sotnikova L.V., Suits V.P., Horuzhy L.I., Cheglakova S.G., Sheremetom A.D., Sheshukova T.G., Shneidman L.Z. and other scientists (Bobkova, 2007).

Many foreign scientists such as Arens E, Adams R, Benisa M, Defiles F.L., Robertson J., Lobbek J., Riley V.M.O., Hirsch M.B. etc. made great contribution to the development of audit (Kubar, 2015).

Problem Statement

During the process of audit, most of the time is often spent on the systematization and formation of a list of issues for cost audit, the sequence and duration of the audit of which depends on the primary and other documentation that is available at an agricultural enterprise. It is necessary to note that one of the problems that often occur in agriculture is the presence of independently developed registers, which are drawn up on paper, the content of which is often not clear for a person without economic education (Dukhnay, 2018). In our opinion, the systematization and formation of documentation required to verify all cost elements at an agricultural enterprise will reduce the time spent on the audit, improve the quality of audit and make it more transparent.

Research Questions

Despite a lot of research in the field of costs audit, including those related to agricultural organizations, the issues of organization and methodological support of audit process are controversial and require additional research. The improvement of the process of cost audit in agriculture requires the development of audit sequence, which will improve the efficiency of enterprise management (Gapon & Golova, 2019).

The subject of the research is the development of methodological provisions for the audit of production costs in order to calculate products in agricultural enterprises.

The object of the research is the formation of an accounting process in relation to the costs of production in agricultural organizations.

The theoretical basis for the study was presented by the scientific works of Russian and foreign scientists in the field of accounting, control and audit, materials of scientific conferences, regulatory and legal literature and media sources (Golova et al., 2020).

Purpose of the Study

The purpose of this study is to develop organizational and methodological recommendations in order to improve the audit of production costs in agricultural organizations using the example of crop and livestock industries.

Scientific novelty the research is the development and formation of a list of documentation for auditing production costs in crop and livestock sectors of agricultural enterprises.

Research Methods

During the research general scientific methods such as analysis and synthesis, data grouping, systematic approach, special methods of accounting and auditing were used.

Findings

The experience of audits shows that the lack of an information package of documentation regarding the industry-specific features of a client and accounting processes in audit organization can take a lot of time to form them. This necessitates the preparation of a working case for various clients, which can be formed in advance or created during the audit process and used in the future as a result of the experience (Musaev, 2018).

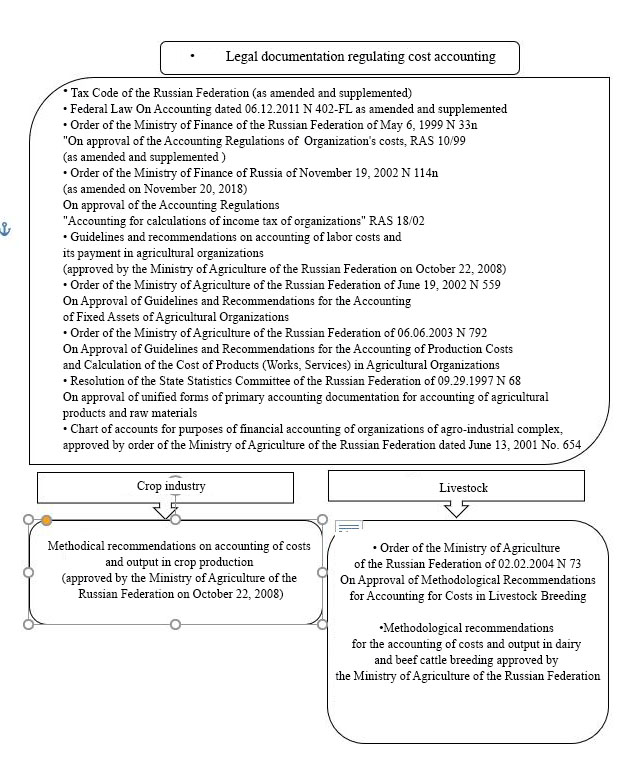

The information base for the formation of methodological support of an auditor is the current regulatory legal acts. The list of normative documentation regarding the accounting of costs in agriculture is quite wide, since in addition to the generally accepted ones, industry documentation regulating the record of costs in agriculture are also added (Fig. 1). In our study, we narrowed the study down to two main sectors of agriculture: crop and livestock production (Pelymskaya et al., 2019).

The costs audit is mostly carried out by cost elements that are defined in RAS 10/99 Organization costs (Order of the Ministry of Finance of the Russian Federation, 1999): material costs, labor costs and deductions from it, depreciation and other costs, a list of which is unique in each organization. We believe that the audit time will be reduced if an audit organization creates templates for working documentation for this audit segment and generates a list of requested documentation for accounting for production costs. Before requesting documentation on cost accounting from an agricultural organization, an auditor should learn how the accounting policy of an agricultural organization reflects the issues such as cost accounting and calculating the cost of production, the methods of distribution of general production, general economic costs and other industries, the methods for assessing work in progress, accounting for finished products and other necessary issues, based on the specifics of accounting of an enterprise (Kuznetsova et al., 2019).

Then an auditor needs:

1. To get a list of production costs (indicating the quantity and cost) and compare the figures with the turnover of the cost accounts;

2. To check the primary documentation on cost accounting and the correctness of their attribution to the cost of finished products;

3. To determine whether the cost of costs is reflected in the accounts properly;

4. To check the correctness of their reflection and inclusion in the cost of products if there are significant costs in terms of the amount (Suyts, 2009).

In order to reduce the time needed to generate a request for documentation, we have developed a working document “List of documentation to verify the audit of costs in crop and livestock production” (Table 1).

During the formation of a request for primary documentation, it is necessary to take into account that in many agricultural organizations, a number of documentation are still maintained in documentation developed independently, but not approved by the adopted policy. Sometimes such documentation do not even contain the required details, which, according to the Law on Accounting, should be in every document. In this case, an auditor must make a mark and recommend supplementing the document with the necessary details and reflecting the form of this document in the accounting policy, or using a unified form (Parushina & Kyshtymova, 2019).

On the basis of this list, which can vary depending on the accounting features, we propose to form a case of working documentation of an auditor “Audit of costs for the production of crop (livestock) products”. It can be stated that the presence of such a case of working documentation is the basis for further professional growth, increasing the rating and competitiveness in the audit services market (Sultanov & Konan, 2019). The forms of working documentation were developed by the authors based on the list of the elements of production costs in agricultural organizations, as reflected in the legal documentation.

Audit organizations develop their own numbering system since there are no mandatory instructions in the legal acts regarding the numbering procedure for working documentation.

Every working document is encrypted with the first capital letters of the cost type, so material costs are designated “WP MCl” and “WP MCc” - these are documentation in which audit evidence will be collected on the accounting of materials. Working documentation, which will collect data on payroll in animal husbandry, are designated as WP Sl, the documentation required to collect evidence to verify the correctness of depreciation in crop and livestock production will be numbered by the authors as WP Аc and WP Аl, other costs will be collected in a group of documentation designated as WP Sc and WP Sl, and synthetic accounting registers are designated as WP SAc, WP SAl.

Conclusion

The working documentation on cost accounting developed by the authors are structured in such a way that an auditor can assess the economic feasibility of the above mentioned operations, as well as the correctness of the compilation of correspondence of invoices for cost accounting and the reliability of the amount of costs (Loseva, 2020). The proposed forms of working documentation, which will be formed on the basis of a request and documentation to assess the correctness of the formation of production costs, allow recording the collected audit evidence. Moreover, they will take into account the peculiarities of accounting for costs in agriculture.

This case will be very useful for auditors who are participating in the audit of an agricultural organization for the first time. This will save time of their preparation and distribute it directly to the audit itself. Time-saving will increase the effectiveness of audits while the quality of the audit will not be reduced. The introduction of the case “Audit of costs of the production of crop (livestock) products” into the practice of audit organizations will reduce these violations in the organization of accounting for production costs and will also make the audit process more useful, transparent and less time-consuming.

References

Bobkova, E. V. (2007). Development of audit of production costs in agricultural organizations. Retrieved from http://economy-lib.com/razvitie-audita-proizvodstvennyh-zatrat-v-selskohozyaystvennyh-organizatsiyah

Dukhnay, O. S. (2018). Methodology for auditing the costs of agricultural production, Theory and practice of modern science, 1(31), 205-208.

Gapon, M. N., & Golova, E. E. (2019). Organization of cost accounting in animal husbandry (through the example of an agricultural enterprise), Siberian financial school, 5(136), 81-85.

Golova, E. E., Gapon, M. N., & Baranova, I. V. (2020). Automation of Real-Time Managerial Accounting in Agricultural Enterprises During Sowing and Harvesting Seasons. In Proceedings of the International Conference on Policies and Economics Measures for Agricultural Development (AgroDevEco 2020) Advances in Economics, Business and Management Research, vol. 147, (pp. 25-29). Atlantis Press.

Kubar, M. A. (2015). Development of methodological support for the audit of accounting for production costs in agricultural organizations. Retrieved from https://rsue.ru/avtoref/KubarMA/KubarMA.pdf

Kuznetsova, I. V., Aleschenko, O. M., & Kretinina, O. N. (2019). Accounting policy in terms of production costs: features of the content and internal control in agricultural organizations, Financial bulletin, 2(45), 90-94.

Loseva, A. S. (2020). Development of internal audit in agricultural organizations, Trends in the development of science and education, 59-2, 14-17.

Meltonyan, M. Yu. (2009). Analytical procedures in the audit of production costs of products of processing enterprises, Retrieved from: https://rusneb.ru/catalog/000199_000009_003464702/

Musaev, T. K. (2018). Organization of an internal audit system for the costs of service industries and farms, Accounting in agriculture, 4, 40-46.

Order of the Ministry of Finance of the Russian Federation of May 6, 1999 N 33n "On approval of the Accounting Regulations of Organization’s costs, RAS 10/99 (as amended and supplemented) Retrieved from: http://www.consultant.ru/document/cons_doc_LAW_12508/ 0463b359311dddb34a4b799a3a5c57ed0e8098ec /

Parushina, N. V., & Kyshtymova, E. A. (2019). Audit: the basics of audit, technology and methodology for conducting audits. FORUM.

Pelymskaya, I. S., Savchenko, N. L., & Voronov, D. S. (2019). Features of accounting and calculation at industrial enterprises. Creative Economy.

Shumakova, O. V., Gapon, M. N., Blinov, O. A., Epanchintsev, V. Y., & Novikov, Y. I. (2018). Economic aspects of the creation of mobile units providing everyday services in off-road conditions in Western Siberia. Entrepreneurship and Sustainability Issues, 5, 736-747.

Sultanov, G. S., & Konan, K. L. (2019). The specifics of the use of working documentation required for the audit of production costs of agricultural organizations, Economy and entrepreneurship, 12(113), 1061-1064.

Suyts, P. V. (2009). Organization and methods of operational audit. Retrieved from https://www.dissercat.com/content/organizatsiya-i-metody-operatsionnogo-audita

Copyright information

This work is licensed under a Creative Commons Attribution-NonCommercial-NoDerivatives 4.0 International License.

About this article

Publication Date

01 February 2022

Article Doi

eBook ISBN

978-1-80296-123-2

Publisher

European Publisher

Volume

124

Print ISBN (optional)

-

Edition Number

1st Edition

Pages

1-886

Subjects

Land economy, land planning, rural development, resource management, real estates, agricultural policies

Cite this article as:

Golova, E. E., & Baranova, I. V. (2022). Working Documentation For The Audit Of Production Costs In Agricultural Organizations. In D. S. Nardin, O. V. Stepanova, & E. V. Demchuk (Eds.), Land Economy and Rural Studies Essentials, vol 124. European Proceedings of Social and Behavioural Sciences (pp. 184-191). European Publisher. https://doi.org/10.15405/epsbs.2022.02.23