Abstract

The article analyzes the dynamics of the gross regional product and investments in the agricultural sector of the Kursk region, identifies the directions of the industry's future development. The Keynesian theory is used to calculate the investment multiplier in agriculture in the region. Substantiates the conclusion about a high level of return on investment and the possibility of transition to the implementation of an innovative and investment scenario for the development of agriculture. The problems of growth are associated with the prospect of the country falling into the middle-income trap, when economic growth in the country, upon reaching a certain per capita GDP, slows down or stops. The necessity of the development of the agrarian industry based on an innovation and investment model, aimed both at introducing innovations into production, and at attracting investments and improving the investment climate, with the simultaneous development of export potential, has been substantiated. A model of conceptual changes in the development strategy of the agrarian industry in Russia is proposed, considering the proposed recommendations. It is concluded that it is necessary to move from resource-driven growth, which depends on cheap labor and capital, to growth based on high productivity and innovation. The article substantiates the role of the education system, which should encourage creativity and provide training for breakthrough development in science and technology, as well as the importance of implementing appropriate institutional changes.

Keywords: Agriculture, innovation, investment, investment multiplier

Introduction

During the food embargo, ruble devaluation, and significant government support (Fomin & Ogu-Oluva, 2020; Latysheva et al., 2020), favorable conditions have been formed for the development of business in the agro-industrial complex. The agricultural industry in Russia managed to prevent food shortages during the coronavirus pandemic and ensured its food security. The agro-industrial complex, despite unfavorable weather conditions and a pandemic, demonstrates certain growth (Fomin & Ogu-Oluva, 2020). The high rates of development of the agricultural sector, which are currently observed, are accompanied by the growth of production in their categories by domestic agricultural organizations, as well as by entering new markets for themselves, occupying niches in which imported products were previously offered. In addition, the low ruble exchange rate makes Russian goods attractive and competitive in foreign markets, which opens new prospects for domestic enterprises. In addition to traditionally exported goods such as grain and sunflower oil (Petrushina, 2021), domestic companies began to export sugar and poultry meat. At the same time, this development necessitates a change in strategic priorities both on the part of agricultural producers and on the part of state authorities that regulate and support the development of the agricultural sector.

Problem Statement

Trends in the development of the agricultural sector in Russia in recent years are associated with the fact that the way out of the deep crisis in the agricultural sector of the 90s, as well as the growth of the zero years in the pre-crisis period (until 2008 - 2009) (Fomin & Boev, 2008) based on the model based on an increase in consumer demand, has exhausted itself. Russia is losing an important comparative advantage due to wage growth (Vodolazskaya, 2013), which necessitates a rapid increase in overall factor productivity (Polterovich, 2014). The problems are aggravated by increased supply and overproduction of certain types of products with limited export opportunities. In this situation, the actual issue is the choice and justification of the strategy and prospects for the further development of the industry.

Research Questions

At present, the Russian economy, including in the field of agriculture, must make a transition from import substitution to an innovation-investment, export-oriented development strategy.

Investment multiplier calculation according to Keynesian theory

Justification of the scenario and model of the development of the agricultural sector

Purpose of the Study

The purpose of the article is to substantiate the prospects for the development of the agricultural industry based on an innovation and investment model aimed at both introducing innovations into production and attracting investments and improving the investment climate, while simultaneously developing the export potential of the country's agricultural industry.

Research Methods

To substantiate the prospects for the development of the agrarian industry and determine the possibility of implementing investment development scenarios, the classical Keynesian theory of the investment multiplier was used. According to the repeatedly tested theory of J. M. Keynes, a slight increase, or an increase in investment, leads to a significantly greater increase in GDP, or at the regional level of GRP (as cited in Zaretskaya & Chernikova, 2020). Applying this model in our studies and considering agriculture to a certain extent as an independent, relatively isolated system, we can assume that the increase in investment in agriculture has a similar effect on its gross value added in the region.

At the same time, according to Keynesian theory, investments are in turn influenced by the dynamics of the real volume of the gross domestic product and the change in the real interest rate. The presence of this dependence in agriculture was investigated and the relationship between dependent and independent factors was assessed in order to justify proposals to change the strategic priorities of state regulation.

Findings

Allocating the size of GDP and the interest rate as arguments, Keynes divides investments into two categories (as cited in Zaretskaya & Chernikova, 2020). He calls investments that are dependent, derivatives of GDP growth induced, and those that are not dependent are autonomous. It is generally believed that autonomous investments are made to introduce innovations, improve product quality. Autonomous investments are associated with long-term, slow-payback investments. State support can certainly be attributed to autonomous investments. At the same time, the investments themselves are a factor in increasing GDP in the future. The source of such investment is savings, loans, government funding, etc.

The relationship between the change in the volume of GDP ( ) and investment ( ) is determined by a factor objective for these conditions - the marginal propensity to invest (MRI). Mathematically, the marginal propensity to invest is defined as follows:

, where(1)

The marginal propensity to invest and the marginal propensity to consume (MRC) combined result in one, so we can write the increase in value added as:

(2)

The multiplier in front of the investment growth indicator is a multiplier, that is, a coefficient, or leverage, that allows you to determine the percentage change in value-added in agriculture with an increase in autonomous investment in this industry by 1%. When describing the dependence of GDP on investment using a continuously differentiable function, then the multiplier can be defined as the derivative of this function .

It must be taken into account that according to the Keynesian theory it will obviously be greater than 1, that is why it is actually called a multiplier. Below are the results of empirical testing of this statement in the agricultural sector of Kursk region. The data for the analysis are presented in table 1.

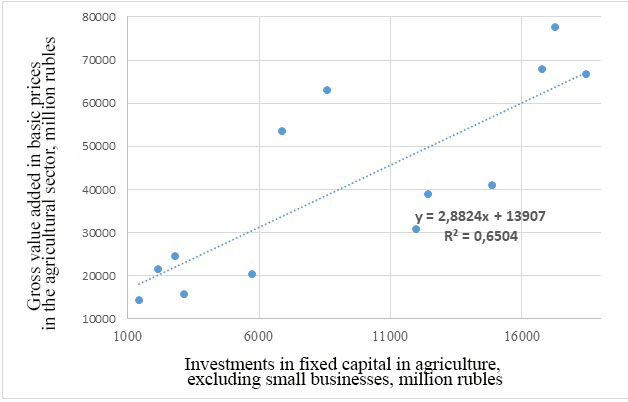

The graphical dependence based on the data in table 1 is shown in Figure 1. At the first stage, we must find a model of the form To solve this problem, we will apply the standard method for determining the regression line.

The constructed function has the form with a sufficiently large approximation coefficient, and the differentiation operation gives us a multiplier equal to 2.88.

Based on the constructed model, it can be concluded that currently in the agricultural sector of the Kursk region there is a multiplier equal to 2.88. This means that each ruble invested in the industry provides a long-term return of 2.88 rubles of value added. The constructed model indicates a high level of return on investment, which allows us to conclude that it is possible and necessary to move to the implementation of an innovative and investment scenario for the development of agriculture.

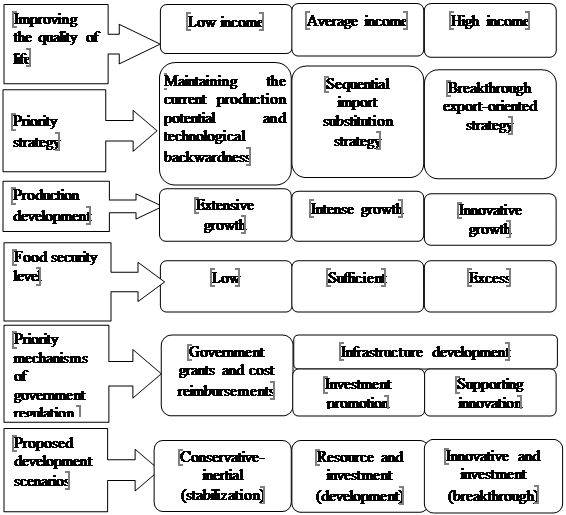

Considering that in many positions important for production, the share of domestic innovations in the growth of agricultural production efficiency is insufficient, and food independence is unattainable without the development of our innovations and our science, support for this direction, in our opinion, should be a necessary element of the proposed model (Epstein, 2014). The formation of a model and strategy for the development of the industry should be based not only on studying its current state and identifying priority and promising areas of development, but also considering the level of income of the population and the saturation of the food market within the country, considering changing geopolitical trends.

These conceptual proposals were used further in the development of the theoretical and methodological foundations of the innovation and investment scenario of the strategy for the development of the agricultural sector, presented in Figure 2.

As wages rise and competitiveness declines, it is necessary to introduce new processes and find new markets to support export growth. Domestic demand is, of course, also important to sustain the industry as an expanding middle class begins to use its growing purchasing power to purchase high-quality, innovative products. The main problem is the transition from resource-based growth, which depends on cheap labor and capital (which is currently available in the economy in general and in the agricultural sector in particular), to growth based on high productivity and innovation

Conclusion

Modern geo-economic and political peculiarities of Russia's position in the world arena make it necessary to build its priorities differently. The experience of the development of states indicates the possibility of building economies based on two model options: a model within the framework of the implementation of an import substitution policy, and an export-oriented approach, characteristic of an industrially oriented development strategy (Evdoshenko & Kotenev, 2016). In our opinion, state regulation of agricultural development should be aimed at ensuring the transition of the industry from an import-substituting and catching-up development strategy to an innovation-investment, export-oriented one (Zukin et al., 2020a, 2020b), based on the development of human capital and creating an environment, which should contribute to the introduction of innovations and the development of free enterprise.

A high-quality education system plays an essential role in the implementation of this strategy, which should encourage creativity and provide training for disruptive development in science and technology. It is also necessary to implement appropriate institutional changes that support competition and innovation.

It should be noted that this process will be fraught with certain difficulties since this development is focused on a long-term perspective and will not bring current benefits, which is difficult for assessing the actions of state authorities on the development of the industry. In this case, we do not get an increase in production volumes or crop yields, an increase in food volumes to ensure food security, therefore, the results achieved, which are not immediately visible, are difficult to attribute to the results of actions of specific politicians and ministries, committees. It is important to note that such changes are necessary for the future perspective development of the industry and ignoring the currently necessary reforms will inevitably lead to a trap of average income and stagnation in the industry in the future.

Political commitment is required to decide whether institutional development is necessary, which will ensure a future outcome with uncertainty of current effects.

References

Epstein, D. B. (2014). Embargo, agrarian policy and paradigm shift in public administration Economic revival of Russia, 4(42), 45-52.

Evdoshenko, V. V., & Kotenev, A. D. (2016). State regulation and support of the agro-industrial complex in the context of the implementation of the import substitution policy. Kant, 1(18), 102-106.

Fomin, O. S., & Boev, S. G. (2008). Directions of state regulation of investment activities in the agricultural sector. Achievements of science and technology of the agro-industrial complex, 1, 8-9.

Fomin, O. S., & Ogu-Oluva, A. A. (2020). Problems of state regulation of agricultural production. Innovations in the scientific and technical support of the agro-industrial complex of Russia. In Materials of the All-Russian (national) scientific and practical conference (pp. 34-37). Kursk State Agricultural Academy.

Latysheva, Z. I., Skripkina, E. V., Kopteva, N. A., Zhilyakov, D. I., & Nikiforov, A. I. (2020). Improving the state regulatory system of the agribusiness. Cuestiones Políticas, 65, 116-126.

Petrushina, O. V. (2021). Export-oriented strategy of grain production. Bulletin of the Kursk State Agricultural Academy, 2, 90-97.

Polterovich, V. М. (2014). Where to go: twenty-four theses. Economic science of modern Russia, 3(66), 7-17.

Vodolazskaya, N. V. (2013). Problems and prospects for improving regional marketing strategies. Eastern European Journal of Advanced Technologies, 10(61), 95-98.

Zaretskaya, V. G., & Chernikova, E. A. (2020). Gross Regional Product Growth: Factor Decomposition. Bulletin of the South-West State University. Series: Economics. Sociology. Management, 5, 89-103.

Zyukin, D., Zhilyakov, D., Bolokhontseva, Y., & Petrushina, O. (2020a). Export of Russian grain: prospects and the role of the state in its development. Amazonia Investiga, 9(28), 320-329.

Zyukin, D. A., Pronskaya, O. N., Golovin, A. A., & Belova, T. V. (2020b). Prospects for increasing exports of Russian wheat to the world market. Amazonia Investiga, 28, 346-355.

Copyright information

This work is licensed under a Creative Commons Attribution-NonCommercial-NoDerivatives 4.0 International License.

About this article

Publication Date

01 February 2022

Article Doi

eBook ISBN

978-1-80296-123-2

Publisher

European Publisher

Volume

124

Print ISBN (optional)

-

Edition Number

1st Edition

Pages

1-886

Subjects

Land economy, land planning, rural development, resource management, real estates, agricultural policies

Cite this article as:

Zhilyakov, D. I., Zaretskaya, V. G., Petrushina, O. V., & Sokolov, O. V. (2022). Substantiation Of Innovation And Investment Model Of Agriculture Development. In D. S. Nardin, O. V. Stepanova, & E. V. Demchuk (Eds.), Land Economy and Rural Studies Essentials, vol 124. European Proceedings of Social and Behavioural Sciences (pp. 134-140). European Publisher. https://doi.org/10.15405/epsbs.2022.02.17