Abstract

The transformation of the world economy in the XX century has led to a significant expansion of markets, the mass production of various goods that became possible to deliver anywhere in the world. The global financial system with free movement of capital has formed. The opportunities to attract foreign direct investment that stimulates economic growth have increased. The global development of the world economy in 21st century is marked by financialization, protectionism, and regionalization. In most countries, the benefits of an open financial system and free movement of capital did not offset the costs. The use of financial resources as political leverage and the financial crisis of 2008 have led to a revision of the global financial system principles. The desire to reduce the negative impact of financialization on national economies has led to an increase in the number of regional agreements and protectionism. At the same time, the Fourth Industrial Revolution began in the G-7 countries. Its main trends are automation and robotization of production along with cloud storage, data computing, intelligent sensors, and the Internet of Things. On top of it, there appeared new types of organizational structures based on the network interaction of technologies and devices in the value chain. It also creates an opportunity to move away from mass production without increasing the cost of products by reducing production costs because of increasing the production efficiency;

Keywords: Financial sector, globalization, global value chains, the Fourth Industrial Revolution

Introduction

The global transformation of the world economy has almost eliminated supply constraints and provoked a rapid expansion of sales markets. Now it is possible to produce various goods in large amounts and deliver them anywhere in the world (Hirst & Thompson, 1996). We have transnational corporations that generate global value chains as well as a system of transnational banks working with international currencies (mainly dollars). Under these conditions, it seemed that globalization would promote long-term economic growth. However, in the second decade of the 21st century, the active development of the world economic system, one of the catalysts of which was China, slowed down. The dynamics of world output weakened, and globalization processes began to diminish (WTO, 2011).

Problem Statement

While discussing economic development, it is appropriate to recall one of the main postulates of economics, formulated by Adam Smith: the division of labour increases productivity. But, as the division of labour becomes deeper, the producers’ risks significantly increase. A necessary condition to reduce the risks is the constant expansion of sales markets. Karl Marx rightly pointed out that the main problem of capitalism, unlike the previous systems, was not production, but implementation. The risks of each manufacturer are compensated through bank lending. The loans encourage short-term economic development, which subsequently gets killed by inflation. The constant stimulation of domestic demand through bank loans in the G-7 countries became the main factor of economic growth in the second half of the 20th century. However, inflation in these countries affected only financial assets; it did not involve the markets of economic benefits.

At the first stages of capitalism development, the increase in banking activities, and then the emergence of various financial tools, provoked a higher share of the financial subsystem of the economy in comparison to its other elements.

Research Questions

The main patterns of global economic development in the 21st century were financialization, protectionism, and regionalization.

Financialization is one of the regularities of the world economic development, which is reflected in the outperformance of the financial sector in comparison to other industries. The share of the financial sector in the total profit of corporations gets increased along with the number and role of financial services in forming GDP, etc.

Another pattern of global development at the current stage is the growth of protectionism and the popularity of regional agreements, which are the tools for reducing the negative impact of financialization.

Purpose of the Study

The purpose of the study is to identify the most important challenges to the world economy amid loose globalization and very low growth rates. We are also going to identify the patterns of global economic development that happened in the first decades of the 21st century.

Research Methods

Various methodological approaches and methods were used in the study. First of all, the dialectical approach, which involved the study of global development, patterns in dynamics. The patterns were viewed against the backdrop of correlations and interdependence between them. Such general scientific methods as synthesis and analysis were also applied.

Findings

The degree, forms, and mechanics of the financial system’s influence on global economic processes have changed drastically. Financial resources are not just servants of other resources anymore. They are a powerful catalyst for economic development.

The role of the financial sector in global economic development started growing with the transition to the Bretton Woods system. Actually, it was growing throughout the second half of the 20th century. The growth of dollar-based international trade as well as the increase in US domestic demand and the monetization of assets in dollars required more and more banknotes. As long as the United States dominated global production and consumption, the exclusive role of the US Federal Reserve, which controlled the number of dollar banknotes, did not have a significant impact on the development of the global economy. However, after the production centre had shifted to China, there was a gap in the production proportions. The US share in world production decreased significantly, but the share of consumption remained high. And then there were serious problems with the global financial system.

Since 2000, money creation in the United States has been limited and the monetary base has not increased. However, the money supply grew due to loan issues and household debts when consumer spending significantly exceeded the actual income received. Nevertheless, there was a growth of speculative activities, which diverted financial resources from the real economy. The financial bubble that grew up due to stimulating private demand, including in the real estate market, and the growth of US household debts burst in 2008, causing another financial crisis. Its consequence was a significant deterioration in the economic performance of transnational corporations engaged in the real economy. Lower yields of foreign direct investment triggered changes in the competitive strategies of many large transnational corporations. They began to sell off foreign assets and curtailed foreign activities, localizing production. Reindustrialization and reshoring became typical of developed countries’ economies.

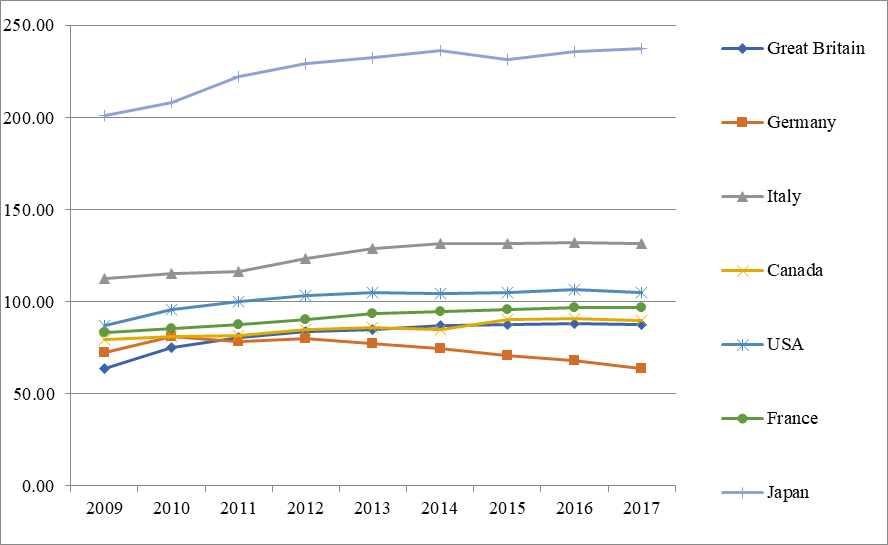

The use of fiscal tools to stimulate domestic demand resulted in the growth of budget deficits and an increase in public debts in the G-7 countries. Public debt growth rates in most of these countries far outstripped the GDP growth rates (fig. 1). This means that the macroeconomic mechanisms for stimulating domestic demand through loans and increased budget spending in developed countries exhausted their potentials (IMF, 2018a).

The financial crisis forced everyone to review the main approaches to the functioning of the global financial system (IMF, 2019). The ineffective functioning of the global financial system in the self-regulation mode became evident. The likeliness of financial markets to form financial bubbles and uncontrolled leverages produced systemic risks (Khudyakova, 2018). Now regulatory authorities (including central banks) are not able to prevent panic and financial crises on time.

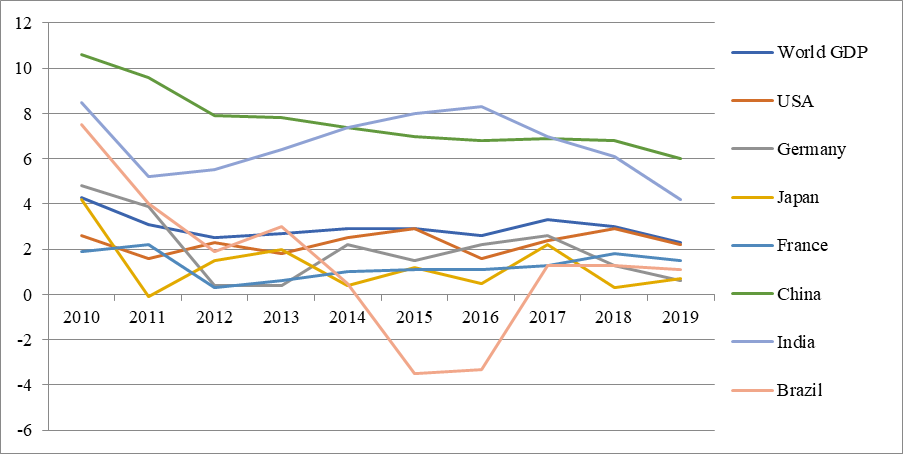

Financial liberalization, innovation, and globalization were initially seen as a way for entrepreneurs with limited financial resources to raise additional funds. The greatest gain from the free capital flow should have been received by developing countries that needed to develop production and diversify the economy, but they did not have their own financial support. However, the availability and costs of loans provided by the financial system, which started in the Bretton Woods, have always been determined by the ratings of international agencies affiliated with the Federal Reserve. A low rating provokes an increase in the cost of loans. This means an additional tax in favour of American banks. If the country supports the US policy, then the amount of this payment is reduced, if not, then it increases. Thus, financial tools in the liberal financial system have become politically significant. Therefore, for many countries, the costs of opening their economies to the free movement of capital were higher than the benefits (Reinert, 2016), since portfolio and speculative foreign investment did not trigger economic growth. The growth rate of world GDP has almost halved over the past decade (fig. 2).

The economic crisis, accelerated in the context of a pandemic, led to a significant increase in the number of unprofitable American companies from the Top-1500 list. Their total debts by the end of 2020 reached a record level comparable to that observed during the Dot-com bubble crisis, the stock collapse of 2000 as a result of the collapse of the NASDAQ technology index. In January-February 2021, the decline in industrial production was –4.0 and –6.4 % in Germany; –0.2 and –6.6 % in France in annual terms. Japan's GDP in the 1st quarter of 2021 decreased by 1.3 %.

Reducing consumer and investment demand means a disruption of the basic reproduction proportions, and as a result leads to active changes in the structure of the economy of both individual countries and the entire world economy. The pandemic has become a catalyst for structural shifts. In 2020-2021 the share of non-productive sectors, which mainly provided the economic growth of developed countries over the past 30 years, has decreased.

The desire to weaken the negative impact of financialization on national economies has resulted in increased protectionism and regionalization (Rodrik, 2001). These processes are also driven by drastic changes in the productive forces of developed economies. They began moving to the technologies of the Fourth Industrial Revolution. This means they rely on digitalization, the unification of information and operating systems, computer design, and the use of new materials. Consequently, the properties of economic benefits are changing together with the manufacturing industry. The traditional industrial enterprises are being replaced with two new types: the first-type enterprises produce standard components and semi-finished products with low costs just because they are big. The second-type enterprises are engaged in producing final products to meet the individual consumer needs. They also provide delivery and after-sales services. The enterprises of the first type are large and focused on the global market. The enterprises of the second type are regional and much closer to ultimate consumers. The high level of automation in both types of enterprises is changing the nature of production and the professional requirements for employees. Thus, the competitive advantage associated with the export of capitals to countries with relatively cheap labour is lost. The economic necessity of exporting capital from developed countries to developing ones is disappearing. At the same time, as GDP grows and domestic demand expands in peripheral countries, labour becomes more expensive (WTO, 2020). For example, the growth of real earnings and incomes in China shows that China is not a cheap labour country anymore. However, on the other hand, there are opportunities for expanding domestic demand and it is a trigger for further economic growth. Thus, reindustrialization and reshoring in the developed countries are associated not only with problems in transnational corporations and protectionism but also with the economic efficiency of the Fourth Industrial Revolution.

Conclusion

The modern world economy has faced such challenges as financialization, the Fourth Industrial Revolution, and regionalization. Financialization has deprived the US Federal Reserve of control over the global financial system and markets. Regionalization and protectionism have grown up. The transition to new technologies due to the Fourth Industrial Revolution has changed the nature of labor, and, consequently, the system of economic relations. We all are moving from a liberal market economy to a new economic model.

References

Hirst, P., & Thompson, G. (1996). Globalization in Question: The International Economy and the Possibilities of Governance. Polity Press.

IMF (2018a). Fiscal Monitor Reports: Managing Public Wealth. https://www.imf.org/-en/Publications/FM/Issues/2018/10/04/fiscal-monitor-october-2018

IMF (2018b). World Economic Outlook. Retrieved on 2019/04/10 from https://www.imf.org/ru/Publications/WEO/-Issues/2018/03/20/world-economic-outlook-april-2018

IMF (2019). Global Financial Stability Report. Retrieved on 2019/04/10 from https://www.imf.org/en/Publications/GFSR/Issues/2019/10/01/global-financial-stability-report-october-2019

Khudyakova, L. (2018). Reforming Global Finances in the Context of Sustainable Development. The World Economy and International Relations, 7, 38–47.

Reinert, E. S. (2016). How Rich Countries Got Rich ... and Why Poor Countries Stay Poor. Publishing house the Higher School of Economics.

Rodrik, D. (2001). Trading in Illusions. Foreign Policy, March/April, 55–62.

The World Bank. (2021). World Bank national accounts data, and OECD National Accounts data files. https://data.worldbank.org/indicator/NY.GDP.MKTP.KD.ZG?view=chart

WTO (2011). International Trade Statistics 2011. https://www.wto.org/-ENGLISH/res_e/statis_e/its2011_e/its2011_e.pdf

WTO (2020). Report on G20 Trade Measures. https://www.wto.org/english/-news_e/news20_e/report_trdev_jun20_e.pdf

Copyright information

This work is licensed under a Creative Commons Attribution-NonCommercial-NoDerivatives 4.0 International License.

About this article

Publication Date

31 January 2022

Article Doi

eBook ISBN

978-1-80296-121-8

Publisher

European Publisher

Volume

122

Print ISBN (optional)

-

Edition Number

1st Edition

Pages

1-671

Subjects

Civilistic Doctrine, Digital Transformation, Sociocultural Transformations, Philosophy of Law, Public Authorities

Cite this article as:

Baryshnikova, N. A., Dushevina, E. M., Naidenova, N. V., Santovich, E. A., & Shkryabina, A. Y. (2022). Patterns Of Global Economic Development In The Context Of Modern Challenges. In S. Afanasyev, A. Blinov, & N. Kovaleva (Eds.), State and Law in the Context of Modern Challenges, vol 122. European Proceedings of Social and Behavioural Sciences (pp. 87-92). European Publisher. https://doi.org/10.15405/epsbs.2022.01.15