Abstract

The subject of enterprises location is one of the key issues in the field of enterprise science. The problem of the location of logistics facilities (including warehouses) is tackled relatively rarely. It is also a relatively new issue, and therefore still poorly researched. The study sets three types of goals: methodical, application and cognitive. The methodological goal is to present a method for assessing the location attractiveness of the warehouse market. The application purpose is related to the provision of practical applications regarding the selection of the area of location of warehouse facilities. The cognitive goal is an attempt to assess the level and diversity of the attractiveness of 29 locations in Poland. The study uses the classical unitarization method adopted for the assessment of partial indices, which were then reduced to the synthetic form of the index. The location factors underlying the assessment are: transport accessibility, business conditions, labour market, and the economic potential of the area. The overriding issue is geographic conditions - resulting from the location. These, in turn, affect the costs of transport, which account for approximately 50% of the costs of operating the supply chain. The result of the research is a ranking of location attractiveness of the warehouse market.

Keywords: Attractiveness, evaluation method, location, warehouse market

Introduction

The choice of the optimal location of an enterprise depends on its specificity, size and development strategy as well as operational space, i.e. geographic conditions. But the location decision is not only of a geographical nature. It is also, and even above all, an economic problem. This is because it determines the investment outlays incurred by the entrepreneur and the operating costs of the enterprise and its overall efficiency. Therefore, the choice of location is mainly determined by the economic calculation.

It is natural and economically justified that every economic entity, when looking for places to do business, chooses those that will best meet its needs. Therefore, we are looking for places with the highest utility values (features) of location from the point of view of our business (Budner, 2004, p. 24). Compliance of these values with the investor's requirements determines the high attractiveness of the location, and thus also high benefits. These benefits can be referred to as location factors. The areas that offer the optimal combination of location factors are attractive in terms of location. Location attractiveness understood in this way is the subject of the analysis conducted in this article.

The study serves three types of goals: methodological, application and cognitive. The methodological goal is to present a method for assessing the location attractiveness of the warehouse market. The application purpose is related to the provision of practical applications regarding the selection of the area of location of warehouse facilities. In turn, the cognitive goal is an attempt to assess the level and differentiation of the attractiveness of this market in Poland. The undertaken goal was achieved thanks to the application of the classical unitarisation method adopted for the assessment of partial indicators. The study covered 29 different warehouse markets in Poland.

The essence of the warehouse real estate market

It is difficult to imagine the modern activity of industrial, logistic and commercial enterprises without warehouse management (Budner, 2020a). This term broadly refers to the construction of storage facilities which are functional, equipped with the necessary machines and devices and in accordance with accepted standards. This activity thus creates the resources of the warehouse real estate market. The warehouse market is a specific part of the overall real estate market. It is an informal market, ie it has no permanent seat or status. Like the broadly understood real estate market, the warehouse market is a set of conditions under which the transfer of rights to use objects takes place and contracts are concluded that create mutual rights and obligations, combined with their ownership (Budner, 2020b).

A warehouse facility is commonly understood as a type of real estate, usually considered to be a building intended for the storage of various types of goods. It can be simplified to assume that a warehouse is an object (building or structure) with space specifically planned for storing and manipulating material goods in the most effective way. Coyle et al. (2002, p. 314) define a warehouse similarly, i.e. as a building structure designed and adapted to store and move inventories (materials) in a specific space.

Warehouses are used for temporary storage of material goods, necessary in all phases of the economic process, carried out in the enterprise: in supply, production, distribution and sale (Rożej et al., 2014). The warehouses are also used for the implementation of such logistic processes as: ordering, receiving and issuing inventories, packing, sorting packages, picking and intermodal reloading, forwarding, administrative processes. The functions of warehouses are subject to change due to the growing importance of additional services they provide. Warehouses are therefore an important link in the supply chain and network, and their functions affect the technologies they use, the organization of work and their location (Kisperska-Moroń & Krzyżaniak, 2009; Majchrzak-Lepczyk & Maryniak, 2020; Szymonik & Chudzik, 2018).

Location attractiveness as a determinant of investment location

There is no universal enterprise, so there are no standard location factors universal for all investments. In case of companies in the warehouse and logistics industry, transport availability is the most typical location factor. Transport should even be regarded as superior to other factors (including the raw material and energy basis). However, it should also be taken into account that the entire logistics chain is important for manufacturing companies. Often, logistics and production companies operate in close proximity, creating clusters. Hence, typical location factors for most companies in the logistics sector are, apart from transport, the proximity and size of the sales market, as well as resources and labour costs. All factors show high spatial variability. Their combination is usually decisive for the location and its attractiveness.

Kuciński (2001) claims that a given place is attractive for an enterprise as long as it creates an opportunity to reduce costs and increase its competitiveness. Hence, it can be concluded that the company's success and its market position may depend not only on what it produces, how it is done, in what quantity and price, but also where it is done. Therefore, there is a natural question of the location of the enterprise, the possibilities and scale of running a business, and the combination of various location factors conducive to achieving market success. It is a matter of the accuracy of the assessment of location criteria, which will allow the incorporation of the company's functions into the market environment, depending on the spatial range of activities and connections. An attractive location thus helps to maximize profits and reduce the risk of potential investment failure.

Location attractiveness here is synonymous with investment attractiveness of a place, because only an attractive location allows to reduce investment outlays, but most of all future costs of the enterprise's activity (see Kalinowski, 2007). Investment attractiveness is one of the most important elements related to shaping economic activity and determining the competitiveness of individual areas. It is a concept that is defined in various ways. Since the word "attractiveness" (Latin attractio) means attraction, in the colloquial meaning investment attractiveness means the ability to attract investors by creating favourable conditions for business activity. In the study by Tarkowski (2015), investment attractiveness was adopted as the ability to encourage investment by offering a combination of location benefits that can be achieved in the course of running a business. The areas offering the optimal combination of location factors create the best conditions for the functioning of enterprises, thus attracting investors. Czerwieniec (2007) defines investment attractiveness similarly, i.e., as a set of advantages of a given place, as some areas show relatively better conditions for investment activity than others. The issue of investment location is multidimensional. Similarly, the assessment of investment attractiveness is complex and depends on the type of activity, on the participation of individual factors in the production process, organization and functioning of the enterprise, and on the subjective perception of individual factors by investors (Małuszyńska, 1996). The real investment attractiveness of a given area can only be determined for a specific type of investment at a certain time. It should be remembered that apart from objective factors, the location decision is also influenced by subjective factors, depending on the value system of the decision-makers, their knowledge, and the image shaped by e.g., the media or politicians.

Measurement of the location attractiveness for the warehouse market

Location attractiveness factors

As we mentioned above, the decision to locate a logistics facility depends on a number of factors. Some of them result directly from the nature of the business. Others are typical cost factors associated with the operation of the entire supply chain. They are a consequence of a simple economic calculation. The geographic, resource and economic criteria for evaluating a given area are also important. Sometimes it is difficult to assign individual factors to particular categories, as they are not always disjoint. Therefore, the measurement of the attractiveness of the location is multi-criteria.

In order to reflect the attractiveness of the location as accurately as possible, several groups of criteria should be analysed, representing the most important areas related to logistics activities. These are: 1) transport accessibility of the area; 2) the situation on the local labour market; 3) the existing economic potential of the area; 4) conditions for the lease of warehouse and office space.

Transport accessibility is, as it was already mentioned, the most important factor in the process of locating a logistics facility and its assessment. The right choice of warehouse location, corresponding to the transport needs of a given company, is crucial for shortening delivery times and the financial result of the network. First of all, it allows you to significantly reduce transport costs and gain a competitive advantage on the market. The analysis of the operational costs of the supply chain shows that transport is the largest component of logistics costs (50% on average) (The share of the remaining most important cost factors is as follows: 22% - inventory carrying costs; 10% - labour; 8% - customer service; 4% - rent (Establish, Inc., Logistics Cost and Service, HWD & Grubb & Ellis, Global Logistics; Exchange, Inc., Logistics Cost and Service Report).

) . Logistic cost is understood here as the sum of all expenditure incurred to provide a good or service on the market, mainly to the final consumer. Such a high share of the cost of transport in general costs is observed regardless of the method of its calculation, i.e. as a share in sales or as a share converted into a unit of weight of goods. This means that despite a significant reduction in the share of transport costs in general costs, the role of transport as a location factor is still significant, and in relation to the logistics industry - dominant and even determining. In other words, transport costs depend on the length of transport routes, which determines the location of the facilities.

Another important criterion for the location of a warehouse is the situation on the local labour market. Labour resources shape the attractiveness of this area. Although labour costs (For example, the scale of differentiation in wages in Poland in terms of regions amounts to as much as 50%, and in the analysed locations it is even greater and amounts to as much as 65%. The highest salaries are received by people working in the largest agglomerations. In turn, the lowest wages apply to employees employed in smaller centres.) account for only about 10% of the operational costs of a logistics centre, a more important issue, significantly increasing the attractiveness of a given location, is the availability of an appropriate number of employees with the desired skills and experience. The weight of employee availability is gaining importance as a location criterion due to the emerging labour shortages in some more developed markets. This factor speaks in favour of less developed locations. The unemployment rate is clearly higher there than in the largest agglomerations. However, the level of employee qualifications in agglomerations is higher than in smaller centres.

Yet another important factor influencing the investment attractiveness and development of the warehouse market is the economic potential of the area and its dynamics. Its impact on attractiveness is related to the existence of the economic environment at the level of technical development corresponding to the investor, enabling the establishment of cooperation in the field of necessary services and supplies, ensuring the optimal functioning of the investment. Capital is attracted by developed and stable areas. The success of the existing companies (including their number) proves that they have found a favourable climate for the development of their activities: an absorbent market, qualified workforce, favourable attitude of local authorities, good administrative climate, etc. These attract further new investors.

The financial terms of the lease result from the location and current trends in supply and demand. They are a derivative of the land price, cost and type of real estate investment. The maturity of a given local market is also important, as a consequence of which is a greater choice of tenants. However, it should be noted that the costs related to the rental of warehouse property and offices constitute only a small share in the operating costs of logistics companies (4-5%), which also include service fees. Therefore, savings in transport costs can more than compensate for the higher rental costs.

Hence, the importance of individual groups of factors is not the same. In order to reflect the attractiveness of the location as accurately as possible, different groups of factors were assigned different weights. These weights result from both economic practice and the opinion of experts on the warehouse real estate market as well as empirical research. Their likely impact on the value of the warehouse property market is presented in Table 01.

Research area, time range and data sources

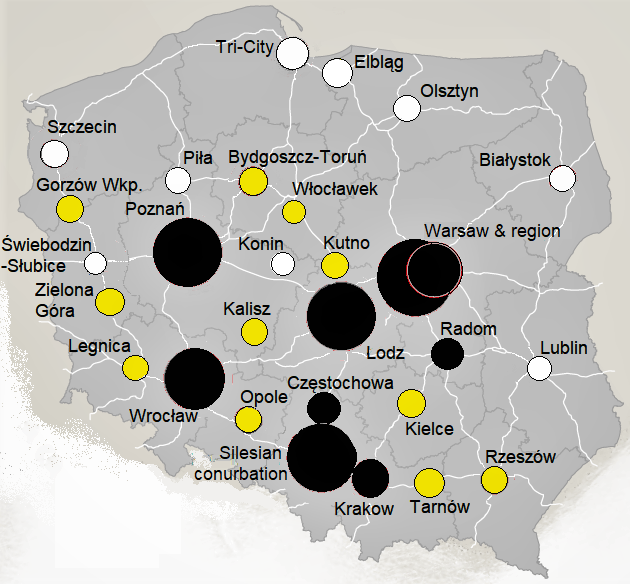

The adopted research area is Poland, where 29 existing warehouse and logistics locations (compact areas) were selected. It is a heterogeneous group, diversified in terms of population potential, area, transport accessibility and the level of development and maturity of the local logistics industry. It is made up of the so-called the big five (i.e. Warsaw and its region, the conurbation of Silesia and the agglomerations of Lodz, Poznań and Wrocław), on the other hand smaller centres, defined as emerging markets (e.g. Szczecin, Tri-City, Lublin) or promising, peripheral markets (such as Włocławek, Piła, Tarnów or Radom).

All analysed locations are treated as urban complexes, small and large agglomerations or the Silesian and Tricity conurbations. Only the city of Warsaw is an independent, separate centre within administrative boundaries. From the statistical point of view, the remaining areas are made up of cities/towns and the surrounding poviats.

The time frame of the study is determined by the availability of the most recent data possible. Due to the different inertia with which they are published, depending on the type of data, the data from the years: 2018 were used to indicate GDP; 2019 to determine the number of GN entities, unemployment, gross salary, average rental price of warehouse space, expressways; 2020 to determine the average price of renting office space.

The study uses quantitative data mainly from the public statistics system - Local Data Bank - Statistics Poland - supplemented with data and information from other sources. The following websites were mainly used: officemap.pl; morizon.pl; Nieruchomości-online.pl, and data from real estate advisory companies Cresa and Jones Lang Lasalle. The obtained data can be considered complete, reliable and allowing for the study.

Research methodology

Each of the 29 locations was analysed in terms of four criteria important from the point of view of logistics operations. In order to reflect the nature of the areas as accurately as possible, each of the criteria was assigned two detailed indicators, which should contribute to greater precision of the results obtained. As a result of the verification of the available empirical material, partial indicators listed in Table 02 were adopted for a synthetic presentation of the issue of attractiveness.

All indicators adopted for the analysis are measurable and expressed in relative terms. Five of the adopted indicators are stimulants, and three are destimulants (Table 2). The essence of the proper selection of partial indicators is that these indicators should be of a different cognitive value. The indicators constituting the basis for determining synthetic measures of development must be primarily characterized by a low level of correlation. The analysis of the feature correlation matrix shows that the adopted partial indicators are characterized by an appropriate level of correlation and all of them can be used to measure the attractiveness of the location.

Two indicators were used to assess the transport accessibility of the analysed locations:

- length of expressways within a radius of 60 km from the selected location;

- population in the area defined by the isochrone of 1 hour.

The assessment of transport accessibility of selected locations was determined on the basis of road transport. In Poland it is dominant over other means of transporting goods. According to the Statistics Poland, road transport accounts for over 85% of cargo (in tonnes). The popularity of road transport in Poland is largely influenced by the developed and constantly expanding road infrastructure. A radial isochrone representing an ideal (circular) service area was used to define the area delineated from the centre by the 60-minute isochrone. Transport accessibility is also the range generated by the selected location, so you should take into account the population located in the area defined by the distance that can be covered in one hour. The 1-hour isochrone designates an area that can be considered as the so-called the last mile. The population within one hour of driving distance also means access to potential employees who, thanks to convenient connections, are willing to cover a slightly longer way to the place of employment.

When analysing the situation on the local labour market in terms of investment attractiveness, the following were taken into account:

- average gross monthly salary at the location;

- unemployment rate.

The analysis of the above-mentioned indicators allowed, although to a limited extent, for the quantitative and qualitative assessment of local labour resources. The amount of remuneration is an important parameter taken into account by companies conducting logistics activities, and it is treated as a destimulant. In turn, the unemployment rate can be viewed as the availability of labour. Therefore, from the point of view of enterprises, it should be treated as a stimulant. In view of the shortage of employees, the importance of this factor has increased.

The economic potential of the location was analysed using:

- GDP per capita in the area in the potential range of the location;

- number of entities per 1.000 inhabitants.

Gross domestic product per capita is the basic and most universal measure determining the level of development. The number of economic entities per 1.000 inhabitants is one of the most frequently used indicators to assess economic activity.

Two indicators were used in the analysis of the lease conditions for the warehouse and office space:

- the average base rent for the rented warehouse space;

- the average cost of renting office space.

The financial aspect related to the rental of warehouse and office space is generally of marginal importance in relation to the savings that can be generated, resulting from the selection of the optimal location. They are the most important for logistics companies that operate with low margins.

There is a large group of methods for creating synthetic indicators for measuring development. Determining the synthetic index requires proper data comparability. Data comparability is ensured by their normalization, i.e. the unification of the range of variable values. Classical unitarisation was used in the analysis where we obtain variables with a uniform range of variation [0-1], defined by the difference between their maximum and minimum values. We calculate them as follows:

(A) for the indicator being a stimulant:

z_ij= (x_ij-min(x_i))/(max(x_i )-min(x_i));i=1,2,...,n; j=1,2,...,m.

(B) for an indicator of a destimulant nature:

z_ij= ( max(x_i )-x_ij)/(max(x_i )-min(x_i));

where: zij-standardized value of j-th feature in i-object,

xij- empirical value of the j-th feature in the i-object,

max (xi) / min (xi) - maximum / minimum value for the i-th feature,

Determining the synthetic index (SI) consists in calculating the arithmetic mean of partial indices taking into account their weights. In accordance with the method proposed by Kaczmarek and Parysek (1977), distinguishing the location attractiveness classes for the calculated indicators will be based on the arithmetic mean (x ̅) and the standard deviation (σ), on the basis of which the categories of units will be distinguished (Table 3).

Location attractiveness - research results

Out of 29 locations, the leaders in location attractiveness (level A) turned out to be: the Silesian conurbation, the Łódź agglomeration and the Warsaw region. High location attractiveness (B) is characteristic of another six locations: the agglomerations of Krakow, Wrocław and Poznań, as well as Częstochowa, Radom and Warsaw. Assuming that Częstochowa belongs, in broad terms, to the Silesian conurbation about 60 km away (isochrone 1h) and similarly Radom to the capital of Poland, located less than 100 km away, all areas belonging to the five agglomerations making up the largest market were in the forefront of the ranking concentrating modern warehouse space in Poland. Their centres are the largest Polish cities - metropolises.

The common strength of these areas is the enormous potential of the demand for warehouse and logistics services. These five locations (including the Krakow agglomeration) are inhabited by approximately 20 million people within the radius of the 1h isochrone (i.e. over 50% of the Polish population). The great demographic potential (large resources of employees and consumers - sales market), as well as economic potential with a diversified sectoral structure justifies the concentration of numerous warehouses. In addition, these areas are characterized by the greatest accessibility due to the multi-branch economic and transport infrastructure (roads with high capacity). This allows for the rapid development of the logistics services market.

The most numerous group is made up of 11 locations belonging to the average attractiveness class. Most of them are defined by industry portals and logistic magazines (including Jones Lang Lasalle, 2017, 2019; Colliers International, 2019) as emerging warehouse markets (e.g., Bydgoszcz-Toruń, Rzeszów, Kielce, Zielona Góra, Opole). These are locations that are usually based on large towns (from 100.000 to 140.000 inhabitants), the largest being Rzeszów (195.000), Kielce (196.000), Toruń (202.000) and Bydgoszcz (350.000). Their location is distinguished by the peripheral nature and distance from the main concentration centres of logistics facilities, and at the same time good transport accessibility (Figure 01).

There were 9 locations in total in the low and lowest attractiveness categories. Apart from Konin and Piła, they are located near the country's borders. Their low position is primarily a consequence of their geographical location, described by the length of expressways and spatial accessibility. Despite significant progress in the expansion and modernization of the transport infrastructure, these areas are still not very well accessible. The second important factor that determined the low position is the low demographic potential in the 1 hour isochrone, resulting from the low level of urbanization and industrialization. Against this background, the very low position of the Szczecin and Tri-City agglomerations, which belong to the dynamic, emerging warehouse property markets in Poland (especially Szczecin), is surprising (see Figure 1). In terms of supply, the Tri-City and Szczecin constitute the sixth and seventh warehouse markets, respectively, with an area of 799.4 thous. m2 and 777.2 thous. m2. This situation is caused by the coastal and border location of both agglomerations, which results in a lower demographic potential and a shorter length of roads around them. Such a low position of both locations does not fully reflect their level of location attractiveness. The border and coastal location with access to seaports is very favourable as it is conducive to the location of entities conducting logistics activities in Western Europe from Poland. This allows you to benefit from both lower rental and labour costs on the Polish side of the border.

Conclusion and Discussions

The warehouse real estate market in Poland has been developing very dynamically since 2004 (Budner, 2020a). The highest increase in warehouse space took place after 2017. Despite the fact that the settlement structure in Poland is characterized by a polycentric, moderate concentration, the demand for warehouse space is constantly concentrated in the key five areas of the agglomeration: Warsaw, Silesia, Lodz, Wrocław and Poznań. The conducted research on the assessment of the level of market location attractions confirms this regularity.

The high position of attractiveness leaders is primarily the result of the best transport accessibility. It is a derivative of the developed road infrastructure and the demographic potential (of consumers and the workforce) within the operational range of enterprises of given locations. The centres with the highest population generate a significant demand for goods produced in industrial facilities and stored in warehouses. That is why the existing economic potential is also such an important factor of the attractiveness of the location. The situation on the local labour market and the financial terms of real estate lease (despite the fact that in the most attractive locations these were unfavourable for investors and tenants) were of marginal importance. A great location allows you to more than compensate for higher rental or salary costs.

The lower location attractiveness of the areas does not mean that they have no chance of attracting investors. There are chances but less than in other, prime locations. Along with the development and modernization of the economy, the demand for modern logistics space will also be generated in smaller centres. Along with the shrinking availability of employees in the largest centres, one can expect more and more interest from logistics companies also in other large and medium-sized towns (Jones Lang Lasalle, 2019, p. 23). This is confirmed by the slowly progressing tendency of the diminishing dominance of the "big five". The share of emerging markets is steadily increasing. This means greater dispersion and uniformity of the distribution of the storage area, on the one hand and strengthening of other smaller and less favourable centres on the other. In addition, investors' attention is attracted more and more often by new, smaller markets, where it is easier to recruit cheaper employees. This should be assessed positively, also in terms of the increased investment attractiveness of these areas.

In this context, the low location attractiveness of Szczecin and the Tri-City is surprising. It is the result of a certain imperfection of the adopted research method, which "assumes" that the state border or the coastline is a barrier preventing cooperation and the flow of goods, services and people. Therefore, in each case the quantitative analysis should be supplemented with logical analysis and qualitative factors (e.g. state policy) should be taken into account. Nevertheless, it can be concluded that the applied research method of measuring the attractiveness of the location turned out to be an interesting and promising analytical tool, the potential of which can be increased provided that more complete and diversified information is available. The undertaken considerations may also become a contribution to further discussion on the methods of measuring the attractiveness of warehouse locations and the factors that are taken into account in these measurements.

References

Budner, W. (2004). Lokalizacja przedsiębiorstw. Aspekty ekonomiczno-przestrzenne i środowiskowe [Location of enterprises. Economic, spatial and environmental aspects]. Wydawnictwo Akademii Ekonomicznej w Poznaniu.

Budner, W. (2020a). Centra logistyczne – uwarunkowania i motywy lokalizacji oraz ich znaczenie dla miast [Logistics centres - conditions and motives of location and their significance for cities]. In W. Jagodziński, & W. Rakowski (Eds.), Szlakami geografii ekonomicznej. Przestrzeń-Instytucje-Metodologia (pp. 127-142). Bogucki Wydawnictwo Naukowe.

Budner, W. (2020b). Determinanty i tendencje zmian na rynku magazynowym w Polsce [Logistics centres - conditions and motives of location and their significance for cities]. Gospodarka Materiałowa i Logistyka, 11, 2-12. https://doi.org/10.33226/1231-2037.2020.11.1

Colliers International. (2019). Rynek nieruchomości magazynowych. Market Insights [Warehouse real estate market]. Warszawa.

Coyle, J., Bardi, E., & Langley Jr., C. (2002). The Management of Business Logistics. A Supply Chain Perspective. South-Western Publishing.

Cresa. (2019). Warehauses. Warsaw.

Czerwieniec, E. (2007). Bezpośrednie inwestycje zagraniczne w środowisku lokalnym [Foreign direct investments in the local environment]. Zeszyty Naukowe nr 94. Poznań: Wydawnictwo Akademii Ekonomicznej w Poznaniu.

Jones Lang Lasalle. (2017). Rynek nieruchomości magazynowych w Polsce w 2016 r [The warehouse real estate market in Poland in 2016].

Jones Lang Lasalle. (2019, October 3). Small town big deal. https://www.jll.pl/en/trends-and-insights/research/small-town-big-deal-2019

Kaczmarek, Z., & Parysek, J. (1977). Zastosowanie analizy wielowymiarowej w badaniach geograficzno-ekonomicznych [Application of multivariate analysis in geo-economic research]. In Z. Chojnicki (Ed.), Metody ilościowe i modele w geografii. PWN.

Kalinowski, T. (Ed.) (2007). Atrakcyjność inwestycyjna województw i podregionów Polski 2007 [Investment attractiveness of voivodships and subregions of Poland 2007]. Gdańsk: Instytut Badań nad Gospodarką Rynkową.

Kisperska-Moroń, D., & Krzyżaniak, S. (Ed.). (2009). Logistyka [Logistics]. Poznań: Instytut Logistyki i Magazynowania.

Kuciński, K. (2001). Przestrzeń operacyjna firmy a jej otoczenie lokalne [The company's operating space and its local environment]. In I. Fierla, & K. Kuciński (Eds.), Lokalizacja przedsiębiorstw a konkurencyjność. Materiały i Prace Instytutu Funkcjonowania Gospodarki Narodowej (pp. 13-37). Szkoła Główna Handlowa.

Majchrzak-Lepczyk, J., & Maryniak, A. (2020). Rynek powierzchni magazynowej i elementy jej wyposażenia [Warehouse space market and elements of its equipment]. Wydawnictwo Uniwersytetu Ekonomicznego w Poznaniu.

Małuszyńska, E. (1996). Lokalizacja inwestycji zagranicznych w zachodnich województwach Polski [Location of foreign investments in western voivodships of Poland]. In R. Domański (Ed.), Nowa generacja badań gospodarki przestrzennej. Biuletyn KPZK PAN, 174, 89-104.

Rożej, A., Stolarski, S., & Śliżewska, J. (2014). Organizowanie i monitorowanie procesów magazynowych [Organizing and monitoring warehouse processes]. WSiP.

Szymonik, A., & Chudzik, D. (2018). Logistyka nowoczesnej gospodarki magazynowej [Logistics of modern warehouse management]. Difin.

Tarkowski, M. (Ed.) (2015). Atrakcyjność inwestycyjna województw i podregionów Polski 2015 [Investment attractiveness of voivodeships and subregions of Poland 2015]. Instytut Badań nad Gospodarką Rynkową.

Copyright information

This work is licensed under a Creative Commons Attribution-NonCommercial-NoDerivatives 4.0 International License.

About this article

Publication Date

31 December 2021

Article Doi

eBook ISBN

978-1-80296-120-1

Publisher

European Publisher

Volume

121

Print ISBN (optional)

-

Edition Number

1st Ed.

Pages

1-286

Subjects

Strategic management, Leadership, Technology, Sustainability, Society 5.0, New strategic challenges

Cite this article as:

Budner, W. W. (2021). Method Of Assessing The Location Attractiveness Of The Warehouse Market. In M. Ozsahin (Ed.), New Strategic, Social and Economic Challenges in the Age of Society 5.0 Implications for Sustainability, vol 121. European Proceedings of Social and Behavioural Sciences (pp. 255-266). European Publisher. https://doi.org/10.15405/epsbs.2021.12.04.26