Abstract

Development of an algorithm and technology of managerial decision-making in conditions of uncertainty is a vital task of the current phase of economic modernization based on digital methods. The success of a company in the market, its reputation and the basis of efficient performance of its production system, the functioning of which is dependent on the uncertainty level of the organizational environment, are determined, first and foremost, by a complex of scientifically justified managerial decisions. The proposed technology of justification of decisions provides the required accuracy and improved quality of development of plans for the operational and strategic tasks. The process technology consists of several stages. The first stage provides a solution to the problem of identifying core conditions in choosing a solution. The second solution forms the composition of possible alternatives as a set of management decisions of the enterprise. At the third stage, the development of target priorities and their reflection in the estimated indicators is carried out. At the fourth stage, alternative solutions are assessed based on a set of optimality principles. The fifth stage involves analyzing the sensitivity of the solution, characterizing the reliability of the choice of the appropriate option. The final stage is a comparative assessment of the results based on vector optimization methods. The proposed algorithm makes it possible to increase the reliability of the choice of solutions, ensuring that the probability of errors is minimized.

Keywords: Decision-making technology, condition of uncertainty, decision matrix, expert assessments, principle of optimality, sensitivity analysis

Introduction

The choice of the method to solve organizational and managerial tasks as well as indicators that are used as the criteria for the analysis of alternatives are determined in the first place by conditions in which the decision is analyzed. In this regard, three approaches towards identification of choice conditions are proposed: certainty – full definitiveness of the most significant factors of the decision; risk – a probabilistic characteristic of forecasted parameters; uncertainty – most of information is simply not available.

Uncertainty is characterized by the fact that the subject responsible for decision-making is not aware of the probability of development of analyzed situations. In such conditions the selection of the best alternative is based on the preference according to the degree of risk, on the one hand; and on the other, it is based on the identification of the respective selection criterion (Syed & Lawryshyn, 2020).

The business environment is being subjected to uninterrupted and chaotic changes. The trend gathered momentum at the end of the last century and has been prevailing for the last three decades. The scale of the field of play, the players themselves and the competition methods transform the conventional rules of doing business (Brazhnikov & Khorina, 2021). Inevitably, this projects onto the solution of tasks of planning the production capacities.

An uncertainty might be defined as a scattering of probable outcomes (solutions) within the frames of stochastic development of factors determining the choice of solutions (Shafiei et al., 2016). The condition of uncertainty is characterized by such a situation that complicates the assessment of possible solutions either due to lack of required information or due to ambiguous results of data analysis that lead to diverse conclusions (Diaz et al., 2021).

An uncertainty is the most complicated situation for decision-making. The problem to be solved is not structured and has no definitive out line, the complex of alternative solutions defies identification, most of information is simply not available. In this case, complications arise in the process of looking for target priorities and possible alternatives.

Problem Statement

The core contradiction lies in the fact that the manager wishing to provide some support to making organizational and managerial decisions and to raise the degree of scientific justification of choice turns to various sources of information, and in doing so, one gets into a methodological trap (Firk et al., 2021). On the one hand, there would be sources consisting of an incomprehensible mass of equations, and it would be difficult to find one’s way in them due to an unconvincing economical basis. On the other hand, there would be sources relying on lengthy generalized discussions of psychological foundation of efficient solutions, and one would find it hard to locate something resembling an algorithm in them due to the lack of the mathematical base.

Research Questions

The formation of a decision-making algorithm is primarily associated with the study of issues:

– identification of selection conditions;

– analysis of the relationship between targets and principles of decision-making criteria;

– determination of the sequence of the use of methods.

Purpose of the Study

The goal is to identify the succession of actions to choose the best option of designing the production capacities according to the target parameters of the object of research.

Development of the technology of choosing the optimal decision involves resolution of several interconnected tasks:

– identification of succession of major steps in the process of managerial decision-making;

– identification of the content of methods enabling optimality of solution choice;

– forming of a system of criteria characterizing the extent to which the target parameters are implemented.

The object of research is specific factors of the market environment affecting the formation of the respective level of uncertainty and industrial specifics of functioning of enterprises. The major group includes machine building and oil and gas companies of the urban district of Samara and of the Samar Region.

The subject of research is modeling of managerial solutions based on concordance of optimization methods within the framework of planning of production capacities.

Research Methods

The basis of the decision-making process technology is economical and mathematical modeling which, in its turn, relies on a complex of interrelated methods:

- Expert methods as the source of alternatives to respond to the uncertainty of the situation under analysis and as a means of preliminary quantitative evaluation of quality of the alternatives.

- Balanced concurrence method (solution matrix) as a tool of structuring the uncertainty factors and possible alternatives ensuring preliminary selection of the optimal solution.

- System of principles (methods) of optimality as a mechanism of alignment of target priorities and assessment of the degree of business risk.

- Sensitivity analysis as a method of assessment of resilience of alternatives under comparison vs. strictly antipodal values of the factor that affect the choice.

- Methods of vector optimization as a means of comparative assessment of analyzed solutions vs. target priorities of the object of research.

Findings

The major result of our research is the model (technology) of managerial decision-making.

The process of managerial decision-making in conditions of uncertainty may be presented as a succession of phases:

1. Identification of conditions of choice.

2. Proposal of alternative options.

3. Forming of the system of targets – selection of assessment indicator.

4. Assessment of alternatives based on principles of optimality.

5. Analysis of sensitivity of decision.

6. Assessment of result based on methods of vector optimization.

The first three stages are responsible for the development of the solution matrix (balance concurrence method).

In the following three stages, alternative options are assessed as well as their resistance to the change of conditions, and the best option is selected.

Identification of conditions of choice

Within the first stage, various factors are analyzed to select the key conditions affecting the decision-making process. The condition of choice is the key factor determining the level of uncertainty in decision-making.

Contrary to the proposal that uncertainty is the reflection of ambiguity, instability and the unknown, one should structure the problem in a special manner and thus obtain the answer to the question of what the hazard is. In other words, one needs to describe the major sources of problems to analyze the existing situation in a deeper way (Kulikova, 2013).

Among the serious challenges, one may identify the following: forecasting the market demand level, tactical decisions of direct competitors, potential changes in the consumer preference, and structural transformation of market environment.

The search for and identification of sources is a topic for another paper. Here we should focus on the importance of identifying (locating) the possible states of the analyzed problem. With respect to evaluation (study) of consumer preference, one may use the following notions: high, medium, or low forecasted levels of market demand. If one needs a broader differentiation of the character of demand, one may use the parameters above or below medium. Of course, these states need digitization, i.e. a range of values is to correspond to each of them.

In order to identify and structure the most preferable conditions of choice one needs to involve different methods to simplify identification of external factors.

It is to be noted that after study in gall the sources of uncertainty the risk of making a wrong decision will not disappear. The situation on the market is ever-changing, new factors emerge as do additional circumstances. Nevertheless, the analysis of conditions of choice unlocks the range of reactive steps, or alternatives.

Proposal of alternative options

The proposal of alternatives is the second step of the decision-making process. The major task is to determine the composition of possible choice options. This is the most complicated and controversial stage. The difficulty of the task lies in the fact that in the practical conditions all the possible options may not be clearly defined and fully grasped due to various reasons. In some cases, it maybe the lack of time or limited resources, or the ambiguous nature of the problem, and, in some cases, it may be the dynamic nature of the market environment.

Therefore, the search for materials is the search for a compromise between two positions. On the one hand, it is the forming of a relatively full picture of alternative solutions – which inevitably results in the labor intensity involved in their assessment; and on the other hand, it is the limitation of the number of alternative possibilities, which might result in the loss of the optimality of the decision.

In this regard, one should focus on organizing a creative and inventive environment. The key role will be with such tools and methods as making proposals, making a cause and effect chart, and making opinion maps.

Forming the system of targets

On the next stage, assessment indicators are selected based on the system of targets.

Proposal of targets is the key to a successful solution of the analyzed problem.

Forming the targets ensures structuring of the system of specific indicators the fulfillment of which plays the crucial role in the functioning of an enterprise. This is the way the priorities are digitized and clear goals are set in the process of justification and assessment of the extent of achievement of a key result in a decision. In other words, justification of targets forms the basis on which the decision is to be made.

If one speaks about launching a new product on the market, the complex of managerial decisions should be based on the analysis of the following variables: required investment to start the production, cost of production, potential size of the market, sales volumes, cost efficiency, and absolute profit value.

Choosing the assessment indicator is choosing the parameter aligned with the condition of choice and the system of alternatives that will serve as a measure of efficiency, and digitizing it.

Solution matrix

Solving tasks in the conditions of uncertainty involves the method of concurrence balance. The solution matrix (situation – plan) is an original tool of structuring the initial parameters (conditions of choice and the alternatives fitting this condition).

Decision-making is done in the conditions of uncertainty that is characterized by a limited number of possible states (options of choice conditions or working hypotheses): . The set of hypothetical states of external factors affects the set of possible alternatives: . The utility function proposes the choice of option that aligns with the set .

Table 1 shows a game example of designing production capacities according to options of demand levels.

Assessment of alternatives

The next stage is assessment of options. The solution matrix is based on the assessment of proposed outcomes by applying different principles of optimality: guaranteed result; optimism; arithmetic mean values; combined approach; assessment of lost opportunities.

On the one hand, these methods are widely known (Chernikov, 2013), but in order to itemize some aspects within the decision-making technology they are to be explained in more detail.

The guaranteed result principle (MAX-MIN) entails the choice of the alternative providing the best outcome from the least favorable consequences:

The guaranteed result principle is to be used in the situation in which the management wants to reduce the risk from the chosen decision to the absolute minimum. The guarantee of the outcome is the pessimistic option the choice of which is explained by the anxiety in the context of holding to the current position on the market or securing a firm financial result.

The example in consideration uses the option .

The optimism principle (MAX–MAX) focuses on the analysis of possibilities of achieving the maximum result from the most favorable consequences:

The optimism principle is practicably used in the conditions when the benefit from fulfillment of strategic goals prevails over the hazard of risk; when the management prefers to attack to gain the leading positions (disregarding the possible losses).

The example in consideration uses the option .

The principle of the mean value is preferred in the situations when the analyzed hypotheses (conditions of choice) are equally probable:

The principle of mean value assessment is usually applied when the management is unable to choose any of the states of choice condition under analysis.

The example in consideration uses the option .

The combined principle ( -factor) is based on the combination of optimism and guaranteed result principles including the factor that characterizes the managers’ inclination to choose risky decisions:

The risk factor varies from 0 to 1. Values closer to the zero characterize maximum risk, which matches such targets as securing leading positions or capturing the sales markets. Values closer to one, conversely, show the management’s desire to be aware of their decision, which meets the target of surviving on the market and to secure stability of financial results.

The calculation made on the basis of combined assessment specifies the preliminary findings. If an enterprise wishes to gain leading positions, the option will be ; otherwise, it will be . The option does not confirm its stability.

The principle of assessment of potential losses (MIN-MAX) uses the criterion based on the assessment of lost opportunities in the event the non-optimal decision is chosen. The comparative analysis of losses is convenient when the management wishes to ‘insure’ the choice of alternative against excessive losses:

Considering these positions, the alternative would be the best option.

Thus, following the proposed options of assessment, the following ranking of the alternatives may be proposed: 1. Choice of the option is most preferable in the solution of the task of the guaranteed result. 2. Option is for the solution of leadership tasks. 3. Instability of the option casts doubt on its choice for the achievement of targets. 4. The last option is .

Sensitivity analysis

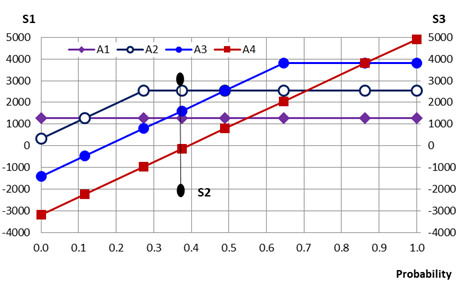

In order to assess the decision’s resistance against various conditions, a sensitivity analysis is performed (Figure 1).

If the sensitivity analysis does not completely alter the vector of conclusions, it surely requires introduction of quite serious adjustments in the initial ranking of alternatives.

1. Option demonstrates high resistance in performing the stability of the utility function in the conditions of certainty relative to the choice condition in the range from 0.12 to 0.49.

2. Option shows a high degree of resistance in the solution of the task of leadership relative to the choice condition in the range from 0.49 to 0.86.

3. Option shows low resistance in the solution of the task of leadership (probability of occurrence of the condition is to be greater than 0.86).

4. Option demonstrate slow resistance (probability of occurrence of the condition is to be lower than 0.12).

Vector optimization methods

In contradictive cases, from the standpoint of analysis of a range of some options one should use methods of comparative assessment (Avramenko et al., 2010).

The choice of decision is based on finding the best result of the integral function – the vector of the utility function (Brazhnikov, 2018).

Discussion

Within this section, we need to discuss some situations that enhance the uncertainty of the decision progress and lead to the differentiation of the very process of decision, which requires development of additional recommendations to ensure quality and reliability of decisions. The result will be some compromise between the accuracy of the decision and the reliability of the model (Rahmani et al., 2013)

Condition of choice. In some situations, one will see some factors influencing the selection of the decision. Within the single solution matrix, these factors might lead to insoluble contradictions. If this is the case, one should perform a parallel analysis of solutions creating a proper matrix for each condition.

In this situation, the researcher inevitably faces the need of comparing the results from several solution matrices using the vector optimization methods.

Structuring of alternatives proposes the use of expert assessment methods. The expert approach is based on intuitive assessments of qualitative parameters (Ershova, 2019), which is different from the mathematical logic of solution that relies on quantitative assessment.

Expert methods are used in the solution of some generic tasks: identification of the set of conditions, differentiation of possible conditions of choice and ranges of their changes, formation of goals, and generation of alternatives.

In the event the information of probabilistic conditions of the environment is lacking, the theory does not give unambiguous and mathematically strict recommendation on choosing the decision-making criteria. To a greater extent, this is explained not by the weakness of the theory but by the uncertainty of the situation itself (Ovchinnikova et al., 2006).

Forming of a system of indicators that may be used as a factor of assessment results in the alternatives in the development of the solution matrix: similar to the previous situation, while assessing each indicator one will need its ‘proper’ matrix.

The contradiction lies in the fact that the characteristics reflecting the condition of real processes may not be absolutely expresses in quantitative indicators (Romanchenko, 2012). The problem of ramping up the production volumes maybe resolved quite simply by hiring new people considering the achieved levels of performance, but it will be difficult to determine how this decision will affect the morale of the staff.

Development of a single criterion in the conditions when each interested party is defending its standpoint is often not possible.

The obvious problem is the contradiction between the marketing goals and the performance indicators. The marketing result is assessed using the growth indicators: current sales volumes, market share, dynamics of launching new products on the market. The major criterion of assessment of efficiency of production functions is the usage of production capacities and the completeness of usage of labor time expresses in the expenditure and volumes of actual output. Thus, the marketing system focuses on expanding the composition of the products manufactured, and the production strives at ensuring the stability of the system and stability of fulfillment of tasks, which is possible when the portfolio of nomenclature items is reduced.

One needs to focus on the fact that the analysis of consequences from various erroneous decisions may differ radically from the standpoint of assessment (Korotkov & Karako, 2012; Morozov, 2009). In some cases, the lost profit may only produce an insignificant effect on the development of the situation that the implementation of a losing strategy. The repercussions of the situation when investment are made in the project that experiences serious problems from achieving the break-even point may not be compared to those when no investments were made in the project that later proved effective. The former situation threats direct financial losses to the extent of the company’s bankruptcy while the latter only means lost profit.

To ensure accuracy and proper justification of decisions, the sensitivity analysis (if it relies on a linear relationship) is to be performed with shorter intervals.

The spatial location of the matrix has a special role. Presenting the options by lines restricts the possibilities for their analysis, which might result in a distortion of outcomes.

Conclusion

Decision-making in controversial problems calls for a complex approach based on a multifaceted assessment of analyzed options. To improve accuracy and degree of justification of decisions, the process of choice may be represented in the form of a technological chain:

– identification of conditions of choice as a tool of assessment of alternative scenarios in the development of the market environment;

– proposal of alternatives as a selection of major directions for the decision based on the expert assessment methods;

– forming of a system of assessment indicators as a reflection of targets of the enterprise’s growth;

– assessment of alternatives using the complex of various principles of optimality;

– analysis of decision sensitivity as a mechanism to confirm the choice results;

– assessment of contradictive results of decision using methods of vector optimization.

The proposed algorithm will enable the formation of a sustainable foundation in addressing the tasks of digitizing the decision-making process and reduce the possibility of errors to a minimum.

References

Avramenko, V. P., Tkachenko, V. F., & Sereda, L. B. (2010). Prinyatie upravlencheskih reshenij v usloviyah neopredelennosti i nechetkosti iskhodnoj informacii [Managerial decision-making in the conditions of uncertainty and vagueness of initial information]. Radіoelektronіka, іnformatika, upravlіnnya, 2, 101-106.

Brazhnikov, М. А. (2018). Integralnaya otsenka alternativnikh upravlencheskikh resheniy [Integral assessment of alternative managerial decisions]. Nauka, biznes, obrazovanie. Electronic publication, 30-38.

Brazhnikov, М. А., & Khorina, I. V. (2021). Upravlenie izmeneniyami [Change Management]. YUrajt.

Chernikov, A. P. (2013). Prinyatie reshenij v usloviyah neopredelennosti [Decision-making in conditions of uncertainty]. Izvestiya Irkutskoj gosudarstvennoj ekonomicheskoj akademii, 2, 57-61.

Diaz, A., Schöggl, J. -P., Reyes, T., & Baumgartner, R. J. (2021). Sustainable product development in a circular economy: Implications for products, actors, decision-making support and lifecycle information management. Sustainable Production and Consumption, 26, 1031-1045.

Ershova, N. A. (2019). Prinyatie upravlencheskih reshenij v usloviyah neopredelennosti po innovacionnomu razvitiyu chelovecheskogo kapitala [Management decision-making in conditions of uncertainty on the innovative development of human capital]. Gosudarstvennoe i municipal'noe upravlenie: Uchenye zapiski, 2, 61-67.

Firk, S., Richter, S., & Wolff, M. (2021). Does value-based management facilitate managerial decision-making? An analysis of divestiture decisions. Management Accounting Research, 51, 100736.

Korotkov, A. V., & Karako, L. I. (2012). Sootnoshenie normativnogo i deskriptivnogo v podhodah k prinyatiyu reshenij v usloviyah neopredelennosti i riska [The ratio of normative and descriptive in approaches to decision-making in conditions of uncertainty and risk]. Vesnіk BDU. Seryya 3, Gіstoryya. Ekanomіka. Prava, 2, 57-61.

Kulikova, O. M. (2013). Algoritm podderzhki prinyatiya optimal'nyh upravlencheskih reshenij v usloviyah neopredelennosti [An algorithm for supporting optimal management decision-making in conditions of uncertainty]. Nauka o cheloveke: gumanitarnye issledovaniya, 1(11), 256-260.

Morozov, V. F. (2009). Konsalting pri prinyatii upravlencheskih reshenij v usloviyah neopredelennosti [Consulting in making managerial decisions in conditions of uncertainty]. Sacyyal'na-ekanamіchnyya і pravavyya dasledavannі, 2, 184-193.

Ovchinnikova, T. I., Bulgakova, I. N., & Khoreva, M. G. (2006). Analiz prinyatin upravlencheskikh resheniy v usloviyakh neopredelennosti [Analysis of managerial decision-making in the conditions of uncertainty]. Ekonomicheskiy analiz: teoriya i praktika, 8(65), 22-23.

Rahmani, D., Ramezanian, R., Fattahi, P., & Heydari, M. (2013). A robust optimization model for multi-product two-stage capacitated production planning under uncertainty. Applied Mathematical Modelling, 37(20–21), 8957-8971.

Romanchenko, S. V. (2012). Osobennosti prinyatiya upravlencheskih reshenij v usloviyah riska i neopredelennosti [Features of management decision-making in conditions of risk and uncertainty]. Putevoditel' predprinimatelya, 14, 214-223.

Shafiei, M., Solimanpur, K. M., & Doniavi, A. (2016). An integrated supply chain configuration model and procurement management under uncertainty: A set-based robust optimization methodology. Applied Mathematical Modelling, 40(17–18), 7928-7947.

Syed, Z., & Lawryshyn, Y. (2020). Multi-criteria decision-making considering risk and uncertainty in physical asset management. Journal of Loss Prevention in the Process Industries, 65, 104064.

Copyright information

This work is licensed under a Creative Commons Attribution-NonCommercial-NoDerivatives 4.0 International License.

About this article

Publication Date

06 December 2021

Article Doi

eBook ISBN

978-1-80296-118-8

Publisher

European Publisher

Volume

119

Print ISBN (optional)

-

Edition Number

1st Edition

Pages

1-819

Subjects

Uncertainty, global challenges, digital transformation, cognitive science

Cite this article as:

Brazhnikov, M. A., Khorina, I. V., & Protchenko, A. V. (2021). Technology Of Managerial Decision-Making In Conditions Of Uncertainty. In E. Bakshutova, V. Dobrova, & Y. Lopukhova (Eds.), Humanity in the Era of Uncertainty, vol 119. European Proceedings of Social and Behavioural Sciences (pp. 499-508). European Publisher. https://doi.org/10.15405/epsbs.2021.12.02.60