Abstract

The relevance of the research topic is due to the need for rapid and adequate management actions in the car service industry, the ongoing structural changes in the issues of both demand and supply of car services, which is especially important against the background of prolonged coronavirus infection. The study showed that the existing structural shifts negatively affect related sectors of the national economy (in particular, oil refining, chemical, mechanical engineering) and are characteristic not only for the national economy, but also for the economies of European countries, the USA and China. The authors formulated factors affecting the functioning of the car service industry during a global pandemic, in particular, precarious work of clients serviced by autoservice enterprises; social and information uncertainty generates negative trends in the sustainable development of the industry; availability and bureaucratization of the declared state support; scope and timeliness of government support. Special attention is paid to the fore-cast of the dynamic characteristics of the car service industry market. The practical significance of this research is to develop recommendations for overcoming permanent instability of the subject of auto service activities through a certain sequence of management actions based on the transfer of management processes in the plane of subject matter, identification of external challenges, selection and implementation of self-organizing processes, analysis of internal and external company relations, development of prompt dilution mechanism and survival strategies.

Keywords: Coronavirus, pandemic, crisis management, risk optimization, transport, car service

Introduction

On March 11, 2020, Tedros Adhanom Ghebreyesus, the director-general of the World Health Organization (WHO) declared a novel coronavirus infection as a global pandemic, i.e., an epidemic spreading in many countries across the globe. The most effective preventive measure is limiting a number of social contacts – self-isolation (Tabatabaeizadeh, 2021). With this in view, the President of Russia decided to introduce a paid non-working week from March 28 to April 3, and then extended self-isolation until April 30 and May 12. Limited social contacts pre-suppose that critical municipal enterprises alone can operate, which do not include car services, car dealerships, auto parts stores. Since May 12, the restrictions were partially lifted in most constituent entities of the Russian Federation and car service companies resumed their activities. Thus, the companies did not work for 6 weeks and were forced, though, to pay salaries to employees, rent and taxes. It should also be borne in mind that the majority of drivers considerably reduced or refused to use cars at all. In the long term, due to a growing number of unemployed and an overall decline in personal income, we should expect a drop in sales of both new and used cars, and as a consequence, a further drop in demand for services. Car owners who decide to maintain and repair their cars by themselves generally violate factory default settings have no proper tools and equipment. This results in a decreased resource of vehicles (Mal'tsev, 2016) and an increased risk of road accidents (Mal'tsev et al., 2019). Thus, the current state of the car maintenance and repair industry should be explored.

Problem Statement

It is now clear that the greatest economic damage from the epidemic came in the second quarter of 2020. Ac-cording to preliminary expert estimates (Akindinova, 2020), losses in the basic sectors of the economy amounted to 11%, in retail trade and services – 22% (in relation to the same periods in 2019). The situation is aggravated by the lack of experience in handling such crises, as well as by a significant decline in personal income. Falling oil prices, lower exports, ruble devaluation and rising unemployment all have a negative impact on the purchasing power of citizens and investment activity in the private sector. In particular, there is a significant decrease in sales of new cars in the motor transport industry, refusal of authorized services in favor of companies offering more custom-er-friendly prices.

In Perm Krai, 132 thousand people are involved in the field of vehicle repair (81 thousand people) and transportation and logistics services (51 thousand people), including workers employed by private workshops, garages, and self-employed. This amounts to about 17% of the total working-age population of the region. The pandemic paralyzed the provision of services for maintenance and repair of road transport, which entailed a rise in unemployment, a reduction in salaries, with many employees to be among the precarious (workers who have no job security) (Koksharov et al., 2020). Almost all spheres of activity are subject to precarization (Toshchenko, 2020), in the field of transport, taxi drivers are of interest (Hua & Ray, 2017).

Given that employment rate in this industry decreases, there is an acute consumer demand. Moreover, a reduction in the volume of services provided leads to shortfall in revenue for the entire industry of motor transport support (gas stations and service stations). According to research results in the Volga Federal District, energy consumption in motor transport is about 12.5 million tons per year (Eder & Nemov, 2016; Eder et al., 2017). It is estimated that prolonged 6-week self-isolation can lead to a decrease in demand by 8-10%.

Undoubtedly, the reduction in road transport has a negative impact on related sectors of the national economy:

- oil refining industry producing fuels and lubricants;

- chemical industry producing detergents, de-icing agents and other operating fluids for cars;

- mechanical engineering manufacturing cars and spare parts (units), as well as equipment and tools for their maintenance;

- rubber industry manufacturing automobile tires and numerous rubber-based products;

- glass industry producing car glass;

- retail and wholesale trade in automobiles and spare parts.

Abroad, in particular in the United States, there has been a similarly significant decline in demand for auto services. Nearly all BayArea retailers have cut opening hours, laid off employees or made other drastic changes, including three of them that have closed, despite being among the top 50 on Yelp.

Nevertheless, most services in the U.S. resumed activities in a couple of weeks after the lockdown. All safety standards were significantly strengthened. These measures allowed the majority of service companies to stay afloat despite a reduction in yield.

According to the National Statistical Office in the UK, despite a significant impact of the coronavirus pandemic (Tabatabaeizadeh, 2021) and a decrease in the total volume of services during April 2020 (12.6% below the same period in 2019). However, as early as July, retail sales of spare parts, sales of new and used cars were 18% higher than in July 20194.

China is currently experiencing a significant slowdown in the production of commodities. The most vulnerable were the companies from the high-tech, tourism and automotive industries. In particular, there is a decrease in the production of auto parts and components (McCloskey & Heymann, 2020; Yan et al., 2020). According to expert forecasts, six months of strict self-isolation in Hubei Province will lead to a 50% reduction in annual production and a 25% decrease in consumption (Vasiev et al., 2020). The transport industry is one of the four promising areas of Chinese-Russian trade and in-vestment cooperation (Lanjian & Wei, 2016; Steblyanskaya & Wang, 2019; Svetlicinii, 2018). The pandemic is likely to lead to a future decrease in trade and investment until 2025. A forecast decrease in financial flows, due to a huge number of unpredictable factors has not been met yet (Vasiev et al., 2020).

Being some governmental responses to the pandemic, blockage and social distancing in almost all countries increased uncertainty at the industry and enterprise levels. However, other types of uncertainty be-came more prevalent during the pandemic, namely social uncertainty and information uncertainty (Sharma et al., 2020a).

Besides, working from home, being some new scientifically grounded form of work, is becoming routine, major response to COVID-19 (Chou et al., 2018; Mustajab et al., 2020). However, this is not fully possible in all sectors of the national economy. Thus, the car cannot be serviced and repaired remotely.

COVID-19 is known to originate from China. Meanwhile, this country responded very effectively and generated effective guidelines and instructions to combat the pandemic (Allam & Jones, 2020).

About 76,000 car service companies are registered in Russia. They have about 2 million employees, which is 2.8% of the total working population of the country. According to the study, Perm is the leader among cities with a population exceeding a million inhabitants in the number of service stations, with 24 service garages for 10,000 cars. A large number of companies indicate high competition and low profits, therefore, Perm is experiencing the greatest damage from the pandemic and restrictive measures, both for companies and employees.

In Perm and Perm Krai, automobile service companies did not work for 45 days in the period from March 28 to May 12, 2020. In the short term, economic damage is associated with a need to pay rent for premises, payments on loans and borrowings, and salaries to employees. In accordance with the decree of the Government of the Russian Federation of April 18, 2020 No. 540, the industry was recognized as affected, including service, sales of cars, spare parts and accessories. This allows the enterprises of the industry to count on the federal support for subsidies that partly compensate for the losses incurred. However, it is already obvious that this is not enough.

Some auto service companies (especially small forms of business), despite a ban on activities, continued to function at least in a limited mode and did not close completely for the quarantine. According to the polls conducted, only 36% of official dealers were going to close for a week during the quarantine period. The authors believe that this circumstance somewhat smoothed out the recession in the industry. In addition, the state, quite controversially, pointed out some OKVED, Russian Classification of Economic Activities, that fall under the state support. In particular, if additional OKVED (for example, the provision of automotive services) provided by car service companies are in the Charter, it is possible to get a 2% loan, conditionally non-repayable. One can also claim for subsidies and restructuring of loans taken before April 1, 2020. For small and medium-sized businesses, a reduction in insurance premiums of up to 15% is provided for wages exceeding the minimum wage from April 1, 2020. All these measures to a small extent contribute to some stabilization of the financial activities of service enterprises. Perhaps, the federal authorities represented by the Ministry of Economic Development of the Russian Federation, will provide additional aids during the second wave of the pandemic that began in October 2020. In any case, the car service would have to turn itself in. Bureaucratic delays in providing support measures had a negative impact. Many car service companies could not apply for state support precisely on formal grounds.

For comparison, information on business support provided abroad is presented below.

In the EU, direct aid of €8 billion was distributed to companies with large losses due to the pandemic, a € 750 billion securities buyback program was implemented to maintain the financial stability of the economy, the possibility was provided to take loans without restrictions to maintain the financial stability of businesses.

In the UK, credit guarantees worth £330 billion ($400 billion) were granted to companies. The maxi-mum loan size was increased from £1.2 million to £5 million (from $1.5 million to $6 million), and interest may not be paid for the first six months. Small businesses exempt from business tax during coronavirus7.

Germany allocated € 50 billion. Small companies can receive direct subsidies of up to €15,0007.

In Poland, the cost of the anti-crisis package is about 212 billion zlotys (€46.2 billion) aimed at entrepreneurs for credit guarantees, microcredits, operational leasing for the transport sub-industry. Companies that do not dismiss employees receive a 40% payroll subsidy7.

Interesting research is being conducted abroad. The researchers have developed a scale for examining the negative effects of COVID-19 on businesses in two countries, namely Serbia and Kuwait, to represent two different continents. The scale was used to study the impact of COVID-19 on business. The findings show that the impact of the coronavirus is equally devastating in both countries, Kuwait with good economic conditions and Serbia with relatively poor (Adžić & Al-Mansour, 2021; Reeves, 2017).

Thus, support for business in Russia is evaluated as moderate.

According to preliminary estimates in April 2020, the revenue of car service companies in Perm Krai decreased to 50% as compared to the same period last year. This is true for those auto service entities that were able to prove to the regional authorities that they worked for the needs of continuous-cycle enterprises. Other services were forced to completely suspend their activities, resuming their work only after a letter of recommendation from the Ministry of Industry and Trade of the Russian Federation

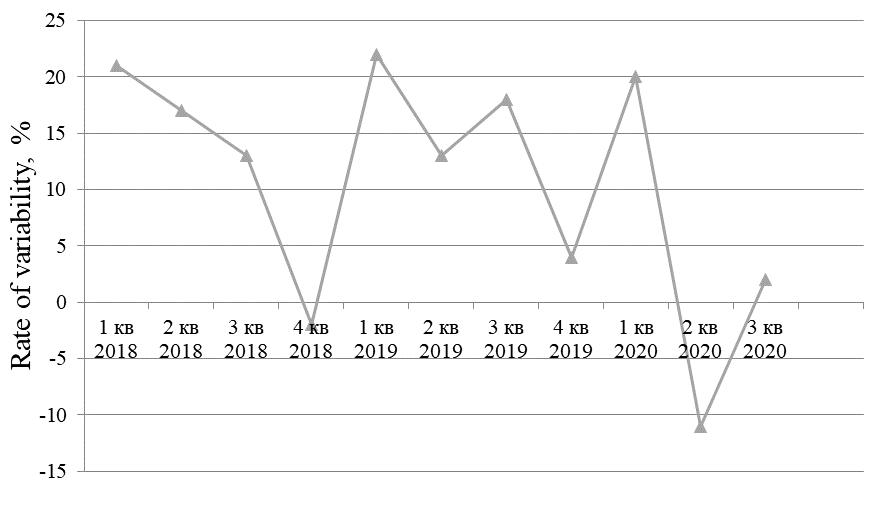

Figure 1 shows demand variability for car maintenance and repair services (Assessment of demand variability for services since 2017, 2021).

The graph shows the unevenness of demand by quarters (2018-2019), linked with natural and climatic conditions, the category of operating conditions, the characteristics of a settlement (stretch, transport accessibility), the standard of living in a particular region. In the first quarter of 2020 the demand remained practically unchanged compared to previous years, whereas in the second quarter there was a decrease by more than 25%. This is due to the fact that individuals switched to a remote mode of work or study, thereby reducing the number of daily trips. In addition, many citizens had a decreased income, which led to forced savings. Car owners prefer to maintain their cars by themselves, in the most minimal form (replacement of consumables: filters, operating fluids), and do repairs that do not require special tools or equipment.

The autumn of 2020 marked the beginning of the second wave of the pandemic. But, despite this, the business has adapted to changing operating conditions. Moreover, many potential buyers decided to buy (re-place) their car here and now, fearing further depreciation of the national currency and another shutdown of automobile production, which will certainly lead to a shortage of cars and increased prices. In this regard, in the 3rd quarter of 2020, the negative trend was halted, at least for the near future. Sales statistics in Russia for 9 months of 2020 show that for some brands (RAV 4) there is even a sales uplift..

Research Questions

It is possible to state the impacts on the performance of the car service industry during the pandemic:

1.Precarization of clients serviced by car service companies.

2.Social and informational uncertainty that generates negative trends in sustainable development of the industry.

3.Availability and bureaucratization of the declared state support.

4.Scope and timeliness of government support.

Purpose of the Study

The paper aims to evaluate and select methods that facilitate sustainable services, based on assessments of the car service market on the example of Perm Krai during the pandemic.

Research Methods

A study was conducted in Perm Krai. The activity of the target automobile service and auto transport companies do not differ from similar organizations in other constituent entities of the Russian Federation. The economic efficiency of service and motor transport companies was assessed against the indicators for similar periods of previous years. Data was collected through a questionnaire survey of the heads of the largest businesses. The questionnaire contained the following questions, namely: about the actual and planned indicators, about changes in the payroll number of employees, about assessing the damage to business from the pandemic on a ten-point scale, about the sufficiency of support measures on a ten-point scale, about anticipated changes in company management (open question).

The findings were analyzed using such methodological approaches as system, process, institutional, dialectical, comparative sociological, risk-oriented management.

In accordance with the purpose of the study, the questions in the questionnaires were grouped into the following blocks:

1.Actual indicators (revenue, average cheque, number of visits)

2.Planned indicators (revenue, average cheque, number of visits)

3.Change in the payroll number of employees

4.Opinion of managers on the current situation (on a 10-point scale or in a free form

Findings

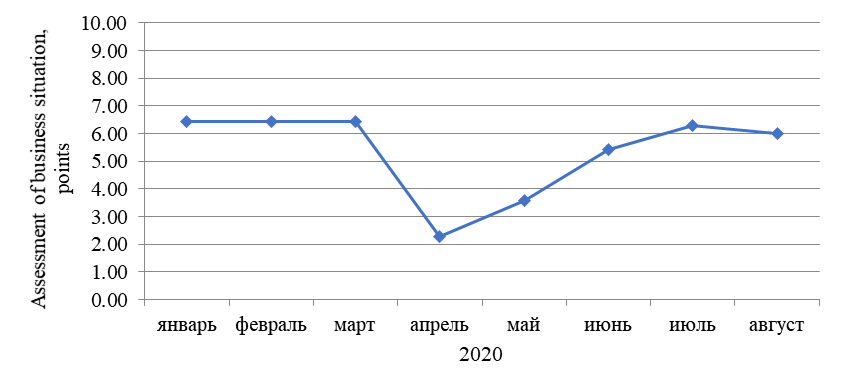

Based on the findings, 9 questionnaires were received from the largest car service companies and holdings in the city of Perm. The opinions coincide with a preliminary estimate – April-May were the toughest months. Figure 2 shows the assessments of business situation by the months of 2020, where 5.5 points is the average state (equivalent to the same periods of previous years), 6 and above is better than usual, 5 and below is worse than usual. It can be seen from the graph that the year began as expected, distracted by strict self-isolation (April), many businesses could flounder, then following a progressive removal of restrictions, the situation began to improve.

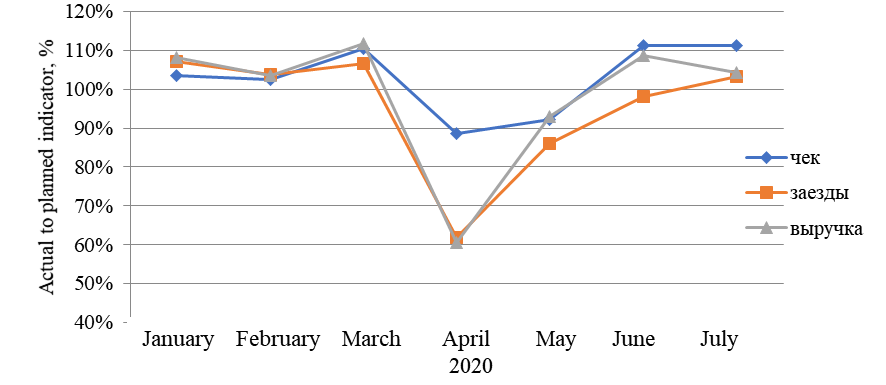

Figure 3 shows the ratio of the actual to planned indicators, with the number of visits, the average cheque and the revenue to be estimated.

At the beginning of the year, the plan was recorded to be 5-10% overachieved, which is due to rising car sales in January-March 2020. In April, the number of visits dropped sharply from self-isolation, but did not reach 0, since commercial carriers were provided with scheduled seasonal and maintenance practices.

Afterwards, demand began to gradually recover, then the end of the third and the fourth quarter of 2020 is most likely be a new recession due to a significant decline in sales of new cars since April 2020 (many plants stopped conveyors).

In terms of possible changes in the structure of the industry market, the authors believe that restoring its position and even ensuring potential growth requires significant transformations. For example, sifting out ineffective entities and replacing them (possibly merging) by more productive ones is underway. In particular, such structures include network car services with well-tailored and proven business processes. The so-called process of “creative destruction” (Akindinova, 2020) will help the economy of the whole country and the car service market, in particular.

In accordance with the goal set, the following recommendations were evaluated and developed.

The current pandemic situation is unique, so there are still no ready-made recommendations. Managing an unstable service company with an integrated anti-crisis component as a tool within anti-crisis management model can be a fairly effective approach. This model corrects for economic, resource, organizational, technical, functional, communication and marketing, motivational, behavioral and other impacts (Gubin et al., 2020).

It is imperative to manage risk and uncertainty during the pandemic. Risk can be predicted and measured through probabilistic methods (Sharma et al., 2020b).

It has been an overriding concern for the industry to overcome permanent instability of an economic agent precisely in the allocated cognitive framework. The algorithm of actions generally can consist of several stages: transferring management processes to a substantive plane, identifying external challenges (the coronavirus pandemic is the most dangerous), identifying (introducing) self-organizing processes, analyzing the internal and external company relations, developing an operational mechanism not only to mitigate the threats, but also a survival-development strategy.

In a period of significant decline in the volume of auto services, competitiveness management with a more efficient process business model created for enterprises is largely a determining factor. This approach is aimed at managing competitiveness through the ratio of impact indicators Cm and the costs Cc incurred to achieve this result, Cm/Cc → max (Il'ina, 2013).

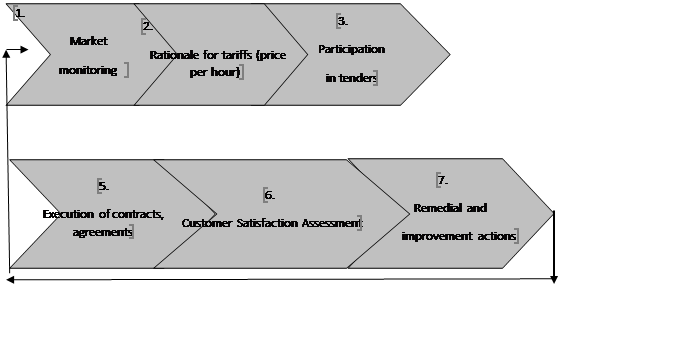

An important aspect of overcoming the crisis is respecting the risks in the context of socio-economic instability that is characteristic of the current situation. It is necessary to come up with a sound mechanism that would reduce the risks of major clients leaving the car service company (Figure 4) (Pestrikov, 2009).

Conclusion

Having gone through all the processes within the optimization system, it is proposed to develop a risk portfolio to measure risks of the client leaving by using certain evaluation criteria and structurally distinguish the following aspects:

- development of a tool to optimize the risks of the client leaving for a competitor;

- coordination with the client of the Service Evaluation Standard;

- approval of an action program that includes specific activities and ways of implementation;

- evaluation of program performance based on an evaluation form. The evaluation form is compiled as a portfolio of interaction-with-a-contractor risks in the form of a matrix of client-leaving-for-a-competitor risks. All types of risks are included in the criteria of this matrix. Each criterion has its own rank, weight, probability and corresponding level of risk.

The study resulted in the following conclusions:

1.The COVID-19 pandemic has had an unexpected and significant negative impact not only on the service economy, but has spread a negative trend worldwide. Car service companies have resumed their activity in the face of a severe drop in demand and are on the verge of starvation. Up to 20% of companies that do not have diversified business areas are predicted to leave the service market.

2.It is important to increase types and sizes of state support for car service companies. It shows that support is not only much lower than that in foreign countries, but also does not always reach the subject. During the pandemic, being partially exempt from the tax burden would be a reasonable step, in particular, to extend the UTII regime for at least one more year.

3.For sustainable development of car services, it is necessary to change action strategy of each business entity. First of all, emphasis on self-organized business processes, development of specific action algorithms tailored to the transformation of the service market, alignment of pricing method-ology, industry development forecasts, as well as competitiveness management within effective business models all become relevant.

4.In other words, a set of effective management methods is sufficient to choose a suitable one for an economic entity through the development and implementation of a specific program for overcoming the crisis and a car service development program for the period of the pandemic. An obligatory condition in such programs should be a plan for obtaining state support for auto service and a related obligation to comply with requirements that exclude the risk of returning this support (preservation of jobs, fulfilment of obligations to pay taxes and fees, exclusion of bankruptcy procedures, etc.). It is necessary to develop procedures for retaining current clients, and, as an opportunity, provide for the attraction of new clients who are willing to change the contractor of car services. In case of an unstable situation at the enterprise, use forms of cooperation with other car services.

5.The choice of methods is conditioned by the current state of the market and the company and the vision of development prospects.

6.More accurate and scientifically sound research from different disciplines is needed.

Acknowledgments

The authors express gratitude to the head of the Department of Economics and Industrial Production Management, Doctor of Economics, E. E. Zhulanov.

References

Adžić, S., & Al-Mansour, J. (2021). Business analysis in the times of COVID-19: Empirical testing of the contemporary academic findings. Management Science Letters, 11(1), 1-10.

Akindinova, N. V. (2020). Perspektivy vosstanovleniya ekonomicheskogo rosta v Rossii (po materialam kruglogo stola v ramkah XXI aprel'skoj mezhdunarodnoj nauchnoj konferencii NIU VSHE) [Prospects for restoring economic growth in Russia (based on the materials of the round table at the XXI April international scientific conference of the higher school of Economics)]. Voprosy ekonomiki [Economic issues], 7, 5-50.

Allam, Z., & Jones, D. S. (2020). On the Coronavirus (COVID-19) Outbreak and the Smart City Network: Universal Data Sharing Standards Coupled with Artificial Intelligence (AI) to Benefit Urban Health Monitoring and Management. Healthcare, 8, 46. DOI:

Assessment of demand variability for services since 2017. (2021). Unified interdepartmental information and statistical system State statistics. https://www.fedstat.ru/indicator/57734

Chou, S. K., Costanza, R., Earis, P., Hubacek, K., Li, L. B., Lu, Y., Span, R., Wang, H., Wu, J., Wu, Y., & Yan, J. J. (2018). Priority areas at the frontiers of ecology and energy. Ecosystem Health and Sustainability, 4(10), 243–246. DOI:

Eder, L. V., & Nemov, V. Yu. (2016). Prognozirovaniepotrebleniyaenergiinatransporte. Metodicheskiepodkhody, re-zultatyotsenok [Projection of energy consumption on transport: methodical ap-proaches, estimate results]. Nauka I tekhnika transporta [Science and Technology in Transport], 1, 37–47. (In Russ.)

Eder, L. V., Filimonova, I. V., Nemov, V. Yu., & Provornaya, I. V. (2017). Prognozirovanie energo-I neftepotrebleniya avtomobil'nym transportom v regionah Rossijskoj Federacii [Forecasting of energy and oil consump-tion by road transport in the regions of the Russian Federation]. Ekonomika regiona [Economy of the region], 13(3), 859-870. (In Russ.)

Gubin, V. A., Shchepakin, M. B., Handamova, E. F., & Lysenko, D. A. (2020). Antikrizisnyj komponent v upravlenii nestabil'nym predpriyatiem [The anti-crisis component in the management of unstable enter-prise]. Ekonomika v teorii I na praktike: aktual'nye voprosy I sovremennye aspekty [Economics in theory and practice: current issues and modern aspects], 16-20.

Hua, J., & Ray, K. (2017). Beyond the precariat: race, gender, and labor in the taxi and Uber economy. Social Identities, 24(2), 271–289. DOI:

Il'ina, I. E. (2013). Formirovanie konkurentosposobnosti predpriyatij sfery tekhnicheskogo obsluzhivaniya I okazaniya transportnyh uslug [Formation of competitiveness of enterprises in the field of maintenance and transport services]. Vestnik Moskovskogo universiteta MVD Rossii [Bulletin of the Moscow University of the Ministry of internal Affairs of Russia], 7, 209-216.

Koksharov, V. A., Agarkov, G. A., & Sushchenko, A. D. (2020). Prekarizaciya truda, kak rastushchaya forma zanyatosti molodyh specialistov v usloviyah pandemii [Precarization of labor as a growing form of employ-ment of young professionals in the context of the pandemic]. Ekonomika regiona [Economy of the region], 16(4), 1061-1071.

Lanjian, C., & Wei, Z. (2016). China energy resources oriented OBOR: Research on OBOR growth strategy of China. Basic Research Journal of Social and Political Science, 4(1), 1–14.

Mal'tsev, D. V. (2016). Analiz prichin maloi narabotki na otkaz turbokompressorov pri ekspluatatsii v usloviiakh kar'erov [Analysis of the reasons for the small time between failures of turbocompressors during operation in quarries]. Aktual'nye napravleniia nauchnykh issledovanii XXI veka: teoriia I praktika, 4, 5-4 (25-4), 267-271.

Mal'tsev, D. V., Pestrikov, S. A., & Utrobin, V. Iu. (2019). Vliianie uslovii ekspluatatsii na nadezhnost' gruzovykh avtomobilei na baze shassi KamAZ [The influence of operating conditions on the reliability of trucks based on the KamAZ chassis]. Khimiia. Ekologiia. Urbanistika, 2, 129-133.

McCloskey, B., & Heymann, D. L. (2020). SARS to novel coronavirus — Old lessons and new lessons. Epidemiology and Infection, 148, e22. DOI:

Mustajab, D., Bauw, A., Rasyid, A., Irawan, A., Akbar, M. A., & Hamid, M. A. (2020). Working From Home Phenomenon as an Effort to Prevent COVID-19 Attacks and Its Impacts on Work Productivity. The International Journal of Applied Business, 4(1), 13–21.

Pestrikov, S. A. (2009). Sistema optimizacii riskov uhoda zakazchika v avtotransportnyh predpriyatiyah na primere otnoshenij administraciya g. Permi – MUP «Avtobaza administraciya goroda» [System for optimizing customer care risks in motor transport companies on the example of the Perm city administration-municipal unitary enterprise "Avtobaza city administration»]. State and prospects of transport. Ensuring road safety: Proceedings of the international scientific and technical conference on the 30th anniversary of the road faculty of Perm state technical University, 1, 140–147.

Reeves, M. (2017). In search of 'vital' companies. Fortune, 176(6), 25-27.

Sharma, A., Rangarajan, D., & Paesbrugghe, B. (2020a). Increasing resilience by creating an adaptive salesforce. Industrial Marketing Management, 88, 238–246.

Sharma, P., Leung, T. Y., Kingshott, R. P. J., Davcik, N. S., & Cardinali, S. (2020b). Managing uncertainty during a global pandemic: An international business perspective. Journal of Business Research, 116, 188–192.

Steblyanskaya, A., & Wang, Z. (2019). Are Sustainable Growth Indicators in Gas Market Compa-nies Comparable? The Evidence from China and Russia. Journal of Corporate Finance Research, 13(1), 76–92. DOI:

Svetlicinii, A. (2018). China’s Belt and Road Initiative and the Eurasian Economic Union: Inte-grating the Integrations. Public Administration Issues, 5, 7–20. DOI:

Tabatabaeizadeh, S. (2021). Airborne transmission of COVID-19 and the role of face mask to prevent it: A systematic review and meta-analysis. European Journal of Medical Research, 26(1), DOI:

Toshchenko, Zh. T. (Ed.). (2020). Precariat: the emergence of a new class (collective monograph). Center for Social Forecasting and Marketing. (In Russ.)

Vasiev, M., Bi, K., Denisov, A., & Bocharnikov, V. (2020). How COVID-19 Pandemics Influences Chinese Economic Sustainability. Foresight and STI Governance, 14(2), 7–22. DOI:

Yan, J., Feng, L., Denisov, A., Steblyanskaya, A., & Oosterom, J. P. (2020). Correction: Complexity theory for the modern Chinese economy from an information entropy perspective: Modeling of economic effi-ciency and growth potential. PloS One, 15(3), e0230165. DOI:

Copyright information

This work is licensed under a Creative Commons Attribution-NonCommercial-NoDerivatives 4.0 International License.

About this article

Publication Date

06 December 2021

Article Doi

eBook ISBN

978-1-80296-118-8

Publisher

European Publisher

Volume

119

Print ISBN (optional)

-

Edition Number

1st Edition

Pages

1-819

Subjects

Uncertainty, global challenges, digital transformation, cognitive science

Cite this article as:

Pestrikov, S. A., Maltsev, D. V., & Belyaev, D. S. (2021). Problems And Prospects Of Car Service Market During The Pandemic. In E. Bakshutova, V. Dobrova, & Y. Lopukhova (Eds.), Humanity in the Era of Uncertainty, vol 119. European Proceedings of Social and Behavioural Sciences (pp. 13-23). European Publisher. https://doi.org/10.15405/epsbs.2021.12.02.2