Abstract

In recent decades, society has seriously thought about environmental problems. Green finance is a unique social investment technology. In world practice, the term "green finance" means improving the environment, mitigating the effects of the global climate and more efficient use of resources. Green finance includes financing and risk management of environmental projects. For the study, the authors used classification and comparison methods, as well as statistical analysis. The purpose of the article is to conduct a comprehensive study of the features associated with the development of green finance in Russia, identify the reasons for the emergence of green finance and assess the consequences of green investment for the efficiency of the financial system. Conclusions: the article examines the features and types of green finance in the context of a green economy and presents an analysis of investment development. The authors analysed green finance instruments, types of investment activities. The article examines the global and Russian experience of green investments, identifies the problems of the Russian green finance market. The authors concluded that the development of green finance instruments helps to protect the interests of future generations in terms of ensuring environmental safety and preserving the environment. In addition, in the face of uncertainty in the development of the global economy, investments in green technologies are a protective financial instrument that provides investors with income.

Keywords: Green finance, eco/green investment, environmental protection, financial instruments

Introduction

In recent decades, environmental issues have been actively discussed in the international arena. Since the mid-1980s, the level of human consumption of natural capital, that is, its ecological footprint, began to exceed the productive capacity of the Earth (Stiglitz et al., 2016), and now “demand” is twice the “supply” of the Earth. The Global Footprint Network, an independent think tank, estimated that the total biocapacity of the Earth for 2019 was approximately 2 hectares per person. Humanity should think about what will remain after it for the next generation: dirt and poverty or a "green" and prosperous Earth. The United Nations Sustainable Development Goals are intended to address this issue. In September 2015, at the UN summit, 193 countries formed 17 core sustainable development goals (SDGs). Also in December 2015, the Paris Agreement (2015) was adopted within the framework of the United Nations Framework Convention on Climate Change. In 2016, within the G20, creep leaders recognized the importance of greening finance and the concept of greening the financial system, leading to the creation of the Green Finance Study Group G20.

Only global integrity and cooperation in financial and “green” issues will allow solving international, regional and national problems related to the environment by “greening” the modern world financial system through the use of “green” instruments that meet common international standards. This cohesion should lead to a "healthier" in global and national finances and the environment.

Problem Statement

Russia, being an integral participant in the international environmental agenda, is involved in the overall process of shaping the green finance market, realizing the environmental vector of development. This requires a careful study and analysis of the accumulated foreign experience in the field of transition to "green" finance for the formation and implementation of an effective strategy for the development of green finance in Russia.

Research Questions

The following questions were raised during the study:

- What is the essence of green finance?

- What instruments are used in the framework of "green" finance?

- What is the global experience in the development of green finance tools and what is the effectiveness?

- What are the main directions for the development of green finance in Russia?

Purpose of the Study

Presumably, the answers to the above questions will help to achieve this goal and will contribute to the development of recommendations to improve the efficiency of the green finance management system in Russia.

Research Methods

The authors used universal methods of scientific research, as well as methods of comparative and statistical analysis.

The essence of green finance and the typology of its instruments

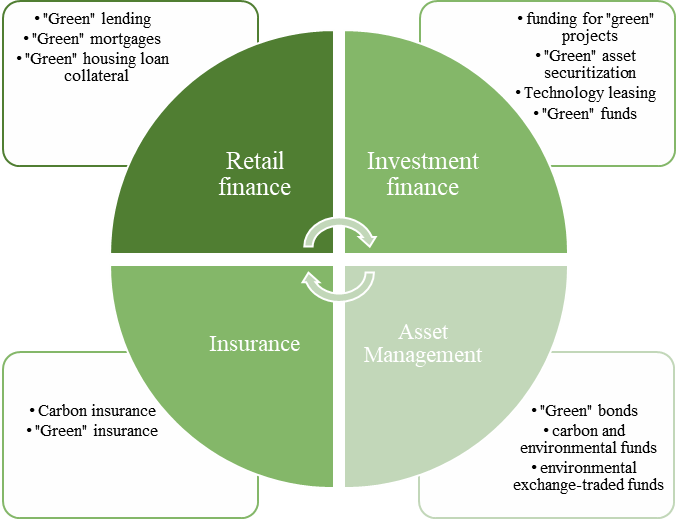

Green finance includes both different branches of finance and different types of financial products and instruments (Figure 1).

Financially, it is customary to distinguish among the main instruments of the “green” ones: “green” bonds and “green” lending.

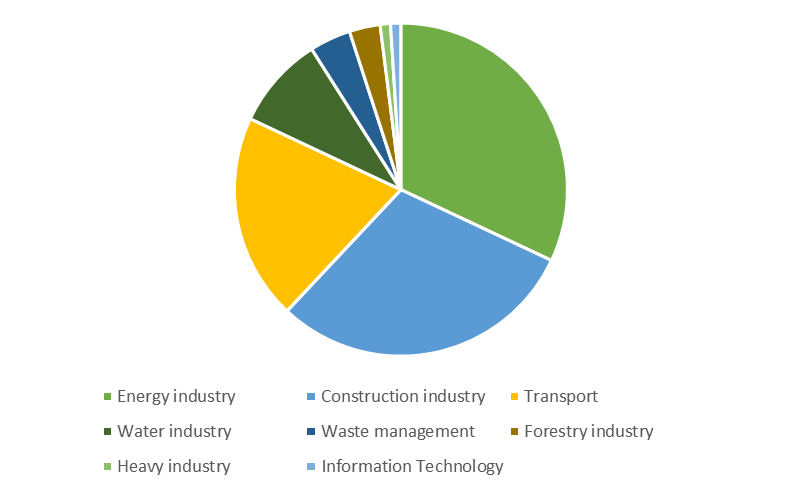

Green bonds are a special type of bonds issued for the implementation of programs and projects aimed at the development of a “green” low-carbon economy, such as the development of renewable energy sources, an increase in the number of “clean” transport, and energy efficiency. Figure 2 shows the sectors that are the largest users of green finance. The top 3 includes:

- energy,

- construction,

- transport.

The World Bank became the first issuer of green bonds in November 2008, initiating the creation of a modern green bonds market (World Bank, 2019). In 2010, the Climate Bonds Initiative was formed, an international non-profit organization that analyses green market analysis and develops standards and criteria for green bonds. Since 2014, the International Capital Market Association (ICMA) has begun to work in the green bonds sector, which has developed the Principles of Green Finance for the sustainable development of the world economy.

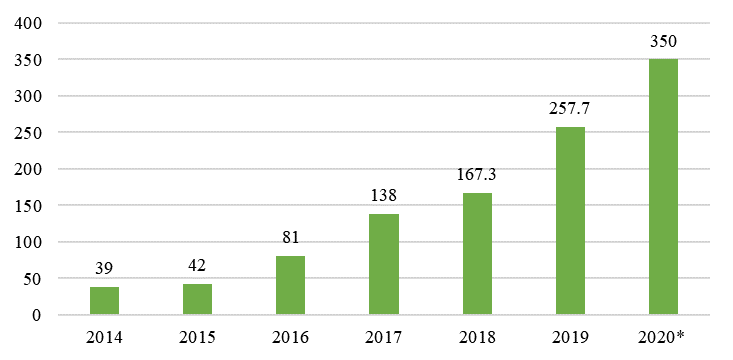

As can be seen from Figure 3, the demand for green bonds is increasing every year. In 2019, the growth in bond issuance amounted to 51% compared to 2018. At the same time, according to estimates by the Climate Bonds Initiative, bonds worth $ 350 billion will be issued in 2020. Today, the leading issuers of green bonds are the United States, China, France, Germany and the Netherlands.

A highly demanded instrument in the green finance market is green loans, which have been developing in parallel with the green bonds market in recent years. Green loans are a type of lending instrument that “is provided solely to finance or refinance, in whole or in part, new or existing green projects” (Luo et al., 2017).

The green credit market has great potential. For example, according to World Bank estimates, about $ 60 billion in green loans were issued in 2019 (Hussain, 2020).

In December 2018, the Loan Market Association worked with leading financial institutions to develop the Green Loan Principles (GLP), based on the widely recognized Green Bonds Principles discussed above. GLP are the criteria for defining a loan as "green". Principle-compliant loans help regulators and supervisors apply eligibility criteria for providing incentives (grants or tax breaks) that enable small, low-investment, green projects to access cheaper financing. If the principles of the Association are widely adopted, then GLP will contribute to the development of the green finance market through consistency in the green lending market. At the same time, these principles will allow investors to more accurately assess the powers of the “green” instrument in the capital market.

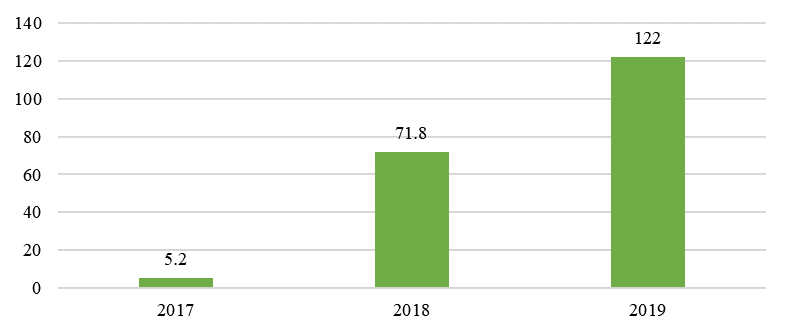

In 2019, there was a sharp jump in the market for another "green" instrument - "loans linked to indicators of sustainable development" (sustainability-linked loans). According to BloomberNEF, in 2019 the volume of such loans increased by 168% to $ 122.60 billion (BloomberNEF, 2018) (See in Figure 4). In order to develop the market for these loans, the Credit Market Association, the Asia-Pacific Credit Market Association and the Credit Syndication and Trading Association developed and adopted standards - "Principles of loans linked to sustainable development indicators" (Green Loan Principles, 2018). The essence of the document is that if the borrower achieves its green goal of environmental sustainability, then it is provided with funds at a more favourable interest rate. Otherwise, the rate will be higher.

Findings

So, green finance is an emerging and rapidly developing segment of the financial market. Despite the explosive growth of such established “green” instruments as “green” bonds and “green” loans in the market, new opportunities are emerging for the development of “green” financing. Therefore, the potential for greening the financial sector is significant and difficult to underestimate.

The Russian Federation, being an integral part of the world community, follows general directions and trends, one of which is the UN Sustainable Development Goals, which ensure a comprehensive balance of economic, social and environmental components. In this regard, the active involvement of Russia in the development of the modern ecosystem of green finance is a priority task.

To date, 132 countries that emit 82% of global emissions have already adopted a number of national projects and initiatives in the field of green finance (Expert Council on the Long-Term Investment Market at the Bank of Russia, 2018). Countries that do not participate in the development of standards, rules and regulations will eventually be forced to accept conditions dictated to them by other countries. Thus, if Russia finds itself "overboard", does not accelerate and does not take part in the current agenda regarding the eco-financial sphere, then in the future it will be forced to "play by someone else's rules." However, the absence of Russian representation in large international organizations, for example, in the field of "green" investment, complicates this process, preventing our country from fully contributing to the development of global rules. This problem can only be solved by joint efforts of the regulator and national market participants.

In addition, one cannot ignore the fact that the Russian financial market is underdeveloped and liquid. In this regard, the problems of further development of the national financial market and its "green" segment are extremely relevant from the perspective of the prospects for the development of the Russian economy. The development of green finance will lead to the growth of the green industry; will contribute to the creation and implementation of new technologies, and therefore new opportunities for companies and the financial industry.

It is extremely important for the Russian economy to keep pace with the changes in the global financial market. Today, the global financial market is in the process of transitioning to an environmentally sustainable development strategy, and international institutions and organizations are showing high interest in the emergence of new "green" instruments. Many countries pay great attention to ecology and energy efficiency, and eco-companies are in significant demand from investors.

It is advisable to highlight the main prerequisites for the development of the green finance market in the Russian Federation (Table 1):

Thus, the formation of eco-finance in Russia is one of the priority areas that will have a significant impact on the place of the Russian Federation in the international arena.

As mentioned above, the sphere of "green" finance in Russia, like the "greening" of the economy, is at the initial stage of development.

It is important to consider the main Russian projects related to the development of the market for "green" instruments (Table 2).

According to the Table 2. As of March 11, 2020, five Russian issuers placed green bonds in rubles, euros and Swiss francs for a total of USD 952.5 million. The objectives of the emission of eco-bonds were projects in the areas of housing and communal services, energy, transport and real estate.

As for the market for "green" loans, it is even less developed than the market for "green" bonds, although the history of this instrument in Russia began much earlier. Thus, the commercial bank Center-invest has been issuing green loans since 2005 for green projects of SMEs in the field of energy efficiency. The amount of loans issued by the bank for 14 years amounted to 16.5 billion rubles. Such loans demonstrate a great contribution to the fight against environmental pollution: the annual reduction in CO2 emissions amounted to 186 thousand tons, which is equivalent to the conservation of 7.3 million trees.

The only bank in Russia that provides loans tied to sustainable growth indicators is ING Bank, which has signed two unique loan agreements with Russian companies: the mining company Polymetal and the mining and metallurgical holding Metalloinvest.

The slow development of the green credit market is due to the disinterest of Russian banks in the topic of ecology and climate change, low return on investments, as well as the lack of an approved methodology for assessing green projects in terms of risks.

It is important to study government support measures for green projects and the relationship between green finance and the Sustainable Development Goals of Russia.

The Ministry of Industry and Trade of the Russian Federation occupies a key place in the development of the market for green bonds and green lending. The Ministry of Industry and Trade subsidizes the issuance of green bonds for the implementation of projects in the field of industrial transition to environmental technologies (Decree of the Government of Russia No. 541, 2019). For this program from 01.01. In 2019, the state will reimburse companies from 70 to 90% of the coupon yield paid by them on bonds (not exceeding RUB 30 billion) issued in order to implement investment projects to reduce waste and emissions.

In 2020, the Ministry of Industry and Trade decided to expand the program to support green projects (Stiglitz, et al., 2016). In addition to green bonds, the government plans to support the issuance of green loans by compensating the interest rate if the funds raised are used to purchase Russian products and technologies for greening enterprises.

In addition to government support, Russia has already begun to form both a regulatory framework and environmental projects aimed at implementing measures to mitigate climate change and adapt to climate change. The decree of 13.05.2019 No. 216 "On the approval of the Doctrine of energy security of the Russian Federation" (Decree of the President of Russia dated No. 216, 2019) has been published. 04.11. 2020 The President signed Decree No. 666 "On Reduction of Greenhouse Gas Emissions" aimed at a 30% reduction in greenhouse gas emissions by 2030 (compared to 1990 levels) in accordance with the "Paris Agreement", the "National Plan measures of the first stage of adaptation to climate change for the period up to 2022 " (Order of the Government of Russia No. 3183-r, 2019) and "Fundamentals of state policy in the field of environmental development of the Russian Federation for the period up to 2030" (Order of the Government of Russia No. 2423-r, 2012). The government published the “rules for subsidizing the costs of paying coupons on green bonds” (Decree of the Government of Russia No. 541, 2019) and “rules for the selection of investment projects and principals for the provision of state guarantees of the Russian Federation on loans or bonded loans attracted for the implementation of “green” investment projects "(Decree of the Government of Russia of December N 101, 2010), as well as a number of other regulations in the field of" environmental "finance.

In the Russian Federation, specialized organizations are being created, the main activity of which is aimed at "greening" the economy and finance. In 2015, the National Association of Concessionaires and Long-Term Investors in Infrastructure (NAKDI) was formed, the goal of which is to form and develop a long-term infrastructure investment market in Russia. As a partner of the International Association for Responsible Investment, NAKDI develops recommendations in the field of sustainable development and green investment. The Association publishes quarterly reviews on Sustainable Development and Green Investments, as well as annual reports on Green Finance in Russia.

The Bank of Russia has established a Working Group on Responsible Finance (ESG-finance), including green finance. Also of great importance for the Russian green finance market is VEB.RF, a state development corporation. VEB.RF puts forward “green financing” as one of its strategic goals for sustainable development. In December 2020, the corporation, together with the Moscow Exchange, held a digital conference "The Present and Future of Green Finance in Russia", at which it was announced that by July 2021 the national green finance system would be launched by VEB.RF. It will include methodological guidelines, a list of approved verifiers and a process for obtaining green status for financial instruments.

For the development of the system of "green" finance and the functioning of the market, taking into account the SDGs, it is necessary to create a national center that would be engaged in the development of uniform principles and standards for "green" instruments that meet both international and national requirements. As practice shows, a huge role in the formation of "green" finance is assigned to the state, therefore Russia needs such a body whose main activity would be aimed at "greening" finance.

It is proposed to establish a National Council for Green Finance and Sustainable Development as a coordinating body between regulators and ministries. The main activity of the Council should be general management of the formation and development of the sphere of "green" finance in Russia. The Council will be entrusted with the tasks of defining the strategy and priority directions for the development of the system of "green" finance in the Russian Federation. An existing non-profit organization, such as VEB.RF, can be appointed as a working group for the new body, or a new one can be created.

This new body in the form of the National Council for Green Finance and Sustainable Development and its working group will create conditions for the development of uniform rules and principles for the national green finance market and will provide an opportunity to attract additional investment for the implementation of green projects. That is, to achieve the goals that are necessary at the initial stage of "greening".

Conclusion

Russia has already laid the foundation for the development of "green" finance "by creating the necessary regulatory framework and created" green "institutions.

Today, "green" finance is one of the priority tasks of the national economic recovery plan, in order to "green" the country's economy and ensure the development of markets for "green" instruments. The efforts of such organizations and government agencies to create a green finance system in Russia are very important to ensure that capital is channelled into environmentally sustainable projects. And, perhaps, the creation of a new body in the form of the National Council for Green Finance and Sustainable Development will allow the Russian Federation to succeed in the world of green finance.

References

BloomberNEF. (2018). https://about.bnef.com/blog/sustainable-debt-sees-record-issuance-at-465bn-in-2019-up-78-from-2018/

Climate Bond Initiative. (2020). 2019 Green Bond Market Summary. https://www.climatebonds.net/files/reports/2019_annual_highlights-final.pd

Climate Bonds Initiative. (2018). https://www.climatebonds.net/https://about.bnef.com/blog/sustainable-debt-sees-record-issuance- at-465bn-in-2019-up-78-from-2018/

Decree of the Government of Russia No. 541. (2019). On approval of the Rules for the provision of subsidies from the federal budget to Russian organizations to reimburse the costs of paying coupon income on bonds issued as part of the implementation of investment projects to introduce the best available technologies. https://www.garant.ru/products/ipo/prime/doc/72137248/

Decree of the President of Russia dated No. 216. (2019). On the approval of the Doctrine of energy security of the Russian Federation. https://minenergo.gov.ru/node/14766

Expert Council on the Long-Term Investment Market at the Bank of Russia. (2018). Green Finance: An Agenda for Russia, Diagnostic Note. https: //xn--90ab5f.xn--p1ai/files/? File = 5bb5ccdd3402a80b2d7e153d511e3ea1.pdf

Green Loan Principles. (2018). Loan Market Association, 2018. https://www.lma.eu.com/application/files/9115/4452/5458/741_LM_Green_Loan_Principles_Booklet_V8.pdf

Hussain, F. I. (2020). Green loans: Financing the transition to a low-carbon economy, 2020. https://blogs.worldbank.org/climatechange/green-loans-financing-transition-low-carbon-economy#:~:text=Banks%20and%20financial%20institutions%20can,US%2460%20billion% 20in% 202018

Luo, C., Fan, S., & Zhang, Q. (2017). Investigating the influence of green credit on operational efficiency and financial performance based on hybrid econometric models. International Journal of Financial Studies. https://www.mdpi.com/2227-7072/5/4/27

Order of the Government of Russia No. 2423-r. (2012). On the Action Plan for the Implementation of the Fundamentals of State Policy in the Field of Environmental Development of the Russian Federation for the Period until 2030. http://government.ru/docs/7280/

Order of the Government of Russia No. 3183-r. (2019). Approved the national action Plan for the first stage of adaptation to climate change for the period until 2022. http://government.ru/docs/38739/

Paris Agreement. (2015). https://unfccc.int/files/meetings/paris_nov_2015/application/pdf/paris_agreement_russian_.pdf

Stiglitz, D., Sen, A., & Fitoussi, J. (2016). Misappreciating Our Life: Why Doesn't GDP Make Sense? Gaidar Institute Publishing House.

World Bank. (2019). 10 Years of Green Bonds: Building a Sustainable Investment Model for All Capital Markets. https://www.vsemirnyjbank.org/ru/news/immersive-story/2019/03/18/10-years-of-green-bonds-creating-the-blueprint-for-sustainability-across-capital -markets

Copyright information

This work is licensed under a Creative Commons Attribution-NonCommercial-NoDerivatives 4.0 International License.

About this article

Publication Date

25 September 2021

Article Doi

eBook ISBN

978-1-80296-115-7

Publisher

European Publisher

Volume

116

Print ISBN (optional)

-

Edition Number

1st Edition

Pages

1-2895

Subjects

Economics, social trends, sustainability, modern society, behavioural sciences, education

Cite this article as:

Pertseva, S. Y., & Paramonova, V. E. (2021). Key Trends Of The Development Of "Green" Finance In Russia. In I. V. Kovalev, A. A. Voroshilova, & A. S. Budagov (Eds.), Economic and Social Trends for Sustainability of Modern Society (ICEST-II 2021), vol 116. European Proceedings of Social and Behavioural Sciences (pp. 2631-2640). European Publisher. https://doi.org/10.15405/epsbs.2021.09.02.293