Abstract

The banking system around the world and in Russia during the Coronavirus pandemic quickly responds to challenges, opportunities and consequences. The 2020 pandemic was the start of a downturn in economies around the world. The crisis influenced the development of all states, both developed and developing. At the end of March 2020, the International Monetary Fund marked the beginning of a global recession. The situation related to the Coronavirus has led to a decrease in the values of the main macroeconomic indicators. The fall in oil prices on the world market also had an important impact. As a result, there was a slight decrease in the business activity of economic entities. This circumstance also affected the banking sector. These circumstances led to a decrease in the key rate of the Central Bank and keeping it at the same level for a long period. This fact is a measure to support the national economy and prevent bankruptcy of bank institutions associated with unforeseen circumstances that have arisen due to the Coronavirus pandemic. The purpose of this article is to study the main financial indicators of Russian banks in the context of the new financial crisis.

Keywords: Banking institution, pandemic, credit, profit, loss, financial condition

Introduction

In the context of the pandemic and the unstable economic situation in the country, Russian banks in 2020 faced numerous factors that negatively affected the main indicators of performance. Thus, the total net profit in the banking system in December 2020 amounted to 1.6 trillion RUB, which is almost 6% less than in the previous year.

The return on equity of Russian banks also tended to decline and amounted to 16% against 13% last year. At the end of March 2020, the International Monetary Fund marked the beginning of a global recession. Later, a report was published in which the crisis was called "the worst recession since the Great Depression". This study analyzes the main financial indicators of Russian banks in the context of the new financial crisis (Galazova et al., 2017).

Problem Statement

In connection with the new global challenges, which currently include the Coronavirus pandemic, there is a problem of avoiding large volumes of losses in the banking sector and obtaining stable profits. Competently, timely and efficiently conducted financial analysis of the financial statements of banking institutions will avoid some unprofitable situations, and direct the resource to making a profit (Kokodey et al., 2018a).

Research Questions

The article discusses the issues of losing profits and minimizing losses in a pandemic.

- How to conduct a qualitative analysis of the financial condition of banking institutions?

- When does a situation arise associated with a shortfall in profits in Russian banks due to a pandemic?

- When do losses occur?

Purpose of the Study

The purpose of this article is to study the main financial indicators of the activities of Russian banks in the context of the new financial crisis (Kokodey et al., 2018b).

Research Methods

The recession in the global economy has had a significant impact on the main Russian macroeconomic indicators. With a simultaneous fall in oil prices, 2020 was marked for Russia by a reduced demand for exported, raw materials and other goods, a large-scale decline in the business activity of many companies and organizations. Naturally, the crisis also affected the banking sector. At the beginning of 2020, there was a phenomenal significant decrease in the key rate of the Central Bank to 4.25%, compared with 6.25% in December 2019.

However, the situation among Russian banks is not uniform (see Table 1).

A record profit growth for ten months of the crisis year 2020 was demonstrated by Saint-Petersburg Bank: 82% compared to the same indicator of the previous year. This result was significantly influenced by an increase in net interest income: by 14.2% in 10 months of 2020, as well as an increase in net fee and commission income, which increased over the period under review by 11.6%. Saint-Petersburg Bank ranks seventeenth in terms of net assets among all Russian banks. The attracted funds of the bank are quite diversified, the client base numbers about one and a half million individuals and more than 40 thousand corporate clients (Komissarova, 2020).

The second place in terms of profit growth for the analyzed period was taken by the bank “Aktsionerny Bank “Rossiya”: 55.2% compared to the same indicator of the previous period. The bank ranks fourteenth in the ranking of all Russian banks in terms of net assets and specializes in investments in securities. With an insignificant increase in interest income: by 3.1%, an increase in net profit was ensured by an increase in the value of net non-interest income, almost 3 times, and the value of net income from trust management operations: by 1.5 times (Mahboud, 2017).

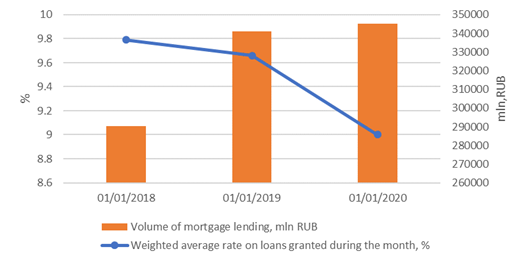

Although the situation with the main indicators of banks' performance is ambiguous and the overall decrease in profit in the banking system reached about 30%, the number of profitable banks prevails in their total number. For 10 months of 2020, both large banks and quite small banks showed losses, only 105 banks were recognized as unprofitable. However, on the scale of the entire banking sector, the situation is not so critical. With a simultaneous reduction in profit indicators in the banking system as a whole, there was an increase in the volume of loans issued to the population by 20 trillion rub. In the third quarter of 2020, there was a high activity of participants in the retail credit market: an increase in household loans was recorded by 1.8%. The preferential mortgage program: 6.5% per annum had the main influence on the growth of the loan portfolio of the population. Figure 1 presents a study of the dynamics of the volume of issued mortgage loans according to statistical data, which are presented on the official website of the Russian Federation Central Bank (Melnikova et al., 2020).

The analyzed volumes of mortgage lending for 3 years have a steady growth trend. So, for example, in January 2020, the size of the mortgage loans issued was almost 5.5 trillion rub more indicator of 2018. Long trends indicate a linear growth in mortgage lending, while the growth trend continued even during the crisis. The mortgage lending market can be characterized by the following parameters: as of 01.01.2020, the number of residential mortgage lending units amounted to 145183, the volume of residential mortgage lending: 345059 million rub, the weighted average rate on loans issued during the month is 9% (Manuylenko et al., 2020).

In 2018, the corresponding indicators were 151308 units, 290469 million RUB and 9.79%, respectively. Thus, it can be noted that there is a tendency for the volume of mortgage lending to grow with a simultaneous reduction in the number of mortgage lending units and a decrease in the weighted average rate. The weighted average term on loans extended during the month was 218.4 months, which is 1.16 times more than in 2018.

Findings

After analyzing all of the above, we can conclude that the situation in the banking sector is ambiguous. And in the banking sector, as in any commercial sector, there is a place for competition. Those banks that were able to readjust to the new Coronavirus wave were even able to get profit growth in 2020 compared to the same period in 2019 (Posnaya et al., 2017). Banks have transformed their services in accordance with the new realities. Most of the services were introduced online, communications became mostly remote (Posnaya et al., 2019a).

The corona crisis has become a catalyst for the digital transformation of banking products and customer service. It was in digitalization that many banks saw growth points for improving their activities and strengthening their positions in the market (Posnaya et al., 2019b). Self-isolation introduced customers to remote communication channels and shaped the user experience for customers who traditionally preferred branch visits to new technologies (Posnaya et al., 2020b). The Russian financial sector is actively introducing remote services, and the share of non-cash payments is growing steadily. This is critically important during an epidemic, and helps to maintain not only accessibility, but also the convenience of payments for citizens and businesses. Therefore, many customers have already appreciated the benefits of remote channels and plan to continue using them after the pandemic (Posnaya et al., 2020a).

But it should be noted that the Coronavirus crisis has not cancelled the financial plans of businesses and individuals. For the development of production, various financial needs of citizens, money is needed. Therefore, the continuous, competent, adapted to the conditions of the time, the functioning of banking institutions is necessary and in demand. And only those banks that were able to adapt to new needs, somewhere lowering interest rates, somewhere using modern technologies, somewhere revising the bank's policy, were able to make a profit even higher than in the "pre-crisis" similar period of time.

For example, Alfa-Bank showed strong profit growth in 2020 compared to the same period in 2019. The bank has demonstrated strong financial performance, proving the sustainability of its business model even during the crisis. Key profit components (net interest income, net fee and commission income) have shown strong growth, reflecting the high dynamics of the client base and the success of the deep digitalization model that the bank has adhered to over the past years. Thanks to its developed remote channels, Alfa-Bank has provided its customers with continuous access to all banking products and services. He was one of the first to offer support programs for individuals, small and medium-sized businesses. At the same time, Alfa-Bank's traditionally conservative risk policy and careful control over its implementation allowed maintaining the high quality of the loan portfolio. Following the strategy, the bank opened the first new generation phygital-office and launched several mutually beneficial partnerships, including with Beeline and Yandex, which created additional value for clients.

Even some small banks were able to demonstrate profit growth during the pandemic. This speaks primarily of the competent policy of the leadership, which, despite the difficulties of the current situation, was able to learn how to work in the new realities.

The largest share in the loan portfolio is taken by pledged loans (mortgages and car loans) is 75%. The share of cash loans was 23%. The share of credit cards was 2% in the portfolio.

The greatest dynamics was demonstrated by mortgage issues: an increase of 32% compared to January-October last year. The growth driver was the implementation of the state program, which allowed banks to offer the lowest mortgage rates in history, for example, Bank Saint-Petersburg reduced the rate to 6% per annum for salary clients and clients who made an initial payment of 40% or more. In other cases, the rate was 6.25% per annum on mortgages for new buildings.

The positive dynamics of retail lending growth became possible due to new products introduced in 2020 (in particular, Time-Money loan, 100 days credit card, Visa Virtual digital card, etc.), attractive terms for loan products and expansion digital sales channels.

In 2020, banks' net interest income exceeded 3.54 trillion rub (+ 8.8%), and the net commission: 1.28 trillion rub (+ 9.6%), follows from the presentation of the Bank of Russia.

On the one hand, banks helped borrowers by actively lending them during a pandemic, but on the other hand, they helped themselves, making a profit on this and not wasting capital.

Of course, those banks that, despite the decline in profits in 2020, have stable capital, were able to stay afloat. For example, the largest Russian bank Sberbank received in 2020 a decrease in profit by 105959 million RUB. Compared to the previous year, Sber's financial result decreased by 7.7%. Bank reserves significantly and positively influenced the financial result of the bank, therefore, the decline in profit for the whole year was not so critical for the largest bank in the country. In relatively calm times, Sberbank has built up capital and liquidity reserves. This resource made it possible to make decisions on loan restructuring, on deferred payments for borrowers in a difficult situation. At the same time, the accumulated safety margin ensures the stability of the banking system and the protection of the interests of depositors. The reduction in net profit did not prevent Sberbank from continuing to consolidate various digital assets into a single system, which in the long term should bring a significant part of its income.

Conclusion

In general, we can conclude that banks went through the difficult 2020 without significant losses, having managed to preserve capital stocks, strength and provide significant support to the economy and borrowers. In 2020, the growth of corporate loans amounted to 9.9%, which is almost twice as high as in 2019. “Thus, banks helped the economy and borrowers to more easily endure the acute phase of the crisis by providing resources when they were most needed,” the Bank of Russia notes. The mortgage portfolio grew by almost 25%, exceeding the result of 2019 (20%) thanks to the state program. The growth rate of consumer lending, on the contrary, more than halved (to 9.2%), which the Bank of Russia associates both with a decrease in the share of approved loans and with a more cautious attitude of borrowers who are not confident in maintaining income levels and, as a result, the ability to service debts.

The banking sector's first year of the pandemic was relatively painless. At the same time, the problems of the sector tend to accumulate, so the next year is fraught with many risks and uncertainties. In 2021, the problem of the outflow of funds from individuals will turn into a problem of maintaining marginality. Banks that want to increase their loan portfolios will be forced to offer depositors more attractive terms, which, if rates remain low, may adversely affect profitability.

References

Galazova, S. S., Manuylenko, V. V., Morgoev, B. T., Lipchiu, N. V., & Biganova, M. A. (2017). Formation of Stakeholders’ Client Capital of Trade Institutions. European Research Studies Journal, XX(4B), 398-411.

Kokodey, T. A., Gnezdova, I., & Lomachenko, T. I. (2018a). Modeling the Global Business Environment Based on Polycyclic Theory. Proceedings of the International Science and Technology Conference "FarEastСon": Smart Technologies and Innovations in Design for Control of Technological Processes and Objects: Economy and Production, 487-499.

Kokodey, T. A., Lomachenko, T. I., & Mikhailov, Y. I. (2018b). Modeling the Optimal Format of Strategic Management of a Company for Establishing a Region's Sustainable Development. Proceedings of the 2018 International Conference ''Quality Management, Transport and Information Security, Information Technologies'', 848-850.

Komissarova, V. V. (2020). Analysis of crediting small and medium businesses in Russia: state-wall support measures during the Covid-19 pandemic. Azimuth of Scientific Research: Economics and Administration, 9(3), (32), 198-201.

Mahboud, R. (2017). Main Determinants of Financial Reporting Quality in the Lebanese Banking Sector. European Research Studies Journal, 20(4B), 706-726.

Manuylenko, V. V., Ryzin, D., Koniagina, M., Lipchiu, N., & Setchenkova, L. (2020). Development and Implementation of Alternative Concept for Expected and Unexpected Losses in Corporations. TEM Journal, 9(3), 1116-1125.

Melnikova, Y. V., Posnaya, E. A., Bukach, B. A., Shokhnekh, A. V., & Tarasenko, S. V. (2020). Defining Key Determinants of the Strategic Economic Security of the Agro-Industrial Complex in Terms of Stabilizing Political Course. In E3S Web of Conferences (Vol. 161, p. 01105). EDP Sciences.

Posnaya, E. A., Ditsulenko, O. I., Kaznova, M. I., & Cheremysynova, D. V. (2020a). Improving the management efficiency of banking institutions through interaction with credit bureau. Proceedings on Engineering Sciences», 2(4), 453-462.

Posnaya, E. A., Ditsulenko, O. I., Kolesnikov, A. M., & Shokhnekh, A. V. (2020b). Features And Advantages Of Loaning Of High Technology Corporations. In European Proceedings of Social and Behavioural Sciences EpSBS (pp. 402-408).Posnaya, E. A., Semenyuta, O. G., Dobrolezha, E. V., & Smolander, M. (2019a). Modern Features for Capital Portfolio Monitoring. International Journal of Economics and Business Administration, VII(1), 53-60.

Posnaya, E. A., Vorobyova, I. G., Ditsulenko, O. I., & Kaznova, M. I. (2019b). Strategy and Tactics of Bank Capital Assessment. International Journal of Economics and Business Administration, VII(2), 393-399.

Posnaya, E. A., Vorobyova, I. G., Sokolova, E. M., & Leonova, M. P. (2017). The Role of Human Factors in the Bank Capital Evaluation Framework. European Research Studies Journal, 20(1), 148-154.

Copyright information

This work is licensed under a Creative Commons Attribution-NonCommercial-NoDerivatives 4.0 International License.

About this article

Publication Date

25 September 2021

Article Doi

eBook ISBN

978-1-80296-115-7

Publisher

European Publisher

Volume

116

Print ISBN (optional)

-

Edition Number

1st Edition

Pages

1-2895

Subjects

Economics, social trends, sustainability, modern society, behavioural sciences, education

Cite this article as:

Posnaya, E. A., Kolesnikov, A. M., & Zima, Y. A. (2021). Profit And Losses In Russian Federation Banking System During The Coronavirus Pandemic. In I. V. Kovalev, A. A. Voroshilova, & A. S. Budagov (Eds.), Economic and Social Trends for Sustainability of Modern Society (ICEST-II 2021), vol 116. European Proceedings of Social and Behavioural Sciences (pp. 1019-1025). European Publisher. https://doi.org/10.15405/epsbs.2021.09.02.113