Abstract

The article presents an analysis of existing models of public-private partnership, as well as guidelines for choosing a particular model in the context of international relations and digitalization of the economy. The purpose of the study is to determine the analysis of existing forms and models of public-private partnership, as well as to identify the main areas of their implementation. The main result that we obtained from the study is the formation of a specific approach to the choice of a PPP model, which is suitable for the implementation of international projects in the context of the digitalization of the economy. The mechanism for selecting a priority PPP model is presented in the form of a simple and understandable algorithm that can be used by government agencies when deciding on the possibility and form of attracting the private sector for the implementation of various projects. We consider the concession models that allow a more reasonable distribution of risks and responsibilities between the state and the private sector the most acceptable in the implementation of infrastructure and international projects based on the experience of other countries. Therefore, the BOT, BOOT, DBFO, DBOO models, as well as the management contract, are analyzed in detail, providing the most preferable option for the implementation of a PPP project under a concession. The article concludes that it is necessary to predict the feasibility of using public-private partnerships for the implementation of infrastructure projects.

Keywords: Digitalization, partnership, PPP model, risks, selection methodology

Introduction

The difficulty of assessing the effectiveness of a PPP project and choosing an appropriate model for its implementation is largely due to the fact that the partners working on the project (the state and the private sector) have different goals. The private partner is more interested in financial efficiency, while the public partner is more interested in social, environmental, innovation, infrastructural, national economic, budgetary (both in terms of increasing budget revenues and reducing budget expenditures). As a result, the economic efficiency, budgetary and social efficiency of the PPP project are distinguished.

Problem Statement

In Russia, as in countries with significant experience in using PPP projects (Australia, Canada, Great Britain), government bodies pay special attention to determining the comparative advantage of a PPP project compared to a government order, while a quantitative risk assessment is made formally or not at all. In our opinion, this greatly simplifies the already complex project evaluation procedure. Nevertheless, many countries with experience in working with PPP projects make a qualitative risk assessment. In connection with this, appropriate techniques and algorithms are needed.

Research Questions

The subject of the research is the substantiation of the methodology for choosing a model for a PPP project taking into account the new trend of digitalization

- It is necessary to answer the question: should the choice of a specific model of a PPP project be algorithmic?

- What models are most acceptable in the implementation of infrastructure and international projects and what are the options for their implementation?

Purpose of the Study

The aim of the study is to substantiate the methodology for analyzing existing forms and models of public-private partnership, as well as to identify the main areas of their implementation.

Research Methods

The choice of a PPP model should be preceded by a qualitative assessment of the project, including the risks of its implementation, which, in our opinion, should be carried out with the involvement of experts from the public and private partners. Such an assessment will make it possible to draw conclusions regarding the feasibility of the project in terms of situational characteristics (described by a set of external and internal project variables) and the risks of implementing threats, opportunities, as well as risks of potential reduction. Such an assessment can be made using the following methods: Delphi, brainstorming, SWOT analysis, survey, etc.

Findings

SWOT analysis, as the qualitative assessment method for a PPP project modified into a decision matrix (Table 1), allows assessing the feasibility of a project, to identify a set of risks, certain and uncertain factors.

The table is compiled from the perspective of project evaluation: its strengths and weaknesses, opportunities and threats for the project. The situation of a weak investment project should cause concern. Here the task of the private partner is to strengthen the position of the project: increase the competence of the executors, enhance investment support, etc. For the investor, the most problematic situation should be the imposition of external unfavorable conditions on the weak potential of the private partner. This circumstance should make the investor think about the feasibility of the project.

In general, a qualitative risk assessment carried out using a SWOT analysis will allow managing risks in terms of minimizing them, as well as rationally distributing risks between the parties to the project. (Akhmetova et al., 2018).

Industry statistics on the use of PPP models allows determining the set of the main current models of PPP projects in the relevant industry. For example, the concession model is more widely used for infrastructure projects. In total, for each PPP model, the most favorable industries for use can be identified (Table 2). (Database of infrastructure projects).

In view of the fact that the mechanisms of public-private partnership in Abkhazia are only developing, and also in view of the fact that concession models, according to the authors of the study, are most successful in the implementation of infrastructure and international projects, it is necessary to consider in more detail those of them that, in our opinion, most applicable.

These include the BOT, BOOT, DBFO and DBOO models, as well as a management contract, which provide the more feasible and affordable concession option. In our opinion, these models allow the optimal distribution of responsibility and risk between the state and the private sector. (Ovchinnikov & Fateev, 2013).

The choice of a specific model of a PPP project, in our opinion, is possible using the algorithm below (Table 3), which makes it the most simple and intuitive. The expediency of algorithmizing the choice of a model is due to the trend towards the digitalization of the economy (Gromova, 2018). The set of models is determined by the prevailing statistics of their use in the infrastructure industry (Merzlov et al., 2015).

As we established in the course of our research, this approach makes it possible to evaluate various PPP models, both from the standpoint of their effectiveness and from the standpoint of their expediency in joint projects of business and government of different countries, including Russia and Abkhazia.

Below we have presented the most significant characteristics of these PPP models.

A management contract is an agreement whereby a business takes on a set of operations and management functions in relation to a public infrastructure facility. These actions are usually carried out by government agencies. In accordance with the contract, the business structure receives the agreed sums of money from the state for the implementation of these works and functions.

A special feature of the BOT model is that the responsibilities of the business include design, construction and financing, and not just management functions and operations. The BOT model provides for the transfer of the created object to the state structure at the end of the operation period. In accordance with this model, the government finances the business structure in different ways (accessibility fees, direct user fees, etc.) (Liu et al., 2016)

In the BOOT and DBFO PPP models, power transfers more tasks and functions to the business, so these models are more complex.

Describing such a PPP model as DBOO, we point out that this is a variant of soft privatization. At the end of the contract, the business retains ownership of the created object.

A number of PPP models should also be highlighted, which are also used everywhere, namely: BOLB (Buy-Own-Lease-Back) model, Alzira model, DFBOT (Design-Finance-Built-Operate-Transfer) model, DCMF (Design-Construct-Maintain-Finance), BRT (Built-Rent-Transfer) model and BOO (Built-Own-Operate) model. (Kalacheva & Uzhegova, 2018).

After all, each project has individual characteristics: the degree of responsibility of the parties, the economic investment of the parties, the risks imposed, and others (Berzel & Riesse, 2005).

Ultimately, the PPP model will be determined by the power structures. At the same time, in our opinion, methodically, the choice of a model should be algorithmized and have the following sequence of actions (stages):

1) at the beginning, the parts of the project are defined as a set of tasks or work that government agencies consider necessary to give to the business;

2) the planned scale of the project is determined;

3) control over the quality of project implementation;

4) further, it is very important to distribute risks between business and government, as well as establish a body to manage them;

5) finally, mechanisms to compensate for the costs of the private sector (choice of payment method) are to be agreed.

Based on the foregoing, we concluded that the choice of a PPP model is a complex multifactorial procedure, which is determined both by the parameters of the project and by the priorities of the authorities. It is often complicated by a lack of information for making a decision (Karlina et al., 2019).

The transfer of part of the risks to private business in the implementation of large infrastructure projects in the field of digitalization of the economy is a significant advantage of the implementation of public-private partnership projects. But the level of preparation of the private sector to take on such a large burden of risk responsibility can reduce the process of project implementation (Berestov, 2013).

First of all, the public sector benefits from cooperation with private business, since as a result of attracting private capital, it has the opportunity to implement the necessary social and socially significant projects (Gromova, 2018). In the process of pooling the capitals of the state and private business, the opportunity to attract additional investment and thus expand production capacity increases, but subject to an even and fair distribution of risks (Rozhentsov, 2017).

One of the main tasks facing the participants in PPP projects is to classify and distribute the risks that each of them assumes as accurately and fully as possible. To classify means to systematize all possible types of risks according to their characteristics by combining a large number of their subspecies. Generally, such a classification can be represented in the form of a table, in which the risks are distributed between private and public partners. For example, let us take two PPP projects that could be implemented as international cooperation with Abkhazia. (Borshchevsky, 2018).

In table 4 (designated as “+”), the distribution of risks occurred under the project “Reconstruction and operation of a hotel and tourist complex in Abkhazia”. Judging by the obligations undertaken, the public partner decided to minimize the risks by taking responsibility only for the provision of land plots. However, this situation is also interesting for the private partner, since he gets almost complete control over the object. Thus, it follows that in this case it would be advisable to use the "DBOO" model.

As the second example (designated as“*”), the project "Construction of an indoor ski complex in Abkhazia" was taken. Judging by the table, all the risks associated with the operation of the facility are assumed by the state, while the private partner is responsible for the design and creation of the facility. In this case, the most rational model would be "BOOT" (Yuryeva, 2018).

Further risk assessment (if necessary, their detailed quantitative analysis) can be carried out using expert methods, the task of which is to obtain the subjective opinion of a group of experts based on the individual opinion of each individual member of the expert group. At the same time, the significance of the risk for the entire project and the likelihood of its manifestation should be assessed by different expert groups (Best practices for implementing public-private partnership projects, 2016).

In general, absolutely for each project, its own risk table is compiled, with the help of which the degree of responsibility of each of the partners is determined, on the basis of which a decision is made to choose a specific model (Parakhina et al., 2019).

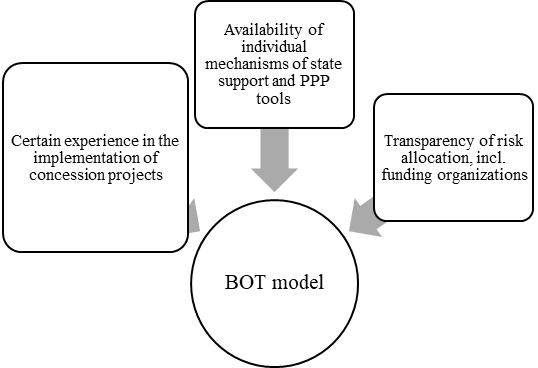

Of course, there are different PPP models, each of which is used in a particular project, depending on its goals and objectives. However, a certain set of advantages of one of the models makes it possible to distinguish it from the background of others (Figure 1).

Conclusion

The interest in the PPP mechanism, which we and other researchers observe in Russia and Abkhazia, as well as around the world, is prioritized by a small amount of budgetary funds for the implementation of infrastructure innovations, as well as a low return on financial investments in them. This, in our opinion, is also due to the lack of entrepreneurial experience among the authorities. These reasons lead the state to the need to use the private sector to solve social and state problems.

As we have shown in the article, an important issue for their solution and the implementation of innovative infrastructure projects is the choice of an effective PPP model. It is determined, first of all, by the global nature of the tasks solved by the authorities and, accordingly, by the ability of business structures to respond with their capacities to the scale of the project.

The use of modern information technologies in the field of PPP also plays an important role in the growth of the country's economy. In such conditions, there will be a constant renewal and improvement of public-private partnership, as well as its models.

Acknowledgments

Russian Foundation for Basic Research (RFBR)No. 19-510-40001 / Аbh-а

References

Akhmetova, L. R., Akhmetov, I. V., & Gavrilenko, I. G. (2018). Some approaches to risk assessment in public-private partnerships. USPTU Bulletin. Science, education, economics. Economics Series, 23, 74-81.

Berestov, V.V. (2013). Instruments of public-private partnership in Russia. University Bulletin. State University of Management, 18, 92-97.

Berzel, T. A., & Riesse, T. (2005). Public-private partnerships: effective and legal instruments of international governance. Integrated sovereignty: restoration of political power in the 21st century, 2005, 195-216.

Best practices for implementing public-private partnership projects (2016). Agency for Strategic Initiatives, PPP Development Center. Special edition for the International Investment Forum "Sochi-2016", 12-43.

Borshchevsky, G. A. (2018). Public-private partnership. Moscow, Yurayt.

Database of infrastructure projects. Retrieved on 20 March 2020 from: https://rosinfra.ru/

Gromova E. A. (2018). Public-private partnership in the digital era: search for the optimal legal form. Yurist, 10, 34-40. http://urfac.ru/?p=1125

Kalacheva, A. V., & Uzhegova, A. M. (2018). Analysis of the forms and models of public-private partnership. Humanities research. No. 12. http://human.snauka.ru/2018/12/25454

Karlina, E. P., Kovalenkova, A. S., & Grigoriev, M. A. (2019). Public-private partnership: models, forms and mechanisms of implementation. ASTU Bulletin. Series: Economics, 4. https://cyberleninka.ru/article/n/gosudarstvenno-chastnoe-partnerstvo-modeli-formy-i-mehanizmy-realizatsii

Liu, T., Wang, J., & Wilkinson, S. (2016). Identification of critical factors affecting the efficiency and effectiveness of tender processes in public-private partnerships (PPPs): a comparative analysis of Australia and China. International Project Management Journal, 34(4), 701-716.

Merzlov, I. Yu., Prudskiy, V. G., & Gershanok, G. A. (2015). An economic model for assessing the effectiveness of the implementation of PPP projects. Modern problems of science and education, 2(1), 26-32.

Ovchinnikov, S. A., & Fateev, M. A. (2013). Topical issues of public-private partnership in e-government. Bulletin of the Saratov State Social and Economic University, 1, 112-116.

Parakhina, V. N., Boris, O. A., Vorontsova, G. V., Momotova, O. N., & Ustaev, R. M. (2019). Innovational Projects of Technological Growth on the Platform of Public-Private Partnership: Risks and Methods of Their Minimization. Tech, Smart Cities, and Regional Development in Contemporary Russia, Emerald Publishing Limited. 15-27.

Reznichenko, N. V. (2010). Models of public-private partnership Bulletin of SPb Uni. Ser. Management, 4, 58-83.

Rozhentsov, I. S. (2017). Development of a financial model for the implementation of public-private partnership projects. International Research Journal, 1(55), part 1, 55-57.

Yuryeva, T. V. (2018). Public-private partnership projects in Russia and in foreign countries. Regional economics and management: electron. sci. journal, 4(48). https://eeeregion.ru/article/4833/

Copyright information

This work is licensed under a Creative Commons Attribution-NonCommercial-NoDerivatives 4.0 International License.

About this article

Publication Date

01 July 2021

Article Doi

eBook ISBN

978-1-80296-112-6

Publisher

European Publisher

Volume

113

Print ISBN (optional)

-

Edition Number

1st Edition

Pages

1-944

Subjects

Land economy, land planning, rural development, resource management, real estates, agricultural policies

Cite this article as:

Parakhina, V. N., Vorontsova, G. V., Boris, O. A., Momotova, O. N., & Ustaev, R. M. (2021). Evaluation Of Public-Private Partnership Models: Methodological Aspects And International Features. In D. S. Nardin, O. V. Stepanova, & V. V. Kuznetsova (Eds.), Land Economy and Rural Studies Essentials, vol 113. European Proceedings of Social and Behavioural Sciences (pp. 797-805). European Publisher. https://doi.org/10.15405/epsbs.2021.07.95