Abstract

The authors consider the process of State cadastral valuation of agricultural land, which is carried out in Russia in order to form the basis for collecting land tax from the late 1990s to the present. The four rounds of cadastral valuation that have passed during this time are analyzed, differences in the applied methods are revealed. Despite the fact that all tours are based on the method of direct capitalization to land valuation, the methodological algorithms used by the appraisers differ significantly in the methods of grouping the valuation objects, in the methods of calculating rental income and capitalization ratio. In the first rounds, the amount of land rent was calculated on the basis of integral criteria of fertility, location and technological properties, and the capitalization ratio was set by normative means. Starting from the third round, the calculation of the capitalization ratio is based on the determination of risks, and the rental income is estimated on the basis of historical data on land productivity, sales prices, production costs and soil fertility maintenance. The fourth round is held in fundamentally different conditions: under the new regulatory framework, with other performers of evaluation works: instead of private appraisers selected at open tenders, since 2017, the evaluation process has been transferred to specially created state organizations. The authors studied the average values of the cadastral valuation in each of the past valuation rounds in the context of all regions of Russia, and analyzed the main trends in cost changes.

Keywords:

Introduction

State cadastral valuation of agricultural land has a long history in Russia, so it is not surprising that it is given a lot of attention.

Today, the area of agricultural land in the Russian Federation as of January 1, 2020 is 382.5 million hectares or 22.3% of the country land fund, including agriculturally used areas (arable land, hayfields, pastures, perennial plantations and fallow lands) - 197.7 million hectares.

During 2017-2019, a fundamentally new system of the State cadastral valuation of land and other real estate began to form in Russia, it was based on the Federal Law of July 3, 2016 No. 237-FL "On State Cadastral Valuation" and "Methodological Instructions for the State Cadastral Valuation" of May 12, 2017. In 2019-2020, a tax base calculated according to a new methodological instruction is created. The first work carried out on the new methodological and legal framework demonstrated the shortcomings and inaccuracies in the methodology, which require reflection, identification of the causes and elimination before the next round of cadastral valuation.

The more relevant is the comparative analysis of the results of the cadastral valuation obtained in different rounds and using different methods.

Problem Statement

The topic of State cadastral valuation of agricultural land in various aspects is reflected in many works of Russian scientists. Works published in recent years are mainly devoted to the problems of methodological support of the State cadastral valuation.

Achmizova and Zhukov (2019) reviewed the methodology of each round by analyzing the advantages and disadvantages. It was noted that in recent years, the determination of cadastral value is taken more seriously. The advantages include the fact that the new methodological instructions consider each land plot (subject to valuation), evaluating its actual use, taking into account the characteristics of the object (Achmizova & Zhukov, 2019). Disadvantages include: first of all, this is the lack of updated cartographic soil material, which does not allow a qualitative valuation of agricultural land, in a number of regions such soil surveys were carried out for a long time, and there are also regions where they are simply not available; no deadlines are provided for limiting the use of existing soil maps and soil sketches, thus there is no obligation to update them. A great problem is the lack of information on the location of the boundaries of land plots in the Unified State Register of Real Estate, on this account, there is no possibility of drawing up an explication of soil types on a land plot. As practice shows, up to 12 or more soil varieties can be present within the boundaries of a single land plot; a methodological problem should be attributed to the lack of methodological expertise by Federal Agency for State Registration, Cadastre, and Cartography.

Also, according to the authors, the lack of a social factor in the cadastral valuation of agricultural land is a disadvantage. Today, a lot of attention is paid to the topic "how to preserve the village" and the problems of the rural population employment.

Such an important aspect as the information support of the State cadastral valuation was considered by Sizov and Ogleznev (2016) in their scientific work. It was found that when working with medium-scale soil maps, there is a need to clarify the Federal list of soils at the level of the studied region in the format of the nomenclature of the Unified State Register of Soil Resources of Russia.

In addition, regional soil lists on regional maps, which were usually formed from large-scale maps of individual farms and districts, need to be adapted to the Federal Soil List, harmonized with the unified nomenclature (Sizov & Ogleznev, 2016).

Prudnikov and Semchenkova (2016) in their article propose to oblige the registration services to enter a number of indicators into the registration documents for agricultural land: basic parameters of soil fertility; indicators of the ecological and cultural conditions of the land plot, and when conducting an agrochemical soil survey when allocating plots, to focus on the boundaries described in the cadastral passport.

For a long time, Maht and Rudi (2016) paid close attention to the methodological support of the cadastral valuation of agricultural land, considering and analyzing various methods. With the adoption of new Methodological instructions in 2010, they considered them not professional, which lead to a deliberately chaotic system for soil fertility valuation and are practically unrealizable.

The authors of the article believe that it is necessary to return to the system of soil valuation in two stages: valuation of comparative natural soil fertility and valuation of soil fertility by crop yield, which will improve the quality and objectivity of the State cadastral valuation of agricultural land (Maht & Rudi, 2016).

According to the authors, to use profitability in order to determine the profit of an entrepreneur in agricultural conditions, when the profitability of production fluctuates widely depending on a number of reasons, from natural and climatic conditions to speculative games to lower prices, it is necessary to use the average value for a long a period, commensurate with the duration of use of the bulk of fixed assets purchased for the implementation of an entrepreneurial project. Taking into account the factors for the short-term period does not give true picture, since, in the conditions of counter-sanctions, there is an increased value of profitability (Zhichkin, 2018).

Other authors (Nosov & Sapozhnikov, 2011; Sapozhnikov et al., 2018) consider the first results of determining the cadastral value of agricultural land under the new rules in specific regions. And the main problems that have arisen are identified, such as the weak development of the land market for agriculture; lack of information about real estate objects in the Unified State Register of Lands; dependence of the current methodology on the opinion of the customer.

Foreign experience in agricultural land valuation allows us to conclude that the multidimensionality of the valuation process and the dependence of land value on a large number of non-market factors is a global state of affairs. There are general factors (Walt, 2017), such as soil cover, topography, precipitation, and moisture content that affect the cost of all types of agricultural land use, and specific factors that adjust the cost of a particular land use. Specific factors include (Barry et al., 1995) the characteristics of available resources of various types (labor, capital, land), ways of combining them and the structure of the products produced.

The abundance of price-forming factors and the need to take them into account to improve the accuracy and efficiency of agricultural property valuation increases labor costs and increases the requirements for the training level of the evaluator. Against this background, some developing countries lack trained evaluators (Pacharavanich & Rossini, 2001). The solution to these problems can be the active introduction of digitalization and automation of evaluation processes.

A significant number of publications on evaluation in recent years have focused on this automation process for example Cervera-Gómez, et al. (2014), Paloma et al. (2010) or Sipan et al. (2012).

The increase in the share of automated processes leads to increased requirements for databases with source information, as well as concerns about job losses due to computerization, but at the same time new points of employment are created, such as satellite images processing (Dimopoulos & Bakas, 2019).

Research Questions

State cadastral valuation in Russia is a set of measures aimed at determining the value of the real estate, in particular agricultural land plots, using mass valuation methods.

Over the past decades, a number of basic transformations have taken place in the country, with the help of which it is possible to achieve a variety of forms of land ownership and the development of a land market (Varlamov, 2015). When creating this infrastructure, the cadastral valuation of land is of particular importance in the system of regulation tools of land relations, and the system of economic regulation and management of territories should be based on the results of the state cadastral valuation of land (Varlamov, 2006).

Since 1999, when the State cadastral valuation was initiated, 4 rounds of agricultural land valuation have been conducted in the Russian Federation: in 2001-2005, in 2006-2010, in 2011-2016, and from 2018 to the present.

Purpose of the Study

The purpose of this article is an analytical review of the development of the State cadastral valuation of agricultural land in Russia.

Research Methods

Cadastral valuation in the first two rounds was conducted in two stages: at the first, agricultural land was evaluated at the level of the constituent entities of the Russian Federation, and basic standards were developed for valuation within the constituent entities of the Russian Federation, at the second stage, the cadastral value was determined within the borders of constituent entities of the Russian Federation by administrative districts and individual landholdings and land uses.

The methodological basis for determining the cadastral value of agricultural land plots at this time was the capitalization of the estimated rental income. The estimated rental income consisted of absolute rental income and differential income. The absolute rental income and the capitalization ratio were set by normative means.

At the second stage, the indicator of the cadastral valuation of a land plot is the average weighted score of normative productivity of the assessed land plot. The score of normative productivity of land plot is defined as the average weighted indicator of productivity of the soils forming the cover of the estimated land plot.

The indicator of the cadastral value of 1 hectare of agricultural land was calculated in accordance with the integral indicators of a land plot (as an object of assessment) in terms of soil fertility, technological properties and location.

The valuation of agricultural land was carried out on the basis of a soil survey with the compilation of a soil-ecological map according to a regulated set of mandatory information characterizing the main parameters of the qualitative state of lands or a land plot and their soil fertility, as well as a cadastral valuation in points and value terms.

The result of the first stage of work was the specific indicators of the cadastral value of agricultural land at the level of the constituent entities of the Russian Federation. At the second stage of evaluation work in 2006-2007 specific indicators of the cadastral value of agricultural land were determined at the level of land plots.

In 2010, new Methodological Instructions for the State Cadastral Valuation of Agricultural Land were approved, which had a number of significant differences.

The first thing to note is that the cadastral value is calculated for each land plot. The developers suggested using indicators of standard productivity and standard costs based on technological maps instead of analyzing statistical data for recent years on crop yields and costs for their cultivation.

New Methodological Instructions did not take into account absolute land rents, the location of land plots, and crop rotation.

In the third round, all agricultural land in Russia was divided into six groups. The basis for determining the cadastral value was the forecast of rental income from agricultural production calculated on the basis of actual historical data. The resulting amount was capitalized using the capitalization rate calculated using the cumulative construction method.

The Methodological Instructions approved in 2010 form the basis of the current Methodological Instructions used in the fourth round of evaluation work.

Work on cadastral valuation in the fourth round has just begun, and the results have been approved in only a small number of regions. Nevertheless, it can already be stated that the main method of estimating the cadastral value of land is still direct capitalization.

Findings

Despite the methodological changes in the cadastral valuation process, described above, it can be stated that over the past twenty years, the main factors affecting the cadastral value of agricultural land have been and are:

- the amount of precipitation and average temperatures of the coldest and warmest months in the climate zone of the estimated site location. These indicators determine the agroecological potential;

- humus level in the arable layer, the thickness of the humus horizon, the content of physical clay in the arable layer, as well as the negative properties of each soil variety. These characteristics directly affect the standard grain yield;

- typical crop rotation structure in the area of the subject to valuation location. The crops included in the crop rotation affect the potential gross income in natural terms;

- historical prices for crop production that directly affect the monetary estimate of the gross income from the site;

- the costs of cultivating and harvesting crops and the costs of maintaining soil fertility, which are participants in the calculation of land rents;

- interest rates involved in calculating the capitalization rate.

The results obtained in this study are based on the analysis of reports on the results of the State cadastral valuation contained in the State Fund of Cadastral Valuation data and literature sources.

The table 1 shows when the cadastral valuation of agricultural land was carried out in the regions of Russia.

The above table demonstrates the State Cadastral Valuation in the context of Federal districts by the terms of their implementation. It should be noted that the table does not include Federal cities that do not have a category of agricultural land. Also, initially, the number of Federal districts was seven. Later there were changes in their composition.

For the first and second rounds, evaluation work was carried out according to the methodology for cadastral valuation of agricultural land, based on the calculation of the basic actual indicators at the level of the constituent entities of the Russian Federation for agricultural land, which was adopted in 2001. Differentiation of basic indicators by land plots was carried out by indicators of fertility, technological properties and location. The third round was conducted according to the new Methodological Instructions for the State Cadastral Valuation of Agricultural Land adopted by the Ministry for Economic Development in 2010. The cadastral value was determined based on soil varieties, calculation of standard values of estimated crop yields, and calculation of standard costs. Currently, work is underway to determine the cadastral value of agricultural land in the fourth round.

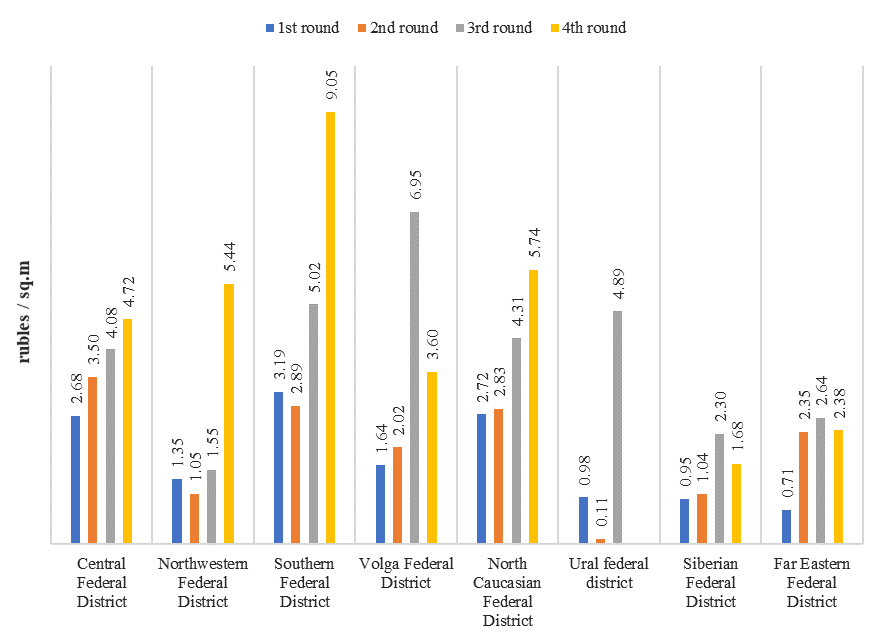

Due to the limited scope of the article, it is not possible to show the dynamics of cadastral value in each region, so Figure 1 shows the average specific cadastral values of agricultural land in the context of Federal districts.

As it can be seen from the data in the Figure, the cadastral value of agricultural land was constantly growing in nominal terms. On average, over 20 years, its value has increased by 221%. The maximum growth was demonstrated in the Northwestern and Far Eastern districts. The largest increases in the cadastral value there were recorded in the Novgorod, Murmansk and Sakhalin regions, as well as in the Kamchatka Territory. In many ways, such a significant increase in cadastral value led to changes in the cadastral valuation process, which were mentioned above.

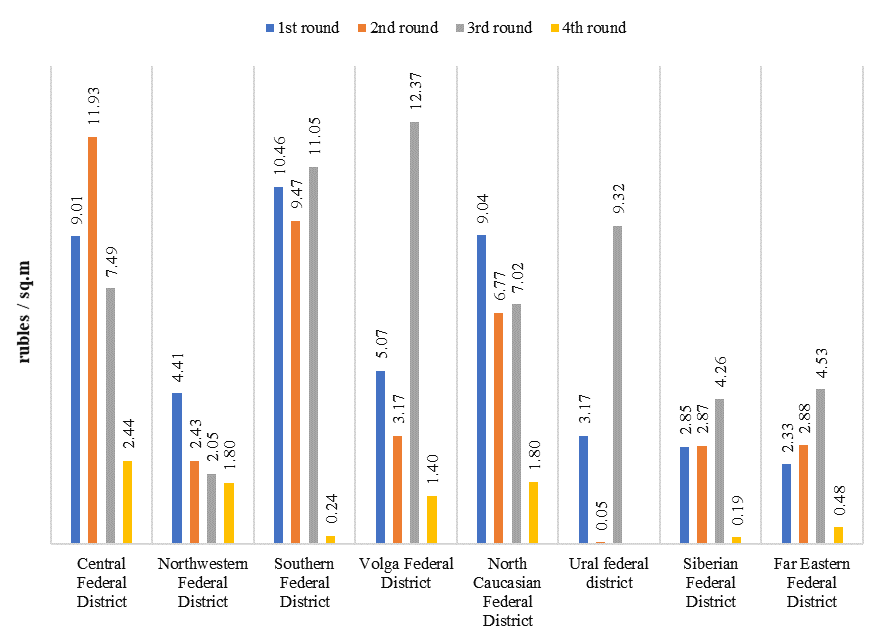

In order to identify real trends in the cadastral value, the cadastral values of 1 sq. m. of agricultural land were recalculated to 2019 prices. As a result, the picture shown in Figure 2 was obtained.

As we can see, the situation is completely different in real prices. The average regional increase in cadastral value since 2000 is 71%, but in many regions there is a significant decrease in cadastral value in real terms. For example, in the Kostroma region, the real cadastral value of 1 sq. m. of agricultural land in the fourth round decreased by 75% compared to the first round. In the Komi Republic, this decrease was 70%, and in the Kursk and Samara regions - about 60%.

Conclusion

Based on the conducted research, it can be concluded that the mass valuation of real estate objects, which is the basis of taxation in the Russian Federation, passes the fourth stage since 2017 to determine the value of land on the territory of all subjects. The transition of an important natural resource - land, from state to private ownership, requires the development of mechanisms to regulate the processes of monitoring and managing land resources. Improvement of the applied methodology for the State cadastral valuation of real estate objects will move forward the processes of making land the property of the country, capable of supporting the regional economy and developing investment programs in remote regions of the Russian Federation.

Having considered the theoretical provisions and methods of conducting the state cadastral valuation of real estate objects, we can conclude that at present, these activities will reveal the scale of the necessary measures for the completion and sustainable development of land management mechanisms.

Modern transfer of responsibility for conducting a cadastral valuation to budgetary institutions, contributes to the fulfillment of tasks to update information in uniformity and compliance with uniform Methodological Instructions. Creating conditions for the openness and validity of the use of algorithms for determining the value of real estate objects, for the implementation of a lawfully appropriate potential of the tax base.

Acknowledgments

Article is prepared with assistance of a grant of the Ministry of Agriculture of the Russian Federation R&D No. АААА-А20-120012290119-6.

References

Achmizova, F. A., & Zhukov, V. D. (2019). Evaluation of methods of cadastral valuation of agricultural land. Modern problems and prospects of development of land and property relations. Proceedings of the all-Russian scientific and practical conference (pp. 46-53). Krasnodar, Publishing house: LLC "Epomen".

Barry, P. J., Ellinger, P. N., Hopkin, J. A., & Baker, C. B. (1995). Financial management in agriculture. 6th edition. Interstate Publishers Inc.

Cervera-Gómez, L., Peña, S., Hernández, V., & Fuentes, C. (2014). Planning Support Systems: A Computer-assisted Mass Appraisal (CAMA) System for Ciudad Juarez, Mexico. Journal of Property Tax Assessment & Administration, 9, 25-40.

Dimopoulos, T., & Bakas, N. (2019). Sensitivity Analysis of Machine Learning Models for the Mass Appraisal of Real Estate. Case Study of Residential Units in Nicosia, Cyprus. Remote Sensing, 11. 30-47.

Maht, V. A., & Rudi, V. A. (2016). Fundamentals of the methodology and modern problems of soil fertility valuation for cadastral valuation of agricultural land. Earth Sciences - OmGAU Bulletin, 4(24), 106,112.

Nosov, S. I., & Sapozhnikov, P. M. (2011). Problems of state cadastral assessment of agricultural land and ways to solve them. Russian Newspaper, 18(800), 5.

Pacharavanich, P., & Rossini, P. (2001). Examining the potential for the development of computerised mass appraisal in Thailand. Seventh Annual Pacific-Rim Real Estate Society Conference Adelaide, Australia.

Paloma, T., Kauko, T., & d'Amato, M. (2010). Mass Appraisal Methods: An International Perspective for Property Valuers. International Journal of Strategic Property Management, 13, 359-364.

Prudnikov, A., & Semchenkova, S. (2016). Enhancement of the system for agricultural land development. International agricultural journal, 4.

Sapozhnikov, P. M., Stolbovoy, V. S., Ogleznev, A. K., & Kuzmina, V. I. (2018). Cadastral valuation of agricultural land in Orenburg region. Use and protection of natural resources in Russia, 1(153), 30,36.

Sipan, I., & Ali, H., Ismail, S., Abdullah, S., Shazmin, S. A. A., & Aziz, Abd. (2012). GIS-based mass appraisal model for equity and uniformity of rating assessment. International Journal of Real Estate Studies, 7, 40-49.

Sizov, V. V., & Ogleznev, A. K. (2016). Quality assessment and cadastral valuation of soils in the Vladimir region based on the Unified State Register of Soil Resources of Russia. Agricultural intensification systems as the basis for innovative modernization of agricultural production. Suzdal, Publishing House: IPK "PresSto".

Varlamov, A. A. (2006). Land cadastre: Vol. 4. Land valuation. Moscow, KolosS

Varlamov, A. A. (2015). Economics and ecology of land use. textbooks and manuals for students of higher educational institutions. Moscow, FOLIUM.

Walt, K. (2017). An analysis of the use of mass appraisal methods for agricultural properties. Acta Structili, 24, 44-76

Zhichkin, K. A. (2018). Profit of an entrepreneur and profitability in cadastral valuation of agricultural land. The Real Estate Cadastre and Monitoring of Natural Resources. Materials of the 3rd International scientific and technical Internet conference (pp. 7-15). Tula, Publishing house of Tula State University.

Copyright information

This work is licensed under a Creative Commons Attribution-NonCommercial-NoDerivatives 4.0 International License.

About this article

Publication Date

01 July 2021

Article Doi

eBook ISBN

978-1-80296-112-6

Publisher

European Publisher

Volume

113

Print ISBN (optional)

-

Edition Number

1st Edition

Pages

1-944

Subjects

Land economy, land planning, rural development, resource management, real estates, agricultural policies

Cite this article as:

Komarov, S. I., Gal'chenko, S. A., Zhdanova, R. V., & Rasskazova, A. A. (2021). State Cadastral Valuation Of Agricultural Land In Russia. In D. S. Nardin, O. V. Stepanova, & V. V. Kuznetsova (Eds.), Land Economy and Rural Studies Essentials, vol 113. European Proceedings of Social and Behavioural Sciences (pp. 240-249). European Publisher. https://doi.org/10.15405/epsbs.2021.07.30