Abstract

For a decade, pig breeding in Russia has been growing and increasing its output by 8% every year. Some significant and powerful structural changes are underway in the industry. Thanks to government support measures, the existing production facilities were reconstructed and new high-tech pig breeding complexes were built. The industry features a significant economy of scale effects, and the level of its concentration rises. Currently, more than 80% of pork is produced by large industrial complexes. The industry consolidation is increasing. Vertically integrated holdings produce the major part of all products. The share of TOP-20 pork producers reached 68.2% in 2019. In the center of European Russia, a group of 11 regions featured very high localization rates for pork production (up to 20.0). By 2019, more than half of Russian pig products were produced within these territories. Studies show that the high level of industry consolidation and the dominance of holdings impose certain restrictions on the application of the cluster approach. However, one should take into account, firstly, the high density of holdings in a given territory, and, secondly, the urgent need for cooperation to solve the problems of industry development. This makes it possible to predict that the next stage in the development of pig breeding may be the use of cluster interaction methods.

Keywords: Cluster, holding, industry consolidation, industry concentration, pig farming, Russia

Introduction

Russian agriculture in the past decade experienced a steady and rapid development. The new cycle began with the priority national project for the Development of Agricultural Sector (2008). Additional growth factors include the counter-sanctions imposed by Russia to retaliate against the food import restrictions and the ruble depreciation (2014). Since 2013, state support is implemented within the State Program for the Development of Agriculture and Agricultural Produce, Raw Material, and Food Market Regulation for 2013-2020.

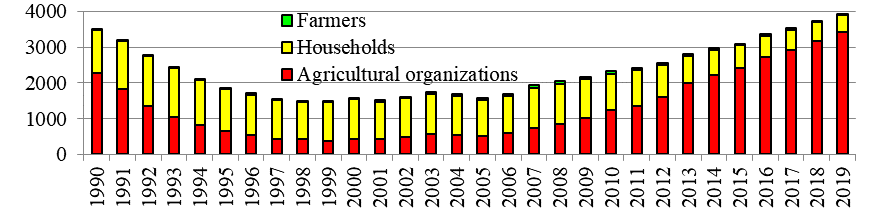

Pork breeding is one of the most rapidly developing sectors of agriculture. Since the beginning of economic reforms, the sector experienced a major downturn. By 1999, the output levels in agricultural companies decreased 6 times as compared to 1990 with private households producing the largest share of pork (72.5%). Steady growth began in 2007, and by 2017, Russia recovered the production volumes of the pre-reform period.

During this period, this industry experienced dramatic structural changes. The outputs of agricultural businesses are increasing rapidly (their share amounted to 86% by 2019). Consequentially, the share of personal smallholdings is decreasing (Figure 01).

We may note that the development of this industry is intensive, i.e., through the increase of productivity of animals and labor efficiency. Pig stock was reduced by a third (from 38 million heads in 1990 to 25 million heads in 2019). The growth rate of the industry output in the past decade amounted to over 8% a year.

Problem Statement

What factors condition this successful development? Firstly, the industry has a powerful scale effect. Technological innovations in pig breeding and the threat of atypical swine fever bring great pressure on the increase of pig farm sizes. Among the agricultural sectors (Barbysheva, 2017, the Kursk Region case), pig breeding has the highest dependence rate between the farm size and profitability (coefficient of correlation = 0.85). As a result, the average farm size over the last ten years in terms of pig stock increased 11 times, and in some regions, the increase was a hundred times and even more (Table 01). Currently, over 80% of pork is produced in modern industrial units (Klimenko et al., 2017).

Secondly, the industry is increasingly consolidated. The governmental support measures were mostly used by the largest vertically integrated agricultural holdings. Within a short time, impressive results were achieved in terms of commissioning new and modern pig-breeding units. According to the data from the National Union of Swine Breeders (http://www.nssrf.ru/documents.php?action=statistics), the share of the ТОР-20 pig producers in Russia increased from 49.2% in 2010 to 68.2% in 2019. The largest pork producer in Russia, Miratorg Agricultural Holding, produces 10% of the industry output. This confirms that large agricultural holdings became the leading organization form in Russian pig breeding.

What are the role and impact of clusterization in the context of increasing concentration and consolidation? Numerous research works (Markov et al., 2017; Simachev et al., 2018) show that the cluster approach became the most widely used method of stimulating the social and economic development of regions in the majority of the world's countries. The cluster approach is viewed as a new type of economic policy, i.e., the “soft” industrial policy aimed at the formation of network organizations and network interactions, including in cluster format (Smorodinskaya, 2015).

Cluster policy plays an important role in Russia’s economic policy (Kutsenko et al., 2017). Today, its priorities are shifting towards supporting cluster projects and cluster member cooperation rather than clusters per se (Markov et al., 2019). It also targets cluster network formation and efficient management team creation (Simachev et al., 2018).

There is a number of global agricultural industry clusters in the world. These include, for instance, Food Valley (ЕС), a grain cop cluster, Denmark's milk cluster, New Zealand's wine and kiwi clusters (Novoselov & Smirnova, 2016), Chile wine cluster, Equador flower cluster, etc. (Smirnova et al., 2016). Some of the clusters were formed without state regulation tools, while others emerged due to governmental support.

Agricultural clusters are included in the economic policies of almost all regions of Russia. Regions’ industry specialization and agriculture sector localization are becoming more prominent. For example, the rye production in Russia is dominated by a group of closely-located regions of the Privolzhsky Federal District producing large amounts of rye grain (their localization coefficients are higher than 2.0). The localization of production in these regions is still progressing (Kostenko, 2020). Pork clusters can be found both in global practice (Grigorieva & Shulga, 2016) and in Russia (Bochkova et al., 2014).

Research Questions

According to the cluster theory, there are three main cluster changes (Aleksandrova & Matveeva, 2014; Kostenko, 2018; Markov et al., 2015): cluster member localization of proximity; economic interdependence or similar type of activities (industrial or cross-sector value chain); network proximity, or the formation of stable interaction networks within the cluster. The specific features of Russian pig breeding pose two main problems.

- The industry has been growing for ten years. Through the state support funds, the business community invests in the areas that comply with the modern technological and organizational innovations in the industry. What are the subsequent changes in the distribution and localization of pig breeding companies in Russia? We assume that the close arrangement trend is evident in pig breeding, like in the majority of other agricultural sectors.

- Russian agricultural holdings built internal sector chains. There are examples of complete vertical integrations and field-to-market strategies. There is a new trend to set up genetic selection centers and corporate universities within the holdings. Does this mean that holdings are not interested in cluster cooperation?

Purpose of the Study

The goal of this research is to analyze localization processes and evaluate the cluster approach prospects in Russian pig breeding taking into account the high concentration and consolidation of this industry.

Research Methods

This study relies on the dialectical method, the theory of clusters and methods of their identification, the systematic approach in economics, reviewing academic publications, and economic and statistical analysis methods. The authors used modified localization coefficients that were calculated according to the "pig live weight gain in agricultural organizations" in proportion to the average annual number of employees. A high localization factor threshold of 2.0 was chosen. The data used in the calculations were taken from the official website of the Federal State Statistics Service of the Russian Federation (https://rosstat.gov.ru/).

Findings

Pig breeding localization in the center of European Russia

To analyze the spatial distribution of pig breeding enterprises, the authors used the localization coefficient method. We obtained the following results:

- according to the data analyzed, there were 12 regions with localization coefficients higher than 2.0 in 2004. The maximum values of the coefficients were relatively low (3.3 for Belgorod, and 3.0 for Omsk Region). The regions were separated from each other and thus did not form a compact localization. This spatial distribution of big breeding facilities can be characterized as even;

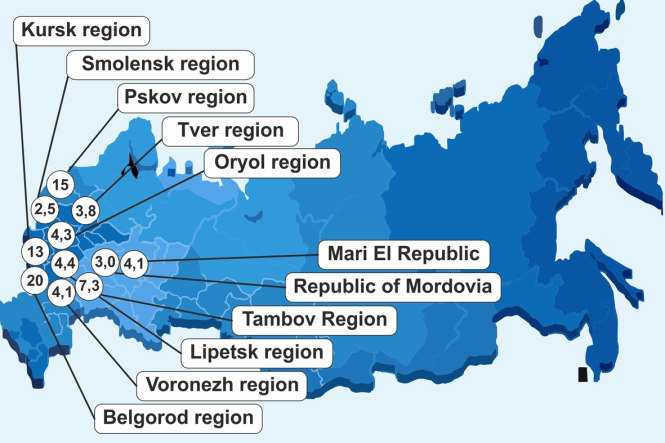

- by 2018, significant changes occurred. The number of regions with localization coefficients over 2.0 fell to 11. Over half of the region list changed. The level of localization increased significantly (20 for Belgorod, 13 for Kursk, and 15 for Pskov). The largest pig breeding cluster was localized in European Russia (Figure 02).

Data from Table 02 let us trace the formation of this cluster over a decade. The absolute growth of pork production in Russia for 2004-2019 amounted to 2996 thousand tons (live weight), including the 2467-thousand-ton (over 80%) growth in the cluster in question.

Almost all large agricultural holdings in Russia have assets and production facilities in this cluster. The share of these 11 regions in the Russian pork production increased from 15% in 2004 to 54% in 2019. The absolute leader of the industry is Belgorod Region. In this region, the outputs increased 21 times (from 43 thousand tons in 2004 to 904 thousand tons in 2019) to compile 18% of the all-Russian figure.

Agricultural holdings and clusters as integration forms

The classic integration forms include vertically integrated companies, holdings, and group corporations. They feature a partial replacement of market relations with a hierarchy, and their advantage is in the scale effect, cost reduction, and prompt decision-making. The current practice relies on “soft” integration forms: strategic alliances, clusters, associations, and network organizations. “Soft” integration forms have such advantages as flexibility, competitive cooperation effects, quick knowledge transfer.

It is believed that clusters are more efficient in innovative economies but today's Russia is dominated by holdings (as illustrated by the pig breeding case). According to (Aleksandrova, 2014), the process of clusterization will be nominal until all the advantages of the classic holding integration have been used up. However, the case of the fat-and-oil industry in Saratov Region shows that even under monopolization and holdings, there are signs of cluster integration: the concentration of competitive resource base attracts new players into the region; industrial alliances and informal clubs emerge.

Let us analyze the cluster effects in Russian pig breeding in the case of Belgorod Region. Pig breeding here is highly localized, and the region's share in all-Russian pork production is 18%. The pig stock at the end of the year is 4.5 million heads, which is three times over the population count.

The region has a high concentration of holdings. Federal (Miratorg, RusAgro) and regional (Agro-Belogorie, Prioskolye, Belgrankorm, PromAgro, Agro-industrial corporation DON, etc) holdings have production facilities here. These results were achieved due to the successful regional program for the development of agriculture that has been in place since 2004. Stanislav Oleynik, vice governor of Belgorod Region, (https://www.elibrary.ru/item.asp?id=30622422) claims that the region is home to a meat cluster (with the annual output of 780 thousand tons of pork and 800 thousand tons of live poultry).

What are the prospects of cluster integration and what areas of cooperation can be interesting for holdings nowadays? Areas like these exist. Many researchers focus on the high dependence of Russian pig breeding on foreign breeding programs (Smirnova & Smirnova, 2016; Zhultauskas, 2016). Brand-new selection technologies for breeding animals are based on genome and big data technologies. The national pig-breeding alliance suggests using foreign experience (from Denmark, Germany, and Canada) to create a uniform database based on the data exchange between breeding companies. A cluster project like this can be highly efficient even if only holdings’ information resources get unified.

Conclusion

For a decade, the Russian pig breeding industry has been growing, and the yearly increase in outputs amounts to 8%. The industry is experiencing dramatic structural changes:

- the level of concentration is increasing, and over 80% of all pork is produced by large industrial units;

- the majority of produce is made by vertically integrated holdings, while the share of the ТОР-20 pork producers was 68.2% in 2019;

- in the center of European Russia, there is a group of 11 regions with exceptionally high pork production localization coefficients (up to 20.0). This cluster produces over half of all pork in Russia.

- research shows that the high consolidation level and holding domination have certain restrictions for the cluster approach. However, we must consider the high density of holdings in the given territory and a pressing need for combining efforts to solve development problems in the industry. It leads us to the conclusion that the next stage in the development of the industry might be the use of cluster interaction tools.

References

Aleksandrova, L. A., & Matveeva, O. V. (2014). The institutional approach to cluster studies. Agrarian Scientific Journal, 10, 65-69.

Aleksandrova, L. A. (2014). Industrial integration: cluster versus holding. Bulletin of the Saratov State Social and Economic University, 2(51), 25-29.

Barbysheva, G. I. (2017). Absolute concentration changes in the Kursk region agriculture in the context of microzones and brunches. Bulletin of the South-West State University, 1(70), 83-94.

Bochkova, E. V., Kuznetsova, E. L., & Sidorov, V. A. (2014). Cluster as the institutional structure in the system of the territorial division of labor. Krasnodar: Novation. https://www.elibrary.ru/item.asp?id=23079948

Grigorieva, E. E., & Shulga, P. S. (2016). Cluster approach in the organization of agricultural research on the example of Canada. Nikon readings, 21, 315-318. https://www.elibrary.ru/item.asp?id=27180573

Klimenko, A. I., Tretyakova, O. L., Svinarev, I. Y., & Degtyar, A. S. (2017). The state and prospect of development of the pig industry in Russia. Bulletin of the Don State Agrarian University, 4(1), 41-50. https://www.elibrary.ru/item.asp?id=32273624

Kostenko, O. V. (2018). The institutional environment of Russia: conditions for clusters networks development. Revista Espacios, 39(47). http://www.revistaespacios.com/a18v39n47/18394710.html

Kostenko, O. V. (2020). Modified localization coefficients for cluster processes identification: a comparative analysis (case study: the Russian rye sector). International Conference on Efficient Production and Processing (ICEPP-2020), 161, E3S Web Conf. DOI:

Kutsenko, E. S., Abashkin, V. L., Fiyaksel, E. A., & Islankina, E. A. (2017). A decade of cluster policy in Russia: a comparative outlook. Innovation, 12(230), 46-58.

Markov, L. S., Kurmashev, V. B., & Nizkovskiy, A. Y. (2019). Russian cluster policy in the context of cooperation. The world of economics and management, 19(4), 38-51. DOI:

Markov, L. S., Kurmashev, V. B., & Nizkovskiy, A. Y. (2017). Federal and regional cluster policy of the Russian Federations. The world of economics and management, 17(4), 107-121. DOI:

Markov, L. S., Petukhova, M. V., & Ivanova, K. Y. (2015). Organizational structures of cluster policy. Journal of New Economic Association, 3, 140-152.

Novoselov, S. N., & Smirnova, S. M. (2016). Formations of innovative agricultural clusters: synthesis of international practices. Economy: yesterday, today, tomorrow, 3, 58-67.

Simachev, Y. V., Akindinova, N. V., Yakovlev, A. A., Kuzyk, M. G., Kutsenko, E. S., Medovnikov, D. S., & Glazatova, M. K. (2018). Industrial policy in Russia: new conditions and possible agenda (the report of NRU HSE). Economic issues, 6, 5-28.

Smirnova, S. M., Elagina, A. S., & Novoselov, S. N. (2016). Impact of globalization on the evolution of the agro-industrial clusters in countries with a developing economy. Economy: yesterday, today, tomorrow, 4, 55-64.

Smirnova, V. V., & Smirnova, M. F. (2016). Development of pig farming in the context of intensification of the industry. Bulletin of the St. Petersburg State Agrarian University, 42, 240-247.

Smorodinskaya, N. V. (2015). The globalized economy: from hierarchies to network order. IE RAS.

Zhultauskas, J. (2016). Pure maternal line Norsvin Landrace from Topigs Norsvin. Efficient Livestock, 8(129), 11-13.

Copyright information

This work is licensed under a Creative Commons Attribution-NonCommercial-NoDerivatives 4.0 International License.

About this article

Publication Date

01 July 2021

Article Doi

eBook ISBN

978-1-80296-112-6

Publisher

European Publisher

Volume

113

Print ISBN (optional)

-

Edition Number

1st Edition

Pages

1-944

Subjects

Land economy, land planning, rural development, resource management, real estates, agricultural policies

Cite this article as:

Kostenko, O. V. (2021). Holdings Or Clusters? Case Study: The Russian Pig Industry. In D. S. Nardin, O. V. Stepanova, & V. V. Kuznetsova (Eds.), Land Economy and Rural Studies Essentials, vol 113. European Proceedings of Social and Behavioural Sciences (pp. 199-206). European Publisher. https://doi.org/10.15405/epsbs.2021.07.24