Abstract

The article presents the results of studying the impact of taxation on the efficiency of the agricultural sector. The research was carried out using the data from agricultural organisations of the Vologda region, which are the region’s main taxpayers. The article presents the results of studying the impact of taxation of agricultural organizations in the Vologda region on the efficiency of the agricultural sector. It has been revealed that the existing taxation system has a negative effect on the efficiency of agriculture in the region because of the heavy tax burden. For example, for agricultural producers in the Russian Federation the tax burden is 3.2%; in agriculture it is 4.1%, and in the Vologda region this indicator for the same period is 9.5% (with the insurance payment it is 16.4%). This deviation of the regional indicator is explained by different regional economic conditions for agricultural producers. This deviation also leads to reducing the budget efficiency ratio and to the downward trend in the basic indicators of tax activity. So, in developing the tax policy for the agricultural sector a region-specific approach is needed.

Keywords: Agriculture, tax, taxation, tax burden

Introduction

In today’s economy different tools are used in regulating industries. One of these tools is taxation. Economic agents functioning in the agricultural sector as well as other taxpayers take an active part in the state budget formation. Considering the unique character of agriculture, the state gave agricultural producers the opportunity to choose the most attractive tax regime using the system of tax benefits and exemptions, and also the budget support. But at the same time the fiscal policy has a negative impact on the efficiency of the sector; that’s why studying taxation of agricultural organizations and its influence on the efficiency of the sector through the analysis of the dynamics, structure of payments and tax burden is relevant and necessary (Lyubushin & Ivasyuk, 2010).

Problem Statement

The problems of taxation of agricultural enterprises and studying its impact on the efficiency of the agricultural sector were covered in the works of Russian scientists such as Botasheva F.B., Orlova E. N., Orobinskaya I.V., Chesnokova L.A., Yashina N.I. etc. (Evstigneyev, 2012; Shipulina & Borovkov, 2018). The system of taxation of agricultural organizations in the Russian Federation has a number of features that are unique to this sector. Firstly, it is characterized by a special tax regime provided by legislation – the uniform agricultural tax which can be introduced by constituent entities of the Russian Federation in their region. The second distinctive feature of the taxation system for agricultural enterprises is a large number of tax benefits (Korostelkina & Simonova, 2019; Voznyuk, 2016).

But, unfortunately, as the practice shows, the exemptions offered to agricultural enterprises don’t show impressive results as evidenced by the heavy tax burden in the sector and the decrease in the economic efficiency. Malyshev et al. (2020) also stress that the regional perspective shows a different level of tax burden in the sector that necessitates the targeted policy in the taxation area depending on the nature of the activity of agricultural producers in the regions (Pashchenko, 2013; Shipulina & Borovkov, 2018).

According to the data provided by the Federal Tax Service of the Russian Federation the level of the tax burden for the economic entities involved in crop production and animal husbandry in the Russian Federation for 2019 is 3.2% and in agriculture in the whole it is 4.1%. At the same time in the Vologda region this indicator is calculated as the proportion of the paid taxes and fees (without insurance payments) to the revenue, for the same period it is 9.5% (with insurance payments it is 16.4%). A considerable deviation of the regional indicator from the nationwide average level is explained by the peculiarities in the regional functioning of economic entities.

Research Questions

The object of the study is the system of taxation of agricultural organizations. In the Russian Federation the legal entities functioning in the agricultural sector, according to the RF Tax Code can be on the common system of taxation or choose another option – a special taxation system such as the unified agricultural tax. The chosen taxation system has a number of peculiarities which are expressed in the number and size of the paid taxes and fees, and in the calculating mechanism. These peculiarities influence the efficiency of the sector.

Purpose of the Study

The purpose of the study is to evaluate the effect of the system of taxation of agricultural organizations on the efficiency of the agricultural sector. The tasks of the study are to determine the dynamics of the main indicators characterizing the taxation activity of agricultural producers, to study the structure of taxpayers according to tax regimes, to reveal the effect of taxation of taxpayers on the efficiency of the sector through the tax burden indicators.

Research Methods

During the research we used a combination of universal scientific research methods such as analysis, synthesis, induction, deduction, abstractions, etc.

Findings

At the end of 2019 in the Vologda region there were 152 functioning agricultural organizations registered as legal entities (Table 01) and being the main taxpayers in the agricultural sector.

Last year they contributed 3,526.65 million rubles of taxes, fees, and insurance payments that constituted 3.02% of the tax revenues in the regional budget. Regional agricultural organizations carry out their tax activities in accordance with the RF Constitution and the RF Tax Code (Turchayeva & Fedotova, 2019).

While the total number of taxpayers in the region decreases, the amount of the accrued and paid taxes and insurance payments increases. This is mostly due to the process of consolidating agricultural enterprises, to increasing tax rates, and growing inflation processes (Sytnik & Lelikova, 2019). It is also noted that the amount due for payment to the budget is growing. The arrears in insurance contributions grow even faster. It is gratifying that according to the Federal State Statistics Service, agricultural organizations of the Vologda region do not have overdue debts to the budget and extra budgetary funds, and the share of these debts in the total accounts payable in the whole decreases from 7.44% to 5.98%. The fact that the paid taxes exceed the accrued ones indicates full repayment of the debt taking the previous year into account. During the period under study there was a tendency to reduce the amount of penalties and fines paid for taxes, fees, and insurance payments. This shows the improvement in the quality of keeping the tax records and maintaining the fiscal discipline at the enterprises of the region. The growth rate of the budget support from the state to agricultural organizations of the region was 48.18%, which is above the paid taxes level by 29.14%, but it is lower in absolute terms by 1,314 million rubles.

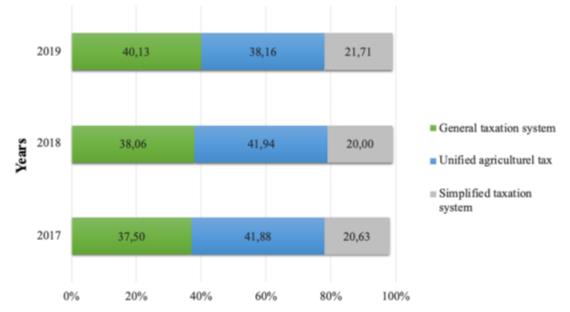

The taxpayers (legal entities functioning in the agricultural sector) use 3 tax regimes: general taxation system, unified agricultural tax, and simplified taxation system (Figure 01).

The structure of taxpayers according to tax regimes used in 2019 compared to 2017 changed toward a rise in the proportion of organizations using the general taxation system (from 37.5% to 40.13%) and a decrease in the share of organizations using the unified agricultural tax (from 41.88% to 38.16%). Nine organizations switched to the general taxation system because of exceeding the limit for using the unified agricultural tax and due to the introduction of an obligatory payment of VAT when using the unified agricultural tax. It is unfavorable for agricultural producers to use the unified agricultural tax in the conditions of the growing crisis. The weaknesses of this taxation system are not covered by the advantages of its using (Selin & Selina, 2018; Kuvaldina & Shumakova, 2020).

It should be noted that on average in the region 61% of organizations use special tax regimes characterized by paying the unified tax at lower tax rates. The general taxation system is used by large and medium-sized enterprises having branches and receiving high revenues (Kipriyanov & Savinykh, 2019).

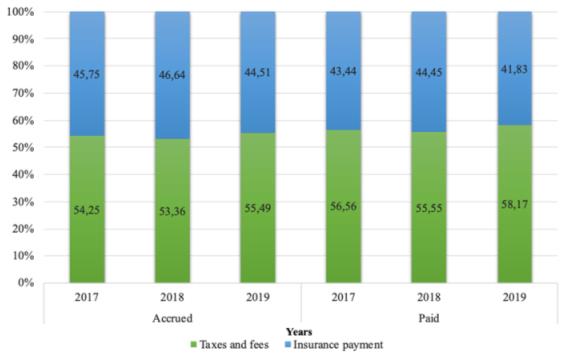

Studying the structure of the accrued and paid taxes (Figure 02) in agricultural organizations of the Vologda region shows that taxes and fees form the largest proportion both in accrued and paid taxes for the whole period of the research. Agricultural organizations pay different taxes and fees depending on the chosen tax regime to the federal, regional, and local budgets. In the structure of paid taxes and fees the largest share belongs to value added tax (VAT). Its share grew from 64.48% to 66.99% in 2019. Its growth is due to an increase in VAT rate and an increase in the fiscal base through the inclusion of the taxpayers using the unified agricultural tax into it. The personal income tax is the second in importance. It tended to decrease from 31.13% to 29.61%. Agricultural organizations act as fiscal agents, count and keep the personal income tax from the incomes of their employees. The tax share from the financial result characterizing each tax regime is not big. So, the share of income tax on average for 3 years is 2.14% from all taxes and fees, the unified agricultural tax is 0.58%, the unified tax on the simplified taxation system is 0.34%. The share of land tax as the main tax levied on the means of production in agricultural enterprises is less than 1% in the structure, and it decreases from 0.74% to 0.58%. In the structure of insurance payments the largest share belongs to pension contributions. This share decreases from 69.29 to 68.95%, towards injury contributions.

The impact of taxation on the efficiency of the sector can be evaluated through the system of indicators showing the tax burden on the resource base of agricultural organizations offered by professor Zaruk (2016; 2018) (Table 02).

In the calculations the amount of paid taxes, fees and insurance payments is presented without taking penalties and interest charges into account. So, this indicator reflects the real tax burden on agricultural organizations of the Vologda region. With an increase in the amount of paid taxes, fees and insurance payments by 19.7%, a decrease in the number of employees of agricultural enterprises by 6.46%, and a decline in agricultural land by 3.73% for the specified period the tax burden calculated for 1 employee and for 1 hectare of agricultural land increased by more than 24%. The tax burden calculated for 1 thousand rubles of capital assets decreased by 6.92%. It means that the renovation of the main production assets has a beneficial effect on the level of the tax burden on agricultural organizations of the region. The tax burden calculated using the methodology of the RF Ministry of Finance reveals a decrease of its level by 8.71% for 2017-19, that is evaluated positively. But in the Vologda region on average for 3 years agricultural enterprises gave 16 kopeks of tax payment from each ruble of the received revenue, which is 4 times the average level in the RF for 2019. This shows a high level of taxation of agricultural organizations in the region. The system of tax burden indicators offered by Zaruk (2016). is supplemented by the indicator of budget efficiency and the share of state support in all paid taxes. These indicators allow determining the efficiency of the sector and the level of state support. The budget efficiency ratio for every year of the period is more than 1. That is, on average, agricultural enterprises of the region give 1 ruble 68 kopecks of taxes from each ruble of state support. In the dynamics there is a decrease of this indicator that shows a drop in the efficiency of the sector (Yureneva et al., 2018). The indicator, opposite to budget efficiency, shows an increase in the budget support of agriculture in the region. In 2019 agriculture received 62.98% of all paid taxes in the form of state support back. It should be noted that for the whole period of study a reverse dynamic is noted in all the indicators under study in 2019, which doesn’t correlate with the general trend (Bayer, 2018).

Conclusion

The results of the study showed that the existing system of taxation of agricultural organizations has a negative impact on the efficiency of agriculture in the Vologda region. It is proved by the high level of the tax burden, a decrease in the budget efficiency ratio, and a negative dynamic in the changes of the main indicators of tax activity. In our opinion, the reason for this is, firstly, a heavy tax burden on the incomes of enterprises using both the general taxation system and the unified agricultural tax. A switch to the general taxation system in 2019 after the changes in paying the unified agricultural tax proves the inconvenience of using the unified agricultural tax. On the other hand, the reason can be found in the peculiarities of agriculture as a high-risk sector. In agriculture, taxpayers receive the outcomes from the invested funds only after a certain period of time. Furthermore, agricultural producers, as it was mentioned in the beginning of the article, have different regional economic conditions. So, as a result of the fact that taxation of agricultural enterprises influences their expanded reproduction, pricing, credit policy, state support, it is necessary to use a region-specific approach when developing the tax policy.

References

Bayer, T. A. (2018). Taxation as a factor of increasing the efficiency of peasant household (homestead) farms. Economy of agricultural and processing enterprises, 11, 50-60.

Evstigneyev, E. N. (2012). Modern etymology of the term «tax planning». Economic analysis: theory and practice, 20(275), 50-53.

Kipriyanov, F. A., & Savinykh, P. A. (2019). Assessment of technical provision in agricultural sector of Russia. EurAsian Journal of BioSciences, 13(2), 1651-1658.

Korostelkina, I. A., & Simonova, T. S. (2019). Tax policy and tax mechanism in the system of strengthening the economic security of the state. Management accounting, 8, 65-79.

Kuvaldina, T. B., & Shumakova, T. V. (2020). Taxation of agricultural organizations: pros and cons of tax regimes. Economic Humanities, 1(336), 22-33.

Lyubushin, N. P., & Ivasyuk, R. Y. (2010). Analysis of taxation systems used by small businesses. Economic analysis: theory and practice, 2(167), 2-11.

Malyshev, S. A., Yashina, N. I., & Chesnokova, L. A. (2020). Tax deduction standards as an influence on the level of budgetary security. Finance and credit, 10, 15-22.

Pashchenko, T. V. (2013). Analysis of tax liabilities as the main stage of tax planning in an organization. Bulletin of Perm University, 4(19), 108-114.

Selin, V. M., & Selina, M. N. (2018). Unified agricultural tax in fishing: problems and judgments. Problems of territory development, 1(93), 98-110.

Shipulina, I. A., & Borovkov, A. S. (2018). Assessment of the impact of tax policy on financial results and efficiency of agriculture in the Altai territory. Regional economy: theory and practice, 9, 1694.

Sytnik, O. E., & Lelikova, E. I. (2019). Analysis of the content of the accounting policy of agricultural organizations in the Stavropol territory for tax accounting purposes. Accounting in agriculture. 9, 67-72.

Turchayeva, I. N., & Fedotova, E. V. (2019). Tax risks and how to assess them. Accounting in agriculture, 7, 50-57.

Voznyuk, E. A. (2016). Taxation as an instrument of state regulation of the agro-industrial complex. Young scientist, 30, 161-163.

Yureneva, T. G., Barinova, O. I., & Golubeva, S. G. (2018). Monitoring of the financial condition of agricultural organizations in the Vologda region of Russia. Towards Productive, Sustainable and Resilient Global Agriculture and Food Systems (рр. 1500-1514). Conference proceedings.

Zaruk, N. F. (2016). Assessment of the tax burden of agricultural organizations and its impact on modern agricultural policy. State and prospects of agro-industrial complex development (p. 148). Penza.

Zaruk, N. F. (2018). Assessment of the tax component in the final price of agricultural products in the EAEC countries. Accounting, analysis and taxation: problems and prospectives (pp. 80-84). Penza.

Copyright information

This work is licensed under a Creative Commons Attribution-NonCommercial-NoDerivatives 4.0 International License.

About this article

Publication Date

01 July 2021

Article Doi

eBook ISBN

978-1-80296-112-6

Publisher

European Publisher

Volume

113

Print ISBN (optional)

-

Edition Number

1st Edition

Pages

1-944

Subjects

Land economy, land planning, rural development, resource management, real estates, agricultural policies

Cite this article as:

Golubeva, S. G., Barinova, O. I., Shilova, I. N., Rodionova, T. G., & Malinovskaya, Y. N. (2021). The Effect Of Taxation On The Efficiency Of The Agricultural Sector. In D. S. Nardin, O. V. Stepanova, & V. V. Kuznetsova (Eds.), Land Economy and Rural Studies Essentials, vol 113. European Proceedings of Social and Behavioural Sciences (pp. 88-95). European Publisher. https://doi.org/10.15405/epsbs.2021.07.12