Divide Between Entrepreneurs And Non-Entrepreneurs: Neuroscientifical Perspective Of The Attitude To Risk

Abstract

Our research is an argument in the discussion about the specificity of entrepreneurial thinking: whether entrepreneur is a person with a special type of thinking (person-centric view), or he is more or less situationally “happens in the right place” (person-opportunity view). We extend traditional cantillonian notion of entrepreneurship and build our hypothesis on it. We observe subjects (self-reported entrepreneurs and non-entrepreneurs), involved in solving laboratory risk task. We measure left-frontal EEG asymmetry (stress) and arousal levels, as well as propensity to risk taking, using standard Balloon Analogue Risk Task (BART). We generally find that the level of propensity to risk, as well as stress and arousal levels, varies among participants according to their position in division of labour system. Patterns of stress and arousal levels in entrepreneurs differ from those of non-entrepreneurs. Our paper makes contribution to both person-sentric and individual-opportunity lines of entrepreneurship research, exploring possible ways to integrate it.

Keywords: Balloon Analogue Risk Task (BART), EEG, entrepreneurial thinking, neuroentrepreneurship, risk perception,risk propensity

Introduction

What makes a person an entrepreneur? Is entrepreneurial behavior (as well as cognition, intention, etc.) emitted by individual themselves or elicited by external environment? Are entrepreneurs “creatively destructing” the world, as Schumpeter noted, or just merely looking for changes, responding to them and exploiting the opportunity, as was noted by Drucker?

What is “entrepreneurship” in general - where is the boundary of this concept? Can we point out something, that unites situations of a local shopkeeper running a shawarma shop; of a technology entrepreneur, creating a space tourism industry; of a corporate manager, launching a new line of business in a corporation; of a departmental clerk, implementing digital innovation in public services; or of a university professor applying for a research grant? Can we point out the common features of their personality and thinking?

The issue of the true nature of the entrepreneur (or entrepreneurship) is not only at the core of academic discussions. It has important implications for varying spheres. When bank or venture capitalist is providing funds to the entrepreneur, should it put more emphasis on personal track-record of the entrepreneur, or it has to emphasize data, characterizing industry perspectives? When regulator in emerging market is designing educational program or distributing grants for SME – should “division of entrepreneurial labour” system, involving many different types of entrepreneurs, or, instead, it should concentrate on finding, educating and providing funds to entrepreneurial high PO’s, some special kind human, possessing unique features?

Regulators, striving to promote entrepreneurship and overcome path dependence, faced with challenges of similar scale. Nowadays, entrepreneurial economy is considered to be one of the most prospective potentiality to recover from the economic downturn (Yu, Meng, Chen, Chen & Nguyen, 2018). To design appropriate policies, regulator as social planner have to model the agent, for which regulation is designed to obtain desired outcome.

This inspires numerous researches in the field of entrepreneurship to understand the way entrepreneurs think; how stress influence entrepreneurial behaviour (Fernet et al., 2016); how affect influences creation and intentional pursuit of entrepreneurial ideas; how passion affects entrepreneurial decision making (Cardon, Mitteness&Sudek, 2017).

Neuroscience has enriched the field of understanding of some aspects of entrepreneurship. At the same time, some scholars express lack of trust towards applying neuroscience for entrepreneurship researches for the reasons of complexity and difficulty to conduct and interpret. Some scholars insist that “fMRI is not and will never be a mind reader”. Nevertheless, some researchers conduct neural studies finding the ways of successful incorporation of neuroscience theory and entrepreneurship experiments. Moreover, the innovations in organizational neuroscience have recently been engaged in corporate culture transformations, with the main focus on the switching of the mindset of employees’ to entrepreneurial behavior as the key to go beyond industrial boundaries (Dehghanzadeh, 2016).

The rest of the paper is organized as follows.In the second section, we point to the broad context of our research, reconstructing discussionin which our research is positioned and clarifying a number of concepts. Namely, we formalize “more inclusive definition”of entrepreneurship and draw some implications from it. In the third section, we formulate key research questions. In Section 4 we indicate broader purpose of our research. In Section 5 we describe research hypothesis and the method for testing it. Inthesixthsection, wedescriberesultsobtained. InSection 7weconclude.

Problem Statement

Our research is an argument in the discussion about the specificity of entrepreneurial thinking: whether entrepreneur is a person with a special type of thinking (person-centric view), or he is more or less situationally “happens in the right place” (person-opportunity view).Before proceeding to the formulation of the research question and the description of our approach, let us clarify several concepts.

Division of labour system is key to understanding unique position of entrepreneur

In our study, we interpret the concept of an entrepreneur broadly. We argue that the archetypes cited in the Introduction — the local shopkeeper, the tech entrepreneur, the corporate intrapreneur, the governmental or academy innovator — at a certain level of abstraction render the same action. They re-design or extra-design the division of laborsystem, creating new positions in it, creatively combining the resources available to them, finding and contracting missing ones, in order to respond to some need that exists objectively, but, perhaps, has not yet manifested itself in the form of a well-articulated "market demand".

Three dimensions of the notion of entrepreneurship

. Thus, the concept of the division of labor system (DLS) is key to our understanding of the essence of entrepreneurial action. The variety of contexts in which this concept can be used corresponds to the variety of situations of taking an entrepreneurial position. A local entrepreneur will design a local system for the division of labor to provide local consumers with fast food. A technological entrepreneur creating a new type of space rocket creates, firstly, an DLS for the design and production of such missiles, and secondly, an DLS that generates a demand for such missiles. Within these high-level DLS’s, thousands of entrepreneurs will extra-design them with their local actions. These two limiting points in terms of the scale of activity confine the continuum of situations corresponding to business entrepreneurship.

.In addition to that, we argue that academician applying for the grant is also engaged in entrepreneurial activity. No research is carried out in isolation from global DLS, both DLS within the research itself (“Whose results will I use as a resource? Who will use my research as their resources?”), and more general DLS, for which research as a whole acts as a provider of knowledge to create new technologies. When entrepreneurship is considered in such broad context, it is important to distinguish independentaction of creating new opportunity proactively, as opposed to reactively taking position in situation, already well-formed by someone else.

. Another dimension that is needed in order to clarify the concept of entrepreneurship is the level of commitment. That is, something,on which (Cantillon, 2010) points comparing people to bonds and stocks; and on which (Taleb, 2018)points, speaking about “skin in the game”. A degree, to which corporate or government intrapreneur, and university grantee as well, depend on the successful implementation of their actions, varies. At one end of the spectrum there is a position at which the actor receives a certain degree of guaranteed flow of gains, at the other - an unstable flow of gains, completely dependent on the situation and actions.

We adhere to the view that entrepreneurship does not depend on the scale of activity, but at the same time, the closer the action to to “100% proactive” point on the Initiative, and to the “100% risky gain” on the Commitent, the more “entrepreneurial” the action in question is. This implies, in particular, that entrepreneurs are not necessarily, inherentlyrisky people: a person can, for example, proactively invest time and effort to create riskless gain opportunity, or commit to multiple situations, thus “diversifying” between them. Having said that, we are not claiming that entrepreneursignore risk/ambiguity at all: it might be important part of theirinternal reality, but as something, which has to be minimized, for example.

Research Questions

Thus, attitude to risk is one of two key features of entrepreneurial thinking. Therefore, in this study, we focus on the entrepreneurial attitude to risk, namely, we ask two questions:

- how integral is the desire to take risks for an entrepreneur?

- Is there anything special about an entrepreneurial attitude to risk?

Hypothesis

On overall, it seems that risk taking propensity and ambiguity tolerance is at the core of almost all views at entrepreneur, both person-centric and person-opportunity-centric. It is believed that tolerance for ambiguity is an entrepreneurial characteristic and those who are entrepreneurially inclined are expected to display more tolerance for ambiguity than other.

Thus, the framework hypothesis of our study is the idea that entrepreneurs have a special type of attitude to risk, i.e. there has to be some specific regularities in the attitude to risk, that would be more often found among people, who in social reality are inclined to take an entrepreneurial position, and less often found among others.

BART, by design, is not only risk-taking, but also ambiguity-tolerance task, as probabilities of balloon pops is unknown to participant, and learning from observations is impossible (each balloon have unique internal probability of pop, unknown to participant).

Our working hypotheses are:

H1: entrepreneurs will be riskier when solving BART task;

H2: they will exhibit less stress during risk task;

H3: they will more arousal during risk task.

Purpose of the Study

In broader sense, our research is a contribution to the construction of a valid system of profiling people for the propensity to take an entrepreneurial position. We want to get a “machine” that allows us to get a combination of behavioral data and EEG as input, and then draw a conclusion about how inclined the subject is to entrepreneurial activity, and how likely his success in this area is.

Research Methods

Participants.

45 adult working participants were involved in research, 18 of them described themself as engaged in entrepreneurial activities, the rest - as employees, having predictable salary. We therefore build on original cantillonian understanding of entrepreneurship. Participants were invited mainly through three channels:

- University MBA programme participants (entrepreneurs and employees);

- Heads and co-founders of “traditional” SMEs, invited through Moscow centers of local entrepreneurship support (entrepreneurs and employees);

- Serial entrepreneurs and startup founders from Winno Moscow community (entrepreneurs).

The BART (Balloon Analogue Risk Task), developed by Lejuez et.al. (2002), is computerized test, designed to measure risk-taking propensity in gamified context. It is argued, that it correlates both with naturalistic and economic risk-taking (Schonberg et.al, 2011). On each trial, participants “pump” a simulated balloon without knowing expected probablility of explosion. Each pump increases the potential reward to be gained but also the probability of explosion, which wipes out all potential gains for that trial. In most studies, balloon explosion probabilities are drawn from a uniform distribution, and participants must learn explosion probabilities through trial-and-error. BART is extensively used as stimulus in neuroscientific research literature. Recently it was also often used in EEG brain research (Pinner, Cavanagh, 2017; Gilmore et.al., 2018), in risk-taking as well as other contexts.

Stress and arousal measurement.

Generally, we follow procedure of Black et. al. (2014). We used NeuroIDSS (http://neuroidss.ru, Moscow) EEG equipment. Experimental session lasted about 30 minutes. Scalp voltages were recorded using 32 Ag/AgCl wet electrodes in a cap according to the 10-20 international system: F7, F3, Fz, F4, F8, FT7, FC3, FCz, FC4, FT8, T7, C3, Cz, C4, T8, TP7, CP3, CPz, CP4, TP8, P7, P3, Pz, P4, P8, PO7, PO3, POz, PO4, PO8. After cap were applied to participant, experienced researcher visually checked quality of the signal from each electrode in test EEG session, during which participants were asked to sit still, and then clench teeth several times, and blink eyes several times.

Experimental session followed test session. During experimental session BART stimulations were displayed using PsychoPy software. EEG signals, stimulation events and participant’s responses were recorded using OpenVIBE software.

Further, data was processed in OpenVIBE Designer and R project software. Raw data was cleaned using bandstop and bandpass filters. Time-based epochingwere further applied, with epochs lasting 1,024 seconds with 0.25 seconds overlap. Alpha and beta waves were further extracted. Left frontal asymmetry was calculated, following Black et. al. (2014), as in Figure 1.

Arousal was calculated as in Figure 2.

Data processing

Arousal, left-frontal asymmetry, BART responses data was further processed in R project. Left-frontal asymmetry was normalized by dividing data, obtained during BART stimulation, to data, collected prior to first stimulus display. For each participant we calculated average stress, average arousal, and BART score. According to Lejuez et.al. (2002), BART score was calculated as average number of balloon pumps for unpopped balloons. Final dataset was united with self-reported data on entrepreneurial orientation.

Findings

Risk propensity among entrepreneurs

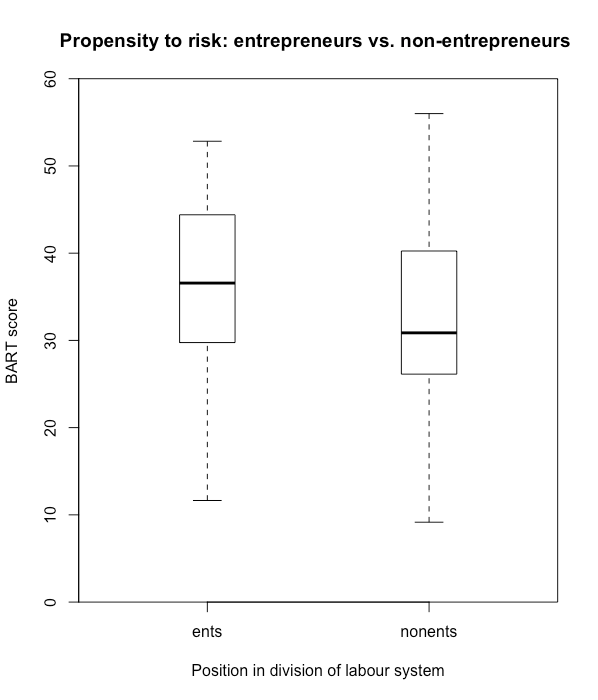

Distribution of BART scores among entrepreneurs and non-entrepreneurs are antipodal (see Fig. 3). On average, entrepreneurs are riskier in terms of BART score. On the other hand, while non-entrepreneurs are less risky as group, they exhibit more variability in individual BART scores.Due to two entrepreneurs-participants with risk tolerance below 20, and generally small size of the sample, tests suggest that difference in means is not significant.

Patterns of stress and arousal among entrepreneurs and non-entrepreneurs

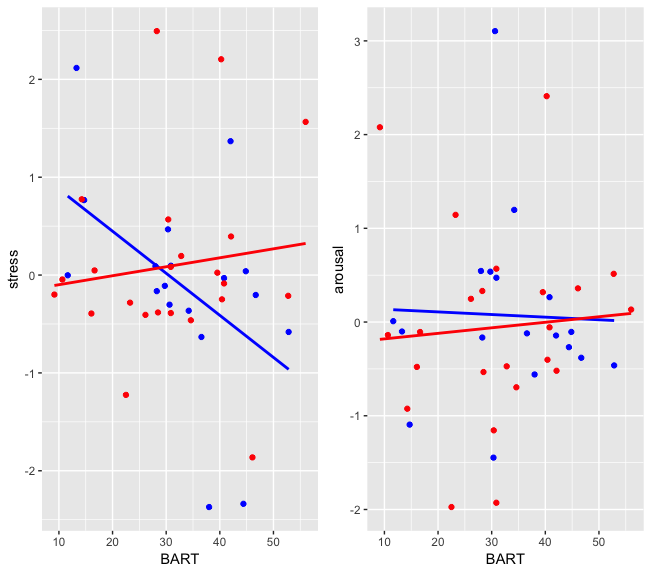

Taken alone, BART scores could be regarded as support for opportunity-centric line of research. While on overall entrepreneurs scored insignificantly higher in BART, the variance of scores was high both among entrepreneurs and non-entrepreneurs (see Figure 4). Hence, there are many risk-seekeres among non-entrepreneurs, as well as risk-avoiders among entrepreneurs. This supports central prediction of opportunity-centric literature that there are at least three types of entrepreneurs (pure arbitrageurs, risky arbitrageurs, and shumpeterian disrupters), and primary distinction is the attitude to risk.

Interpretation changes, when we add neuro-measurements to consideration. It reveals that stress pattern for entrepreneurs and non-entrepreneurs significantly differs. Risk-takers in entrepreneurs group exhibit the lower level of stress within group, and risk averse entrepreneurs – higher levels; which is symmetrically opposite to non-entrepreneurs’ group.

Research limitations

Our research is not without limitations. It is believed that BART risk task is good at measuring both financial (monetary, economic) and non-financial (casual, existential) riskaversion. Prior evidence shows that these two aspects of risk taking are deeply interrelated. However, as literature survey shows, referring to risk taking notion in entrepreneurial context is usually connected with economic aspect of risky behavior, while using risk-taking terms in non-entrepreneurial context usually is connected with casual aspect of risk. We measured both aspects simultaneously, as BART provides such opportunity and is usual tool in both contexts, and we discovered high variability in BART scores among both entrepreneurs and non-entrepreneurs. It is possible that risk-seeking non-entrepreneurs are those, who are seeking non-monetary lifestyle risks, and thus could not be treated on the same basis as entrepreneurs. Another limitation is connected with using self-reporting as a measure of entrepreneurship attitude. Probably, special questionnaire based on cantillonian notion of entrepreneurship would be more proper tool, which is one of possible direction of further research.

Conclusion

Our research builds on original cantillonian notion of entrepreneurship. We observe subjects (self-reported entrepreneurs and non-entrepreneurs), involved in solving laboratory risk task. We measure left-frontal EEG asymmetry (stress) and arousal levels, as well as propensity to risk taking. We generally find that the level of propensity to risk, as well as stress and arousal levels, varies among participants according to their position in division of labour system. Patterns of stress and arousal levels in entrepreneurs differ from those of non-entrepreneurs. Our paper makes contribution to both person-sentric and individual-opportunity lines of entrepreneurship research, exploring possible ways to integrate it.

Suggestions for further research.

This research is first in the research program that we would briefly outline further. On our mind, EEG and other neuroscientific approaches may enrich and deepen our understanding of risk-stress and person-centric – opportunity-centric nexuses in several ways. First, as many entrepreneurship researchers put it, risk-taking is major, but not the only antecedent of entrepreneurial orientation. Second by importance is pursuit of achievement feature. In this respect, it is interesting to further advance our studies by testing hypothesis that variance in stress levels is correlated with pursuit of achievement.

Second, by further extending person-centric with research on genetic determinants. According to (Kuhnen and Chiao (2009), “genes that control emotional brain activation generate stable differences in risk taking across people”, which generally is in line with our findings. But applying this issue to entrepreneurship research, it might be interesting to know, to what extent entrepreneurship features could be determined by genes, and what part of these determination could be connected with genetically determined risk-taking attitude. This findings may also contribute to research front dedicated to family firms innovation, effectiveness, strategies, etc.

Another potentially rich direction of research is introduction of EEG-stress-arousal issues to the research of firm entrepreneurial orientation, corporate entrepreneurship, SME entrepreneurship. Wales et.al. (2011), analyzing 123 papers on firm entrepreneurial orientation and describing corresponding research fronts, highlights key entrepreneurial construct dimensions. 121 out of total 123 papers mention risk-taking attitude as one of key constructs of firm entrepreneurial orientation. Given our preliminary finding that entrepreneurship could be connected to varying levels of risk-aversion, it is interesting to see how intrapreneurs with varying risk aversion are interacting within organization. Does division of entrepreneurial labour within organization differs from the one beyond the borders; are there any good practices; are intrapreneurs are cantillonian entrepreneurs and do they exhibit similar patterns of stress and arousal within group. Research of firm entrepreneurial orientation among russian firms is especially interesting, as Wales et.al. (2011) puts it, “we note several important omissions in international EO research. A particularly glaring finding is the lack of EO research in Brazil, India and Russia. Given that these three countries are considered to be among the world’s most rapidly emerging major economies, it is notable that research on EO is virtually non-existent.” This line could be further extended by introduction of national work ethics and cultural differences issues: namely, whether our findings hold for different communities, work ethics, etc.

Acknowledgments [if any]

References

Aparicio, S., Audretsch, D.,Urbano, D. (2021). Whyis export-orientedentrepreneurshipmoreprevalent in some countries thanothers? Contextualantecedents and economicconsequences. Journal of World Business, 56 (3), 101177.DOI:

Black, C. L., Goldstein, K. E., LaBelle, D. R., Brown, C. W., Harmon-Jones, E., Abramson, L. Y., &Alloy, L. B. (2014). Behavioralapproachsystemsensitivity and risktakinginteract to predictleft-frontal EEG asymmetry. Behaviortherapy, 45(5), 640-650.DOI:

Cantillon, R. (2010). An Essay on EconomicTheory. Auburn, Alabama: Ludwig von Mises Institute.

Cardon, M. S., Mitteness, C., &Sudek, R. (2017). Motivational cues and angelinvesting: Interactions amongenthusiasm, preparedness, and commitment. Entrepreneurship Theory and Practice, 41(6), 1057-1085. DOI:

Dehghanzadeh, M. R., Kholasehzadeh, G., Birjandi, M., Antikchi, E., Sobhan, M. R., &Neamatzadeh, H. (2016). Entrepreneurship psychological characteristics of nurses. ActaMedicaIranica, 595-599.

Fernet, C., Torrès, O., Austin, S., & St-Pierre, J. (2016). The psychologicalcosts of owning and managing an SME: Linking jobstressors, occupationalloneliness, entrepreneurialorientation, and burnout. Burnout Research, 3(2), 45-53.DOI:

Yangjie, H.,An, L., Wang, J.,Chen, Y.,Wang,Sh.,& Wang,P. (201). The Role of Entrepreneurship Policy in College Students’ Entrepreneurial Intention: The IntermediaryRole of Entrepreneurial Practice and Entrepreneurial Spirit.Frontiers in Psychology.DOI:

Kroeger, T.,& Wright, G. (2021).Entrepreneurship and the Racial Wealth Gap: The Impact of Entrepreneurial Success or Failure on the Wealth Mobility of Black and White Families.Journal of Economics, Race, and Policy, 1 (13). DOI:

Lejuez, C. W.,Read, J.P.,Kahler, Ch.W.,Richards, J.B.,Ramsey, S.E.,Stuart, G.L.,Strong, D.R.,&Brown,R.A. (2002). Evaluation of a behavioralmeasure of risktaking: the BalloonAnalogueRisk Task (BART). Journal of Experimental Psychology: Applied, 8(2), 75. DOI:

Pinner, J. F., &Cavanagh, J. F. (2017). Frontal thetaaccountsfor individual differences in the cost of conflict on decisionmaking. Brain research, 1672, 73-80. DOI:

Rajan, P. (2021).Making-Do on the Margins: Organizing Resource Seeking and Rhetorical Agency in Communities During Grassroots Entrepreneurship.Journal of Business and Technical Communication, 35, 254 - 292.DOI:

Ricciardi, F., Giacosa,E.,&Culasso,F. (2021). Stepchildren or prodigal employees? Motives and consequences of employee entrepreneurship in family business.International Entrepreneurship and Management Journal, 17,229-247. DOI:

Taleb, N.N. (2018) Skin in the Game: Hidden Asymmetries in Daily Life. City: New York. Random House.

Yu, X., Meng, X., Chen, Y., Chen, Y., & Nguyen, B. (2018). Work-familyconflict, organizationalambidexterity and newventurelegitimacy in emergingeconomies. Technological Forecasting and Social Change, 135, 229-240.DOI:

Wales, W. (2011). Entrepreneurialorientation: A review and synthesis of promising researchdirectionsInternational Small Business Journal 34(1). DOI:

Copyright information

This work is licensed under a Creative Commons Attribution-NonCommercial-NoDerivatives 4.0 International License.

About this article

Publication Date

25 June 2021

Article Doi

eBook ISBN

978-1-80296-111-9

Publisher

European Publisher

Volume

112

Print ISBN (optional)

-

Edition Number

1st Edition

Pages

1-436

Subjects

Personality, norm, pathology, behavior, uncertanity, COVID-19

Cite this article as:

Didenko, A., Golovin, T., Malovitsa, Y., & Morozova, A. (2021). Divide Between Entrepreneurs And Non-Entrepreneurs: Neuroscientifical Perspective Of The Attitude To Risk. In M. Ovchinnikov, I. Trushina, E. Zabelina, & S. Kurnosova (Eds.), Personality in Norm and in Pathology, vol 112. European Proceedings of Social and Behavioural Sciences (pp. 369-378). European Publisher. https://doi.org/10.15405/epsbs.2021.06.04.42