Abstract

The purpose of the study is to assess the state and dynamics of the region's development. The research object is the production sphere of the Central Federal District - the leader in Russia in terms of socio-economic indicators. Modeling the state of the production system was carried out using stream models of economic dynamics. At the first stage, the state of the system in 2010 and 2018 was analyzed. Attempts to find equilibrium in the system under study did not yield results - the system had no solutions. The equilibrium state does not occur for any values of the parameters and phase variables. At the second stage, the dynamic development of the production system was simulated by numerical methods, graphs of the change in phase variables in time for two cases were built - the parameters of the system remain unchanged and change over time. As a result, we concluded that over time, economic agents become richer - the amount of money grows both among organizations and the population. However, the pace of production remains unchanged. The volume of shipped goods of own production decreases by increasing the number of imported goods in national markets and the rapid development of the financial sector during the period under review, stimulating the inflow of additional funds from enterprises and the population. Thus, financial flows do not remain in the production system and do not contribute to production growth, but flow into another institutional structure.

Keywords: Dynamic systemequation of statenumerical methodsphase variableproduction functionregional production system

Introduction

The region is an economic structure that is influenced by specific internally determined factors and, for this reason, is not subject to federal trends. Interest in regional studies at the present stage is caused by a seemingly contradictory trend towards the autonomy of regional structures against the globalization process (Kargapolova & Dulina, 2019).

The region as a complex economic system in modern studies is analyzed in structural and functional (Rumyantsev, 2018), institutional, spatial and territorial (Kargapolova & Dulina, 2019), social, demographic (Shakleina & Midov, 2019), natural landscape aspects (Pechenskaya, 2018), as well as in the context of resource security, resource dependence (Kurbatova et al., 2019), tax burden (Povarova, 2018) and tax competition (Troyanskaya, 2017).

Difficulties in assessing the state of regional structures are associated with the complexity of taking into account the entire set of macroeconomic factors, as well as with the high uncertainty of the dynamics of the macroeconomic situation in the country and the region, due to the peculiarities of modern industrial development (Ilyukhin et al., 2017).

Problem Statement

The state of the region largely depends on the key source of its own financial flows generated in the production sector, for this reason, a quantitative assessment of the state and dynamics of the production sector is the main applied task facing regional authorities and the academic direction of research.

The traditional method of analysing the effectiveness of the functioning of a production facility to identify its resource capabilities is the production function. The application of the production function to the regional economic system is a tool that exists within the concept of convergence of micro and macroeconomics. Individual production functions to be applied to the analysis of regional data are subject to aggregation; various methods of such aggregation are explored in (Grebnev & Schultz, 2016).

The most commonly used types of production functions are presented in the work of Arzhenovskiy and Shekhovtsov (2016), among them a linear function, a Cobb-Douglas production function, as well as a translog with a constant (CES - function) and variable elasticity of substitution. Evaluation of the efficiency of the use of production resources using a model economic analysis of production functions is studied in (Fedorova et al., 2016; Matveenko & Bronstein, 2016; Sokol et al., 2017; Verbus & Osharin, 2019).

Research Questions

The traditional application of production functions is associated with the study of quantitative and qualitative relationships between economic determinants and diagnostics of the efficiency of using resource opportunities, but we set ourselves the task of determining the stage of evolution (development) of the production system of the region at the chosen starting point and finding the dynamic trajectories of the system's development.

Purpose of the Study

The basis for building a dynamic system is based on the idea of a region as an aggregated production structure that produces a homogeneous product flow.

A qualitative model describing the dynamics of material and financial flows in a macroeconomic system was proposed by Professor Neimark and Ostrovsky (1998).

Note that some of its provisions currently require significant clarifications, firstly, due to the obsolescence of some statements, for example, it is proposed to take into account only cash as a financial flow, then in the modern world cash settlements are practically ousted from the economic circulation by non-cash payments, -second, due to the lack of initial statistical information.

A similar idea of assessing the influence of factors on the development of a regional economic structure by forming a matrix of financial flows is implemented in the study (Naumov & Trynov, 2019). The authors define the matrix of financial flows as a tool reflecting, on the basis of balance sheet identities, the movement of financial resources from the formation of income to their final use in various institutional sectors, which makes it possible to use it to assess the relationship between regional economic indicators. At the same time, the simplest arithmetic calculations of multipliers serve as a tool for identifying quantitative relationships, while in (Cherkashin & Myadzelets, 2017) numerical methods are used for these purposes.

In our study, the flow model was somewhat simplified - the analysis is focused only on the production sphere, without taking into account institutional links between other sectors.

By accumulating the results of studies of the regional economic system, through a certain set of macroeconomic indicators reflected in (Grebnev & Schultz, 2016; Granitsa, 2020; Makarov et al., 2016; Malkina, 2017; Maslennikov et al., 2019) we have formed the composition of phase variables and the parameters of the system of differential equations.

Please note that when constructing production functions, we neglected the heterogeneity of industries, although it is obvious that along with industries that are the locomotives of economic growth, there are also unprofitable industries, and production functions in different groups of industries can fundamentally differ from each other (Naumov & Trynov, 2019), however, due to the limitations imposed by the regional statistics base, the data by industry are aggregated.

Research Methods

Let's analyse the indicators of the Central Federal District for the period from 2004 to 2018. The choice of such a small time lag is due, firstly, to the limitations of open access to regional statistical data, and secondly, to the tendencies emerging at the present stage towards the analysis of short periods, but historically significant in terms of duration, where the variable time.

The format of the article does not allow us to carry out a detailed description of the procedure for constructing differentiated equations included in the system that characterizes the economic structure of the region, therefore, we will display only the final description of the dynamic system, represented by a system of 4 differential equations, the variables of which characterize changes in the values of flows of material and financial resources, and the parameters of the dynamic systems depend on the capabilities and selected strategies of economic agents.

Based on the data of official statistics for the regions, we have formed the main and additional financial parameters, which are a reflection of the characteristics that describe various aspects of the functioning of the region at different time intervals. We included accounts receivable of enterprises, investments in fixed assets, and the volume of fixed assets to additional financial indicators.

Note that we have chosen the volume of shipped goods, works, and services of our own production as an indicator of the output of goods; other studies on a similar topic use data on the value of the annual gross output of goods and services, the value of the gross regional product.

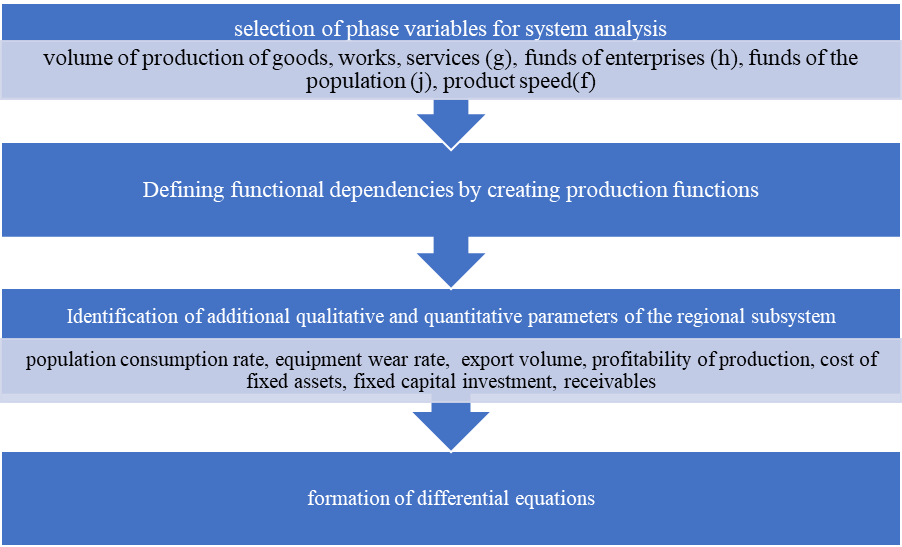

The methodology for constructing the dynamics of the state of the regional system is shown in Figure

At the first stage, we will find the values of the phase variables at which the system at the zero point (arbitrarily chosen 2010) is in equilibrium. For this we equate to zero all derivatives in the equations of the system and try to find solutions.

The system of linear equations was solved by the Gauss method. As a result, it was found that no solutions were found for the given parameters, that is, the state of equilibrium is not achieved.

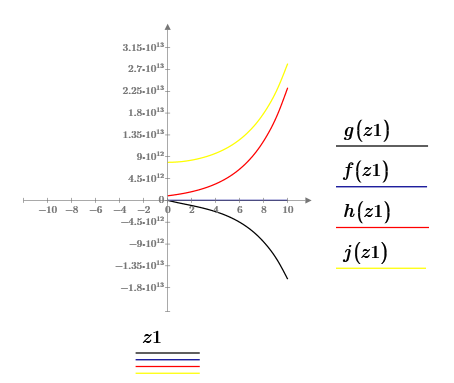

To determine the direction of the dynamics of the production system, we will use the solver of the system of differential equations "odesolve" in the program for the implementation and visualization of engineering calculations Mathcad Prime 6.0 Let's generate oscillograms - graphs of the change in phase variables in time for the case when the parameters of the system change in time (Figure

Findings

Analyzing the graphs presented in Figures

1. Over time, economic agents become richer - the amount of money increases both among organizations and among the population

2. The rates of production initially remain unchanged, however, the volume of shipped products of own production significantly decreases

The results obtained, in our opinion, are explained, firstly, by an increase in the number of imported goods in national markets, which create competition for goods in the domestic market, and, secondly, by the rapid development of the financial sector in the analyzed period from 2010 to 2018, which is stimulated by the inflow of additional funds from enterprises and the population.

Due to the redistribution of cash flows between the production and financial sectors, the production sphere of organizations ceases to develop, the index of real physical volume of production decreases, against the background of an increase in the consumer price index, real money incomes of the population begin to decrease, while the total amount of money is growing.

The funds of economic agents (enterprises and the population) are accumulated in investment funds and other credit institutions, all this leads to the development of the investment sector of the economy.

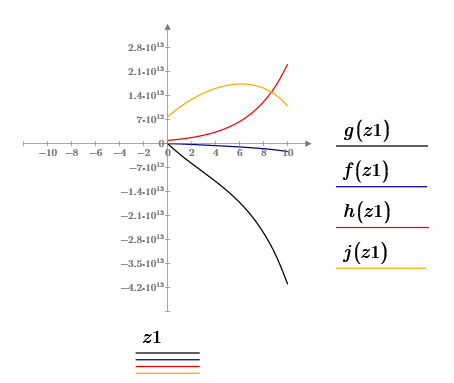

If you fix the values of additional economic parameters, then the oscillogram will take the form shown in Figure

the dynamic system

Analysis of the graphs in Figure

1. Economic agents are becoming richer again - the amount of money increases both among organizations and among the population, but at a certain moment the money supply of the population begins to decline.

2. The rates of production at first remain unchanged, and from a certain moment they begin to decline, the volume of shipped products of own production significantly decreases.

All these conclusions are relevant only if the production parameters are unchanged, however, this simulation model is far from reality, obviously, additional parameters, such as the volume of exports, capital intensity, investments in fixed assets, have a positive trend over time.

Conclusion

As the prospects for the development of our research, we designate:

1. Formation of a model for assessing the relationship between individual sectors of the economy - production, financial, trade, investment and the allocation of spillover effects in it

2. Replacement of linear production functions with a generalized production CES-function, which takes into account the propensity for diversity and product quality, which will allow distinguishing between consumers̆ with different attitudes towards product quality. Subjectivism in assessing quality can be overcome by introducing additional quality parameters, for example, production period, cost, product life, functionality.

Acknowledgments

The reported study was funded by Ministry of Education and Science of the Russian Federation, project number 0729-2020-0056.

References

- Arzhenovskiy, S. V., & Shekhovtsov, R. V. (2016). Priorities for the long-term socio-economic development of the region: econometric models of production functions. Regional economy: theory and practice, 10(433), 147-156.

- Cherkashin, A. K., & Myadzelets, A. V. (2017). Сharacterization of regional economic development in response to macroeconomic factors and conditions. Economics and Mathematical Methods, 53(4), 13-25.

- Fedorova, E. A., Korkmazova, B. K., & Muratov, M. A. (2016). Spillover Effects of the Russian Economy: Regional Specificity. Economy of Region, 1, 139-149.

- Granitsa, Yu. (2020). Analysis of the Interrelations of Economic Indicators as a tool for Predicting Regional Financial Instability Atlantis. International Scientific Conference "Far East Con" (ISCFEC 2020), 128, 2772-2779. https://doi.org/10.2991/aebmr.k.200312.394

- Grebnev, M. I., & Schultz, D. N. (2016). Statistical method for aggregating production functions. Economics and Mathematical Methods, 52(2), 112-128.

- Ilyukhin, A. A., Ponomaryova, S. I., & Ilyukhina, S. V. (2017). Macroeconomic Analysis of Sverdlovsk Oblast Budget Forecast in the Context of Economic Growth in Russia. Upravlenets – The Manager, 6(70), 72–79.

- Kargapolova, E. V., & Dulina, N. V. (2019). Modernization of a region as a heterarchical system. Economic and Social Changes: Facts, Trends, Forecast, 12(1), 70-86.

- Kurbatova, M. V., Levin, S. N., Kagan, E. S., & Kislitsyn, D. V. (2019). Resource-type regions in Russia: definition and classification. Terra Economicus, 17(3), 89–106.

- Makarov, V., Ayvazyan, S., Afanasyev, M., Bakhtizin, A., & Nanavyan, A. (2016). Modeling the Development of Regional Economy and an Innovation Space Efficiency. Foresight and STI Governance, 10(3), 76–90.

- Malkina, M. Yu. (2017). Social Well-Being of the Russian Federation Regions. Economy of Region, 13(1), 49–62.

- Maslennikov, D. A., Mityakov, S. N., Kataeva, L. Yu., & Fedoseeva, T. A. (2019). Identification of the Characteristics of the Regional Strategic Development Based on the Indicators’ Statistical Analysis. Economy of region, 15(3), 707-719.

- Matveenko, V. D., & Bronstein, E. M. (2016). On the properties of production CES-functions in the production model with intermediate goods. Economics and Mathematical Methods, 52(2), 91-102.

- Naumov, I. V., & Trynov, A. V. (2019). Modeling the investment attractiveness of the types of economic activities in the region with the use of the matrix of financial flows. Economic and Social Changes: Facts, Trends, Forecast, 12(4), 53-66.

- Neimark, Yu. I., & Ostrovsky A. V. (1998) Stream model of economic dynamics. Vestnik NNSU. Mathematical modeling and optimal control, 1(18), 105-115.

- Pechenskaya, M. A. (2018). Budget capacity in the system of capacities of the territory: theoretical issues. Economic and Social Changes: Facts, Trends, Forecast, 11(5), 61-73.

- Povarova, A. I. (2018). Problems related to regional budgeting amid fiscal consolidation. Economic and Social Changes: Facts, Trends, Forecast, 11(2), 100-116.

- Rumyantsev, A. A. (2018). Research and innovation activity in the region as a driver of its sustainable economic development. Economic and social changes: facts, trends, forecast, 11(2), 84-99.

- Shakleina, M. V., & Midov, A. Z. (2019). Strategic classification of regions according to the level of financial self-sufficiency. Economic and Social Changes: Facts, Trends, Forecast, 12(3), 39–54.

- Sokol, G. A., Kutyshkin, A. V., & Petrov, A. А. (2017). On the Use of Production Function for Simulation Functioning of Regional Economy. Bulletin of the South Ural State University. Ser. Computer Technologies, Automatic Control, Radio Electronics, 17(4), 85–97.

- Troyanskaya, M. A. (2017). Competition in taxation and the forms of its implementation among the subjects of the Russian Federation. Journal of Tax Reform, 3(3), 182-198.

- Verbus, V. A., & Osharin, A. M. (2019). The price of quality: monopolistic competition with heterogeneous consumers. Economic policy, 14(3), 152-175.

Copyright information

This work is licensed under a Creative Commons Attribution-NonCommercial-NoDerivatives 4.0 International License.

About this article

Publication Date

16 April 2021

Article Doi

eBook ISBN

978-1-80296-104-1

Publisher

European Publisher

Volume

105

Print ISBN (optional)

-

Edition Number

1st Edition

Pages

1-1250

Subjects

Sustainable Development, Socio-Economic Systems, Competitiveness, Economy of Region, Human Development

Cite this article as:

Granitsa, Y. (2021). Streaming Dynamic Model Of Regional Production System. In E. Popov, V. Barkhatov, V. D. Pham, & D. Pletnev (Eds.), Competitiveness and the Development of Socio-Economic Systems, vol 105. European Proceedings of Social and Behavioural Sciences (pp. 939-946). European Publisher. https://doi.org/10.15405/epsbs.2021.04.99