Abstract

Credit allocation has not been considered as a monetary policy instrument by orthodoxy. From this perspective, markets allocate credit to its best and most productive uses, and markets are neutral regarding income distribution. In this paper, however, we argue that credit allocation should be considered the core of monetary policy, and this is the quality of credit allocation that explains inequality between wage earners and owners of capital. To provide empirical evidence, we focus on developing countries and estimate a panel data model. The research results shows that different credit types stimulate different dynamics in economy and affect economic growth, macroeconomic stability, and income distribution differently; while productive credit alleviates income inequality significantly, unproductive credit expansion reflects an inequality–increasing sign. This finding indicates that even in developing countries, the quality of credit extension matters. Central banks should be mandated to consider the quality of credit and its effect on income distribution, to avoid monetary dominance.

Keywords:

Introduction

There is growing evidence of income inequality in the United States (Palley, 2013), advanced countries (Piketty, 2014), and many other developing economies, especially after the 1970s, after which policymakers were inspired to adopt neoliberal laissez-faire policies.

This paper aims to scrutinize the impact of monetary policy on income inequality. Historically, monetary policy has been evolved in such a way to become limited to setting policy rates by central banks and leaving credit allocation to commercial banks. This conventional approach implies that credit creation's private return is congruent with its social return: allocating money to its best and most productive uses best serves banks' self-interest.

According to the second theorem of welfare economics, markets, including the money market, are neutral concerning income distribution (Bowles, 2006). Combining the neutrality theorem with the mainstream neoliberal approach to the monetary policy indicates that monetary policy does not affect income distribution through credit allocation.

In the empirical literature, to examine monetary policy's effect on income distribution, most scholars have paid attention to two alternative transmission mechanisms (Samarina & Nguyen, 2019): Macroeconomic and financial transmission mechanisms.

The former differentiate direct and indirect effects (Ampudia et al., 2018). The direct effect indicates that lowering policy rate, interest-bearing deposits, and other stocks yield much lower returns, and in so doing, income distribution is improved in the interest of low-income individuals. Indirect macroeconomic transmission mechanism connects policy rate to finance cost and thereby to capital formation and job creation. This enhances the demand for the labor force and pushes wages up. Since wages are more important for low-income individuals, we can reasonably expect that expansionary monetary policy improves income distribution.

The financial transmission mechanism, in contrast, emphasizes an adverse effect of monetary expansion on income distribution; because monetary expansion inflates the price of financial assets and, in that way, benefits high-income individuals.

Samarina and Nguyen (2019) show that “expansionary monetary policy in the euro area reduces income inequality, …, through the macroeconomic channel …. However, there is some indication that the financial channel may weaken the equalizing effect of expansionary monetary policy.”

Such a result is imperative, as recognizes a significant link between monetary policy and income distribution, and implies an inevitable role for monetary policy in income distribution and differentiates itself from ancestors who 1) do believe in “inflation targeting framework”, 2) take the allocation of new credit as granted and 3) do not deal with the ways that commercial banks affect income distribution.

Following Bezemer & Samarina (2019), we argue that this is the allocation of credit by commercial banks which determines both economic growth and income distribution: if banks flow funds toward non-financial businesses and constrain credit flows toward mortgages and financial businesses, in effect, they enable the macroeconomic channel and ensures money expansion will lead to capital formation and job creation, and thereby enhances wage earners relative position. Otherwise, the macroeconomic channel is weakened, and the financial mechanism is strengthened, and income distribution become deteriorated because of financial asset inflation.

To examine this bold conjecture, we use a panel of developing economies. In this model, the dependent variable is the Gini coefficient of gross income inequality in each country. The primary explanatory variable is the relative share of loans to non-financial businesses in total credit in each country. By separating mortgage credit and credit to non-financial businesses, we will emphasize that considering credit allocation is a non-separable part of monetary policy.

This paper is organized as follows: We begin with a theoretical discussion and emphasis on different credit types. In this section, we discuss thoroughly that the economic impact of productive credit differs from unproductive one, and especially, they have different implications in terms of income inequality. Then, we restate research questions and clarify its objectives. In sections

Problem Statement

Traditionally, Monetary Policy Authorities are not considered responsible for income distributions. According to the legal mandate of Central Banks, their main target is to control inflation and to safeguard the stability of the price levels. In this setting, the fiscal policy authorities are legally in charge of inequality and obligated to employ their instruments to alleviate income disparity.

Such an institutional environment reflects theoretical literature, according to which CBs should be independent to set their goals and employ their instruments. The most effective instrument of these independent CBs is the policy rate (the rate in which they provide commercial banks with extra reserves). They use this single instrument to achieve their unique target (i.e. inflation). Both of targets and instruments are determined independently and without any communication with fiscal policy authorities. These three pillars framework of monetary policy is the core of theoretical literature.

This theoretical perspective implicitly assumes a "unique causal relationship for policy rate to inflation”. In this view, any fluctuation in the level of prices can be controlled by adjusting the policy rate. In the wake of the 2007-2008 global financial crisis, Oliver Blanchard, the chief economist of IMF, critically summarized this theoretical framework, by emphasizing that:

Before the crisis, mainstream economists and policymakers had converged on a beautiful construction for monetary policy. To caricature just a bit: we had convinced ourselves that there was one target, inflation. There was one instrument, the policy rate. And that was basically enough to get things done. … If you had the right rule for the policy rate, you would achieve low and stable inflation. (Blanchard, 2011, p. 1) He continues that:

If there is one lesson to be drawn from this crisis, it is that this construction wasn't right, that beauty is unfortunately not always synonymous with truth. The fact is that there are many targets and there are many instruments. How you map the instruments onto the targets, and how you use these instruments best is a very complicated problem. (emphasis added)

In this regard, , the governor of the Bank of England, invites CBs to take environmental risks and climate change seriously because they face banks with effective risks and confront CBs with significant obstacles and makes it difficult to safeguard the stability of the monetary system.

Furthermore, from an orthodoxy point of view, "Credit allocation is not the matter of policy”. After the 1970s, under the influence of market-oriented, neoliberal policies, credit allocation policies were perceived as inefficient, and policymakers were prescribed widely to withdraw such policies. The main idea was that credit has its market, and if governments do not intervene in this market, market discipline allocates credit to its best uses. The 2007-2008 credit crunch invites us to give a second thought to this understanding.

“Irrelevance of income distribution” is another presumption maintained by orthodoxy. Efficient credit markets allocate money to their best uses and do not differentiate among poor and wealthy customers. Anyone who proposes a feasible project will find a financial institution that is volunteer, in a competitive market, to grant credit. If a customer is not creditworthy to receive funds, we should not blame the market. It is not the fault of the market that a poor entrepreneur being omitted from the market. It is because of poor fiscal policies that do not place people in the right starting point.

Samuel Bowles (2006, Ch. 9) gives due scrutiny to this idea and discusses why the competitive credit market is not neutral with regard to income distribution. He concludes that "wealthier borrowers will be able to fund larger projects and projects of lower quality; moreover, for projects of the same size and quality as those of the less wealthy, the wealthier borrowers will pay lower interest rates.” (p. 318).

To be brief, from mainstream perspectives, monetary policy has nothing to do with inequality and income distribution. In modern central banking, as they say, monetary policy is reduced to setting policy rates by an independent entity to achieve the inflation target. Efficient markets allocate credit if governments do not intervene, and markets do not discriminate among poor and rich.

As clear from the abovementioned comments, we are going to argue that 1) monetary policy cannot be limited to interest rate targeting and should include clear and cut policies regarding credit allocation, 2) Credit allocation affects income distribution as well as economic growth and financial stability (which are beyond the scope of this paper). This completes our theoretical discussion to draw our empirical problem and connect "credit allocation" with "income distribution".

Productive vs. unproductive credit

Nowadays, banks issue more than 97% of the money supply (Werner, 2017). Banks do not use customers' deposits to extend loans. Banks are privileged to issue money (credit) out of nothing. In this meaning, banks are not mere financial intermediaries. Instead, they are debt manager entities who create money (as their own debt) and more vitally allocate money to uses, which satisfy their self-interest.

In this regard, one may ask two related questions. First, is there any difference among different types of credit from an economic perspective, and second, is banks' private return congruent with the social return of extending new credit.

Types of credit are categorized differently by different authors. Bertay et al. (2017), for example, differentiate between loans granted to use for consumption and loans made to finance new investments. Bezemer (2020) differentiates between loans to financial and non-financial businesses and mortgages and consumer loans.

Following Bezemer (2020) classification, we distinguish productive credit from unproductive credit. The criterion that can be used to recognize productive credit from non-productive one is credit play to financing activities. If credit finances a project or firm to produce new goods and services and thereby contributes to value-added or equivalently to the generation of income and profit, the credit can be named productive one. In contrast, if credit finances, transactions of existing assets result in their price inflation and benefits asset holders. This type of credit, including loans to financial businesses and mortgages, can be called unproductive credit.

When a bank extends a productive credit and contributes to generating revenue and profits, loans will be repaid by employing the flow of income. In this way, the money created in stage one becomes deconstructed in stage two. In this meaning, banks' balance sheets expand to finance economic growth and then contract and do not add to the money supply and do not push up consumer prices. By extending an unproductive credit, in contrast, asset prices inflate. Besides, as Minsky describes, in bust cycles of the economy, asset prices deflate, and asset holders will not repay bank loans. Thus, while banks' assets contract, their debts expand. This process creates a gap in the banks' balance sheets and contributes to banking system crises and inflation of goods and services prices. (to see a recent and complete review of different types of credit and their diverse consequences for the economy, see Bezemer, 2020)

If we recognize the difference among different types of credit from an economic point of view, then the second question arises that if banks are motivated to direct funds to productive uses rather than unproductive ones. While ignored extensively in mainstream economics, it is well established in economic literature for a long time that there is a significant discrepancy between private return and social return of banks' credit making function.

All in all, we made two interrelated points. First of all, there are alternative forms of credit with significantly diverse consequences for the economy, and then, banks are not necessarily motivated to flow funds to productive uses. Now, we are ready to delve into the relationship between credit allocation and income distribution.

Credit allocation and income distribution

In the empirical literature, rather than the theoretical one, it has been deduced a positive impact of financial development, measured by total credit, on inequality reduction. This is because financial development is conceived to reduce financial barriers to investment and stimulate economic growth, resulting in more jobs and higher wages.

The important point is that researchers who find inequality- decreasing impact for financial development typically focus on developing countries with underdeveloped financial institutions or provide evidence from the early stages of adopting neo-liberal policies and extensive deregulations. But gradually, empirical research provided growing evidence that implies a negative impact of financial development on income equality (e.g. De Hann & Sturm, 2017).

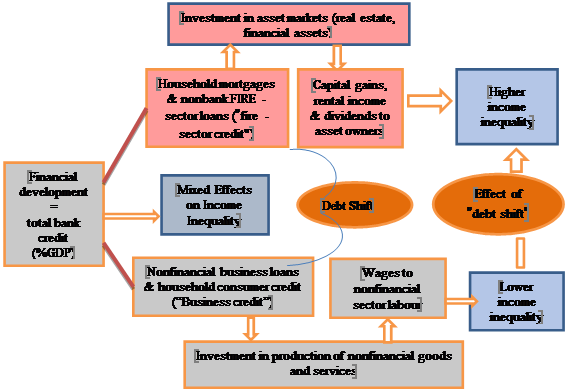

As mentioned before, there are significant distinctions between productive and unproductive credit. Over the last three to four decades, total credit has increased, but the composition of total credit also has changed and the share of mortgages has increased significantly. Bezemer et al. (2017) report that in a panel of 14 countries from 1990 to 2011 total bank credit has increased and this was mainly due to the increase of unproductive credit from 30% to 66% of GDP (reported in Bezemer & Samarina, 2019). Jorda et al. (2016) by studying 17 advanced economies show that “the share of mortgages on banks’ balance sheets doubled in the course of the twentieth century”. Bezemer and Samarina (2019) call this change of credit composition as “debt shift’ (Figure

By acknowledging this "debt shift," one may ask what's the implication of increasing the weight of unproductive credit for the relationship between financial development and income distribution. Recent empirical studies, including (Bezemer & Samarina, 2019), indicate that traditional arguments that support the positive impact of financial development on alleviating income inequality are just relevant in the case of productive credit. This is the productive credit that promotes investment in the real sector and creates demand for its products. (Bahadir and Gumus (2016), in their analysis of business cycles, argue that household and business credit have differential effects on business cycles in emerging market economies.) When "debt shift" occurs, and most of the credit flows to support transactions of existing assets, the scene changes, and inequality increases due to financial development.

When credit is allocated to unproductive uses, the underlying dynamics of the economy changes. The flow of funds inflates the price of existing assets. Inflation in asset prices, by and large, means an increase of capital gain both in real estate and financial assets as well as an increase of rents. These gains are in benefit of capital owners. Wage-earners, in contrast, do not have any gain directly. Furthermore, if increasing asset prices affect the price level of goods and services, their relative income distribution status deteriorates. (Figure

To sum up, credit is either productive or unproductive. Productive credit contributes to financing investments in real sector and creating jobs and enhances wage earners position in income distribution. Instead, unproductive credit not only provides fuel to combat economic growth, but also increases income disparity by inflating capital gains and benefitting capital owner. Because of this inequality increasing effect of credit allocation, monetary policy authorities cannot be indifferent concerning credit allocation and leave this job to market discipline. In recent decades we are told about fiscal dominance (damaging consequences of fiscal policy for monetary discipline), but considering the ignorance of distributive effects of monetary policy, we can talk about "Monetary Dominance" (damaging consequences of monetary policy for fiscal discipline.

Research Questions

Credit allocation policies should be considered as a gradient of monetary policy. For this reason, the paper study the relationship between credit allocation and income distribution. While the relationship between total credit, as an indicator of financial development, and income distribution has been studied in several studies, the effect of “debt shift” (i.e. change of the credit composition during time) on income distribution have been studied only by Bezemer and his coauthors, including in Bezemer and Samarina (2019). This study focuses on developing countries and deals with this question: Does the quality of credit allocation affect income distribution in Developing countries?

Purpose of the Study

This paper aims to understand the effect of different types of credit on income distribution. While mainstream economics considers the amount of total credit and assumes that market discipline directs the credit to its most productive uses, this paper will decompose total credit to its components and analyse their effect on income inequality.

Research Methods

We use annual data for 10 developing economies over 2000-2019. Both the time period and selection of sample of developing economies constrained by the availability of data. We use a panel data model to understand the effects of different total credit components on income distribution. In following sub-sections data and method are described in more detail.

Data description

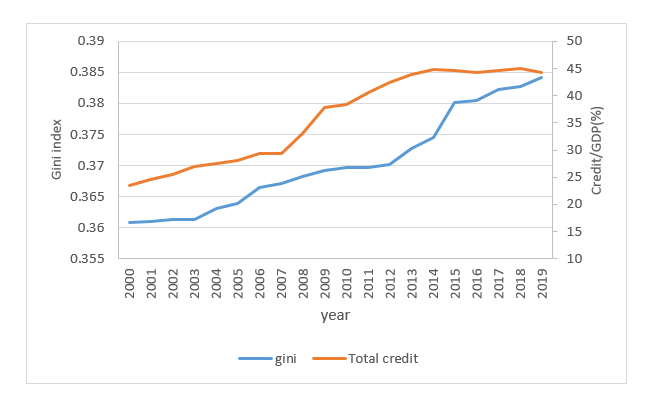

To describe inequality, we employ Gini coefficient. Values between 0 and 1 can be assigned to this coefficient, which zero implies extreme income equality and one, complete income inequality. Required data is taken from the Standardized World Income Inequality Database (SWIID). Based on Gini Coefficient, in average income inequality increases over time in our sample economies (Armenia, Hungary, Indonesia, Macedonia, Pakistan, Romania, Thailand, Turkey, Ukraine, and Uruguay). (Figure

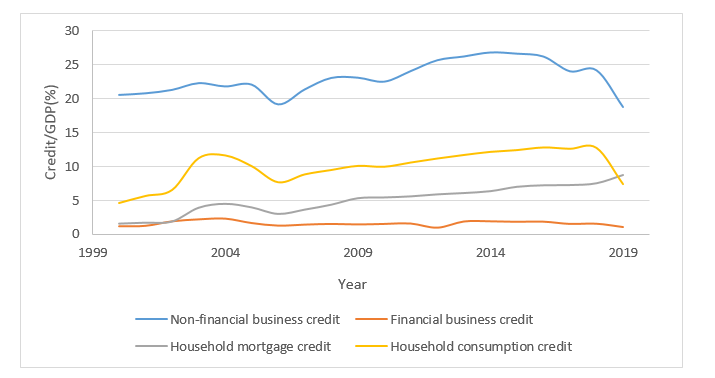

The main explanatory variable in this paper is the composition of total credit. By employing the methodology introduced in Bezemer et al. (2017), to extract data for bank credit and its components, we used the consolidated balance sheets of Monetary Financial Institutions from CB statistics of each country.

Data analysis indicates that:

Total credit has increased significantly from less than 25% of GDP to 45% of GDP over the 2000-2019. (Figure

2 ) Even in these developing economies the size of financial sector became almost doubled and the fruitfulness of this financial expansion for real sector growth is the question.The composition of total credit has been changed in the course of last two decades and mortgage loans as a percentage of GDP has increased from less than 2% to 8% of GDP. (figure

3 ) Notice that it is not households’ mortgages per se which has important consequences for economy. Instead, it is the increasing share of this type of credit which affects economy negatively.

Credit to GDP ratio shows that to what extent an economy is leveraged. (figure 4) While the non-financial private sector's debt to banks is inevitable, the growing private leverage makes the economy unstable. Data demonstrates that some of these developing economies (such as Thailand) are highly leveraged. In addition, households' mortgages play an important role in increasing leverage.

In line with our paper's basic objective, we need to know if there is any correlation between income inequality and credit composition. The rough data does not display a clear pattern. Therefore, we conducted a statistical test. Results indicate that the correlation between unproductive credit and inequality over the whole period for our sample is 0.17. This correlation increases to 0.23 if we constrain the time period to 2008-2019. While there are signs of correlation between variables, we need to wait for regression analysis and test the correlation, after controlling for other effects.

To identify the effect of credit composition in explaining inequality, we need to control the effect of other variables that have been identified as determinant factors of income inequality. These include economic growth, unemployment and inflation. Economic growth raises the size of the economic pie, but from distributional perspective, the important point is the inclusiveness of growth: to what extent the poor are included in the process of growth and benefited from its gains. Decrease of unemployment makes ensures more percentage of society earn a wage income and this is the increase of earned income that determines how inequality evolves. Finally, inflation affects inequality at least in two ways. First, it pushes wages up and proportionately is to the benefit of low - income individuals. Second, inflation affect asset prices to the gain of capital owners. Thus, theoretically the effect of inflation on income distribution is ambiguous.

The summary of the descriptive statistics of our sample is reported in table

Method

In order to investigate the relationship between the composition of bank credit and income inequality, we use the following regression model:

(1)

Where〖 is the Gini coefficient of gross income distribution in country i and period t is a matrix of bank credit to the private sector, including four categories of total credit denoted as credit to non-financial businesses, consumption credit, households’ mortgages, and credit to financial businesses. All types of bank credit are scaled by GDP. CTRL is the control variables which include economic growth, unemployment and inflation, which have been selected based on existing literature and are identified as drivers of economic inequality. are unobserved country- fixed effects, are time fixed effects and is a white noise error term.

Equation (1) is estimated using the two-way fixed effect panel regression model which controls the effect of time trend and all of the invariant countries’ characteristics with respect to time. The Hausman test indicates that a fixed effect specification is preferable. The model is estimated based on both total credit and credit composition in a sample of 10 developing countries over the period 2000-2019. In addition, to control for the effect of short-term business cycles, 3-year non-overlapping averages of annual data were employed and a system-GMM method were used to account for the possibility of endogeneity.

Findings

Table (2) reports the results of estimations of the model specified in equation (1). Results indicate that all control variables significantly explain dynamics of income inequality in our sample: lower unemployment, higher inflation and higher economic growth are negatively correlated with income inequality.

After controlling for those variables, results display damaging effect of financial development (higher total credit) on income inequality. (Columns 1 and 2 in table

To understand the transmission mechanism of credit expansion, we need to consider the results in columns (3) and (4) of table (2) which decomposes the effects of different components of total credit. Results indicate that extending credit to non-financial businesses and to consumers alleviates income inequality, while, in a sharp contrast, expansion of households’ mortgages is inequality-enhancing.

In fixed effects estimation, a one percent increase in non-financial businesses credit reduces inequality by 0.043 percent. This impact for Consumption credit is 0.022 percent. In contrast, one percent increase in households’ mortgages and credit to financial businesses increases inequality by 0.035 and 0.016 percent respectively. Outcomes of system-GMM method is consistent with the results of fixed effects estimations.

These results are consistent with theoretical literature reviewed in previous sections. Implication of these results is that different types of credit has diverse effect on income distribution and monetary policy authorities are not permitted to ignore these discrepancies. When they formulate policies, they should give a due attention to the composition of credits. This is why CBs should be mandated to consider variety of targets and use variety of instruments, when they make policies, as Blanchard (2011) reminds us.

Conclusion

Should CBs consider consequences of their policies in terms of income distribution, or the control of inequality is the sole duty of fiscal policy authorities? In terms of mainstream economics conceptualization and the mandates of CBs, the main objective of CBs is to safeguard the stability of prices by targeting interest rate while enjoying a great independence of central governments.

In this paper, we indicated that monetary policy could not be understood without considering credit creation and allocation, as 1) more than 97 percent of total credit created and allocated by commercial banks and 2) Types of credit are not homogenous and its different components affects economy distinctively and 3) private return of credit creation and allocation is not congruent with its social return.

Different credit types stimulate different dynamics in economy and affect economic growth, macroeconomic stability, and income distribution differently. If this is the case, monetary policy authorities should behave in a more responsible manner. To understand this theory's validity, we tested the effect of different components of total credit on income distribution. While productive credit alleviates income inequality significantly, unproductive credit expansion reflexes an inequality – increasing signs. This finding indicates that even in developing countries with underdeveloped financial markets and financial institutions the quality of credit extension matters, and to avoid “monetary dominance”, CBs should be mandated to consider the quality of credit and its effect on income distribution.

References

- Ampudia, M., Georgarakos, D., Slacalek, J., Tristani, O., Vermeulen, P., & Violante, G. (2018). Monetary Policy and Household Inequality. Frankfurt am Main: European Central Bank.

- Bertay, A. C., Gong, D., & Wagner, W. (2017). Securitization and economic activity: The credit composition channel. Journal of Financial Stability, 28, 225-239.

- Bahadir, B., & Gumus, I. (2016). Credit Decomposition and Business Cycles in Emerging Market Economies. Journal of International Economics, 103, 250-262.

- Bezemer, D. (2020). The Economic Consequences of The Global ‘Debt Shift'. Groningen: Private Debt Project.

- Bezemer, D., & Samarina, A. (2019). Debt Shift, Financial Development and Incom Inequality. Ansterdam: De Nederlandsche Bank. DOI:

- Bezemer, D., Samarina, A., & Zhang, L. (2017). The Shift in Bank Credit Allocation: New Data and New Findings. De Nederlandsche Bank Working Paper, 559. DOI:

- Blanchard, O. (2011). Monetary Policy in the Wake of the Crisis. IMF Macro Conference, 8.

- Bowles, S. (2006). Microeconomics: Behavior, Institutions, Evolution. Oxford: Princeton University Press.

- Carney, M. (2018). A Transition in Thinking and Action. International Climate Risk Conference for Supervision, 9.

- De Hann, J., & Sturm, J. E. (2017). Finance and Income Inequality: A Review and New Evidence. European Journal of Political Economy, 50(C), 171-195.

- Jorda, Ò., Schularick, M., & Taylor, A. M. (2016). The Great Mortgaging: Housing Finance, Crises and Business Cycles. Economic Policy, 31(85), 107-152.

- Palley, T. I. (2013). Financialization: The Economics of Finance Capital Domination. London: Palgrave MacMillan.

- Piketty, T. (2014). Capital in the 21st Century. Harvard: Harvard University Press.

- Samarina, A., & Nguyen, A. D. (2019). Does monetary policy affect income inequality in euro area? Amsterdam: De Nedelandsche Bank.

- Werner, R. A. (2017). Shifting from Central Planning to a Decentralised Economy: Do we Need Central Banks? Rawjapan, 1-36.

Copyright information

This work is licensed under a Creative Commons Attribution-NonCommercial-NoDerivatives 4.0 International License.

About this article

Publication Date

16 April 2021

Article Doi

eBook ISBN

978-1-80296-104-1

Publisher

European Publisher

Volume

105

Print ISBN (optional)

-

Edition Number

1st Edition

Pages

1-1250

Subjects

Sustainable Development, Socio-Economic Systems, Competitiveness, Economy of Region, Human Development

Cite this article as:

Aghdam, A. N., & Babapour, M. (2021). Monetary Policy, Credit Allocation, And Income Inequality. In E. Popov, V. Barkhatov, V. D. Pham, & D. Pletnev (Eds.), Competitiveness and the Development of Socio-Economic Systems, vol 105. European Proceedings of Social and Behavioural Sciences (pp. 67-80). European Publisher. https://doi.org/10.15405/epsbs.2021.04.8