Abstract

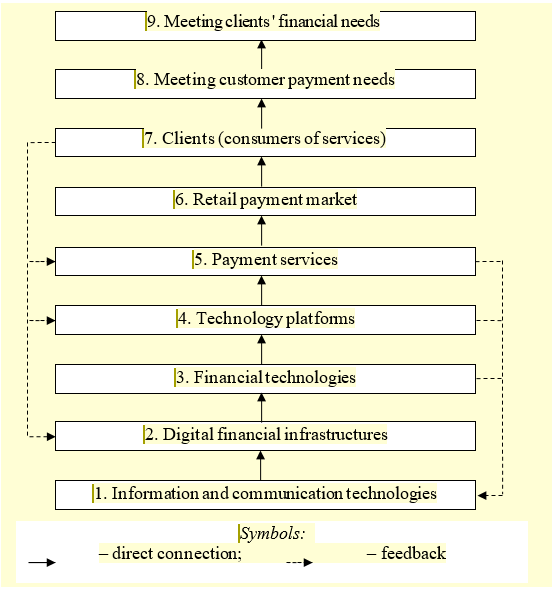

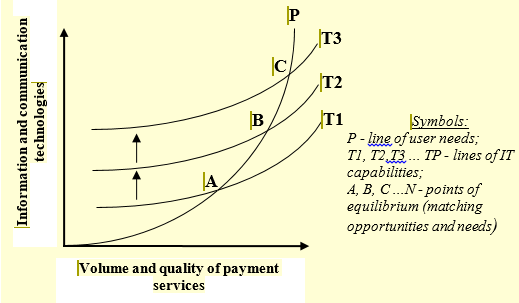

The aim of the study is to identify the main trends in the development of the Russian retail payment market, caused by the diffusion of digital innovations into the payment sector. An algorithm for studying the digital transformation of the payment market is proposed: information and communication technologies → digital financial infrastructure → financial technologies → technological platforms → payment services → retail payment market → customers (service consumers) → meeting the payment needs of customers → meeting customers' financial needs. The payment services market infrastructure is investigated as a set of institutions, technologies, and mechanisms of interaction between supply and demand; institutions are the material condition for the emergence of digital platforms and innovative financial technologies' operational scaling. The classical representation of the equilibrium of supply and demand is adapted to the conditions of the modern payment market; adaptation consists in identifying the dependences of demand (user needs) on supply (information and communication technologies) based on the variables ОХ (volume indicators of payment services) and ОУ (information and communication capabilities). It is graphically substantiated that the increasing user needs outstrip the offer and intersect at the point where IT capabilities and user needs match. When the point shifts upward in the transition to a new technology level, the demand is satisfied in greater volume and better quality.

Keywords: Digital economyFinTechinnovationmoney circulationpayment market

Introduction

The payment services sector is developing rapidly: new participants appear on the market, innovative payment instruments that bring new financial technologies to the economy, non-standard innovative solutions. A common digital environment is being formed, the market payment infrastructure is changing qualitatively and going beyond its physical boundaries. At the same time, the client can receive the service quickly and regardless of the financial institution's location. The need for a territorial network of banks and other financial intermediaries is eliminated (Nelson & Phelps, 1996). For participants in retail payment systems and the market they occupy, this is reflected in the development of competition, expansion of the range of payment services and channels for their provision. Customer centricity is becoming a significant success factor. The article's relevance is also determined by the fact that, under the influence of scientific and technological progress, the modern payment market is digitalizing at a faster rate than other non-financial areas (Burkaltseva, Borshch et al., 2017). Interfaces are opened, a symbiosis of financial and non-financial services occurs, new (including non-financial) participants are involved in the standard processes of providing payment services, the nature and forms of economic relations are changing.

Problem Statement

The theory and methodology of money circulation, payment markets, payment services, payment infrastructure, were considered in the works of scientists and practitioners: (Kobayakawa, 1997); (Korobeynikova et al., 2017); (Sukhodolov et al., 2018), etc. Innovations and innovative technologies have been studied (Elmquist et al., 2019); (Volkov et al., 2019), etc. The conceptual issues of retail consumer markets and the social significance of the retail services sector in Russia are discussed in the works (Morozova et al., 2019); (Skokov, 2018); (Shakhovskaya & Bezlepkina, 2019). Sectoral aspects of the innovation of finance and payment markets have been developed by (Bech & Hobijn, 2007); (Burkaltseva, Voronin et al., 2017); (Korobeynikova et al., 2018), etc. Analysis of the works of modern scientists showed that financial innovations in the retail payment market are devoted to only foreign studies (Ercevik & Jackson, 2009); (Laven, 2014); (Muegge, 2013), Russian scientists pay insufficient attention to these issues.

Research Questions

The need to develop a methodology is because:

structure of the retail payment market is not static, new, innovative elements supplement it;

the retail payment market is growing: new participants, payment instruments, financial technologies, innovative payment infrastructure are emerging, and a unified digital environment is being formed;

main changes in the payment market are associated with information and communication technologies and the emergence of non-financial structures performing market participants' financial functions.

Purpose of the Study

The aim of the study is to identify the main trends in the development of the Russian retail payment market, caused by the diffusion of digital innovations into the payment sector.

Research Methods

This study is based on general methodological scientific principles (unity of theory and practice, objectivity, complexity of a specific historical approach) and a systematic approach, which involves the formation of a holistic picture of the digital transformation of the payment market.

Findings

To study the payment market and identify its development drivers, an author's approach is proposed, according to which the study should take place in a certain logical sequence (figure

Information and communication technologies

All innovative changes taking place in the payment market are associated with the achievements of information and communication technologies. It is information and communication technologies that underlie the ongoing market transformations. IT developments are changing the landscape of the financial and payments markets deeply and quickly. The changes taking place can be interpreted as transformation, that is, a deep transformation of the structures, forms and ways of something. Information and communication technologies are the basic condition and the main driver of the digital transformation of the payment market. Without appropriate technology, no further digital change is possible.

Digital financial infrastructures

Based on the achieved level of development of IT technologies, it becomes possible to optimize the digital financial infrastructure: transformation of traditional institutions and information transmission channels, elimination of intermediary institutions, transformation of regional infrastructure channels into global channels (Akimova et al., 2020). We propose to consider the infrastructure of the payment services market in a broad sense as a set of institutions, technologies and mechanisms of interaction between supply and demand. Digital financial infrastructure is a necessary material condition for the emergence of digital platforms and the operational scaling of innovative financial technologies.

Financial technologies

Open interfaces, big data and data analysis, mobile technologies, artificial intelligence, robotization, biometrics, distributed ledgers and blockchain, cloud technologies, QR coding for reading by mobile devices are recognized as promising financial technologies. The technologies are most successfully applied in the following financial areas: financing: consumer P2P lending, P2P business lending, crowdfunding; capital management: robo-advising, programs and applications for financial planning, social trading, algorithmic exchange trading, targeted savings services, etc. Thanks to the development of financial technologies, not only are traditional areas of financial services modernized, but also a technological base is being formed to develop specialized technological platforms and payment services.

Technology platforms

The specialized technological platforms developed by the Bank of Russia for the financial (payment) market are the remote identification platform (Unified Identification and Authentication System) (ESIA) and the Unified Biometric System (UBS), the fast payment platform, the marketplace platform, and the Masterchain platform. The platforms' main purpose is to provide barrier-free and competitive access to market participants both to the provision of payment services and to their convenient and quick receipt. For communication between platforms, it is planned to use open interfaces (Open API). Open API provides receiving and transfer of information between various information systems using standard data exchange protocols. Technological platforms create an opportunity for market participants to develop and quickly introduce payment services to the market. The list of platform solutions should expand following the emergence of new user requests (for example, a platform for state interdepartmental interaction, the need for which has increased due to the pandemic and the forced isolation of the population).

Payment services

Financial and non-financial companies create payment services through the adaptation of IT technologies in the financial sector. For this, the capabilities of infrastructure and technology platforms are used. The list of payment services is open and quickly updated. For example, these are mobile payment services (mobile banking, SMS banking, mobile applications of payment operators), remote banking services (Internet banking), non-banking remote services (electronic money services), and others.

Retail payment market

The modern retail payment market is closely linked to the financial technology market. The bulk of financial and technological startups in Russia are in the FinTech industry. These are payment systems, lending (P2P lending and online lending), remote provision of products to customers in digital channels, an instant (fast) payment system, personal finance management and biometric identification. Russian startups are financed mainly by state corporations-banks (Sberbank, VTB and others), as well as by private financial companies: AFK Sistema, Tinkoff Bank, Alfa-Bank, Moscow Exchange, payment systems QIWI and Yandex.Money and others. The modern payment market in Russia is innovative in comparison with the payment markets of other countries. This means a high volatility of the institutional organization and the functional characteristics of the payment market. For this reason, theoretical studies of the payment market are quite objectively fragmentary, and its elements are unsystematic, the classical theory lags behind practical experience and this makes it difficult to understand the structure of the market as a single system.

Clients (consumers of services) and satisfaction of their payment and financial needs

According to market theories, any market can develop in parallel with the development of commodity production (provision of services), involving in exchange both produced products (actually rendered services) and products (services) that are not the result of labor. In the context of this study, this means the development of the payment market based on the capabilities of information and communication technologies (starting point of the logical scheme in figure

The Bank of Russia regulates the main factors of production in the modern Russian market of payment services. The Bank of Russia ensures the balance of market participants' interests in both the traditional payment market and the FinTech market. The traditional direction is represented by the Bank of Russia's payment system, which acts as a systemically important participant in the payment market of Russia. The Bank of Russia largely determines the dynamics, state and general trends in developing the payment market. For practical testing and symbiosis of financial and technological innovations in the Bank of Russia structure, the FinTech Association was created. The main results of the regulatory activities of the Bank of Russia in the innovation area were the approbation in cooperation with the largest banks of the prototype of the Masterchain platform based on blockchain technology (Ethereum), the Marketplace project, the development of legislation in the field of cryptocurrencies, the introduction of the ESIA for bank clients, the project of regulation of new models interaction of lenders and borrowers (crowdfunding, P2P lending and P2B lending).

One of the retail payment market drivers, initiated by the Bank of Russia, is the technology of instant money transfer. In the future, on its basis, it is planned to create a decentralized payment system. Since the beginning of 2019, a fast payment system has been operating in Russia. It provides instant transfers of funds to the accounts of retail clients of different banks using a simplified identifier - a phone number - as well as access to the virtual space in online and offline modes. For this, the international standard for the exchange of electronic messages between financial institutions (ISO 20022) is used. In addition to the Bank of Russia and the FinTech Association, fast payment technology is used by global payment systems (such as Mastercard), large and medium-sized banks. The innovativeness of the fast payment system lies in the versatility of instruments and accounts for conducting transactions regardless of the type of payment system. The fast payment system is a universal platform infrastructure solution.

An example of another public technology platform developed by the Bank of Russia is the unified biometric system. The system uses a unified identification and authentication system to identify users by voice profile and photo. The operator of the unified biometric system is the largest Russian state telecom operator Rostelecom. Starting from mid-2018, Rostelecom has been providing information acquisition, storage and verification of compliance of the submitted data with the biometric parameters database. The use of biometric identification allows you to standardize and unify payment processes, reduce the time and money spent on transactions. A unified biometric system can become a stage to the diffusion of the digital economy into various sectors of the economy and social sphere and contribute to the acceleration of other digital innovations.

The economic theory state that any market is an interaction of supply and demand. Theoretically, both parties can act as drivers in the retail market: both demand from retail consumers of payment services and supply from the payment market subjects. But the development of the supply of services and satisfaction of demand and the achievement of a balance of interests are limited by the achieved technological level. Between the first and the last (7-9) blocks of the algorithm shown in figure

To characterize the payment market, we use the classic categories of economic theory. Market demand is represented by users' needs of payment services, and supply is represented by the achieved level of information and communication technologies (Figure

The nature of the lines in Figure

The achieved level of information and communication technologies acts as a limiting factor on the supply side. As technology develops, the T line moves up (from T1 to T2, from T2 to T3, etc.), respectively, it intersects with the P line at a higher point. This means providing payment services in higher volumes and better quality. To the right of line P is the consumer satisfaction zone.

The deduced patterns confirm that the main driver of changes in the retail payment market in modern conditions is information and communication technologies.

Conclusion

The above examples show that in Russia the state-owned Bank of Russia is the main institutional driver of organizational, technological and regulatory changes in the payment market. The Bank of Russia creates digital platforms for the development of innovative payment services and presents them to private financial and non-financial market participants.

The study of the proposed algorithm and the identification of features and patterns at each stage confirmed that information and communication technologies are the main driver of changes in the payment market in modern conditions. For their application in the market, a digital financial infrastructure is needed that allows the creation of financial technologies. Financial technologies are the backbone of technology platforms and payment services, and together they form a payment market offering that meets the growing payment and financial needs of customers.

The proposed methodology for researching the retail payment market and the financial algorithms developed on its basis made it possible to:

create a holistic perception of the modern payment market, which is characterized by volatility, eclectic institutions and functional features;

identify the main drivers of the payment market;

promote a balance between supply and demand in the retail payment market, between the interests of consumers and the chains of payment service providers.

References

- Akimova, O. E., Volkov, S. K., Kabanov, V. A., Ketko, N. V., & Kuzlaeva, I. (2020). Regional entrepreneurship support infrastructure: Volgograd region case study. WSEAS Transactions on Environment and Development, 16, 397-412.

- Bech, M. L., & Hobijn, B. (2007). Technology Diffusion within Central Banking. The Case of Real-Time Gross Settlement International Journal of Central Banking, 3(3), 147–181.

- Burkaltseva, D. D., Borshch, L. M., Blazhevich, O. G., Frolova, E. E., & Labonin, I. V. (2017). Financial and economic security of business as a primary element in the economic system. Espacios, 38(33), 3.

- Burkaltseva, D. D., Voronin, I. N., Lisitsky, A. M., Mazur, N. M., & Guk, O. A. (2017). Assessing the effects of investments into innovative activity as a regional competitiveness factor. International Journal of Applied Business and Economic Research, 15(8), 11-27.

- Elmquist, M., Gawer, A., & Le Masson, P. (2019). Innovation Theory and the (Re-)foundation of Management: Facing the Unknown Introduction. European management review, 31(3), 417–433.

- Ercevik, K., & Jackson, J. (2009). Simulating the impact of a hybrid design on the efficiency of the CHAPS large-value payment system. The Quarterly Review of Economics and Finance, 49, 1-25.

- Kobayakawa, S. (1997). The Comparative Analysis of Settlement Systems. Centre for Economic Policy Research Discussion Paper, 1667, 1-38.

- Korobeynikova, O. M., Korobeynikov, D. A., & Popova, L. V. (2018). Problem solving payment innovations in the digital economy. Advances in Economics, Business and Management Research (AEBMR), 39, 26-30. https://www.atlantis-press.com/proceedings/cssdre-18/25896312 (accessed: 06.09.2019).

- Korobeynikova, O. M., Korobeynikov, D. A., Popova, L. V., Savina, O. V., & Kamilova, R. S. (2017). The current state of the payment infrastructure and development of payment systems in Russia and the Volgograd region. Espacios, 38(62). http://www.revistaespacios.com/a17v38n62/17386211.html (accessed: 29.10.2019).

- Laven, M. (2014). Money evolution: How the shift from analogue to digital is transforming financial services. Journal of Payments Strategy & Systems, 7(4), 319-328.

- Morozova, I. A., Popkova, E. G., & Litvinova, T. N. (2019). Sustainable development of global entrepreneurship: infrastructure and perspectives. The International Entrepreneurship and Management Journal, 15(2), 589-597.

- Muegge, S. (2013). Platforms, Communities and Business Ecosystems: Lessons Learned about Technology Entrepreneurship in an Interconnected World. Technology Innovation Management Review, 3(2), 5–15.

- Nelson, R., & Phelps, E. (1996). Investment in Humans, Technological Diffusion, and Economic Growth. American Economic Review, 56(2), 69-75.

- Shakhovskaya, L. S., & Bezlepkina, A. A. (2019). Using information and communication technologies in joint entrepreneurship as a priority of cooperation activities’ development. Advances in Intelligent Systems and Computing, 726, 217-220.

- Skokov, R. Yu. (2018). State Regulation And Determinants Of Demand And Supply Of Addictive Goods. The European Proceedings of Social & Behavioural Sciences EpSBS, L, 1106-1114.

- Sukhodolov, A. P., Popkova, E. G., & Kuzlaeva, I. M. (2018). Modern foundations of internet economy. Studies in Computational Intelligence, 714, 43-52.

- Volkov, S. K., Gushchina, E. G., & Vitaleva, E. M. (2019). Asynchrony formation 4.0 industry in the Russian regions. Regional and Sectoral Economic Studies, 19(2), 45-56.

Copyright information

This work is licensed under a Creative Commons Attribution-NonCommercial-NoDerivatives 4.0 International License.

About this article

Publication Date

16 April 2021

Article Doi

eBook ISBN

978-1-80296-104-1

Publisher

European Publisher

Volume

105

Print ISBN (optional)

-

Edition Number

1st Edition

Pages

1-1250

Subjects

Sustainable Development, Socio-Economic Systems, Competitiveness, Economy of Region, Human Development

Cite this article as:

Korobeynikova, O., Korobeynikov, D., Peters, I., & Smotrova, E. (2021). Digital Transformation Of The Retail Payment Market. In E. Popov, V. Barkhatov, V. D. Pham, & D. Pletnev (Eds.), Competitiveness and the Development of Socio-Economic Systems, vol 105. European Proceedings of Social and Behavioural Sciences (pp. 573-581). European Publisher. https://doi.org/10.15405/epsbs.2021.04.61