Abstract

The article analyzes the influence of the media agenda on the behavior of economic agents. The paper discusses newsgroups devoted to one topic, which forms information cascades. The author traces the influence of information cascades, comparing the media context with the change in market indices. Correlation between economic processes and their representation in the media is considered based on frequency analysis techniques to measure economic policy uncertainty. To trace the relationship between media publications and economic agents' actions, 1255 publications from the Russian periodical, published from January 1, 2018, to January 1, 2019, were examined. A total of 5,213 publications on economic topics were analyzed, of which 1,255 publications approached the criteria for final content analysis. The study results are verified using two groups of respondents who took part in the focus group. The author concludes that publications in the Russian press influence economic agents' behavior, although the latter do not always realize this.

Keywords:

Introduction

The study's relevance should be associated with the increasing influence of media on decision-making in various spheres of public life, including economic agents' behavior. It is all the more important to understand what can encourage specific economic agents to act based on publications in the media and which triggers create the so-called "economy of action" when the information guide is transformed into a real economic effect with traceable financial consequences. This study introduces two information cascades in the agenda of contemporary media as an instrument of influence.

As (Herman & Chomsky, 2002) note, the formation of economic thinking using the media provides a specific response in the audience's behavior. Thus, the media have influenced the behavior of economic agents and the audience's economic thinking is associated with several factors determined by the behavioral patterns of economic agents and the lexical context of economic topics in the media.

In this study, we used to adapt the monograph's provisions (Raizin, 1980). The linguistic and sociological aspect of the problem was considered with reference to Radaev (2005). Baker speaks about the problem of measuring the economic policy uncertainty, using the “economy + uncertainty” and “policy + uncertainty” bigrams to compare the media agenda and market indicators (Baker et al., 2016). The impact of policy uncertainty is also considered by Bahmani-Oskooee & Nayeri (2020); Davis et al. (2017); Li (2020) and Yung & Root (2019). The Russian experience of economic policy is considered by Alexeev & Chernyavskiy (2018) and Voskoboynikov (2017). Fogarty (2005) notes that media publications can have a direct impact on public opinion and encourage readers to take action. In this article we’ve combined these approaches for economic thinking subject, taking into account the specific characteristics of the media.

Problem Statement

As Bikhchandani et al. (1998) note, information cascades can influence the behavior of economic subjects. Meanwhile, Mahdi (2017) is considering information cascades as a part of complex networks, when Belák et al. (2016) and Sattari & Zamanifar (2018) focus on the effect of hidden nodes on information diffusion.

In this case, we define the information cascade as information and data (mainly through the media) that are actively spreading with an increasing rate and form a certain angle of perception of economic reality for economic agents. The behavior pattern of the audience changes as a reaction to the dynamics of the spreading of these data (journalistic publications, reposts in social networks, discussion in blogs, rumors, etc.). At the same time, the measure of the audience response (in some cases statistically measured) determines the effectiveness degree of the information cascade.

The interrelation between the information cascade and the behavior of economic agents is more pronounced, the more actively the following factors are expressed in it: the activity factor (how often a fact, news or author's point of view is published independently from the original source), the integration factor - the degree of coincidence of the original text and all subsequent ones (It can be measured by shared word forms, such as unigrams, bigrams, trigrams and other consistently produced elements) and dispersion factor (time interval between the publications included in the information cascade).

In other words, the particular time interval between the publications with elements of the information cascade may indicate that some of them may not fit into the information cascade in full.

Also, the media mechanism that pushes economic agents to take certain actions is fanning fears and panic. This happens both because of the spread of rumors, and due to improper retransmission of information. For example, a fact taken from publications of large business press is in some cases incorrectly interpreted by local or unspecialized press, often simplifying informational context.

Research Questions

To catch the influence of the media agenda on the behavior of economic agents, we have formulated two key questions clarifying the correlation between economic processes and their representation in the media:

1) How we can identify the relationship between the media agenda and economic agents’ behavior?

2) What conditions are required for decision-making by economic agents based on information cascades proliferation?

Purpose of the Study

In this study we identify the relationship between the media agenda and economic agents’ behavior. In order to do that, we clarify the scenarios that form the behavioral factor in the field of economic decision-making based on publications in the mass media. We also identify the main conditions necessary for decision-making by economic agents based on information channels and considering the "economy of action" scenarios based on distribution of information cascades.

To trace the relationship between media publications and economic agents' actions, we examined 1255 publications from the Russian periodical, published from January 1, 2018 to January 1, 2019. The following periodicals were included in the sample: "Arguments and Facts", "Arguments of the Week", "Vedomosti", "Izvestia" , "Kommersant", "Komsomolskaya Pravda", "Moskovsky Komsomolets", "Nezavisimaya Gazeta", "Novaya Gazeta", "Novye Izvestia", "Ogonyok", "RBC Daily", "Rossiyskaya Gazeta", "Sobesednik", "Trud", "Financial newspaper", "Expert", "Forbes Russia", " Echo Moscow", "Fontanka", "Gazeta.ru", "Lenta.ru", and "Vesti.ru".

Research Methods

The research was based on publications from electronic media libraries (East View Information Services, East View’s Universal Database, Integrum.ru and Polpred.com database), including Russian federal and regional periodical and Internet publications (23 media sources). A total of 5,213 publications on economic topics were analyzed, of which 1,255 publications approached the criteria for final content analysis.

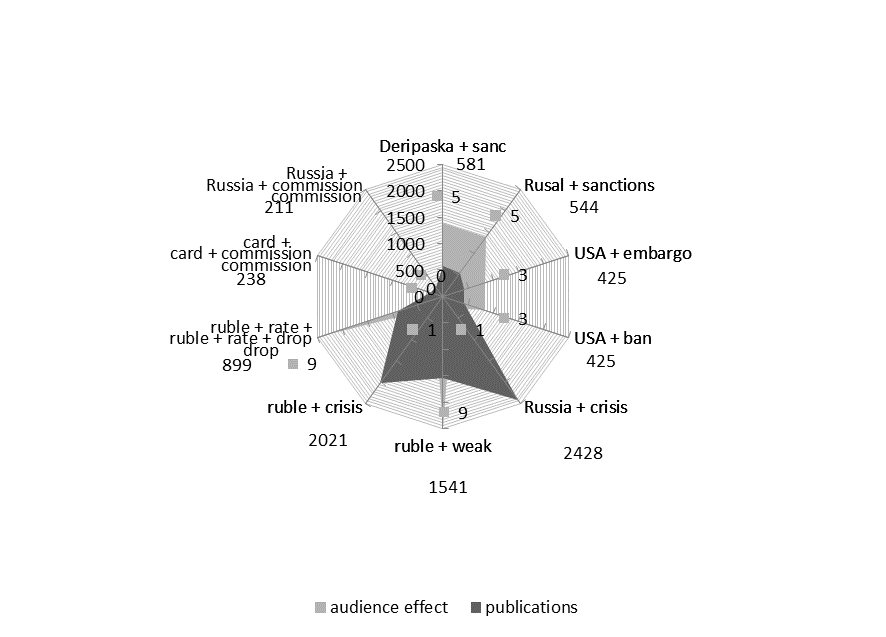

The units of content analysis were: words and phrases, judgments and the general topic of publication. The sample materials revealed groups of thematic bigrams and 3-grams: Deripaska + sanctions, Rusal + sanctions, USA + embargo, USA + ban, Russia + crisis, ruble + weakening, ruble + crisis, ruble + rate + drop, Russia + card + commission, Russia + new law + commission.

An additional tool for assessing the emotional component of publications was phonosemantic analysis based on the Vaal platform. The emotional component of the texts was evaluated according to the following criteria for automatic categorization: 1) positive / negative emotional message; 2) motivation (calls to action); 3) psychoanalytic symbolism (motives of extinction, destruction, rebirth, and so on).

Content analysis was performed by coding publications from the sample database that underwent phonosemantic analysis. The results of the content analysis were summarized using a coding matrix. The Vaal, Wordstat and QDA Miner software tools were used for research database content analysis. The results were selectively checked manually.

The data obtained as a result of content analysis were entered into frequency tables for each thematic group of publications.

The overall result showing the correlation between publications and market indicators is reflected in the work by contingency tables in the form of diagrams.

The focus group technique was used for targets of comparative survey. The focus groups results were processed manually based on responses of participants.

Findings

In the course of the study, classified blocks of publications on economic topics were compared, the general idea of each of which was then formulated in the form of theses. These theses were taken into account only if they stimulated a certain behavioral pattern (sell a dollar, make deposits in banks, buy gold, and so on). At the second stage, the economic agents behavior were studied by comparing theses and opinion polls (1) and comparing theses and key market indicators (2) (exchange rate, stock exchange rate, consumer demand for certain goods). At the third stage, cases were excluded from the sample base where the interconnection between the publication of information in the media and economic agents' behavior could not be established with sufficient accuracy.

In order to identify the relationship between the media agenda and the actions of economic agents, we selected 1255 articles that were published between January 1, 2018 and January 1, 2019. All selected publications contained calls for the actions in the economic sphere. The research was based on electronic media libraries content analysis.

As a result, we identified five thematic groups, which later formulated theses that stimulated certain economic agents' actions.

These groups included the following thematic blocks: international sanctions against "Rusal" company and its owner, businessman Oleg Deripaska (block one), a proposal by Russian officials to impose a ban on the import of goods from the US to Russia (block two), new tax setting for bank card to card transfers (block three), forecasts of ruble devaluation and inflation growth in Russia (block four) and review materials about the crisis in the Russian economy (block five). Research has demonstrated that the relationship between publications in the media and economic agents' behavior cannot be identified in the individual news stories, but can be found in so-called information cascades.

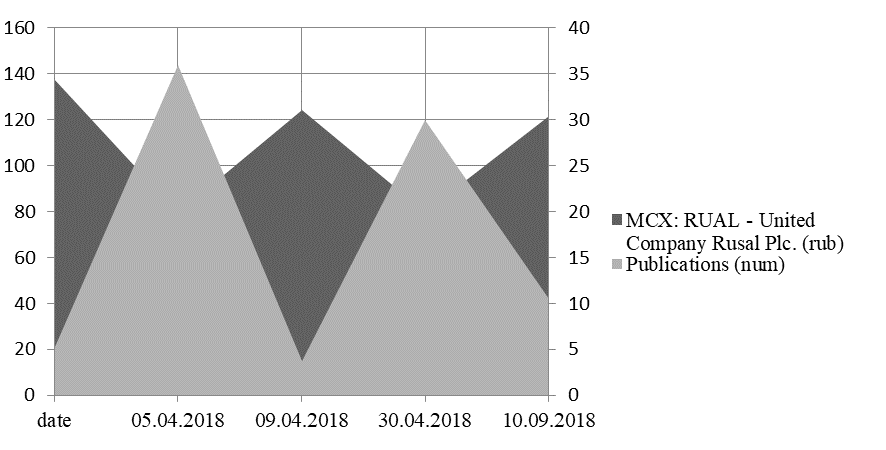

In this research, we identified two information cascades, which were able to establish an obvious connection with economic agents' behavior and three thematic blocks, the relationship of which to publications in the media was not detected. The first of the identified information cascades was associated with the international sanctions against "Rusal" company and its owner businessman Oleg Deripaska (block one). In total, 581 articles were published on this subject for the selected period, 575 of which can be attributed to the information cascade.

Shares in Rusal, the aluminum giant controlled by the Russian businessmen Oleg Deripaska, cost 34.41 rubles by April 5, 2018 (all quotes data taken from MCX: RUAL - United Company Rusal Plc). By the time of the announcement of the imposed sanctions (April 9, 2018), the quotes plunged nearly 42.35% had sunk to 19.84 rubles. At this time, the volume of publications in the media on this topic was still insufficient to directly impact economic agents. The reaction went directly through the markets and shareholders began to dump a company's shares.

By April 30, 2018, the shares' value had been adjusted, having won back almost all of the lost value and stopped at the level of 31.06 rubles. This time the information cascade came into effect. During the summer of 2018, more than 300 articles that predicted large-scale company problems in foreign markets were published. As a result, the media actually repeated the first phase's direct market effect - by September 10, 2018 the value of Rusal shares decreased to 20.00 rubles again. Rusal shares began to grow closer to the year's end on an additional plot in the media with the possibility of lifting the sanctions from the company. Confidence returned to investors in the second half of December 2018 and the share price stopped at 30.40 rubles by December 20, 2018 (figure

A similar scenario develops with the Russian stock market indices. If we juxtapose a graph of Rusal shares price on the dynamics of the MOEX and RTSI indices, we will see that the indices' low levels coincide with the peaks of publications on anti-Russian sanctions in the media. So RTSI index began the year from 1311.21 points, (January 25, 2018), than rose to 1083.53 points by April 11, 2018 and then dropped sharply throughout the summer of 2018 to 1043.46 points (September 10, 2018). MOEX, in turn, went up after the stock market won back news of the sanctions against Rusal (123.06 points by May 11 2018), but declined at the peak of the information cascade (83.20 points by October 29, 2018).

Obviously, in the case of stock markets, we cannot exclude several other factors affecting the shares and indices, understanding that the role of media is not always decisive for economic behavior. Therefore, to confirm this relationship, we compared the second identified information cascade with ordinary consumers' behavior in the market for goods and services.

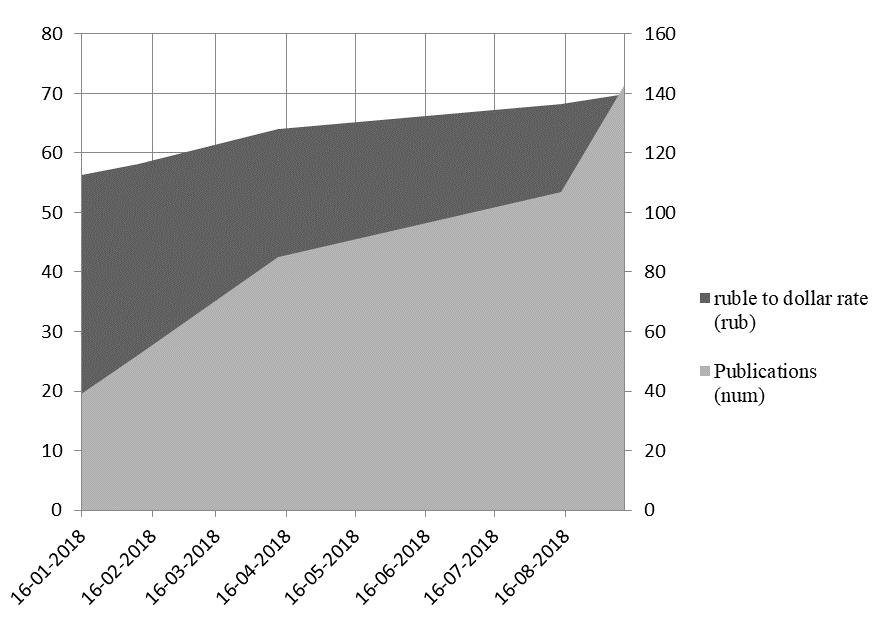

The second of the identified information cascades was associated with forecasts of ruble devaluation and inflation growth in Russia causes price increase for goods and services. In total, 1541 articles were published on this subject for the selected period. 680 of which can be attributed to the information cascade. The first publications predicting ruble devaluation appeared in the analyzed sample in mid-January 2018. These articles came out against the background of small fluctuations in exchange rates and cannot be considered in connection with economic agents' behavior.

The ruble exchange rates fluctuations are also insignificant and from January 16, 2018 to February 10, 2018 were in the range from 56.35 to 58.17 rubles per dollar. However, by April 2018, a series of publications predicting ruble devaluation and inflation growth in consumer markets began to form an information cascade. Given the fact that these publications are superimposed on the event series of the first information cascade (sanctions against "Rusal" company and Oleg Deripaska) we have considered, it is also not easy to separate one from another. Nevertheless, in this period of time, the ruble dropped sharply to 64.04 rubles per dollar by April 12, 2018.

During May, June and July 2018, we face intensifying the panic sentiments broadcast by the media. The peak of the information cascade falls on the first days of August 2018. At this point, the media actively discussed the consequences of a possible tax increase, further ruble devaluation over the new package of anti-Russian sanctions from the United States, and retailers' statements about a forthcoming possible price increase. In the course of the content analysis of the sampling base, it is noteworthy that only in July 2018 we found 235 cases of using of the "old price + time to buy + inflation acceleration" trigram in the media. The media thereby stimulated their audience to make purchases, predicting further ruble devaluation, financial hardship and even unemployment. Advertisers did the same, especially Russian electronics retailers and clothing stores.

Publications included in this informational cascade produced a dual effect. The first factor, judging by official statistics, was the growth in demand for the U.S. dollar. According to the Russian Central Bank, in March 2018 there were 13.9 billion rubles converted to dollars in the Russian bank customer accounts. By August 2018 there were already 14.581 billion, and as of September 1, 15.458 billion. The demand for foreign currency immediately influenced the exchange rate of the ruble to the dollar. Albeit, this rate changes every day because currencies are traded on the foreign exchange markets, the trend towards a weaker ruble has become obvious. By August 14, 2018 ruble fell to 68.22 rubles per dollar. By September 11, 2018 the Russian ruble hit its lowest level against the dollar since autumn 2016 - 69.86 rubles per dollar (figure

At the same time, at a moderate pace of consumer prices (+ 2.4% compared to the same period in 2017 in May 2018 and + 3.1% in August 2018, according to Rosstat), sales of durable goods increased - primarily electronics and home appliances, as well as (although and to a lesser extent) cars.

The growth in demand for consumer electronics and household appliances was +15.2% in August 2018 (data from the Association of E-commerce Companies - AEC), for passenger cars market showed an increase of 10.8% for the same period (data from the Association of European Business - AEB). Research suggests that in this way economic agents reacted to an active discussion in the media of the upcoming acceleration of inflation, and, accordingly, price increases.

Remarkable that is, the rise in prices has not yet occurred, but the consumer has already decided that it is more profitable to spend money now than wait for a surge in inflation, predicted by media. Meanwhile, at the peak of the information cascade, prices rose by 3.1% in annual terms. Such a reaction is all the more revealing, given that the summer period in Russia is traditionally a time for the falling demand for consumer goods and services. At the same time, other publications, also stimulating economic agents to certain actions in the market, had no effect. Three large blocks of publications devoted to a proposal by Russian officials to impose a ban on the import of goods from the US to Russia (425 publications), the introduction of a new tax setting for bank card to card transfers (238 publications), as well as an extensive body of journalistic texts about the crisis in the Russian economy (2428 publications) are not reflected in the actions of economic agents.

We assume that such a connection could not be identified because the indicated publications did not form a whole information cascade and did not spread in information waves when the event reviewed in the source picked up by the media quoting it, thereby enhancing the psychological impact on the audience and creating an effect of the importance of the event. In addition, publications on the crisis in the Russian economy can be considered heterogeneous. These articles did not have common thematic blocks, which can be combined into semantic groups. In fact, at the level of content analysis, these articles were connected only by general concepts and phrases, such as "crisis", "economic problems", "stagnation", "inflation", "unemployment", etc.

Behavioral patterns are clearly visible if we overlay data on economic decision-making by two groups of respondents and data on the number of publications obtained in the course of content analysis (figure

The maximum intersection of the graphs falls on information cascades, according to which respondents can make personal economic decisions (for example, buy a dollar against the background of news about the ruble's weakening). Where personal decisions are impossible (for example, with the introduction of bank commissions), economic agents' effect is not traced.

As a result of comparing the indicators of behavioral activity of economic agents and publications in the Russia media, we concluded that economic agents begin to act following the principles formulated in the media in one form or another if all three conditions are met. The information or fact distributed through the media directly affects the economic agent in his daily life (condition 1).

The economic agent can act independently concerning the specified information or fact, distributed by media. That is why the general overview publications on Russia's economic crisis do not have a direct behavioral effect. These publications only fix several facts and do not offer any scenario for economic agents. In other words, the economic agent is not able to influence what is happening at this level. In turn, the publications that encourage you to make purchases, save money, buy a dollar, etc. can have a traceable effect precisely because the economic agent can act (condition 2).

The publication must be located within the information cascade framework and make practical sense (explicit or implicit) of the thematic and logical sequence of the economic agent. Thus, the audience should see a trend in publications, act according to which could be profitable. Therefore, one separate publication in the media on economic topics does not give a traceable effect on the economic agents’ behavior (condition 3).

We assume that the relationship between media publication and economic behavior is directly related to information cascades. The more actively information cascades are distributed and the more clearly formulate the problem and the scenario of its solution, the more likely information cascades are leading to economic agents' active actions. Supported by the media effect, the reaction to an event, information, or fact can develop beyond the event's scope.

If the information cascade continues to evolve, although the initial information occasion has lost its relevance, the economic agents' behavior will be marked by a traceable reaction to the media's coverage of events. The study showed that even a completed or no longer relevant event, information or fact can impact economic agents if it is located within an active information cascade. If we exclude the media, it can also be supported by rumors and discussion in social networks.

When economic agents perceive the economic information through media, a semantic distortion effect arises. This effect is the more pronounced, the more the time range between publications within or outside the information cascade. Semantic distortion is the weakening of the lexical context, which is accompanied by the sense blurring. In other words, if publications on one topic are sufficiently distant from each other in time, they will most likely not be perceived as united by a common topic. Accordingly, they will not cause economic agents to act immediately.

Research showed that for information cascades with more than 200 publications, semantic distortion occurs when one publication is more than 8 days away from another. When the distance is 16 to 18 days long, the information cascade begins to disintegrate. When the distance becomes more than 28 days economic agents do not identify the information cascade as a whole.

These results are based on two focus groups conducted. A sample of 18 members of the Russian general public (11 male and 7 female, median age = 37.15) were recruited to participate in two separate focus groups. The first focus group included eight businessmen from 35 to 55 years old. The second focus group included ten participants aged 25-45 years old, employees.

Each group was asked to familiarize themselves with two texts on each topic from the sample database. A total of 10 journalistic materials were submitted for discussion. After that, participants were asked two questions - did they read about this problem in the media? (Question one). And did they make any economic decisions after they learned about this problem, if they knew about it earlier - before the focus group was held? (Question two) (table

Research showed that in those cases where the distance between publications did not exceed the established limits, the economic agents' behavior was manifested to one degree or another.

Thus, the focus group participants confirmed the hypothesis of a correlation between publications in the media and economic agents' actions. We assume that the media can influence economic agents' behavior if publications in the information cascade follow each other almost without interruption. In this case, economic agents develop a complete picture of economic reality. It is noteworthy that until the focus groups were held, part of the participants (5 from group one and 7 from group two) did not suspect that they made economic decisions after learning about certain facts from the media.

Conclusion

Since the research was conducted on a limited sample of Russian media as an example, its results can be transferred to a more general level with additional verification only. Also, an additional problem may be the revealed regularity between the media agenda and economic agents' behavior, since it is directly determined by the content and can potentially show a different result on other material.

The research showed that economic agents' behavior depends on their psychological characteristics (for example, suggestibility and anxiety), and the results may differ depending on the mentality of the audience. The study can be useful in information policies creation to highlight economic problems and achieve the desired effect. Research can also have practical meaning for understanding the psychology of the perception of economic agents and the formation of curves of these agents' response to various informational stimuli.

The study results can be useful for the formation of ideas about the actual behavioral factors of economic agents, which can be influenced through the media, and accordingly, they can be pre-programmed. This study also points to some critical questions for further research. First of all, it concerns the research of economic agents' reaction to various information events and facts in the framework of information cascades, when these cascades are formed by fake news and do not exist in the real economic agenda. Future research can examine influence of these information cascades on the value economic agent’s behavior.

Can information cascades serve the tasks of propaganda and the formation of public opinion in general and not just economic agents? Does the influence of information cascades differ depending on the socio-demographic characteristics of the audience? These questions will also be answered in a further research.

References

- Alexeev, M., & Chernyavskiy, A. (2018). A Tale of two crises: Federal transfers and regional economies in Russia in 2009 and 2014-2015. Economic Systems, 42(2), 175-185.

- Bahmani-Oskooee, M., & Nayeri, M. (2020). Policy uncertainty and consumption in G7 countries: An asymmetry analysis. International Economics, 163, 101-113

- Baker, S., Bloom, N., & Davis, S. (2016). Measuring economic policy uncertainty. The Quarterly Journal of Economics, 131(4), 1593-1636.

- Belák, V., Mashhadi, A., Sala, A., & Morrison, D. (2016). Phantom cascades: The effect of hidden nodes on information diffusion. Computer Communications, 73(1), 12-21.

- Bikhchandani, S., Hirshleifer, D., & Welch, I. (1998). Learning from the Behavior of Others: Conformity, Fads, and Informational Cascades. Journal of Economic Perspectives, 3(1), 151–170.

- Davis, S., Arbatli, E., Ito, A., Miake, N., & Saito, I. (2017). Policy uncertainty in Japan. IMF, 17, 128.

- Fogarty, B. (2005). Determining economic news coverage. International Journal of Public Opinion Research, 17(2), 149-172.

- Herman, E., & Chomsky, N. (2002). Manufacturing Consent: The Political Economy of the Mass Media. New York: Pantheon Publishing.

- Li, X. (2020). The Impact of economic policy uncertainty on insider trades: A cross-country analysis. Journal of Business Research, 119, 41-57.

- Mahdi, J. (2017). Information cascades in complex networks. Journal of Complex Networks, 5(1), 665-693.

- Radaev, V. (2005). Ekonomicheskaya sotsiologiya: Novyye podkhody k institutsional'nomu i setevomu analizu [Economic sociology: New approaches to institutional and network analysis]. Moscow: Russian Political Encyclopedia.

- Raizin, D. (1980). Klassifikatsiya i klaster [Classification and cluster]. Moscow: Mir.

- Sattari, M., & Zamanifar, K. (2018). A cascade information diffusion based label propagation algorithm for community detection in dynamic social networks. Journal of Computational Science, 25(1), 122-133.

- Voskoboynikov, I. (2017). Sources of long run economic growth in Russia before and after the global financial crisis. Russian Journal of Economics, 3(4), 348-365.

- Yung, K., & Root, A. (2019). Policy uncertainty and earnings management: International evidence. Journal of Business Research, 100, 255-267.

Copyright information

This work is licensed under a Creative Commons Attribution-NonCommercial-NoDerivatives 4.0 International License.

About this article

Publication Date

16 April 2021

Article Doi

eBook ISBN

978-1-80296-104-1

Publisher

European Publisher

Volume

105

Print ISBN (optional)

-

Edition Number

1st Edition

Pages

1-1250

Subjects

Sustainable Development, Socio-Economic Systems, Competitiveness, Economy of Region, Human Development

Cite this article as:

Konoplev, D. (2021). Information Cascades Of Economic Thinking: The Formation Experience Of Behavioral Media Patterns. In E. Popov, V. Barkhatov, V. D. Pham, & D. Pletnev (Eds.), Competitiveness and the Development of Socio-Economic Systems, vol 105. European Proceedings of Social and Behavioural Sciences (pp. 188-198). European Publisher. https://doi.org/10.15405/epsbs.2021.04.20