Abstract

Innovative activity and readiness to renew products, technologies, equipment have become key competitive advantages for the firms in the modern world. In theory, these abilities drive both firms' rapid growth and the industries in which they operate. The growth of industrial production and high-tech industries is significant for the modern economy. On the other hand, high-growth firms provide growth in production and creating new workplaces. The paper presents the analysis of innovation activity and the level of distribution of high-growth firms in the manufacturing industries of the Russian economy. The data sources include both Rosstat and the information and analytical system FIRA PRO. Methods of correlation and regression analysis were applied for the analysis. The authors found a statistically significant direct correlation between the level of innovations and the share of high-growth firms and the level of renewal of fixed capital and the share of HGFs. The character of correlation is different for high- and low-innovative industries.

Keywords: Innovative activityhigh-growth firmsHGFRussian industryRussian manufacture

Introduction

One of the critical competitive advantages in current conditions of firms' continuous transformations is the ability to generate and put into practice various innovations quickly. Innovations can have a different base, such as technological, organizational, marketing, financial, engineering. According to practice (Pletnev & Barkhatov, 2020), high-growth firms (gazelles) are becoming an essential element of the national economy's innovation system. Gazelles create most of the jobs and contribute to the economic growth of the whole industry. High-growth firms became more particularly important in manufacturing, where the introduction of innovations is a complicated and risky process. In the Russian economy, where the manufacturing industries are in the process of revival, innovative development, high-growth firms become particularly important.

Problem Statement

The innovative development of national economies is a relevant topic for modern economists. Scholars research specific features of innovative development in different types of economic systems. Anyakoha & Nwolisa (2017) accessed the connection between entrepreneurship development and financial innovations in one of the world's poorest countries, Nigeria, which economy is based on the oil industry. Panarina (2017) also analyzed the creative development problem within the regional and national actions in Russia. Economic growth is an aggregated index, which summarizes the growth of all entities in a system. The focus of innovative growth should be divided into particular firms. Innovation implementation as a factor of development of firms, enterprises is widely discussed (Barasa et al., 2017; Mukhtarova et al., 2017; Nanda et al., 2019; Pypłacz & Liczmańska-Kopcewicz, 2020).

The gazelles take a significant role in economic growth and innovative development of national economies (Bleda et al., 2013; Bos & Stam, 2014; Brown & Mawson, 2016; Brown et al., 2017). Innovations and their development are included in the list of drivers of HGF’s growth (Demir et al., 2017; Mogos et al., 2020).

HGFs in Russia have standard and specific features, which are formed under the influence of several factors such as the phase of development of the Russian market, political processes, features of the economic system, and geographical distribution. These features of high-growth firms in the Russian economy are presented in the following researches Dragunova (2017); Litau (2018); Yudanov & Yakovlev (2018); Zemtsov & Maskaev (2018); Zemtsov & Chernov (2019).

Research Questions

How is HGF’s distribution rate in sectors of the Russian manufacturing industry connected with innovative activity? This question was specified in the form of two hypotheses:

Hypothesis 1. The share of high-growth industrial firms influences the level of innovation activity in the Russian industry's manufacturing sectors.

Hypothesis 2. The share of high-growth industrial firms influences the share of reconstruction and modernization investments of the Russian industry's manufacturing sectors.

Purpose of the Study

Evaluate the relationship between the HGF's distribution in the Russian manufacturing industry sectors and its innovation activity.

Research Methods

The authors used methods of statistical grouping, generalization, correlation, and regression analysis in the research.

The research base is financial data of Russian firms obtained using the First Independent Rating Agency "FIRA PRO" with the period from 2015 to 2018. Only operating companies are allowed to be included in the sample. The company's basic indicators for the sample formation are the total revenue from 2015 to 2018. These indicators will help to form a sample of high-growth firms. It is necessary to exclude from the sample micro-enterprises with revenues less than 100 million rubles in 2018 and firms with zero revenue in at least one analyzed period. It is also necessary to exclude from the sample outlying observations. Outlying observations are firms with an annual revenue increase of more than 900% or less than 90% and a return on sales of more than 1 and less than -1. The elimination of such firms is necessary to form a statistically significant sample and exclude the influence of the factor of the firm's atypical behavior.

The criterion of industry affiliation is also applied to the sample. The structure of industrial firms is based on the All-Russian Classifier of Economic Activities, version 2. The authors selected firms of section C "Manufacturing" as industrial firms. Section C includes 24 subsectors. However, the authors decided to group and exclude some manufacturing industries to represent a more homogeneous structure. The combined groups have similar activities, and a similar grouping is presented in some reports of government statistics, including the size of GDP by sectoral division.

During the research, the following indicators were also used. The level of innovative activity is defined as the share of firms that carried out technological, organizational, or marketing innovations to the total number of firms surveyed for a certain period in the country, industry, region. This index calculates as a percentage. The share of investments aimed at reconstruction and modernization is also used and calculated as a percentage. In the analysis of the level of innovation activity and the share of investments received data on the official website of Rosstat by industries, the authors faced the limitation of data presenting only for 2017 and 2018. The counting system changes in accordance with version 2 of the Classifier led to the lack of data for earlier periods.

So, based on the restrictions above, the authors formed a sample of 8320 industrial firms. Applying the criterion of revenue growth of more than 20% for at least 3 years period, the observation period is 2016-2018, to the general sample of industrial firms and a sample of industrial high-growth firms were determined. The sample of industrial gazelles is presented by 438 firms, which is 5.26% of the total industrial firms in Russia.

The earlier research (Naumova, 2020) determines high-growth firms in Russian manufacturing industries' structure and estimates their share for each industrial sector (Table

Findings

Hypothesis 1. The share of high-growth industrial firms influences the level of innovation activity in the Russian industry's manufacturing sectors.

In 2017, 17.8% of all industrial firms participated in innovations and 15.6% in 2018. The sector “Manufacture of computers, electronic and optical products” (C 26) shows the most significant innovative activity index in 2017, resulting from 55.4% of all firms employed in this field. The least innovative activity is demonstrated by the firms of “Manufacture of textiles, clothing, leather and leather products” - 16.7%. The leader in the decline of the level of innovative activity in 2018 was the sector “Production of food products, beverages, tobacco products” (С 10-12) with a decrease of almost 10%. The exception to the negative trend was the sector " Manufacture of motor vehicles and trailers " (C 29), the level of innovation activity in this sector increased by 3.4% in 2018.

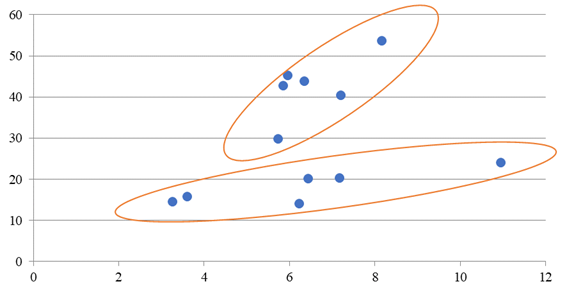

Correlation analysis is used to identify the relationship between the share of high-growth firms and the growth rate of innovative activity in the industry. Figure

Visual analysis makes it possible to identify two different trends for sectors with high (more than 25%) and low (less than 25%) innovative activity. The relationship between the level of innovative activity and the share of HGFs are different for these groups.

In the first case, the linear correlation coefficient is 0.675 (n = 6, the coefficient is significant at 5% level). A linear regression model describing this relationship is presented below:

y = 4.4949x + 13.478; R2 = 0.592

‘y’ is the level of innovative activity in the industrial sector

‘x’ is HGFs’ share in the industrial sector

In the second case, the linear correlation coefficient is 0.854 (n = 6, the coefficient is significant at 5% level). A second linear regression model describing this relationship is presented below:

y = 1.2014x + 10.616; R2 = 0.729

It is more convenient to represent the result of a hypothesis testing in the form of a universal model with a variable structure by adding the variable ‘z’:

In this case, the model describing the entire sample look in the following way:

y = 1.256x + 3.709xz + 10.219; R2 = 0.915

R2 is statistically significant at the 1% level, all coefficients are also statistically significant. The first hypothesis has been successfully confirmed.

Hypothesis 2. The share of high-growth industrial firms influences the share of reconstruction and modernization investments of the Russian industry's manufacturing sectors.

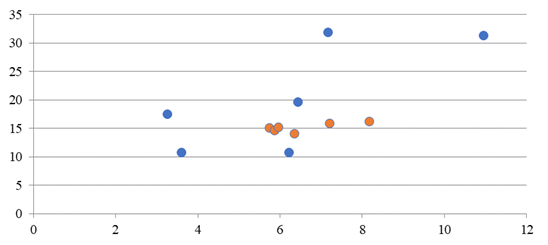

Methods of econometric analysis are also used to identify the relationship between the share of HGFs and the growth rate of the share of investments aimed at the industry's reconstruction and modernization. Figure

The linear correlation coefficient is 0.625 (n = 12, the coefficient is significant at the 5% level). A linear regression model describing this relationship is presented below:

y2 = 2.165x + 3.905; R2 = 0.391 (R2 is significant at the 5% level)

‘y2’ is the share of investments aimed at reconstruction and modernization

The addition of the z variable to the regression model improves the model performance:

y2 = 3.130x - 0.831xz; R2 = 0.944 (R2 is significant at the 1% level)

The authors note the negative value of the xz coefficient. This can be interpreted as the absence of the need for equipment modernization in those actively innovatively developing industries. Such firms are already involved in the process of new equipment installation. Hypothesis 2 is confirmed.

Conclusion

HGF's share in the manufacturing sectors has a positive effect on them' level of innovation activity. An increase in the share of HGFs by 1% on average leads to an increase in innovative activity by 1.2% in industries with low innovative activity and by 5.0% in industries with high innovative activity.

High-growth firms have a significant influence on industry-wide investment levels. Confirmation of this hypothesis was formed based on one of the features of high-growth industrial firms of a high degree of depreciation of fixed assets. The correlation shows that gazelles are forced to invest part of their funds in the renewal, reconstruction, and modernization of their funds.

References

- Anyakoha, C., & Nwolisa, C. (2017). Financial innovation and entrepreneurship development in Lagos state of Nigeria: challenges and prospects for small and medium scale enterprises. In O. Dvouletý, M. Lukeš, & J. Mísa (Eds.), Innovation management, entrepreneurship and sustainability (pp. 15-28). Prague: Vysoká škola ekonomická v Praze.

- Barasa, L., Knoben, J., Vermeulen, P., Kimuyu, P., & Kinyanjui, B. (2017). Institutions, resources and innovation in East Africa: A firm level approach. Research Policy, 46(1), 280-291.

- Bleda, M., Morrison, K., & Rigby, J. (2013). The role and importance of gazelles and other growth firms for innovation and competitiveness. Innovation Policy Challenges for the 21st Century, 110-134. DOI:

- Bos, J. W. B., & Stam, E. (2014). Gazelles and industry growth: A study of young high-growth firms in The Netherlands. Industrial and Corporate Change, 23(1), 145-169. DOI: 10.1093/icc/dtt050

- Brown, R., Mawson, S., & Mason, C. (2017). Myth-busting and entrepreneurship policy: the case of high growth firms. Entrepreneurship and Regional Development, 29(5-6), 414-443.

- Brown, R., & Mawson, S. (2016). Targeted support for high growth firms: Theoretical constraints, unintended consequences and future policy challenges. Environment and Planning C: Government and Policy, 34(5), 816-836. DOI:

- Demir, R., Wennberg, K., & McKelvie, A. (2017). The Strategic Management of High-Growth Firms: A Review and Theoretical Conceptualization. Long Range Planning, 50(4), 431-456.

- Dragunova, E. (2017). High-growth firms: Multivariate estimation of growth potential evidence from Russia. In L. Štofová, & P. Szaryszová (Eds.), New Trends in Process Control and Production Management (pp. 85-93). London: Taylor & Francis Group. DOI:

- Litau, E. (2018). The information problem on the way to becoming a "Gazelle". In C. Costa, M. Au-Yong-Oliveira, & M. P. Castro Amorim (Eds.), Proceedings of the European Conference on Innovation and Entrepreneurship (pp. 394-401). Lisbon: Acpi.

- Mogos, S., Davis, A., & Baptista, R. (2020). High and sustainable growth: persistence, volatility, and survival of high growth firms. Eurasian Bus Rev. DOI:

- Mukhtarova, K., Kupeshova, S., Ziyadin, S., & Doszhan, R. (2017). Problems of developing the foundations of sustainable competitiveness of industrial and innovative economy in Kazakhstan. Economic Annals-XXI, 168(11-12), 38-43.

- Nanda, T., Gupta, H., Singh, T. P., Kusi-Sarpong, S., Jabbour, C. J. C., & Cherri, A. (2019). An original framework for strategic technology development of small manufacturing enterprises in emerging economies. Benchmarking, 27(2), 781-816.

- Naumova, K. (2020). Bystrorastushchiye kompanii v promyshlennosti kak drayver ekonomicheskogo rosta Rossii [High-growth firms in industry as a driver of Russian economic growth]. Scientific works оf the free economic society of Russia, 4(224), 464-481. DOI:

- Panarina, E. (2017). The innovation centers development in the regional context of Russia. In O. Dvouletý, M. Lukeš, & J. Mísa (Eds.), Innovation management, entrepreneurship and sustainability (pp. 697-714). Prague: Vysoká škola ekonomická v Praze.

- Pletnev, D., & Barkhatov, V. (2020). Ups and Downs of High-Growth Firms in Russia. In G. Prostean, J. Lavios Villahoz, L. Brancu, & G. Bakacsi (Eds.), Innovation in Sustainable Management and Entrepreneurship. SIM 2019. Springer Proceedings in Business and Economics (pp. 127-136). Springer, Cham. DOI:

- Pypłacz, P., & Liczmańska-Kopcewicz, K. (2020). Process innovation as a factor for the development of small enterprises in Poland. Proceedings of the 31st International Business Information Management Association Conference, IBIMA 2018: Innovation Management and Education Excellence through Vision, 3156-3165.

- Yudanov, A. Yu., & Yakovlev, A. A. (2018). «Neortodoksal'nyye» bystrorastushchiye firmy-«gazeli» i poryadok ogranichennogo dostupa [“Unorthodox” fast-growing firms (gazelles) and North’s limited access order]. Voprosy Ekonomiki, 3, 80-101. DOI:

- Zemtsov, S., & Chernov, A. (2019). What high-tech companies in Russia grow faster and why? Zhournal Novoi Ekonomicheskoi Associacii, 41(1), 68-99.

- Zemtsov, S. P., & Maskaev, A. F. (2018). High-growth firms in Russia: Characteristics and growth factors. Innovations, 6(236), 67-75.

Copyright information

This work is licensed under a Creative Commons Attribution-NonCommercial-NoDerivatives 4.0 International License.

About this article

Publication Date

16 April 2021

Article Doi

eBook ISBN

978-1-80296-104-1

Publisher

European Publisher

Volume

105

Print ISBN (optional)

-

Edition Number

1st Edition

Pages

1-1250

Subjects

Sustainable Development, Socio-Economic Systems, Competitiveness, Economy of Region, Human Development

Cite this article as:

Barkhatov, V., Pletnev, D., & Naumova, K. (2021). Innovativeness And High-Growth Firms In The Russian Manufacturing Industries. In E. Popov, V. Barkhatov, V. D. Pham, & D. Pletnev (Eds.), Competitiveness and the Development of Socio-Economic Systems, vol 105. European Proceedings of Social and Behavioural Sciences (pp. 1243-1250). European Publisher. https://doi.org/10.15405/epsbs.2021.04.131