Abstract

High-growth firms are one of the drivers of economic growth and development of the national economy. Especially prominent aspect is their importance in the field of industrial production, where the role of new technologies and the ability to use them are high. The paper aims to detect the differences in the strategies orientation of ordinary and high-growth industrial Russian firms. The research is based on the accounting data of more than 10,000 Russian industrial firms for 2015-2018. The high-growth firms are identified by the criterion of a three-year revenue growth rate of at least 20%. Firstly, the analysis results are that for certain types of activities, ordinary firms' strategies are more often oriented on higher current efficiency than gazelles, which is measured by return on sales. Secondly, the opposite trend is revealed in such activities as food products, light industry products, wood processing industry, pharmaceuticals and the chemical industry, computer equipment, and electrical equipment production, metal products, and equipment repair and installation.

Keywords:

Introduction

High-growth firms (HGF, gazelles) as an economic phenomenon engage the interest of many scholars and entities involved in economic activity. High-growth firms are a relatively young phenomenon in the economy, but HGF makes a significant contribution to the formation of economic growth not only of an industry or a sector but of the whole country. They promote the creation of new jobs, accumulate and contribute to the development of innovation and new technologies. Understanding the nature and the mechanism of achieving the status of "high-growth" is of great interest not only for the owners and senior management staff of companies but also for politicians and government employees who formulate strategies for economic development and financial policy of both regions and the whole country.

Problem Statement

One of the critical drivers of economic development is industry because it contributes to quantitative growth and a qualitative improvement in GDP structure. The leading politicians of the country widely discuss the problems of industry and industrial policy. They find a solution to the current problem in eliminating the influence of institutions that impede entrepreneurial innovation activity, increasing the share of investments in the manufacturing sector of the economy, and developing and implementing revised state policy on industrial regulation.

Partly, the Russian industry's main problems are discussed in the research of Dmitrieva et al. (2017). They are mostly focused on the Russian potash industry's characteristics, but most founded features are standard for all industries.

There is also a connection between the innovation strategy of a firm and its success. Trachuk and Linder (2018) detected a nonlinear relationship between the investment in innovation and the growth so that a strong positive relationship is stated after a critical mass of innovation investment has been obtained.

In connection with the recent events that led to the suspension of many enterprises and firms' functioning, including industrial ones, a decline in economic growth is expected in Russia and around the world. The depth of the decline in Russia, according to scientists, will be more significant for the economy compared with the world level. One of the useful tools for solving slow economic growth problems may be the support of the enterprises of a special type, which makes a significant contribution to the formation of general economic growth. This particular type is high-growth firms (gazelles). Many authors stated the high importance of high-growth firms for the economy. Gazelles have a significant impact on the economic and social sphere by creating jobs that are ahead of the average growth rate and stability of their functioning, raising the general standard of living of the population and promoting economic growth.

For the first time, high-growth firms as an economical category were proposed by Birch in the 70s of the last century (Birch, 1981). During the analysis of millions of individual firm's behavior, he discovered a small group of atypical firms that differ, firstly, in their financial “success” from ordinary firms. Secondly, these firms make a disproportionate contribution to the growth of employment. Representatives of this small group of extraordinary firms were later called gazelles. Birch applied the criteria of at least 20% of annual revenue growth for at least five years in sequence. Employment growth is a critical factor in regional growth. Some scholars note that gazelles tend to have young age and small size. These features lead to high and rapid growth (Birch, 1981; Birch & Medoff, 1994). However, Acs et al. (2008) refute the statement above in their research. Indeed, most of the gazelles are centralized in the small business sector, but the most significant impact on employment growth is exerted by gazelles belonging to large businesses. Also, they point out that gazelles are older than ordinary firms. They are older than the academic community previously thought. Actual results of high-growth firms' studies, including its differences from ordinary firms, are presented in Anton and Carp (2020); Eklund (2020); Yudanov and Yakovlev (2018).

Strategies of HGF are widely researched in different countries and types of economic systems with the aim to identify common features and differences in strategies formation. The specific features of the financial strategies of African high-growth firms were discussed by Fowowe (2017). Long-term success trends for gazelles in Denmark are presented in the research of Senderovitz et al. (2015). The connection between growth and profitability among gazelle firms are stronger for such firms, which follow broad rather than a niche market strategy.

There are a number of internal and external factors which influence the HGFs’ success. The impact of migrants on the efficiency of high-growth firms in France was analyzed by Mitaritonna et al. (2017). A comprehensive analysis of the factors that determine the success of rapid growth strategies for the UK firms was presented by Bravo-Biosca et al. (2016). The scholars also bring up an issue of government employment regulation and connection between factors, including employment regulation and firms’ success. The recent research of Autor et al. (2020) confirms that high-growth firms still generate the bulk of new employment growth. The structural shifts in employment and the transition of many employees to freelancing do not fundamentally affect this trend.

Pletnev and Barkhatov (2020) analysed the high-growth firms phenomenon in Russia on the base of the financial results of all Russian small and medium-sized enterprises in several periods in order to detect and compare the dynamics of gazelles and ordinary companies. The analysis of firms' success showed that in the post-crisis period, gazelles have a greater ability to generate profits, which reflects their resistance to changes in the economic macroclimate. Many of the identified characteristics of Russian high-growth firms coincide with foreign research results, including revealed statistically significant relationships between the year of foundation and the growth rate. “Younger” firms tend to have more rapid revenue growth. Pletnev and Nikolaeva (2018) analyzed the financial pathway of ordinal and high-growth middle-sized firms. The "younger" firms show the ability to grow more swiftly. Gazelles also have a higher share of added value in revenue. The ability to generate added value contributes to rapid growth in the future. As the research result, scholars conclude that high-growth firms are more successful according to the growth ability and profit-generating ability.

Research Questions

The research questions are:

Are high-growth industrial firms in Russia different from ordinary firms by their strategy orientation?

Are the different groups of industrial firms (by branch) in Russia different by their strategy orientation?

Purpose of the Study

The purpose of the research is to analyze the strategies of high-growth industrial firms in Russia compared to ordinary firms.

Research Methods

One of the essential theoretical issues is the criteria for classifying firms as gazelles. Birch proposed the most widespread approach. A high-growth firm is a firm with at least 20% revenue growth for 5 or more years in a row. However, in 2012, the Organization for Economic Co-operation and Development (OECD) issued a document identifying high-growth firm nature. High-growth firms are all firms with more than twenty percent average annual growth over three years and ten or more employees at the beginning of the observation period. This approach allows us to measure growth in the number of employees and turnover.

The authors formed a sample of ordinary firms and high-growth firms to evaluate industrial firms' strategies. First, the authors formed a structure of industrial firms based on the All-Russian Classifier of Types of Economic Activities (OKVED) - 2.

According to the Classifier, the next step is forming a statistically significant sample by type of activity within the group "manufacturing industries". To analyze Russian industrial firms' financial reporting, we use the rating agency "FIRA PRO" in the period from 2015 to 2018. The firm's basic indicators are revenue from 2015 to 2018, net profit from 2015 to 2018, and a year of foundation. The crucial aspect of the sample forming is the application of some restrictions. We exclude from the sample micro-enterprises with less than 100 million rubles in 2018 and firms with zero revenue indicators in one of the analyzed periods. Calculation of the return on sales ratios is a ratio of net profit to revenue. Also, we exclude outliers with the annual revenue growth more than 500% or less than -80%, and a return on sales more than 100% or less than -100%. After applying these restrictions, we can use the sample for identifying high-growth firms. The criterion for identifying high-growth firms is revenue growth of more than 20% for three-years and more in a row. We compare the features of strategies for ordinary and high-growth firms within "manufacturing industries."

The authors define a high-growth firm with annual revenue growth of at least 20% for three years or more in a row. This approach is consistent with the OECD definition. The research is based on the analysis of industrial firms. The All-Russian Classifier of Types of Economic Activities (OKVED) – 2 presents section "C" of manufacturing activities. This section contains 24 groups. The author decided to combine some of them into blocks since they have similar activities. Moreover, similar to the authors' view, the grouping is presented in the state statistics report of GDP by industry division. The names of the groups are presented in Table

Using the FIRA PRO database, we generated a sample of 14,930 manufacturing firms with data of revenue and net profit from 2015 to 2018. The revenue criterion in 2018 for more than 100 million rubles was also applied. Then firms with zero values or missing revenue data of at least one year were filtered. The authors also removed outlying observations from the sample and excluded firms with atypically high revenue or profit growth rates to obtain more objective data. Some firms show revenue/profit growth rate of 10 or more times, which can significantly affect the average values. The number of firms with a return on sales of less than 1 is significantly larger, approximately five times than the number of firms with an indicator more than 1. In general, the number of outlying observations had been gradually decreasing from 2015 to 2018. After applying restrictions, the sample reduced up to 11,228 firms. To form the sample of high-growth firms, we applied the criterion of revenue growth rate of more than 20%. 644 high-growth firms were identified. All firms were divided into four types within industry groups to assess ordinary and high-growth firms' strategies:

a. simultaneous revenue and return on sales (ROS) growth are above the group's average.

b. the firm's revenue grows above the average, but the return on sales (ROS) is below the average in the group.

c. the firm's revenue grows below the average, while return on sales (ROS) is above the group's average.

d. simultaneous revenue and return on sales (ROS) growth is below the average level in the group.

Findings

The largest number of ordinary firms is the concentration in the group "Food, Beverage, Tobacco Product Manufacturing," with a share of 21.76% of the total sample. The smallest group is "Production of coke and petroleum products" with a share of 0.77%. The distribution by the share of groups in the total mass does not vary much for samples of ordinary and high-growth firms.

7,848 firms belong to the small businesses (revenue does not exceed 800 million rubles in the last year of observation), 469 firms are gazelles. Medium-sized businesses (revenue varies from 800 million rubles to 2 billion rubles) include 1,753 firms, 94 of them are gazelles. 1,627 firms refer to the large business sector; 81 of them are gazelles.

The average age of the ordinary firms' sample is 16.73 years. The average age of gazelles is 16.7 years. Thus, the statement about the more remarkable ability of young firms to become gazelles is not confirmed.

The total revenue growth for a sample of ordinary firms was 17.81% in 2016, 13.64% in 2017, and 13.82% in 2018. For a sample of high-growth firms, the same indicators are higher and amounted to 73.56%, 67.83%, and 58.88%. The downward trend in the average level of revenue growth is a characteristic of both the ordinary firm sample and gazelles. The common trend denotes the presence of general negative factors in the economy. The average net profit growth for a sample of ordinary firms is 115.72% in 2016, 109.03% in 2017, and 15.24% in 2018. The average gazelles' net profit growth is 864.09% in 2016, -5803.44% in 2017, and 72.40% in 2018. The average ROS of ordinary firms is fixed at 3.75% in 2016, 4.47% in 2017, and 4.23% in 2018. The average ROS of gazelles is 2.62%, 6.41%, and 7.36% for the same years.

The highest average revenue growth rate among the groups of ordinary firms was observed in the coke and petroleum products group production with a value of 29.78% (average value of 13.8% in the sample). The lowest average growth rate is 7.66% in the group "Printing and copying of information media". The group, "Production of medicines and materials used for medical purposes", has the highest average ROS rate of 8.85%, with an average ordinary firms sample value of 4.23%. The lowest average ROS value is in the group "Manufacture of other non-metallic mineral products" (only 1, 62%). Coke and Petroleum Products Production firms have the highest revenue growth among ordinary firms and the lowest average ROS rate for the gazelles of (1.79%), but the revenue growth rate is also high among gazelles (85.69%). The group "Production of other non-metallic mineral products" presents the lowest ROS rate for ordinary firms. Simultaneously, the group has an enormous revenue growth rate among the gazelles, and the gazelle group ROS average rate is 8.91% (which is higher than the average gazelle sample of 7.36%). The highest ROS average rate among gazelles is noted in the group "Production of computers, electronic and optical products" (17.18%). Also, in this group, the ROS average is high for ordinary firms (8.06%).

In 15 out of 19 groups, more than half of the firms present the behavior type "c". The share of firms whose revenue grows below the average and ROS above the average varies from 42 to 48% in the remaining four groups. More than 30% of the firms demonstrate the first strategy of behavior, their revenue and ROS grow above the average rate for the general sample in most groups among ordinary firms. About 2-4% of the firms in each group stick to have a "b" behavior strategy. About 8% of the firms cannot achieve success in either revenue growth above the average or ROS average rate. The highest percentage of "lagging firms" in category "d" is in the group "Production of other non-metallic mineral products" with a share of 18.38%.

In general, the distribution of firm shares by type of strategy within groups does not differ much. That is, there is no industry-specific behavior of ordinary firms.

The distribution of high-growth firms by type of strategy is different from the behavior trends of ordinary firms. In 11 groups of 19, the share of companies with behavior type "d" (simultaneous revenue and return on sales (ROS) growth are below the average level in the group) is more than 40%. In the remaining groups, the share varies from 23% to 38%. The average share of companies with an "a" behavior strategy is much lower than ordinary firms' trend and remains at the level of 9% (against the average share of ordinary companies of 33.68%). In general, the average shares of companies with strategy "b" and "c" do not differ significantly and amount 23.58% and 26.87%, respectively.

An equal distribution of firms by type is presented in the group "Manufacture of other vehicles and equipment". 20% of the firms (the highest share among all groups) stick to the strategy "a". The remaining three types have the same number of representatives (26.67%).

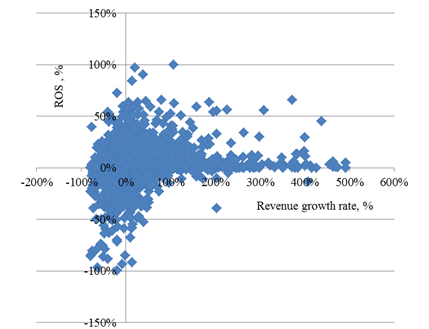

Within the industrial firms in groups of different activities, firms can incline to both strategies of a higher return on sales value and faster growth. The general graph of ordinary firms is presented in Figure

The bulk of firms demonstrates "standard" behavior for the company, so they have moderate growth and ROS value. However, a significant number of firms are prone to a trend of negative return on sales. In particular, the most striking growth trend among ordinary firms is manifested in the group "Printing and copying of information media" (C 18). Greater attention to achieving a high return on sales values is paid by the group "Production of medicines and materials used for medical purposes” (C 21).

The representatives of printing and copying media group are more focused on achieving high rates of revenue growth, only a small part of firms is "outstripped" from the total mass, they have an ultra-high return on sales values). The following activities show similar dynamics to rapid growth: Manufacture of rubber and plastic products (C 22), manufacture of other non-metallic mineral products (C 23), manufacture of fabricated metal products, except machinery and equipment (C 25), Manufacture of computers, electronic and optical products (C 26), Maintenance and installation of machinery and equipment (C 33).

The manufacturers of medicines and materials used for medical purposes demonstrate an orientation towards achieving a high level of return on sales, while the bulk of them is not interested in rapid growth (this may also be due to the industry). The firms of the group "Manufacture of furniture and other finished goods” follow the same strategy of behavior.

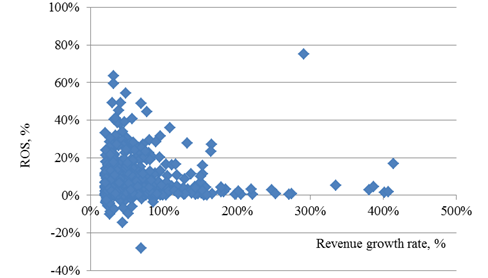

Based on the general graph of gazelles, it is difficult to single out one trend (Figure

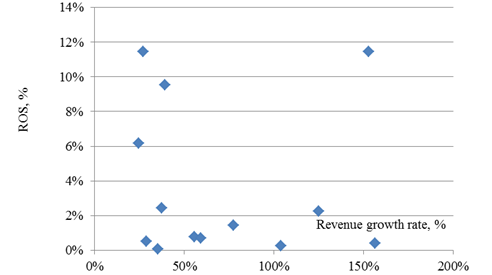

The strategy orientation of high-growth firms of the group “Printing and copying of information media” is presented below (Figure

The tendency to achieve a high return on sales rates has also been preserved among the gazelles engaged in the production of medicines and materials used for medical purposes. About half of the companies have a return on sales value above 10%. However, this trend is also not apparent due to the small sample (12 firms).

Most firms in different groups stick to the same tendency in strategy in comparison with ordinary firms. This trend is presented in such groups as Food, Beverage, Tobacco Product Manufacturing (C 10-12), manufacture of other non-metallic mineral products (C 23), Manufacture of computers, electronic and optical products (C 26), Manufacture of electrical equipment (C 27), manufacture of machinery and equipment not included into other groups (C 28), manufacture of furniture and other finished goods (C 31-32), Maintenance and installation of machinery and equipment (C 33).

However, despite the coincidence of the two groups' trends represented on the graphs, the remaining groups of industrial production of ordinary and high-growth firms practically do not coincide.

Conclusion

The analysis shows that Russian high-growth firms are focused on rapid growth in their strategies to the detriment of profitability. This trend is defined both in the whole sample of industrial firms and in most types of activities. The profitability (ROS rate) of gazelles is steadily less compared with ordinary firms. For example, a certain number of high-growth has a ROS rate above 50%, while the same level is trivial for ordinary firms. Rapid growth combined with high ROS is a rare phenomenon. It is not possible to identify standard features among the industrial groups which follow this trend. At the same time, the paper presents a list of groups in which the strategies of high-growth firms as a whole were more successful in terms of economic efficiency, which is measured by return on sales (ROS). These efficient activities are production of food products, light industry products, the wood processing industry, medicines, and the chemical industry, the production of computer equipment and electrical equipment, metal products, and repair and installation of equipment. For these types of activities, a rapid growth strategy also involves high performance. The growth is achieved with effectiveness determent in the other groups.

Acknowledgments

The reported study was funded by RFBR and VASS, project number 20-510-92006

References

- Acs, Z. J., Parsons, W., & Tracy, S. (2008). High-Impact Firms: Gazelles Revisited. Washington, DC: Corporate Research Board, LLC.

- Anton, S. G., & Carp, M. (2020). The effect of discretionary accruals on firm growth. Empirical evidence for SMEs from emerging Europe. Journal of Business Economics and Management, 21(4), 1128-1148. DOI:

- Autor, D., Dorn, D., Katz, L. F., Patterson, C., & Van Reenen, J. (2020). The Fall of the Labor Share and the Rise of Superstar Firms. The Quarterly Journal of Economics, 135(2), 645–709. DOI:

- Birch, D. L. (1981). Who creates jobs? The Public Interest, 65, 3-14.

- Birch, D. L., & Medoff, J. (1994). Gazelles. In L.C. Solmon, & A. R. Levenson (Eds.), Labor Markets, Employment Policy and Job Creation (pp. 159-168). Boulder: Westview Press,

- Bravo-Biosca, A., Criscuolo, C., & Menon, C. (2016). What drives the dynamics of business growth? Economic Policy, 31(88), 703–742. DOI:

- Dmitrieva, D., Ilinova, A., & Kraslawsk, A. (2017). Strategic management of the potash industry in Russia. Resources Policy, 52(1), 81-89. DOI:

- Eklund, C. M. (2020). Why do some SME's become high-growth firms? The role of employee competences. Journal of Intellectual Capital, 21(5), 691-707. DOI:

- Fowowe, B. (2017). Access to finance and firm performance: Evidence from African countries. Review of Development Finance, 7(1), 6-17. DOI:

- Mitaritonna, C., Orefice, G., & Peri, G. (2017). Immigrants and firms’ outcomes: Evidence from France. European Economic Review, Elsevier, 96(C), 62-82.

- Pletnev, D., & Barkhatov, V. (2020). Ups and Downs of High-Growth Firms in Russia. In G. Prostean, J. Lavios Villahoz, L. Brancu, & G. Bakacsi (Eds.), Innovation in Sustainable Management and Entrepreneurship. SIM 2019. Springer Proceedings in Business and Economics (pp. 127-136). Springer, Cham. DOI:

- Pletnev, D. A., & Nikolaeva, E. V. (2018). Dynamics and Factors of Business Success of Middle - Sized Gazelle Enterprises in Russia. Economic and Social Development Book of Proceedings, 96-104.

- Senderovitz, M., Klyver, K., & Steffens, P. (2015). Four years on: Are the gazelles still running? A longitudinal study of firm performance after a period of rapid growth. International Small Business Journal: Researching Entrepreneurship, 34(4). DOI:

- Trachuk, A., & Linder, N. (2018). Innovation and Performance: An Empirical Study of Russian Industrial Companies. International Journal of Innovation and Technology Management, 15(3), 1850027 (2018). DOI:

- Yudanov, A. Yu., & Yakovlev, A. A. (2018). «Neortodoksal'nyye» bystrorastushchiye firmy-«gazeli» i poryadok ogranichennogo dostupa [“Unorthodox” fast-growing firms (gazelles) and North’s limited access order]. Voprosy Ekonomiki, 3, 80-101. DOI: 10.32609/0042-8736-2018-3-80-101

Copyright information

This work is licensed under a Creative Commons Attribution-NonCommercial-NoDerivatives 4.0 International License.

About this article

Publication Date

16 April 2021

Article Doi

eBook ISBN

978-1-80296-104-1

Publisher

European Publisher

Volume

105

Print ISBN (optional)

-

Edition Number

1st Edition

Pages

1-1250

Subjects

Sustainable Development, Socio-Economic Systems, Competitiveness, Economy of Region, Human Development

Cite this article as:

Pletnev, D., Naumova, K., & Pham, V. D. (2021). Strategies Of Russian High-Growth Industrial Firms. In E. Popov, V. Barkhatov, V. D. Pham, & D. Pletnev (Eds.), Competitiveness and the Development of Socio-Economic Systems, vol 105. European Proceedings of Social and Behavioural Sciences (pp. 1010-1020). European Publisher. https://doi.org/10.15405/epsbs.2021.04.107