Abstract

The global pandemic provokes a new round of volatility, which is fundamentally different, so the modern stage of development actualizes the task of determining regional economic systems' trajectories. The decisive role associated with the choice of inclusive or extractive policies, the pace of escalation of state assistance, belongs to the state. As a generally risk-neutral investor during a crisis, the state decides on the optimal distribution of funds between regions - structures affected by specific internally determined factors, which deprives them of the transitivity property. However, given the considerable uncertainty and resource constraints, there is a need to rank possible options for allocating budget flows based on risk and investment efficiency. Rank regions and industries by the degree of risk of budget investments determine regional structures and industries with unstable characteristics. The results will be used to formulate an optimal budget policy for the allocation of funds from the federal budget and the budget of entities and the development of regional strategies for overcoming the crisis finding the option of using budget funds effective according to Pareto, comparing the initial options for allocating budget funds by the method of stochastic dominance of the first and second orders using elements of voting theory. Conduct the majority choice according to the Condorcet rule, the rank ordering of alternatives. Industries and regions were ranked for the riskiness of budget investments and the efficiency of their use with applied stochastic tools of econometrics.

Keywords: Budgetary policycrisisrankregionstochastic dominancetheory of votes

Introduction

Regional budgets play a key role in a federal state's economic policy, with a high degree of autonomy (Shakleina & Midov, 2019). Despite the fiscal decentralization, the issue of the flow of funds into the entity's consolidated budget in the form of financing programs, state aid or interbudgetary transfers remains relevant.

Due to differences in the structure of the economy, the unequal adaptation of regions to the market, in the traditions of production, consumption and management, leads to the emergence of non-equilibrium economies and income asymmetry (Pechenskaya, 2018). The state's main function in these conditions is to eliminate territorial disproportions through the redistribution of funds at the planning stage of the budget process. The concept of risk appetite plays an important role in deciding on the redistribution of funds between the subjects' budgets.

The issues of the origin, classification and assessment of budgetary risk as a key indicator taken into account in the budgetary process are set out in the works of Gamukin (2014). The decision-maker can be risk averse (riskophobic), risk averse (riskophile), and risk neutral. We believe that the state can occupy all three positions, depending on the specific goals of financing. The risk of investments in the regional budget is estimated by researchers on the basis of a huge number of factors, in particular, social, demographic, natural landscape, territorial (Kurbatova et al., 2019), resource provision and resource dependence (Troyanskaya, 2017), tax competition (Makarov et al., 2016); (Povarova, 2018).

Problem Statement

When making decisions under risk conditions, the problems of choosing the best probability distribution arise, therefore the ordering of the sets of probability distributions is one of the most important aspects of risk theory. In conditions of uncertainty, when there is not enough information to apply the theory of utility in full, the theory of stochastic dominance is used. The introduction of stochastic domination elements in the assessment of various alternatives is described in research (Kustitskaya, 2012); (Polshkov, 2018); (Tokareva & Makarov, 2016). As the advantages of this tool, the researchers note a significant reduction in the level of uncertainty and the reduction of the original problem to the rank ordering of alternatives.

Depending on the priorities of the executive authorities of the constituent entities, the choice of regional objects for investment can be based on the analysis of various determinants, the composition of which is described in the works of researchers (Belousov et al., 2019); (Grebennikov & Magomedov, 2019); (Granitsa, 2020); (Ivanov & Sahapova, 2014); (Maslennikov et al., 2019). Let's draw an analogy between the sphere of public finance and the sphere of business.

The measure of sustainability for the business sector is profitability, that is, the ratio of the balanced financial result to the gross regional product (Malkina & Balakin, 2017). We believe that a symmetric indicator for assessing the sustainability of the regional budget is the profitability of the regional budget system, which, by analogy, is defined as the ratio of the income of the subject's consolidated budget to the gross regional product. Let us evaluate the relationship between the regional budget profitability and the profitability of the business sector using the econometric tools, displayed and ranked according to the principle of decreasing model quality, in table

Thus, an obvious relationship has been established between the public sector's profitability and the business sector. If the measure of stability is profitability, then it is reasonable to consider unprofitability to measure instability.

We accumulate data on twelve unprofitable industries in federal districts for 2018 and correlate the amount of loss with the gross regional product's value attributable to unprofitable industries. The data source is information from the official website of state statistics (https://www.gks.ru/free_doc/doc_2018/region/reg-pok18.pdf, date of access: 12.06.2020).

Research Questions

Regions will be ranked according to the degree of risk of budget investments, and regional structures and industries with unstable characteristics will be identified. The results obtained can be used to form an optimal budgetary policy for allocating funds from the federal budget and the budget of the subjects and developing regional strategies for overcoming the crisis.

Purpose of the Study

As usually a risk-neutral investor during a crisis, the state decides on the optimal distribution of funds between regions - structures that are influenced by certain internal factors, which deprives them of their transitivity properties.

However, given the significant uncertainty and limited resources, it is necessary to rank the possible options for the distribution of budget flows based on risks and investment efficiency.

Research Methods

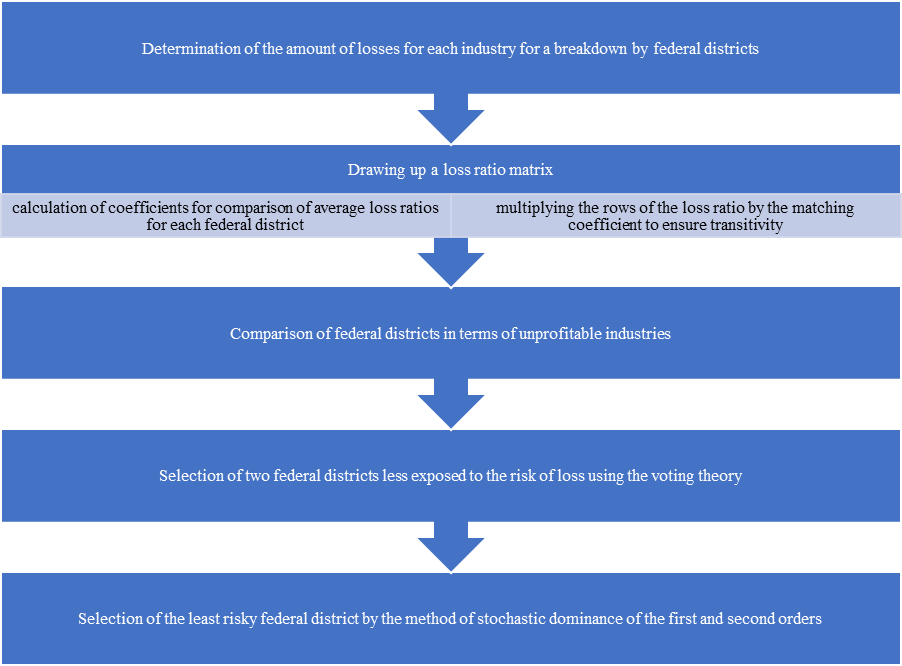

The procedure for comparing federal districts by the degree of unprofitable industries is shown in Figure

Using elements of the voting theory, we will hold a majoritarian tournament, order the federal districts following their advantages according to the Condorcet rule, and assign them rank in the majoritarian tournament. We have obtained the following sequence of districts regarding the degree of risk reduction - North Caucasian, Siberian, North-West, Central, South, and Privolzhsky. We are left with two federal districts - the Ural and the Far East, from which it is necessary to choose the least risky one for making investments. Let us compare the distribution functions of the loss coefficients for these two regions by performing sequentially the following procedures

Finding the variance of the loss ratio and comparing the results.

Findings

Calculations have shown that the dispersion of unprofitable industries is lower in the Far Eastern Federal District, a smaller dispersion is characterized by greater stability and, consequently, lower risk.

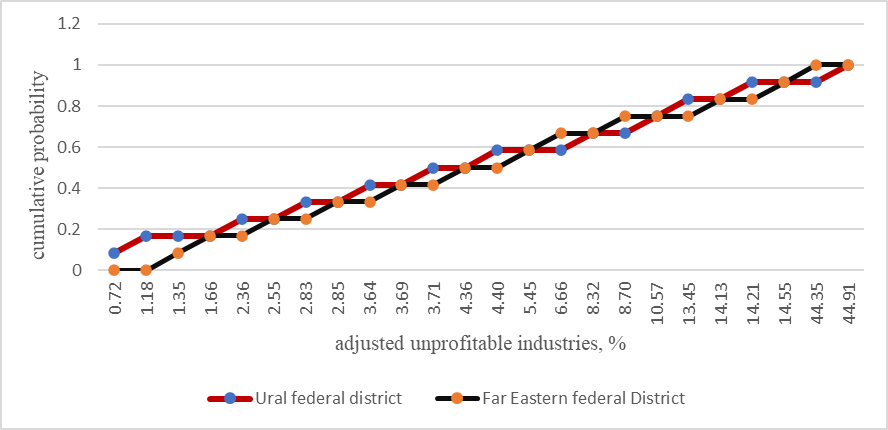

To select the most risk-free preference, taking into account the probability distributions, we use the method of stochastic dominance of the first two orders. The distribution functions of unprofitable industries in the federal districts are shown in figure

For stochastic dominance of the first order, it is true that the distribution function F (x) dominates the distribution function G (x) if the relation.

F (x) <= G (x) (1)

Based on the analysis of figure

Since in this case the situation is ambiguous and the distribution functions of the unprofitable regions overlap and it is impossible to unambiguously determine the preferences for the distribution of funds in the budget system. Let us assess budgetary preferences for the distribution of budgetary funds using the method of second-order stochastic dominance, which is an extended concept of first-order stochastic dominance.

This type of distribution imposes an additional constraint on the utility function. For a stochastic distribution of the second order, the decision maker, in our study in our study, is a subject distributing budgetary funds, should not be inclined to risk. In the current situation of a crisis caused by a pandemic, the consequences of which will obviously have a very long-term effect, the condition of aversion to risk is more than relevant.

The second-order stochastic dominance criterion involves the analysis not of distribution functions, but of the areas under such functions.

The use of the second-order stochastic dominance criterion has been successfully demonstrated in the study Trifonov et al. (2010) when choosing options for lending by commercial banks.

Let us analyze regional alternatives using the principles of second-order stochastic dominance.

The calculation results are presented in table

Thus, the calculation results show that, since all the numbers in the last column of table

The results obtained are explained by the fact that the Far Eastern Federal District for Russia has an important strategic value, refers to a district of a resource type. The presence of large reserves of natural resources and, consequently, a significant income from raw materials exports provides the region with an important competitive advantage.

The huge resource potential of the region, which will make it possible to realize the investment potential of the region and ensure the interest of potential investors. In addition, the location of the district to the largest consumers of the extracted resources is the most important competitive advantage, as it allows the implementation of major investment priorities in the region.

The high resource potential of the region is a determining factor in the sustainability of the budget and financial system as a whole. This circumstance must first be taken into account when choosing one or another variant of monetary and budgetary policy.

Conclusion

During the crisis, it is more important for the state than ever to implement an effective budgetary policy by investing budget funds in regions where either you can get a greater return on the use of funds or incur the least losses.

As a criterion for ranking regions, we chose the amount of loss (unprofitableness) of industries due to a close relationship between the public sector's profitability and the business sector.

The regions are ranked from the point of view of the riskiness of budget investments and the efficiency of their use using applied stochastic econometrics tools, and regional structures with unstable characteristics from the standpoint of loss-making are identified - these are the North Caucasian and Siberian Federal Districts.

The results obtained can be used to form an optimal budgetary policy for the allocation of funds from the federal budget and the budget of the subjects and to develop regional strategies for overcoming the crisis.

Acknowledgments

The study was funded by the RFBR project number 19-010-00716

References

- Belousov, V. E., Gulevskaya, E. K., & Zang, H. K. (2019). Decision-making mechanisms in conditions of incomplete information on the basis of fuzzy dominance. Construction Management, 1(14), 79-85.

- Gamukin, V. V. (2014). Research of the budgetary risks in Russia. Journal of International Finance and Economics, 14(1), 27-38.

- Granitsa, Y. V. (2020). Some approaches to the selection of regional determinants financial instability. IOP Conf. Series: Materials Science and Engineering, 753, 082035.

- Grebennikov, V., & Magomedov, R. (2019). Budgetary Self-Sufficiency as a Problem of the Governmental Programming of Regional Development. Economics and the Mathematical Methods, 55(4), 68-77.

- Ivanov, P. A., & Sahapova, G. R. (2014). Financial instability in the region: assessment methods and elimination tools. Economic and Social Changes: Facts, Trends, Forecast, 6(36), 183-198.

- Kurbatova, M. V., Levin, S. N., Kagan, E. S., & Kislitsyn, D.V. (2019). Resource-type regions in Russia: definition and classification. Terra Economicus, 17(3), 89–106.

- Kustitskaya, T. (2012). Representation of Preferences by Generalized Coherent Risk measures. Journal of Siberian Federal University. Mathematics & Physics, 5(4), 451–461.

- Makarov, V., Ayvazyan, S., Afanasyev, M., Bakhtizin, A., & Nanavyan, A. (2016). Modeling the Development of Regional Economy and an Innovation Space Efficiency. Foresight and STI Governance, 10(3), 76–90.

- Malkina, M. Yu., & Balakin, R. V. (2017). Assessing the Risk and Performance of Tax Systems Based on Industry-Specific, Regional and Mixed Portfolios. Finance and Credit, 23(47), 2823–2842.

- Maslennikov, D. A., Mityakov, S. N., Kataeva, L. Yu., & Fedoseeva, T. A. (2019). Identification of the Characteristics of the Regional Strategic Development Based on the Indicators’ Statistical Analysis. Economy of region, 15(3), 707-719.

- Pechenskaya, M. A. (2018). Budget capacity in the system of capacities of the territory: theoretical issues. Economic and Social Changes: Facts, Trends, Forecast, 11(5), 61-73.

- Polshkov, Yu. N. (2018). A stochastic methodology for assessing indicators of investment and innovation development in the regional economy management system. Institute of Economic Research Vestnik, 3(11), 88-95.

- Povarova, A. I. (2018). Problems related to regional budgeting amid fiscal consolidation. Economic and Social Changes: Facts, Trends, Forecast, 11(2), 100-116.

- Shakleina, M. V., & Midov, A. Z. (2019). Strategic classification of regions according to the level of financial self-sufficiency. Economic and Social Changes: Facts, Trends, Forecast, 12(3), 39–54.

- Tokareva, E., & Makarov, S. (2016). Search for a solution in conditions of stochastic uncertainty and multicriteria using methods of the theory of voting. Models, systems, networks in economics, technology, nature and society, 1(17), 142-150.

- Trifonov, Yu. V., Koshelev, E. V., & Chukhmanov, D. V. (2010). Management credit risk in commercial banks using the stochastic dominance algorithm. Management of economic systems: electronic journal, 4(24).

- Troyanskaya, M. A. (2017). Competition in taxation and the forms of its implementation among the subjects of the Russian Federation. Journal of Tax Reform, 3(3), 182-198.

Copyright information

This work is licensed under a Creative Commons Attribution-NonCommercial-NoDerivatives 4.0 International License.

About this article

Publication Date

16 April 2021

Article Doi

eBook ISBN

978-1-80296-104-1

Publisher

European Publisher

Volume

105

Print ISBN (optional)

-

Edition Number

1st Edition

Pages

1-1250

Subjects

Sustainable Development, Socio-Economic Systems, Competitiveness, Economy of Region, Human Development

Cite this article as:

Granitsa, Y. (2021). Formation Of Regional Budgetary Policy Using Stochastic Dominance Methods. In E. Popov, V. Barkhatov, V. D. Pham, & D. Pletnev (Eds.), Competitiveness and the Development of Socio-Economic Systems, vol 105. European Proceedings of Social and Behavioural Sciences (pp. 947-955). European Publisher. https://doi.org/10.15405/epsbs.2021.04.100