Employees Accounting Functions Development For High-Tech Manufacturing Enterprises In Digital Modernization Conditions

Abstract

In the era of modern digital technologies, there is full automation or a change in the current realities in the automation and digitalization of the functions of enterprise workers. This also applies to the functions of employees related to accounting. Many existing large high-tech industrial enterprises in Russia keep up with the times in terms of digitalization of all processes, especially accounting, since it is financial accounting that is the basis for the correct formation of the cost, as a result of reducing costs and increasing accounting transparency. Therefore, among such enterprises, there is a tendency to switch to new automated accounting systems, the practice of forming the cost price for them is undergoing changes. The accounting profession itself and its constituent functions are subject to strong fluctuations. As part of these changes, the functions of employees in departments or cost centers are changing. In the course of these innovations, with the involvement of employees at cost centers, the workload of accounting specialists more than doubles, due to the need to conduct double accounting when introducing a new automated system and adjusting its functions for a particular enterprise. For this reason, there is an urgent need to develop the accounting functions of workers in high-tech manufacturing enterprises. In this regard, this article proposes and substantiates recommendations in accounting processes for employees of the investigated high-tech manufacturing enterprises.

Keywords: Cost centersdepartments expensesdigitalizationmanagement

Introduction

The object of the research will be the accounting functions of employees of large high-tech manufacturing enterprises in the context of digital modernization, including the introduction of new automated systems. The subject of the research is a set of theoretical and methodological aspects related to accounting processes at high-tech manufacturing enterprises. The theoretical and methodological basis of the research is based on fundamental concepts and hypotheses, which are reasoned and demonstrated in the works of domestic and foreign experts specializing in cost accounting. Methods of expert and logical analysis were used. The scientific novelty of the research is the analysis of accounting processes of various large high-tech manufacturing enterprises in the process of updating automated accounting systems and not only. The novelty of the research also lies in solving a set of problems in setting accounting processes in the context of digitalization. The paper shows the adaptation of the obtained conclusions into recommendations for the application and further development of the accounting functionality of employees of large high-tech manufacturing enterprises (Eremeeva, 2017; Magomedova & Khlebnikova, 2018).

Problem Statement

In modern realities, the main players in the arena of accelerating the digitalization of accounting processes are large manufacturing enterprises. Since it is such economic agents that have great means to apply this method of achieving the first positions in the competition. Since, with the introduction of new modern automated accounting systems, transparency, openness of accounting increases, the share of settlements in Excel decreases. But the most important point of innovations in the accounting functionality for the studied enterprises is cost accounting (Rabinovich, 2015; Sheshukova & Erokhin, 2019). Large industrial enterprises in modern realities develop and implement a set of new accounting systems, as well as acquire various ready-made solutions for integrated automated accounting. This trend is largely due to the desire to increase the detail in the cost, as well as to subsequently reduce costs, despite the high costs of introducing new and changing and redesigning existing accounting systems and methods (Sheshukova & Mukhina, 2015).

Sheshukova and Erokhin (2019) in their article imply that the studied enterprises are implementing complex automated systems in order to be able to most accurately form the production and full cost. And as a result, determine the most rational price for products, but also, in addition, reduce costs by reducing the number of management employees, and transferring their functions to establish basic primary documents for expenses, directly to employees in departments that directly incur expenses. This aspect expresses the current trend in the changing role of the accountant in a large high-tech enterprise. But in fact, current realities show that changes must also overtake employees directly in the centers of financial responsibility or in the services and departments of the enterprise (Egorova & Yudanova, 2015). Therefore, the main task of the research is to develop new schemes for accounting functionality of employees on modern automated systems.

Research Questions

Research questions for this article will be: How do modern technologies change accounting processes in the enterprise? The changing of the accounting function in today's realities? How do the functions of managers change in modern realities? How to manage costs more effectively using modern automated accounting systems? How is the training load distributed among employees in the context of digital modernization? What are the main recommendations for changing accounting processes for employees of the high-tech manufacturing enterprises under study? What effect will the proposed method bring?

Purpose of the Study

The authors' goal is to propose new schemes for the functioning of employees of high-tech manufacturing enterprises in the context of digital modernization. Show how the accounting functions of the accounting department will change. Highlight changes in the functions of managers when implementing new automated accounting systems. Give recommendations for changing accounting processes for employees of high-tech manufacturing enterprises in general. Make it clear to readers how to manage costs more effectively using modern automated accounting systems. Investigate the effect of the proposed method. Draw conclusions on the recommendations.

Research Methods

The study was conducted by studying various internal documents of high-tech manufacturing enterprises. The authors examined internal instructions and standards. Internal documents such as methods of cost accounting and cost calculation are studied. The authors considered various corporate standards. We studied the accounting policies of various companies in the industry under study. The authors studied reports of internal and external audits and opinions of employees of such organizations. Various aspects of working on modern automated accounting systems are analyzed. The current business processes related to the accounting functionality of employees of high-tech manufacturing enterprises are investigated.

Findings

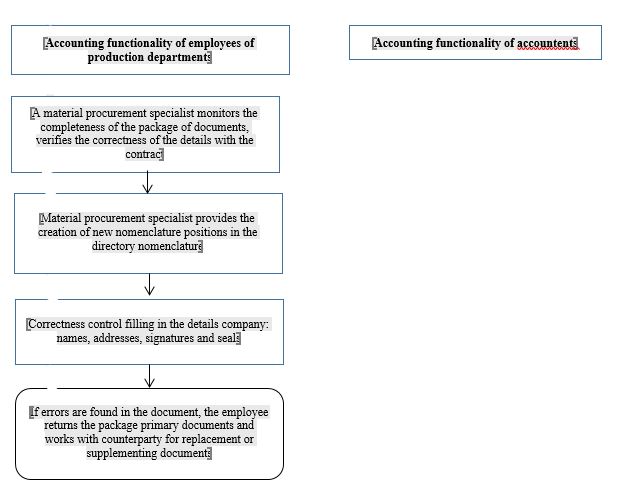

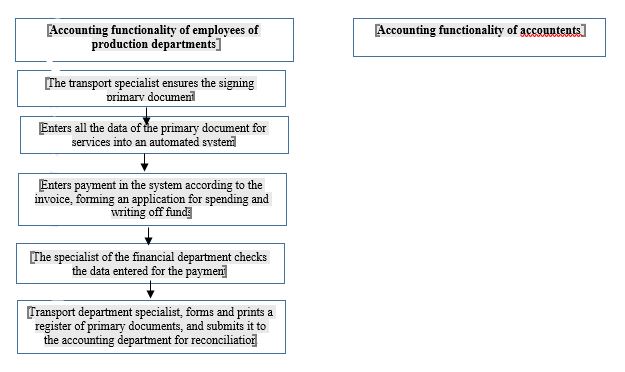

For the rational organization of the accounting process on modern automated systems, the author proposes that the employees of each department, who directly incur expenses, themselves start up primary documents for various expenses and control them, including the payment process (Voekova & Karpenko, 2017). We will describe this accounting process using an example, the procurement of materials used in the production of basic types of products. These purchases are usually handled by the Material and technical supply department (Foster & Horngren, 2003; Innes, 1998). According to the historically established practice, the received documents for the purchase of materials, in particular invoices, were sent after the materials were accepted by the accounting department of the materials for reflection in the system. But in this case, the following scheme of the accounting functional of employees is proposed (Udovikova, 2018). The author proposes to consider this scheme in parts. The first part of the diagram reflects the initial stage of obtaining the primary document (Figure

As can be seen in Figure

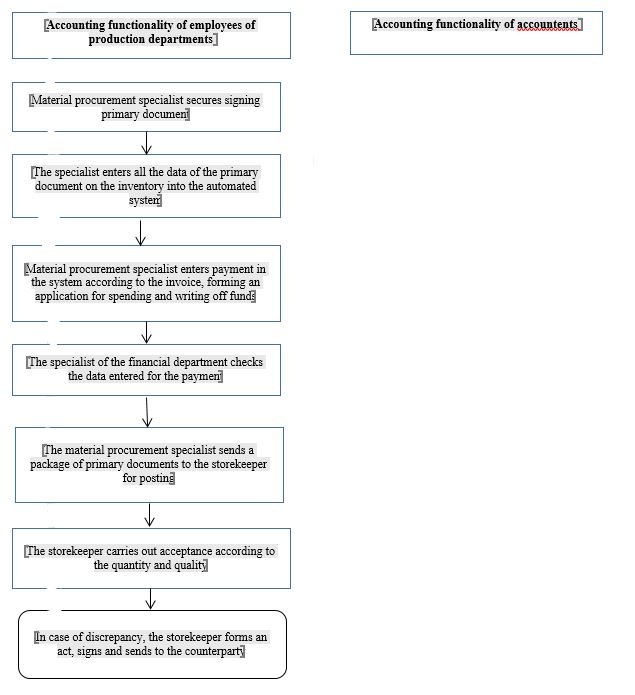

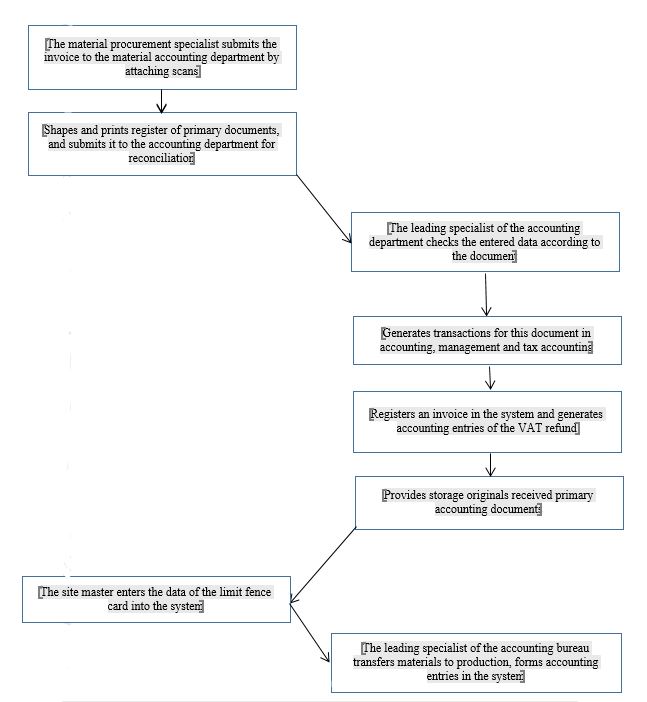

In Figure

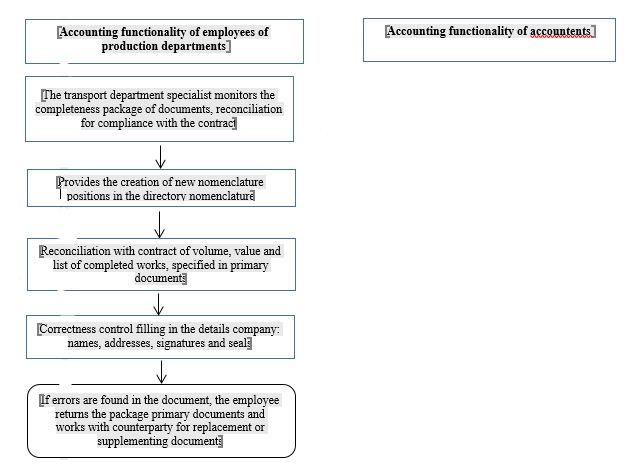

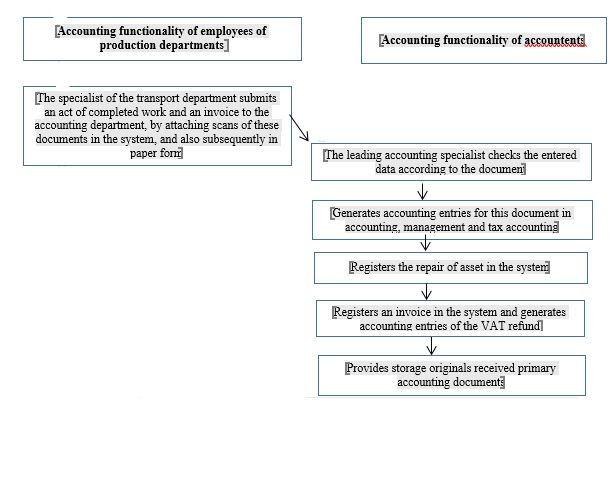

This scheme, with minor changes, is applicable in any divisions for the acquisition of other goods and materials and other assets. The author proposes to reflect the purchase of services in approximately the same way, for example, the purchase of vehicle repair services.

As can be seen in Figure

According to Figure

Conclusion

According to this methodology, the accounting department only has the function of checking the document, the establishment of all primary data is transferred to the employees of the departments. But the main responsibility for the reflection of documents in the system, the attribution of expenses to the cost price remains with the employees of the accounting department. However, when creating a document, the service worker will have to master some accounting competencies, otherwise the document will be entered incorrectly. These permutations are necessary since accounting at such large aircraft building enterprises is much more complicated for accuracy and reliability than at similar industrial enterprises. For example, only a specialist accountant should keep track of fuel costs. Since, part of these costs must be distributed directly to cost accounts, some to transport and procurement costs, and more. In this case, the accountant must document these costs and distribute them in an appropriate way, based on their competencies. The use of this methodology will allow the studied enterprises to use the most modern accounting systems, relieve the staff of the accounting department and increase the transparency of cost accounting and subsequently reduce costs. The economic benefit from this proposal must be calculated individually.

References

- Egorova, S. E., & Yudanova, L. A. (2015). Comparative analysis of new methods and systems for cost accounting and calculating the cost of production. Bulletin of the Pskov State University, 2, 90-94.

- Eremeeva, S. V. (2017). Problems of cost accounting during research and development work at the enterprises of the rocket and space industry. Reshetnevskie Chteniya, 21(2), 470-471.

- Foster, G., & Horngren, C.T. (2003). Cost accounting an cost management in a JIT environment. Journal of Cost Management for the Manufactory Industry, 1, 4-14.

- Innes, J. (1998). Strategic management accounting. Gee.

- Magomedova, N. M., & Khlebnikova, M. V. (2018). The forecasting of operational expenses on railway transport enterprises. Inženernyj Vestnik Dona, 3, 3-5.

- Rabinovich, A. M. (2015). The full cost and administrative expenses. Accounting, 9, 106-109.

- Sheshukova, T. G., & Erokhin, V. N. (2019). Development of cost management accounting at aircraft manufacturing enterprises. International Accounting, 2, 174-186.

- Sheshukova, T. G., & Mukhina, E. R. (2015). Development of management accounting at enterprises for the production of electrical products. Publishing House Perm National Research Polytechnic University.

- Udovikova, A. A. (2018). Methodological approaches to the formation of the cost of production at a manufacturing enterprise. Finance of Russia in the Conditions of Globalization, 3, 276-280.

- Voekova, D. A., & Karpenko, S. V. (2017). Problems of determining the total cost of a unit of production and ways to solve them. Economics and Management in Modern Conditions, 2, 140-142.

Copyright information

This work is licensed under a Creative Commons Attribution-NonCommercial-NoDerivatives 4.0 International License.

About this article

Publication Date

30 April 2021

Article Doi

eBook ISBN

978-1-80296-105-8

Publisher

European Publisher

Volume

106

Print ISBN (optional)

-

Edition Number

1st Edition

Pages

1-1875

Subjects

Socio-economic development, digital economy, management, public administration

Cite this article as:

Erokhin, V. N., Sheshukova, T. G., & Korneeva, T. A. (2021). Employees Accounting Functions Development For High-Tech Manufacturing Enterprises In Digital Modernization Conditions. In S. I. Ashmarina, V. V. Mantulenko, M. I. Inozemtsev, & E. L. Sidorenko (Eds.), Global Challenges and Prospects of The Modern Economic Development, vol 106. European Proceedings of Social and Behavioural Sciences (pp. 811-819). European Publisher. https://doi.org/10.15405/epsbs.2021.04.02.97