Abstract

The growth of capital investments in fixed assets requires an examination of the main problems of their accounting and reporting in the implementation of investment activities. From all forms of accounting (financial) reporting, indicators for investment activities are found in the statement of cash flow. When assessing the effectiveness of capital investments, interested users lack the information posted in the statements, they need indicators detailing the financial results obtained from capital investments in fixed assets, as well as the volume of output attributable to such objects. These calculations can be carried out only with additional internal information, which is not disclosed in the reports. The study considered the prospects for resolving these problems by state bodies and proposed options for improving accounting reporting to conduct an effective assessment of capital investments in order to ensure the financial security of the functioning of the economic entity. From the state, measures are being taken to resolve the problem of reflecting indicators for capital investments. A federal standard project has been developed. Major Russian economic entities are actively involved in the discussion and revision of the regulatory document project, taking into account its further practical application. Compilation of reports on committed capital investments is important, especially in capital-intensive organizations. Capital investments in non-fixed assets indicate not only an increase in the efficiency of the enterprise, but also a competent decision taken for production purposes, ensuring the financial security of the company's functioning in the future.

Keywords: Сapital investmentscapital investments in progressinvestment activities

Introduction

Reporting on capital investments, this is the primary issue in ensuring financial security, which requires a solution in each organization conducting investment activities. From all forms of accounting (financial) reporting, indicators for investment activities are found in the statement of cash flow. This report is divided into three sections depending on the type of cash flows, some of which are cash flows from investment transactions. In relation to capital investments, information on cash flow during operations with non-current assets will be reflected: when selling non-current assets, the receipt of cash, when acquiring non-current assets, the transfer from the settlement account of funds. But this information is only for cash flows caused by capital investment operations.

There is no information on capital investments in the results reporting. In the balance sheet, capital investments are reflected in the items Fixed assets or Other non-current assets. But again, this information is reflected in the curtailed, in addition to capital investments, information is reflected on other objects of non-current assets. The statement of financial results will show information on capital investments under the lines "Other income" and "Other expenses." As part of other revenues, information on capital investments will be reflected when identifying the object of non-current assets as a surplus during the inventory, for example. Other costs may include costs incurred for fixed assets that have not improved their performance. Information on the movement of capital investments is disclosed in the explanations of the reporting forms. In this case, there are no separate sections allocated for capital investments (perfect), the information is reflected in the applications for the movement of assets under the column "Received". Unfinished capital investments are separately reflected. Thus, information on capital investments is not reflected in the reporting forms. This moment is very important, due to the growth of investments in capital investments, observed in recent years according to Rosinfostat (2020) (Figure

Problem Statement

The first step in solving the main problems is the planned adoption of the project of the new FSBU (federal accounting standard) "Unfinished Capital Investments." At the moment, it is planned to regulate the process of accounting for capital investments in the organization. A Draft federal accounting standard such as "Pending Capital Investments" has been proposed. This project was developed by the accounting methodological center.

The need for its application is primarily determined in large phonodomous enterprises. For external users, it is problematic to obtain information about pending capital investments even from accounting (financial) statements. Pending capital investments in the balance sheet are shown as "Other non-current assets." Maybe this information was not so significant, for example, for investors, but this is not so. Unfinished capital investments, especially those made in large quantities, indicate a diversion of production capacity from the main work process. Here we are talking about the fact that if a large capital investment project is carried out, then huge funds and resources are spent on its implementation in the form of the use of fixed assets, material resources and raw materials and labor. In this case, there is always a need to analyze whether capital investment projects should be implemented or not, it may be more profitable to direct the free production forces of the organization for other purposes of activity than for the implementation of such projects. That is why, when it comes to attracting investment in an organization, one of the first points of analysis is unfinished capital investments, since they take a lot of resources to implement.

Research Questions

Is it possible to comprehensively assess the effectiveness of capital investments based on the indicators reflected in the reporting provided by the organization as part of the annual report? In what context should the detailed reporting indicators be carried out in order to ensure the calculation of the efficiency of capital investments? What principles of evaluating the effectiveness of capital investments can be distinguished? What measures are being taken to resolve the issue of capital investments from the state? What organizations need a regulatory document to resolve this problem? What measures does the company take to address the issue of improving the accounting of capital investments? What indicators will allow to give an objective assessment of the effectiveness of capital investments?

Purpose of the Study

The authors developed a methodology for improving the disclosure of the company's capital investments in the financial statements. The issue of regulation of investments accounting by the state is studied. The need for further development of methodological recommendations is determined. One of the purposes of the study is to assess the possibility of detailing capital investments and the formation of specific positions in the reporting forms. Another goal is to provide interested users with objective information containing analytics on capital investments. The obtained data will allow further evaluating the effectiveness of capital investments by investor organizations. The calculated performance indicators will serve as the basis for making decisions on long-term business development.

Research Methods

The study uses theoretical research methods, including: description, generalization, formalization, financial analysis. The financial analysis in this study includes disclosing the calculation of the estimate of the effectiveness of capital investments. Standardization of such analysis is possible only when developing intra-corporate standards for each industry. Standards must be constantly updated to meet current conditions. Indicators characterizing the efficiency of capital investments: profitability of capital investments, payback period, unit capital investments. The difficulty of calculating these indicators is the absence of detailed data on capital investments in the reporting forms. In this regard, it seems difficult for interested users to make an objective assessment of the effectiveness of capital investments on the basis of reporting forms posted on the Internet, on the official websites of organizations and other sources.

Findings

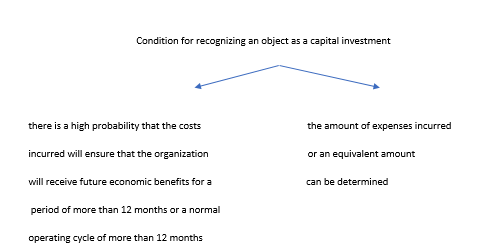

Pending capital investments will be, capital investments that are not drawn up by special acts for commissioning of facilities, that is, there are documents confirming the implementation of actual costs, but the capital investments process has not been completed (Popov, 2019; Nemtseva, 2018). The draft of such a standard introduces not only the concept of "pending capital investments," but also the conditions for their recognition (Figure

This standard provides a fairly broad list of actual costs that can be included in the value of pending capital investments. The standard is still in development, but now you can notice how important its application will be, since a fairly wide range of issues on accounting for pending capital investments is regulated. In addition to the listed costs, additional costs can also be included in the cost.

In the case of property that is additionally used for capital investments and paid by any non-monetary means, its value is determined on the basis of fair value. Determining fair value in Russian accounting is not yet commonplace, it is more international practice. Therefore, if the organization were to apply the standard in practice, it needed clarification of such calculations. So far, there is only a reference to international standards, but it is advisable to develop domestic practices based on international standards and implement it.

A fairly wide list of costs that are not to be included in the value of pending capital investments is also determined. In the standard, the list is presented under the name of costs, but in fact, from the point of view of professional judgment, it is worth using the term "expenses" in addition to the term "costs." Subsequent valuation of pending capital investments involves an impairment check. This moment is also new for domestic practice, so it should be carried out on the basis of international practice, using international standards of financial reporting (Federal accounting standart 26/2020)

The BMC website contains comments on this draft standard (BMC, 2020d). Comments are reflected both on the definition of concepts and terms, and on all moments of accounting for unfinished capital investments, from valuation, to disposal and disclosure in reporting. Basically, comments are made by such large companies as PJSC Gazprom Neft, PJSC NK Rosneft, PJSC Surgutneftegaz, PJSC MMC Norilsk Nickel. This is understandable, since it is such companies that are phonodomous and they will have to put this standard into practice to a greater extent.

PJSC Rosneft put forward the issue of the moment of initial recognition of pending capital investments (BMC, 2020a). It is proposed to develop a recommendation with an illustrative example of the moment of recognition of pending capital investments, and not to amend the text of the standard. In particular, we are talking about construction by contract with a long term of more than 1 year. And as recognition criteria, the customer's control over all construction processes and risks is put first. In turn, Rosneft proposes to amend the text of the standard itself and clarify the moment of recognition regarding the receipt of property from persons who are not owners or the state. PJSC "Surgutneftegas" provides comments on the terminology corrections according to the text. It is proposed to remove terms such as "maintenance" and "inspection," since these actions do not improve the functional quality of objects (BMC, 2020b). MMC Norilsk Nickel PJSC proposes amendments to the wording of the recognition conditions - obtaining economic benefits not from pending capital investments, but from an object of non-current assets, which will eventually be created (BMC, 2020c). On this basis, a controversial situation arose, and the decision was to leave the original wording. Thus, the adoption of this standard will be an excellent regulator for accounting for pending capital investments in the organization. Further development of guidance on accounting for pending capital investments will also be an important step, as clarification of some items of the standard for accounting in the organization will be needed. It is also important that many organizations can participate in the development of draft standards. This is quite convenient for them, since they look from a practical point of view, and having in their practice many different situations, I have the opportunity to regulate them with a regulatory document to avoid in the practice of litigation.

The new FSBU will simplify the accounting process, but will also contribute to a more convenient presentation of reporting information and its further analysis. The effectiveness of capital investments is assessed according to the following principles:

˗ making capital investments only on the basis of a specific project or financial proposal in which cash flows are modelled during the capital investment;

˗ modeling of the capital investment project taking into account the temporary factor: time is estimated for receipt of necessary material resources for the construction of facilities, performance of works by third-party organizations;

˗ analysis of loss of profits in capital investments, that is, assessment of the feasibility of other projects that are more cost-effective for the organization;

˗ consideration as a source of financing of capital investments of own funds without attraction of borrowed capital;

˗ assessment of inflation and the corresponding economic situation in capital investments;

˗ analysis of risks specific to the company's activities in capital investments.

The valuation of capital investments is based on two methods:

1. Simple (static method), independent of time factor.

2. Time-dependent discount method.

Regardless of the time factor, the payback period and the accounting rate of return can be calculated, for example.

The payback period will be calculated using the following formula:

SOC = KV0/ DPg

where KV0 is the Initial capital investment,

DPg – Cash flow for the period (year).

Accounting rate of return:

Пn КВ0

UNR = ∑(PP/n) / Kv0 / 2

where, Pn is the profit for the nth year,

n is the number of years.

When calculating these indicators, the time factor is not taken into account, therefore, cash flows will be equal during the entire period of capital investment. But these indicators are easy to calculate, which is the convenience of using them.

Depending on the time factor, the internal rate of return (IRR), the discounted payback period (DPP) can be calculated.

Thus, the Internal rate of return (IRR) can be calculated using the following formula:

NPV = - KVO + ∑ DPn/ (1+VNR)n

where, NPV is net present value,

DPn is cash flow for the nth year.

The discounted payback period (DPP) can be calculated using the following formula:

DPP= ∑ DPn/ (1+r) n

where, r is the discount rate.

In this case, all cash flows that appear in the implementation of capital investments are discounted, i.e. cash flows will be different in each time period. The calculation of indicators for evaluating the effectiveness of capital investments is given in Table

Payback period - the interval for which investment costs will be reimbursed from net cash flows. The normative period of time is established when the capital investment project is agreed. In this case, the payback period was 4 years. The accounting rate of profitability is the ratio of the average profit to the average investment. The target (normative) value is determined on the basis of the investment policy established in the organization. In this case, the accounting rate of profitability was 27, 69%. The internal rate of profitability is the lowest amount of profitability, in which all funds invested in the capital investment project will pay off over the entire period of the project. In this case, the internal rate of profitability was 9.70%. The discounted payback period is the payback period adjusted for the discount rate. In this case, the discounted payback period was 3 years at a discount rate of 11%. Thus, when making capital investments, it is necessary to take into account the provisions of the investment policy of the enterprise, in which not only the main points of investment activity should be determined, but also the normative values of all calculated indicators. The calculation of each key figure requires initial data in the form of sales volume, operating expenses, depreciation charges, on the basis of which the average profit for a certain period will be calculated. The amount of investment costs for capital investments is also required, this information should initially be reflected in the capital investment project. Thus, with the capital investment project, the investment policy of the enterprise and the key performance indicators, it is possible to assess the effectiveness of capital investment in order to ensure financial security.

Due to the fact that individual risk reflects specific information about the company and will fluctuate depending on the information itself, the risk assessment of the effectiveness of capital investments should be calculated from the information data open to the user, and therefore the reporting indicators for capital investments should be (Asri, 2017).

You can propose the following as suggestions for expanding reporting forms:

˗ return the line "Unfinished Capital Investments" to the accounting practice and enter a decryption to reflect unfinished capital investments if the indicators are materialized;

˗ provide for the Accounting Balance Sheet and Financial Performance Statement to reflect interest on loans and loans related to the creation of investment assets. In the section on loans and loans, include an additional table "Interest on debt obligations included in the value of investment assets."

˗ separately disclose in the reporting the indicator characterizing the volume of output made at the expense of fixed assets in which capital investments were made. This is necessary to calculate unit capital investments.

˗ as part of the annual net profit, allocate part of the profit earned through the use of the corresponding funds, which will allow to more accurately calculate the profitability of capital investments and the period of their payback, all this in the future will give a positive development of the business of the corresponding industry. Failure to include details in the financial results report when forming the present value model may lead to inaccurate estimates of profit and rate of return on assets and equity, as well as inconsistent ranking of mutually exclusive investments (Robison & Barry, 2020). Such innovations will help external reporting users. Information on pending capital investments will be reflected in the first section of the balance sheet, which is primarily consistent with usability. Also important is the reflection of interest on debt obligations in relation to the investment asset. This information is not available even in the reporting explanations. Fundamental information about investments explains one third of the predictability of profitability (Petrovic et al., 2016), and further business success.

Conclusion

Thus, reporting on capital investments is important, especially in fund-intensive organizations. This process is not currently settled at the legislative level. But each organization can independently determine internal forms of reporting on capital investments. This process will help improve the investment process within the organization. Capital investments in non-current assets indicate not only an increase in the efficiency of the enterprise, but also a competent decision made for production purposes, ensuring the financial security of the company's operation in the future. Without capital investments, it is difficult to expand production in phonodomous enterprises. New capital investment projects help the organization enter new markets and improve its competitiveness.

References

- Asri, M. (2017). Idiosyncratic risk and asset pricing. In M. Munizu, M. Y. Zamhuri, R. Shunsuke, G. Pagalung, M. Alexander, S. Chamberlain, & M. Nohong (Eds.), Proceedings of the 2nd International Conference on Accounting, Management, and Economics. Advances in Economics Business and Management Research, 40 (pp. 154-174). Atlantis Press.

- BMC (2020a). Comments on the FSB project «Incomplete capital investments», received from PJSC "NC "ROSNEFT" and the results of the discussion http://bmcenter.ru/Files/13-10-17_Rosneft_N_K_V

- BMC (2020b). Comments on to the draft Federal budget service «Incomplete capital investments » received from OJSC "SURGUTNEFTEGAS" and the results of the discussion. http://bmcenter.ru/Files/Surgutneftegaz_N_K_V_20-10-17

- BMC (2020c). Comments on the draft of the FSB «Incomplete capital investments », received from JSC "MMC "NORILSK NICKEL" and the results of the discussion. http://bmcenter.ru/Files/prilogeniye1_08-09-17_Nornikel_N_K_V

- BMC (2020d). List of comments received in writing from interested parties and results of their discussion on the draft FSB "Incomplete capital investments". http://bmcenter.ru/Zamechaniya_NKV_svod

- Draft Federal Accounting Standard Such as "Pending Capital Investments". https://www.garant.ru/products/ipo/prime/doc/72169984/

- Federal accounting standard 26/2020 "Capital investments". http: //bmcenter.ru/Files/proekt_N_K_V

- Nemtseva, Y. V. (2018). Comparative characteristics of accounting (financial) reporting forms under IFRS and RAS. In I. L. Surat (Ed.), Proceedings of the International Scientific and Practical Conference "Current Problems of Economic Development in Modern Conditions" (pp. 168-174). Modern Humanities University.

- Petrovic, N., Manson, S., & Coakley, J. (2016). Changes in non-current assets and in property, plant and equipment and future stock returns: The UK evidence. Journal of Business Finance & Accounting, 43(9-10), 1142-1196.

- Popov, A. Yu. (2019). Modern approaches to the definition, recognition and evaluation of pending capital investments in accounting and financial reporting. Finance and Management, 1, 68-78.

- Robison, L. J., & Barry, P. J. (2020). Accrual income statements and present value models. Agricultural Finance Review, 80(5), 715-731.

- Rosinfostat (2020). Investments in fixed assets according to Rosstat. Statistics and indicators: Federal and regional. https://rosinfostat.ru/investitsii-v-osnovnoj-kapital/

Copyright information

This work is licensed under a Creative Commons Attribution-NonCommercial-NoDerivatives 4.0 International License.

About this article

Publication Date

30 April 2021

Article Doi

eBook ISBN

978-1-80296-105-8

Publisher

European Publisher

Volume

106

Print ISBN (optional)

-

Edition Number

1st Edition

Pages

1-1875

Subjects

Socio-economic development, digital economy, management, public administration

Cite this article as:

Arkhipova, N. A., & Smirnova, O. A. (2021). Capital Investment Accounting Is The Basis Of Financial. In S. I. Ashmarina, V. V. Mantulenko, M. I. Inozemtsev, & E. L. Sidorenko (Eds.), Global Challenges and Prospects of The Modern Economic Development, vol 106. European Proceedings of Social and Behavioural Sciences (pp. 732-740). European Publisher. https://doi.org/10.15405/epsbs.2021.04.02.88