Abstract

The article focuses on the issues of grouping and presentation of extraordinary income and expenses in accounting and management statements. The modern approach providing for recording of these account items solely as part of miscellaneous expenses results in blurring of the boundaries between different categories of income and expenses and fails to take into account the differentiation of causes of their occurence. The article elaborates the necessity of improving the category of extraordinary income and expenses, further development of methods of their identification, measurement and presentation in statements of companies. The article aims to present theoretical basis and guidance to providing users of financial statements with information about extraordinary income and expenses, reflecting the response of a business entity to the impact of global social and economic factors. The author justifies the feasibility of establishing a separate category for extraordinary income and expenses, suggests criteria and conditions making it possible to put them into separate elements in accounting financial or/and internal management statements. The article identifies what information-related advantages for users of accounting information may be obtained if the accounting of extraordinary income and expenses is maintained as a separate category. It is shown that generating information about extraordinary income and expenses broadens the range of factors having an impact on the company’s performance, which, in turn, provides for improved soundness of managerial decisions in the presence of a contingency.

Keywords: Extraordinary expensesextraordinary income

Introduction

Goal-based business activities of companies are exposed to a multitude of unexpected (uncommon) factors. This exposure leads to the generation of income and expenses different from those that are typically generated in the regular course of the company’s business. The existing practice of international accounting identifies the mentioned category of income and expenses as "extraordinary income and expenses", hereinafter referred to as Ieor and Eeor. During the times of centralized, state-controlled economy, the category of extraordinary income and expenses had a very limited use in the official Russian accounting system. It was believed that its content is inconsistent with the very essence of planned economy. The central focus of Soviet planned economy suggested the minimal influence of unplanned, unpredictable factors. The formation of market relations in Russia has changed this point of view. Rapid growth of entrepreneurship and the emergence of a large number of previously unknown risks and factors resulted in the accounting practices unusual for a centralized economy.

Reforms of accounting in Russia and its harmonization with international accounting practices led to the extension of the scope of application of account items such as extraordinary income and expenses. Ieor and Eeor are considered to be a result of a contingency. The later are characterised by the rarity of their occurence and impossibility to predict them; they are not connected with decision of the company’s management in any way. Business events characteristic of the scope of the company’s business are not considered to be contingencies. In the environment of developing Russian market economy, Ieor and Eeor categories are considered to be an integral component of highly risk activity of a business enterprise. Accounting regulations of early 2000s provided for presentation of this group of income and expenses as a separate element of accounting financial statements. However soon thereafter, the presentation of Ieor and Eeor as a separate element in official Russian accounting financial statements was discontinued. This decision of Russian policymakers in the field of accounting was due to the following to the provisions of international accounting standards establishing that a business enterprise should not to submit any revenue and expense items as extraordinary items in its accounting financial statements (International Financial Reporting Standard (IAS) 1, 2019). Corresponding changes regulating the recognition of income and expenditure were made in Russian standards. Hereafter Ieor and Eeor became to be considered as miscellaneous income and expenses. Their presentation as separated items in accounting financial statements was discontinued. As justification for it, specialists state that it is impossible to unambiguously separate Ieor and Eeor from income and expenses resulting from the regular course of business as well as from other expenses.

Obviously, Ieor and Eeor themselves have not disappear from the actual operations of Russian companies. They are still characteristic of areas with high risks of unexpected events (for example, agricultural and extractive industries). In other cases, presence of this category of income and expenses in the company could be considered as a sign of poor internal corporate governance. To minimize Ieor and Eeor, business entities should actively apply insurance instruments (external instruments) and reservation methods (internal instruments). In our opinion, the current approach providing reflecting of Ieor and Eext solely as part of miscellaneous expenses results in diminishing the importance of this group of accounting items, blurring the boundaries between them and other groups of income and expenses. This approach fails to take in account the differentiation of causes of Ieor and Eeor generation, connected to some extent with the company’s business activity or absolutely indifferent to it. We believe it is appropriate to bring up the issue of reintroducing the category of extraordinary income and expenses, improvement of methods of their identification, measurement and presentation in companies’ statements. This concern is brought to life by new conditions of business entities management when normal activity of the companies came to the threat of global scale caused by the global pandemic of the novel coronavirus disease (Vakhrushina, 2020).

A review of scientific literature of recent years on the subject matter of this research shows lack of researches dedicated solely to this topic. This situation can be explained by two causes: firstly, it is obligatory for an accountant to adhere to regulations explicitly instructing to recognize Ieor and Eeor as part of miscellaneous income and expenses; it has been again confirmed by official regulatory information during the spread of the novel coronavirus disease (Information No. PZ-14/2020, 2020); not yet significant time period for the response of business entities to the effects of the pandemic to manifest itself in the economy. This being said, high sensitivity and scales of these reactions, high probabilistic nature of income and expenses generating in conditions significantly deviating from the norm, having no equivalent in the past and characterized by global nature, should be taken into consideration.

Problem Statement

Dramatic complication of conditions for the companies’ activities, negative results of their economic activities caused by spread of the novel coronavirus disease, make the problem of improving Ieor and Eeor accounting increasingly relevant. The mentioned income and expenses category starts to play an important role in the assessment of the pandemic effects on the economy of an individual business entity. Therewith, the high extent of mutual interference of negative results of activities of business entities should be taken into account. Specialists rightly note that the contemporary accounting practice underestimates the importance of provision of information about external factors influencing the company’s operations (Unerman et al., 2018). Moreover, according to these specialists, the main challenge for reflection of such information in statements is the complexity of its quantitative assessment, as well as conceptual restrictions imposed by national accounting standards for the purpose of compliance with the principle of comparability. In our case, even with the existing possibility of valuation of Ieor and Eeor arising in the context of the novel coronavirus disease, there are some regulatory restrictions on the disclosure of this income and expenses category as a separate item. On the one hand, this approach is consistent with accounting conservatism in response to difficultly predictable events: companies facing more uncertainty and report with more conservatism

The aspects described above make it possible for us to speak about a problem of formation and reporting of Ieor and Eeor incurred due to the pandemic. Importance of this category of income and expenses for the formation of high-quality accounting and information recourses comes into contradiction with the existing regulatory frameworks. Further development of Ieor and Eeor accounting with further disclosure of information about them in the company’s statements becomes particularly relevant for the purpose of high-quality accounting and information support of managerial activity of the company in difficult economic environment.

Research Questions

The problems reviewed above suggest the necessity of solution of a number of methodological questions. At the same time, we consider the possibility of separating Ieor and Eeor from other categories of income and expenses as basic, elaborating them as atypical, dramatically influencing the company’s activities. This assumes the presence of existing system of criteria and features. The solution to the presented problem should take into account the extraordinary business environment, but at the same time it should be based on the general methodological approaches of accounting science and not contradict with the generally accepted accounting principles.

The main issues in the context of the identified problems are the following:

- is it feasible to separate Ieor and Eeor emerging under the influence of global negative factors from other groups of income and expenses?

- according to what features and criteria Reor and Eeor incurred due to the novel coronavirus disease can be separated in individual elements of accounting, financial and/or internal management statements?

- will external and internal users of accounting information benefit from any increased utility of accounting information in case of accounting and presentation of Ieor and Eeor as a separate group?

We are aware that the above list of issues does not cover all problems of extraordinary income and expenses caused by the spread of the novel coronavirus disease. At the same time, their statement and solution will provide for supplementing the existing methodological basis for the improvement of income and expenses accounting.

Purpose of the Study

The aim of this article is the development of theoretical and methodological provisions for providing users of financial statements with accounting information about extraordinary income and expenses, reflecting the degree of response of the business entity on the influence of global social and economic factors. In order achieve this objective and according to issues raised above in the study, the following aspects of research work were provided:

- to justify the feasibility to separate Ieor and Eeor emerging under influence of global negative factors from other groups of income and expenses;

- to propose principal criteria, features and conditions that enable the company to separate Ieor and Eeor into individual elements of accounting, financial and/or internal managerial statements;

- to determine information and analytical preferential advantages which will be provided to both external and internal users of the accounting information upon separated accounting of Ieor and Eeor.

Implementation of the specified aspects provide for the growth of utility of accounting statements for interested users. Generating information about extraordinary income and expenses broadens the range of factors having an impact on the company’s performance, which, in turn, provides for improved soundness of managerial decisions in the presence of a contingency.

Research Methods

The theoretical basis of the article comprises studies of scientists in the field of accounting and financial statements, as well as the current legal and regulatory framework in the field accounting and reporting in Russia, as well as international financial reporting standards. The article was prepared using general scientific methods of research, such as scientific abstraction, generalization of data, systematization, grouping, comparison methods. The research tools used include tabular and graphical techniques for visualizing information. Suggestions for the grouping of Ieor and Eeor are based on use of comparison and rejection methods, principles of materiality and relevance of accounting information, as well as the method of differential expenses and income. The criteria for Ieor and Eeor grouping were developed using classification and structuring. Justification of extension of grouping signs is based on the admission of the multi-focal nature of item’s reflection. Application of the listed methods and tools is aimed at achieving reasonableness of the article’s conclusions.

Findings

Feasibility of separating Ieor and Eeor emerging due to the global pandemic, is explained by a critical change in the characteristics of activity of the overwhelming majority of participants of the business environment. A catastrophic violation of economic interests of business entities is observed with the disruption of the established proportion of income and expenses. In such conditions, the official regulations stipulating the reflection of Ieor and Eeor as merely "miscellaneous" does not meet the information interests of companies in the process of maintaining continuous operation. The same statement is also true for the information needs of public authorities that implement state support measures in relation to the most affected sectors of the national economy. Ieor and Eeor should not only accounted by "commingling" method as part of miscellaneous income and expenses. They should be identified, evaluated and set out into a separate element of the accounting financial statements.

An accounting event should be reflected in the accounting based on compliance with the principle of the prevalence of the economic content of this transaction over the legal form. Let us suppose that this principle is observed in relation to each accounting event. But in this case, adhering to the content of economic processes and logic of their interpretation, a similar approach should be followed with respect to collection of events forming the reporting elements. It is necessary to adhere to the principle of hierarchical order: the content of a reporting element should comply with its structural position in accounting and financial statements. An aggregate of accounting events characterizing the company’s activity in conditions of a high probability of disruption of activity continuity should not be reflected in the same way as under normal operating conditions. The requirements of current regulations prescribing to reflect Eeor as part of miscellaneous expenses and expenses for usual activities emerging under the influence of the novel coronavirus disease (Table

We think that the causes for expenses incurred, presented in Table

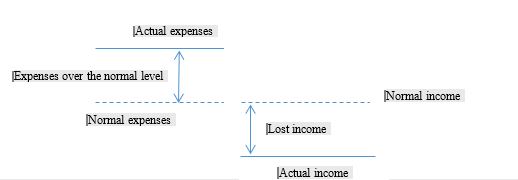

Separation of Ieor and Eeor requires a number of grouping features that could be applied by a business entity for solution of this problem. These features should be used in the context of certain conditions of company functioning. Operation against the backdrop of the novel coronavirus disease have led to various impacts on corporate economy, which may demonstrate not only a deep crisis state but also a highly dynamic development. The later, as a rule, is typical of companies engaged in industries products and services that turned out to be highly demanded by public during the pandemic. Accordingly, approaches for separation of Ieor and Eeor and their evaluation for the companies will vary. For companies whose activity continuity is at risk, it becomes informationally important to divide expendses into ones incurred within normal activities and ones caused by the contingency associated with the pandemic (Figure

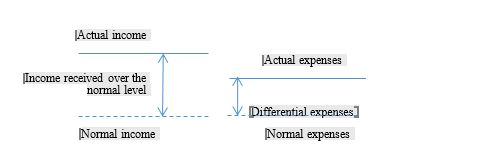

If the pandemic situation turns out to be a factor of active development for the company, the following can be distinguished when analyzing Ieor and Eeor: the actual income and income calculated for the regular course of business; expenses calculated at the normal level and differential expenses called into being by the expansion of the company’s activities (Figure

Managerial grouping of income and expenses can provide for as many criteria as necessary for a multifocal research of Ieor and Eeor as a result of impact of stress factors. Generation of Ieor and Eeor can be due to a number of causes, and it is possible to apply managerial grouping of these items ranked both by the source of their occurrence and by their amount. One of the criteria of Eeor grouping can be their grading based on the causes of occurrence: under the influence of direct state prohibitive measures (primary factor); under the influence of indirect incidental causes (secondary factor). This grouping is valuable for estimation of level of compensation potential of state support measures for the real economy sector. Systematization of expenses and income aimed at separation of Reor and Eeor should be based on compliance of principles of relevance and importance of accounting information.

Multi-focal information about Ieor and Eeor provides informational advantages to both external and internal users of the accounting information and makes it possible to reduce uncertainty in the assessment of the situation. For the companies with a declining economy, the information about Ieor and Eeor would help to resolve compensation issues. For companies that find themselves in a situation of growth of income and operations in the presence of a contingency, the most important managerial task is to map out a smooth retreat to the previous performance indicators after the end of the contingency period. Improving the accounting of Ieor and Eeor involves solution of the issue of the period during which income and expenses can be qualified as extraordinary. If the spread of the the novel coronavirus disease continues for a long time, we should talk about the transformation of extraordinary items of accounting supervision into traditional ones. This process is connected with adaptive properties of business entities as flexible social and economic systems.

Conclusion

The provisions of this study are aimed at improving accounting and presentation of extraordinary income and expenses in the reporting, reflecting the response of a business entity to the global social and economic factors. The necessity of reintroducing a category for Ieor and Eeor, as well as improving the methods of their identification, measurement and presentation in company statements, are due to the role of these items for assessing the consequences of the pandemic for economies of business entities. With that information capacity of the extraordinary income and expenses category is limited by effective statutory regulations (Keune et al., 2017).

The article justifies the feasibility of separating Ieor and Eeor from the broad category of miscellaneous income and expenses, suggests the criteria and conditions providing for putting them into separate group of items in accounting, financial or/and internal management statements. The author identifies data advantages which the users of accounting information will receive upon separate accounting of extraordinary income and expenses. The article shows that generation of information about extraordinary income and expenses broadens the range of factors that may influence the company’s performance, as they should be accounted for by the company’s managers. Multi-focal information about Ieor and Eeor provides informational advantages to both external and internal users of the accounting information and makes it possible to reduce uncertainty in the assessment of the situation. Correspondently, the suggested measures for reintroducing Ieor and Eeor category for the purpose of management will provide for increasing the soundness of managerial decisions made in the presence of a contingency.

References

- Bay, C. (2018). Makeover accounting: Investigating the meaning-making practices of financial accounts. Accounting, Organizations and Society, 64(1), 44-54. DOI:

- Hsieh, C.-C., Ma, Z., & Novoselov, K. E. (2019). Accounting conservatism, business strategy, and ambiguity. Accounting, Organizations and Society, 74(4), 41-55.

- Information No. PZ-14/2020 Ministry of Finance of the Russian Federation «On the practice of generating information in accounting in the context of the spread of a new coronavirus infection». http://minfin.gov.ru/ru/document/?id_4=130806-pz_-_142020_o_praktike_formirovaniya_ v_bukhgalterskom_uchete_informatsii_v_usloviyakh_rasprostraneniya_novoi_koronavirusnoi_infektsii

- International Financial Reporting Standard (IAS) 1 «Presentation of Financial Statements» (put into effect on the territory of the Russian Federation by Order of the Ministry of Finance of Russia dated December 28, 2015 № 217n) (as revised on 05.08.2019). http://minfin.gov.ru/ru/document/?id_4=117373-mezhdunarodnyi_standart_finansovoi_otchetnosti_ias_1_predstavlenie_finansovoi_otchetnosti

- Keune, M. B., Keune, T. M., & Quick, L. A. (2017). Voluntary changes in accounting principle: Literature review, descriptive data, and opportunities for future research. Journal of Accounting Literature, 39(12), 52-81.

- Unerman, J., Bebbington, J., & O’dwyer, B. (2018). Corporate reporting and accounting for externalities. Accounting and Business Research, 48(5), 497-522.

- Vakhrushina, M. A. (2020). IFRS 16 leases: Standard's novation and the impact of the COVID-19 pandemic on the accounting and reporting information disclosure. International Accounting, 23(9), 962-980.

Copyright information

This work is licensed under a Creative Commons Attribution-NonCommercial-NoDerivatives 4.0 International License.

About this article

Publication Date

30 April 2021

Article Doi

eBook ISBN

978-1-80296-105-8

Publisher

European Publisher

Volume

106

Print ISBN (optional)

-

Edition Number

1st Edition

Pages

1-1875

Subjects

Socio-economic development, digital economy, management, public administration

Cite this article as:

Andreeva, S. V. (2021). Reintroducing The Category Of Extraordinary Income And Expenses In The Accounting Practice. In S. I. Ashmarina, V. V. Mantulenko, M. I. Inozemtsev, & E. L. Sidorenko (Eds.), Global Challenges and Prospects of The Modern Economic Development, vol 106. European Proceedings of Social and Behavioural Sciences (pp. 723-731). European Publisher. https://doi.org/10.15405/epsbs.2021.04.02.87