Abstract

This article examines the importance of innovation as a basis for the effective functioning of an enterprise. For this, the indicators were analyzed, which characterize the external economic and macroeconomic environment by assessing the economic state of Russia for the period 1990 - 2019. The oil sector is considered from the point of view of the analysis of the share of the extractive and manufacturing industries in the gross domestic product and the budget structure. The importance of the oil and gas complex has been proved through the analysis of elements and types of economic activity. The variation of indicators of innovation activity is shown depending on the dominant regions. The structure of industrial goods (works, services) in terms of federal districts for 2020 is given. The key factors that determine the process of forming innovations are highlighted. There has been a proven track record of significant growth in marketing and manufacturing innovation in the oil and gas industry. An assessment of the influence of the selected factors on the level of innovation in industrial enterprises was carried out, as a result of which a linear regression was derived, which became the basis for drawing up an econometric model. It was proved that despite a slight increase in the share of enterprises engaged in innovation, in value terms there is a more significant growth, which leads to an increase in the cost of manufactured technological products.

Keywords: Digital technologiesindustrial enterpriseinnovationinvestmentsmacroeconomic environment

Introduction

Russia is at the stage of active transition to an innovative economic model. The basis for achieving this goal is the functioning of the national innovation system. New macroeconomic problems are emerging, primarily in the area of investment policy implementation for the formation of an innovative economy. The main condition is to intensify investment activities to improve economic security, innovation potential and technical equipment of Russian enterprises in the industrial sector. A decisive contribution to the pace of innovation development is made by the external conditions for production activities created in the regions. The conditions for the innovative development of the region are formed under the influence of various factors of the macroenvironment, which can be grouped and classified. Macro-environment factors are parameters that reflect the intensity and nature of innovation processes in the region. The innovative development of the territory is determined by the result of the systemic interaction of macroenvironmental factors (Akberdina & Volodin, 2020)

The strategy for the development of the Russian economy until 2022 is still focused on innovative factors of development, i.e., the formation of the knowledge economy remains a priority. This is fundamentally important for our country, since the competitiveness of the Russian economy is still low. Therefore, it is especially important to assess the level of organizations that carry out technological innovations, to understand how research in the field of STI (scientific and technological progress) is funded, and to assess the importance of the oil and gas sector in the structure of the Russian economy.

Problem Statement

Innovations introduced into production are one of the competitive advantages that allow increasing the efficiency of the enterprise and gaining additional profits, but to obtain this advantage, a set of conditions is needed to facilitate the emergence of innovations and their diffusion (Antipina, 2019). In this regard, let us consider the main indicators characterizing the foreign economic and macroeconomic environment that has developed in the world and in Russia over the period 1990-2019. At the first stage, we will assess the place of the Russian Federation in the world oil and gas market (Table

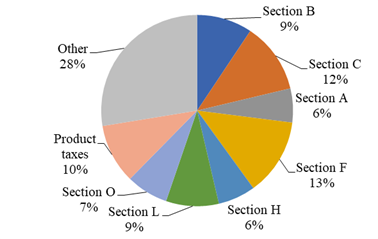

To prove the importance of oil in Russia, it is necessary to consider the shares of the extractive and manufacturing industries in the gross domestic product and the budget structure (Figure

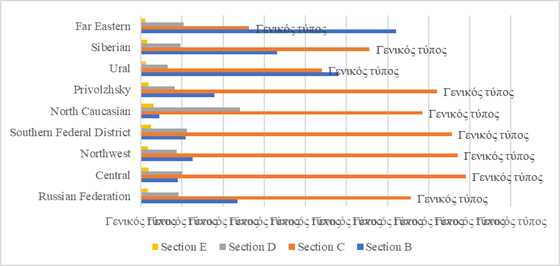

The above structure clearly shows that the largest contribution to Russia's GDP is made by trade (section F), this industry accounts for 13.2%, followed by manufacturing (section C - 11.9%) and mining (section B – 9.4%). Since the elements of the oil and gas complex are scattered across all the selected types of economic activity and occupy key positions in them, it can be argued about the importance of the complex for the country's economy. Many economists agree with this, noting that in the 2000s the driver of the economy was the extraction and processing of hydrocarbons, but in connection with the change in the external economic situation, this direction has been lost and new points of economic growth are needed. The availability of resources in each individual region of Russia determines the structure of its economy; to identify the dominant components of a particular type of economic activity in a regional context, let us refer to Table

The data presented in Table

As expected, the availability of a resource base has a significant impact on the type of industry. So, in the regions in which there are no minerals (or represented in small quantities), the manufacturing industry dominates, while in the federal districts with huge reserves of oil and gas, section B prevails (these are the UFO and the Far Eastern Federal District). Sections D and E have practically no effect on the volume of industrial output in any region of Russia. If we turn to the revenue side of the consolidated budget of the Russian Federation, we will notice the importance of the extractive and processing industries. Together, the two categories "taxes, fees and regular payments for the use of natural resources" and "payments for the use of natural resources" brought 14.6% of all revenues to the treasury in 2019, if we separate the share of oil and gas enterprises from tax revenues, then this figure will rise to 45%. Thus, despite the prevailing negative external economic conditions, the role of the sector in question in the country's economy is enormous, and accordingly, it requires close attention from economic science, namely, consideration from the perspective of the introduction of new technologies and innovations (Gorodnikova & Gokhberg, 2019). For the formation of innovations, a combination of several key factors is required: investments, scientific personnel and information technology (Figure

It is innovations that become the basis for the successful functioning of the enterprise and, as a result, allow the company to successfully operate in the market (Smagina, 2018).

Research Questions

During the study, questions were raised about the importance of industrial production in the structure of the country's economy. The question of what is the share of the extractive and manufacturing industries in the gross domestic product and the budget structure has been resolved. The question was raised about the importance of the structure of industrial production depending on the dominant industries. The question of comparing the costs of the consolidated budget for science and the costs of technological innovations of industrial enterprises was investigated. The issue of the use of digital technologies by industrial enterprises, the scale of implementation and the potential of their technical equipment was resolved. The question of the influence of factors on the process of forming innovations was clarified. The question of the variation of indicators of innovation activity, depending on the dominance of the region, was resolved.

Purpose of the Study

The aim of the study is to analyze the innovative potential of the oil and gas sector through the assessment of indicators characterizing the external economic and macroeconomic environment. The goal was also to study the structure of the GDP of Russian regions to determine the dominant industries and regions. The study of the structure of industrial production was carried out in order to prove that it has a significant impact on the type of industry. The aim was also to compare the dynamics of expenditures of the consolidated budget for science and the costs of technological innovations of industrial enterprises to identify the reasons for low investment in the development of new technologies. The goal bordered on indicators characterizing the use of information technology in business in order to understand the level of equipment of enterprises with technological means. The aim was to identify variations in the use of digital technologies by industrial enterprises. The goal was also to assess the impact of the identified factors on the level of innovation in industrial enterprises for the period 2005-2019. through the system of selected indicators through checking the econometric model for its significance.

Research Methods

During the research, the methods of theoretical, empirical and mathematical research were used. An analysis of the innovative potential of the oil and gas sector was carried out, as well as a synthesis of the information obtained from an analytical summary of data on the use of information technologies in the industrial sector. A comparison is made between the costs of the consolidated budget for science and the costs of technological innovations of industrial enterprises. The assessment through an econometric model of the influence of the selected factors on the level of innovation at industrial enterprises. The basis of the study was based on the share of the volume of shipped innovative industrial goods (works, services) in Russia, the cost of technological innovations in industry, the number of scientific personnel (per 10,000 employed population), the share of industrial enterprises using personal computers. An analysis of the estimation of the parameters of the econometric model was carried out, as a result of which a linear regression was obtained. By analyzing the data obtained, a check was made for the relevance and reliability of the study.

Findings

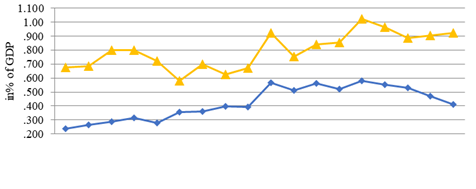

The development of innovations is completely associated with significant financial injections, while the risk of non-return on investments is high, as a result of which investors are reluctant to invest in the development of new technologies. Let us refer to Figure

The main source of financing of costs is the own funds of enterprises; this category for various types of industrial production accounts for 45% to 79% of all costs. Although the share of federal budget funds under section E is also significant and amounts to 40%, this is explained by the relative “youth” of this industry and significant depreciation of fixed assets. It is also worth noting that in all types of industry the highest costs are spent on the purchase of machinery and equipment (from 42% to 68%). That is, research and development is not funded sufficiently. So, in section E, they account for only 2.2%, and only in manufacturing (section C) the share reaches 24%. Thus, industrial enterprises are reluctant to invest in development, but at the same time willingly buy finished high-tech products. If we turn to the indicators characterizing the use of information technologies in business, then we can say about the high level at which Russian enterprises are located, since more than 80% of enterprises in the country use broadband access to the Internet, this value is comparable to countries such as Bulgaria, Romania and Croatia.

The information given in Table

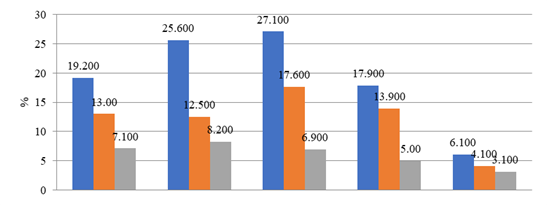

So, ERP-systems (Enterprise Resource Planning, enterprise resource planning, were blue) are largely implemented at enterprises of the processing industry (27.1%) and in the smaller extractive industry (25.6%), in other types of industrial enterprises this type of system is implemented in a smaller number cases (less than the average for the economy) (Salem et al., 2020). CRM-systems (Customer Relationship Management - customer relationship management, were yellow) are introduced into the practice of industrial enterprises even less (no more than 20%), which limits marketing. Finally, SCM (Supply Chain Management, were grey) systems are practically not used in industrial enterprises. Thus, we can conclude that there is a significant margin for the growth of innovations in the field of marketing and production organization in the oil and gas industry (Poteralska & Walasik, 2020). According to the information presented in the statistical collection “Science. Technology. Innovations: 2019 in Russia, the share of organizations implementing technological innovations is still low and in 2019 is only 7.5%, while in the USA - 12.8%, in China - 26.9%, in Japan - 28.3 %, in Germany - 52.6% (Gorodnikova & Gokhberg, 2019). As for the species variation in the Russian Federation, the data given in Table

The influence of the selected factors on the level of innovation in industrial enterprises for the period 2005-2019 will be assessed, while the following system of indicators will be used:

Y is the specific weight of the volume of shipped innovative industrial goods (works, services) in Russia, %;

X1 is the cost of technological innovation in industry, in% of GDP;

X2 is the number of scientific personnel (per 10,000 employed population);

X3 is the share of industrial enterprises using personal computers, %.

To assess the strength and direction of the connection, we use the paired linear Pearson correlation coefficient, the calculation results of which are presented in Table

5 .

According to the data presented in the Table

Y’= – 1,405 + 9,665X1

The resulting model is characterized by a high value of the multiple coefficients of determination (0.740), which indicates a high quality of the constructed regression. The actual value of Fisher's F-test is 31.350 higher than the tabular 4.844 (a= 0.05; df1 = 1; df2 = 11), this indicates the statistical significance of the entire model. Also, the significance of the estimated parameters is indicated by the high actual values of the Student's t-statistics (t (b0) = 2.82 and t (b1) = - 2.24). The graphical test given in Appendix 3.3 indicates the absence of heteroskedness. The interpretation of the model's coefficients is as follows: an increase in the costs of technological innovation in industry by 1% to GDP will lead to an increase in the share of shipped innovative goods by an average of 9.67%, with the remaining factors unchanged. Thus, we can conclude that the receipt of innovative goods (works, services) in industry largely depends on the availability of research funding. The data given in Table

According to the information given in Table

Conclusion

Thus, in Russia there is a significant variation in the indicators of innovation activity, while large regions (internally not homogeneous) are distinguished in which the indicators are very high, these are the Central Federal District, the Volga Federal District, the Ural Federal District and the Siberian Federal District, for the rest there is a deteriorated situation, the minimum values of investment in innovation and how as a consequence, the volume of innovative goods (works, services) is of low value. Extraction and processing of minerals in general, and oil in particular, plays a significant role in the Russian economy, these are jobs, enterprises and organizations, investments, which means decent wages, taxes to the budget and further progressive development. In support of this assumption, one can point to the structure of exports, so throughout the period 1990-2019. mineral products occupied the largest share (in different years from 45% to 70%), while oil accounts for 43% or 26% of all exports. Industry accounts for about 25% in the GDP structure of the reporting period, the consolidated budget revenues of the Russian Federation from the extraction, production and sale of hydrocarbons (including oil), according to experts, are about 45%, all this indicates the significant role of the industry in the national economy of the country. The importance of industry poses for economic science the task of analyzing the existing external and internal threats, as well as finding ways (reserves) for the growth of the sector in question.

The number of innovations and their quality content depend on a number of factors, the most important of which are investments, scientific personnel and information technology. Unfortunately, for the period 1990-2019. in Russia, the number of organizations engaged in scientific research has significantly decreased (by 13.6% over the period), and, accordingly, the number of scientists (by 63.6%), but despite this, the number of issued patents for inventions has been increasing since the mid-2000s and in the current time exceeds the level of the Soviet period. Scientific activities in the country are financed from the budget (this expenditure item is insignificant in relation to the developed countries of the world) and from the own funds of enterprises, so the costs of technological innovations of industry (in% of GDP) have a growth trajectory. If we turn to the structure of costs, then in the first place is the purchase of machinery and equipment (in 2017, from 42% to 68% for various types of industry), but research costs are insignificant (from 2.2% to 24%), which indicates on the unwillingness of owners to spend money on fundamental developments with the existing alternative to buying a finished product. The penetration of IT technologies in industrial enterprises follows a general trend, as more than 90% of enterprises use personal computers in their activities that have access to the Internet, but more specific forms are manifested to a lesser extent (Sokolov, 2020). So, servers and local area networks have about 70% of enterprises, and their website about 60%. Special systems of management and control of production and the entire enterprise (ERP systems, CRM systems, SCM systems) are used by less than 30% of enterprises. Thus, we can conclude that there is a significant margin for the growth of innovations in the field of marketing and production organization in the oil and gas industry.

References

- Akberdina, V. V., & Volodin, A. I. (2020). Models of public investment management at the regional level. Economy and Business, 1(11), 45-57.

- Antipina, N. V. (2019). Optimization of investments in fixed assets of an oil company. Bulletin of the Baikal State University: Economics and Business, 2(29), 262-272.

- Gorodnikova, N. V., & Gokhberg, L. M. (2019). Science. Technology. Innovation: 2019: A brief statistical compendium. NRU HSE.

- Kleiner, G. B. (2016). Production functions: Theory, methods, application. Finance and Statistics.

- Poteralska, B., & Walasik, M. (2020) Models of implementing innovative technologies into industry. In T. Lankauskienė (Ed.), Proceedings of the 11th International Scientific Conference: Business and Management 2020 (pp. 131-138). Vilnius Gediminas Technical University.

- Salem, H. S., Marchand, K. B., Mathew, K. K., Tarazi, J. M., Ehiorobo, J. O., & Mont, M. A. (2020). The place for innovative technology. In G. R. Scuderi, A. J. Tria, & F. D. Cushner (Eds.), Rapid Recovery in Total Joint Arthroplasty (pp. 229-238). Springer.

- Smagina, M. N. (2018). Theory and methodology of studying the patterns of regional development. Monograph. TSTU.

- Sokolov, A. P. (2020). Interaction of macro and micro levels in the formation of the country's economic security. Industrial Economics: Economics and Business, 1, 6-10.

Copyright information

This work is licensed under a Creative Commons Attribution-NonCommercial-NoDerivatives 4.0 International License.

About this article

Publication Date

30 April 2021

Article Doi

eBook ISBN

978-1-80296-105-8

Publisher

European Publisher

Volume

106

Print ISBN (optional)

-

Edition Number

1st Edition

Pages

1-1875

Subjects

Socio-economic development, digital economy, management, public administration

Cite this article as:

Titov, A. K., Korkin, M. A., & Ivanchenkov, A. V. (2021). Macroeconomic Environment As A Factor In The Development Of Innovations In Industry. In S. I. Ashmarina, V. V. Mantulenko, M. I. Inozemtsev, & E. L. Sidorenko (Eds.), Global Challenges and Prospects of The Modern Economic Development, vol 106. European Proceedings of Social and Behavioural Sciences (pp. 662-673). European Publisher. https://doi.org/10.15405/epsbs.2021.04.02.80