Abstract

Mergers and acquisitions (M&A) are becoming a significant part of the global flow of foreign direct investment. Corporations around the world often use M&A transactions as a strategic tool to improve their competitiveness and efficiency. In Russia, corporations are also actively using M&A to increase their strategic performance. The purpose of this study is to conduct a comparative analysis of the global and Russian M&A trends. In this paper, we focused on the comparative dynamics of the global and Russian M&A markets for 1993-2019, highlighting the main reasons for M&A activity. In our work, we also analyzed the Russian M&A market in 2019, identified the prospects and features of its development, taking into account the current situation. The trends of the M&A market in different sectors of the Russian economy were determined, and the industry leaders in terms of the number of M&A were named. Attention was paid to cross-border mergers and acquisitions, in transactions which involve companies representing two or more countries. The paper analyzes the impact of M&A transactions on the economic growth of Russia using correlation-regression analysis. The main focus of our work is on measuring the impact of indicators of M&A market activity (number and volume of transactions) on indicators of economic growth in Russia and in the world.

Keywords: Acquisitionscross-border mergerseconomic growthimpact of mergers and acquisitionsM&A

Introduction

In the modern world, corporations are increasingly using mergers and acquisitions strategies to strengthen their positions, as well as expand their influence on local and international markets. It is mergers and acquisitions that are becoming the subject of international expansion and continue to shape the global business environment (Sarala et al., 2019). Most M&A transactions were registered in developed countries (USA, European market), so most of the studies in this area was conducted in these countries (Erel et al., 2012). In Russia, as a country with a transition economy, much smaller volumes and number of M&A transactions are registered, so less scientific literature is devoted to these issues (Lukyanova et al., 2019; Vedernikov, 2017). This article provides a comparative analysis of the dynamics of the global and Russian M&A market. The article discusses the hypothesis of the existence of interrelation between activity on the M&A market and the state of the economy. As an indicator of economic growth, the authors of the article took such an indicator, calculated by the World bank, as market capitalization.

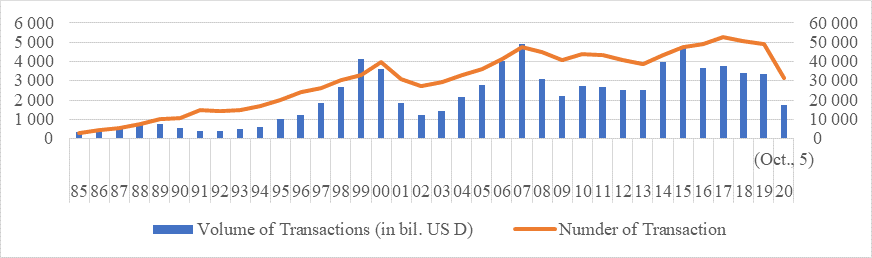

The global mergers and acquisitions (M&A) market has been actively developing for several decades, and changes in its quantitative and qualitative indicators have the same dynamics (Figure

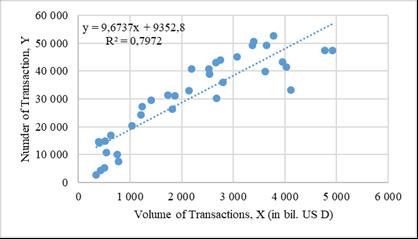

This trend is confirmed by the correlation coefficient, whose value is 0.8, indicating a strong direct dependence between the number and volume of transactions on the global M&A market in 1995-2020 (Figure

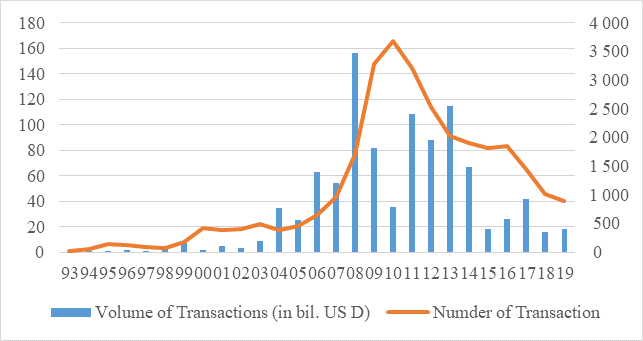

Let's consider whether the trends in the development of the global and Russian M&A markets are similar. In this regard, we will consider the dynamics of the Russian M&A market (in terms of the number and volume of transactions). The research period begins from 1993 - the year of the Russian market formation. It should be noted that the dynamics of the Russian M&A market (Figure

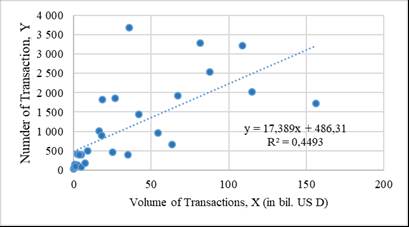

The Russian M&A market in 1993-2019 shows a positive correlation between the number of transactions and their volume. The correlation coefficient is 0.67 (Figure

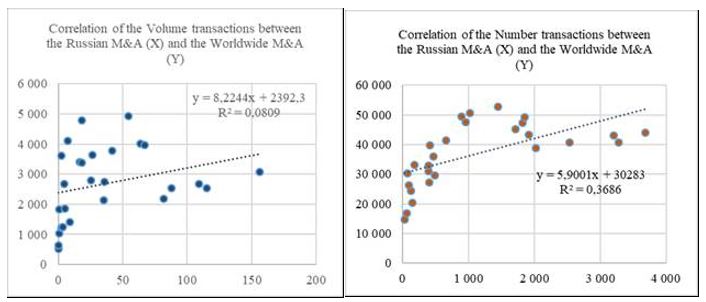

After analyzing the dynamics of the development of the global and Russian M&A markets, it can be stated that the corresponding trends do not always coincide (Figure

The range of fluctuations in the volume share of the Russian M&A market on the world market is from 0.005% (1993) to 5.1% (2008). In 2019, the share of the Russian market was only 0.5% of the world market, and the average share for the period 1993-2019 was 1.4% of the world market. The range of fluctuations in the quantitative share of the Russian M&A market on the world market is from 0.2% (1993) to 8.2% (2010). In 2019, the number of M&A transactions on the Russian market in relation to the world market was only 2%, and the average share of the Russian market for the period 1993-2019 was 3% of the world market.

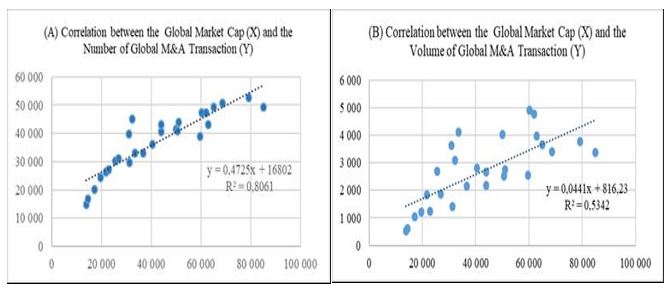

Our correlation analysis shows that there is interrelation between activity on the M&A market and the state of the economy (Table

The results of this study suggest that there is a fairly strong direct interrelation between such an indicator of economic growth in the world as global capitalization and indicators of activity on the global M&A market. The correlation coefficient between global capitalization and the number of transactions on the M&A market was 0.898, and the volume of transactions was 0.731 (Figure

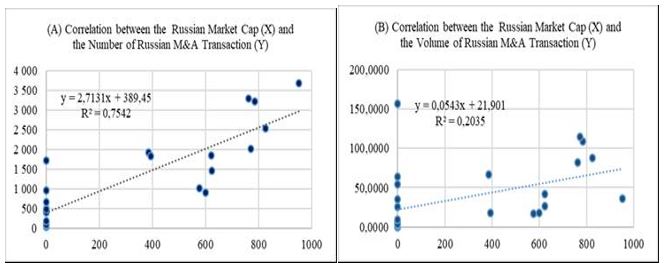

Now let's analyze the Russian M&A market in 1993-2019 (Figure

According to many studies, 61% of the total number of M&A transactions on the world market absolutely do not pay back the funds invested in them, and can bring considerable losses (KPMG, 2020; IMMA, 2020). In this regard, the study is interested in the impact on the M&A market of new economic shocks faced by the Russian economy, as part of the global economic system, in 2020.

2019 can be considered quite successful for the Russian M&A market. Compared to 2018, in 2019, the total amount of transactions increased by 21.5% and amounted to $ 62.9 billion, while the growth in the number of transactions was not so significant ($not-found(+3% compared to 2018)3% compared to 2018) (KPMG, 2020). The main factor contributing to the growth of the total value of M&A transactions was large-scale transactions in the oil and gas sector. The number of M&A transactions in this sector increased significantly in 2019 (32 transactions in 2018 and 59 transactions in 2019), which is an indicator of the successful adaptation of the economy to lower oil prices. At the same time, the total value of M&A transactions increased by 53%. In second place in terms of M&A transactions, after the oil and gas industry is followed by retail trade, followed by the telecommunications sector. In general, it can be noted that in 2019, M&A deals with the purchase of Russian assets were gaining popularity in all sectors, which proves the fact that investors are getting used to the impact of sanctions and expect returns on investments in Russian assets above the average level.

The analysis of cross-border M&A transactions in Russia reflects the following situation. The amount of M&A transactions in 2019 for the acquisition of Russian assets by European investors increased by 49% - from $ 14 billion in 2018 to $ 20.9 billion in 2019. The total number of M&A transactions involving American investors increased by 2 times, accounting for about 16% of the $ 20.9 billion invested in Russia by foreign investors. In addition, the volume of M&A transactions with Asian investors increased by 340% (from $ 2.4 billion to $ 8.2 billion), while their number fell from 18 to 10. This indicates an increase in the average cost of a single M&A transaction for Asian companies to purchase Russian assets. At the same time, the amount of M&A transactions on the purchase of Russian assets by foreign companies from a region such as Latin America has increased a lot. Russian companies have been more active in buying foreign assets in the CIS, increasing the number of transactions from 8 in 2018 to 13 in 2019. The amount of transactions involving the purchase of foreign assets by Russian companies in the Middle East and Africa increased by 3 times, while their number remained unchanged at 6 in 2018 and 2019. This indicates that the quality of M&A transactions with partners in these regions has increased significantly. We can say that there is a significant geopolitical diversification on the Russian M&A market.

In the III quarter of 2020, the total value of M&A transactions decreased by 2 times compared to the same period in 2019, amounting to $4.99 billion against $10.16 billion a year earlier. According to the AK&M Information agency, this is the worst indicator of the III quarter in the entire history of observations: even compared to the failed M&A market in 2016, the amount of transactions was lower by 19.5%. The number of transactions in the III quarter of 2020 remained virtually unchanged and amounted to 96 transactions (in the same period of 2019, there were 101. The amount of transactions in the III quarter of 2020, compared to the same period of 2019, decreased by 1.71 times (to 382.51 billion rubles from 656.72 billion rubles). The average transaction value increased by 13.5% over year, from $45.8 million to $52 million (excluding major transactions) (АК&М, 2020).

The peculiarity of the Russian M&A market is the predominance of domestic transactions - i.e. transactions concluded by domestic companies, rather than foreign ones. So, for the period 2013-2019, the share of internal M&A transactions, on average, amounted to 75% of their total number. The volume of internal M&A transactions amounted to 69% of their total volume in monetary terms (KPMG, 2020).

The following key trends in the development of the Russian M&A market can be identified: flexibility in the face of sanctions, increased geopolitical diversification, and an increase in the number of foreign direct investment in Russia. Restraining factors for further growth of the M&A market in Russia include: the implementation of new USA sanctions; lower oil prices, as a result, the Russian budget deficit; the epidemiological situation with COVID-19, which has a significant impact on the economic slowdown; the impact of global negative attitudes on the volume of foreign direct investments.

Summarizing the trends on the Russian M&A market for the period 2018-2020, we will formulate our vision of its prospects:

1. At the beginning of 2020, the Russian economy faced a drop in oil prices. This factor has a significant impact on the parameters of the Russian M&A market, as the oil and gas sector is its key element. The budget of the Russian Federation for 2020 includes an oil price of $ 42.45 per barrel. At the time of the fall in oil prices to $ 29.17 per barrel during March 2020, experts have already predicted losses in the amount of 55.8 billion rubles, as well as a possible budget deficit of the country. As of April 1, 2020, the price of oil continued to fall and reached a record low level (the historical minimum since 1999) of $ 10.54 per barrel. In November 2020, the price increased almost 4 times and amounted to $ 44 per barrel. In the context of the global crisis and the decline in investment, the continuation of negative sentiment towards Russia from the OPEC (Organization of the Petroleum Exporting Countries) and the United States of America, as well as a strong weakening of the country's main industry, the inflow of foreign direct investment into the Russian economy will fall significantly, which will affect the country's economy in general, and the M&A market in particular. Amid falling oil prices, reducing GDP (the decline in Russian GDP in 2020, according to KPMG forecasts, will amount to 5.5%) and the budget deficit, the number of M&A transactions for oil and gas fields development will reduce (KPMG, 2020). In addition, at current oil prices, even as cheap extraction may become uneconomical. This can serve as a positive catalyst for the M&A market in Russia: investments will not go beyond the country, which will create an opportunity for the implementation of new M&A, in particular, economies of scale will encourage oil companies to unify their capitals to optimize costs.

2. For several years, Russia will remain an attractive region for foreign investments in the oil and gas sector. The trend of acquiring geological exploration assets or early stage of development will continue. We agree with the opinion of KPMG that investors will show interest to the objects of the Arctic, especially to the project "Vostok oil" (KPMG, 2020). In 2019, this Rosneft project received significant tax benefits, which prompted the company's leadership to start implementing it with the help of investments from foreign partners. The interests of foreign buyers will be constrained by existing sanctions against large Russian companies and the threat of their innovations. Thus, a new version of the draft law DASKA (Defending American Security from Kremlin Aggression Act of 2019) is under development by the US Government. And, although the new sanctions will cause minimal damage to the Russian economy, this will limit the demand of American and European investors (Belyaninov, 2020).

3. In the real estate and construction sector, we can also expect an increase in investment activity. In 2019, there were significant changes in Russian legislation, which will lead to the transformation of the development market in the future. Back in 2018, the State Duma of the Russian Federation adopted amendments to the law "On shared-equity construction of housing" No. 214-FZ (Federal Law of 30.12.2004 "On participation in shared-equity construction of blocks of flats and other real estate objects and on modification of some legal acts of the Russian Federation"), in accordance with which all developers had to transfer all calculations to escrow accounts from July 1, 2019. This means that the money began to flow only to authorized banks, and the company can receive them only after the house is put into operation. Financing will be carried out at the expense of credit funds in the same bank on concessional terms. These changes did not significantly affect the M&A market in 2019, as many developers had a construction permit under the old conditions until October 2019. The market prospects will only emerge in 2020 and beyond. We believe that under these conditions, it will be natural for large, systemically important developers to take over small companies, as well as for small companies to form large alliances to co-finance large projects. As for commercial real estate, we can expect positive investment expectations in the industry.

4. After a brief recession in 2015-2016, the Russian consumer (including food) sector has been rapidly increasing not only the growth rate, but also the number and total value for three years. The presence on the M&A market of such major players as "Magnit", "Lenta", "Dixie", etc., indicates the popularity of transactions among manufacturers and suppliers of retail, as well as the extensive experience of their implementation (KPMG, 2020). We also expect positive investment expectations in the industry.

5. The decline in foreign direct investments to Russia, in particular, will undoubtedly correlate with the overall decline in foreign direct investment in the world. According to UNCTAD (2020) (United Nations Conference on Trade and Development), the overall decline in the flow of foreign direct investment will be 30-40% in 2020-2021. In addition, the decline in foreign direct investment in transition countries, which includes Russia, is expected to be 10% more than in developed countries. At the same time, the industry most affected by the decline in foreign direct investment is the oil and gas industry (since it is affected by both the pandemic and oil price shocks); the decline in foreign direct investment in this industry is projected at 208%, compared to 2019. This fact will negatively affect the business environment in Russia, including investments in M&A transactions.

6. The spread of COVID-19 continues to have a significant impact on the M&A market. According to a study (Heyden & Heyden, 2020), during the COVID-19 pandemic, large firms are less affected by COVID-19 than smaller ones. These authors also believe that the investment attractiveness of companies is influenced by fiscal and monetary policy measures. According to studies (Pulvino, 1998; Shleifer & Vishny, 1992), asset sale is an effective way for companies to raise money, especially in times of financial crisis, to avoid bankruptcy. Analysis of the Russian M&A market shows that many Russian companies have abandoned previously planned acquisitions, directing their resources to support existing assets. We believe that such situation in Russia will continue until the threat to public health is eliminated.

7. The cost of financing transactions, and, first of all, the cost of borrowed capital will have a direct impact on the volumes of M&A transactions. In May 2020, the key rate of the Central Bank of the Russian Federation (Bank of Russia, 2020) returned to the pre-crisis values of 2014, when the increase in crediting rate was associated with the introduction of international sanctions. If the Central Bank of the Russian Federation continues to support credit institutions during the pandemic, we expect a continuation of the trend (it began in mid-2015) to lower interest rates. The lower cost of financing for the buyer company will allow the successful implementation of mergers and acquisitions and have a positive impact on the amount of synergy. However, buyer companies should take a responsible approach to choosing the currency used in financing mergers and acquisitions transaction. The Russian ruble is sensitive to political changes. When borrowing in foreign currency, on the one hand, there is a risk of exchange rate changes (the amount of foreign currency liabilities of the company can grow sharply), on the other hand, favorable opportunities for making multinational M&A transactions become open up. If the financing of an M&A transaction is planned through the issuance of corporate bonds, the interest rate on them will be correlated with the G-Curve (the yield curve on federal loan bonds), which, in turn, correlates with the key rate of the Central Bank. The rate on such bonds is relatively low-it includes the risk-free rate and the issuer's credit risk. All these factors lead to a reduction in the discount rate for the company and, consequently, an increase in the synergistic effect of M&A transactions.

Problem Statement

The number and value of M&A transactions on the global market is constantly growing. M&A deals affect all sectors, some M&A deals are cross-sectoral. Most mergers and acquisitions involve one industry. These can be both strategies for acquisition of competitors and strategies of geographical diversification, depending on the strategic goals of the market participant. The implementation of all these transactions directly affects the global and Russian economy. In this regard, it is necessary to find out whether there is a interrelation between the indicators of the global and Russian market of mergers and acquisitions. If this interrelation exists, how strong or weak is it? It should also be clarified whether there is an interrelation between the indicators of the Russian M&A market and the indicators of Russia's economic growth. It is important to substantiate the main trends and prospects for the development of the M&A market in Russia in the current conditions of economic instability.

Research Questions

Since the Russian M&A market is relatively young (it has existed only since 1993), it is important to understand the main key trends in the development of the global M&A market, to compare these trends with the trends of the Russian M&A market. In this article, we wanted to identify the main areas of investors’ attention when making transactions on the Russian M&A market. We also wanted to analyze cross-border M&A transactions in Russia as part of foreign direct investment in our country's economy. We wanted to find out whether the Russian M&A market really has an impact on the Russian economy. If this influence is found in the study, the extent of this influence should be determined. We wanted to highlight the main constraints of the development of the M&A market in Russia. Summarizing the trends on the Russian M&A market for the period 2018-2020, we considered it important to predict how the current situation will affect the M&A market in Russia in the future.

Purpose of the Study

The topic of the impact of M&A transactions on the economy of different countries was considered by researchers from different countries. However, the impact of such transactions on the economic growth of developed countries and countries with transition economy was assessed as questionable. The purpose of the article is to test the hypothesis of the influence of mergers and acquisitions transactions on the economic growth of Russia. If the impact of mergers and acquisitions on Russia's economic growth is found, an assessment of this impact will be made. To do this, the main trends in the development of the global and Russian M&A market will be identified. The industry structure of M&A transactions in Russia will be shown, and the impact of negative trends in the economy in 2020 on the Russian M&A market will be reflected. We will try to determine the prospects for the development of the M&A market in the context of a pandemic and low oil prices.

Research Methods

The study is empirical. Data and facts were collected from IMMA statistics. These data were supplemented with information from Russian and international economic newspapers, magazines and websites, KPMG analytical reports, and data from Russian companies. The study period is 1985-2020. However, a comparative analysis of the global and Russian M&A market covers 1993-2019, since 1993 is the year of the formation of the Russian market. In the process of studying trends on the Russian market of mergers and acquisitions, a systematic approach was used with the use of statistical analysis methods. The study of the interrelation between factor and effective features was carried out using correlation and regression analysis.

Findings

The study showed that there is a fairly strong direct interrelation between the capitalization of the global market and the indicators of activity on the global M&A market in 1995-2020. In Russia, the connection between market capitalization and the volume of the M&A market in 1993-2019 was significantly less than the global one. The results of the study revealed the existence of an interrelation between such an indicator of economic growth as market capitalization and indicators of activity on the M&A market. The hypothesis about the interdependence of Russia's economic growth and the number of M&A transactions was confirmed. The strong direct connection between the volume of transactions on the global M&A market and capitalization can be explained by the synergy effect, the strengthening of the business during M&A, the change in the strategy of investors - from short-term to long-term. The hypothesis about the dependence of economic growth on the volume of M&A transactions was not confirmed. It is established that the dynamics of the Russian M&A market for 2017-2019 does not indicate a slowdown or contraction of this market, but rather its reorientation to small-scale transactions related, among other things, to the digitalization of all spheres of the economy and increased attention to the B2C segment. This, although it reduces the total volume of transaction costs, contributes to the development of the M&A market. There is also a trend towards localization of the market. Almost 90% of M&A transactions occur within the country. At the same time, cross-border M&A transactions account for about 40% of the value volume, but this is mostly due to several large foreign investments in the oil and gas sector. The study analyzes the impact on the M&A market of new economic shocks faced by the Russian economy, as part of the global economic system, in 2020. In particular, we considered the impact of new US sanctions, lower oil prices, and the epidemiological situation with COVID-19.

We summarized the trends on the Russian M&A market for the period 2018-2020 and formulated our vision of its prospects. It is concluded that it is necessary to take measures to increase the investment attractiveness of the Russian market in order to increase activity on the market of mergers and acquisitions. Mergers and acquisitions, as one of the forms of foreign direct investment, can have a positive impact on the economic growth of Russia.

Conclusion

Russian companies are successful participants in international M&A transactions within the framework of strategies aimed at strengthening competitiveness, corporate growth and expanding their presence on the markets of goods and services. The coronavirus pandemic, the fall in GDP, the unstable political situation and the weakening of the main (oil and gas) sector of the economy are likely to have a general negative impact on both the Russian economy in general and the M&A, market in particular. However, for some players on this market, the current situation is an opportunity to implement profitable M&A deals with the attraction of cheap financing and further quiet integration process. In the absence of support from the state, forced employee termination and curtailment of investment projects, many Russian companies will estimate the value of their assets much lower than the real value, which will make M&A transactions cheaper and more affordable. In addition, in the context of a pandemic, it is easier to implement the integration process of the absorbed company, since competing companies are engaged in survival. The reduction of geopolitical tensions, the creation of the COVID-19 vaccine in the Russian Federation and the positive results of its use can affect the inflow of foreign investment into the Russian economy and increase activity on the Russian M&A market. The leading role in this belongs to the state, which can solve such tasks as improving the mechanism for implementing M&A transactions and ensuring their transparency, promoting the inflow of foreign capital to the Russian market, and protecting the Russian market from the negative impact of foreign expansion. All these measures can ultimately have a positive impact on Russia's economic growth.

References

- AK&M (2020). AK&M summed up the results of the Russian M&A market in the III quarter of 2020. Bulletin of the AK&M Information agency "Mergers and acquisitions market". https://www.akm.ru/news/ak_m_podvelo_itogi_rossiyskikh_rynka_m_a_v_iii_kvartale_2020_goda

- Bank of Russia (2020). Key rate. https://www.cbr.ru/hd_base/KeyRate/

- Belyaninov, K. (2020). What's in store for the toughest package of anti-Russian measures? https://www.bbc.com/russian/features-50874856

- Defending American Security from Kremlin Aggression Act of 2019. https://www.congress.gov/bill/116th-congress/senate-bill/482/text

- Erel, I., Rose, C., & Michael, W. (2012) Determinants of cross-border mergers and acquisitions. The Journal of Finance, 67(3), 1045-1082.

- Federal Law of 30.12.2004 N 214-FZ "On participation in shared-equity construction of blocks of flats and other real estate objects and on modification of some legal acts of the Russian Federation". https://www.mos.ru/authority/documents/doc/8078220/

- Defending American Security from Kremlin Aggression Act of 2019. https://www.congress.gov/bill/116th-congress/senate-bill/482/text?q=%7B%22search%22%3A%5B%22Defending+American+Security+from+Kremlin+Aggression+Act+of+2019%22%5D%7D&r=1&s=2

- IMMA (2020). M&A statistics. https://imaa-institute.org/mergers-and-acquisitions-statistics/

- Heyden, K. J., & Heyden, T. (2020). Market reactions to the arrival and containment of COVID-19: An event study. Finance Research Letters, In Press.

- KPMG (2020). Russian M&A overview in 2019. https://assets.kpmg/content/dam/kpmg/ru/pdf/2020/02/ru-ru-ma-survey-2019.pdf

- Lukyanova, A., Nikulin, E., & Vedernikov, A. (2017). Valuing synergies in strategic mergers and acquisitions using the real options approach. Investment Management and Financial Innovations, 14(1), 236-247.

- Mytsenko, I., Romaniuk, L., Mytsenko, V., Reshytko, T., & Synytsia, L. (2019) Investment security models in mergers and acquisition agreements for international corporations. Journal of Security and Sustainability Issues, 9(1), 185-198.

- Pulvino, T. C. (1998). Do asset fire sales exist? An empirical investigation of commercial aircraft transactions. Finance, 53(3), 939-978.

- Sarala, R., Vaara, E., & Junni, P. (2019). Beyond merger syndrome and cultural differences: New avenues for research on the “human side” of global mergers and acquisitions (M&As). Journal of World Business, 54(4), 307-321.

- Shleifer, A., & Vishny, R.W. (1992). Liquidation values and debt capacity: a market equilibrium approach. Finance, 47(4), 1343-1366.

- UNCTAD (2020). Impact of Coronavirus outbreak on global FDI. https://unctad.org/en/PublicationsLibrary/diaeinf2020d2_en.pdf

Copyright information

This work is licensed under a Creative Commons Attribution-NonCommercial-NoDerivatives 4.0 International License.

About this article

Publication Date

30 April 2021

Article Doi

eBook ISBN

978-1-80296-105-8

Publisher

European Publisher

Volume

106

Print ISBN (optional)

-

Edition Number

1st Edition

Pages

1-1875

Subjects

Socio-economic development, digital economy, management, public administration

Cite this article as:

Likhacheva, O. N., & Setchenkova, L. A. (2021). Current Trends On The Russian Mergers And Acquisitions Market. In S. I. Ashmarina, V. V. Mantulenko, M. I. Inozemtsev, & E. L. Sidorenko (Eds.), Global Challenges and Prospects of The Modern Economic Development, vol 106. European Proceedings of Social and Behavioural Sciences (pp. 514-525). European Publisher. https://doi.org/10.15405/epsbs.2021.04.02.62