Abstract

The financial market, which is a combination of collective and individual investments, develops ways to attract the savings of the population. In the process of attracting funds from investors, financial market institutions need to ensure appropriate conditions that meet the requirements of owners of capital and personal savings, which provide guarantees for the safety of funds and ensure profitability. Today the problem of ensuring favorable conditions for investing the population's savings in national investment assets is quite urgent. An individual investor in the process of preserving and increasing his assets is faced with the choice of a specific method of investment. The choice of the most effective method is very important for the investor who wants to both secure his funds from inflation and ensure good returns. Individual investors are the main subjects of the market for investment resources in countries with developed market economies. They play the role of a special stabilizing force in times of crises, covering a certain part of the investment market. Wealth maximization is a fundamental goal of individual investors - households. The process of achieving such a goal is the management of your income, expenses and savings. The level of the household budget and savings reflects the overall socio-economic situation of the family, its level of activity in the market, as well as its investment ability.

Keywords: Financial instrumentindividual investmentstock market

Introduction

Today, the desire for passive income is gaining popularity. This kind of popularity is primarily because any information is open and accessible in the modern world, it is also explained by the development of the securities market. Today, individual investors, to generate income from their savings, can participate in purchase and sale transactions both in the securities market and in the over-the-counter sector. However, for the investor to carry out such a transaction, an intermediary is needed, in other words, a professional participant in the securities market, represented by a broker or a management company (Lee et al., 2020). It is important to note that the business of generating home equity income is challenging and risky and requires not only special preparation, but also experience and ability to react quickly in conditions of uncertainty. Also, when forming passive income, there is a need for initial capital investments and a willingness to incur losses, since the forecasts for receiving income are not guaranteed. In this regard, we need additional research of instruments and forms of placing individual capitals on the stock market.

Problem Statement

The analysis of works devoted to the issues of individual investment allows us to conclude that interest in this issue is growing. The growing processes of expanding the investment system instruments require a deep theoretical and methodological study of both the investment instrument and consequences of these processes. Today there is a list of ways of investing savings in the economy that are available to Russian households. Investment instruments are investment methods (Nedorezova et al., 2021). These instruments perform a necessary function for the investor, which is to facilitate the diversification of the investment portfolio. In other words, investment instruments represent the directions of monetary investments, which should bring the profit in the future. A comparative analysis of the existing instruments of the individual investment system allows you to get the maximum profitability for all participants in financial processes.

Research Questions

The problem outlined earlier requires a well-thought-out theoretical study with clearly defined and structured stages and objectives. First, it is necessary to identify and classify the main forms and types of instruments of the individual investment system, to show their features in the Russian economy. Income is the main source of meeting the needs of the household. These incomes, like those of other business entities, represent an active and passive part. In addition, special attention should be paid to the analysis and assessment of individual investment accounts in modern conditions, comparing them with the main financial instruments on the securities market according to the following criteria: average profitability of the instrument; average investment risks; urgency; commission charged by the broker; minimum and maximum investment amounts; the possibility of buying the instrument on the individual investment account. The practical part of the study is aimed, firstly, at the choice of key financial instruments used by individual investors. Secondly, at identifying their individual characteristics, allowing the investor to determine the benefits and possible risks.

Purpose of the Study

The purpose of this study is to provide theoretical and analytical substantiation of the peculiarities of individual investment in the Russian stock market, to consider the main financial instruments used by individual investors in the modern securities market. And to find the most profitable ways for the investor to invest his own funds. To achieve growth in the value of their investment assets, investors choose certain models of investment behavior. However, without the sphere of production of goods and services, real growth in the value of assets is impossible, since the added value is formed in this area. The continuous renewal of production and its qualitative development are necessary to achieve economic growth. It is necessary to constantly form additional resources that would ensure this kind of development. The object of the research is the system of individual investment. The subject of the research is financial, organizational and economic relations arising from individual investment in the Russian securities market in the process of using financial instruments. The information base of the work was made up of official statistical and analytical data of the Federal State Statistics Service, the Central Bank of the Russian Federation, materials of Management Company VTB Capital Asset Management, Moscow Exchange, NAUFOR, as well as materials of scientific publications, periodicals, Internet resources on the subject under study.

Research Methods

The study of the choice and application of tools for the individual investment system involves the use of various methodological approaches and local methods. The reliability of the conclusions and recommendations obtained during the study is ensured by general scientific methods and technologies of scientific knowledge, including: experimental and theoretical methods (comparison, analysis, generalization, systematization), technologies of tabular and graphic interpretation, methods of econometric analysis. The peculiarity of research using the methods of experimental Economics is that the researcher sets the initial state, rules for the generation and evolution of objects, and conducts a computer experiment. Its results allow you to get new information about the system. The resulting models not only reflect the main properties of economic systems and objects, but also serve as a tool for their knowledge. The systemic approach was used as the main methodological approach, since it allows us to analyze individual investment as a system, with the existing interactions between individual financial elements. Another methodological approach used in the study is comparative, which allows formulating criteria to classify investment instruments.

Findings

For savings to work, they need to be invested. However, in this case, the potential investor must choose a suitable financial instrument. There are several stages of choosing the individual investment instrument: first, the purpose of the investment is determined, for example, saving funds or increasing; then the instruments are compared in terms of availability, profitability and risk. Most inexperienced investors tend to choose the simplest way of investing funds, for example, a bank deposit. However, upon careful consideration, it becomes clear that if it is possible to save funds from inflation, then a good return cannot be expected. In the case when the individual investor still wants to receive income from his investments, he should choose promising assets, for example, shares. Making such a choice, the investor will undoubtedly increase his risks, but at the same time, the potential profitability increases.

First, let's turn to Table

average profitability of the instrument;

average investment risks;

urgency;

commission charged by the broker;

minimum and maximum investment amounts;

possibility of buying the instrument on the individual investment account (IIA).

To understand the question of which financial instrument to choose for investments in terms of minimizing risks and maximizing profits, it is worth conducting a comparative analysis of financial instruments and methods of investing in them. Financial instruments such as stocks, bonds, individual investment accounts and mutual funds were selected for analysis. The most reliable instruments are government securities and corporate bonds. This also includes various mutual funds, the profitability of which is relatively low, but the risk is minimal. However, there is a tool, namely IIAs, the risks of using which are completely reduced to zero. Moreover, almost all the above instruments have a common feature: they can purchase through the IIA. Let's see if investing in individual investment accounts is so profitable.

The most popular financial instruments among individual investors are stocks and bonds (Rebelsky et al., 2019). But it would be incorrect to compare the profitability of these instruments with the profitability received from investments in the individual investment account. The advantage of the IIA is the ability to effectively use the individual account to make a profit in addition to tax deduction. That is, by investing in the individual investment account, in addition to income from tax deduction, it is also possible to receive income from investments in securities in the same stocks and bonds. Investing money held on the IIA in bonds and shares increases the yield. That is, the yield received from the cash flow of coupon payments of the bond or, in the case of investments in shares, the yield received from dividends is added to the 13% received from the tax deduction.

Thus, it is more correct to compare not investment instruments, but the possible ways of investing in stocks and bonds, in other words, consider investing by opening a brokerage account and by opening the individual investment account. Before identifying exactly what the differences between accounts are, it is necessary to study the definition of each of them. A regular brokerage account is the investor account that is opened with a broker to conduct transactions in the securities market. This account reflects all cash flows, investment operations and transactions, the main purpose of which is to make a profit. At the same time, you can invest in absolutely any assets, for example, in stocks, mutual funds, bonds and others.

Since the broker is the tax agent of the investor, the income goes to the brokerage account minus the personal income tax, which is 13%. As for the individual investment account (IIA), such an account is practically the same as a brokerage account, however, there are a few certain differences, which consist, first, in tax benefits and some restrictions.

The first and most important difference is that the IIA has tax deductions for investors, which cannot be counted on with the regular brokerage account. Secondly, if we consider from the standpoint of the limits on the contribution of funds to the account, then the amount of the contribution to the regular brokerage account is not limited, which cannot be said about the IIA, the maximum contribution amount to which is one million rubles. The next difference is the fact that you can withdraw money from the regular brokerage account at any time without restrictions, which cannot be said about the IIA, funds from which cannot be withdrawn for three years. This is fraught with the fact that in case of early closure of the account, the investor will have to reimburse all the benefits received to the budget. However, in defense of the IIA, we note that it is possible to withdraw coupons on bonds or dividends on shares from it. The next thing worth mentioning is that only rubles can be traded and deposited on IIAs, while rubles and currency, as well as stocks and bonds, can be deposited into the regular brokerage account. The single brokerage account can be used to transfer assets of any kind and carry out transactions with securities, while only assets that are traded on Russian stock exchanges can be purchased on IIAs. However, in defense of IIAs, it should be said that at present this list includes many companies from the United States, China and other countries. To buy foreign shares, the owner of the IIA must first deposit money into the account in rubles, and then convert them on the exchange into dollars, which can later be used to pay for the purchase of securities. The next difference is that there is no limit on the number of brokerage accounts for one owner. In the case of the IIA, the investor can have only one such account at a given time. A new individual account can be registered only after the expiration of the old one. However, together with the IIS, it is not forbidden to own the regular brokerage account.

It is important to note that in the case when the investor owns several ordinary brokerage accounts, you can balance the financial result for all accounts to calculate personal income tax. However, if the investor owns both the brokerage account and the IIS account, then financial results on them are not balanced. The methods of making money on the IIA and on the regular brokerage account are practically the same. In both cases, the client's income consists of the difference in price between buying and selling assets, coupons of bonds, constant income in the form of dividends.

Owning any of the listed accounts, you can earn, for example, in the following ways:

invest in municipal, government or corporate bonds;

purchase of shares for the sake of dividends or for further resale and income from the price difference;

invest in foreign investment funds that are traded on Russian stock exchanges.

Thus, despite some similarities, these accounts have significant differences in a few key features. The actual and, in some cases, the key problem remains - which account to choose for a novice investor. Before deciding on the choice, it is necessary, firstly, to consider all the pros and cons, and secondly, to think over the following points:

what operations are planned to be performed on the account;

how long the investor can invest in the account;

what is the maximum amount the depositor can invest;

whether the investor has an additional source of income.

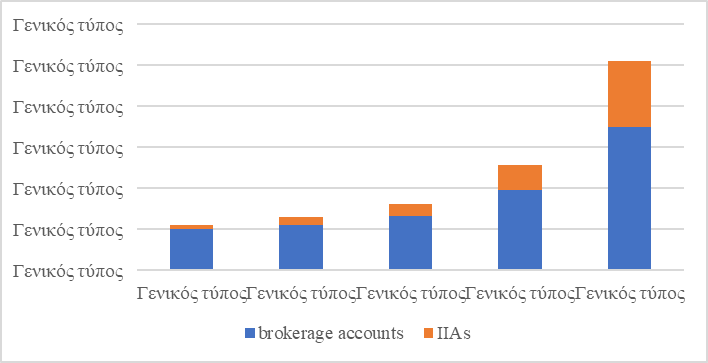

Subsequently, you can accurately determine which type of account is suitable for the investor. However, the best option is to combine both accounts and distribute funds, considering the advantages and disadvantages of each. Let us analyze the level of public confidence in IIAs and determine how many brokerage accounts are IIAs (Figure

In the figure, you can see that the share of IIAs in the total volume of brokerage accounts has significantly increased over 4 years, which means that public confidence in such accounts has increased. The volume of IIAs for the entire period of their existence is growing rapidly. As of 2019, the number of accounts turned out to be 218.7% more than a year ago, and in general, 1697.8% more than four years ago in 2015. It can be seen from the table that the share of IIAs in the total number of open brokerage accounts is actively increasing, for example, during the period of IIA’s operation, their share increased by 36.9% and as of 2019 already amounted to 45.7% of the total number of open brokerage accounts. The dynamics are quite positive, and it is associated with the availability of amenities and special benefits for individual investors to generate income.

Thus, the purchase of shares and bonds on the IIA can be more profitable than buying them through the simple brokerage account. This can be explained by the fact that the IIA is quite suitable both for a person who does not have investment experience, since in this case he is guaranteed to receive a deduction, and for a person who independently carries out operations in the stock market, because with a properly selected strategy, you can invest with minimal risks and good returns. This method of investing has the only limitation, which is access only to the Russian securities market. Now, we propose to compare the IIA with another financial instrument that is quite well-known and convenient for many individual investors - a mutual fund. Whether it is worth comparing these two instruments at all, because you can also invest your funds in mutual funds through the IIA. This is not entirely true, so we will understand the complexity and some impossibility of such an investment.

In fact, the legislation concerning IIAs reduces this opportunity, if not to zero, then to a minimum. As mentioned above, the IIA can be used in two ways: through a broker or through trust management. Through a broker, you can only buy shares of those funds that are traded on the exchange. Only what is offered by management companies can be purchased through trust management. Theoretically, mutual funds can be offered for purchase, but such offers are reduced to zero. Also, the point is that the shares of mutual funds are sold by the management company that created this same mutual fund. The shares of these funds are not in free circulation, therefore they cannot be bought or sold on the exchange. You need an agreement with the management company.

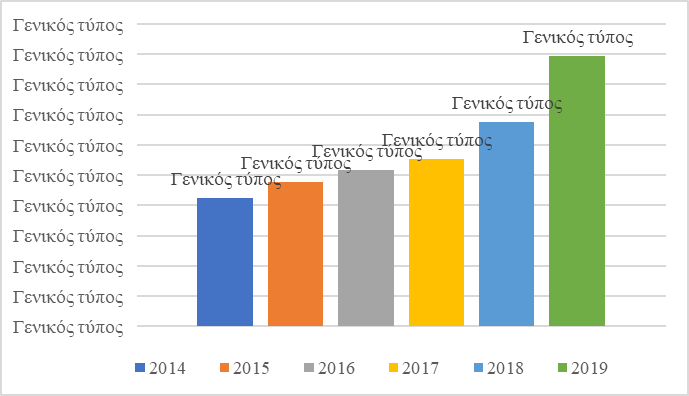

Thus, it is extremely problematic to buy shares of funds on the IIA due to the almost complete absence of specific investment products and conditions that allow it to be done. Therefore, a comparative analysis of investments in IIAs and in mutual funds will be quite appropriate. The Russians got the opportunity to open individual investment accounts five years ago.

During this time, the number of account holders exceeded 2 million. Since the beginning of the year, according to the Moscow Exchange, the number of new IIAs has grown by 25% (Moscow Exchange, 2020).

As for mutual funds, an important characteristic of this industry is the net asset value (NAV) of funds. The net asset value of unit investment funds increased by 32.4%, to 4.48 trillion rubles in 20019. This is the largest net inflow of funds into mutual funds over the past 5 years. Figure

Summarizing the above, we conclude that all instruments have their own characteristics and each investor will find a suitable instrument, the main thing is to determine their goals and possible risks. And the IIA, in turn, is an excellent way of investing both for a novice investor and for an experienced one due to the variety of opportunities and a wide range of returns. The main thing to remember is that when choosing a financial instrument, in any case, you will have to balance between its profitability and safety.

Conclusion

The following conclusions were formulated. The internal source of long-term financial resources necessary for the development of the Russian economy and ensuring its competitiveness are investment resources, in other words, the population's savings. Individual investors are the main subjects of the market for investment resources; they play the role of a special stabilizing force in times of crises, covering a certain part of the investment market. An individual investor in the process of preserving and increasing his assets is faced with the choice of a specific method of investment. The main problem when choosing a financial instrument for the individual investor is the desire to get the largest possible income with minimal risks. Today there is a list of ways to invest savings in the economy that are available to Russian citizens. In Russia, in the face of a deteriorating macroeconomic environment, it was necessary to introduce additional instruments for individual investment in the securities market. One of these instruments was the individual investment account recently appeared on the Russian market, which gave the population the opportunity to receive tax deductions. Having carried out a comparative analysis of individual investment instruments, we conclude that all instruments have their own characteristics and each investor will find a suitable instrument, while the determining factors are the risk level acceptable for the investor, as well as the planned investment period, which, in turn, depends on preferences of the specific investor.

References

- Lee, Y., Kim, W. C., & Kim, J. H. (2020). Achieving portfolio diversification for individuals with low financial sustainability. Sustainability (Switzerland), 12(17), 7073.

- Moscow Exchange (2020). 3 million IIS are registered on the Moscow exchange. https://www.moex.com/n30606/?nt=106/

- NAUFOR (2020). The value of net assets of exchange-traded mutual funds of the Russian Federation for the year increased 5 times, to 31.2 billion rubles. https://naufor.ru/

- Nedorezova, E. S., Ermolaev, K. N., & Salamov, F. F. (2021) Innovations in the development of the individual investment system in Russia. In S. I. Ashmarina, J. Horák, J. Vrbka, & P. Šuleř (Eds.), Economic Systems in the New Era: Stable Systems in an Unstable World. Lecture Notes in Networks and Systems, 160 (pp.677-683). Springer.

- Rebelsky, N. M., Alferov, V. N., Smirnov, V. V., & Prasolov, V. N. (2019). Forming an optimal investment portfolio. International Journal of Innovative Technology and Exploring Engineering, 9(1), 3909-3914.

- VTB Capital asset Management (2020). Monthly analytical review of VTB Capital asset Management. https://www.vtbcapital-am.ru/

Copyright information

This work is licensed under a Creative Commons Attribution-NonCommercial-NoDerivatives 4.0 International License.

About this article

Publication Date

30 April 2021

Article Doi

eBook ISBN

978-1-80296-105-8

Publisher

European Publisher

Volume

106

Print ISBN (optional)

-

Edition Number

1st Edition

Pages

1-1875

Subjects

Socio-economic development, digital economy, management, public administration

Cite this article as:

Nedorezova, E. S., Ermolaev, K. N., & Pavlova, J. A. (2021). Comparative Analysis Of The Individual Investment System Instruments. In S. I. Ashmarina, V. V. Mantulenko, M. I. Inozemtsev, & E. L. Sidorenko (Eds.), Global Challenges and Prospects of The Modern Economic Development, vol 106. European Proceedings of Social and Behavioural Sciences (pp. 327-335). European Publisher. https://doi.org/10.15405/epsbs.2021.04.02.40