Abstract

The modern digital financial services market can be characterized as a set of classical credit and non-credit institutions with a range of financial products available to them with the latest innovative achievements of companies that are manufacturers of solutions in the field of digital financial assets. The improvement in the range of financial products and digital financial services provided is due to the very time in which the consumer is to resort to financial institutions as intermediaries in monetary transactions between counterparties. The latter circumstance is due to the development of mobile gadgets which provide customers’ access to Internet banking without a personal visit to the bank's office. The development of new types of services and a line of financial products, in general, is caused by the growing competition of financial counterparties with each other, as well as with organizations that have not previously been involved in the provision of digital financial services. The subject of the research is economic and institutional relations arising in the process of providing potential and current consumers of financial services with new digital financial products, as well as the process of their regulation. The factor that significantly slows down the development of the digital financial sector is the lack of both domestic and foreign investment. Currently, only very large banks can allow the development of digital technologies planned for implementation in financial transactions.

Keywords: Competitioncryptocurrencyfinancial technologyinstitutional environmentneobank

Introduction

Currently, there is uncertainty in determining the range of application of the current law to the digital financial sector, which is actively used in digital financial transactions. The key problem of regulating the scope of application of financial technologies in the economy (hereinafter - Fintech) is the lag of regulatory bodies behind trends in the field of technological innovation. In the process of diverting a significant part of their resources to understand the newly emerging technology, market macro regulators run the risk of developing a final regulatory document that does not correspond to the emerging economic and technical realities.

Digital transformation is proceeding so quickly that government regulation does not have time to change the regulatory framework for its implementation and, in this regard, often acts as an inhibitory element of this process (Yang & He, 2019). At the same time, as mentioned above, macro-regulators understand that they become a barrier to some technologies that cannot be used in the absence of legal mechanisms for their implementation. As a result, tasks are being formed to reduce regulatory restrictions, create favorable conditions for new financial services and software products, and stimulate innovation in the Russian financial market.

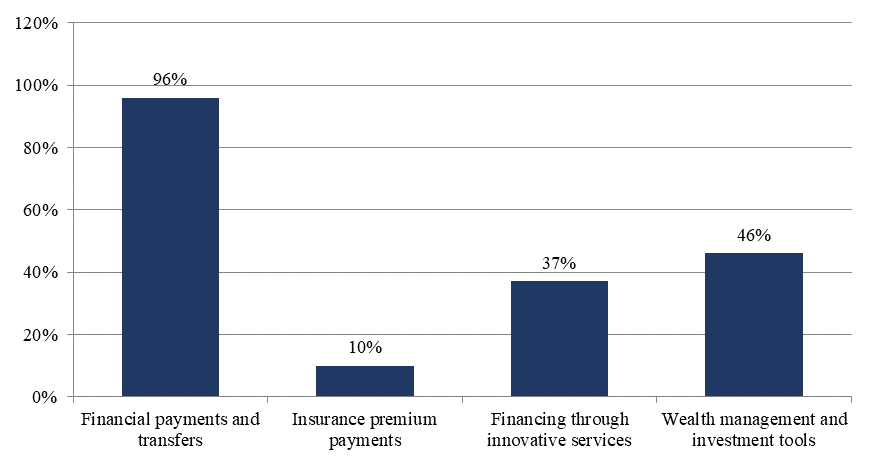

The expansion of the areas and frequency of application of digital financial services will receive its further logical development in close accompaniment with the improvement of financial technologies. According to the forecast for the development and application of financial technologies in the Russian economy, made by Ernst & Young (2018) experts, about 50% of most financial transactions will be carried out through digital transactions by 2035 (Figure

Based on the foregoing, the undoubted incentive in the development of digital financial services through innovative technologies in the domestic economy is the approval of the program “Digital Economy of the Russian Federation” (Order of the Government of the Russian Federation No. 1632-r, 2017) by the Government of the Russian Federation in July 2017.

Problem Statement

Among the most anticipated changes in mechanisms for improving the digital financial market in Russia, the following can be distinguished: lower barriers to entry and increased competition in the high-tech financial services market; increasing the degree of confidence of the population and business (especially micro and small businesses) in the work of financial institutions; increasing the level of financial stability and availability of financial services and funding sources in general (Ledneva & Povetkina, 2018).

The current Fintech 3.0 system (based mainly on startups) differs fundamentally from its previous version Fintech 2.0 (traditional financial institutions) - all technological solutions were developed by participants in the digital financial sector and they also carried out self-regulation. Market macro regulators turned to Fintech's control only when identifying negative scenarios of legal consequences in introducing certain financial technologies (Filippov, 2018).

Considering the fact of a greater impact on the digital financial sector of banks, as well as to promptly make the necessary changes to the existing regulatory framework, the Bank of Russia created the Fintech Association in 2017, which studies financial technologies, as well as ensures control over the transfer of ownership of financial instruments (Bank of Russia, 2019). Another problem of Fintech regulation is the lag, and in some cases, untimely adaptation of new information terms contained in draft laws of market macro regulators to the modern legal field (Tereshchenko, 2016).

The problem that really hinders the development of the Fintech industry is the lack of a specialized regulatory mechanism, which casts legal doubt on a separate range of operations, for example, the circulation of cryptocurrencies in the field of financial transactions (Balachandran & Williams, 2018). Also, one of the problems of regulation of the digital financial sector is the lack of competent personnel with high level of knowledge necessary to detect and prevent cybercrime in the future. To mitigate this risk, individual educational institutions are planning to introduce professional standards “Cybersecurity Specialist” and “Digital Financial Specialist”.

Research Questions

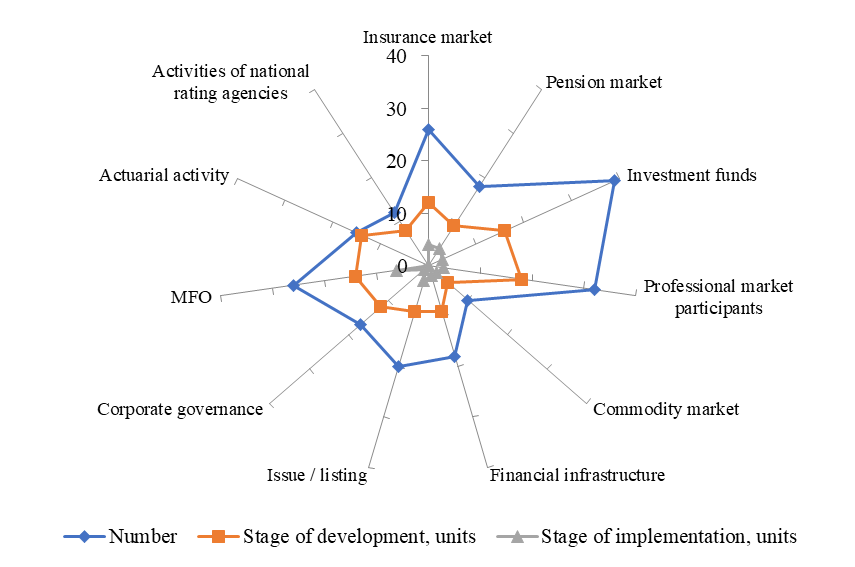

The study, conducted by the Bank of Russia, concerning the analysis of the current institutional environment in the domestic financial market is very interesting (Bank of Russia, 2019). The study covered various segments of the financial market, based on target indicators of operational efficiency in each of the financial segments. Based on the results shown in the table below, one can judge the imperfection of the current financial market, namely the institutional environment that regulates it.

As of 2018, only 28 (12%) indicators, out of 233, were implemented and 124 indicators are under active development (53%). Thus, about 35% of the “institutional field” of the financial market remains unaffected by the latest trends in financial innovation. Table

An increase in the level of competition is planned to be achieved through the development of availability of digital customer identification platforms, the introduction of open APIs to unify the interaction of counterparties (Ashraf, 2018). The most important component of the national digital financial environment is increasing the level of trust in financial institutions. The growth factor of the national economy is undoubtedly an increase in the level of liquidity of the domestic financial market and the development of tools for non-cash transactions (Munemo, 2017).

Purpose of the Study

One of the purposes of this study was to identify the key areas for the implementation of RegTech and SupTech events. RegTech is a digital mechanism for the compliance of market counterparties with the requirements of market macro regulators, SupTech is a direct process of automation of the compliance with the supervisory requirements of macro regulators. The main regulator of the digital financial sector in the Russian Federation is the Central Bank of the Russian Federation. In this direction, the Bank of Russia is taking measures to develop regulatory and supervisory technologies (RegTech and SupTech, respectively). Summarizing the areas of regulation, Table

In addition to the work carried out in terms of determining the ways of institutional transformation of the digital economy in Russia, the study posed and solved the problem of determining the level of competitiveness of the banking sector, as the most developed in terms of availability and provision of financial products to legal entities and individuals. The task of identifying new participants in the financial transactions market - neobanks - has also been solved. Also, the purpose of the study is to find and propose measures aimed at improving the quality of financial services provided and increasing the range of banking products. So, it is necessary to solve the problem of the absence of serious competition in the Fintech industry, which hinders the development of modern high-tech solutions.

Research Methods

The study of the financial market structure cannot be carried out without a detailed analysis of its participants, namely the study of the aspect that shows how competitive the market of banking services in Russia is. Since the level of monopolization of the financial market depends not only on the range of provided banking products and their cost, but also on the level of innovation in the lending mechanism, the performance of settlement and cash transactions, currency exchange operations and the functioning of other banking products and services.

To study the situation on the domestic market of banking services in the context of its participants, a few statistical indicators were used, and a model of market monopolization was built. For this, the following coefficients were used in the analysis: Concentration ratio CR; Herfindahl - Hirschman index; Hall – Tideman Index (Filippov, 2018; Ozili, 2018; Tereshchenko, 2016).

One of the most accessible for calculation and effective indicators, in terms of the interpretation of the results, is the Concentration ratio - CR. It can be calculated as follows:

CRn = ,

It is calculated as the sum of the occupied shares (Sn) of the largest companies in the market. The closer the indicator is to 100, the more monopolized the market is. This ratio can be calculated for a different number of companies; in this study, the 3 largest credit and financial institutions (Sberbank, VTB, Gazprombank) are selected based on their share of the domestic banking market and annual indicators of the balance sheet currency. The disadvantage of this ratio is that it ignores the distribution of market shares of the companies themselves, the values of which are included in this indicator.

The next indicator we use is Herfindahl-Hirschman index (HHI index). It reflects the degree of monopolization of the market, calculated as the sum of squares of percentages of the market ( ), occupied by its individual player. You can calculate it as follows:

HHI = ,

HHI = + + … +

To determine HHI index, the most significant participant with its market share is initially included in the analysis and new agents are added to the analysis before the start of a significant adjustment of the index. It is assumed that, in theory, the maximum value of HHI index can reach 10,000 (1 participant with 100% market share). There are three key groups of market monopolization:

Group I: the most significant share of counterparties in a specific market

1,800 <HHI <10,000

Group II: the market situation is close to oligopoly

1,000 <HHI <1,800

III group: the most competitive market

HHI <1,000

Hall-Tideman Index (HT - index) is determined based on a comparison of the ranks of firms in the market (the rank can be determined based on the level of capitalization of the company, the level of revenue, sales and other indicators). Calculated as follows:

,

where Ri is an indicator of the rank of the organization in the market, yi is the share of this organization.

Using this index, you can analyze firms in the industry in terms of their importance, both for the industry and for the economy.

Findings

Based on the data in Table

Using the methodology proposed in the study by the Bank of Russia, the key threshold values for each of the areas for improving the digital financial services market in the Russian Federation for the period up to 2021 were reflected in Figure

Analyzing the general conjuncture of the domestic banking sector in terms of the dynamics of its participants, we can indicate the following: the number of players in the banking services market as of 01.01.2018 amounted to 561 organizations with a corresponding license. Compared to 2008, there is a significant decrease in the number of participants (a decrease of more than 50%), and a decrease in the number of banks is observed in all Federal Districts. So, for example, in the Central Federal District, the number of organizations with a banking license decreased in 2018 compared to 2008 by 313 organizations (-50.5%) and amounted to 319 participants. In the Volga Federal District, the reduction in the number of participants in the same period amounted to 63 market participants (-52.9%, to 71 organizations), and in the Northwestern Federal District, the number of organizations holding a banking license amounted to 43 participants (-53.1%) in 2018 compared to the number of organizations per 2008 year. In Russia as a whole, the number of participants in the banking market from 2008 to 2018 decreased from 1136 to 561 organizations (-49.4%) (Bank of Russia, 2019).

The number of credit institutions is decreasing due to revocation of their licenses for reasons of violation of banking legislation, realization of risks of clients and investors. So, for example, according to the Central Bank of the Russian Federation for 2019, licenses were revoked from 5 banks, including:

- B&N Bank Digital (license revoked on 01.01.2019, reason: liquidation);

- B&N Bank (license revoked on 01.01.2019, reason: liquidation, merger with FC Otkritie);

- Eurocapital-Alliance (license revoked on 25.01.2019, reason: inconsistency with the law);

- Kamchatkomagroprombank (license revoked on 30.01.2019, reason: inconsistency with the law);

- Radiotechbank (license revoked on 31.01.2019, reason: inconsistency with the law).

The process of the emergence of new credit institutions and liquidation of existing ones is an objective process in the economy, but the most important is preservation of the existing systemically important credit and financial institutions, whose activities the economic growth in the country and economic national security depend on.

In the Russian Federation, as of October 14, 2019, the following important systemically important banks are included: AO UniCredit Bank, Bank GPB (AO), VTB Bank (PJSC), AO Alfa-Bank, PJSC Sberbank, PJSC “Moscow Credit Bank”, PJSC Bank FC Otkritie, PJSC Rosbank, PJSC Promsvyazbank, JSC Raiffeisenbank, JSC Rosselkhozbank. Table

Thus, analyzing the structure of the domestic banking market, one can see that 9 banks in the country occupy more than 60% of the entire banking sector in the country. However, this fact does not show how strong the degree of monopolization of the domestic market of banking services is in the context of products themselves. For example, PJSC Sberbank occupies a leading position in connection with historical conditions of development, Rosbank, being a division of French bank Société Générale, has occupied a leading position in car lending for quite a long time. Therefore, it is necessary to conduct a quantitative and qualitative analysis of the level of competition in the Russian banking market in the context of financial products provided to them. The results of this analysis are presented in Table

The authors studied the dynamics of competition in the domestic banking system objectively, and despite the emergence of new participants in the financial market, for example, neobanks that are considered, the indicators of competitiveness of the domestic banking sector define it as oligopolistic, but do not require immediate intervention of antimonopoly institutions. At the same time, there is a noticeable tendency towards the deepening of the degree of monopolization of the banking services market based on CR3 and HHI data. Such structuring of the market, from the point of view of its participants, can have a stimulating effect on the ongoing transformation processes of the digital financial services provided. When examining the influence of the financial sector on the modern banking system, it is important to point out the formation of a fundamentally new model of banks: neobanks that are actively using the latest achievements of the Fintech area in their operations. So, among the existing banks, the following institutions can be distinguished (Table

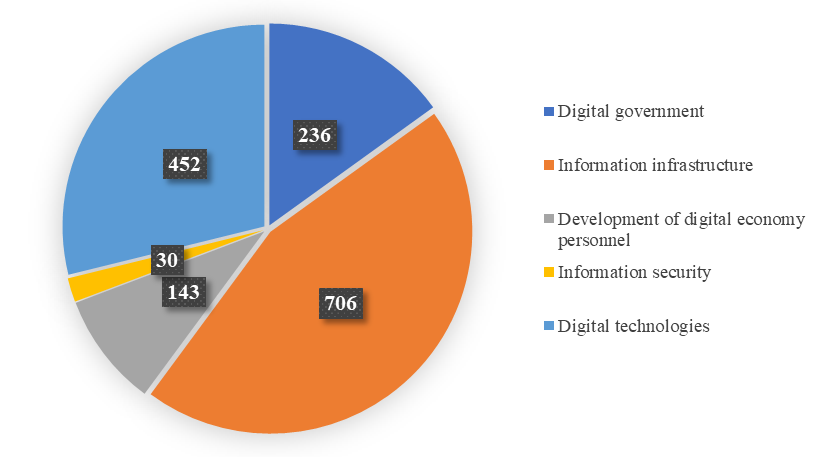

In 2019, BloomChain Research agency experts conducted a study of the online resource Public Procurement to determine the volume of government spending planned for investment in digital transformation (BloomChain Research, 2019). According to the national program “Digital Economy”, it is planned to provide more than 1 trillion rubles from the federal budget for the development of the domestic segment of the digital economy and more than 535 billion rubles from extra-budgetary sources (Order of the Government of the Russian Federation No. 1632-r, 2017). Figure

Conclusion

The key findings of the evaluation

The monopoly of banks on lending has been declining in recent years, and new ways of attracting investment by market entities are emerging (Ozili, 2018). In the digital economy, in addition to traditional (equity and borrowed capital) methods of financing, an approach related to the issue of digital financial assets called cryptocurrencies and called the initial placement of cryptocurrencies (hereinafter - ICO) can be used. The cost of ICO tokens is usually lower than the IPO share price: for example, tokens can cost less than one dollar, and the cost of shares can be several tens of dollars (Calcagnini et al., 2019). At the same time, ICO tokens are a currency that investors can use as a means of payment if the situation develops favorably. IPO shares are securities that cannot be used as a means of payment.

You can also consider STO (Security Token Offering) as an alternative providing investors with a higher level of security. STO (Security Tokens) allows a business to sell shares of its company in the form of a tokenized asset. They are backed by various financial rights of investors, including dividends, stocks and other financial instruments. In general terms, STO operates as an investment vehicle. In addition, security tokens represent a share of ownership in a company, like traditional shares, and give the right to receive dividends and other financial benefits (Huang et al., 2019).

Future research

Among the most promising vectors for the development of the domestic digital financial services market are:

- develop healthy competition between financial market participants (providing conditions for collecting and processing data, developing electronic document management (e-invoicing)), provide free implementation of elements of open platforms and create legal conditions for the smooth circulation of digital financial assets;

- assist in infrastructure platforms (conclusion of transactions on the Marketplace, development of solutions for the digital profile of participants in transactions, provision of clientele against cyber threats);

- increasing the quality and quantity of available financial products;

- develop instruments for long-term debt financing;

- assist in corporate relations;

- Develop international cooperation, primarily with the BRICS countries and the EAEU;

- ensure the rights of investors, residents and non-residents;

- increase the level of financial literacy of participants in financial transactions;

- implement Open API standards and distribute Open Banking technologies to accounts of non-bank financial institutions;

- ensure proportionality in the regulation of professional participants in the securities market, including in relation to the requirements for their reporting;

- ensure equal opportunities for cross-identification of clients for credit institutions and investment companies providing intermediary services;

- develop the institution of regulatory arbitration between providers of financial services, for example, between credit and non-credit organizations in terms of information and technological accessibility of customer data, guarantees to protect the property interests of customers

References

- Ashraf, B. N. (2018). Do trade and financial openness matter for financial development? Bank-level evidence from emerging market economies. Research in International Business and Finance, 44, 434-458. https;//doi.org/

- Balachandran, B., & Williams, B. (2018). Effective governance, financial markets, financial institutions & crises. Pacific-Basin Finance Journal, 50, 1-15. https;//doi.org/

- Bank of Russia (2019). The main directions of the development of the financial market of the Russian Federation for the period 2019-2021. http://www.cbr.ru/content/document/file/71220/main_directions.pdf

- BloomChain Research. (2019). Who makes money from the digital economy in Russia? https://bloomchain.ru/detailed/kto-zarabatyvaet-na-tsifrovoj-ekonomike-v-rossii

- Calcagnini, G., Giombini, G., & Travaglini, G. (2019). A theoretical model of imperfect markets and investment. Structural Change and Economic Dynamics, 50, 237-244. https;//doi.org/

- Ernst & Young (2018). Fintech course: Market development prospects in Russia. https://ru.investinrussia.com/data/files/sectors/EY-focus-on-fintech-russian-market.pdf

- Filippov, D. I. (2018). On the influence of financial technologies on the development of the financial market. Russian Entrepreneurship, 19(5), 1437-1463.

- Huang, Y. S., Li, M., & Chen, C. R. (2019). Financial market development, market transparency, and IPO performance. Pacific-Basin Finance Journal, 55, 63-81. https;//doi.org/

- Ledneva, Yu. V., & Povetkina, N. A. (2018). Fintech and regtech: The boundaries of legal regulation. Law. Journal of the Higher School of Economics, 1, 46-67. https;//doi.org/

- Yang, M., & He, Y. (2019). How does the stock market react to financial innovation regulations? Finance Research Letters, 30, 259-265. https;//doi.org/

- Munemo, J. (2017). Foreign direct investment and business start-up in developing countries: The role of financial market development. The Quarterly Review of Economics and Finance, 65, 97-106. https;//doi.org/

- Order of the Government of the Russian Federation No. 1632-r “Digital Economy of the Russian Federation” dated July 28, 2017. https://www.garant.ru/products/ipo/prime/doc/71634878/

- Ozili, P. K. (2018). Impact of digital finance on financial inclusion and stability. Borsa Istanbul Review, 18(4), 329-340. https;//doi.org/

- Tereshchenko, L. K. (2016). The conceptual apparatus of information and telecommunications law: Problems of law enforcement. Journal of Russian Law, 10, 101-108.

Copyright information

This work is licensed under a Creative Commons Attribution-NonCommercial-NoDerivatives 4.0 International License.

About this article

Publication Date

30 April 2021

Article Doi

eBook ISBN

978-1-80296-105-8

Publisher

European Publisher

Volume

106

Print ISBN (optional)

-

Edition Number

1st Edition

Pages

1-1875

Subjects

Socio-economic development, digital economy, management, public administration

Cite this article as:

Mikhaylov, A. M., & Petrov, N. A. (2021). Economic And Institutional Analysis Of Domestic Digital Financial Market Trends. In S. I. Ashmarina, V. V. Mantulenko, M. I. Inozemtsev, & E. L. Sidorenko (Eds.), Global Challenges and Prospects of The Modern Economic Development, vol 106. European Proceedings of Social and Behavioural Sciences (pp. 30-41). European Publisher. https://doi.org/10.15405/epsbs.2021.04.02.4