Abstract

Today factors that might relate to subjectivity of perception in financial activities relations have a significant impact on subjects of financial and investment activities. Personal views and different psychological characteristics of investors and other subjects influence their ways of thinking. But, today in theoretical and practical fields of Russian science behavioral factors and behavior features of financial and investment activities subjects are not taken in account even though they play a big role within making of a certain decision. Aside from a need of getting the maximum income with minimal risks one of the most important problems during the choosing of financial instruments in the context of digitalization and innovations in the market by an investor is a wish to increase a level of a trust and psychological tranquility in the investment process. In the process of digitalization, stock market instruments are constantly being improved. New ways of free funds investing regularly appear that causes many active disputes. These facts determine the relevance of this research of behavioral barriers in the financial market. The study of the human factor that takes part in the formation and development of the financial market will contribute to a better understanding the origin of its phenomena linked with digital, technological, and informational innovations. Identifying barriers will contribute to mitigate them, to eliminate investors’ distrust in the market and make more rational decisions by subjects of economic relations.

Keywords: Behavioral financesfinancial instrumentsfinancial technologies

Introduction

Today, there is an increased interest from households in personal finance management that is significantly related with consequences of a difficult epidemiological situation. Households face a task to save and to multiply their financial resources using innovative financial technologies and possibilities that digital economy provides. Realizing it households encounter problems caused with a complexity and some inconsistency of financial products. High risks of using these financial products, an unsuccessful experience among surrounding people, absence of sufficient competence are behavioral barriers that slow down development of a digital economy sector. Consumers tend to make very odd choices making certain purchases and managing their own financial resources. In the same way there is a trend to make irrational decisions and to have a group or crowd mindset in the financial markets. It impresses how so many economic subjects might unconsciously react so identically. The relevance of the research is based on the fact that the study of the human factor that plays a big role in the formation and development of the financial market conjucture will help to understand the origin and certain phenomena of it better. Barriers affect the entry of market participants. This contradicts the strategy of developing a free innovative market.

Despite the fact that consumers often make the same mistakes as professional investors, financial psychology specialists pay much attention to the psychology of investing process. It is most likely linked with the widespread expansion of financial markets activity. In the future this focus may change allowing scientific advances support consumers to study with their mistakes and to make the most effective financial decisions. Today it is possible to say that new products are appearing in the financial market, financial technologies are improving, however not all the potential investors are ready to use these offers. In addition to making bad decisions sometimes consumers and investors have trend to follow each other in difficult financial situations. Behavioral finance theorists try to track the most irrational decisions of investors that they make and their impact on markets in general. They can use this information to help investors make better decision during stock market investing or to gain more profits. These concepts may contradict the hypothesis of the free market efficiency and actually not supporting investors to get profits from following market movements or changes. However, they can help investors to make best investing decisions.

Investors often take in account the most recent report from a group of analysts when all of them have access to the same information. Plus, they overlook the fact that analysts might look at the same data over the same period of time but come up with different results. As if the events or studies that happened before are insignificant and shouldn’t be included in the sample. Today three basic definitions in the field of the business models transformation that appeared under the influence of the widespread implementation of financial technologies should be taken in account. They are digitalization, informatization and digital transformation of financial services. Digitalization might be determined as a process when products and services move into the digital environment losing its material form. In fact, a client begins to directly realize his or her interactions with a financial services provider with any device. This device might be, for example, any computer, smartphone, ATM or even a home digital mini office.

For a group of financial products digitalization aims at a remote getting of services. So, examples in the field of digital finance services illustrating it are a home banking services and trading. Regardless of the financial situation of a potential investor a user of banking services can use available software from supplier or a representative of a banking product. For users this is a possibility to get a service regardless of his or her location, remoteness from financial centers, to use extended offers from financial organizations from all over the world. In general it lets clients in less developed countries and regions where the level of a banking infrastructure penetration is not as high as in leading economies use digital financial services to have access to banks and their services like retail payments, loans, financial instruments that are unavailable so far. Each type of financial market has its own instruments which involve using digital technologies. What they have in common are Internet banking systems and bank-client applications which provide possibility to realize financial transactions with different instruments in various combinations.

The issue of informatization is linked with the transition from paper and physical storing instruments to the formation of united virtual databases, registries and the use of cloud technologies. So, there are several psychological and behavioral factors that have a significant impact on various actions of investors including Russian ones. The exclusivity and relevance of the behavioral finance theory is based on the need for a more profound research of investors’ psychological behavioral motives in the stocks and bods market. It is important to take in account not only objective element like visible actions that led to the result but also emotional and psychological elements (DeBondt et al., 2010). Detecting trends of behavioral barriers plays an important role in a home financial management (Jünger & Mietzner, 2019). Their following suppression might lead to an improvement, an efficiency increases in financial decision making, a trustful use of digitalization products and increase of household wealth.

Problem Statement

Behavioral finance is a perfect approach to analyze behaviors of investors and other financial market participants that contribute overcoming difficulties of rational approach. According to it many of the phenomena of the financial market can be explained with special models in which economic units are not completely rational. Modern concepts contradict classic understanding of an economic man. In particular models of the behavioral finance investors have expectations that are not completely correct. In other models investors have clear expectations but make incompatible with model of expected benefits decisions (Zahera & Bansal, 2018). Indeed, investors have a behavioral bias in their decision-making. Factors that have an impact on behavior and decision-making process of financial and investing activity subjects are still not explored enough. To analyze behavioral barriers in formation and development of digital economy it is important to make a research to identify reasons of insufficient citizens involvement in usage of technological financial products. It is necessary to detect situations from life in which economic units face with possibilities of using digital products, instruments of digitalization and informatization. Also, it is important to get a feedback within making the research among different age groups that will contribute to weaken behavioral barriers and to project design of digital environment.

Research Questions

Our research lets analyze barriers of economic subjects linked with accepting digital financial technologies. Taking in account that financial markets are considered as the most effective among all the markets it is expected that individual mistakes doesn’t have a big impact in general. However, looking back it seems like making financial decisions is very unnatural for people. So, we can make a conclusion there are behavioral barriers in this field. Sometimes consumers collectively tend to make rather strange choice when time comes to make purchases and to manage their finances. In the same way investors tend to think as a group and make irrational decisions. It is really interesting how one occasion can make so many economic units unconsciously react identically. So, there is the same question for researchers in a field of finance what reasons of different moves in the financial market from on the part of investors are. And also, why does an investor choose a certain strategy and then change his or her own opinion and market moves? What slows down a new technology implementation process in the financial market? Why do investors not tend to try digital technologies? What scares newcomers in the market?

Purpose of the Study

It should be noticed that the highest rates of technology development implementation in the financial sector are reached by countries where a culture contributes users to accept innovations. These countries are Japan, South Korea and USA. The level of digitalization is high due to the fact that in these countries innovations are usually implemented very fast in all the parts of a social life. Russia doesn’t have a leading position in these ratings. It might be explained with a law level of financial technology implementation from a side of economic subjects. It radically slows down digitalization. In countries that are just starting moving forward in this field will quickly accelerate the development process (Ansong & Boateng, 2019).

Today trust to digital technologies remains to be a cornerstone of the global digital economy. In countries with higher level of a digital trust consumers are more tolerant to technical failures that sometimes happen during a usage of internet-services and making online-transactions. Psychological and behavioral barriers of a technological implementation in Russia are a problem that is based on historical mistakes in a governmental management and an absence of a law basis in a financial technology field and innovations in the beginning of a market economy formation. A trust and following implementation of innovations reflect competitiveness of a digital economy in the country. Authors of this article created a questionnaire that includes questions about behavioral barriers, conducted a structured sociological survey and analyzed its results. This made it possible to identify main behavioral barriers, reasons of their occurrence even in a small surveyed group. This approach let classify behavioral barriers and find ways to mitigate them. Making a survey on an ongoing basis can significantly contribute the process of a digital finance technologies implementation with detecting specific problems including psychological and behavioral ones.

Research Methods

Theoretical basis for detecting trends of behavioral barriers that arise among economic units and for developing an effective financial strategy to create an adequate model of behavior in an environment of a digital economy formation and development is a modern science of a financial management. However, many basements of financial theory are considered to be outdated. They do not analyze many factors that have an impact on a behavior in a financial field. Probably it might be somehow explained with a growth of financial relations units’ irrational behavior and arising of factors that were not so important in the past. Several authors work with problems of behavioral factors. There is an important fact: the more financial markets are developed the problems arise (Huang et al., 2016).

Different methods might be used for a research of behavioral barriers in financial activities and making decisions by potential investors. The reliability of conclusions and recommendations obtained during the research is provided with a usage of general scientific methods and technologies. There are experimental and theoretical methods like comparison, analysis, systematization, technologies of tabular and graphical interpretation, methods of sociological analysis among them. The statistical sample of this study is one hundred people of different sex and age. It made the analysis more representative without reference to a specific social group. Respondents were asked with open questions. They could make their own choice of factors that have the strongest impact on them. The empirical base of the study is statistical and empirical data, information and opinions from official websites of stocks and bods market professional participants.

Findings

Within the survey respondents were asked several questions that let considers problems on this issue. The first group of respondents were asked with a question linked with life situations when they have an ability to use products of a digital economy. Respondents named several situations. They are:

a work with documents and archives;

a work with Big Data;

a work with technologies of an uninterrupted connection and communications;

marketplaces;

trading systems;

online platforms for single information windows;

internet of things;

implementation of financial and investment transactions.

Also, thy answered the question «Do you consider the usage of digital economy technologies are necessary for developing economic systems. 82% of respondents answered «Yes». The rest that is 18% answered it is possible to develop an economy system without innovative technologies.

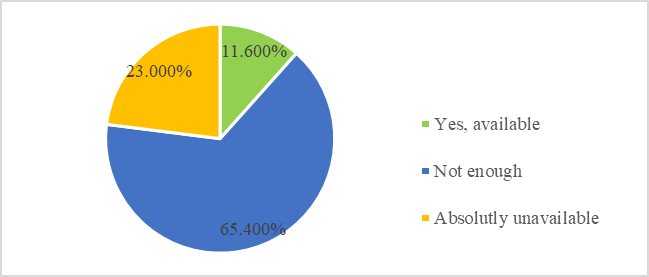

The next question asked respondents if implementation or usage of digital products is available or not. Results are in the Figure

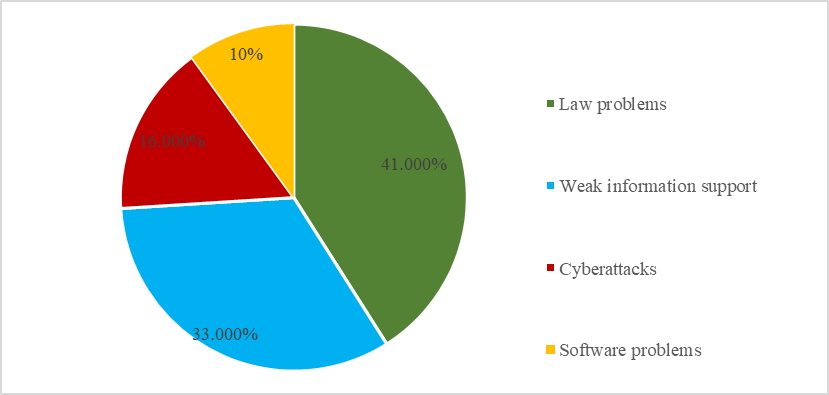

Only 11,6% of respondents said that the system of digital technologies is sufficiently developed. The remaining 88,4% are not satisfied or completely dissatisfied with these technologies. The next question contributed to identify problems that slow down an implementation process of digital technologies and products in the sphere of economic relations. The results can be seen in the Figure

It should be noticed that 41% of respondents name problems with law and its backwardness that slaw down the implementation process as one of the most important. There is a rather long time lag between a new innovative product and its legalization. Regulating of the digital products market is connected with the need to stop money laundering and terrorist financing. What is about a taxation there is no the only approach that can solve all the problems. The second place is taken by a weak innovation information support in the market. Economic units do not get a full information about a product or special software from official sources. Also, they do not have a possibility to get consultations with developers. Problems of cyberattacks and cybercrime are relevant among economic units. Online systems are associated with the storage of personal data, arrays of information disclosure of which, as well as their entry into the public space, may affect the reputation and financial stability.

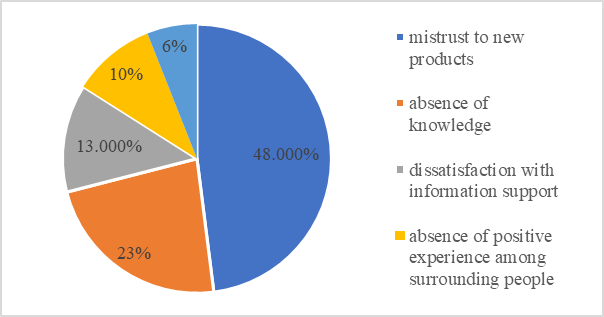

Problems with software are associated with problems of digital products and their technological components. There is a way to solve the problems. It is improvement of industry standards and rules that establish requirements for ensuring technological stability and safety in the use of financial technologies. There was a question what the reason of your mistrust to digital technology products. The answers are presented in the Figure

So, respondents face different behavioral barriers they told in the survey. Mistrust to new products reflects a feeling of fear. A weak information support, absence of knowledge and not having ways to get knowledge contribute investors not to make new innovative risky choices and to accept conservative strategies as well as the most of other investors. Absence of positive experience among surrounding people makes investors stop and not to realize further moves in the investing activity. It causes a fear of new products and a general mistrust to instruments of financial market. In our research behavioral barriers can be classified in two groups: communicative and psychological. The first group includes barriers of information. The second group includes psychological reasons: a fear, mistrust, following conservative strategies, «effect of a crowd», a negative experience of investing activity.

Conclusion

Potential investors are wary of the widespread introduction of digital technologies because of behavioral and psychological reasons. The sociological survey confirmed the existence of behavioral barriers:

-distrust, absence of knowledge, conservatism;

-to mitigate barriers it is necessary to analyze their origin, to reorganize law basis and organize special financial education;

-investor’s behavior is influenced with a big set of internal and external factors;

-improvement of legislation (Federal Law of 31.07.2020 N 259-FZ);

-it should taken in consideration that many economic processes have an untypical progress line because of innovations and a rapid implementation of financial technologies.

There was not so many respondents in our survey because of practical reasons that limited it. But, sufficient data was obtained to evaluate the presence of behavioral barriers that appear during a process of digital economy products implementation.

In future it is possible to discuss a complex of actions to mitigate behavioral barriers. It might be, for example, a course of educational events about new technologies in a field of finance for different groups or projects of financial volunteers and development of application with necessary information.

Results of this research confirm that economic units face behavioral barriers of testing and regular using of an innovation. Any decision that is made within an investing activity is influenced with internal factors like a mistrust and external factors like an environment. Economics creates a perfect model of a market evolution, processes and phenomena are shown and explained. But, psychological, behavioral and emotional factors are not taken in account in economics. Psychologists proved it long time ago that man’s activity is influenced by these factors. According to it identifying behavioral barriers in purpose to mitigate them should become a regular process that will contribute early implementation and usage of new technologies.

References

- Ansong, E., & Boateng, R. (2019). Surviving in the digital era – Business models of digital enterprises in a developing economy. Digital Policy, Regulation and Governance, 21(2), 164-178.

- DeBondt, W., Forbes, W., Hamalainen, P., & Muradoglu, Y. G. (2010). What can behavioural finance teach us about finance? Qualitative Financial Market Research, 2(1), 29-36.

- Federal Law of 31.07.2020 N 259-FZ "On digital financial assets, digital currency and on amendments to certain legislative acts of the Russian Federation". http://www.consultant.ru/document/cons_doc_LAW_358753/

- Jünger, M., & Mietzner, M. (2019). Banking goes digital: The adoption of FinTech services by German households. Finance Research Letters, 34, 101260.

- Huang, J. Y., Shieh, J. C. P., & Kao, Y. -C. (2016). Starting points for a new behavioral finance researcher. International Journal of Management Finance, 12(1), 92-103.

- Zahera, S. A., & Bansal, R. (2018). Do investors exercise behavioral bias in investment decisions? A systematic review. Qualitative Research in Financial Marketsт, 10(2), 210-251.

Copyright information

This work is licensed under a Creative Commons Attribution-NonCommercial-NoDerivatives 4.0 International License.

About this article

Publication Date

30 April 2021

Article Doi

eBook ISBN

978-1-80296-105-8

Publisher

European Publisher

Volume

106

Print ISBN (optional)

-

Edition Number

1st Edition

Pages

1-1875

Subjects

Socio-economic development, digital economy, management, public administration

Cite this article as:

Kornilova, K. A., & Pupko, D. A. (2021). Research Trends In Behavioral Barriers In The Formation Of The Digital Economy. In S. I. Ashmarina, V. V. Mantulenko, M. I. Inozemtsev, & E. L. Sidorenko (Eds.), Global Challenges and Prospects of The Modern Economic Development, vol 106. European Proceedings of Social and Behavioural Sciences (pp. 290-297). European Publisher. https://doi.org/10.15405/epsbs.2021.04.02.36