Abstract

The success of any business is largely assessed by the return on equity indicator. Analysis of this indicator in the context of aggregated groups of factors gives an enlarged estimate of the reasons for its specific value at each time. However, a detailed estimate (which takes more factors into account) may not match an enlarged estimate. The impact of each factor on the change in the return on equity is evaluated based on its qualitative certainty, in particular, on the signs of extensiveness or intensity. A rational combination of these features largely determines the effectiveness of management decisions to achieve the desired level of return on equity. The category of return on capital, all other things being equal, is identified as an intensive factor of financial efficiency. However, the quantitative expression of this category in the form of a specific indicator, for example, the annual return on capital is determined by both an intensive factor (the average daily level of business activity) and an extensive factor (the number of working days per year). In other words, aggregated intensive factors may include an extensive component. In financial management, it is often used to estimate the value of return on equity in the context of three aggregated factors that appear in the well-known DuPont formula. Aggregation and unbundling of these factors may change the assessment of the ratio of reasons that led to a particular level of return on equity when the level of detail of the analysis changes.

Keywords: Extensive and intensive factorslevel of analysis detailreturn on equity

Introduction

Modern assessment of the success of a particular business involves at least two aspects. First, a harmonious combination of ways to achieve its success with general objective trends in the development of the universe is of great importance for the sustainable development of business. These trends do not have an unambiguous and clearly defined definition in any legislation (Dudin et al., 2016). Often these tendencies are expressed allegorically in various religions, literary works, and art in the form of concepts of good and evil. A particular business deals with analogies of these trends (we can call them "custos"), which are manifested in particular cases of human civilization, for example, in terms of legislation, altruism, moral obligations. The temptation to violate custos is to make a "monopoly" profit (Igoshina et al., 2019) at the expense of other people who comply with written and unwritten laws. General trends of the universe and specific "custos" imply ensuring equal conditions for the development of all people, that is, the indifference of the universe in relation to the personal interests of people. It has long been observed that "volentem ducunt fata, nolentem trahunt". In other words, a high assessment of a particular business should be confirmed by the fact that the ways it chooses to achieve success generally correspond to the entire complex of all "custos" hierarchies.

History shows that a relatively small part of the implemented temptations of violating custos requirements are justified in the future (Bruskin et al., 2017). As a rule, this happens when existing "custos" (undoubtedly useful in the past) become a hindrance to the utilitarian application of an increasing amount of knowledge about the world around us. Inevitably, there is a need for new, more adequate "custos". Changes that occur often violate the interests and destinies of specific people. Examples include the death of Giordano Bruno, as well as persecution and losses in the business of manufacturing and selling telescopes for Galileo. All this was caused by a change in cosmological paradigms (a kind of "custos") of the structure of the universe (geocentric, heliocentric). Currently, the benefits of new and more adequate cosmological paradigms for human civilization are becoming clear. On their basis, accurate systems of marine navigation were developed, which contributed to new geographical discoveries. Modern civilization uses these paradigms to build meteorite protection systems, to explore space as a new area of vital interests of mankind.

It seems that a laconic formulation of general trends in the development of the universe in the projection of the values of human civilization should include at least three principles characteristic of representative democracy. First, the success of the structural elements of civilization (including each specific business) must be ensured through the internal efforts of this element, that is, not at the expense of damage to other elements (businesses). Second, business results must be useful to society, and their achievement must be effective. The condition for efficiency is the excess of the results obtained over the costs incurred. Thirdly, transparency of business activity should be ensured, that is, indirect control of compliance with the two previous principles on the part of any citizen should be provided.

The first principle involves assessing the success of a business only through the use of its own, that is, internal resources. This principle is clarified by the fact that the activities of each entrepreneur are not carried out at the expense of the interests of other members of society. It seems that this provision does not contradict the fact that an individual specific entrepreneur can use the resources of other members of society, but for a certain fair price. Concretization of the content of the second principle follows from a detailed understanding of the first principle. In other words, the level of efficiency of each specific business should, first of all, ensure the payment of loans and at the same time satisfy the needs of the owner. It is not excluded that the business activity of a particular business uses only its own resources. In this case, the interpretation of the second principle of representative democracy requires that the return on equity (ROE) does not fall below the average lending rate at any given time.

The interpretation of the third principle of representative democracy from the point of view of the current state of the economy of human civilization should include not only financial aspects. Institutional, social, environmental, regional and other relevant aspects of business activity play an important role in ensuring sustainable economic development of a particular business. One of these most important and general aspects for a particular business is the correspondence of the way of its implementation to the general trends in the development of the universe. The generalization of the known facts of the development of the universe allows us to assume that the objective reality of the present time is the product of a competitive selection of a multitude of previous variants of the state of being. Hence, it is possible to conclude that the universe is indifferent to its individual elements but has obvious tendencies in its development that determine the future viability of these elements. Extrapolation of this conclusion to human civilization, in particular to specific types of economic activity, convinces of the need to observe the principles of democratic equality. Compliance with these principles corresponds to the tendencies of the higher forces of nature, therefore, is one of the grounds for a high assessment of business in relation to the prospects for its sustainable development.

The success of a particular business largely depends on how well its management understands the surrounding reality and individual events from the perspective of general trends in the development of the universe (Rasskazov et al., 2020). In particular, these trends are manifested in the fact that the modern economy is increasingly focused on the information component of business, on the provision of services, and not on the production of goods. However, the success of a modern information business depends on the reliability and progressiveness of its material and technical base. Therefore, we can say that the priority in the modern economy belongs to the production of high-quality material and virtual goods. A modern group of virtual goods has a complex structure. First of all, there are virtual products that directly satisfy user requests (search engines, games, training programs, etc.). However, specific virtual products in the form of ready-to-implement projects and algorithms for providing various services to paying users are becoming increasingly important. There is a trend of Orthodox business development in the direction of meeting a closed circle of internal needs of individuals. It seems that specific entrepreneurs in such an Orthodox business may suffer if they are not able to make their development trends become a private specification of the trends in the development of the universe as a whole. Therefore, the assessment of the past and future success of the business should be increased if there are facts confirming compliance with the trends and laws of the universe.

Evaluating the success of a particular business in terms of ways to achieve goals should take into account not only compliance with the principle of compliance with the state and trends of the universe as a whole. Important points for clarifying such an assessment are the facts of the positive or negative impact of business on the immediate phenomena of the surrounding world. These phenomena, first of all, include nature and human capital.

A threat to future business success is, for example, disruption of the ecological balance due to the clogging of nature with technological waste, as well as social tension due to unfair payment of staff, and so on. It is also necessary to clarify the business assessment depending on the speed of its response to technological innovations (Fomin & Potokina, 2020). Here is a vivid example of the company "Polaroid", which secured rapid financial success in 1963 by mastering the technology of obtaining analog photos directly at the time of shooting. Decades later, this example inspired many companies to produce digital-based photographic equipment.

Evaluating a business according to general humanitarian criteria allows each interested user to draw conclusions about the reliability and prospects of this particular business based on their personal worldview. The general humanitarian assessment is universal and applies not only to business, but also to politics, literature, and so on. Direct assessment of the business should be linked to the most general understanding of its purpose, namely, to ensure the growth of invested financial resources. This provision is a methodological justification for the possibility and necessity of quantifying the success of a business at a specific time and in dynamics by comparing the resources spent and the results obtained. The universality of the assessment is ensured by the use of cost indicators of resources spent and results obtained. From the point of view of the business owner, it is of paramount importance to compare the equity capital with the net profit received from its use, which remains at the disposal of the owner after all mandatory payments (Manyaeva et al., 2016). From the point of view of management, it is also important to compare all the resources used (including borrowed funds) with all types of results (total accounting profit, sales volume, etc.).

Problem Statement

The direct assessment of business success consists in describing the financial efficiency of financial resources spent by owners. This type of characteristic includes many different factors. For the sake of simplicity and practical expediency, these factors are grouped by generalizing indicators (Haber & Schryver, 2019). There are two main parts of the information that is used to evaluate and then analyze the level and dynamics of the financial performance of the business. First, the necessary primary information is determined, which is formed on the basis of direct observations and systematic accounting data. Secondly, analytical indicators are calculated based on the initial data, which can be used to achieve the desired level of detail in the characteristics of the immediate subject of assessment. The theory and practice of financial management shows that the most popular indicator that reflects the financial performance of a business is the return on equity. The main indicators that are required for the analysis of this indicator are shown in Table

Problematic issues in the analysis of business success from the point of view of return on equity are, first of all, determining the significance of individual factors in accordance with the priority of their economic content. It is also important to rank individual factors according to the direction of their impact on changes in return on equity. Among the unidirectional factors (acting in the direction of increasing or decreasing the return on equity), it is recommended to rank them according to the strength or magnitude of influence.

Research Questions

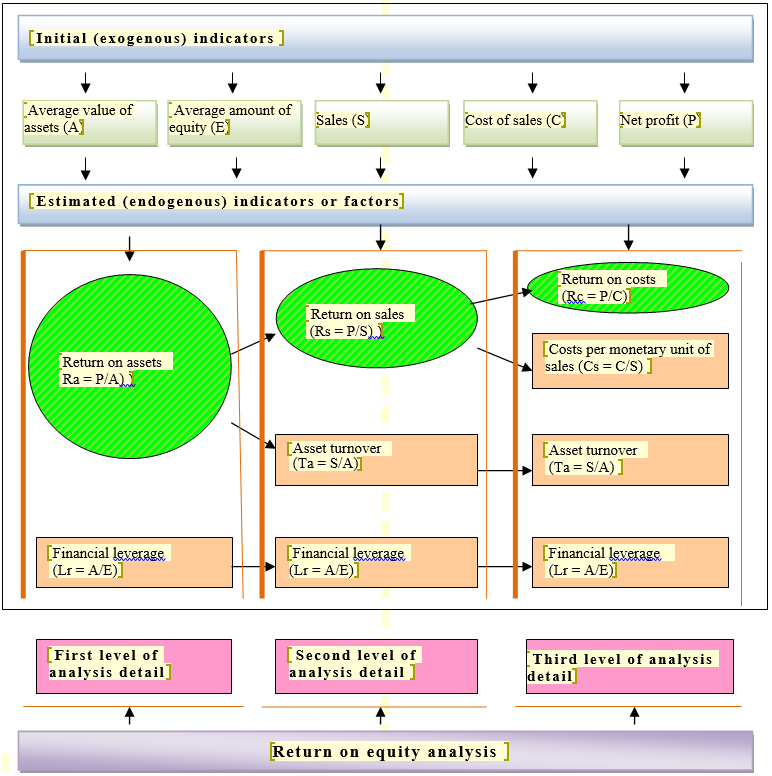

The depth of the return on equity analysis is determined by two main factors. Much depends on the needs of a particular user in the specific results of this type of analysis. As a rule, in conditions of consistently high business profitability, a superficial analysis that gives a general idea of the state of affairs is sufficient. Non-rhythm and low profitability of the business force owners, management and various stakeholders to be more demanding to the results of the analysis, that is, to be interested in as many reasons as possible, on which the value of profitability depends. The number of factors that are taken into account during the analysis determines the level of depth or detail of the analysis. The simplest or first level of analysis involves at least two factors, the second level – three, and so on. Figure

Source: authors.

Figure

Re = P/E = (А/Е) * (P/A) = Lr * Ra (1)

Re = P/E = (А/Е) * (S/A) * (P/S) = Lr * Ta * Rs (2)

Re = P/E = (А/Е) * (S/A) * (C/S) * (P/C) = Lr * Ta * Cs * Rc (3)

all symbols of indicators are taken from Table

In Figure

Purpose of the Study

The main objective of the return on equity analysis is to identify specific factors that affect the amount of return on equity, as well as to identify the impact of these individual factors on changes in return on equity. The theoretical basis for calculating the impact of individual factors on changes in return on equity is the sequence of calculating factors: from quantitative to qualitative, as well as in the sequence: from extensive to intensive. The influence of another factor is defined as the product of its change on the actual value of other factors that are more quantitative (more extensive) than the calculated factor. The result obtained is multiplied by the product of all other factors that are more qualitative (more intensive) than the calculated factor.

The formalized representation of the schemes for calculating the influence of factors assumes the following conventions. Let the previous or basic values of the indicator values be indicated by the symbol (0), and the changed, actual or current values of the indicator values are indicated by the symbol (1). At the same time, a change in a specific indicator is indicated by the symbol"∆", which is placed to the left of the indicator designation. The impact of individual factors in the projection of each level of detail in the return on equity analysis is presented as follows:

For the first level of detail analysis of return on equity:

- change in return on equity under the influence of changes in the level of financial leverage:

∆Re(Lr) = ∆ Lr * Ra(0) (4)

- change in return on equity due to changes in the level of return on assets:

∆Re(Rа) = ∆Ra * Lr(1) (5)

For the second level of detail analysis of return on equity:

- change in return on equity under the influence of changes in the level of financial leverage:

∆Re(Lr) = ∆ Lr * Ta(0) * Rs(0) (6)

- changes in return on equity due to changes in the rate of asset turnover:

∆Re(Та) = ∆Ta * Lr(1) * Rs(0) (7)

- changes in the return on equity under the influence of changes in the level of return on sales:

∆Re(Rs) = ∆Rs * Lr(1) * Ta(1) (8)

For the third level of detail analysis of return on equity:

- change in return on equity under the influence of changes in the level of financial leverage:

∆Re(Lr) = ∆ Lr * Ta(0) * Сs(0) * Rс(0) (9)

- change in return on equity due to changes in the rate of asset turnover:

∆Re(Та) = ∆Ta * Lr(1) * Сs(0) * Rс(0) (10)

- changes in the return on equity under the influence of changes in the level of return on sales:

∆Re(Cs) = ∆Cs * Lr(1) * Ta(1) * Rс(0) (11)

- change in return on equity due to changes in the level of return on sales:

∆Re(Rc) = ∆Rc * Lr(1) * Ta(1) * Сs(1) (12)

Research Methods

Real calculations of changes in the level of return on equity in the context of individual factors highlight a wider range of issues than can be assumed only on the basis of the methodology of such an analysis of return on equity. In particular, the conclusions from the results of the analysis at different levels of its detail regarding the ratio of the strength of the influence of extensive and intensive factors may not coincide. To illustrate the features of quantitative expression of the influence of factors on changes in return on equity, we use the data in Table

The calculation of the impact of individual factors on the change in the level of return on equity in the context of the levels of detail of the analysis is presented in Table

Findings

The first level of detail analysis showed that there is a predominant positive influence of the intensive factor (return on assets) in the change in return on equity by +0.0126. The financial leverage factor had a slight negative impact (-0.0004). The general conclusion from the results of factor analysis is that the situation is very favorable for a business that effectively uses its internal resources. The total increase in return on equity of +0.0122 is the sum of the impact of these identified factors.

The conclusions made at the first level of detail are confirmed at the second level of analysis detail. Here, too, intensive factors are clearly distinguished by their impact on increasing the return on equity. In particular, the largest positive impact belongs to the "return on sales" factor of + 0.0112. This positive effect is slightly supplemented by the factor that has a less intensive "asset turnover" of + 0.0014. The negative effect of the financial leverage factor (-0.0004) is identical to the insignificant value obtained at the first level of analysis detail.

The third level of detail analysis provides a more detailed picture of the ratio of extensive and intensive factors by the strength of their influence on changes in return on equity. It also confirms the predominant positive impact of the most intensive "return on costs" factor (+0.0117) in the overall increase in return on equity (+0.0122). A slight negative impact was found in another intensive factor "costs per monetary unit of sales", which acted in the direction of reducing the return on equity (-0.0005). This indicates the heterogeneity and multidirectional actions of similar economic content (degree of intensity) factors.

Conclusion

The calculations show the correctness of the conclusions that each intensive factor contains an extensive component, which is revealed at a higher level of analysis detail:

∆Re(Rа) = ∆Ra * Lr(1) = [∆Re(Та) + ∆Re(Rs)] = 0.0126 = 0.0096 * 1.3098 = 0.0014+ 0.0112 (13)

∆Re(Rc) = ∆Rc * Lr(1) * Ta(1) * Сs(1) = [∆Re(Cs) + ∆Re(Rc)] = 0.0112 = 0.0082 * 1.3098 * 1.0405 = -0.0005 + 0.0117 (14)

Generalized factors at a lower level of analysis detail may contain intensity and extensiveness components that are detected at higher levels of detail. In Table

References

- Bruskin, S. N., Brezhneva, A. N., Dyakonova, L. P., Kitova, O. F., Savinova, V. N., Danko, T. P., & Sekerin, V. D. (2017). Business performance management models based on the digital corporation’s paradigm. European Research Studies Journal, 20(4A), 264-274.

- Dudin, M. N., Frolova, Е. Е., Lubents, N. A., Sekerin, V. D., Bank, S. V., & Gorohova, А. Е. (2016). Methodology of analysis and assessment of risks of the operation and development of industrial enterprises. Quality - Access to Success, 17(153), 53-59.

- Igoshina, N. A., Manyaeva, V. A., & Fomin V. P. (2019). Evaluation of the financial security of the competitive environment of the firm. European Proceedings of Social and Behavioural Sciences, 79, 1462-1467.

- Haber, J., & Schryver, C. (2019). How to Create key performance indicators. The CPA Journal, 89, 4.

- Manyaeva, V. A., Piskunov, V. A., & Fomin, V. P. (2016). Strategic management accounting of company costs. International Review of Management and Marketing, 6(5S), 255-264.

- Fomin, V. P., & Potokina, E. S. (2020). Trends in optimizing the formation of consolidated reporting in holding companies in the context of global digitization. In S. Ashmarina, M. Vochozka, & V. Mantulenko (Eds.), Digital Age: Chances, Challenges and Future. Lecture Notes in Networks and Systems, 84 (pp. 233-242). Springer.

- Rasskazov, S., Rasskazova, A., & Deryugin, P. (2020). Corporate governance. Infra-M.

Copyright information

This work is licensed under a Creative Commons Attribution-NonCommercial-NoDerivatives 4.0 International License.

About this article

Publication Date

30 April 2021

Article Doi

eBook ISBN

978-1-80296-105-8

Publisher

European Publisher

Volume

106

Print ISBN (optional)

-

Edition Number

1st Edition

Pages

1-1875

Subjects

Socio-economic development, digital economy, management, public administration

Cite this article as:

Fomin, V. P., & Tarasova, T. M. (2021). Peculiarities Of Quantitative Assessment Of Business Financial Success Factors. In S. I. Ashmarina, V. V. Mantulenko, M. I. Inozemtsev, & E. L. Sidorenko (Eds.), Global Challenges and Prospects of The Modern Economic Development, vol 106. European Proceedings of Social and Behavioural Sciences (pp. 1774-1783). European Publisher. https://doi.org/10.15405/epsbs.2021.04.02.211