Abstract

At the present stage of the development of society, the digitalization of all processes of life and people's work as a new stage of its development becomes an important component. Increasingly, the population is using modern technological means for work, study, travel, etc. Most of the innovations and changes have been integrated into the economy and finance, reducing transaction costs, improving the efficiency of production and financial cycles, and ensuring the reliability and security of information resources. Modern means of payment, calculation, data analysis are all resources that directly affect the economies of individual companies, countries and regions. Innovative digital assets have found their application in various sectors of national production by being able to attract the necessary sources of financing to provide a quality new product, as well as the absence of restrictions on investment within one country. The international use of digital payment tools has led to the expansion of their use every year. Thus, in early 2017, the token was perceived only as another digital means of payment, but over time its functionality has undergone changes: tokens began to be used as securities, goods, and companies engaged in innovative technologies, began to consider this digital asset as a mechanism to protect cloud storage and, accordingly, user information. Thus, the relevance of the presented work is to study and analyze the new possibilities of the token.

Keywords: Cloud storagedigital economydigital asseteconomic securityinternational investment

Introduction

The Decree of the President of the Russian Federation of 09.05.2017 №203 "On the strategy for the development of the information society in the Russian Federation for 2017-2030" has become one of the fundamental documents in the development of the digital economy. The principles established by the Strategy are aimed at ensuring access to information with free choice of means for its receipt, the legality of collecting, storing and distributing information data, obtaining goods and services in the usual (traditional) form, as well as protecting citizens in the information environment. However, the main objective of the document is to create general knowledge where the production, preservation, acquisition and dissemination of reliable information for the development of all economic actors is paramount, taking into account national strategic objectives.

The Government of the Russian Federation, whose legislation has made an invaluable contribution to the digitalization of the national economy, has contributed to the promotion of the already built direction. The digital economy, in accordance with the regulations of the Government of the Russian Federation, is a set of objects, entities, institutions and legal relations involved in the economic turnover of end-to-end digital technologies listed by the Government of the Russian Federation in the Digital Economy of the Russian Federation National Program, namely:

1. Big data.

2. Industrial Internet.

3. Neurotechnology and Artificial Intelligence.

4. Distributed registry systems.

5. Quantum technology.

6. New manufacturing technologies.

7. Robotics and sensor components.

8. Wireless technology.

9. Virtual and augmented reality technology (Resolution of the Russian Government of 2 March 2019 N 234 (ed. 21.08.2020) "On the system of management of the implementation of the national program "Digital Economy of the Russian Federation").

In the last few years, there has been another qualitative leap in the development of information and communication technologies, due to four circumstances:

1. Digital technologies are constantly expanding their scope.

2. The cost of implementing and operating the tools involved is constantly falling.

3. The degree of digitization of economic activity is constantly increasing (including due to the influence of the first two factors).

4. The availability and prevalence of digital devices (computers, phones, smart devices and machines connected to the Internet of Things) is constantly growing.

The set of these circumstances has led to the formation of qualitatively new conditions in which new business models based on the development of digital ecosystems supported by digital platforms become economically meaningful.

Problem Statement

According to the Federal Law of 23.07.2020 N 259-FZ On Digital Financial Assets, Digital Currency and Amendments to Certain Laws of the Russian Federation, adopted by the State Duma in its third reading on July 23, 2020, but not effective at the time of writing, it can be noted that digital financial assets are digital rights, including monetary requirements, the ability to exercise rights on emission securities, the right to participate in the capital of a non-profit, the right to require the transfer of emission securities, which are provided for by the decision to issue digital financial assets in accordance with this Federal law. The Federal Law does not contain the concept of "token" and "mining" but defines the digital currency. These "digital" data can be used as a means of payment, but such "money" is neither an international currency nor a currency of a foreign state or Russia, that is, cannot be used to pay for goods and services. The document establishes that only a person licensed to carry out depositary activities can act as a nominal holder of digital financial assets. The operator of the information system in which these digital financial assets are issued cannot act as a nominal holder of digital financial assets. In practice, digital financial assets can be divided into two main classes - tokens and coins. Coin is a virtual coin, which is just called cryptocurrency. It is used as digital money with the ability to purchase goods and services, as well as other payments directly between users, without intermediaries. Technically, such a cryptocurrency necessarily has its own blockchain.

The token is a virtual token, a kind of certificate for receiving economic benefits in the form of goods, works, services or money (when selling a token). It can also play the role of virtual money, because it has a certain value, but its main purpose is to provide certain rights or services. Tokens do not have their blockchain, and their use is based on the functionality of other platforms. If the coin is a cryptocurrency, an analogue of digital money, which is provided for real (fiat) money, then tokens are purchased as access to certain services.

Ethereum has been widely praised for its additional smart contract functionality, which allows you to encode logic into the blockchain, creating the ability to replicate, for example, business processes that run automatically. Smart contracts also allow the developer to create a token on top of the protocol. The token can have functionality that goes beyond the exchange of values - it can represent any asset or function set by the developer. When an Ethereum token is created, it is created as a smart contract, with each token being managed by one unique contract manager. Startups and mature companies have taken advantage of Ethereum's smart contract functionality by creating decentralized applications (Dapps) on top of Ethereum and creating their own unique tokens. Over time, a standard of tokens called ERC-20 was adopted, which ensures the compatibility of tokens in the Ethereum network. The token standard controls a set of functions for each token, which essentially creates a pattern by which other tokens compatible with ERC-20 can be cloned in a relatively simple way. Companies that create tokens using the ERC-20 standard benefit from being able to easily interact with other tokens (e.g. by exchanging one token for another). Tokenization of the economy involves lowering the cost of creating and selling securities, establishing a base for creating a more efficient financial market. Many authors highlight the following benefits of using tokens for both investors and issuers (Dotsenko & Mishchenko, 2020):

1. The token due to the possibility of crushing, which traditional securities do not have, allows to significantly expand the range of potential investors. And tokenization of low-liquidity assets will allow you to take into account the value of the underlying asset, as well as trade it.

2. Because tokens are based on smart contracts created specifically for them, the process of obtaining or selling the token can be automated, allowing transactions to be made faster. At the same time, the number of intermediaries is reduced, as is the administrative costs, which saves financial resources on such economic transactions.

3. The token stores all the necessary information related to ownership, due to the fact that the blockchain technology, which is the basis of the token does not allow to change records, all transactions with token become open and accessible.

4. As mentioned earlier, the token can be broken into pieces. Thus, it allows investors to buy the token not entirely, but, for example, some part of the expensive digital asset. However, under such circumstances, the minimum amount of investment cannot be established, allowing any person to invest absolutely any amount of money he has.

However, there are a number of drawbacks to the use of tokens in corporate finance. First of all, it is the absence of a regulatory framework capable of regulating the circulation and directly the process of tokenization of assets. In the absence of proper legislation, there are risks associated with fraudulent schemes. The main problem is the concealment of existing assets, the reduction of the tax base (the judicial practice of the Russian Federation, as a rule, does not classify tokens as electronically monetary units), as well as the creation of fraudulent ICOs (Shulga & Kolomoets, 2018).

Research Questions

However, the potential for the development of crowdfunding, which carries a token, cannot be understated. The cost of conducting an ICO is much lower than the initial issue of shares, although they provide an opportunity to get dividends only after the project is implemented (Kornilov & Kornilova, 2019). At the same time, it allows the owners of the asset or the creators of the project to essentially present their small economic system, where the main unit (including payment) becomes a digital product. However, some obstacles must be overcome to enable tokenization and the broader token economy to develop. The big problem arises around regulatory alignment, as blockchain-based platforms are decentralized (Vasilevskaya, 2019). Security requirements vary from jurisdiction to jurisdiction, this problem is solved by security markers may fall under the full scope of the relevant rules.

At the same time, a new obstacle raises the question of assessing the company's capitalization through tokens. Capitalization is usually calculated based on the number of shares issued, multiplied by their current value. The inclusion of tokens in this system raises many questions for existing companies, the main of which is how to estimate the value of the company using digital assets? It is worth recalling that the token, unlike the stock does not provide the right to vote and dividends (although additional payments can be promoted by the company itself), nevertheless they are subject to sale on the secondary market, therefore, their price may change. Although, of course, the same volatility as securities will not.

In terms of valuation approaches, all digital financial assets now carry high risks and are highly volatile. The valuation of tokens is comparable to the assessment of early-stage startups, where the market, the founding team and the subjective opinion of investors play a major role. Objectively assess the market value is possible only those that have value in the technological sense, as well as attract the attention of a large number of market newcomers and inexperienced investors. Projects that do not have innovative technological value, to evaluate pointlessly, as private transactions are quite rare and very subjective, and exchange transactions are mostly purely speculative (for example - "buzcoin" - a token issued under the brand Olga Buzova).

Purpose of the Study

It is also not scientific to evaluate crypto assets with a cost approach, as their cost largely depends on the interest of the market and is not related to mining costs. Mining is a separate type of business. In addition, not every blockchain can calculate the cost of mining. The revenue approach is also not applicable in the case of the evaluation of crypto-monitors, due to the fact that it is impossible to predict neither the future market trend nor cash flows. However, it can be used to evaluate tokens. The only method that allows you to correctly estimate the market value of popular coins and tokens is a comparative (market) approach. Then there is the question of whether to buy a token. The company's net profit, turnover and revenue are the support of each stock. To issue a token, the company can use any asset that, for example, is not suitable for the stock. It can be human labor, basic assets, intangible assets, jewellery, etc. After drawing up an electronic certificate of assets that underpin the token (by the way, these may be the same securities), the company creates a smart contract on a special platform. And if the conditions set by the organization, such as the implementation of the project, are met, the contract receives information about all transactions, including this one, and automatically "closes" by distributing the money received among the token holders. As described earlier, due to the lack of regulatory regulation, companies take advantage of the fact that they transfer all their assets to tokens. In Russian practice, there is a case when tokens recognized as part of electronic funds and collected from the organization the necessary payments. But most of the tokens do not appear in court proceedings, as no law determines what the token is and how to regulate the legal relations in which it participates (Shulga & Kolomoets, 2018).

Research Methods

Consequently, many of the benefits of tokenization do not apply if regulations governing the issuance and circulation of tokens prevent the free and international exchange of security tokens. It is therefore necessary to develop compatible methods for the creation and exchange of tokens on a national and, ideally, international scale. Up to a certain point, the issue of regulating transactions related to tokens has not been raised. However, the growth of financial transactions could not help but attract the attention of the legislative industry in various countries

The initial issue of tokens is one of the tools to attract the financial resources of domestic investors from foreign markets. According to the data of the consulting company Ernst & Young (2018), in 2017 the Russian Federation was in second place in the number of ICO projects implemented, most of which were implemented outside the country. According to the agency ICO Bench, for the fourth quarter of 2018, Russian residents raised more than $2 billion in total tokens, conducting more than 300 ICOs-projects (ICO Bench, 2019).

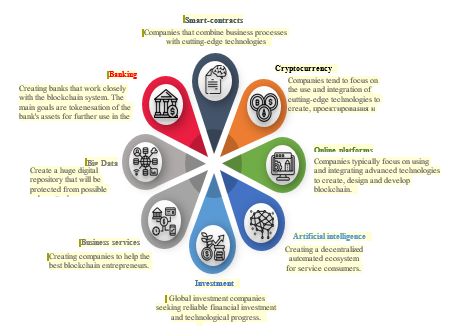

At the same time, the categories in which funds are attracted through the digital assets presented are not limited (Figure

The development of fundraising technology in different areas of activity becomes more attractive every year (Table

Source: authors based on (STO.token-economy, 2020).

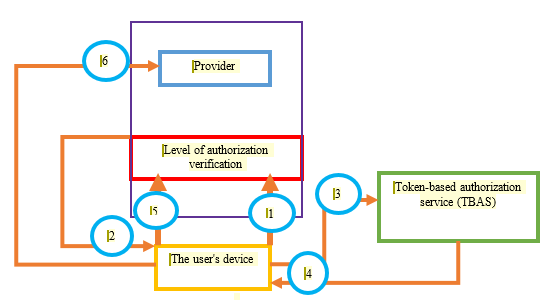

At the same time, attracting financial resources is not the sole purpose of using tokens. The number of spheres where tokens are used are replenished every year. However, since the tokens are based on smart contracts based on the blockchain system, recently found a new application of this innovation. Internet of Things (IoT) devices are generally characterized by low power consumption, limited memory and computing power, but are limited in reliability, computing performance, security, and privacy. Thus, the Internet of Things and cloud computing complement each other perfectly. Thanks to the mature technology of cloud platforms, the storage space of cloud services is virtually unlimited. Distributed and parallel computing capabilities allow you to process large amounts of perceptive data from ubiquitous wireless sensors. The integration of cloud computing and the Internet of Things makes software services and consumption available anywhere and at any time. So the way the cloud server authenticates and authorizes billions of devices is a huge challenge. As a reason, foreign companies have started to create a token-based authorization service (TBAS) because devices will have safer access to cloud services through a token. Hundreds of millions of IoT devices access a variety of cloud services through the communications network. There are many devices in this area, and authentication and authorization platform is needed to ensure that each device is legally authorized to access cloud resources. Therefore, foreign authors propose to use the basic structure and ensure control of access to privacy and authorization structure, which is integrated by the launch of external TBAS. It generates a set of tokens in accordance with the requests of the devices and checks the reasonableness and legitimacy of the creation of the token. The token has time and quantity restrictions and can effectively take information security protection measures with such a record (Figure

Source: authors based on (Lee et al., 2017).

The standard TBAS process is presented on the above. The implementation process is as follows:

The user's device does not use a token to access services in the cloud.

The user's device stops the level of authorization verification and is asked to use the token for authentication and authorization.

The user's device asks for a marker from TBAS.

TBAS verifies the validity and legality of the request and provides a marker.

The user's device re-requests services from the provider. The level of authorization verification approves authentication.

The user's device can use the service for a certain period of time and for a certain number of times.

Findings

Thus, each token is issued by a third-party verification center, and it has limitations on time and quantity. Every access to cloud services will be counted once. When the number of links to the token exceeds the value set by the system, the marker becomes invalid and the user receives a notification about the request for a new marker issued by the system. Prolonged non-use of the token will result in its expiration date. As a result, the risk of hacking into Internet of Things devices will be reduced. Every use of IoT devices is recorded by a token that can effectively protect information security through such a record. For example, if a token grows rapidly in a short time, it can be used as an opportunity for DDoSS-attacks (the system sends a lot of requests that it is unable to process). In other cases, if IoT devices try to illegally access other services or data, such attempts can be tracked by observing the token's behavior.

In addition, network information security monitoring is focused on the token, so device privacy can be protected. The system can only know whether the token is valid or not, or has the right to access what types of services and data, but cannot know the true identity of the devices. In addition, the token can be used to integrate a wide range of cloud services, so the application of the token is not only limited to platforms developed by developers, but can also create more innovative applications and greater security. That's why developers don't have to worry about the privacy of their products.

In international practice, in particular the Organization for Economic Union and Development, the following types of tokens have been identified:

1. Tokens as a means of payment.

2. Utility token – the emission takes place within the framework of the project and is used as means of payment within the project.

3. Security token – a digital asset that gives ownership of a stake in a company is, in some cases, the right to make a profit.

This separation allows legislators to take the best approach to regulating digital financial relations in the same way as international practice. Legislation is being developed in the Russian Federation for the most popular types of tokens - utility token and security token. This activity is directly related to the laws on taxes, securities and consumer protection.

There are two approaches to securities legislation that emerged in 2017-2018:

1. Regulating token-related relationships. In this case, rights and obligations are established for token holders and issuers. This approach is used by Germany, the United States, Singapore, etc.

2. Regulation of the initial issue of tokens, regardless of the content of the financial relationship. In this approach, separate regulations should be adopted for tokens. This is the way France uses, the same logic is present in the bills of the Russian Federation on digital financial assets.

One of the first countries to apply securities laws to tokens that are used as securities was the United States. In 2017, the Securities and Exchange Commission announced that token transactions are required to comply with securities laws (International Organization of Securities Commissions, 2017). The document issued by the Commission provides criteria by which the token can be classified as securities, and provides an example of the DAO project (Securities and Exchange Commission, 2017), whose tokens were recognized as a security in the same year. This has had a huge impact on the international experience of regulating digital assets, as U.S. securities law is extraterritorial - meaning that the initial issuance of tokens by a company registered in another jurisdiction must comply with U.S. securities regulations, even if the main parties to the transaction are citizens of another country. Legislative bodies in Germany, Hong Kong, Singapore, the European Union, Canada and other countries subsequently launched similar initiatives. In the fourth quarter of 2017, the Central Bank of the Russian Federation made a similar statement, noting that ICO-projects can carry high investment risks (The Central Bank of the Russian Federation, 2020).

As noted earlier, special rules of law may be developed for the initial issuance of tokens if the ICO is not covered by securities legislation. This approach is being implemented in France, where a public ICO bill has been created. In accordance with the regulations, the token issued publicly to attract financial resources will be subject to special regulation. The person who is issuing tokens must prepare documents providing all the information regarding the issued tokens and the issuer itself, as well as obtain permission from the Financial Markets Authority in France. The documents prepared by the issuer must meet the disclosure requirements: accuracy, clarity, notification of possible risks associated with the release, and suppression of input into the confusion of investors. In turn, the Financial Markets Authority evaluates the submitted documents. If the regulator notices a discrepancy in the issuance of tokens to documents that were previously provided, it immediately informs all investors, revoking the permission for ICO.

Conclusion

Thus, the example of France can be observed a mechanism to protect the interests of investors, which is implemented on the basis of permissive order. It should be noted that the bill does not limit the volume and maximum amount of investment in ICO-projects, the subsequent resale of tokens on organized crypto-platforms is also not regulated and, therefore, is not limited. Regulatory regulation is the fundamental basis for the development of financial relationships based on digital assets. At the same time, tokens provide an opportunity to invest in assets that are not highly liquid, as well as to invest in assets available amounts of funds. The digital asset under consideration is relevant for the Russian economy, as one of the strategic goals is to diversify the economy and move away from the commodity economy. Thus, tokens become a necessary tool to raise funds for new innovative start-ups both in the sphere of large enterprises and for small and medium-sized enterprises. In the new economic model, digital assets will be able to protect the rights of investors (including their data) and greatly facilitate the search for financial resources for economic actors.

References

- Decree of the President of the Russian Federation of 09.05.2017 №203 "On the strategy for the development of the information society in the Russian Federation for 2017-2030". http://kremlin.ru/acts/bank/41919

- Dotsenko, D. A., & Mishchenko, O. A. (2020). Types of asset tokenization in the finances of business entities. Vestnik SIBITA, 1(33), 26-31.

- Ernst & Young (2018). Initial coin offerings: The class of 2017 – One year later. https://assets.ey.com/content/dam/ey-sites/ey-com/en_gl/news/2018/10/ey-ico-research-web-oct-17-2018.pdf

- Federal Law of 23.07.2020 N 259-FZ "On Digital Financial Assets, Digital Currency and Amendments to Certain Laws of the Russian Federation". http://www.consultant.ru/document/cons_doc_LAW_358753/

- ICO Bench (2019). ICO market quarterly analysis. https://icobench.com/reports/ICO_Market_Quarterly_Analysis_Q1_2019.pdf

- International Organization of Securities Commissions (2017). Investor bulletin: Initial coin offerings. https://www.iosco.org/library/ico-statements/United%20States%20-%20SEC%20-%20Investor%20Bulletin%20Initial%20Coin%20Offerings.pdf

- Kornilov, D. A., & Kornilova, E. V. (2019). Cryptocurrency and the tokenization of the business. Bulletin of the NGIEI, 5(96), 107-118.

- Lee, S. -H., Huang, K. -W., & Yang, C. -S. (2017). TBAS: Token-based authorization service architecture in Internet of things scenarios. International Journal of Distributed Sensor Networks, 13(7).

- Resolution of the Russian Government of 2 March 2019 N 234 (ed. 21.08.2020) "On the system of management of the implementation of the national program "Digital Economy of the Russian Federation". http://www.consultant.ru/document/cons_doc_LAW_319701/

- Securities and Exchange Commission (2017). Report of Investigation Pursuant to Section 21(a) of the Securities Exchange Act of 1934: The DAO. https://www.sec.gov/litigation/investreport/34-81207.pdf

- Shulga, A. V., & Kolomoets, D. A. (2018). Signs of fraudulent transactions conducted under the guise of the initial placement of tokens (ico). Vestnik CRU of the Russian Interior Ministry, 4(42), 29-33.

- STO.token-economy (2020). Security token offering (STO) in 2019. https://sto.tokens-economy.com/country.html?country=2019&year=2019

- The Central Bank of the Russian Federation (2020). Overview of cryptocurrencies, ICO (initial coin offering) and approaches to their regulation. https://cbr.ru/content/document/file/36009/rev_ico.pdf

- Vasilevskaya, L. Y. (2019). Token as a new object of civil rights: Problems of legal qualification of digital law. Actual Problems of Russian Law, 5(102), 111-119.

Copyright information

This work is licensed under a Creative Commons Attribution-NonCommercial-NoDerivatives 4.0 International License.

About this article

Publication Date

30 April 2021

Article Doi

eBook ISBN

978-1-80296-105-8

Publisher

European Publisher

Volume

106

Print ISBN (optional)

-

Edition Number

1st Edition

Pages

1-1875

Subjects

Socio-economic development, digital economy, management, public administration

Cite this article as:

Pavlova, I. V., & Nurislamova, N. R. (2021). Assessing The Capabilities And Functionality Of The Token. In S. I. Ashmarina, V. V. Mantulenko, M. I. Inozemtsev, & E. L. Sidorenko (Eds.), Global Challenges and Prospects of The Modern Economic Development, vol 106. European Proceedings of Social and Behavioural Sciences (pp. 1563-1573). European Publisher. https://doi.org/10.15405/epsbs.2021.04.02.187