Abstract

Keywords: Corporationcorporate controlcorporate governance assessmentcorporate propertycorporate relations

Introduction

In modern reality, which is taking place under the sign of a change in the technological order, the restructuring of the existing system of economic relations primarily affects property relations. As a system-forming element, property relations determine the directions and establish acceptable (objective) boundaries for the progressive development of the socio-economic system. Catching changes in the level and nature of the development of productive forces, forms of ownership send specific "signals" to capital (real, financial, human intellectual), form a coordinate system for its sustainable development.

Corporate property in its historical development goes from private ownership to the Association of individuals (owners of capital), and then to institutional corporatization, when shares are owned by large institutions (insurance companies, pension funds, investment and banking structures). The world is on the path of increasing capital expenditures, and the corporate form of production organization is closer to effective. Until now, the competitiveness of the national economy is determined by the availability of organizational and legal forms that can integrate and mobilize resources, effectively distribute them in the right direction and at the right time. The study of long-term directions of corporate property reproduction requires the development of methodological approaches to corporate property management, the application of which in practice will allow attracting and redistributing limited resources at the lowest cost, and quickly and effectively adapting to changing conditions of technological development.

Problem Statement

OECD (2019) specialists dealing with corporate governance and corporate law have recently announced an interesting fact - in developed countries there is a tendency to concentration of corporate property, a decrease in the influence of small shareholders (more often individuals), and an increase in the influence of large institutional investors. What's the matter? Have the previous institutions defining ownership turned out to be ineffective? Is the institutional environment for framing corporate structures ineffective? Or is it a manifestation of the trend of oligarchization, including corporate capital managers?

Curious and very important for a corporate structure based on a corporate form of ownership, the following pattern is that a clear designation of property rights is beneficial before the income from the specification does not exceed the cost of overcoming the “dilution”. An important point is the concept of "co-ownership" (Belayeva et al., 2019). An interesting and important approach to the concept of a dominant owner, as the owner of more than half of the property, which allows him to feel like the only owner of the collective property. At the same time, no one denies that in conditions of extreme dispersal of powers, the status of the dominant owner can be changed (Filatova, 2013; Karamova, 2009; Tullock, 2011).

In Russian reality, for large corporate structures, and not only that, dominance of a large owner is characteristic. Some experts try to explain this phenomenon by the desire to avoid numerous corporate conflicts caused, as we assume, by the imperfection of the institutional environment, insufficiently clearly spelled out rights of owners. A clear definition of their powers is a condition for the effective use of corporate property. The specification of property rights will lower transaction costs and reduce market uncertainty. In our opinion, there is a very thin line of economic understanding of corporate property and the legal aspect - the definition of the rights of economic entities in the field of ownership, disposal and use, development of a mechanism for their effective implementation.

True, this is not provided for in Russian practice, the scattering of powers did not take place, the lack of a clear definition of property rights led to an increase in conflict situations and a growing concentration of corporate property. Until now, this has been seen as a serious drawback in the development of corporate property in the Russian realities.

It should be assumed that the world economy is entering a new level of concentration of capital and production, determined by a new technological order, and in the new conditions of socio-economic development, property relations, primarily corporate, are being rebuilt, reflecting the ongoing changes and new needs (Belayeva et al., 2020). There is a serious rationale for issues related to the transformation of property relations: nationalization and privatization, the definition of a potential effective owner, the assignment of property rights to a certain economic entity.

The objective reason for the genesis of the institution of corporate property is determined by the need to mobilize huge amounts of money capital, by combining individual capitals, primarily sufficient for the implementation of certain types of economic activity in order to realize the rights of economic entities to receive appropriate capital income.

Research Questions

Corporate ownership is in the form of money capital, but by its nature reflects the diverse activities of the corporation:

- production - ownership of industrial assets: fixed and working capital, manufactured products;

- scientific and technical (innovative): the state and share of intangible assets, characteristics of intellectual property;

- financial - attracting financial resources, investing, organizing accounting, incl. income and expenses related to the disposal and use of corporate property;

- a special place is occupied by the assessment of the effectiveness of the use of corporate property: the production and sale of quality goods and services, the determination of quantitative parameters of financial activities (profit, loss, dividends, etc.).

The economic map of the world is changing, property relations, determined by the specificity of corporatization of capital, break all ideas about competition, market interaction and economic influence. We are talking about the globalization of property relations associated with the appropriation and distribution of goods. The practice of globalizing economic relations requires new research and clarification. Globalization is an "oscillatory" process. The trend of closeness and protectionism, which has now come to the fore, is a temporary phenomenon.

The national economy cannot effectively exist outside of international cooperation, outside the sources of technologies, sources of raw materials, markets for products and services. The idea should be to form multiple (multi-vector) value chains. It means that at each stage of industrial chains and value added chains there should be a reserve channel that allows expanding international cooperation and at the same time insuring the economy from adverse influences, including from subjective political factors (Danilova, 2020).

Purpose of the Study

The purpose of this study is to determine the system of methodological approaches to the study of the interrelated modification of property relations. Any form of ownership has its own economic content, which is defined as a historically specific, objective production relationship. It is necessary to establish the factors influencing the processes of transformation of property relations. The theory of corporate relations as a reflection of the impact of systemic socio - economic transformations also requires further development. The functions of corporate property change and are supplemented in the context of systemic changes in the economy. The characteristics of the subjects of corporate ownership are manifested in the functions they perform, and the actually functioning capital, which determines the main production characteristics, acts as an object of ownership of all owners of the corporation as a legal entity. To study such deep-seated problems, an integrated approach is required, an analysis of the foundations that form the interests of economic subjects of the Russian economy, determination of the boundaries of their rights and opportunities to motivate effective activity, which is especially important in the context of digital transformation, when all ideas change and the boundaries of the economic space are breaking.

Research Methods

In analyzing the modification of property relations and the development of corporate relations, it seems appropriate to focus on neo-Marxist and neo-institutional methodological approaches, in no way diminishing the importance of the basic principles of neoclassicism. Neoclassicism and neoinstitutionalism pay much attention to economic organization. However, the application of the methodology of neoinstitutional economic theory in relation to the specific characteristics of modern forms of ownership seems to be the most appropriate from the point of view of understanding the general picture of the ongoing changes and topical problems of economic science. Neoinstitutionalism does not deny the methods of neoclassical economic theory, but rather, on the contrary, quite actively uses them. Comparing the methodology of neoclassicism and neoinstitutionalism, we can come to the conclusion that the methodology of neoinstitutionalism to a greater extent allows us to explore the specifics of the post-industrial era and the system of relationships between economic actors, since the behavior, interaction and interests of individuals are explained through the characteristics of institutions. Without going into theoretical discussions on the content and specific characteristics of institutions, we adhere to the well-known opinion that economic institutions are the organizational expression of real-life processes in the practice of managing social reproduction within the framework of generally accepted economic norms (Danilova, 2009).

Neoinstitutional economic theory makes it possible to better understand the goals of modern corporate entities, where maximizing the utility of profit (according to neoclassicism) recedes and the need to harmonize the interests of participants in property relations, defining all interest groups, developing interpersonal interaction and increasing dependence on social factors comes to the fore.

In turn, the methodology of the neo-Marxist approach, focusing on a critical rethinking of the content of property (including socialist), and modern economic processes, allows us to identify the objective reasons for the transformation of property relations and the evolution of capital, the emergence of new organizational and legal forms of management, the formation of specific groups of interests (clannish) (Fedotova et al., 2019). The neo-Marxist approach is characterized by the dominance of the economic content of property relations over the legal (legal) one. Property relations are considered as relations between people about the production, appropriation, alienation, distribution and use of goods. The conclusion is made that in different economic systems, similar property relations can have qualitatively different socio-economic characteristics. Consequently, the studied corporate property as historically determined relations is determined by the civilizational order, the prevailing economic system and is formed depending on the answers to the questions - to whom it belongs, in what way and for what it is used. The transformation of property appears as an objective process of transformation of the existing organizational and economic forms of property realization, forms and methods of capital accumulation, changes in the functions of industrial capital.

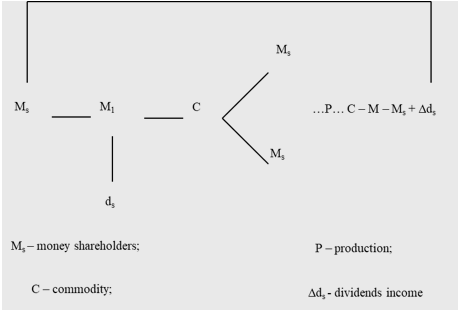

No one denies that "there really is only industrial capital and the profit it brings." However, corporate property arising at a certain stage on the basis of corporatization of capital, ultimately, acquires a leading role in changing the functions of industrial capital, in the form and nature of the distribution of created benefits (Auzan, 2011). Capital in industry through corporatization acquires the form of money capital. There is a separation of M (money capital) from P (production stage). The attitude towards production is changing, because the owner of money capital (shareholder) is not focused on production, but on proceeds from invested capital. This is where the concept of "fictitious capital" appears, which is often used in Marxist theory. The conduct of industrial production passes into the hands of the owners of money capital, respectively, the share capital turns into a kind of additional - fictitious - capital. Equity capital will receive the status of industrial capital only when it is directly connected with the means of production, when money will be used to purchase everything necessary for the production process (Figure

Source: authors based on (Belayeva, 1999).

Neo-Marxists prove, and it is not unreasonable, that the divergence of cash and commodity flows leads to a violation of the dynamic market equilibrium, the emergence of instability of money income. Clash of interests between groups representing financial and industrial capital often leads to the prevalence of speculative tendencies. The owners of money capital are not interested in the production process (they are separated from it in time and space), but in obtaining benefits. The share capital underlying corporate ownership reflects not the real capital embodied in industrial assets, but the prevailing market situation. Accordingly, discrepancies in the value of real and fictitious capital are inevitable.

The advantage of the neo-Marxist approach is that it allows one to study the transformation of property relations as a systemic process leading to the transformation of the existing organizational and economic forms of property realization (Belayeva et al., 2019). The study of neo-Marxists on modifications of forms of ownership expands the boundaries of analysis, explains the reasons for the state-bureaucratic system of property relations, the legalization of criminal forms of the emergence of private property, and the problems of vulnerability of the Russian model of corporate relations.

The advantage of the neoinstitutional approach in the theory of property relations is that it allows linking legal and economic aspects. The basic concept is “property right” (Danilova & Belayeva, 2020). Property rights apply to tangible and intangible objects (including the results of intellectual property). Behavioral factors come to the fore. Each person must comply with certain norms of behavior in relation to goods. All rights are perceived as sanctioned by society (state laws, administrative orders, customs, traditions). Behavioral relationships arising from the availability of goods and their use can be protected not only by the state, but also by social institutions - morality and customs. Property rights are certain rules of the game, any act of exchange is an exchange of bundles of powers, the wider the choice of powers, the higher the value of the resource. If property rights are not clearly defined, we are faced with the erosion of property rights, a violation of the connection between management decisions in economic structures based on the corporatization of capital and the results obtained.

Findings

At present, any transnational corporate structure can have influence through participation in the capital of another equally significant company and claim certain rights as an independent subject of the corporate process. It would seem that it is necessary to assess this spread and development in the world of corporate property positively. Investment opportunities are growing, property rights are being implemented quite effectively. However, a number of problems arise, without solving which, the world will face a deepening contradiction between corporate and public interests.

As we are seeing in the COVID19 pandemic, this could have far-reaching consequences. Of course, first of all, the concentration of economic power in such a vital area, the desire to maximize profits is an objectively determined process. However, after this, the desire for political influence on human society begins to manifest itself. Modern technologies are beginning to serve the monopolist with all the ensuing consequences, suppression of competition and the predominance of the interests of certain groups of influence. Corporate ownership is an interesting phenomenon. This is a mixed form of ownership with a certain institutional structure, which is characterized by a multi-entity, collective - individual character of appropriation, which is based on the shared pooling of capital through the issue and sale of shares (Nureyev, 2017). Corporate property is an independent form of ownership with a certain institutional structure, is limited from the influence and control of owners and, accordingly, needs a special organization of interaction and management, which represents the right to receive additional benefits. The structure of corporate property determines the diversity of economic interests and underlies the conflict between the main participants in corporate relations, the circle of which is expanding and determines the development of the powers of the subjects of corporate property. On the one hand, the influence of capital owners is increasing, which has far-reaching consequences in relation to the corporate redistribution of property, on the other, the interaction of the corporation with the external environment is changing. And this applies to instability, continuous technological change and the growing impact of social factors on absolutely all aspects of the corporation's life. Thus, we can talk about serious changes in the interaction of participants in corporate relations, the formation of a new model, where presumably not only the quantitative, but also the qualitative composition changes.

Conclusion

There is no clear boundary between the property of the corporation as a legal entity and the property of the owners of monetary capital - shareholders - but with such interaction and rejection of interests, determined, first of all, by the different nature of the economic content of actually functioning capital and fictitious, the contradiction between the interests of owners and executive power represented by money management representatives.

The contradictions between the subjects of corporate ownership are aggravated as a result, as already noted, of the diversity of interests of various categories of owners of money capital (shareholders). In practice, this is reflected in the inconsistency of the provision of capital income and the expansion of the scale of the corporation's activities, the need to limit the profitability of money capital in conditions of expanded reproduction, which already infringes on the rights of capital owners to ensure the expansion of the scale of economic activity. In other words, the possibility of receiving dividends is always limited by the need not only to fulfil current obligations, but also by the need to reinvest profits, incl. and in order to modernize production. If the so-called “patient” shareholders dominate in growing companies, this contradiction does not worsen and does not interfere with the implementation of strategic goals and the implementation of large-scale investment projects. However, there may be another option: the internal inconsistency of the corporate form of ownership causes deepening contradictions and intensifying the struggle of shareholders for power and the redistribution of the results of economic activity. Ultimately, there is an intra-corporate redistribution of property in favor of certain categories of shareholders and senior management.

References

- Auzan, A. A. (2011). Institutional economics: New institutional economic theory. INFRA-M.

- Belayeva, I. Y. (1999). Integration of equity capital and formation of the financial and industrial elite: Russian experience. Financial Academy.

- Belayeva, I. Yu., Danilova, O. V., & Fedotova, M. A. (2020). Trends of property transformation and development of corporate relations in the digital economy. Bulletin of the Astrakhan State Technical University. Series: Economics, 1, 7-16.

- Belayeva, I. Yu., Danilova, O. V., & Uskov, K. V. (2019). Influence of property relations on corporate administration elements in Russian companies. Bulletin of the Astrakhan State Technical University. Series: Economics, 4, 7-13.

- Belyaeva, I. Yu., Kharchilava, H. P., & Danilova, O. V. (2019). Corporative governance and corporate Finance in joint-stock companies with state participation. KnoRus.

- Danilova, O. V. (2009). Social responsibility of business in the market economy system (Theoretical and economic aspect) [Doctoral dissertation]. Financial University under the Government of the Russian Federation.

- Danilova, O. V. (2020). Transformation of property and corporate relations in the aspect of systemic socio-economic transformations. In E. Grigorieva, A. Bystrakov, & D. Vukovic (Eds.), Digital Finance 2020: Collection of Articles of the International Scientific and Practical Conference (pp. 110-115). Peoples' Friendship University of Russia (RUDN).

- Danilova, O. V., & Belayeva, I. Y. (2020). The power grid complex of Russia: From informatization to the strategy of digital network development. In S. Ashmarina, A. Mesquita, & M. Vochozka (Eds.), Digital Transformation of the Economy: Challenges, Trends and New Opportunities. Advances in Intelligent Systems and Computing, 908 (pp. 42-53). Springer.

- Fedotova, M. A., Belayeva, I. Yu., & Danilova, O. V. (2019). Corporate property: Development trends and management risks. RISK: Resources, Information, Supply, Competition, 4, 133-139.

- Filatova, U. B. (2013). The concept of development of the institution of common property in Russia and abroad. Yurlitinform.

- Karamova, O. V. (2009). Features of the methodology of Russian economic and theoretical science. Bulletin of the Finance Academy, 4(52), 37-42.

- Nureyev, R. M. (2017). Economic comparative studies (comparative analysis of economic systems). KNORUS.

- OECD (2019). OECD Corporate Governance Factbook – 2019. http://www.oecd.org/corporate/corporate-governance-factbook.htm

- Tullock, G. (2011). Public goods, redistribution and rent seeking. Publishing House of Gaidar Institute.

Copyright information

This work is licensed under a Creative Commons Attribution-NonCommercial-NoDerivatives 4.0 International License.

About this article

Publication Date

30 April 2021

Article Doi

eBook ISBN

978-1-80296-105-8

Publisher

European Publisher

Volume

106

Print ISBN (optional)

-

Edition Number

1st Edition

Pages

1-1875

Subjects

Socio-economic development, digital economy, management, public administration

Cite this article as:

Danilova, O. V., Belayeva, I. Y., & Strizhov, S. A. (2021). Reproduction Of Corporate Property And Structural Changes In The Economy. In S. I. Ashmarina, V. V. Mantulenko, M. I. Inozemtsev, & E. L. Sidorenko (Eds.), Global Challenges and Prospects of The Modern Economic Development, vol 106. European Proceedings of Social and Behavioural Sciences (pp. 1450-1457). European Publisher. https://doi.org/10.15405/epsbs.2021.04.02.172