Abstract

Nowadays, due to the intensive development of intellectual capital, it is becoming a base of innovative and high-tech development. Intellectual capital includes such elements as knowledge, skills, abilities, mental abilities, employees’ experience, which maximize the profit and other economic, technical results. In order to improve intellectual capital, innovative, scientific and technical centers and multifunctional centers of applied qualification, platforms, training and technological complexes are created; corporate programs for professional development and self-development are launched; professional standards are introduced; new mechanisms of material and non-material motivation and personnel encouragement are developed; investments in research and development and design are implemented; corporate competitions of professional excellence are held, the pool of highly potential employees is created. In this regard, intellectual capital has to be properly evaluated in the society to obtain accurate results and to apply the data effectively, that will result in raising the level of intellectual capital of enterprises in the future. The article carried out a comparative analysis of various evaluation methods for intellectual capital of the organization, identified the advantages and disadvantages of each of the methods, as well as features of their operation. On the basis of the formulated recommendations, using the methods of market capitalization on the example of PJSC "Kamaz" and PJSC "KuibyshevAzot", the ways of methods’ enhancement are proposed to obtain the most reliable result.

Keywords: Evaluation methodsintellectual capitalvalue of intellectual capital

Introduction

Today, in the post-industrial civilization and digitalization, the economic competitiveness of an organization and its innovative development is directly influenced not only by material but also by non-material factors. One of the main values in the activity of any organization is its personnel. Employees’ work performance has a value, i.e., from the financial point of view, the employee applying his or her knowledge and skills, is able to generate a cash flow, which is the intellectual capital of organization’s personnel. Consequently, for the company’s development it is necessary not only to understand the nature of intellectual capital, but also to have special competences to use it efficiently to ensure future economic benefits (Andreeva & Garanina, 2017).

Many scientists researched the intellectual capital. During this period a lot of methods of intellectual capital’s evaluation are compiled, which are grouped into five: methods of direct evaluation, methods of market capitalization, methods of evaluation of intangible assets, which are applied when market is efficient, methods of return on assets and methods of scoring. Despite the detailed classification of methods of intellectual capital’s value, in practice the experts often do not use only one method, but average values from several options. In the conditions of digitalization, it is more and more likely that an employee's key characteristics will be quickly assessed and his salary will be determined.

Problem Statement

Due to the fact that in the conditions of economic innovative development the employee is not just a labor resource, but intellectual capital, the organization has a problem: how to transform the qualitative characteristics of the employee into a cost estimate? During many decades researchers look for new methods to determine the level and dynamics of intellectual capital. Therefore, the methods to ensure effective management of the intellectual capital of an organization are relevant now, they are based on knowledge management, aimed at maximizing organization’s profit and value and forming its competitive advantages (Naumova & Tyugin, 2021; Ponomarenko et al., 2015). At the same time, the choice of a particular method in each individual situation depends on many factors: industry, business reputation, company's development strategy, etc.

The described problem can be solved by achieving the following objectives:

1. To Identify the intellectual capital as one of the key components of business success.

2. To analyze the main methods of calculating the cost of intellectual capital in the context of major groups by appropriate indicators for calculation and by qualitative characteristics.

3. To identify the advantages and disadvantages of methods of intellectual capital evaluation.

4. To carry out monitoring of economic entities of the Samara region to assess the adequacy of the existing methods of intellectual capital evaluation, to identify gaps.

5. To create ways of growth of intellectual capital.

6. To suggest ways to improve the methods and develop a correction system of the received value of intellectual capital by means of evaluation methods of indirect factors.

Research Questions

The research issues that have to be considered are the following ones. What is intellectual capital? What are the approaches to the theoretical essence of intellectual capital? What is their main difference among themselves, and what are their advantages and disadvantages? How to evaluate intellectual capital in terms of value? What indicators, factors will make the results more accurate? Is there a link between intellectual capital and company performance? What elements of intellectual capital play the crucial role in positive results of company performance?

Purpose of the Study

The aim of the study is:

1. Analysis of the existing theoretical and methodological approaches to intellectual capital evaluation in the context of the main groups.

2. Identification of pros and cons of various methods of intellectual capital evaluation of a business entity.

3. Testing methods of intellectual capital evaluation of an economic entity based on market capitalization approaches on the example of enterprises, including the Samara region – PJSC "KuibyshevAzot" and PJSC "Kamaz".

4. Identification of the system of indirect indicators characterizing different areas of economic entity’s activity.

5. Development of methodical recommendations, scientific ideas to improve methods of intellectual capital evaluation taking into account a wider range of factors.

6. Determining the impact of intellectual capital on functioning of economic entities now and in the future.

Research Methods

In the study the interdisciplinarity of the research was ensured: for the reviewing the groups of methods of intellectual capital evaluation and their advantages and disadvantages theoretical methods were used. The calculation of the cost estimate of intellectual capital and dynamics of its values within a certain period was carried out by using empirical methods, the assessment of qualitative indicators and probable problems of intellectual capital evaluation of business entities was implemented by using expert evaluation method. Numerous approaches to the theoretical essence of intellectual capital, analytical comparisons, study of its structure, etc. produced a lot of methods of intellectual capital evaluation as an element of business reputation; these methods are different from each other in terms of indicators for calculation and qualitative characteristics. Some of them were used in this work:

1. Methods of direct evaluation is based on identification and evaluation of individual assets or components of intellectual capital. Subsequently, the integral evaluation of the company's intellectual capital is made by summing it up.

1.1. Expanded Balance Sheet Method – based on IAS 38 "Intangible Assets" (International standard of accounting of 28.12.2015 N 38), which states that an intangible asset created or acquired by an organization is reflected in the balance sheet at its value (or price), if any:

- the intangible asset does not have a tangible form, is managed and differs from the company's business reputation (goodwill);

- there is a probability that future economic benefits associated with the intangible asset will flow to the company;

- the value (or price) of the asset can be measured reliably.

If the above conditions are not met, the value of the intangible asset must be recognized as an expense (at the time of making this expense).

1.2. Costs approach - methods of initial costs, restoration and replacement costs of the intangible asset which are evaluated. When evaluating actual costs, such indicators as inflation and the degree of moral wear and tear of an asset are taken into account.

In addition, the cost approach may have a different classification of methods:

- the method for calculating total cost of reproduction minus wear rate;

- the method for determining full replacement cost minus wear rate;

- the method for calculating full historical cost;

- method of gain evaluation in cost of production.

1.3. The goodwill evaluation using business activities is a multiplicative model in which the components of business cost depend on the business activities.

2. Market capitalization methods – methods showing the conditional definition of intellectual capital and limiting the distinction between the value of partnerships and the business reputation of a company (Manuilenko & Ermakova, 2018).

2.1. Balance sheet combined information approach – an evaluation method based on the fact that decrease of the obtained value indicates decrease of intellectual capital stock (and value).

2.2. The multiplier (coefficient) of Tobin (1969), which allows evaluating intellectual capital by calculating the ratio between the market value of the company and the cost of replacing its assets (Kolomytseva & Chekudaev, 2016). The change in this multiplier shows the extent to which the intellectual capital is used effectively.

At the same time, the company's capitalization information, which reflects stock market estimates, allows determining the company market price.

3. Evaluation methods of intangible assets used in the conditions of effective market - methods with different evaluation purposes, specificity of intangible assets and conditions of their use.

3.1. Comparative (market) methods - direct comparative analysis of sales (evaluation of intangible assets (IA) at the price of purchase and sale transactions similar to IA according to certain characteristics of assets-analogues and the asset being valued) and comparative analysis of income, taking into account the rates of royalties which are used in international licensing trade for certain industries and nomenclature of products.

3.2. Income methods - methods that focus on the ability of a client or investor to benefit in the future. This group includes profit advantage method, loss advantage method (the royalty exemption and cost advantage methods), the profit and loss advantage method and the cash flow discount method (Al-D, 2018).

3.2.1. The royalty exemption method is a method characterizing the situation when the owner of an intangible asset licenses it to manufacturers of goods and receives a license payment calculated on the basis of manufacturers' income (revenue).

3.2.2. Method of excess (additional) income or profit - a method that illustrates the situation in which the owner of an intangible asset reserves the rights to produce, sell and use the profit of the asset. In the process of applying the method, dividing the excess (additional) profit by the capitalization rate (Galiev et al., 2016), the economic benefits are calculated which are associated with obtaining profit at the expense of unaccounted intellectual property objects, providing additional return on equity above the average level.

3.3. Calculated value of intangible assets - a method in which the assessment of intellectual capital is expressed in discounting the cost of excess profitability of the organization in comparison with its competitors.

To assess the adequacy of applying some existing methods of intellectual capital evaluation to domestic enterprises, we take two well-known companies-leaders in their industries not only in Russia but also abroad.

The first company is Kamaz, a public joint-stock company that produces diesel trucks, diesel engines, buses, tractors, combines, electric units, mini thermal power plants and components in Naberezhnye Chelny. The second company is KuibyshevAzot, a public joint stock company. KuibyshevAzot is one of the leading chemical companies, the leader in Russia and Eastern Europe in caprolactam and polyamide production, and the largest producer of technical and textile yarns, cord fabrics, polyamide and blended fabrics, and nitrogen fertilizers in Togliatti. To assess performance, in Table

We determine the value of intellectual capital of these companies using market capitalization methods. Calculation of the company's capitalization depends on the market value of shares according to the data of exchange quotations. It is supposed that such evaluation determines the company's value on the basis of public expectations as a complex evaluation of its stability, profitability, competitive position in the market, society’s need for its products, novelty of equipment, personnel qualification and many other characteristics. Under the conditions of effective market, the society is supposed to have sufficient information to evaluate the cost reliably based on its expectations. Application of these methods is necessary for a company to correctly evaluate the ratio of real value of its assets and liabilities, taking into account the amount of intellectual capital. Based on the Moscow Exchange data on prices of preferential (PS) and common stock (CS), Table

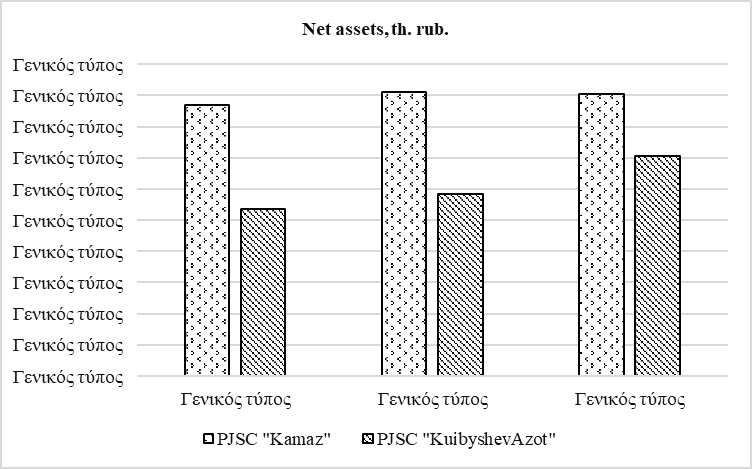

To calculate the balance sheet value, companies' accounting data for the last 3 years have to be referred. Balance sheet value = total assets - liabilities and intangible assets. Net assets are shown on the basis of annual financial statements (Figure

Source: authors.

Balance sheet value for the certain periods is then calculated in Table

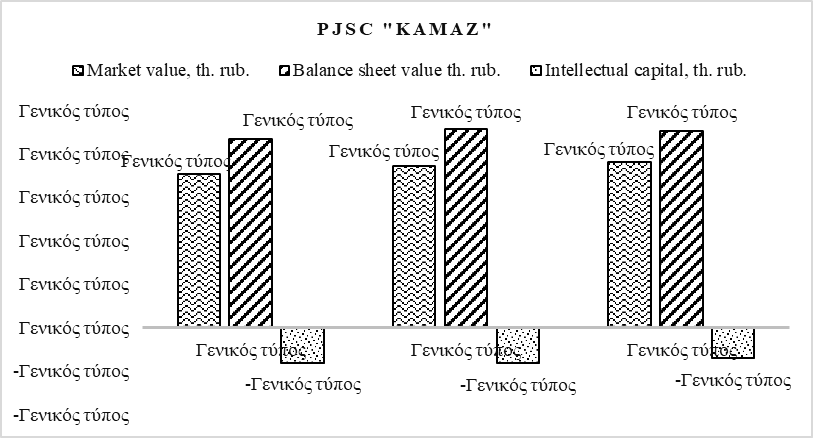

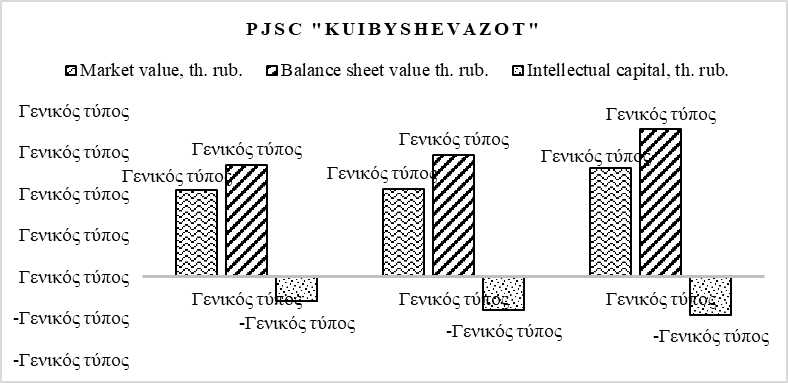

Next, we will find the difference between market and balance sheet value for each of the companies, which will be the value of intellectual capital (Figure

Source: authors.

Source: authors.

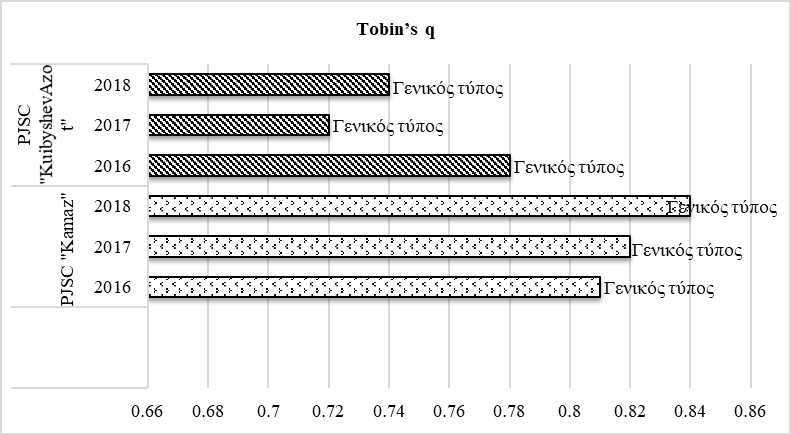

The next popular method used in practice by many companies is the James Tobin coefficient. With the help of this multiplier we will estimate the cost of intellectual capital of companies for the last three years. For example, the Tobin coefficient of PJSC "Kamaz" company in 2016 will make K=35113947.6 / 43311480 = 0.81. Other calculations are performed in the same way (Figure

Source: authors.

Findings

Intellectual capital is especially important for such companies, which operate in some high-tech industry. If it is in the market for a long time, has a good reputation, highly skilled workforce, then the intellectual capital should have high values. The review of the financial performance of the organization based on the financial statements for 2016-2018 showed that PJSC "KuibyshevAzot" has the largest amount of net profit. While the amount of the company's equity capital is almost 2 times less than that of PJSC "Kamaz". The chemical giant demonstrates growth throughout the whole period, first by 48.2%, then by 129.9% in 2018. In PJSC "Kamaz" net profit growth in 2017 was 150.8%, but in 2018 there was a decline. Based on the results of the market capitalization calculation of the intellectual capital of the companies, using the combined information of the balance sheet, it can be concluded that in the companies there is an excess of the balance sheet value over the market, therefore, the negative value of intellectual capital. Also, in both companies the Tobin coefficient doesn’t exceed one. It can be concluded that the level of management of the organizational structure contributes to capital reduction. However, we can immediately conclude that the companies PJSC "Kamaz" and PJSC "KuibyshevAzot" have low intellectual capital, human resources and competitiveness, because the used methods do not take into account those factors that affect market capitalization, which is their main disadvantage. Some of the indirect characteristics of intellectual capital growth are recruitment, training, retraining, staff development and innovation investments. In Table

This table shows that the investment in intellectual capital is low, as the results of the methods of intellectual capital evaluation showed, so we can conclude that the results of the methods are correct. However, the presented method shows that it is possible to achieve more accurate results to draw conclusions about the current level of intellectual capital. The developed method can be used as an instrument of organization management. The method seems to be effective for the activities of a particular economic entity in order to form, save and develop intellectual potential, i.e. a competent and highly qualified employees who are directly involved in corporate programs which aim to improve their skills and competencies in scientific schools, innovation centers, scientific and technological complexes of the Samara region and other administrative centers of Russia, as a strategic resource of the entity, which will contribute to long-term profitability, competitive advantage, sustainable development in the market, as well as create the necessary conditions for economic security. Many practices related to key provisions of the regional standard of personnel support for industrial (economic) growth in the Samara region, are already successfully implemented, for example, such as professional navigation, dual training, professional development, "Worldskills" and others. In general, according to the results of the study, we can say that the research objectives are fully achieved. The main results of the conducted scientific research are the following ones:

1. The main groups of methods of intellectual capital evaluation with corresponding algorithms and calculation formulas are defined;

2. Positive and negative moments in information availability during calculations process, calculation complexity and application areas requiring attention when choosing a method for intellectual capital evaluation in each particular case are revealed;

3. The level of intellectual capital of some enterprises is defined, including the Samara region, its impact on the condition and activities of these enterprises, as well as possible growth reserves for intellectual capital;

4. The assessment of adequacy of methods of intellectual capital cost calculation on the basis of market capitalization approaches and accuracy of the obtained results was carried out;

5. The factors on which the choice of a specific method of intellectual capital cost evaluation depends are classified;

6. The method of intellectual capital evaluation was developed by expanding the range of used indicators for estimating more fair value of intellectual capital;

7. The place of intellectual capital in the economic system of enterprises is formulated.

Conclusion

In order to achieve the highest accuracy of the results and to determine the real level of intellectual capital of the organization, it is necessary to research all directions of the organization and correct the obtained value of intellectual capital by evaluation methods that depend on such indirect factors as personnel costs (including labor remuneration), investments in R&D and expenses on employee’s training (including professional development). All above-mentioned results in qualified and competent personnel which is one of the most essential and valuable resources within an organization. The specific features of intellectual capital of a particular enterprise and exceptional features of its external and internal environment have to be considered. The system of information accounting adopted in most business entities does not give the total volume of the information which is sufficient to evaluate certain components of intellectual capital. At the stage of modern economic development, there is a problem of identification lack of accounting and capturing of intellectual capital components in the balance sheet of an enterprise, which creates extra difficulties in accounting process. Researchers dealing with this issue proposed several methods of accounting of intellectual capital, for example, on account 06 "Intellectual assets". The model of accounting of intellectual capital of an enterprise will make it possible to create intellectual assets’ data in the financial accounting. Such accounting of intellectual capital in the balance sheet can lead to improvement of financial stability of a business entity and stability, independence from external creditors. Thus, the intellectual capital management has to aim at creating, saving and development of intellectual potential as a strategic resource of a company, which facilitates to increase its competitiveness and create necessary conditions for economic security. Management of intellectual capital, its cost correction taking into account indirect factors, namely, investments into personnel, its recruitment, training, retraining is the basis of long-term business profitability. And the higher will be the size of the intellectual capital of the organization, the more opportunities will be available for huge total capital, which will make each employee maximize his potential and the potential of his organization as a whole.

References

- Al-D, H. M. J. (2018). Methods of financial assessment of intellectual capital: Russian and foreign experience. Bulletin of the South Ural State University. Series Economics and Management, 12(3), 39-48.

- Andreeva, Т., & Garanina, Т. (2017). Intellectual capital and its impact on the financial performance of Russian manufacturing companies. Foresight and STI Governance, 11(1), 31-40.

- Galiev, Zh. K., Galieva, N. V., & Tyurin, A. S. (2016). Economical and theoretical aspects of small business. Mining Informational and Analytical Bulletin, 9, 11-21.

- International standard of accounting of 28.12.2015 (IAS) N 38 "Intangible Assets". http://www.consultant.ru/document/consdocLAW193595/

- Kolomytseva, O.Y., Chekudaev, K.V., & Chekudaeva, I.A. (2016). Evaluation methods of the intellectual capital of the enterprise as a factor of production. Proceedings of VSUET, 4, 280-283.

- Manuilenko, V. V., & Ermakova, G. A. (2018). Adaptation and implementation of key tool estimates of intelligent capital in Russian corporations. Problems of Economy and Legal Practice, 6, 253-256.

- Naumova, O.A., & Tyugin, M.A. (2021). Information and analytical support for enterprise business management. Lecture Notes in Networks and Systems, 133, 295-303.

- Ponomarenko, T.V., Khaertdinova, D.Z., & Koveshnikova, K.I. (2015). Results of intellectual activity as a factor of oil companies competitive advantage formation. Mining Informational and Analytical Bulletin, 40, 89-99.

- Tobin, J. (1969). A general equilibrium approach to monetary theory. Journal of Money, Credit and Banking, 1(1), 15-29.

Copyright information

This work is licensed under a Creative Commons Attribution-NonCommercial-NoDerivatives 4.0 International License.

About this article

Publication Date

30 April 2021

Article Doi

eBook ISBN

978-1-80296-105-8

Publisher

European Publisher

Volume

106

Print ISBN (optional)

-

Edition Number

1st Edition

Pages

1-1875

Subjects

Socio-economic development, digital economy, management, public administration

Cite this article as:

Aksinina, O. S., Ermolina, L. V., & Voropai, A. Y. (2021). Development Of Methods Of Intellectual Capital Evaluation In The Organization. In S. I. Ashmarina, V. V. Mantulenko, M. I. Inozemtsev, & E. L. Sidorenko (Eds.), Global Challenges and Prospects of The Modern Economic Development, vol 106. European Proceedings of Social and Behavioural Sciences (pp. 1429-1438). European Publisher. https://doi.org/10.15405/epsbs.2021.04.02.170