Samara Region Transport And Logistics Infrastructure Development Assessment In Digital Modernization Context

Abstract

The transport and logistics system development is an important factor in improving the region competitiveness in the long term. The basic structural elements (favorable geographical location, developed physical infrastructure, transport organizations, large warehouses, etc.) create conditions for the transport and logistics cluster formation. The development strategy of Samara region transport complex is connected with the problem of including the region in the of Euro-Asian transport link system. The Samara transport hub is the transport gateway of Russia, where cargo and passengers travel to Europe, the Urals, Siberia, Far East, Central and South-East Asia, and the Caspian basin. As part of the international transport corridor system development on the territory of Russia, the Samara transport hub can become one of the main centers of cargo processing and transit and export-import cargo flow consolidation in Euro-Asian relations. The purpose of this study is to assess the transport and logistics infrastructure of the Samara region, identify existing problems and find ways to solve them. The article analyzes the main characteristics of various means of transport; identifies problems, trends and prospects for the transport and logistics infrastructure development of Samara region. Currently, digitalization covers all segments of transport and logistics, and as predicted will be successfully implemented in all business areas. To improve management efficiency of Samara region transport and logistic infrastructure in the digitization conditions the economy strategic objectives and recommendations have been identified. Strategic guidelines for Samara region transport and logistics sector development were identified, based on the results of the study.

Keywords: Economy digitalizationstrategic guidelinestransport and logistics infrastructure

Introduction

The relevance of this research study is doubtless, because transport has strategic importance for Russia, providing its cargo and passenger transportation needs, stability in national security and international cooperation matters. The transport and logistics infrastructure development is based on the partnership agreements between various transport sectors to provide complex services to consumers, develop a scheme for interaction between them, create a unified logistics database for optimal cargo transportation route choice, analyze all transport services provided; cargo and passenger flow end-to-end management in the logistics system.

The economy digitalization opens up new opportunities for the transport and logistics industry development, which are the following:

Business process improvement in the logistics system based on the digital solution application.

Business risk reduction through the information and communication technologies (ICT) introduction.

New business model, marketplaces, and services creating which can become new sources of revenue.

Profit increase due to expanded interaction of participants in the transport and logistics cluster via digital channels.

Cost reduction and customer service quality improvement.

Customer satisfaction through the new transport and logistics services provision.

The main objectives of the transport and logistics infrastructure development of the Samara region are:

- region inclusion in the Euro-Asian transport link system (transit transport development, international transport corridors);

- providing large industrial organizations in the region with the required high-quality transport services in the required volume;

- providing small and medium-sized businesses and federal retail chains with high-quality transport and logistics services.

The main factors that ensure the overall effect of the transport and logistics infrastructure in the region are shown in Figure

According to the presented factors, we can conclude, it is necessary to develop comprehensive schemes for the regional transport and logistics infrastructure development in Samara region, which will give rise to the formation and development of new and existing infrastructure facilities for various types of transport, transport corridors, multimodal logistics centers and terminal complexes. Special attention should be paid to improving multimodal transport, a unified information enviroment formation, an integrated information management system, an appropriate legislative and regulatory base formation, meeting higher environmental standards, etc.

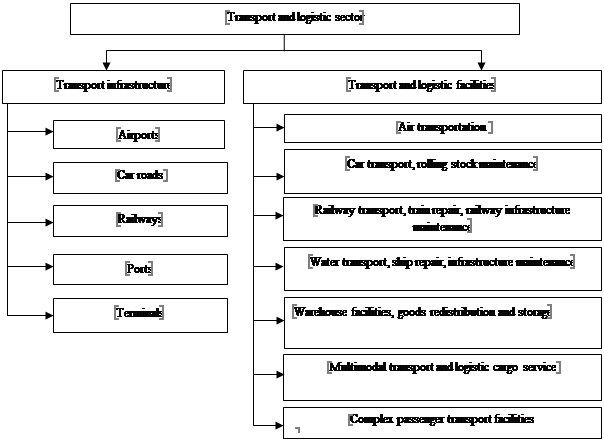

Samara region has a favorable economic and geographical position. It is located at the intersection of the most important transport corridors: North-South and West-East. As part of the international transport corridor development system throughout Russia, in particular the "Europe - Western China" international transport route development, the regional transport hub should become one of the main centers for cargo processing and their consolidation, as well as a distribution spot for transit and export-import cargo flows to the Eurasian countries. As for the country transport and logistics system, the Samara transport hub, represented by all major means of transport, except sea, has the ability to serve national and international cargo flows to / from Kazakhstan, the Middle and South-Eastern regions. Asia, Europe and China. Samara region transport and logistic infrastructure physical base is formed by warehouses, terminals, railway and transport hubs, transport and loading facilities, and the maintenance facilities (Figure

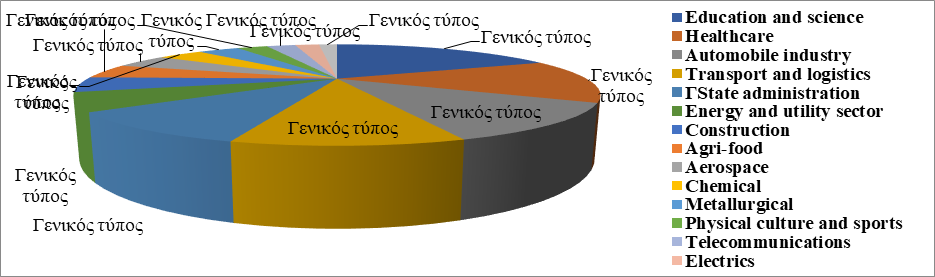

The transport and logistics sector includes construction, operation and repair of relevant infrastructure, cargo and passenger transportation, warehouse facilities, and multimodal transportation services (Fedorenko et al., 2020). The main segments are the transport services segment (goods and passengers transportation) and the logistics services segment (warehouse facilities and complex service for cargo transportation). Enterprises connected with various transport types provide services for passenger and cargo transportation, rolling stock repair and maintenance, and infrastructure maintenance. Organizations providing warehouse services focus on the goods and cargo redistribution and storage. In the Samara region economy, the transport and logistics sector is characterized by relatively high productivity compared to other sectors and takes the fourth place in employment (Figure

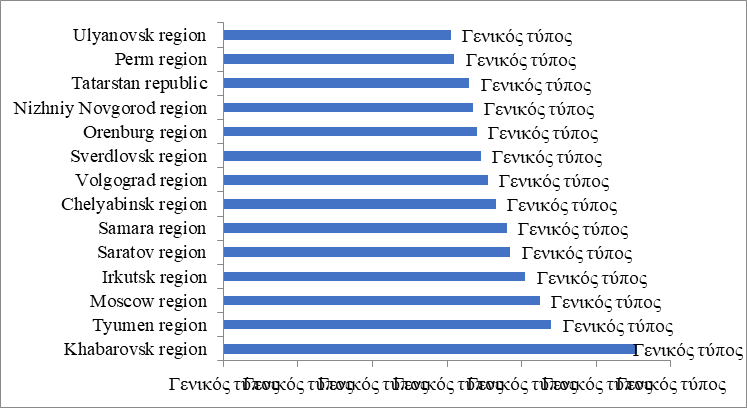

Samara region is among the leaders (6th place) in the industry volume, its role in the economy and industry productivity in comparison with other regions (Figure

Currently, each participant in the transport and logistics sector needs to coordinate their actions with partners in the supply chain, preserving what has been formed and successfully developing, as well as creating something new not available yet (Banchuen et al., 2017; Kumar et al., 2017). Partnership relations between all participants in the transport and logistics sector play an important role in the entire supply chain sustainability and efficiency improvement (Kumar & Rahman, 2015; Waters & Rinsler 2014). In order to make the supply chain manageable, it is necessary to develop strategic and operational goals for each participant at a certain hierarchical level (Lee & Nam, 2016; Saak, 2016). Thus, this study covers a range of issues related to the transport and logistics infrastructure development of Samara region in the economy digitalization context.

Problem Statement

The recent research revealed a number of problems existing in the transport and logistics infrastructure of Samara region:

1. The state and level of the road transport infrastructure development of Samara region do not meet the regional economy needs. The current state of the federal highway M-5, the section between Samara, Tolyatti, Syzran cities and at their entrances, does not ensure proper passage of cargo and passenger traffic.

2. Samara region is the only one in the Volga Federal District that does not have a bridge crossing over the Volga river. Motor transport passes through the Zhigulevskaya HPS hydraulic structures, which are not able to provide the standard traffic capacity.

3. The road and street network capacity of the region major cities is almost exhausted.

4. There is a problem of bridge crossing lack as to leave the Samara city district to other highways.

5. The existing terminal and logistics and warehouse complexes do not meet the region needs. There is no various means of transport unified coordination and interaction for cargo and passenger traffic service.

To solve these problems, one needs a clearly formulated strategy allowing to make the right management decisions and develop logistics activities.

Research Questions

Research questions: What problems exist in the Samara region transport and logistics infrastructure? What factors ensure the region transport and logistics infrastructure overall effect? What are the challenges participants in the Samara region transport and logistics sector facing? What new opportunities are appearing for the transport and logistics industry development in the economy digitalization context? What is the main performance indicators of various transport dynamics in Samara region? What are the prospects for Samara region in the field of transport and logistics customer service? What measures should be developed for the Samara region transport and logistics sector strategic development?

Purpose of the Study

The purpose of the study was to study the Samara region transport and logistics infrastructure strategic development. The authors evaluate the Samara region transport and logistics infrastructure development in the digitalization context. The transport and logistics service trends for cargo and passenger transport based on the different means of transport interaction are identified. Special attention is paid to the modern transport and logistics and information technologies importance and its interaction into the transportation process. They also stress the need to develop international transit flows, foreign trade and interregional relations to strengthen the company transport and logistics sector competitive position. The study identifies opportunities for the transport and logistics industry development in the digital modernization context. The authors have developed the Samara region strategic direction map for the transport and logistics infrastructure development, contributing to the region's competitiveness improvement in the long term.

Research Methods

The transport and logistics infrastructure development forecasting and planning should be preceded by its region state analysis. The functioning and transport and logistics infrastructure development analysis methods used in the study are the following: comparative, graphical, analytical and matrix. The Samara region various means of transport main performance indicators dynamics (Table

1. The region has several main railways, connecting the Western, Southern, South-Western and Eastern regions of the country. The region railway operational length is 1,374 kilometers. The JSCo “Russian Railways” branch, the Kuibyshev railway, operates large passenger, cargo and repair complexes. Samara region takes the first place in the Volga Federal district and twelfth place in Russia in railway density.

2. The Samara region public paved roads length is 17,471 km, including 707 km of federal highways, 7,000 km of regional and municipal roads, and 9818 km of local roads. The region has several federal highways, including the M-5 Ural (Moscow-Ryazan-Penza-Samara-Ufa-Chelyabinsk) and the A-300 (Samara - Bolshaya Chernihiv - Kazakhstan Republic border).

3. The European part of Russia main waterway - the Volga flows across the territory of Samara region. The inland navigable water total length is 687 km, there is also an access to the Unified waterway system of the European part of Russia and an access to the Caspian, Black and Baltic Seas. River ports operate in Samara and Tolyatti.

4. Samara region has three largest Russia's main gas pipelines: Chelyabinsk - Petrovsk, Urengoy-Petrovsk, and Urengoy - Novopskovsk. The oil and oil product pipeline total length exceeds 5000 km.

5. The International Airport “Kurumoch” is one of the largest in the Volga region (12th place in Russia). More than 50 Russian and international airlines flights are operated to more than 80 domestic and international destinations. The International Airport “Kurumoch” has its own cargo terminal with a total area of 5300 square meters. The airport provides a full range of warehouse services and has a cargo turnover of 150 tons per day. The passenger and cargo transport market dynamics for the period 2015-2019 is presented in the Table

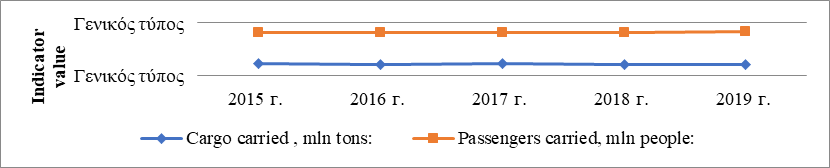

The Samara region passenger transportation market remains at a low level after the crisis (Figure

There has been a downward trend in the cargo market turnover (Figure

Findings

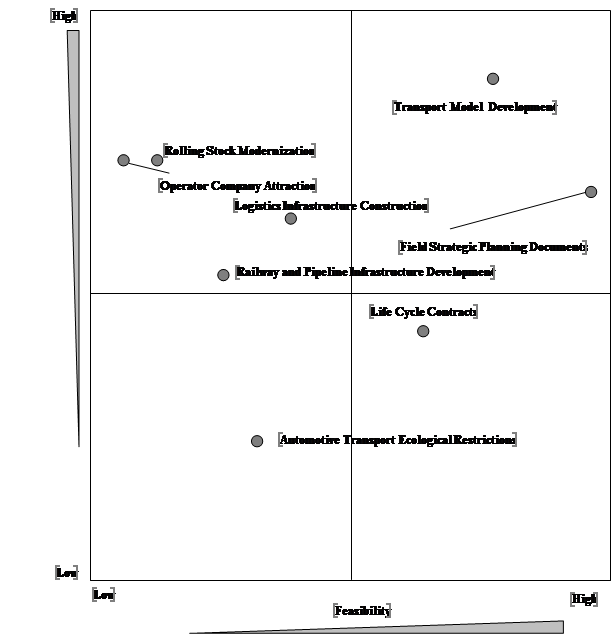

The priority transport and logistics sector supportive measures have been identified for the transport infrastructure and public transport system strategic development. The priority activities were selected using the matrix method, based on the two criteria assessment (Figure

- the event relevance: job opportunities created, industry growth dynamics and productivity improvement;

- the event feasibility: the funding amount, the availability of competencies, powers, implementation conditions and time intervals.

Source: authors.

Based on the matrix analysis, the activities were divided into two priority groups.

The first priority supportive strategic measures are:

- transport and logistics development model of Samara region;

- strategic planning documents in the transport and logistics sector

- public - private partnership (PPP) mechanism implementation for infrastructure construction.

The second priority supportive strategic measures are:

- large logistics services companies-operators attraction;

- the municipal transport enterprise rolling stock modernization;

- warehouse logistics infrastructure construction;

- automotive transport ecological restrictions

- "life cycle" contract implementation in the design, construction and infrastructure perfomance;

- railway and pipeline transport infrastructure development in accordance with the growing needs of the region industrial enterprises.

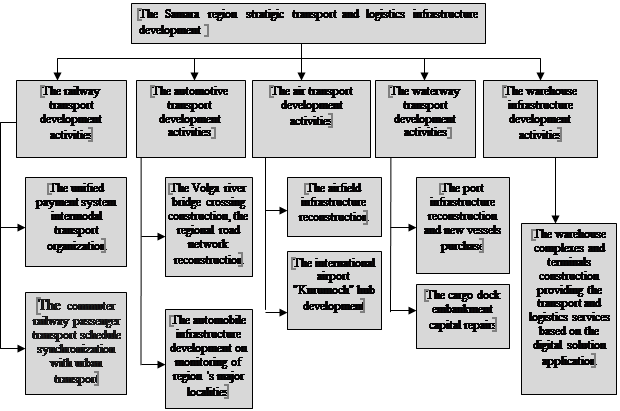

Figure

Thus, the Samara region strategic goal of the transport and logistics sector development is to ensure the interaction of all its participants to provide consumers with comprehensive services, as well as to achieve a integral transport and logistics infrastructure development.

Conclusion

The Samara region strategic transport and logistics sector development growth points for the 2025-2030 period should be:

‾ various means of transport unified coordination and management based on the digital solution aplication;

‾ multimodal transport and logistics services improvement;

‾ transport and logistics infrastructure development.

The key areas of strategic development at this stage will be:

- new automobile bridge crossings over the Volga river construction

- automobile infrastructure development on on monitoring of region 's major localities

- warehouse infrastructure development ;

- regional road network reconstruction ;

- PPP mechanism improvement for the transport and logistics infrastructure development.

- passenger transport hub formation;

- transport service quality improvment (The strategy of socio-economic development of the Samara region for the period up to 2030 (approved by the Government of the Samara region 12.07.2017 N 411).

Further research can be conducted in order to identify factors that affect the transport and logistics infrastructure development, the customer service quality integral indicator calculation, and the Samara region transport and logistics infrastructure effectiveness assessment. Based on the research, the existing problems in the Samara region transport and logistics infrastructure were identified, the current state was assessed, and the strategic direction further development map was developed. In addition, the results can be used to quantify the investment benefit in the Samara region transport and logistics infrastructure development. Thus, it can be concluded that it is impossible to assess the Samara region transport and logistics infrastructure efficiency by one single criterion, and it is essential to make up a system of criteria. A complex assessment should be based on the expert approach and economic and mathematical modeling.

Acknowledgments

The reported study was funded by RFBR and FRLC according to the research project № 19-510-23001.

References

- Banchuen, P., Sadler, I., & Shee, H. (2017). Supply chain collaboration aligns order-winning strategy with business outcomes. IIMB Management Review, 29(2), 109-121.

- Fedorenko, R. V., Toymentseva, I. A., & Tsegledi, T. (2020). Current state of logistics of foreign trade transport in Russia and European Union countries. Humanities, Socio-Economic and Social Sciences, 1, 152-155.

- Kumar, D., & Rahman, Z. (2015). Sustainability adoption through buyer supplier relationship across supply chain: A literature review and conceptual framework. International Strategic Management Review, 3(1–2), 110-127.

- Kumar, G., Banerjee, R. N., Meena, P. L., & Ganguly, K. K. (2017). Joint planning and problem solving roles in supply chain collaboration. IIMB Management Review, 29(1), 45-57.

- Lee, T., & Nam, H. (2016). An empirical study on the impact of individual and organizational supply chain orientation on supply chain management. The Asian Journal of Shipping and Logistics, 32(4), 249-255

- Saak, A. E. (2016). Traceability and reputation in supply chains. International Journal of Production Economics, 177, 149-162.

- The strategy of socio-economic development of the Samara region for the period up to 2030 (approved by the Government of the Samara region 12.07.2017 N 411). https://economy.samregion.ru/upload/iblock/82a/strategiya-so_2030.pdf

- Waters, D., & Rinsler, S. (2014). Global logistics: New directions in supply chain management (7th edition). Kogan Page.

Copyright information

This work is licensed under a Creative Commons Attribution-NonCommercial-NoDerivatives 4.0 International License.

About this article

Publication Date

30 April 2021

Article Doi

eBook ISBN

978-1-80296-105-8

Publisher

European Publisher

Volume

106

Print ISBN (optional)

-

Edition Number

1st Edition

Pages

1-1875

Subjects

Socio-economic development, digital economy, management, public administration

Cite this article as:

Toymentseva, I. A., Fedorenko, R. V., & Czegledy, T. (2021). Samara Region Transport And Logistics Infrastructure Development Assessment In Digital Modernization Context. In S. I. Ashmarina, V. V. Mantulenko, M. I. Inozemtsev, & E. L. Sidorenko (Eds.), Global Challenges and Prospects of The Modern Economic Development, vol 106. European Proceedings of Social and Behavioural Sciences (pp. 1277-1287). European Publisher. https://doi.org/10.15405/epsbs.2021.04.02.151