Abstract

Currently, the information support of evaluation activities is actually assigned to each subject of evaluation activities, but not to the evaluation community as a whole. The existing aggregators of the real estate market of the Russian Federation mostly do not meet modern requirements and trends. The absence, insufficiency, unreliability of information makes it difficult to determine the cadastral value of real estate objects. In Russia, there is still information secrecy, and analysts have to use indirect and not always reliable information, develop and apply sophisticated methods of data collection, processing, analysis and forecasting. In this regard, we set a goal to analyze the aggregators of the real estate market for the presence of shortcomings that prevent the formation of a single database of real estate objects in the Russian Federation. Due to the extensive experience in evaluation activities and analysis of market aggregators, the methodology of the rating system consisting of 7 evaluation criteria has been developed. Digital platforms are analyzed for compliance with the criteria presented using the author's rating system. The result of the study is the formulation of the necessary criteria by study and comparison, conclusions for compliance with certain criteria based on the base of classifayds analysis, as well as recommendations for the use of innovative technologies for the most advanced functioning of real estate market aggregators. The formulated proposals are useful for professional participants of the residential real estate market and state regulatory authorities of the market.

Keywords: cadastral valuationdata aggregatorsdigital platformsgeographic information systemsopen data

Introduction

The relevance of the study of aggregators (classifayds) of the real estate market, as innovative programs, is due to modern changing conditions. The predominance of innovative products in the form of real estate market aggregators has almost completely replaced the printed version of advertisements submission, however, the full use of digital platforms is currently not involved, but can solve a large number of problems on the real estate market, as well as more correctly organize state regulation of the real estate market. For example, the absence, insufficiency, unreliability of information makes it difficult to determine the cadastral value of real estate objects, and also does not allow meeting the requirements established by the current methodological guidelines on state cadastral assessment (Gubanishcheva, 2019).

Since the entry into force of the Federal Law of the Russian Federation from 24.07.2007 № 221-FZ "On state cadastre of real estate" all "rushed" to put the real property on cadastral registration since without a cadastral passport it is impossible to perform any actions with the property (registration of rights and encumbrances, sale, consolidation, transfer, etc.). Mandatory cadastral registration as one of the stages of accounting and registration of real estate will help to get the necessary information about the right holder and other equally important information about real estate objects.

The sphere of the real estate market can also be considered as a special sphere of the innovative economy. In the recent history of the Russian real estate market, there is still an information closure, and the analyst has to use indirect and not always reliable information, develop and apply sophisticated methods of data collection, processing, analysis and forecasting. The author has developed a basic model of the information system. The model includes three components: - "Information space" (databases and their processing units); - "Consumers" (functional units that need this information: Analytical center (AC), Marketing department (MD), Financial and economic department - FED) (Sternik, 2009).

Problem Statement

Currently, the information support of evaluation activities is actually assigned to each subject of evaluation activities, but not to the evaluation community as a whole. Everyone forms their own arrays of information that are available to a limited number of people, but there is no single information portal. In the formation of the digital economy of the Russian Federation, the collection and comprehensive presentation of cadastral, urban planning, topographic, and thematic information using geoportal technologies is relevant. At the same time, the main task is to provide individuals and legal entities with information about spatial structures and objects. In this direction, the best experience is the creation and operation of the Rosreestr geoportal. The object of the study is aggregators of the real estate market. The subject of the study is the shortcomings of real estate market aggregators. The objectives of the study are to identify the main shortcomings of real estate market aggregators and solutions to eliminate them.

Research Questions

The basis for the implementation of machine processing of information flows between system elements is the creation of a database for the information system. The most promising and technically convenient sources of information for filling the database can be recognized as regional multi-listing systems (hereinafter referred to as MLS) on the Internet. Not completely devoid of the shortcomings inherent in periodicals, MLS, as a rule, contain more structured and cleared of "noise" information. The analysis of the number and dynamics of offers, the composition of market participants, the terms of exposition of the presented objects allows to exclude inefficient (abandoned, "noisy") MLS (Kazimirov, 2014). Information sources may include offers, deals, and auctions from relevant real estate market aggregators.

The acceleration of information processing at the recognition and identification stage allowed to conduct revaluation of real estate objects in real time. However, the main problem is that the value of a product or service based on a digital platform is visible only to developers and the complexity of creating and using the platform significantly exceeds the benefits. More successful are the creation and application of digital platforms in the field of trade and information. Companies such as Ulmart and Ozon have already announced the creation of cross-border trading platforms, which indicates their readiness to compete on the global market. Major companies on the digital platform include Avito, Price.ru, Torg@mail.ru (Russian Internet portal owned by a technology company Mail.Ru Group) (Zavyalov et al, 2019). It is necessary to formulate the main criteria for the analysis of aggregators by research and comparison, analyze the classification data for compliance with the selected criteria, and develop recommendations for the use of innovative technologies for the most advanced functioning of real estate market aggregators.

Purpose of the Study

The purpose of the study is to analyze the aggregators of the real estate market for the presence of shortcomings that prevent the formation of a single database of objects on the real estate market of the Russian Federation. As part of the study, it is necessary to identify and analyze the main shortcomings of market aggregators by selecting information platforms that provide information on real estate objects mainly on the Russian Federation market. When identifying the main shortcomings, it is necessary to propose effective solutions to eliminate them, as well as to develop a methodology for implementing a single digital platform that takes into account the identified shortcomings. To determine the shortcomings, it is necessary to analyze the most competitive aggregators of the real estate market of the Russian Federation. The key factors for choosing aggregators are the resource attendance, ease of using, free access, a sufficient amount of content, the ability to register in your personal account and use it for its actual purpose. The ability to analyze the selected platforms will allow to identify the relevant "gaps" on the market and existing systems, thereby enabling the further development of similar resources. Nowadays, classifayds for providing information on the territory of the Russian Federation in the form of advertisements for real estate objects are "morally" outdated, but with the necessary adjustments and proper use, they can contribute to the creation of a "transparent" system that unites real estate market participants.

Research Methods

The study was conducted on the basis of personal experience and professional opinion, the experience of performers in this field since the early 2000s. The research methodology consists in the analysis, search and comparison of certain shortcomings necessary for providing full-fledged information on real estate objects on the selected aggregators of the real estate market. In this study, the following market aggregators were analyzed:

Bulletin Board "AVITO".

Database of real estate "CIAN".

Database of real estate "Domofond".

Database of real estate "MIRKVARTIR".

Information portal "MOVE".

Database of Sberbank real estate "DOMCLICK".

Real estate database "MLSN".

Real estate database "TATRE".

Website "ONREALT".

Bulletin Board "From hand to hand".

American real estate database "ZILLOW".

The analysis of aggregators was carried out according to certain criteria and comparison of the selected platforms according to the rating system. Information about the rating system methodology is provided below. The authors have defined 7 evaluation criteria (see results and discussions), each criterion is assigned a certain number of points from 1 to 10, where 10 is the maximum value, depending on the compliance of the selected criterion, since compliance is possible in the range from 0% to 100%. Points were awarded in accordance with the objective opinion of researchers, based on the analysis of information on the presented market aggregators.

Further, the percentage of compliance with the selected criteria for each object under study was determined using the following formula:

CCP=TN/70*100%,

Where CCP Is the criteria compliance percentage, %;

TN – total number of points according to the selected criteria;

70 are the maximum score.

Based on the results of the study, we can conclude the shortcomings of aggregators (classifayds) of the real estate market.

Findings

We presented the analysis of the above digital platforms in terms of information saturation in the form of compliance with the system of criteria selected on the basis of the authors' professional experience in evaluation activities:

For example, on the website https://www.avito.ru/ to search for a land plot for commercial and office purposes in the search filter, we should select "industrial land" in the item "category of land", since when we select the item "settlement lands (private housing projects)", the search engine shows land plots for individual housing construction, which makes it misleading and difficult to search. The real estate database https://cian.ru/ has a separate filter for commercial land plots; however, commercial land plots differ in the type of permitted use. The concept of "commercial land plot" can include both land plots for multi-store residential development, as well as land plots for the placement of a railway station.

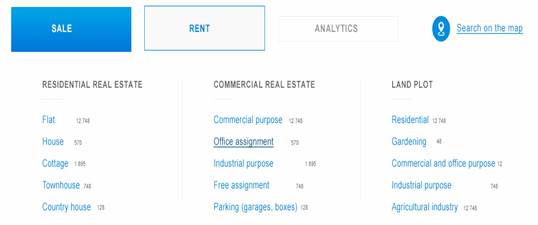

Based on the analysis of existing classifications (Leifer & Krainykovo, 2018) and the author's analysis, the classification or filter of real estate objects in a simplified form without additional filters can be presented in the following form Figure

In the above classification, it is important to note that real estate objects are divided by type of purpose: residential and commercial real estate, and land plots are allocated to a separate group in accordance with the types of permitted use, where the above-mentioned list is not exhaustive. Figure

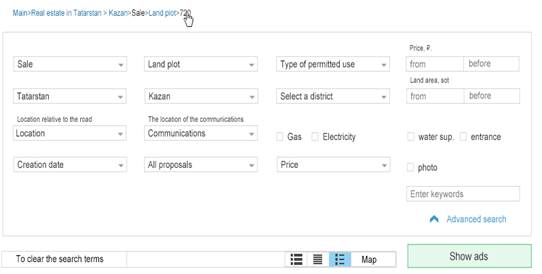

Menu of land plots search:

- type of permitted use;

- location relative to the road – 1 line, inside the block, near the road (but not the first line), away from the road;

- communications – on the site, on the border of the site, removed from the site (in this case, it displays the most complete information, so, for example, when the "gas" check mark is pressed, you can display a more correct presence of communications, which is important for users and analysts of the real estate market).

Also, this search is not limited, you can add such criteria as:

- type of right is property, lease for 49 years, lease for up to 10 years (not shown in Figure

2. Identification of the real estate object by cadastral number

Absence or partial absence of the cadastral number of the property object.

If you have a cadastral number, you can check the object using the following parameters:

- for the presence of encumbrances on the Rosreestr website in free access (https://rosreestr.ru/wps/portal/online_request);

- order an extract from the Unified State Register of Taxpayers to clarify information about the owner (through the service of the personal account on the website of Rosreestr);

- check the location information on the cadastral map (https://pkk.rosreestr.ru/);

- find out information about the cadastral value and the property tax (https://pkk.rosreestr.ru/);

- analyze the history of the price of the real estate for a certain period of time.

According to the analysis of the above-mentioned aggregators of the real estate market, there is a cadastral number in the part of advertisements, but its filling is not necessary and is of a recommendatory nature. However, the presence of a cadastral number for a real estate object causes confidence and the greatest demand, and can also be a tool for regulating "tax-market" relations between the owner and the state.

In this case, it is most optimal to consider linking of the advertisement and cadastral number, as well as automated data submission from the Rosreestr website according to the above parameters to the aggregator's website with appropriate updates.

Thus, it is possible to implement the relationship between the structures that regulate property relations and up-to-date information on the market of a particular object in the segment of real estate objects in accordance with the correct classification, forming a real estate object card.

3. Availability of geospatial modeling

Linking the location of an object on the map with full information about the object, including the presence of layers on the map:

- layer of town-planning regulations;

- the objects of capital construction and facilities;

- boundaries and shape of the land plot;

- heat maps of supply and demand availability;

- spread of prices of real estate objects in accordance with the correct classification;

- retrospective data layer;

- heat map of traffic flows, pedestrian traffic, etc.;

For example, the main function of GIS-based systems is the ability to use economic and cadastral information in coordination with other elements, such as physical factors, social factors, taxation, infrastructure, pollution and noise, economic and legal factors. Together, this can make it easier to assess the value of real estate (Droj & Droj, 2015).

For the development of GIS projects, it is possible to use ready-made map data from various WEB sources. For example, you can add Open Street Map basemaps, National Geografic maps, and others to an ArcGIS project. The disadvantage of the current stage of development of multi-scale mapping is the lack of a unified methodology for creating a multi-scale cartographic framework, in most cases it is developed in accordance with the production requirements of individual enterprises.

Greek scientists used GIS to study the level of relationship between urban integration processes and housing market prices (Giannopoulou et al., 2016). The researchers addressed the findings to the city authorities for further adjustment of the municipal policy of managing the development of the city.

Finnish researchers, in our opinion, are the leaders in the study of cadastral information – they consider it as a sociotechnical system (Krigsholm et al., 2017). As part of the study, they divide it into urban and rural, predict integration with other information platforms, and generally formulate a forecast for the development of cadastral information until 2035. The platforms analyzed for this parameter are limited, and there is practically no information about layers. For some objects, the location does not correspond to reality, in particular, land plots without a cadastral number, as well as "garbage" information about objects that cannot be identified by location.

An important area of use of geoinformation systems is the use of spatial data, primarily information about the value of the territory, for the evaluation of real estate objects (including for state purposes, for taxation) (Zhang et al., 2013). Researchers from Nizhnevartovsk have proposed their own approach to the use of geoinformation methods in real estate valuation. For the tax system, the authors have built maps of the city with the display of areas within walking distance of social facilities (Sokolov & Antonov, 2017). Some researchers believe that the next stage in the development of GIS technologies is forecasting-and not only the cost of residential real estate, but also modeling the development of the market as a whole. Artificial intelligence, machine learning and augmented reality technologies will be involved. GIS, for example, will help identifying profitable segments of the residential real estate market that have been inadvertently overlooked in past periods. Markets and locations where investments in residential real estate and infrastructure are relevant will be identified (Gareev, 2018).

Romania is also working on creating a single GIS that can collect all the data necessary for the assessment of a particular land plot, as well as correlate the characteristics of the plot with market prices and transfer them to the map (Deac, 2014). Adding the selected layers, as well as developing and implementing new ones, can affect both the user's choice of a property, as well as fill in the missing data of the property in accordance with the selected goals. Also, this information will be relevant and in demand when compiling high-quality monitoring of the real estate market in an automated form.

4. Data availability

This criterion is highlighted separately, since according to the analysis of the selected aggregators, the free period of advertisements placement is limited to an average of 30 days (depending on the aggregator). However, for example, in the case of the implementation of the production and warehouse base, the exposure period, which can be from 9 to 25 months, is not limited to 30 days, which means that the advertisement may be closed, but the relevance of the sale of the object is not completed. It is also possible to change the offer price over time for a certain period.

According to the results of the study, it was revealed that most transactions in Russia are closed, information is not published in open sources and is confidential. According to the authors, it is necessary to add information about the exposure time of the object (since when it is for sale, how to change the offer price and other retrospective information that allow to be informed and to make a more correct choice of the user), as well as the opportunity of open data.

The experience of Finnish researchers who studied the consequences of data disclosure in Helsinki is noteworthy (Eerola & Lyytikainen, 2015). In particular, a website with detailed information on individual housing transactions in the country was launched in 2007. In particular, the study allowed us to obtain the following main results:

- the discovery of data has increased public awareness of real property prices and real housing affordability (ultimately, this has affected the acceleration of home purchase decisions);

- the impact of open information on transactions and real estate prices on the functioning of the residential real estate market itself is quite clearly observed. For example, the appearance of open information was more valuable for sellers who underestimated the value of their property than for sellers who overestimated the value of their property. Because of this asymmetry, information about housing prices has led to higher prices. In other words, the open information affected different sellers in different ways;

- the results of the analysis of price dynamics indicate that the increase in the volume of information about past transactions led not only to an increase in prices.

5. Availability of high-quality market monitoring

Availability of high-quality market monitoring in contrast to the correct classification of real estate objects, including analysis of the real estate market for a certain period, the presence of links between markets, the dynamics of supply and demand, market capacity, information about the timing of exposure of similar real estate objects. This issue is most acute when submitting advertisements and evaluating real estate objects in inactive or closed markets, where there is almost no information and individual offers are presented. For residential real estate, this problem is observed exclusively in localities with a low population.

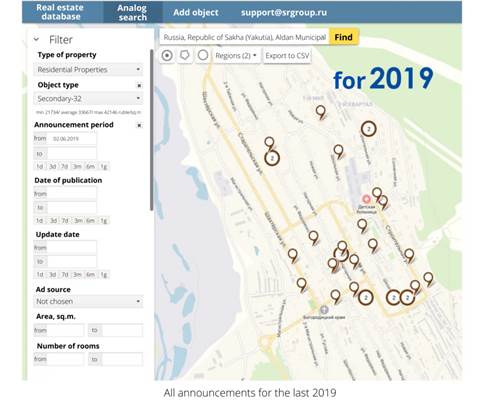

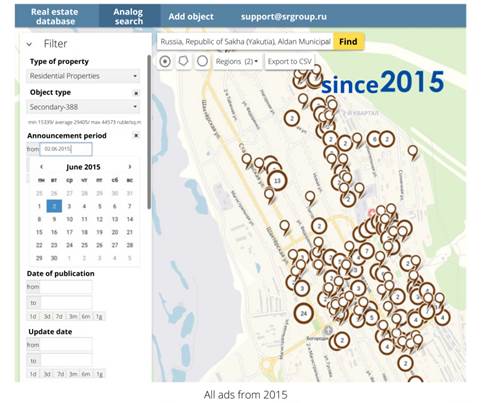

Retrospective information using the identification of a real estate object, the availability of geospatial modeling and the openness of data allow to solve the above-mentioned problem in an automated mode. For example, this function is implemented in one of the software products of the "SRG group of companies" (Figure

As you can see from the figures, the number of advertisements submitted since 2015 is much higher than in 2019 (the search is shown for residential real estate). Using this functionality, you can create a market monitoring of the required object in the corresponding market segment, not only for a retrospective date, but also for today, in conditions of limited sampling.

6. Using innovative platform technologies to present information in a comfortable way

This function of the aggregator is mostly an opportunity to use innovative technologies to present the property to users, in particular the following services:

- ability to publish real estate advertisements on multiple digital platforms by filling out a single form (duplication of advertisements);

- conducting auctions for the sale of real estate objects;

- inspection of the property object online or using virtual reality glasses;

- use of software products to visit the property object without the participation of an agent;

- the relationship of banking structures with the platform in order to use credit funds for transactions with real estate objects;

- automated property evaluation;

- electronic registration of real estate rights (use of electronic signature for registration of ownership of a real estate object online through the Rosreestr website);

- implementation of real estate transactions without intermediaries;

- artificial intelligence for calculating the economic and technical parameters of a real estate object for construction at a specific location;

- traffic analysis of retail, office premises, as well as premises related to the provision of services.

7. Interconnected "universe" of objects

Lack of interconnection between digital platforms, real estate market participants, banking structures and property regulators. In practice, there are often situations with overestimation of the cadastral value of real estate objects, which affects the interests of owners and tenants. However, there are situations when the cadastral value is estimated on a retrospective date and the tax is calculated from the "outdated" estimate. For example, according to the Report No. 2 (Rosreestr) dated 10.10.2014 on determining the cadastral value of capital construction objects of the Republic of Tatarstan, the assessment was carried out as of 01.01.2014 (Rosreestr, 2014), and the amount of property tax is calculated based on the results of the above assessment. At the time of writing this article, 6 years have passed (2020), which, according to the author, prices for capital construction projects have increased. The data of digital platforms, the results of operations on the assessment and provision of credit obligations in the tax authorities do not appear. There is no e-cards of real estate objects with information about the offer price, data on transactions results over a selected period of time are not used to "real estate market monitoring" from the website of Rosreestr.

The interaction and direct relationship of the above structures can lead to the most correct determination of the cadastral value, as well as awareness of real estate objects in different life cycles, which will directly affect the interests of all sections of the real estate market. Further, the analysis of aggregators of the real estate market is carried out according to the method presented above. The comparison was made for the presence (or absence) of the proposed criteria. The results are presented in Table

Among the domestic sites, we can mention the platform based on PJSC Sberbank - https://kazan.domclick.ru/, where the possibility of buying real estate online is presented, so far no analogues have been identified. The rest of the market aggregators are mostly mediocre in order to make a profit on advertising products or promotion of advertisements, in part there is a monitoring of the market exclusively for residential real estate. Innovative technologies are practically not used.

Conclusion

The disadvantages of market aggregators are due to the lack of information and technological development of innovative technologies due to the unavailability of data and the cost of implementation. One significant factor is the interaction of information structures among themselves, which entails a pricing policy on the real estate market. The use of innovative technologies to solve the problems of "shortcomings" of aggregators of the real estate market as a whole can affect not only the real estate market of Russia, but also the economy of individual regions. At the present stage of development, the digital economy is at the initial stage of formation, innovations in the field of real estate will allow the system to be more "transparent" and open to all participants of the real estate market. Step-by-step implementation of existing capabilities in its digital environment, use and adjustment of classifayds in accordance with the analyzed criteria will lead to a huge competitive advantage on the market for providing information, and the use of this information on the basis of determining the cadastral value can lead to an increase in budget collection.

The innovation of the idea ("novelty") is as follows:

⁻information interaction of real estate market sites in one system is proposed;

⁻a methodology for implementing a single database of real estate objects based on innovative technologies has been developed;

⁻effective methods for solving the problems of real estate market participants are proposed;

⁻the possibilities of innovative technologies for providing information in the relevant segments of consumers are proposed;

⁻a modern approach for determining the cadastral value is proposed;

⁻an effective way of implementing software products for automation and structuring information of real estate objects has been developed.

Phased implementation of existing opportunities in their digital environment, the use and adjustment of classifayds in accordance with the analyzed criteria will lead to a huge competitive advantage on the market of provision of information and use of this information on the basis of the cadastral value may lead to an increase in the budgets collection of regions and of the Russian Federation. Due to the above-mentioned, we are developing a digital service for conducting transactions with real estate objects – KVADU.RU. This service is a digital platform for conducting transactions with real estate objects, taking into account the identified shortcomings.

References

- Deac, V. (2014). Land valuation in Romania: Challenges and difficulties. Procedia Economics and Finance, 15, 792-799.

- Droj, L., & Droj, G. (2015). Usage of location analysis software in the evaluation of commercial real estate properties. Procedia Economics and Finance, 32, 826-832.

- Eerola, E., & Lyytikainen, T. (2015). On the role of public price information in housing markets. Regional Science and Urban Economics, 53, 74-84.

- Erzina, K.V. (2019). Using databases for reasonable calculation of adjustments. https://inform-ocenka.ru/wp-content/uploads/2019/06/Ерзина-К.В.-Использование-баз-данных-для-обоснованного-расчета-корректировок.pdf

- Federal Law of the Russian Federation No. 221-FZ of 24.07.2007 "On the State Real Estate Cadastre». http://www.consultant.ru/document/cons_doc_LAW_70088/

- Gareev, I. F. (2018). Information systems and data sources for housing projects. Housing Strategies, 5(4), 531-560.

- Giannopoulou, M., Vavatsikos, A. P., & Lykostratis, K. (2016). A process for defining relations between urban integration and residential market prices. Procedia – Social and Behavioral Sciences, 223(10), 153-159.

- Gubanishcheva, M. A. (2019). The main directions of improvement of the state cadastral assessment system. Interexpo Geo-Siberia, 3(2), 42-49.

- Kazimirov, I. A. (2014). Problems of creation and primary filling of the database of transactions and offers on the real estate market. Bulletin of IGTU, 12(95), 283-286.

- Krigsholm, P., Zavialova, S., Riekkinen, K., Ståhle, P., & Viitanen, K. (2017). Understanding the future of the Finnish cadastral system – A Delphi study. Land Use Policy, 68, 133-140.

- Leifer, L. A., & Krainykovo, T. V. (2018). Real estate appraiser's guide-2018. Office and retail real estate and similar types of objects. Correcting coefficient. Discounts for a comparative approach. 4th edition. Privolzhsky Center for Methodological and Informational Support of Assessment.

- Rosreestr (2014). State cadastral assessment data Fund. https://rosreestr.ru/wps/portal/p/cc_ib_portal_services/cc_ib_ais_fdgko/!ut/p/z1/lVBNC8IwDP1JSa06r3PIUA9Ohx_tRcoWtNCt0nX69229iIqIIZfkvZc8Hkg4gGzVVZ-U17ZVJsxCjo_5ejhj2ZAt8-10jOm8WEx38wwRE9i_EdYsCYR0yTjLEVcM5H_6D0LU45dKMejl24tXB9ngByFa_PVEBJPJV5MThDLeqGzrnTWGHIi2NybuHHXeOiqp60KgpVeeQHjXUwS7s71t6PJcqCrGDuKq6VY4W1HduwegaxCc8xFcmu0BddE0Ex47vQMtw9H_/#inline_rep

- Sokolov, S., & Antonov, Y. (2017). Valuation of residential property of Nizhnevartovsk by using GIS methods. In N. Krasnova (Ed.), Proceedings of the International Research Conference on Science, Education, Technology and Management Conference Proceedings (pp. 247-268). Smashwords.

- Sternik, G. M. (2009). Real estate valuation based on discrete spatial-parametric modeling of the market. http://masters.donntu.org/2012/igg/zheleznov/library/sternick.pdf

- Zavyalov, D. V., Zavyalova, N. B., & Kiseleva, E. V. (2019). Digital platforms as a tool and condition for the country's competitiveness in the world market of goods and services. Economic Relations, 9(2), 443-454.

- Zhang, H., Li, Y., & Li, H. (2013). Multi-agent simulation of the dynamic evolutionary process in Chinese urban housing market based on the GIS: The case of Beijing. Automation in Construction, 35, 190-198.

Copyright information

This work is licensed under a Creative Commons Attribution-NonCommercial-NoDerivatives 4.0 International License.

About this article

Publication Date

30 April 2021

Article Doi

eBook ISBN

978-1-80296-105-8

Publisher

European Publisher

Volume

106

Print ISBN (optional)

-

Edition Number

1st Edition

Pages

1-1875

Subjects

Socio-economic development, digital economy, management, public administration

Cite this article as:

Sternik, S. G., Gareev, I. F., & Ahmetgaliev, Т. А. (2021). Disadvantages Of Real Estate Market Aggregators Preventing Real Estate Objects Base Formation. In S. I. Ashmarina, V. V. Mantulenko, M. I. Inozemtsev, & E. L. Sidorenko (Eds.), Global Challenges and Prospects of The Modern Economic Development, vol 106. European Proceedings of Social and Behavioural Sciences (pp. 1247-1259). European Publisher. https://doi.org/10.15405/epsbs.2021.04.02.148