Abstract

The financial strategy of the company occupies a key position in the company’s successful development. The financial strategy of a company is defined as a system that has a wide potential for the qualitative achievement of the company's priority goals, and based on a continuous process of formation and rational use of financial resources. The main goal of the financial strategy is to maximize the income, minimize different risks and reduce external diseconomies. The contemporary state of the financial market is influenced by many factors of the internal and external environment, which encourages companies to develop effective financial strategies for the current term as well as for the long term. In this research, the essence of the concept of a financial strategy is expressed in its functions. The author identifies and characterizes the internal and external factors of the environment that can significantly affect the success of the implementation of the company's financial strategy. The research defines the essential methods of assessment of the factors of the internal and external environment: methods of PEST and SWOT analysis and methods of stress testing. The author concludes that companies need to pay their attention particularly to the externalities due to their unpredictable nature. The most effective way to assess the factors is a combination of methods that should be systematic. In its activities, the company should focus on progressive methods and use only effective financial management tools.

Keywords: Analysis of the factorsfinancial strategyfinancial managementSWOT analysisPEST analysis

Introduction

In the modern economy, the efficiency of a company in most cases depends on its financial strategy. The financial strategy plays a key role in improving the competitiveness of the company. It provides the necessary inflow of financial resources, contributes to the competent redistribution of financial flows, and eventually ensures the growth of the company's market value. The company’s financial strategy represents a group of actions aimed at achieving the long-range financial goals (Degtyareva & Dudin, 2019). Economists, whose field of activity is mainly represented by financial management, define financial strategy as one of the components of the company's general strategy. Most researchers and economists consider the financial strategy as one of the most effective tools for achieving the goals of financial management and realization of management functions. The analysis of contemporary sources on this issue leads to the conclusion about the formation of a unique financial strategy in each company, their choice depends on the specificity of a business activity, its intermediate and final objectives, etc. An important element of the research is to determine the specific functions of the financial strategy, expressing its economic essence:

Organizational function. This function provides the process of developing and implementing a financial strategy with the necessary labor, intellectual resources, instruments of labor; including coordination of the actions of interested departments and persons, motivation, rewards and punishments for the personnel controlling and monitoring their activity.

Resource function. It implies the timely provision of the enterprise with the necessary financial resources for work, forecasting and planning their income in order to find the optimal combination of sources of their attraction.

Distribution function. The function consists in forecasting and planning the timing and investment volume, other expenses and in beforehand search for objectives of capital investment.

Information function is to centralize, systematize and process incoming information and form on its basis recommendations for organizing the financial, production and sales activities of the enterprise, as well as developing proposals for the areas of strategic activity.

Optimisation function allows companies to ensure the efficiency of investments and attract financial resources, achieving a synergistic effect.

Adaptive function consists in the constant adaptation of the financial strategy to the changing conditions of the external and internal environment in order to use new opportunities and protect the enterprise from newly identified threats.

Control function. The realisation of this function allows us to study tendencies in the development and implementation of a financial strategy, identifying external and internal factors that negatively affect the strategic management process and developing proposals for their elimination or leveling their impact.

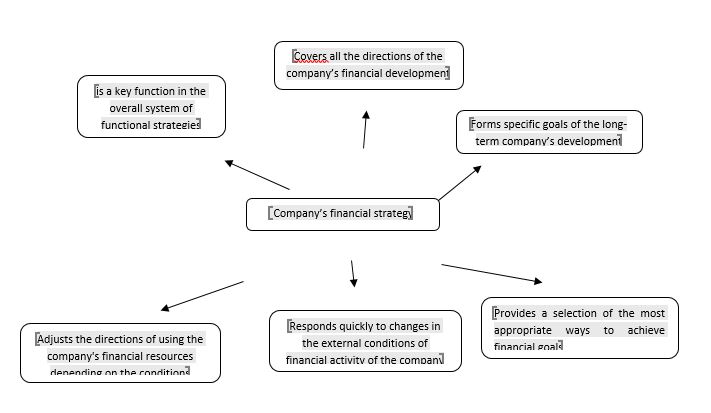

At the present stage of development, characterized by replacing one after another financial crisis, and quite aggressive competition in the financial sector, it is important to mention the most relevant function executable financial management which is called crisis management. The realisation of this function provides the most efficient way in terms of time and financial resources to derive the company from the state of crisis (bankruptcy) (Kuzmenko & Chernyshov, 2019) In its arsenal, financial management uses many methods, such as forecasting, planning, budgeting. However, in our opinion, the most effective one is a timely and detailed analysis of the external and internal environment of the company. The main characteristics that reflect the essence of the company's financial strategy are presented in Figure

The process of creating and launching a financial strategy is not simple and quick, it requires a manager's creative approach, because the procedure of strategic decision making, as well as the development of the financial strategy of the company depends on the specifics of its activities and the goals that are of prime concern. This process is carried out in a formalized framework, it is influenced by a large number of factors of the external and internal environment and requires a systematic accounting in the conditions of limited resources of the enterprise.

Problem Statement

Today the strategic management is the most important factor in the successful development of the company in a constantly changing externalities that force companies to use their resources and capabilities as much efficiently as possible. Due to the uncertain external environment, companies constantly have to solve a lot of problems:

1.Search and development of new financial resources.

2.Development of optimal investment decisions.

3.Systematic monitoring of accounts payable and receivable.

4.Assessment and minimization of possible risks of the company.

These key points were initially involved in the financial strategy concept which is an integral part of the company's sustainable financial development. Companies that do not pay enough attention to the formation of a financial strategy are faced with unprofessional approach to finding potential opportunities, with poor knowledge of the specifics of market relations, with many problems such as: a unprofessional approach to finding potential opportunities, poor knowledge of the specifics of market relations, unaccounted and unhedged risks, focusing only on short-term results; all of this in the future can lead to ineffective work of the company and negative financial results (Melecky & Podpiera, 2020). It is impossible to envisage at the planning stage the whole range of factors of external and internal influence that can affect the course and results of ordinary activities. In order to pretend and avoid the mistakes in selection of the strategy and in the direction of company’s development, it is necessary to identify the degree of impact of specific factors on the company, and to develop measures to minimize depending on their exposure.

Research Questions

The main questions need to by analyzed in the research:

1.What factors can have a significant impact on the company's financial strategy?

2.What factors of the internal environment can be distinguished?

3.What external factors affect the financial development of the company?

4.How can the company's financial strategy be adjusted and how can the negative impact of mentioned factors be minimized?

5.What are the methods for assessing factors, their strengths and weaknesses?

6.What group of factors should be a given special attention in realisation of the financial strategy of the company?

Purpose of the Study

The main goal of each commercial company is the efficient use of financial resources in conditions of their limitedness and maximization of profits with minimal risk indicators. Regular systematization of factors external and internal environment to some extent affect the successful implementation of the company's financial strategy. It is impossible to develop the financial strategy without identifying priority factors and assessing the degree of their impact. A significant moment in the formation of financial strategy is the separation of factors with spontaneous nature from factors which are easily predictable. The process of systematization of factors will enable the company to successfully implement strategic planning at all stages. Timely assessment of the factors of external and internal impact on the financial strategy of the company will allow to adjust and ultimately prevent or minimize possible losses of the company. Correct and prompt assessments of factors are important not only at the first stage of strategy development, but also at the following stages, since the application of tools and methods of financial strategy changes depending on conditions.

Research Methods

The research used different studies of national and foreign authors in the field of financial management that raise issues of formation and launching the company’s financial strategy. The research used the methods of theoretical research: analysis, classification and modeling. Analysis and grouping of the factors affecting the company's financial strategy reveal the most vulnerable part of the company and minimize risks in these areas. A systematic approach to the analysis of external and internal environment factors allows us to model the most optimal financial strategy of the company (Liao & Lo, 2021). Through this approach in case of need it is possible to effect adjustments in strategies to improve the financial results of the company. The methods of modeling and systematization of influencing factors are based on the most important economic categories. The factors can be sorted and grouped according to the following criteria: by their specificity, by the nature of the impact and the degree of development, by possibility of control and accounting.

Findings

The research showed that a huge number of factor’s classifications affecting the company's financial strategy are presented in the scientific literature. Mainly the factors characterize by their location (external and internal), in terms of their structure (simple and complex) and in time their occurrence (permanent and temporary). The most time-consuming is the analysis of the external environment, since its implementation is associated with many uncontrolled factors, as well as unknown variables. The external factors are related to the company's environment, so it needs to adjust its financial strategy in such a way as to minimize their negative impact. The systematization of external factors is presented in Table

Thus, the main factors of the external environment can be distinguished:

State financial and economic policy and state regulation of the economy.

Current financial and investment mechanism.

The existing conditions of the financial market, the market economy as a whole.

Financial market conditions.

External factors can be divided into indirect and direct factors. The first category of factors may not have a direct and immediate impact on the financial strategy, but may affect it in the future (Pribytkov, 2020).

Indirect factors include:

Financial and economic: state regulation of inflation, the level of incomes of the population, tax and monetary policy.

Foreign economic: the foreign policy of the state, the level of international competition, the conditions of world financial markets.

Others: political, scientific, technological, demographic and others.

Direct impact factors directly affect the development and implementation of a financial strategy.

The main factors of direct impact are:

Suppliers and buyers: current needs, the cost of raw materials, established connections between market participants.

Competitors: their level of development, ways of forming competitive prices, the level of innovation development.

Credit and financial system: creditors and investors, availability and development of financial market infrastructure, financial intermediaries, financial support of the state.

Internal factors in the formation of the financial strategy of the corporation include factors that depend on the conditions of organization and operation of the company. The grouping of internal factors is shown in Table

In addition to the factors highlighted in the table, internal factors can also include: the mission and values of the company, the degree of economic independence, the degree of risk of activity, and experience in implementing previous strategies. The human factor also has an impact on the development of a financial strategy. The level of professionalism of employees, as well as their intuition, can radically change the direction of strategic activity. Analysis of modern studies showed that earlier economists did not consider this factor significant, but recently there have been significant changes in the field of strategic management (Schegolevatyh, 2020).

Now more attention is paid to the degree of development of strategic thinking, since it can significantly affect the course of strategic activities of the company. Undoubtedly, creative thinking cannot be put on a par with more significant factors, since their impact on the development of the company's strategy has completely different reasons. However, it is also impossible not to mention it, since it is the employees of the company who work and implement all stages of strategy formation: from studying the factors of the external and internal environment and collecting the necessary data, to setting goals and tasks, choosing methods and tools for its implementation. There is no template for making a strategic decision; it is always taken after studying alternatives based on professional experience, including management intuition. Having analyzed the above factors, it is worth noting that the economic effect of each factor can be both positive and negative. In this regard, another classification of factors by effect can be distinguished: braking, stimulating, regulating, innovative.

Inhibitory factors. Among such factors, regulatory documents can be distinguished, which in one way or another impose restrictions on the company's production activities. Among the economic factors, one can note the inflation rate, the unemployment rate in the country, and the change in the key rate of the Bank of Russia. The unstable economic situation in the country is also restraining and affects the level of profitability and solvency of the company. Another example is the company's incorrect choice of suppliers and customers. Often the choice of suppliers without careful analysis of the basis, negatively affects the quality of the company's work. And the lack of proper analysis of the client base may not allow an increase in the number of active clients for a long time.

Stimulating factors. Factors leading to stable growth of the company and contributing to strengthening of competitive position in the market. First of all, such a fact can include periods of recovery in the economy, leading to an increase in company profits, an influx of investment in various sectors of the economy. Another example is the regulation of the legislative framework and the introduction of new regulations that contribute to the growth of the investment climate. For example, the introduction of tax incentives or tax holidays leads to both an improvement in the financial situation of the country and a single company. Of particular importance are technological factors. Improvements in production technologies, computerization lead to optimization of the company's costs, which positively affects profits.

Regulatory factors. These factors are the responsibility of the state, since it is precisely the market climate that depends on its regulation, relations between business entities. The state can influence the financial sector in two ways: direct and indirect. Direct methods: lawmaking, state orders, targeted financing, lending, etc., Indirect methods, including monetary and fiscal policy, planning, pricing tools, etc. Such regulatory factors contribute to the development of certain favourable market conditions in which the enterprise can operate and develop effectively.

Innovative factors. Factors contributing to the growth of innovative activity of the company. Such factors include a change in the existing preferences of consumers, which leads to certain innovations, for example, to the expansion of the assortment of products, to a change in appearance, to an improvement in the quality of the goods produced. The growth of competition in the market also contributes to the enterprise's activity in the field of innovation in order to occupy a leading or more stable position in its niche.

Thus, it is obvious that the choice of the company's financial strategy is influenced by many factors of an external and internal nature and that in order to identify them on time and prevent the company from receiving losses from its activities, monitoring must be carried out. The monitoring of factors allows for the timely and sufficiently accurate identification of a specific factor having a negative impact and the assessment of its impact. Modern financial management offers various methods for evaluating factors, including: PEST, SWOT and the method of stress testing (Ulusoy & Hazir, 2020).

PEST analysis is one of the most common methods of assessment, it includes a comprehensive analysis of aspects of the external environment: social, political, economic and technological. The method is quite reliable and allows you to assess the position of the company in the market, to identify its significant shortcomings and strengths in comparison with competitors. This method is good in that it gives an assessment not only of the current situation, but also makes it possible to assess the prospects for the development of the company in the long term. The positive aspects of the method include its low cost, ease of use and clarity. From the disadvantages of the method we can distinguish that it is often not so easy to get reliable information. It is common for official data to differ from those provided to external users, which can therefore have a significant impact on the quality of the assessment. Another disadvantage is the fact that such an analysis should be carried out on a regular basis, and not from "case to case," which also affects the reliability of the result. The result of this analysis is a financial strategy formed taking into account the influence of environmental factors.

SWOT analysis is a method of comprehensive assessment of factors in contrast to the PEST technique. The purpose of this methodology is to determine the priority directions for the development of the enterprise. This takes into account the systematization of information about the strengths and weaknesses of the enterprise, as well as about opportunities and potential threats. The advantages include the possibility of using SWOT analysis for enterprises of various fields of activity, the possibility of adapting the analysis to the object of study, using it in the framework of operational control and strategic planning, as well as relatively free selection of analyzed objects (Crowder & Wills, 2019).

The stress testing method is used to model situations in which a company may find itself and determine risk factors that can contribute to the deterioration of the company's financial performance. Thus, an idea is formed about what steps and how quickly the company will take them to overcome the current situation, how large the losses from such actions will be. Thus, simulation of different situations allows you to observe the behavior of the company. The advantages of the method include the fact that in addition to modeling and identifying strengths and weaknesses, the company helps to draw up and implement a plan of corrective actions. The disadvantage of the method is its labor intensity: labor and financial, as well as temporary resources are needed to implement this method.

Thus, the methods highlighted in the study can timely identify factors of the external and internal environment that negatively affect the financial stability of the company. It is worth noting that in order to obtain the most reliable result, you should alternate or use the combination of the above evaluation methods. The factors identified in time can be quickly corrected, which will directly affect the formation of the company's financial strategy.

Conclusion

Summing up the study, it is worth noting the following points. The financial strategy is part of the overall development strategy of the company, which has a significant impact on its development as a whole. The company's financial strategy must be flexible in order to respond quickly to changes in the internal and external environment. Regular assessment of the company's financial situation is an integral part of the successful implementation of the company's financial strategy. Since the modern financial market is characterized by instability and regularly changing needs of society, the implementation of a financial strategy should take place in the context of a thorough analysis of the company's strengths and weaknesses and be able to quickly adapt to new market demands through various methods. It is important to evaluate the external and internal factors affecting the company's financial strategy at all stages of its implementation. Among the most common methods for analyzing the external and internal environment are the PEST and SWOT analysis methods, as well as the stress testing method. These methods give the most reliable result when combined, as well as if the information necessary for analysis is exhaustive and reliable. Most attention should be paid to the factors of the external environment, since quite often they are uncontrolled and if adjustment measures are not taken on time, they can lead to significant losses to the company.

References

- Crowder, R. M., & Wills, G. B. (2019). Importance-performance analysis based SWOT analysis. International Journal of Information Management, 44, 194-203.

- Degtyareva, L. N., & Dudin, N. M. (2019). Features of the influence of the organization's external environment on the process of managing its activities. Innovative Economy: Prospects for Development and Improvement, 6(40), 84-90.

- Kuzmenko, O. V., & Chernyshov, D. S. (2019). The role of strategic planning in increasing the sustainability of enterprise development. Scientific Methodological Journal Concept, 1, 212-217.

- Liao, P.-C., & Lo, F.-Y. (2021). Rethinking financial performance and corporate sustainability: Perspectives on resources and strategies. Technological Forecasting and Social Change, 162, 120346.

- Melecky, M., & Podpiera, A. M. (2020). Financial sector strategies and financial outcomes: Do the strategies perform. Economic System, 44(2), 100757.

- Pribytkov, E. V. (2020). Financial strategy, the benefits of having an effective financial strategy in the activities of enterprises. International Journal of Humanities and Natural Sciences, 4-1(43), 191-193.

- Schegolevatyh, N. L. (2020). Factors influencing the company's financial strategy. Russian Economic Bulletin, 2, 107-112.

- Ulusoy, G., & Hazir, O. (2020). A classification and review of approaches and methods for modeling uncertainty in projects. International Journal of Production Economics, 223, 107522.

Copyright information

This work is licensed under a Creative Commons Attribution-NonCommercial-NoDerivatives 4.0 International License.

About this article

Publication Date

30 April 2021

Article Doi

eBook ISBN

978-1-80296-105-8

Publisher

European Publisher

Volume

106

Print ISBN (optional)

-

Edition Number

1st Edition

Pages

1-1875

Subjects

Socio-economic development, digital economy, management, public administration

Cite this article as:

Ramzaeva, E. P., Kravchenko, O. V., & Gorbunova, O. A. (2021). Analysis Of The Internal And External Environment Affecting The Company’s Financial Strategy. In S. I. Ashmarina, V. V. Mantulenko, M. I. Inozemtsev, & E. L. Sidorenko (Eds.), Global Challenges and Prospects of The Modern Economic Development, vol 106. European Proceedings of Social and Behavioural Sciences (pp. 1142-1150). European Publisher. https://doi.org/10.15405/epsbs.2021.04.02.135