Abstract

2020 has become a turning point in the tourism sector. Due to the new coronavirus infection Covid-19 emergence and worldwide spread, tourist flows in both foreign and domestic markets have collapsed. The tourism sector was in very difficult condition. At the moment, in Russia there is a gradual revival of the tourism sector. The regions are gradually lifting restrictions, tour operators and tourist infrastructure are resuming their activities. However, during the quarantine period, domestic tourism began to get more and more attention. The article presents the results of a comprehensive study aimed at creating and developing Samara Region's competitive tourist and recreational cluster (TRC) on the Zhigulevsk urban district and the national Park "Samarskaya Luka" territory. The concept of a comprehensive investment project of the TRC Zhigulevsk involves the appearance of new real estate and tourism by 2028. For investors, lots of different formats have been formed: accommodation, food and entertainment facilities. The methodological basis in the concept formation process was carried out marketing research of tourism services consumers. The future of the brand TRC Zhigulevsk is connected with the domestic tourism development, growth of demand for tourist services, formation of a ecological tourism culture. Since families at different stages of their formation and development are chosen as the basis for segmentation, a certain stability of consumption can be expected. In this regard, consumption patterns can be expected to shift towards increased demand for domestic tourism.

Keywords: Сompetitivenessintegrated researchlife qualityregiontourism

Introduction

The tourist and recreational cluster (TRC) is a territory of health and environmentally active tourism. The brand of TRK is a trade name, image and symbol, color combination, characters and their attributes, which are registered as a trademark and are protected by the law on the use of trademarks and copyright. The main consumer value that is characteristic of tourist services is recreation and restoration of physical and mental condition. Currently, during a period of adverse epidemiological situation, competition in the domestic market of tourist services has intensified. Tourist destinations within the country are becoming popular. That is why the constituent entities of the Russian Federation need to focus not only on maintaining their positions on the tourist market, but also on developing the existing tourist potential of the territory. In this situation, the role of regional tourism development policy becomes extremely important in the Russian tourism market. Of particular importance is the targeted promotion of certain tourist destinations of the regional tourism services market (Mamraeva & Tashenova, 2020). A project to create and develop a tourist and recreational cluster in the territory of the Zhigulevsk urban district as a key element of the future special economic zone of the tourist and recreational type within the national Park "Samarskaya Luka" territory is intended to become one of the effective tools to achieve this goal (Guseva & Dmitrieva, 2020).

Problem Statement

One of the main project tasks is to create conditions for the environmentally active tourism development and attract investment in the Samara region. In the future, a tourist and recreational cluster on the Zhigulevsk urban district is a large-scale project of public-private partnership. The state invests in engineering, transport infrastructure and in the development of anchor facilities - tourist traffic attraction points. Business can create various tourist service facilities in the TRC territory, taking the cluster association advantage. The main cluster development directions are: active recreation, nature, culture, entertainment, comfortable environment, security. Priority types of tourism: active ecological tourism, sports and recreation, river cruise tourism. The cluster creation and development is aimed at active tourists and athletes; lovers of mountains and nature; lovers of river travel; lovers of history and art.

Research Questions

The study focuses on a number of issues:

-trends in the development of the tourism services market in the Samara region;

-rationale for the creation of a tourist and recreational cluster on the Zhigulevsk urban district territory;

-research of demand in the Samara region tourism services market;

-content analysis and perception of the Zhigulevsk tourist and recreational cluster by potential consumers of tourist services;

-analysis of tourist services offer;

-volume and conditions of the domestic tourism market;

-key competitive findings.

Purpose of the Study

The purpose of the study is to create and develop a competitive tourist and recreational cluster on the Zhigulevsk urban district and the national Park "Samarskaya Luka" territory. This territory is characterized by a developed all-season infrastructure and a high level of service. At the same time, the environment, natural and cultural values are preserved here. The key audience of the tourist and recreational cluster is active tourists and athletes, lovers of mountains, river travel, history and art. This audience will increase the average check, not significantly increasing the anthropogenic load on the territory. The presence of tourist and recreational zones of different orientation will expand the audience, however, the general function, based on the formation of a culture of a healthy lifestyle and unity with nature, will help solve the problem of a low tourist culture of the existing audience and attract a higher quality.

Research Methods

Sociological demand study in the Samara region tourism services market

In the process of developing the TRC Zhigulevsk concept, research on tourism services consumers was carried out:

- internet questionnaire, in which 1,200 people took part;

- problem interviews with representatives of target audiences and the turbine business.

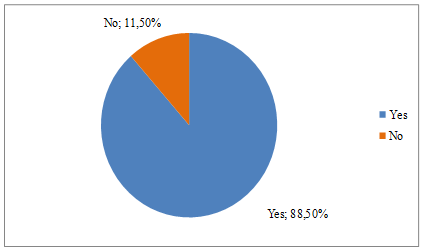

The questionnaire was attended by people from various regions of Russia European pare. Taking into account the general population parameters and the sample with a statistical validity of 95%, the confidence interval was 5%. The possibility of choosing domestic tourism was noted by 88.5% of respondents, related to coronavirus pandemic (Streimikiene & Korneeva, 2020). The answer about the possibility of choosing domestic tourism does not mean actual readiness to purchase a tour in the near future.

Content analysis and perception of tourist and recreational cluster Zhigulevsk by tourism services potential consumers

When forming the cluster concept, it is important to differentiate the perception of the brand relative to competitors. It is necessary to evaluate the qualitative characteristics of the perception by potential consumers of the Zhigulevsk city and related names (Polyanskova et al., 2019). The search queries popularity analysis on the Internet was carried out using the WordStat service.

The tourist services offer analysis. Volume and market conditions of domestic tourism

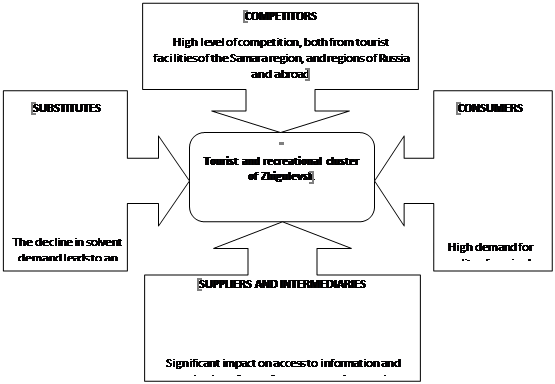

The competitive environment characteristic is necessary to form the brands' competitive advantages. One of the tools for describing the competitive situation is M. Porter's competitiveness diamond, which allows us to consider the level of competition in the industry from the point of 4 existing forces view: substitute goods, relations with suppliers and intermediaries, consumer pressure, a direct competitors influence.

Findings

The measures result taken by the region state authorities was the tourism industry dynamic development. Let's consider the main trends in Samara region tourism development.

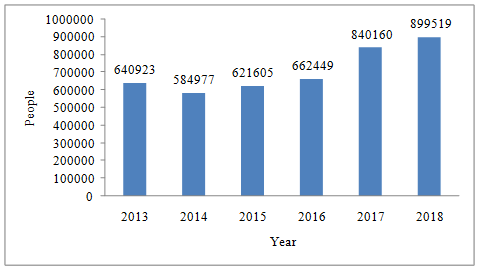

Increase of tourist flow to Samara region. In 2019, 1.2 million unique tourists visited the region (visitors from the Samara region, Moscow and other Russian regions). From 2013 to 2019, the tourist flow to the region increased by 47.95 %. If you compare 2019 and 2020, then there is an increase in tourist flow, which may be due to restrictions on travel abroad.

Increasing the tourism industry contribution to the Samara region economy. According to the results of the National Ranking of Inbound Tourism-2019, Samara Region took 21st place among the regions of the Russian Federation (Figure

1 ).

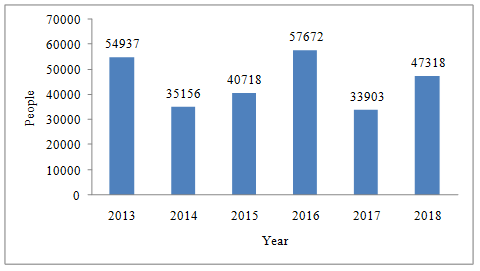

Over a 6-year period, the number of Russian citizens accommodated in collective accommodation facilities has increased by 40.3% in the Samara region. A similar indicator for foreign citizens, on the contrary, decreased by 13.8 % (Figure

3. Growing demand for domestic tourism. At the moment, there is a gradual revival of the tourism sector in Russia. The regions are gradually lifting restrictions, tour operators and tourist infrastructure are resuming their activities. However, during the quarantine period, domestic tourism began to get more and more attention. Trends in the development of the tourist area indicate a growing demand for domestic tourism, and the Samara region has the necessary potential to create and develop a tourist and recreational cluster (Figure

The respondents majority were people aged 31 to 45 years - 46.9 %. Less activity - 31.3 %, showed young people (from 18 to 30 years old). In third place are adults aged 46-65 years - 20.0 %. The distribution received corresponds to the project parameters of the main and additional target audiences. The respondents distribution by sex shows a large proportion of women among respondents - 58.5 %. In general, it should be noted that it is women in the family who initiate and decide on the organization of recreation.

The respondents distribution by material situation shows that the majority of 55.7 % as a whole rate it optimistically ("We live without special material problems," and 38.2 % experience difficulties with large purchases ("There is enough money for food and clothing"). 6.1 % of respondents are limited in funds ("There is not enough money even for products", "There is only enough money for products").

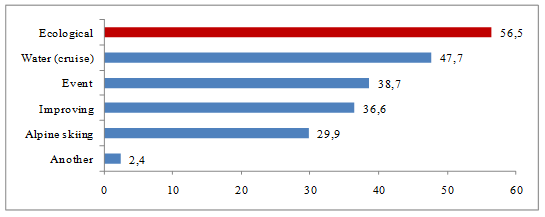

The social status of respondents is represented by the following structure: the largest share among respondents is made up of workers and public sector workers (19.2 % each), entrepreneurs (15.3 %), students (11.9 %), housewives (10.9 %), service employees (9.8 %), civil servants (6.0 %). The characteristics of the tourism services consumption by the target audience include the study of issues related to preferences and patterns of purchasing behavior. Regarding preferences for tourism, respondents' answers were distributed as follows: ecological (56.5%), water (47.7%), event (38.7%), health (36.6%), ski (29.9%) (Figure

The priority of choosing environmental tourism is determined by the high proportion of respondents for whom a responsible attitude to the world and the ability to influence through their own contribution are important. The development of environmental tourism with a probability of 95% can be supported by 53.5-59.5% of consumers.

Water (cruise) tourism is traditional for the Volga regions and is favorably received by potential consumers. Event tourism is attractive because it creates the atmosphere of the holiday, allows you to get unusual or memorable impressions.

In the Samara region, the festival theme is quite developed, there are long-term traditions of holding festivals that traditionally gather their supporters. Health tourism is chosen by 36.6% of respondents. In addition to medical care, recovery involves living with an environmentally friendly region, high-quality nutrition, moderate physical activity.

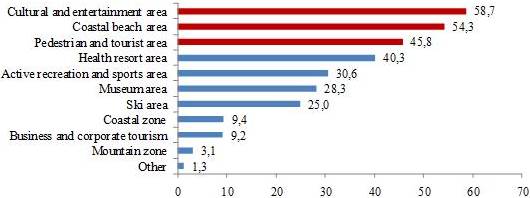

Preferred tourist activities among respondents were distributed as follows (Figure

About a third of respondents chose active forms of leisure: 30.6 % of the active recreation and sports zone, 25.0 % of the ski recreation zone, 3.1 % of the mountain zone. Cognitive tourism is attractive for 28.3 % of respondents who chose a museum zone. Business and corporate tourism is attractive to 9.2 % of respondents. The main criteria for choosing a holiday destination are price policy (33.0 %) and service level (31.3 %). Unfortunately, Russian resorts often differ for the worse in terms of service and price. The restrictions of 2020, of course, will help Russian tourism attract a solvent audience, but after the borders opening, the main tourist indicators flow will decrease. In this regard, increased attention should be paid to service training and competitive pricing policies.

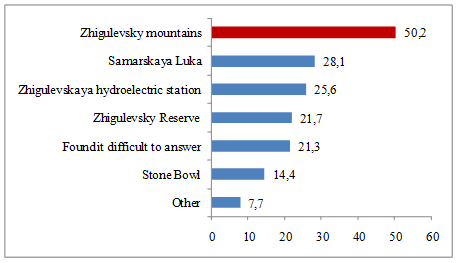

During the study the following results of content analysis and perception of tourist and recreational cluster of Zhigulevsk city district were obtained by potential consumers of tourist services. When forming the cluster concept, it is important to differentiate the perception of the brand relative to competitors. It is necessary to evaluate the qualitative characteristics of the perception by potential consumers of the Zhigulevsk city district and related names (Gubarev et al., 2019). The most popular associations of respondents with the word Zhigulevsk are presented on (Figure

More than half of the respondents (50.2 %) associate the city with the Zhigulevsky Mountains, in second place in the popularity of answers is Samarskaya Luka 28.1 %. 21.3 % of respondents found it difficult to answer. This may mean that the image of Zhigulevsk remains uncertain for a fifth of potential consumers. An analysis of the popularity of search queries on the Internet using the WordStat service showed that most of the search queries on the objects of the TRC Zhigulevsk come from the Samara region (Table

The popularity dynamics of the Zhigulevsk request in accordance with the data of the GoogleTrends service fluctuates throughout the year. It can be assumed that user activity is associated with the holding of events in the city. Zhigulevsk (literary holiday "Yeseninskaya Autumn" (September 22), festival "Zhigulevskaya Cherry" (August 12), etc.), as well as in connection with calendar holidays and long weekends (New Year, March 8, May holidays). Traditionally, high interest is noted in the summer. In this regard, it is necessary to expand information about the possibilities of the Zhigulevsk city district and create informational grounds for attracting consumers of tourist services. In general, compared to competitors, the Zhigulevsk request is more popular than Khvalynsk, but less than Elabuga.

Content analysis of feedback and guidance information systems included an examination of the following resources:

1. Tripadvisor, the world's largest travel platform tripadvisor.ru.

2. Online publication for business travelers komandirovka.ru (2.6 out of 5).

3. Russian accommodation booking service Tvil.ru.

As part of the comprehensive study, the offers of tourism services, the volume and conditions of the domestic tourism market were analyzed. The results showed that the leader in income is the Krasnodar territory with an indicator of 60.51 billion rubles. It can be observed that the largest number of hotels falls on the Krasnodar territory (more than 14,000 units) with an average of 3,000 units. The region is the center of domestic tourism among all resort regions of the Russian Federation due to its favorable geographical position. But, considering the drivers of the growth of tourist flow, a developed tourist infrastructure is no less important. Competitive analysis is necessary for the formation of competitive advantages of the TRC Zhigulevsk brand. One of the tools for describing the competitive situation is M. Porter's competitiveness diamond, which allows us to consider the level of competition in the industry from the point of view of 4 existing forces: substitute goods, relations with suppliers and intermediaries, consumer pressure, the influence of direct competitors (Figure

Substitutes (substitutes) can pull consumers away from the domestic tourism market. So, you can single out the entertainment sphere, field tourism, apartment rentals, visiting relatives in various Russian regions, vacations on a home plot or cottage. About 27 % of respondents said that, in principle, they fear long-distance trips after quarantine, and 8 % of respondents are not ready to travel abroad at least a year after the end of the pandemic out of fear. Most respondents (88 %) replied that they would prefer holidays abroad, with 44 % of respondents going to Europe, 23 % to Asia. 12 % of respondents are ready to relax in Russia, despite the opening of borders. 63 % of our compatriots are going to meet on vacation in the amount of no more than 50 thousand rubles. 31% estimated their vacation in the amount of 50 to 100 thousand. Only 6 % of Russians are ready to spend from 100 to 200 thousand rubles on vacation and only 1 % - more than 200 thousand rubles (TASS, 2020). In general, the decline in real incomes of the population negatively affects the services consumption, including tourism. In crisis periods, Russians prefer free alternatives - a trip to relatives or a vacation in the country.

Consumers - a youth audience under the age of 30 years has a rich experience of traveling abroad, therefore poses high requirements for the quality of service. For them, value for money is important, which is manifested in the level of infrastructure, the state of accommodation, the quality of food and the availability of additional services. The choice of Russian resorts in 2020 was a forced measure for them due to restrictions due to the coronavirus pandemic. As a rule, they have extensive travel experience and plan trips in advance. Young people under age 30 years can contact travel companies or independently plan holidays. Travel 2-3 times a year is normal practice for them. Pressure from this group of consumers may consist in making requirements for accommodation facilities, aggravating the issue of quality of service, forming demand for high service at moderate prices.

Suppliers and intermediaries include information portals and recommendation services that provide information about travel directions; specialized services for booking and comparison of accommodation facilities; travel companies (both tour operators and travel agents). All of them can create the image of the TRC and contribute to its development with the help of recommendations, the formation of a favorable image among the consumer. As a possible alternative, create your own portal on which all TRC objects can be placed. In this case, it is necessary to consider options for forming an advertising fund for cluster members that can be aimed at promotion.

Direct competitors. The Top 3 main tourist destinations in Russia, which are able to compete with foreign tourist destinations, included Sochi (it was named 35 % Russians), Crimea (30 %) and St. Petersburg (16 %). When determining the nearest competitors, you should focus on the Volga regions with an emphasis on small cities with tourist attractiveness, similar to the Zhigulevsk city district in terms of main characteristics. The closest in terms of the range of services provided, climatic conditions, landscape features and other factors is the Khvalynsk city, Saratov region.

Conclusion

According to the reviews of many travelers in the territory of Zhigulevsk city, there are not enough accommodation facilities. The highest rating is the hotel "Zhiguli." Among other objects, Burlatsky Camp, Home Hotel and Hotel Alpina are also noted. In the ranking of the best attractions in the first place is the national Park "Samarskaya Luka", in second place is the I. Repin House Museum. Zhigulevsk entered the Top 5 popular among tourists of Russia small cities in the summer of 2019 (NIASam, 2018). Among the main advantages of Zhigulevsk travelers note natural landscapes. But at the same time, more than 80 % of reviews reflect the main drawback - the lack of tourist infrastructure.

When developing the concept of the TRC Zhigulevsk, it is important to take into account the anthropogenic influence and minimize it. The Samara region residents are very dear to nature monuments located in the region, so any concept for the creation of tourist and recreational complexes will be widely discussed and criticized.

At the initial stage TRC Zhigulevsk development and in the process of developing the concept should focus on the regional brand formation, popular among the Volga region residents. It is advisable to form fame and stable competitive advantages for consumers of the Saratov, Ulyanovsk, Penza, Orenburg regions, the Republics of Tatarstan and Bashkortostan.

The comprehensive study results of the TRC Zhigulevsk competitiveness were the following key conclusions:

- a decrease in solvent demand contributes to the tourist services reduction in sales even in domestic tourism areas, Russians prefer free leisure and leisure options;

- young solvent consumers, who traditionally preferred outbound tourism, can reorient to domestic destinations, however, they initially have a negative perception of domestic service, they are not satisfied with the value for money of services, they are selective and demanding to the level of service;

- interaction with intermediaries and suppliers requires organizational work and formation of conditions of cooperation with participants of the tourist and recreational cluster;

- the closest competitor in terms of tourist potential characteristics is Khvalynsk, Saratov Region. It is advisable to study the experience of the development of the region and use the best practices for the development of the TRC Zhigulevsk city district.

Acknowledgments

The authors thank the Zhigulevsk city district Administration of the Samara region for information support in conducting the study.

References

- Gubarev, R. V., Dzyuba, Е. I., Kulikova, О. M., & Fayzullin, F. S. (2019). Quality management of the population in the regions of Russia. Journal of Institutional Studies, 11(2), 146-170. DOI:

- Guseva, M. S., & Dmitrieva, E. O. (2020). The competitiveness of single-industry cities in the digital transformation of the economy. In S. Ashmarina, A. Mesquita, & M. Vochozka (Eds.), Digital Transformation of the Economy: Challenges, Trends and New Opportunities. Advances in Intelligent Systems and Computing, 908 (pp. 216-226). Springer. DOI:

- Mamraeva, D. G., & Tashenova, L. V. (2020). Methodological tools for assessing the region's tourist and recreation potential. Economy of Region, 16(1), 127-140. DOI:

- NiaSam (2018). Zhigulevsk entered the top 5 popular among tourists of small Russian cities in the summer of 2018. https://www.niasam.ru/Turizm/---ZHigulevsk-voshel-v-top---populyarnyh-u-turistov-malyh-gorodov-Rossii-letom-------115817.html

- Polyanskova, N. V., Nuykina, E. Y., & Belyaeva, G. I. (2019). Sociological research of population vital activity based on a municipal residents' survey. The European Proceedings of Social & Behavioural Science, 57, 1532-1541. DOI:

- Shabalina, S., Shabalin, E., Kurbanova, A., Shigapova, A., & Vanickova, R. (2020). Social media marketing as a digital economy tool of the services market for the population of the republic of Tatarstan. In S. Ashmarina, A. Mesquita, & M. Vochozka (Eds.), Digital Transformation of the Economy: Challenges, Trends and New Opportunities. Advances in Intelligent Systems and Computing, 908 (pp. 3-19). Springer. DOI:

- Stepanova, T. E., & Polyakov, R. K. (2020). Digital economy institutional traps: A regional-sectoral approach. In S. Ashmarina, A. Mesquita, & M. Vochozka (Eds.), Digital Transformation of the Economy: Challenges, Trends and New Opportunities. Advances in Intelligent Systems and Computing, 908 (pp. 356-367). Springer. DOI:

- Streimikiene, D., & Korneeva, E. (2020). Economic impacts of innovations in tourism marketing. Terra Economicus, 18(3), 182-193. DOI:

- TASS (2020). Survey: Most Russian tourists after the opening of borders will prefer holidays abroad. https://tass.ru/obschestvo/8514893

Copyright information

This work is licensed under a Creative Commons Attribution-NonCommercial-NoDerivatives 4.0 International License.

About this article

Publication Date

30 April 2021

Article Doi

eBook ISBN

978-1-80296-105-8

Publisher

European Publisher

Volume

106

Print ISBN (optional)

-

Edition Number

1st Edition

Pages

1-1875

Subjects

Socio-economic development, digital economy, management, public administration

Cite this article as:

Polyanskova, N. V., & Belyaeva, G. I. (2021). Tourism And Recreation Cluster Competitiveness Comprehensive Study In The Region's Quality Life. In S. I. Ashmarina, V. V. Mantulenko, M. I. Inozemtsev, & E. L. Sidorenko (Eds.), Global Challenges and Prospects of The Modern Economic Development, vol 106. European Proceedings of Social and Behavioural Sciences (pp. 1100-1110). European Publisher. https://doi.org/10.15405/epsbs.2021.04.02.131