Abstract

The purpose of this publication is to assess the prerequisites and prospects for the development of TNC (transnational corporations) in Russia and the Samara region. The process of entering of Russian TNC into the global economic system is carried out both on an objective and subjective basis. The general process of globalization, shifts in the centers of economic growth, and increased competition serve as objective prerequisites for the integration of Russian companies into the world economy. The author's argument is based on such methodological principles and methods as the principle of duality of the economic nature of economic entities, methods of system and institutional analysis. The openness of the Russian economy was a kind of primary basis that stimulated the penetration of Russian companies into foreign markets. Taking into account all its negative consequences, including for society as a whole, openness stimulated the rapid development of the most important skills by young Russian entrepreneurs and their dynamic introduction into the global economic system. This process is associated with significant losses, losses, but still the most important skills were gradually acquired, many previously untested strategies and mechanisms began to be implemented. Despite all the costs of openness, as well as the "Dutch disease" syndrome that was observed until recently, an important goal was achieved – a temporary respite and accumulation of financial reserves, which later became the basis for the expansion of Russian enterprises to the CIS countries, and then to foreign countries.

Keywords: Activities of foreign TNC in the Samara regionforeign TNCprerequisites for the emergence of Russian TNCprospects for the development of Russian TNCtransnationalization in Russia

Introduction

During the USSR times, a relatively effective system of division of labor and international cooperation coordinated with it were formed within the framework of the socialist commonwealth. Strictly within the framework of state organizations, the production of Soviet enterprises was internationalized with the help of CMEA (Council for Mutual Economic Assistance). Large Soviet state-owned companies usually were vertically integrated multinational organizations. At the same time, the supply chain to the countries of the "democratic commonwealth" was completely controlled (Shevchenko et al., 2017). The supply structure was almost completely destroyed due to the collapse of the USSR, and existing economic relations between the subjects were interrupted. Thus, the most important goal of Russian enterprises after entering the transition period was to update and reconstruct the supply chain, as well as to find new markets.

The situation was aggravated by the lack of a solution other than a political one. As a result, a positive response was received to certain types of cooperation between Russian and CIS enterprises based on market principles. Capital from Russia consolidated quickly enough and soon took the lead among the post-Soviet states, carrying out active expansion on the markets of neighbouring countries. At the same time, newly formed Russian firms wanted to consolidate their own assets, and were engaged in corporate wars. These phenomena were the result of a lack of administrative resources to build value chains. At the same time, the profit received on the market, including the profit from the export of goods, was quite large, so the vector was taken for the transnationalization of economic activity. The relatively short period of existence and the interest in instant capital turnover did not allow Russian companies to approach foreign consumers. In addition, there was no experience in conducting international business, and an outdated management system prevented the active offensive of Russian companies on the global market.

Problem Statement

At an early stage of economic reforms, the formation of private property was recognized as the most important basis for improving economic productivity. At the same time, the protection of the owner's rights was practically not affected. Weak legal protection led to an unstable economic environment, where formal, real ownership structures often did not match, and legal, and real property rights often did not match. In the new post-industrial economy, TNC began to function both as independent entities and as instruments of states. They created areas of economic and geopolitical influence by redistributing resources in the interests of competitive countries (Klimovets, 2013). At the same time, the exchange rate of the Russian national currency is actually completely dependent on the US dollar. Unfortunately, the budget of the Russian Federation is still 60% formed by the sale of hydrocarbons, which are sold on the global market for dollars. Currently most of the domestic companies are in a stage of active expansion. This is largely due to a significant increase in household incomes and an increase in consumer loans, but the growth rate is primarily provided by the largest state-owned TNC. As the capitalization increased and the global ambitions of domestic TNC expanded, which began to claim at leading positions in the world in a number of industries, they began to be perceived warily, and sometimes unfriendly.

Research Questions

We consider it necessary to carry out a political and economic analysis of the causes of Russian TNC. Developing the author's understanding of the key reasons for the transnationalization of the Russian economy makes it possible to comprehensively assess the current situation in the Russian economy. It is important to determine the significance and role of the transnationalization of the economy for preserving and strengthening Russia's economic security. This will allow us to offer an understanding of the problems and prospects for the development and strengthening of the position of Russian TNC in the world. It is also necessary to analyze the investment opportunities of the Samara region. To consider the effectiveness of foreign TNC in the Samara region. For further effective and safe development of the transnationalization process in Russia, it is necessary to develop and offer new solutions. These recommendations should be considered both at the macro level and at the level of the Samara region.

Purpose of the Study

The purpose of the study is shown in the research questions considered. The purpose of the study is to assess the prerequisites and prospects for the development of TNC in Russia and the Samara region. The process of entering of Russian TNC into the global economic system is carried out both on an objective and subjective basis. The general process of globalization, shifts in the centers of economic growth, and increased competition serve as objective prerequisites for the integration of Russian companies into the world economy. The progressive implementation of globalization processes leads to the formation of the so-called "new economy". This development inevitably, in turn, leads to the emergence of companies "born to be global". Their main feature is that the management structure of these companies from the very beginning perceives the whole world as a single market system, i.e. the foreign market is considered inseparably from the domestic one. The author seeks to offer his understanding of the prospects for the development of Russian TNC on the world market in the context of the possibilities of preserving and strengthening Russia's economic security. We are confident that the largest Russian companies need to use the existing potential to develop and then increase exports of high-tech products.

Research Methods

The author's argument is based on the methodological principles of duality of the economic nature of economic entities. Methods of comparative, system and institutional analysis are used. The economic and statistical method is used. On this basis, the analysis of the current state of transnationalization of the Russian economy and its features is carried out. The analysis is carried out in the context of maintaining and developing Russia's economic security. The author's understanding of the perspective directions of TNC development in the world, in Russia and in the Samara region is being developed. It also takes into account such a factor as the forced displacement of Russian companies abroad. At the same time, we consider primarily institutional causes and the impact of the shadow economy. The prospects for strengthening the position of Russian TNC on the global market are analyzed. Recommendations are given for further effective development of the transnationalization process in Russia.

Findings

The domestic Russian market, having a small demand, and, consequently, a small capacity, began to gradually rebuild to go beyond national borders. The reason for this was the largest enterprises built in Soviet times, which in their scale were intended to provide for all the countries of the Soviet Union, as well as the countries of the socialist camp. After the collapse of the Soviet Union, the volume of demand for many products, especially raw materials, decreased. Further consolidation of the business led to the inevitable entrance to the foreign market. At the same time, the main problem for Russian business was the limited capacity of the resource base. For example, the logistics system of the transport network in the oil sector was largely limited. Oil exports could not exceed 40% (Zaytsev, 2018). This situation was key for most raw materials industries at the turn of the century. The way out of this situation, according to the authors, looks quite logical: solving the problems of the transport network, as well as searching for raw materials abroad, forming processing capacities closer to foreign consumers.

Despite the rapidly increasing globalization processes, these trends did not seem so indisputable for Russian business in the 1990s. Perceiving quite clear signals of the transnationalization of the world economic system, young Russian entrepreneurs were extremely weak and not adapted to work on the international arena. The emergence of Russian companies in the global market coincided with its profound transformation.

Thus, according to the author, the key reasons for the transnationalization of the Russian economy include the following:

- market motives - expansion of the market through the formation of production facilities abroad;

- resource-oriented motives typical for Russian mining and metallurgical and oil and gas industries;

- the aspiration of some Russian TNC, including both metallurgical production and fuel and energy, as well as machine-building, high-tech companies to have access to the latest technologies and innovations in the field of marketing and management;

- the desire to increase productivity through international resource management within the company.

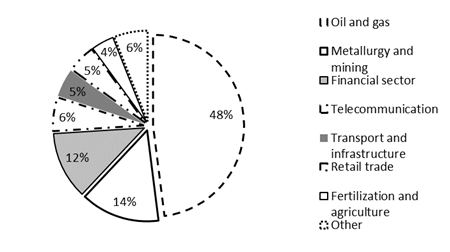

In the system of global economic relations, where transnationalization processes are the leading trend, domestic companies have faced a number of serious problems. Thus, the structure of the mechanism of the transnationalization process is largely archaic because it is focused exclusively on the raw materials sector. Multinational companies engaged in the extraction and sale of primary raw materials, are leading in the Russian economy (Figure

There is another negative point in the foreign expansion of Russian business. This is a huge scale of export and non-return of capital (Figure

On average, about 60 firms proclaiming global development strategies are approaching the leading "thirty" of domestic companies. In addition to retail companies, a number of companies in the automotive, chemical, light and other industries have announced their global expansion plans. According to the forecasts of some researchers, after 2025, these enterprises may be included in the list of full-fledged global participants of the world market.

At the same time, the relatively high level of innovative technologies, creative management and marketing solutions, and the ability to calculate their niche on the international market favor their strengthening on the world stage. However, such companies are currently a minority in the structure of Russian business (Kondratov, 2015).

These firms not only refuse to compete at the international level, but also do not compete with each other. About 30% of TNC sell the big amount of their products in their own region. At 35% of enterprises, the share of exports in revenue is estimated at 10% or higher. About 40% of companies say that they "don't compete with anyone." These companies lack both the resources and the desire to reach the global level and to enter foreign markets. Of course, not every Russian company is "born to be global". Various firms operating in the well-established, but not yet mature Russian market do not provide for access to the global level, mainly due to the fact that the domestic market is not yet developed, there is no effective competition, but the demand is high. Such a status cannot always remain unchanged and risks being deformed when foreign companies or larger Russian competitors fill the domestic market.

As for the international response to domestic TNC engaged in global processes of transnationalization of the economy, the following trends should be noted. First of all, this is a concern on the part of the governments of developed countries regarding the largest Russian TNC that actively penetrate the markets of developed countries (Libman & Hayfets, 2006). However, this attitude is inherent not only to Russian companies, but also to companies in developing countries such as India, China, and the Arab countries. This is due to the intersection of not only economic (competitive), but also political interests of developed and developing countries. However, according to the author, competitive motives prevail. It is necessary to analyze the investment possibilities of the Samara region. According to the Russian rating agency "Expert RA", the Samara region ranks 13th in terms of investment potential and 20th in terms of investment risk among 85 subjects of the Russian Federation (rating for 2019) (RA Expert, 2020). The council for improving the investment climate in the Samara region implements the possibility of a dialogue between business and government. Since 2015, there is a non-profit U-form organization-the fund "Agency for attracting investment of the Samara region". It provides state support to investors in the form of subsidies in order to reimburse their expenses. For investors, organizing new production, there is the provision of subsidies. As of the beginning of 2020, residents of the SEZ (Special Economic Zone) Togliatti are 9 foreign companies with a total amount of declared investments of 15.7 billion rubles. Most investors are large international companies. Among the residents of the SEZ Togliatti are subsidiaries of Sanoh, Edsha, Mubea, Toyota and others.

Anchor resident of the industrial park "Preobrazhenka" is LLC "Robert Bosch Samara". On July 31, 2013, the German concern Robert Bosch GmbH, a manufacturer of cutting-edge, high-tech products, signed an investment memorandum with the government of the Samara region, which provides for the launch of production of automotive components in the region: steering racks for cars and stability systems ABS and ESP. The company decided to place its production in the Preobrazhenka industrial park, which is equipped with the entire necessary infrastructure and meets the requirements of modern production.

According to representatives of LLC Robert Bosch Samara, the Samara region is a very attractive region for the German concern. A particularly significant factor is that the plant receives full support from the government of the Samara region, and all conditions are created for its further development. Moreover, the region's educational system provides highly qualified specialists, and its logistics potential provides access to new markets. Thus, in 2016, LLC Robert Bosch Samara established cooperation with a number of countries in Europe and Asia, which once again confirms the Bosch group's intention to be developed in the region in the long term.

On September 28, 2016, Tolyatti district was granted the status of the Priority Social and Economic Development Area (PSEDA) "Tolyatti". For residents of PSEDA, significant benefits are established for corporate income tax and land tax. In addition, residents are provided with a simplified procedure for conducting state control (Resolution of the Government of the Samara region dated 21.11.2016 No. 658). In 2006 in the Samara region (Togliatti) a branch of Federal-Mogul Powertrain, the world's leading supplier of technologies and components for powertrains in the automotive industry was founded. Federal-Mogul Powertrain has more than 37,000 employees worldwide. The company has 90 production sites and 14 technical research and development centers located in 20 countries.

The main reason in choosing the Samara region as the region to host production for Federal-Mogul Powertrain was the proximity to the main consumer of the company's products – JSC AVTOVAZ, the developed industrial sector of the region, the availability of qualified personnel and a developed logistics system. From 2006 to 2011, LLC Federal-Mogul Powertrane Vostok (Tolyatti) carried out assembly and delivery of the connecting rod and piston group to JSC AVTOVAZ, as well as delivery of other Federal-Mogul products manufactured by the company's foreign branches. In 2012, the production of pistons for Lada passenger cars was localized at the production site of the region, as a result of which the number of employees of the enterprise increased 4 times. The top management of Federal-Mogul Powertrain continues to confidently follow the path of production development in the Samara region. In 2016, it was decided to expand the product line produced by the Togliatti branch. In addition, LLC Federal-Mogul Powertrain Vostok has successfully passed the validation procedure for the production of pistons for export deliveries to one of the leading engine factories in the European Union. In addition, an investment project is being actively developed to localize the production of valves, the implementation of which will create additional jobs.

Since 2013, TM Samara "Electroschit" group of companies has been a part of one of the largest multinational corporations, Schneider Electric, a world leader in energy management and automation. Schneider Electric's divisions operate successfully all over the world. The corporation was interested in acquiring a company that is already well-known on the Russian market. Representative offices of TM Samara CJSC "Electroschit" group of companies are located in other regions of Russia and abroad. Moreover, the company had a well-established logistics system and established interaction with the power grid, which made this strategic investment extremely important for Schneider Electric.

Conclusion

For further effective development of the process of transnationalization in Russia it is possible to offer some recommendations. First, it is an unconditional expansion of the markets of presence. The most promising direction is currently recognized as the markets of developing countries. Thus, an active increase in production in the BRICS countries can serve as an element of such a strategy. Secondly, it is necessary to ensure the formation and development of exports of various high-quality petrochemical products, i.e. to determine the production of high-tech products as a key direction. This requires the qualitative improvement of the efficiency of research and development. The highest export potential in the field of high-tech production is assigned to those companies that have begun to implement a program of radical re-equipment. Ignoring the latest technological developments and their implementation in the production process seriously threatens the future competitiveness of Russian TNC. Therefore, the largest Russian companies need to use the existing potential to develop and then increase exports of high-tech products. To do this, it is necessary to make appropriate investments in a radical upgrade of the production base.

References

- FinCan (2019). Capital outflow from Russia by year. http://fincan.ru/articles/28_ottok-kapitala-iz-rossii-ctatistika-po-godam/

- Klimovets, О. В. (2013). TNK of Russia. Infra-M.

- Kondratov, D. I. (2015). International investments of Russian companies and financial institutions. The Age of Globalization, 2, 190-208.

- Libman, A., & Hayfets, B. (2006). Economic power and strategies of Russian TNC in the post-Soviet space. Society and Economy, 11-12, 152-165.

- Poscrebysheva, N. A. (2017). Prerequisites for the transnationalization of modern oil and gas TNC. Russian Foreign Economic Bulletin, 3, 109-117.

- RA Expert (2020). Rating of investment attractiveness of Russian regions-2019: Results and main conclusions. https://raex-a.ru/ratings/regions/2019

- Resolution of the government of the Samara region dated 21.11.2016 No. 658 "On ensuring the functioning of the territory of advanced socio-economic development "Togliatti". https://www.samregion.ru/external/adm/files/c_91230/3_PPSO_658_ot_21.11.2016.pdf

- RIA Rating (2019). The largest companies in Russia by capitalization. http://www.riarating.ru/infografika/20190129/630115992.html

- Shevchenko, I. V., Mudrova, L. I., Scheblykina, Y. S. (2017). Problems of transnationalization of Russian business. Finance and Credit, 4(722), 2-10.

- Zaytsev, S. Yu. (2018). Transnational corporations as agents of globalization. Society: Politics, Economics, Law, 3, 15-19.

Copyright information

This work is licensed under a Creative Commons Attribution-NonCommercial-NoDerivatives 4.0 International License.

About this article

Publication Date

30 April 2021

Article Doi

eBook ISBN

978-1-80296-105-8

Publisher

European Publisher

Volume

106

Print ISBN (optional)

-

Edition Number

1st Edition

Pages

1-1875

Subjects

Socio-economic development, digital economy, management, public administration

Cite this article as:

Nesterov, O. V. (2021). Prospects For Tnc Development In Russia In Context Of Its Economic Security. In S. I. Ashmarina, V. V. Mantulenko, M. I. Inozemtsev, & E. L. Sidorenko (Eds.), Global Challenges and Prospects of The Modern Economic Development, vol 106. European Proceedings of Social and Behavioural Sciences (pp. 1053-1060). European Publisher. https://doi.org/10.15405/epsbs.2021.04.02.126