Abstract

The aim of the study is to determine the factors that cause the productivity lag of Russian and foreign manufacturers of automotive components and ways to improve it. In general, the level of labor productivity of Russian enterprises lags behind the leading global companies approximately twice. To achieve this goal, the national project "Labor Productivity and Employment Support" was studied, which is aimed at the development of labor productivity of domestic enterprises and employment. The article is relevant due to the fact that Russian auto components manufacturers lag significantly behind the world leaders. This research is devoted to the analysis of Russian manufacturers' activity at the auto components market, in particular, labor productivity as the main characteristic of competitiveness. The paper identifies the problems of domestic manufacturers of auto components, identifies the main reasons for the lag between Russian and foreign companies' labor productivity, and suggests ways to improve it through the introduction of lean production tools or product differentiation. The data for the calculation were the materials of enterprises participating in the national project "Labor Productivity". The article formulates the main problems of Russian auto components manufacturers and suggests solutions. The results on increasing productivity should be used in the development strategies of economic entities which are engaged into the production of automotive components.

Keywords: Auto componentscost optimizationlabor productivityproduct differentiation

Introduction

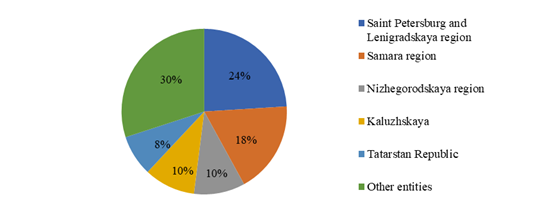

At present, there are about 1,500 legal entities in the Russian Federation whose main economic activity is the production of components and accessories for motor vehicles. These enterprises provide jobs for about 80 thousand people. In 2019, the volume of production on RNCE (Russian National Classifier of Types of Economic Activity) 29.3 was more than 400 billion rubles, which is equivalent to about 0.4% of Russia's GDP. The key regions where most of the industry's companies are located are the Volga, North-Western and Central Federal Districts. These regions are the key centers (clusters) of the Russian automotive industry. Distribution of automotive components industry revenue by regions of the Russian Federation at year-end 2019 is shown in Figure

The main consumers of products of these companies are car manufacturers, concentrated on the territories of car clusters, shown in Table

Problem Statement

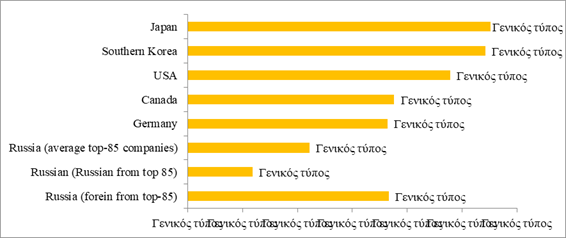

To compare labor productivity of Russian and foreign manufacturers of automotive components, the labor productivity of 85 largest Russian manufacturers of automotive components with the revenue over 200 million rubles and the number of employees over 100 people was evaluated, as well as a number of the largest international companies, which are among the top 100 world manufacturers of automotive components, aggregated by country (Figure

In general, the level of labor productivity of Russian enterprises lags behind the leading global companies approximately twice. If we compare the global level of labor productivity with the labor productivity of Russian companies that have no foreign "roots", the lag is even more noticeable, almost 4 times behind the best world practices. The labor productivity of foreign companies operating in Russia is almost at the same level as in the leading companies producing auto components abroad. Foreign manufacturers of auto components in Russia are leaders in terms of revenue. Among the producers of auto components in Russia in 2019, companies with foreign participation are not more than 10%. At the same time, these companies generate 54% of industry revenues. Out of 30 largest car components manufacturers in Russia only 8 are Russian companies.

The analysis of automation level and production facilities revealed that the residual value of fixed assets in foreign companies is on average 1.9 million rubles per employee, in Russian companies - 0.4 (The FCC study of the best Russian and foreign practices of increasing labor productivity in the production of components and accessories for motor vehicles, 2019). This indicates that foreign manufacturers invested greatly into modern equipment that requires less labor and, consequently significantly fewer employees. The number of personnel in Russian companies producing auto components is on average 40% higher than in foreign companies.

So, taking into account the lower level of labour remuneration, Russian companies have twice more Wage and Salary Fund (WSF) in costs than foreign companies (20% and 11%, respectively). The high share of WSF is the result of outdated equipment, which requires a lot of labour, and low work performance. Foreign companies have a significantly higher share of material costs than Russian companies, which may indicate higher quality of raw materials used in production or differences in the product portfolio.

As the main measures to improve competitiveness, we offer two well-known strategies: cost optimization and product differentiation. Analysis of international auto parts manufacturers shows that both strategies stimulate competitiveness and positive financial results. Depending on the situation in the industry for Russian manufacturers both strategies can be relevant: product development and innovation strategy and optimization costs strategy by improving processes. The first strategy is most suitable for large diversified companies, the second for small specialized manufacturers (Merkulova, 2019). For the companies that chose differentiation and creation of new products, it is crucial to timely update the product portfolio, to participate with car manufacturers in the development of new solutions and to choose their place in the value chain from the strategic point of view. This strategy is described in detail in the research by Matvienko (2018).

In turn, for local specialized companies due to given limited resources, the priority should become process optimization and subsequent cost reduction. The main tools of the cost optimization strategy are the scientific approach to labor organization and implementation of production automation tools. These tools improve product quality and reduce human factor in production (Dong et al., 2017). The decrease in the share of defective products causes the decrease in material costs. Increased efficiency of production processes also contributes to personnel optimization: production operation requires less staff time, and some operations become robotic.

Research Questions

The research base on labor productivity issues is large. Btnar et al. (2017) in their work defines the automation efficiency as the main tool for increasing labor productivity, without mentioning social issues in this area. Eliseeva and Agafonova's (2016) research is devoted to studying the impact of innovative development on the quality of the business entity as a whole. Matvienko's (2018) work analyzes the experience of companies using the product differentiation strategy to increase labor productivity in the current market conditions. The study of Kirillova (2015) identifies factors contributing to the development of car assembly facilities in Russia, the expansion of import substitution and the growth of export potential of the country as a whole. Each industry has its own peculiarities of functioning, problems and reasons for lagging behind developed countries in terms of labor productivity (Lavrovskii & Goryushkina, 2020). The issues of labor productivity in the sphere of auto components production are still insufficiently studied. It seems necessary to make a comprehensive evaluation of the factors of labor productivity increase, which complement each other.

Purpose of the Study

The aim of the study is to determine the factors causing the labor productivity lag of Russian and foreign manufacturers of automotive components and ways to improve it. In May 2018, by Decree of the President of the Russian Federation No. 204 «On national goals and strategic objectives of the development of the Russian Federation for the period up to 2024»the Government of the Russian Federation, together with the state authorities of the Russian Federation by 2024 were set the following goals:

- to stimulate the introduction of advanced managerial, organizational and technological solutions to increase productivity and modernize fixed assets, including through tax preferences;

- to reduce regulatory and administrative restrictions that restrain labor productivity growth, as well as to replace outdated and inefficient jobs;

- establishing a system of methodological and organizational support to increase productivity at enterprises;

- creating the training system aimed at training the staff on the basics of increasing productivity through the use of digital technologies and solutions platforms (Decree of the President of the Russian Federation № 204 "On national goals and strategic objectives of the development of the Russian Federation for the period up to 2024", 2018).

In December 2018 the Ministry of Economic Development of the Russian Federation developed the passport of the national project (program) "Labor Productivity and Employment Support" (Passport of the national project (program) "Labor Productivity and Employment Support", 2018). The passport provides financial support to companies in the implementation of projects aimed at increasing labour productivity: 300 million rubles for a period of up to 5 years at 1% per annum, subject to certain conditions. An obligatory condition for obtaining a loan under this program is a conclusion (certificate) of the Federal Commission on key elements of the production system and a sufficient level.

Table

Research Methods

In the current conditions of production development, the government, whose tasks are to ensure the competitive level of labor productivity at domestic enterprises, faced the need to use new approaches to organizing the development of production processes. This caused the change in the existing system of labor productivity regulation at the enterprises by creating the national project in this area. In the research the method of theoretical analysis of literary and documentary sources was used. The study includes regulatory documents, national statistical systems and databases. Also, analytical, systematic and comparative approaches were used to identify key problems in the industry and their causes. In quantitative evaluation of the findings, the methods of economic and statistical analysis were used. In addition, such general scientific research methods as induction, deduction and comparative analysis were used in the article.

Findings

In our opinion, the significant difference in productivity between Russian and foreign companies can be due to various factors and peculiarities:

- the level of automation: foreign companies are more frequently investing in automation and robotization processes, which means that there is no need for manual labor;

- level of production localization: foreign companies located in Russia buy a significant share of components abroad, and there is no need to keep employees for production line in Russia, so companies generate the same revenue with fewer people;

- quality and products innovation: technologies of international companies facilitate them to create a better product and sell it at a higher price. This factor increases the number of productivity indicators, which is a key factor of government productivity programs in order to save jobs (Mason & Shetty, 2019).

Modern developments and technologies of auto components in terms of automation and robotization allows solving a number of technological, production and economic tasks, including:

- improve the quality of products through the unification of production processes;

- expand the current level of production, reduce production costs by reducing material and labor costs in the producing of various components;

- increase products’ competitiveness due to quality improvement.

For companies that chose the differentiation and creation of new products, it is fundamentally crucial to timely update the product portfolio, to participate with car manufacturers in the development of new solutions and to choose the place in the value chain from strategic point of view. Since foreign companies allocate much more funds for R&D than in Russia (on average 4% of their revenues abroad, compared with 1% in Russia), the technological level of foreign companies gives them a competitive advantage through the products’ quality characteristics (Kalaitzandonakes et al., 2019).

Russian companies are not global and do not have the scale of the leading world manufacturers (Balatsky & Ekimova, 2019). This limits their ability to make long-term investments and create breakthrough innovations. Nevertheless, large diversified companies can play the role of "follower innovators" and create products by analogy with market leaders. Established links with local car manufacturers, the relatively low cost of intellectual labour in Russia, and protectionist government policies can support to maintain competitive market positions (Bjuggren, 2018).

In turn, for local specialized companies due to given limited resources, the priority should become process optimization and subsequent cost reduction. Important levers are to minimize production losses of time and materials, as well as automation. At the same time, it is vital to maintain the relevance of supply for the market and to update the products together with other companies, without being lagged due to outdating and being late. Companies that can neither create modern products nor achieve leadership in costs, are risking to leave the market in a short time.

Conclusion

According to the results of the efficiency analysis of participants of the national project "Labor productivity" engaged into the production of automotive components, it is obvious that there is no universal solution to this problem. Each of the research objects used its own tools, relevant to the current conditions. The authors reviewed the main practices that consider the specifics of the industry and combine the results of Russian and foreign companies. Two well-known strategies were proposed as the main measures to improve competitiveness: cost optimization and product differentiation. The specific features of their implementation for enterprises of auto components manufacturers were defined. The main recommendations are to introduce the tools of these strategies into the activity not with direct implementation, but in stages, taking into account the specific conditions of production and production areas. Only in this case, active participation of the state will bring positive effect. Preferential government lending will allow using cheaper resources to achieve strategic goals. Thus, government support for auto component manufacturers, the allocation of a greater share of funds by companies for R&D, as well as the widespread introduction of lean production system can increase productivity of the enterprises and improve their competitiveness at the global market.

References

- Balatsky, E. V., & Ekimova, N. A. (2019). Russia in the world system of labor productivity. The World of New Economy, 13(3), 14-28.

- Bjuggren, C. M. (2018). Employment protection and labor productivity. Journal of Public Economics, 157, 138-157.

- Botnar, O. V., Naumchik, K. A., & Shilova, N. N. (2017). Automation of business processes as a factor in increasing labor productivity. Scientific Community of Students of the XXI century. Economic Sciences, 4(52), 20-26.

- Decree of the President of the Russian Federation No. 204 «On national goals and strategic objectives of the development of the Russian Federation for the period up to 2024» (2018). http://kremlin.ru/acts/bank/43027

- Dong, K., Men, Yu., & Fan, R. (2017). Labor mobility and the growth of labor productivity. In B. Sankar, A. Waas, & M. Hyer (Eds.), International Conference on Economics, Management Engineering and Marketing (EMEM 2017) (pp. 35-45). DEStech Publications, Inc.

- Eliseeva, Yu. V., & Agafonova, O. V. (2016). The impact of innovation on organizational performance. Actual Problems of the Agro-industrial Complex, 9(2), 93-96.

- Kalaitzandonakes, N. G., Bredahl, M. E., & Gehrke, B. (2019). Competitive pressure, productivity growth, and competitiveness. Competitiveness in International Food Markets, 23(2), 169-187.

- Kirillova, T. V. (2015). Prospects for the development of car assembly plants and their contribution to the development of the export potential of the Russian Federation. In the World of Scientific Discoveries, 65(5), 143-159.

- Lavrovskii, B. L., & Goryushkina, E. A. (2020). Trends in labor productivity and investment: Empirical observations. Herald of the Russian Academy of Sciences, 90(2), 266-272.

- Mason, A. D., & Shetty, S. (2019). Sustaining productivity growth. A Resurgent East Asia: Navigating a Changing World, 13(2), 55-89.

- Matvienko, A. V. (2018). Strategic behavior of firms in the context of product differentiation. Actual Problems of Economics and Management: Theoretical and Applied Aspects, 15(4), 284-290.

- Merkulova, E. Y. (2019). The effect of labor productivity on economic growth. Statistics and Economics, 16(2), 34-44.

- Passport of the national project (program) «Labor Productivity and Employment Support» (2018). http://static.government.ru/media/files/Ki3g5TzKdmVyX2ogBvNTIxH3BQ6YFADA.pdf

- The FCC study of the best Russian and foreign practices of increasing labor productivity in the production of components and accessories for motor vehicles (2019). https://xn--b1aedfedwqbdfbnzkf0oe.xn--p1ai/ru/projectmembers/knowledgebase/

Copyright information

This work is licensed under a Creative Commons Attribution-NonCommercial-NoDerivatives 4.0 International License.

About this article

Publication Date

30 April 2021

Article Doi

eBook ISBN

978-1-80296-105-8

Publisher

European Publisher

Volume

106

Print ISBN (optional)

-

Edition Number

1st Edition

Pages

1-1875

Subjects

Socio-economic development, digital economy, management, public administration

Cite this article as:

Naumova, O. A., Berbasova, L. V., & Panteleeva, Y. A. (2021). Trends Of Labor Productivity Increase Of Car Components Manufacturers. In S. I. Ashmarina, V. V. Mantulenko, M. I. Inozemtsev, & E. L. Sidorenko (Eds.), Global Challenges and Prospects of The Modern Economic Development, vol 106. European Proceedings of Social and Behavioural Sciences (pp. 1045-1052). European Publisher. https://doi.org/10.15405/epsbs.2021.04.02.125