Abstract

The paper addresses regional aspects of applying tax incentive mechanisms for business investment activity in the Russian Federation. Currently, these mechanisms do not contribute to overcoming the investment crisis, which actualizes the development of approaches to improving their effectiveness. The rationale for these approaches is related to the problem of finding internal reserves for investment growth and mobilizing built-in mechanisms to stimulate it. The research focuses on assessing the application specifics of the appropriate tools for tax incentives for investment, and the purpose is to develop recommendations in this area. The research methodology is based on content analysis. Accordingly, the study examines the relevant tax legislation and key features of its application at the regional level. It is revealed that the regional policy of tax incentives for investment is determined by such determinants as the budget efficiency of tax expenditures, regional development priorities, and readiness for a flexible dialogue with business, supported by a sufficient level of budget mobilization. In this regard, proposals are being made to develop tax incentive mechanisms, including adjusting the conditions for differentiating tax benefits, introducing conditions for their receipt aimed at preventing "shadow schemes" of business, introducing special credit contracts, and transferring the investment tax deduction to the medium term.

Keywords: Business investment activityinvestmentinvestment activityinvestment activity of Russian enterprisesregional policy of tax incentives

Introduction

The expediency of tax incentives for business investment activity is confirmed by the results and conclusions of many scientific studies. The data of the study cover both developed (Mayoral & Seguro, 2017; Ohrn, 2018), emerging (Fan & Liu, 2020; Panskov & Lukasevich, 2017) and other developing markets (Bedianashvili et al., 2019). In particular, such tax incentive instrument as depreciation policy is characterized by a consistently high significance of the impact on investment (Maffini et al., 2019; Ohrn, 2019). At the same time, the dynamics of investment processes in the Russian Federation shows that the mechanisms used in this area are ineffective and generally do not contribute to overcoming the crisis.

This is largely due to the fact that a significant part of the envisaged tax incentives of investment nature rather contributes not to business development, but to current consumption or even investment in high-risk investment instruments (Saksonova & Kuzmina-Merlino, 2019). It should also be noted that tax incentives reduce the tax potential of the state as a whole (Ivanov et al., 2016) and its individual territories (Pokrovskaia, 2019; Pokrovskaia & Belov, 2020), which requires an assessment of their budgetary performance, adjusted for their effectiveness in relation to investment processes.

Recent studies have shown the importance of the influence on the investment behaviour of a business exerted by such factors as stage of the organization's life cycle (Ivanov et al., 2018), type of economic activity (Alexiou & Tyagi, 2020), general level of corporate taxation (Steinmuller et al., 2019), company size (Zwick & Mahon, 2017). This means that tax incentives for investment should be based on differentiated instruments that take into account the business climate. With allowance for this premise, the presented study is aimed at substantiating approaches to increasing the efficiency of tax incentives for investment activity of Russian companies with an emphasis on the regional aspect.

Problem Statement

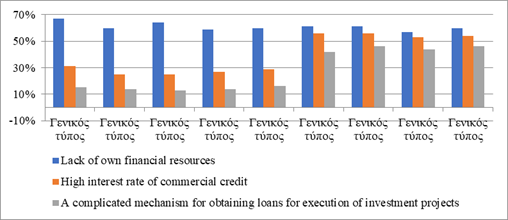

According to entrepreneurs, investments in Russia are constrained by heightened uncertainty and investment risks are not compensated by expected returns. This position is clearly reflected in the regular polls of the Federal State Statistic Service (Rosstat). The majority of respondents point out "the uncertainty of the economic situation in the country" among the most important restrictions on investment activities. According to the results of recent years, this is, first of all, a high level of inflation, a lack of own financial resources, investment risks, and a high percentage of commercial loans. One more related challenge for investment activity of Russian business concerns lack of financing. In particular, lack of own financial resources, high interest rate of commercial credit as well as a complicated mechanism for obtaining loans for execution of investment projects are recognized as key factors limiting investment in the Russian Federation. Notably, the awareness of external financing limitations increased since 2015 (Figure

Under these conditions, overcoming the stagnation of investment processes should be objectively facilitated by the development of channels for transforming savings into investments, subjectively – by increasing entrepreneurial confidence. Both tasks are complicated by the coronavirus crisis and the unfavourable external environment associated with international sanctions. The above circumstances actualize the problem of finding internal reserves for investment growth and mobilizing built-in mechanisms to stimulate it, including at the regional level.

Research Questions

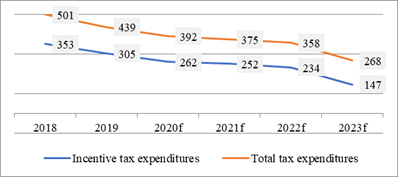

In 2019, the volume of tax expenditures at the subfederal level, including those of a stimulating nature, decreased in 59 constituent entities of the Russian Federation, which led to an overall decrease in regional tax expenditures. According to the Ministry of Finance of Russia, in 2019 they fell by 14% compared to the previous reporting period. Predictive estimates for the period up to 2023 indicate a further significant reduction (Figure

At the same time, the share of stimulating tax expenses in the total volume of investments in fixed assets of the subjects of the Russian Federation remains insignificant. In 2019, the corresponding tax expenditures averaged only 1.58% compared to investments in fixed capital, in a number of regions this value does not exceed 0.5% (for example, 0.48% in Arkhangelsk and 0.15% in Belgorod regions) (Rosstat, 2020). It is unlikely that such amounts of tax incentives can have a significant impact on business investment activity. Reducing regional tax expenditures is largely related to their low budgetary efficiency.

Against the general background of a decrease in the size of regional stimulating tax expenditures in the total volume of investments in fixed capital, in a number of regions, their growth is taking place. In particular, this is typical for Bryansk region, Krasnodar region, Moscow region, the Republic of Adygea and a number of other subjects of the Russian Federation. So, for example, in Moscow region, the corresponding indicator exceeded 7% in 2019 (Ministry of Finance of the Russian Federation, 2020a). The volumes of tax expenditures at the federal level are growing, and, according to the Ministry of Finance estimation, their further increase is predicted. A significant part of them falls on the expenses of the non-oil and gas sector of the economy, and mainly due to tax incentives for VAT. Considering this trends, the questions of our research will focus on assessing the features of the use of built-in tax incentives for investments: investment tax deduction and a special investment contract.

Purpose of the Study

The main premise of the study is that financial incentives for Russian business should be aimed at developing mechanisms for transforming savings into investments. This can be accomplished in two interrelated ways. First, it is necessary to activate the internal reserves of investment growth. Second, there is a need to expand the use of built-in tax incentives. At the same time, the approach to tax incentives for investment should be differentiated. In particular, the regional specifics of the business must be taken into account. Thus, the purpose of the study is to develop recommendations for tax incentives for investment, which require studying the issues under consideration at the regional level. Taking into account the formulation of the problem and questions of the study, it is necessary to identify the features of the application of the existing built-in mechanisms of tax incentives for investment activity of business, which will allow to elaborate author's proposals for its development.

Research Methods

Research methodology is based on the content analysis approach. Accordingly, the research addresses corresponding tax legislation and key peculiarities and its application on the regional level. The study information database is formed by the information of the Ministry of Finance of the Russian Federation on tax expenditures of subnational budgets, the Ministry of Industry and Trade of the Russian Federation on investment contracts with Russian companies, as well as relevant materials of regional legislation (Ministry of Industry and Trade of the Russian Federation, 2020).

Key legal provisions in the research area are systemized as follows:

1. Introduction of investment tax deduction (ITD) in the Tax Code of the Russian Federation was aimed at creating incentives for organizations to make investments. The right to use ITD by taxpayers is directly established by the laws of the constituent entities of the Russian Federation. The Tax Code of the Russian Federation establishes only “framework” conditions for the application of this regulation. The amount of the deduction under federal law can be up to 100% of the cost of the acquisition or modernization of fixed assets with a useful life of 3 to 20 years, belonging to depreciation groups 3-10 (excluding buildings, structures, transmission devices), including 10% – at the expense of the share of the tax that goes to the federal budget, and up to 90% – due to the regional part of the income tax. At the same time, the income tax received by the regional budget, after applying the deduction, cannot be less than 5% of the tax base. In addition, organizations using ITDs cannot apply a depreciation premium, nor can they accrue depreciation to be included in expenses.

2. Special investment contracts (SPICs), introduced in 2014, were intended to intensify the growth of investment in high-tech industries of Russian production sector. A SPIC is an agreement between an investor who undertakes to create, or modernize and (or) master the production of industrial products, and the state (jointly the Russian Federation, a subject of the Russian Federation, a municipality), which in turn undertakes to ensure the stability of the conditions for conducting economic activities for the investor and apply a preferential system of taxation of profits and property of the investing organization. The SPIC is concluded based on the results of a competitive selection of projects for a period of up to 10 years, based on the period of the investment project reaching the project operating profit in accordance with the business plan of this project, increased by 5 years. The minimum investment is RUB 750 million, VAT excluding. Regional authorities establish the procedure for concluding SPICs within the framework of the requirements of federal legislation.

Findings

The study of the regional practice of the analysed instruments shows the following. In 2020, the ITD was introduced in almost a third of all subjects of the Federation. Regions individually approach both the establishment of the categories of taxpayers who are given the opportunity to apply the INV, and the establishment of the amount of deduction in terms of the minimum income tax rate received by the regional budget, and other conditions for the application of the ITD, which reflects the priorities of regional development.

For example, the Law of St. Petersburg dated December 17, 2019 No. 630-144 "On Amendments to the Law of St. Petersburg "On Tax Benefits" provides for the introduction from January 1, 2020 of an ITD on corporate income tax. The law is focused primarily on manufacturing enterprises. At the same time, the organization's income from activities in the manufacturing industry should be at least 70%, the number of personnel should be at least 100 people, the average salary should be at least three times the minimum wage in St. Petersburg, and the fixed assets renewal rate should be at least 15%. For railway transport organizations, an additional condition for the use of ITD is the volume of investments in the economy of St. Petersburg over 500 million roubles annually.

The reasons for the restrained attitude towards the transition to the use of ITDs by the subjects of the Russian Federation are often associated with the need to revise the entire composition of tax benefits and other preferences established by regional legislation in order to “compensate” at least partially the “lost income” of the regional budget caused by the introduction of individual ITDs. As for the application of the second instrument, by October 2020, 45 federal SPICs were concluded in 11 industries with investments of more than 1 trillion roubles, which made it possible to create 21 thousand new jobs. Given the rather tough conditions for concluding the SPIC for investors, regional authorities are trying to provide additional preferential terms for doing business on their territory, which obviously requires a flexible dialogue with the business community, which must be supported by a sufficient margin of budgetary strength. This also applies to rental rates for the use of land plots, and the volume of products to be sold under the SPIС, and a number of other conditions.

Conclusion

The regional policy of tax incentives for investments is determined by such determinants as budgetary efficiency of tax expenditures, priorities of regional development, readiness for a flexible dialogue with business, supported by a sufficient level of budget funds mobilization. These determinants are significant not in all subjects of the Russian Federation. Thus, the share of tax expenditures of the subjects of the Russian Federation to stimulate investment activity remains very low for most territories. The planned reduction in the scale of tax incentives at the sub-federal level reflects its low budget efficiency. Revision of government support measures in favour of built-in and more targeted instruments (investment tax deduction, special investment contract) makes it possible to more adequately take into account the interests of federal, regional authorities and business. It should be noted that the types and volumes of tax preferences, both when concluding SPICs and within the framework of the ITD, are established for organizations on a case-by-case basis, depending, first of all, on the main type of their economic activity, the volume of investments, being also subject to a number of additional conditions, such as the number of personnel, the coefficient of fixed assets renewal, the average wage for which the minimum amount is established. A number of suggestions should be made in this regard:

1. In our opinion, instead of the “average wage” indicator, it would be more reasonable to use the indicators of the median or minimum wage to solve the problem of increasing the level of wages (mainly for low-paid categories of hired personnel).

2. For enterprises of certain sectors of the economy, as the conditions for granting tax preferences, it seems advisable to set also threshold values for such indicators of their activities as the volume of tax transfers to budgets of different levels per employee, profitability of sales, and return on investment. In our opinion, this will help to reduce "shadow schemes" of doing business.

3. In addition to the special investment contract, the special loan contract should also be envisaged at the legislative level, according to which banks that provide investment loans to certain groups of borrowers at rates below market rates will be able to reimburse the lost income through tax deductions. The introduction of this instrument will contribute to the transformation of savings into investments.

4. In the face of a sharp decrease in profits for many companies in 2020 due to the coronavirus pandemic, in order to maintain the renewal of fixed capital, it would be advisable for regional authorities to provide for the possibility of transferring the investment tax deduction to the medium term.

Acknowledgments

The reported study was funded by RFBR according to the research project № 19-010-00198.

References

- Alexiou, C., & Tyagi, A. (2020). Gauging the effectiveness of sector rotation strategies: Evidence from the USA and Europe. Journal of Assets Management, 21(3), 239-260.

- Bedianashvili, G., Ivanov, Yu. B., & Paientko, T.V. (2019). Tax reforms in Ukraine and Georgia: Changing priorities. Journal of Tax Reform, 5(2), 107-128.

- Fan, Z., & Liu, Yu. (2020). Tax compliance and investment incentives: Firm responses to accelerated depreciation in China. Journal of Economic Behavior & Organization, 176, 1-17.

- Ivanov, V. V., Lvova, N. A., Pokrovskaia, N. V., & Naumenkova, S. V. (2018). Determinants of tax incentives for investment activity of enterprises. Journal of Tax Reform, 4(2), 125-141.

- Ivanov, V., Pokrovskaia, N., & Lvova, N. (2016). Tax potential of a state: Development factors. In J. Alver (Ed.), Proceedings of the 5th International Conference on Accounting, Auditing, and Taxation (ICAAT 2016), AEBMR-Advances in Economics Business and Management Research, 27 (pp. 139-145). Atlantis Press.

- Maffini, G., Jing, X., & Devereux, M. (2019). The impact of investment incentives: Evidence from UK corporation tax returns. American Economic Journal: Economic Policy, 11(3), 361-89.

- Mayoral, J., & Segura, A. (2017). Taxes as determinants of corporate investment: Empirical evidence in Spanish private firms. Revista de Contabilidad – Spanish Accounting Review, 20(2), 195-209.

- Ministry of Industry and Trade of the Russian Federation (2020). List of investment projects, the implementation of which entitles industrial entities to receive financial support in the form of tax and fee benefits until 2025 in accordance with the legislation on taxes and fees. https://minpromtorg.gov.ru/opendata/7705596339-investprojects/

- Ministry of Finance of the Russian Federation (2020a). Information on tax expenditures of the subjects of the Russian Federation as of 01.10.2020. https://minfin.gov.ru/ru/perfomance/budget/policy/?id_57=131619-informatsiya_o_nalogovykh_raskhodakh_subektov_rossiiskoi_federatsii

- Ministry of Finance of the Russian Federation (2020b). The main directions of the budget, tax, customs and tariff policy for 2021 and the planning period 2022-2023. https://minfin.gov.ru/ru/document/?id_4=131644-osnovnye_napravleniya_byudzhetnoi_nalogovoi_i_tamozhenno-tarifnoi_politiki_na_2021_god_i_na_planovyi_period_2022_i_2023_godov

- Ohrn, E. (2018). The effect of corporate taxation on investment and financial policy: Evidence from the DPAD. American Economic Journal: Economic Policy, 10(2), 272–301.

- Ohrn, E. (2019). The effect of tax incentives on U.S. manufacturing: Evidence from state accelerated depreciation policies. Journal of Public Economics, 180, 104084.

- On Amendments to the Law of St. Petersburg (approved on December 17th, 2019 by the Law of St. Petersburg No. 630-144). https://www.gov.spb.ru/law/?d&nd=537964894&nh=0&header=010000004F00&frame=left

- Panskov, V. G., & Lukasevich, I. Ya. (2017). Tax mechanisms for stimulating the modernization of the Russian economy. Finance, 8, 42-48.

- Pokrovskaia, N. (2019). Sources of local budget revenue in Russia: Local taxes versus shared taxes. In L. Sedmihradská (Ed.), Proceedings of the 24th International Conference Theoretical and Practical Aspects of Public Finance (pp. 104-110). University of Economics, Oeconomica Publishing House.

- Pokrovskaia, N., & Belov, A. (2020). Tax revenues of local budgets in unitary states: A case study of Japan. Journal of Tax Reform, 6(1), 73-89.

- Rosstat (2017). Investment in Russia 2017. https://rosstat.gov.ru/bgd/regl/B17_56/Main.htm

- Rosstat (2019). Investment in Russia 2019. https://rosstat.gov.ru/bgd/regl/b19_56/Main.htm

- Rosstat (2020). Investments in fixed assets by the subjects of the Russian Federation. https://rosstat.gov.ru/storage/mediabank/invest_sub.xlsx

- Saksonova, S., & Kuzmina-Merlino, I. (2019). Cryptocurrency as an investment instrument in a modern financial market. St. Petersburg University Journal of Economic Studies, 35(2), 269-282.

- Steinmuller, E., Thunecke, G., & Wamser, G. (2019). Corporate income taxes around the world: A survey on forward-looking tax measures and two applications. International Tax and Public Finance, 26, 1-39.

- Tax Code of the Russian Federation. Part two. (approved on August 5th, 2000 by the Federal Low of the Russian Federation No. 117-FZ). http://nalog.garant.ru/fns/nk/

- Zwick, E., & Mahon, J. (2017). Tax policy and heterogeneous investment behavior. American Economic Review, 107(1), 217-248.

Copyright information

This work is licensed under a Creative Commons Attribution-NonCommercial-NoDerivatives 4.0 International License.

About this article

Publication Date

30 April 2021

Article Doi

eBook ISBN

978-1-80296-105-8

Publisher

European Publisher

Volume

106

Print ISBN (optional)

-

Edition Number

1st Edition

Pages

1-1875

Subjects

Socio-economic development, digital economy, management, public administration

Cite this article as:

Ivanov, V. V., Lvova, N. A., & Andrianov, A. Y. (2021). Developing Regional Mechanisms Of Tax Incentives For Investment Activity Of Russian Business. In S. I. Ashmarina, V. V. Mantulenko, M. I. Inozemtsev, & E. L. Sidorenko (Eds.), Global Challenges and Prospects of The Modern Economic Development, vol 106. European Proceedings of Social and Behavioural Sciences (pp. 838-845). European Publisher. https://doi.org/10.15405/epsbs.2021.04.02.100