Abstract

The article focuses on determining the directions of financial technologies development in the perception of the financial market transformation. The article reveals the essence of the term “fintech” and considers the current level of fintech services adoption in Russia and globally. The main representatives of Russian fintech market are also identified. Particular attention is paid to issues related to identifying the most promising segments of the fintech industry in the Russian Federation, among which the most interesting are neobanks, online lending platforms, personal finance management, and e-wallets. The growth potential of fintech services in Russia is observed in such segments as transfer and payments, P2P lending (crowdfunding), smart insurance and predictive banking. Based on analysis, the main strengths and weaknesses, as well as key opportunities and threats for the Russian market of fintech services, are formulated, which ultimately will determine the way for the transformation of the entire Russian financial industry.

Keywords: FinTechfinancial technologiesfinancial sectorinformation technologydigitalization of the economyfinancial market

Introduction

Currently information technologies have an impact on all spheres of life and participate in the transformation of the financial services market, actively replacing traditional business models with digital ones. The integration of new financial solutions modifies the structure of consumption, reduce costs for certain functional capabilities, increase the efficiency and quality of business processes, as well as significantly affect the sustainability of business development (Vaganova et al., 2019). Consequently, the financial technology industry (or FinTech) is gradually turning into an independent intensively developing sector of the modern economy.

The financial services sector is increasingly applying new technologies and tools to fulfill its functions and implement fundamentally new solutions in which consumers are interested. Furthermore, new financial technologies enter the real sector (including retail, telecommunications, pharmacy, agriculture), exert their influence on insurance, lending, accounting services, mass valuation of real estate, asset management, investment, tax administration, etc. (Maslennikov et al., 2017).

However, thus far there is no consensus in the scholarly literature about definition of the term “fintech” (Eskindarov et al., 2018). After reviewing more than 200 scientific articles citing the term “fintech” and published over the past forty years Professor Patrick Schaufel from the School of Management Fribourg derived the following definition: Fintech is a new financial industry that applies technology to improve financial activities” (Povetkina & Ledneva, 2018, p. 47).

From our perspective, fintech can be defined as a comprehensive system that unites the sector of new technologies and financial services, startups and the corresponding infrastructure.

Methods

The research methodology is based on materials from Russian and foreign scientists of economists on the issue under study. The research is based on such methods as analysis, synthesis, statistical and monographic analysis. Such method of scientific research as synthesis was implemented in the process of collecting information about the level of financial technologies adoption across world markets.

Results

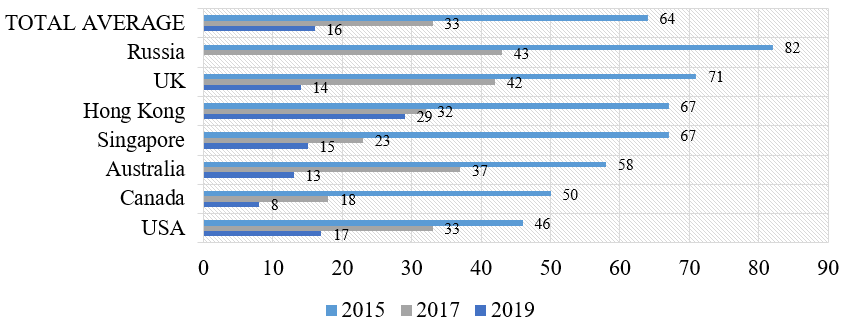

The global financial technology market is one of the fastest growing segments. According to the EY’s “FinTech Adoption Index 2019” research, in 2019, the Index was estimated at 64 %, whereas four years ago the Index was 4 times less. Certainly, fintech services have become popular around the world, turning into a massive trend in the financial markets, as evidenced by the data presented in Fig.

Thus, the highest Adoption Index among developed countries is observed in the UK, Hong Kong, and Singapore, which is partly due to the development of open banking. Over the past two years, adoption rate in Russia has almost doubled (as well as total average rate) and amounted to 82% in 2019. Currently, Russia is among leaders in the adoption of fintech by users and ranks third globally for this indicator.

Such a high technological breakthrough in Russia is due to the high Internet adoption rate and its accessibility to wide categories of the population, low margin of banking products and services, the desire to create ecosystems by traditional participants in the financial sector and their loss of monopolistic position in a financial services market.

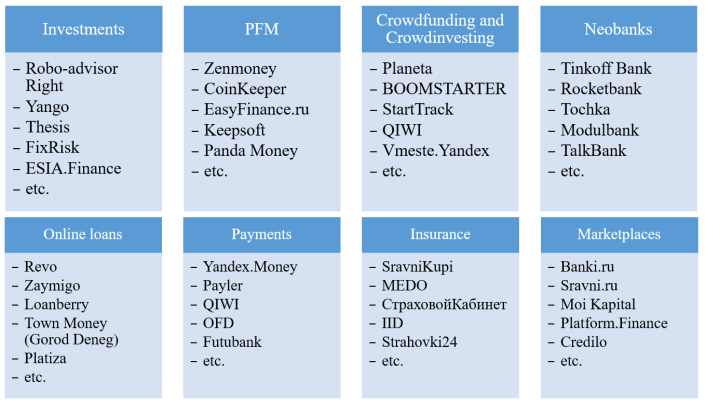

The main participants of Russian fintech industry are the largest banks and fintech startups. As for the latter, fintech companies appear and develop in almost all activities: authentication and verification, e-commerce services, loyalty services, peer-to-peer platforms, etc. (see Figure

The most promising segment of the fintech industry in the global financial sector is neobanks, which should be singled out for mention. Neobanks are digital banks which suggest traditional products and services, but they generally operate without a network of branches and use special mobile applications, websites, or social media accounts (Shkhalahova, 2019). The customer convenience of a new generation bank requires an intuitive interface, a remote support service and profitable rates. Examples of such banks in Russia are Tinkoff Bank, Modulbank, Rocketbank, Tochka, etc. (Katrich, 2017).

The opposite of bank lending in the form of customer interaction are online lending platforms. The main technology with which any online lending service operates is scoring. Due to scoring, the borrower is assessed along predetermined parameters. Innovative scoring technologies using artificial intelligence analyze a large amount of data about a potential borrower for a variety of parameters, ranging from social media and ending with human behavior when making a request on a website. Thereby, it is possible not only to identify troubling signals for the lender, but also to increase the attractiveness of the borrower compared to traditional bank checks. For example, it became possible to consider the popularity of a business on social media or check the regular flow of funds for electronic wallets. Currently, Russia is actively developing a partnership of online lenders with fiscal data operators and payment operators. Platforms such as Platiza, Revo, etc. are working successfully in the field of online loans (Zhdanova, 2018).

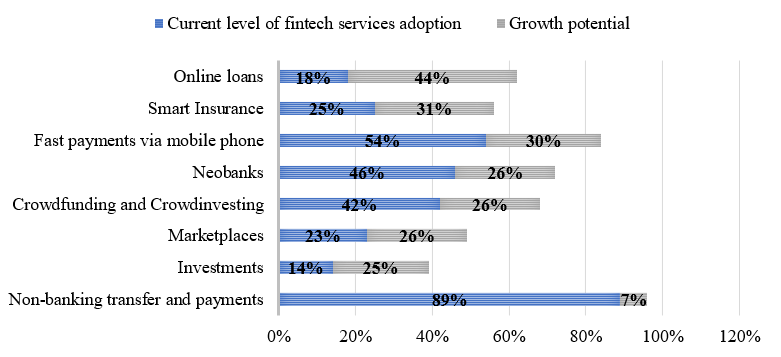

The Personal finance management (PFM) market is represented by PFM applications of independent developers and banking PFM services. Most of these services allow you to keep records and get analytics of your expenses, set financial goals, keep a family budget, and record transactions in cash or on several cards at once. Currently, banks are developing their services of finance analytics. They order a product from developers or develop their own solutions, drawing on existing experience. PFM is a promising area, because it can give the bank information about the financial behavior of its clients. In the future it will help to provide customers with relevant products and personalized services in accordance with their expenses and habits. Thus, Easyfinance jointly with TKB Bank created a bank in the messenger (TalkBank.io), which offer a bank card and chat bot, through which all interaction takes place. Panda Money is a Russian mobile application that is designed to educate children in financial literacy in a playful way (Bryanov & Morozov, 2017). The direction of e-wallets (online services for storing electronic money and making remote payments) is also actively developing. In Russia, Yandex.Money and QIWI are the main leaders in this area. As for the growth potential, the use of fintech services by Russian companies, the actual areas of development are online loans, neobanks, fast payments via mobile phones, and smart insurance (Figure

According to the EY’s research, by 2035, 96 % of all transactions related to transfers and payments in the Russian Federation will proceed using special technological solutions. In general, the areas, which are subject to efforts for Russian technological banks and fintech companies, are in line with global trends. The most promising segments that will be actively developing in the near future in the Russian financial market are transfer and payments (8.8 trillion dollars in 2025); financing (84.3 billion dollars in 2025 — the largest segment); capital management ( 2.6 billion in 2025) and insurance ( 1.5 billion in 2025).

The positive dynamics of the fintech services sector, according to industry analysts, will be ensured by a combination of factors. In particular, it is referred to increased adoption of mobile devices (smartphones, tablets, smart watches, etc.), increased cross-border mobility of the population and coverage of unbanked and underbanked segments (Digital technologies in Russian banks, 2019). Furthermore, the dynamic development of e-commerce market is of great importance for the fintech industry. This is particularly relevant, since this segment will stimulate the growth of the amount of transfer and payments, as well as financing.

It should be noted that in the near future in the Russian Federation and in the world at large, major banks and payment systems are expected to be able to create even faster money transfer technologies and push IT companies out of the online payment market. As for financing, by 2035, according to experts, the level financial technologies adoption into the financing segment will be 37 % and the amount of financing will total $ 178.6 billion.

The Internet adoption and the rapid implementation of new technologies in the financial sector lead to actively creating alternative online tools to ensure the effective development of financing (Filippov, 2018). One of the key areas in Russia and in the world, may be P2P lending or crowdfunding, mainly secured by assets. With regard to this area, according to EY analysts, the market size associated with private capital management and financial advisory services could reach $ 665.6 billion in 2035.

Insurance can also be considered a rather promising segment. According to the forecasts of EY analysts, by 2035, 9.8 % of all premiums will be paid by fintech services insurance operators. At the same time, the total insurance premiums paid by technology insurers are expected to reach $ 5.0 billion.

At this stage in the development of the smart insurance segment, the ERA-GLONASS emergency response system will be the optimal platform for insurance telematics. According NP “Glonass”, the Russian market is the most promising market in the world for implementing smart car insurance solutions, introducing pilot projects to test technical solutions, equipment, platforms and business models for providing innovative insurance services.

Apart from that, another possible development area may be P2P insurance (InFocus Payment Trends, Deloitte, 2019). International practice indicates that P2P communities may be considered as additional channels for promoting insurance services and as a mechanism for creating a positive customer experience. However, at present, the development of P2P insurance in the Russian Federation is hampered by the lack of an appropriate legislative framework.

It is worthwhile to note predictive banking. Thus far, as already has been mentioned, banks have access to a large amount of customer data, analyzing which financial institutions can know their customers better and provide follow-up actions.

Discussion

Thus, identifying promising areas for the development of the Russian fintech industry, we can establish possible threats and weaknesses (Table

As a result of the analyzed trends, it becomes clear that the way of transformation of the entire financial industry, the role of financial service providers, and the areas which are subject to efforts for Russian technological banks and fintech are promising and prospective.

References

- Adoption of financial and technological services in megacities of Russia and in the world [Proniknovenie finansovo-tekhnologicheskih uslug v megapolisah Rossii i v mire]. (2017). EY. https://media.rbcdn.ru/media/reports/EY-fintech-index-russia-rus-2017.pdf

- Bryanov, G. A., & Morozov, S. V. (2017). Development of fin-tech startups in the Russian Federation [Razvitie fintekh-startapov v rossijskoj federacii]. Global'nye rynki i finansovyj inzhiniring, 4(1), 57-64.

- Digital technologies in Russian banks [Cifrovye tekhnologii v rossijskih bankah]. (2019). KPMG. https://docplayer.ru/122726951-19-marta-2019-goda-moskva-cifrovye-tehnologii-v-rossiyskih-bankah-marianna-danilina-kpmg-zamestitel-direktora-praktiki-operacionnoy-effektivnosti.html

- Eskindarov, M. A., Abramova, M. A., Maslennikov, V. V., Amosova, N. A., Varnavskii, A. V., Dubova, S. E., Zvonova, E. A., Krivoruchko, S. V., Lopatin, V. A., Pishchik, V. Y., Rudakova, O. S., Ruchkina, G. F., Slavin, B. B., & Fedotova, M. A. (2018). The Directions of FinTech Development in Russia: Expert Opinion of the Financial University [Napravleniya razvitiya fintekha v Rossii: ekspertnoe mnenie Finansovogo universiteta]. Mir novoj ekonomiki, 12(2), 6-23.

- Filippov, D. I. (2018). About influence of financial technologies on the financial market development [O vliyanii finansovyh tekhnologij na razvitie finansovogo rynka]. Rossijskoe predprinimatel'stvo, 19(5), 1437-1464.

- FinTech Adoption Index 2019. [Indeks proniknoveniya uslug fintech 2019]. (2019). EY. https://www.ey.com/Publication/vwLUAssets/ey-fai-2019-rus/$FILE/ey-fai-2019-rus.pdf

- Fintech: map of the Russian market. [Fintech: karta rossijskogo rynka]. (2018). Rusbase, https://rb.ru/fintech/

- InFocus Payment Trends, Deloitte. (2019). https://www2.deloitte.com/content/dam/Deloitte/us/Documents/financial-services/usi-fsi-infocus-payments-trends-2019.pdf

- Katrich, A. S. (2017). Fintech – through transformation to a new economy [Fintekh – cherez transformaciyu k novoj ekonomike]. Global'nye rynki i finansovyj inzhiniring, 4 (1), 65-72.

- Market of innovative financial technologies and services [Rynok innovacionnyh finansovyh tekhnologij i servisov]. (2019). Nacional'nyj issledovatel'skij universitet Vysshaya shkola ekonomiki, Centr razvitiya.https://dcenter.hse.ru/data/2019/12/11/1524406294/Рынок%20финансовых%20технологий-2019.pdf

- Maslennikov, V. V., Fedotova, M. A., & Sorokin, A. N. (2017). New financial technologies change our world [Novye finansovye tekhnologii menyayut nash mir], Vestnik Finansovogo universiteta, 21, (2, 98), 6-11.

- Povetkina, N. A., & Ledneva, Y. V. (2018). Fintech and Regtech: Boundaries of Legal Regulation [Fintekh i regtekh: granicy pravovogo regulirovaniya]. Pravo, ZHurnal Vysshej shkoly ekonomiki, 2, 46-67.

- Shkhalahova, S. Y. (2019). Fintech dependence as an imperative of competitive transformation of traditional banking: features of the strategic convergence of fintech companies and banks [Fintekh-zavisimost' kak imperativ konkurentnoj transformacii tradicionnogo bankinga: osobennosti strategicheskoj konvergencii fintekh-kompanij i bankov]. Finansovye issledovaniya, 1(58), 60-70.

- Vaganova, O. V., Bykanova, N. I., Mityushina, I. L., Mohanad, A. S., & Salim, R. (2019). Introduction of the Latest Digital Technologies in the Banking Sector: Foreign Experience and Russian Practice. Humanities and Social Sciences Reviews, 7(5), 789-796.

- Zhdanova, O. A. (2018). Fintech accelerators as the institutions of fintech ecosystem [Fintekh-akseleratory – instituty fintekh-ekosistemy]. Obshchestvo: politika, ekonomika, pravo, 4, 34-36.

Copyright information

This work is licensed under a Creative Commons Attribution-NonCommercial-NoDerivatives 4.0 International License.

About this article

Publication Date

08 March 2021

Article Doi

eBook ISBN

978-1-80296-102-7

Publisher

European Publisher

Volume

103

Print ISBN (optional)

-

Edition Number

1st Edition

Pages

1-644

Subjects

Digital economy, cybersecurity, entrepreneurship, business models, organizational behavior, entrepreneurial behavior, behavioral finance, personnel competencies

Cite this article as:

Vaganova, O., Bykanova, N., Gordya, D., & Evdokimov, D. (2021). Growth Points Of Fintech Industry In The Perception Of Financial Market Transformation. In N. Lomakin (Ed.), Finance, Entrepreneurship and Technologies in Digital Economy, vol 103. European Proceedings of Social and Behavioural Sciences (pp. 435-441). European Publisher. https://doi.org/10.15405/epsbs.2021.03.54