Abstract

The paper analyzes the economic structure of modern Russia and identifies possibilities of using progressive software applications. The study revealed the adaptive loyalty of economic doctrines to the prevailing political structure and the conditional role of the government in the economic structure, which determines the strategic guidelines for the goal-setting of adapted economic systems. The economic structure is a “man-made” object with a complex internal structure performing functions determined by the dominant class. The work shows the desire of Russian scientific schools to replace the concept of the national economic structure with an economic system connected with political will, which preserves the government’s right to property. The compatibility of the key components of hardware and software developed by the Russian scientific school for the economic structure of Russia is established by analyzing activities of the government, the movement of goods and capital, and quality of GDP growth. The study revealed inconsistency in hardware and system software – the volatility of the growth rate of structural balance indicators; a decrease in the growth rate of exports of goods and services not offset by the high growth rate of total investment and gross national savings; the growing difference in the dynamics of GDP growth per capita and GDP, with an excess in national currency relative to the US dollar. The process of globalization of the world economy has had an impact on the economic structure of Russia, which has become a state-owned trans-regional corporation "Moscow and Moscow Region".

Keywords: Adapted economic systemsglobal competitionstate-owned trans-regional corporation

Introduction

In order to analyze possibilities of economic development of modern Russia and pay attention to numerous discussions about the theory, concept, paradigm and methodology, it is necessary to understand what kind of an economic system you have to deal with. The desire of scientific schools to replace the concept of the national economic structure with an economic system is connected with political will. In the neoclassical paradigm, the description of the economic system is revealed through the behavior of people maximizing their usefulness in the environment of limited resources and unlimited needs. The main function is economic activities, and the elements are firms, households, and the government.

Institutionalists emphasize institutions – the desire to separate institutions and organizations. The Institute is considered as a rule or norm of economic behavior within the framework of the existing economic system, which determines the possibility of conducting business activities.

The new institutional theory pays attention to the analysis of such factors as transaction costs, property rights, contract agent relations. Neo-institutionalists are trying to get out of the limitations of the economic system, focusing more on the economic space. The emergence of the digital economy is not only a way to reduce transaction costs, but to eliminate the excessive influence of the state on economic activities.

Problem Statement

In the modern Russian school of economics, A.G. Aganbegyan, S.Yu. Glaz'ev, E.G. Yasin, V.A. Mau point to the need to analyze the effectiveness of an economic system through the appropriateness of changing hardware and system software.

Considering the results of Russia's economic development for 1991–2017, Aganbegyan (2018) identified three main periods: the transformation crisis (1991–1998), the recovery socio-economic growth (1999–2008) and the 10th anniversary of the global crisis, recession and stagnation (2009–2018). The Russian economy is still in stagnation.

It is necessary to evaluate possibilities of increasing the efficiency of the modern Russian economic system, namely, the transition from stagnation and recession to sustainable economic growth, with an excess of global indicators of annual GDP growth of 3.5...4 %, investment in fixed and human capital by 8...10 % (Aganbegyan, 2017a). Previous sources of economic growth (high oil prices, foreign capital inflows, outstripping budget and credit growth) are in the past. Russia needs a comprehensive plan with targeted indicators for enterprises and organizations controlled by the state, with a single financial credit (project) plan (Aganbegyan, 2017b).

Glaz'ev (2014), developing the Marxist trend in combination with theories of economic cycles of Kondratiev and Schumpeter, points to the need to assess the effectiveness of the economic structure. An attempt to orient key public policy measures to the modernization of the economic structure, new industrialization and development of the Russian economy, “brought” Glazyev out of the Russian state.

Implementation of the government’s capabilities to intensify investment and innovation activities to the level required for structural restructuring of the economy based on the new technological structure with diversification of the Russian economy and concentration of resources in breakthrough areas will ensure its withdrawal to the path of sustainable growth (Glaz'ev, 2014). E.G. Yasin is smoothly moving from the hardware of the economic system to the system software, supporting the opinion of A.G. Aganbegyan about the need to reduce inflation to 3-4%, increasing long-term lending to large and medium-sized businesses, cancelling burdensome fees for entrepreneurship, etc. (as cited in Akindinova, Kuzminov & Yasin, 2016).

Mau (2017) argued that economic growth is the main challenge to the political agenda of leading countries, including Russia. Constraints of growth are contributing to a new global political trend and the emergence of populism, namely the transition from political to economic populism (Mau, 2017). The most important elements of economic growth are the transition from the stimulating demand to the stimulating supply, strengthening the project approach in public administration based on formulated national goals and projects, and maintaining conservative macroeconomic policies (Mau, 2019).

The policy aimed at stimulating the supply is hindered by isolation from the influx of foreign capital and scientific and technical knowledge (Smirnov, Osipov, Babaeva, Grigorieva, & Perfilova, 2019). Continued technological isolation undermines the competitiveness of Russian civilian exports and brings the economy back to the oil and military industries (Soubbotina & Weiss, 2009).

Federal democracy (Lynn & Novikov, 1997), which promotes international scientific and technological cooperation, while improving fiscal federalism and using the financial reform process to liberalize the market, should reduce the level of scientific and technical isolation of the Russian economy (Rosefielde & Vennikova, 2004).

Research Questions

The subject of the study is the economic structure of modern Russia as an established order or organization of reproductive activities of the national economic system. The economic structure reflects structural complexity of the national economic system of Russia – the ratio of parts, location, structure, description of the internal structure of the object, its parts and their relationships.

Purpose of the Study

The purpose is to determine the nature of the economic structure of modern Russia and possibilities of using software applications of Russian economic schools. To assess characteristics of the economic structure, an analysis of the dynamics of growth rates was carried out: government activities, changes in the structural balance; movement of goods and capital – export and import of goods and services, investment and gross national savings; quality of GDP growth.

Research Methods

The statistical analysis and the application package IBM SPSS Statistics were used. The statistical analysis in the form of a method for collecting, studying and presenting large amounts of data was used to identify main patterns and trends in the dynamics of indicators of the Russian economy. It involves data collection followed by mathematical processing; the use of data for certain signs; identification of the relationship of data and reasons why the data depend on each other; identification of the strength, intensity and frequency of changes in objects and phenomena.

Findings

Estimation of median values and variance of growth rates of government performance indicators, taking into account variance for 2000–2024. according to the International Monetary Fund (IMF) (2019), made it possible to identify (table

- high positive values of the growth rate of the total state gross debt in national currency with high dispersion;

- relatively stable growth rates of state revenues;

- Highly volatile growth rates of the structural balance of government.

The volatility in the growth rates of structural balance indicators is the dominant characteristic of the Russian government (Smirnov, Semenov, Kadyshev, Zakharova, & Perfilova, 2019). The volatility is caused by fluctuations in the growth rate of total gross national debt and stability of the growth rate of government revenues as a percentage of GDP. The government aligns the structural balance of government by changing the ruble exchange rate and reserve additional export revenues from market hydrocarbon prices.

Estimation of median values and variance of the growth rate of goods and capital, taking into account the variance for 2000–2024 according to the International Monetary Fund (IMF), made it possible to identify (table

- high positive growth rates of total investment as a percentage of GDP, with high dispersion;

- relatively stable growth rates of gross national savings;

- highly volatile growth rates in the volume of imports of goods and services, the volume of exports of goods and services.

A decrease in the growth rate of exports of goods and services (with a high share of a decrease in the growth rate of exports of goods whose basis is hydrocarbons), has a negative effect on the growth rate of the volume of imports of goods and services. Relatively high positive values of the growth rate of total investment and gross national savings do not compensate for the double gap in the dynamics of growth rates of imports and exports of goods and services.

The share of Moscow and Moscow Region in the exports is growing, TNVED 27 – “Mineral fuel, oil and products of their distillation; bituminous substances; mineral waxes "from 2016 to 2019 (Q1-2019) reaching about 60% of the total Russian volume. The main consumers of TNVED 27: 2016 – 97,268.9 million US dollars, large consumers: Germany – $12925.5 million; China – $ 11901.3 million; Netherlands – $ 11,243.5 million; 2017 – $123896.2 million, significant consumers: China – $15839.6 million; Germany – $ 15,305.0 million; Netherlands – $ 13823.4 million; 2018 – $ 172,711.3 million, large consumers: China – $ 28,356.5 million; Germany – $ 20082.5 million; Netherlands – $ 20082.5 million. Despite the change in leadership positions (Germany lost to China), in 2017 export growth (year-on-year) reached 27 %, in 2018 – 39 %, and in 2019 – more than 45 %.

The leader in the consumption of imports of TNVED 85 – “Electrical machines and equipment, their parts; sound recording and reproducing equipment, equipment for recording and reproducing television images and sound, their parts and accessories” is Moscow. The main importer of TNVED 85 is China: in 2016 – $ 5457.6 million, in 2017 – $ 7276.7 million, in 2018 – $ 8875.3 million. There is a decrease in imports: in 2017 – 33 %, 2018 – 22 %, in 2019 – less than 20 % (Customs statistics of foreign trade of the Russian Federation, 2019).

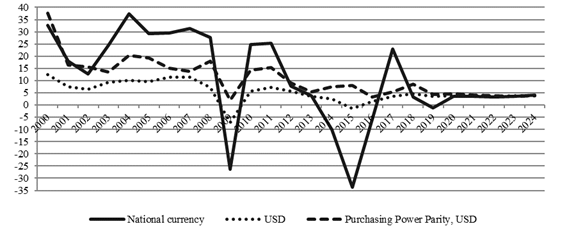

The assessment of the dynamics of per capita GDP growth rates (Figure

The growth rate of per capita GDP in the national currency is sensitive to crisis phenomena. In 2009, the growth rate of per capita GDP was 26.38 % in rubles and 7.12 % in US dollars, and PPP – 1.99 % in US dollars. In 2015, the growth rate of per capita GDP in national currency was 33.69 %, and in US dollars – 1.46 %, and PPP in US dollars was 7.99 %.

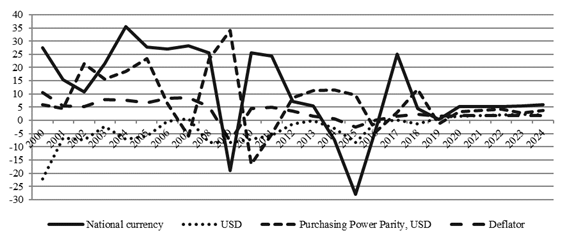

Assessing the difference in the dynamics of the growth rate of per capita GDP and GDP (Figure

The difference between the dynamics of the growth rate of per capita GDP and PPP GDP in US dollars is volatile. Comparing the difference in the dynamics of the growth rate of per capita GDP and GDP with the GDP deflator, one can see increasing discrepancies during the crisis in the national currency in 2009 – 2.4 times, in 2015 – 10.8 times; in US dollars: in 2009 – 1.1 times, 2015 – 3.2 times.

The growth rate of per capita GDP is the most stable and highest in US dollars. GDP growth rates for PPP in US dollars against the background of stable high values of the GDP deflator become the most attractive for the government when the positive dynamics of development of the Russian economy is declared. The growing difference in the dynamics of per capita GDP growth rates and GDP, with an excess in national currency relative to the US dollar, shows the high dependence of the Russian economy on the US dollar, primarily to cover risks from falling hydrocarbon prices and the transformation of Russian savings into American assets.

Conclusion

The economic structure of modern Russia can perform public functions which is important in the conditions of a pronounced cyclical recession of the global economy and intensification of global competition (Morova, Zakharova, Talanova, Dulina, & Nikolaev, 2017). The tolerant attitude and the historical path of development of the Russian scientific community to the public economic system have limited the possibility of using hardware and system software to ensure stable economic growth.

The limited use of software applications of Russian economic schools has caused volatility in the growth rate of structural balance indicators as a characteristic of activities of the Russian government. The government aligns the structural balance by changing the ruble exchange rate and reserve additional export revenues from market hydrocarbon prices.

The economic structure of modern Russia demonstrates limited characteristics, which are determined by its model – the state trans-regional corporation “Moscow and the Moscow Region.

References

- Aganbegyan, A. G. (2017a). Kak vozobnovit' sotsial'no-ekonomicheskiy rost v Rossii? [How to resume social and economic growth in Russia] Ekon. Vozrozhd. Ross., 3(53), 11–20.

- Aganbegyan, A. G. (2017b). Kakoy kompleksnyy plan do 2025 goda nuzhen Rossii? [What comprehensive plan until 2025 does Russia need?] Ekon. Polit., 12(4), 8–29.

- Aganbegyan, A. G. (2018). Pochemu ekonomika Rossii topchetsya na meste? [Why is the Russian economy marking time?] Probl. teorii i prakt. upravlen., 3, 11–26.

- Akindinova, N., Kuzminov, Ya., & Yasin, E. (2016). Russia’s economy: before the long transition. Russian Journal of Economy, 2(3), 219–245.

- Customs statistics of foreign trade of the Russian Federation (2019). Tamozhennaya statistika vneshney torgovli Rossiyskoy Federatsii. Retrieved from: http://stat.customs.ru (Accessed: 2019/08/23).

- Glaz'ev, S. Yu. (2014). O politike razvitiya rossiyskoy ekonomiki [On the development policy of the Russian economy]. Nauch. trudy Vol'nogo ekon. obshch. Ross., 181, 165–206.

- Lynn, N. J., & Novikov, A. N. (1997). Refederalizing Russia: Debates on the Idea of Federalism in Russia. The Journal of Federal., 27(2), 187–203.

- Mau, V. (2017). Lessons in stabilization and prospects for growth: Russia's economic policy in 2016. Russian Journal of Economy, 3(2), 109–128. Retrieved from:

- Mau, V. A. (2019). National goals and model of economic growth: new in the socio-economic policy of Russia in 2018–2019. Economical issues, 3, 5–28.

- Morova, N. S., Zakharova, A. N., Talanova, T. V., Dulina, G. S., & Nikolaev, E. L. (2017) Psychology of personal competitiveness of students in the system of higher education. Proc. of the 30th Int. Busin. Inform. Manag. Associat. Conf., IBIMA 2017 – Vision 2020: “Sustainable Economic development, Innovation Management, and Global Growth”, 4460–4468.

- Rosefielde, S., & Vennikova, N. (2004). Fiscal federalism in Russia: a critique of the OECD proposals. Cambridge Journal of Economy, 28(2), 307–318.

- Smirnov, V., Semenov, V., Kadyshev, E., Zakharova, A., & Perfilova, E. (2019). Management of Development Efficiency of the Russian Economy. The Europ. proc. of Soc. & Behavioural Sci. – Social and Cultural Transformations in the Context of Modern Globalism (SCT 2018), 218, 1871–1877).

- Smirnov, V. V., Osipov, D. G., Babaeva, A. A., Grigorieva, E. V., & Perfilova, E. F. (2019). Parity of innovation and digital economy in the Russian management system. Modern Management Trends and the Digital Economy: from Regional Development to Global Economic Growth (MTDE 2019), Advances in Economics, Business and Management Research, 22–27.

- Soubbotina, T., & Weiss, C. (2009). A new model of technological learning for Russia. Science and Public Policy, 36(4), 271–286.

- The International Monetary Fund (IMF) (2019). Retrieved from https://www.imf.org

Copyright information

This work is licensed under a Creative Commons Attribution-NonCommercial-NoDerivatives 4.0 International License.

About this article

Publication Date

07 December 2020

Article Doi

eBook ISBN

978-1-80296-095-2

Publisher

European Publisher

Volume

96

Print ISBN (optional)

-

Edition Number

1st Edition

Pages

1-833

Subjects

Management, human resources, resource efficiency, investment, infrastructure, research and development

Cite this article as:

Smirnov, V. V., Semenov, V. L., Babaeva, A. A., Grigoryeva, E. V., & Rezyukova, L. V. (2020). The Modern Economic Structure Of Russia. In A. S. Nechaev, V. I. Bunkovsky, G. M. Beregova, P. A. Lontsikh, & A. S. Bovkun (Eds.), Trends and Innovations in Economic Studies, Science on Baikal Session, vol 96. European Proceedings of Social and Behavioural Sciences (pp. 596-603). European Publisher. https://doi.org/10.15405/epsbs.2020.12.77