Abstract

The implementation of an investment project, the creation of a new business, and the effective functioning of an existing enterprise should be carried out in a favorable economic environment, which is also relevant for the catering enterprises. The article considers the spheres of the analysis of the catering market segment. The authors proposed to perform the following typical stages of the market analysis: the analysis of the dynamics of the main indicators of the catering market; the analysis of the structure of the catering market according to the type of establishments; the analysis of the consumer preferences; the analysis of the main organizational and economic characteristics of the enterprises according to the type of institutions. The first three stages of the algorithm were tested on the example of the catering market of the Krasnoyarsk territory. The testing of the fourth stage was carried out on the example of the coffee shops in the city of Krasnoyarsk. The analysis of the dynamics of the main indicators of the catering market in the Krasnoyarsk territory for 2012-2018 shows its intensive development and growing demand for the catering services. The turnover of the public catering grew almost throughout the period under study. A similar trend can be seen according to the results of the analysis of the turnover of the catering enterprises per capita.

Keywords: Cateringmarket analysisalgorithmcoffee shopconsumer preferences

Introduction

It is necessary to increase the investment attractiveness, to create new jobs, to increase tax revenues and real incomes of regional residents to activate the socio-economic development of some regions. The significance of these areas of regional development is confirmed by the fact that the "Yenisei Siberia" complex investment project (CIP) has been started. The "Yenisei Siberia" complex investment projects (CIP) projects cover various areas of activity, including social infrastructure and tourism, which implies the creation of new jobs (new hotels, cafes, restaurants, sports facilities, etc.) (Yenisei Siberia, 2019).

The concept of "an investment project" can be viewed both as the process and as a document having certain sections.

As the process, an investment project is a set of measures to invest funds in order to generate income or meet the needs of the national economy.

From the point of view of drawing up the document, the essence of any investment project is to justify economically the need to invest capital in a specific asset. We can say that this is a business plan, but in a broader, global sense. An investment project is designed not only to make a decision about starting a business, but also to analyze the prospects for funding research, infrastructure development, or the region's economic sector.

For the preparation of the investment project, the developers have two essential objectives:

- To make sure, that the investment will actually bring profit, and to calculate the payback period. This is especially true when the investor (Migunova & Elgina, 2013) makes the investment project himself.

- To convince the investor to put funds in the asset. An investor here can be not only an individual, but also a financial institution (structure), a manufacturing company or a government agency.

It seems that the process of evaluating the effectiveness of an investment project should be preceded by an analysis of the market segment in which the investment project is expected to be implemented.

Problem Statement

The clear algorithm for analyzing the catering market segment has not been currently formed despite the ongoing research of this market in different regions (Bolshanina, 2017; Frolov & Kim, 2015; Krapiva, Sukhanov, & Borovskikh, 2017; Rudachev & Shcherbakov, 2015; Sandakova, & Wire, 2019; Tsimokha, 2016; Zhdanova & Nettle, 2016).

Research Questions

The method of analyzing the catering market is the subject of this article.

Purpose of the Study

In this regard, the purpose of the article is to develop an algorithm for analyzing the catering market and testing it on the example of the public catering enterprises in the city of Krasnoyarsk.

Research Methods

The research of the market of the public catering enterprises of the Krasnoyarsk territory was carried out with the help of the unified interdepartmental information and reference system (UIIRS). This system contains the information generated by the subjects of the official statistical accounting within the framework of the Federal plan of statistical work. In addition, in order to study the market situation, we used software and websites that provide complete, reliable information about public catering companies: 2GIS, Flamp, catering Library, Vibirai.ru et al.

Findings

We define the following stages of the analysis of the catering market:

1. Analysis of the dynamics of the main indicators of the catering market

2. Analysis of the structure of the catering market according to the type of establishments

3. Analysis of the consumer preferences

4. Analysis of the main organizational and economic characteristics of enterprises according to the type of institutions

Let's consider the proposed stages of the analysis on the example of the catering market of the Krasnoyarsk territory and the city of Krasnoyarsk.

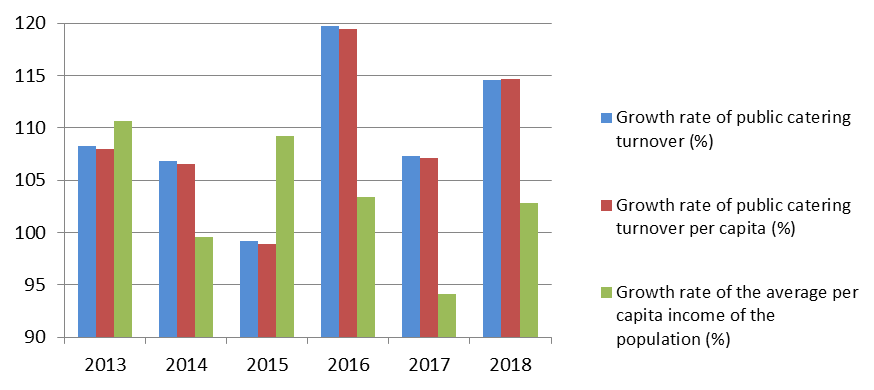

The analysis of the dynamics of the main market indicators (Demchenko, Melnikova, Suslova, Yamschikov, & Ruyga, 2017; Suslova & Satsuk, 2015; Shcherbenko, Suslova, Ananeva, & Ivanova, 2016) of public catering are carried out according to three main indicators (table

- the turnover of public catering;

- public catering turnover per capita;

- per capita income of the population.

Based on the results of the analysis (Figure

The turnover of public catering grew almost throughout the study period; the growth rate for the period from 2012 to 2018 was 68.88 %. The largest increase compared to the previous year was achieved in 2016 and amounted to 19.75 %. However, in 2015, there was the decrease in the turnover of public catering in the Krasnoyarsk territory by 0.83 %. This decrease was covered by the results of the industry's activities in the following year of 2016.

A similar trend is observed according to the results of the analysis of the turnover of the public catering enterprises per capita. For all the years studied, this indicator decreased by 1.05 % compared to the previous year only in 2015. During other years, this indicator has increased compared to the level of the previous year. In general, during the period from 2012 to 2018, the turnover of public catering per capita increased by 66.91 %.

This trend was not always followed by the increase in average per capita income, which allows concluding that there is no direct proportional relationship between the considered indicators.

During the study period, the average income per capita decreased by 0.47 % in 2014 and by 5.86 % in 2017 compared to the previous year. There was no decrease in the turnover of public catering during these periods. In general, the average per capita income of the population increased by 20.35 % within the considered time interval.

The study suggests that the decrease in the average per capita income by more than 6% does not lead to the decrease in the turnover of public catering.

Today, the catering market is developing, which is confirmed by the significant increase in the number of the public catering enterprises in the Krasnoyarsk territory. The services by the public catering enterprises are formed under the influence of the increased consumer demand using new technologies and under the influence of the global trends in the conditions of global competition.

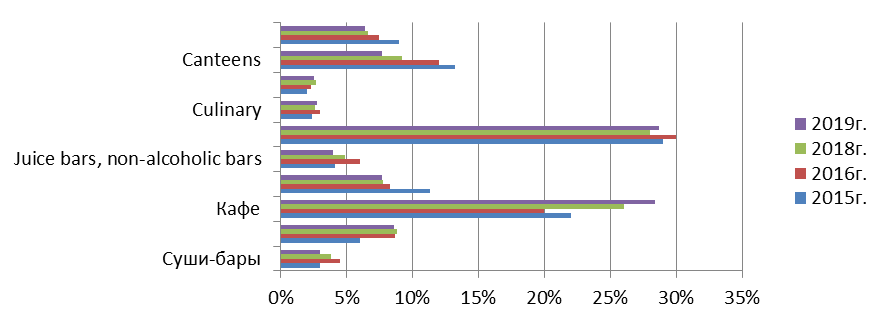

We analyzed the structure of the catering market of the Krasnoyarsk territory (stage 2 of the analysis of the catering market). For analysis, we selected the following groups: sushi bars; cafe-pastry shops, coffee shops; cafes; bars; fresh bars, places of sale of non-alcoholic cocktails and hot drinks; fast-food places, snack bars; cookeries; pizzerias; restaurants; canteens.

The change in the structure of the catering market for the proposed groups for the period from 2015 to 2018 is shown in figure

The analysis of the structure of the catering market showed that the cafes and fast-food places, snack bars had the largest share in the structure for the period under study. Moreover, the share of fast-food places and snack bars for all the years studied varied slightly in the range from 27 to 30 %, but the share of cafes has increased to the level of 28.4 % by 2019 against 22 % in 2015 and 20 % in 2016.

The share of canteens, bars and restaurants has decreased significantly compared to 2015. The share of pizzerias, sushi bars and cookeries, fresh bars, and places for non-alcoholic cocktails and hot drinks remained approximately at the same level. The share of cafes, pastry shops and coffee shops increased by 2.7 % in 2016 compared to 2015 and kept the achieved level in 2018 and 2019.

According to the market research done, one can conclude that today the public catering industry of the city of Krasnoyarsk is a large number of enterprises with different levels of service, product quality, variety of equipment used and the services provided. Every year, the number of the public catering facilities is increasing, significant qualitative changes are taking place, new production technologies and services are being introduced.

The study of the structure of the catering market in Krasnoyarsk allows grouping enterprises into three main groups, which differ both in the number of participants and in the volume of production: fast food places, medium-priced establishments and haute cuisine (Protasova & Tohirien, 2013).

The catering market is different in various segments Mayurnikova, Krapiva, Davydenko, & Samoylenko, 2015). Fast-food establishments are developing especially fast. They are popular because of their availability and the speed of service. In addition, the canteens take the considerable share of the market – 12 %. Consumers prefer the places of this type with self-service and a wide choice, reasonable prices for dishes, since the average check of such places is about 150–250 rubles.

The specialized establishments have also developed in the catering market. The coffee shops that have become an integral part of the city life should be noted first.

At the third stage of the analysis, it is necessary to study the consumer preferences. It seems that it is necessary to find out what type of catering places are more popular, what criteria are used by the consumers when choosing a place, which category of the population visits a catering company, and what goals the consumer pursue when visiting a catering place.

The selective survey of the residents of the city of Krasnoyarsk was performed to study the consumer preferences (Ruban, Reznichenco, & Ustinova, 2019). The questionnaire included the following questions:

1 What type of catering places do you prefer?

2 Will you give the three main criteria for choosing a catering place, please?

3 Whom do you usually go to a catering place with and for what purpose?

The respondents' answers to the question: «What type of a catering place do you prefer?" are presented in table

The study showed that the largest number of respondents, namely 22.50 %, prefer spending time in coffee shops. Small, quiet cafes (19.00 %) and pizzerias (18.00 %) are a little less popular. We also note that fast-food establishments are also in high demand, namely 14.00 %.

The choice of the main criteria that the respondents take into account when choosing a coffee shop is the second, not less important question (table

There is an important question in the survey: "Who do you usually go to catering establishments with and for what purpose?".

The study showed that most people (31 % of respondents) prefer spending time with friends. The respondents of this group pointed out time for rest, meeting with their friends, and a birthday party in approximately equal proportions as the purpose of visiting a catering company.

Having considered the stages of the analysis, the researcher is likely to choose one or two most popular places from all the types and continue with the analysis of the enterprises of this group.

1) As the object of further analysis, we select the group of "coffee shops". Let's go to the analysis of the main organizational and economic characteristics of the enterprises of this group.

2) Today, this type of restaurant is a competitor for the fast food establishments and the traditional restaurants.

3) The analysis spheres within this group were selected according to the results of the previous stages. These are:

- analysis of the mode of operation of the enterprises of a particular type by the service method;

- analysis of the location of places;

- analysis and structure of the market of the public catering enterprises of a particular type by the average check;

- analysis of the additional services provided by the enterprises.

The coffee shop is a catering company that specializes mainly in preparation and sale of a wide range of hot beverages – coffee, cocoa and tea.

In addition, such shops sell the bakery and confectionery products, the culinary products, salads, snacks and purchased goods. A distinctive feature of the coffee shop is the presence of a wide range of coffee and coffee drinks, a tea collection, as well as a rich selection of desserts and confectionery. Coffee and drinks, snacks and desserts play a dominant role in the restaurant's menu.

All coffee shops can be divided into two main groups:

1) individual ones – the owner has the right to determine the style of the institution and the rules of stay in it. Today, themed coffee shops are very popular, which reveal a certain theme, whether it is history, cinematography or style in culture. Such establishments are completely individual and do not look like other catering establishments;

2) the chain of coffee shops (franchising business) – are a complex of institutions united by the common rules; they do not need special advertising, since they are already, in most cases, have a great popularity. Such coffee shops have already taken their place in the market.

In both groups there are three main types of the coffee shops:

1) traditional coffee shop (American type), is an institution in which the main part of the menu is coffee, various types of tea and hot chocolate. Visitors are offered sweet and rich desserts. The presence of waiters in a coffee shop is not necessary. Guests make an order at the bar and take it to their own table. Prices in this place are lower than average one. The main advantage of this type of the coffee shop is small financial investments.

2) the Russian coffee shop is very popular among visitors today. In such places, guests sit at tables waiting for the waiter, as in a restaurant, and make an order from their seats. In such an institution, you can sit down with a cup of delicious coffee reading newspapers or magazines; you can hold business meetings or meet with your friends. The range of coffee in establishments of this type is quite wide and of high-quality, as well as a wide range of desserts, cold appetizers, salads, hot main dishes. This type of a coffee shop is more expensive, but it is very popular among visitors.

3) the fast food type is very popular in large areas. In this case, the name of a place speaks for itself – fast food and coffee from a plastic cup with a tightly closed lid and a tube on the run. This type of a coffee shop is more suitable for large stores, train stations, busy places. The advantage of this type is a minimum of investment, and the disadvantage is the lack of the calm and cozy atmosphere, the magic of the aroma of coffee and gatherings.

In recent years, coffee shops have become very popular and are in great demand, this is due to the fact that this type of institution can be visited by people not only with a high income level. This type of institution is not just a catering company, but also a place of leisure, where a visitor, based on his income, has his ideas for visiting the place (Yakovleva, 2015).

The authors analyze the coffee shops in Krasnoyarsk (table

The average check is one of the most important indicators of the public catering enterprises. Naturally, the growth of the average check is positive, which has a good effect on all the economic indicators of the catering company.

As part of our study of the enterprises, we selected the binary scale for the average check with the following values: the average check is up to 500 rubles; the average check is more than 500 rubles.

The share of businesses with an average check of up to 500 rubles was 83.08 % in 2016 and, consequently, the share of coffee shops with an average check of more than 500 rubles was 16.92 % of all the coffee shops surveyed in the city of Krasnoyarsk. By 2019, there was the increase in the share of coffee shops with an average check to 500 rubles by 2.94 % and the equivalent decrease in the share of the coffee shops with an average check of more than 500 rubles, which cannot be evaluated positively.

Let's analyze what dependence of the average check on the operating mode, the location of the places, and the service can be established.

When analyzing the mode of operation, we identified 4 groups of enterprises of the "coffee shop" type.

1. Working hours-around the clock.

2. Mode of operation – the start of the working day from 7.00 to 8.00, the end of the working day from 20.00 to 23.00.

3. Mode of operation – the start of the working day from 7.00 to 8.00, the end of the working day from 23.30 and later.

4. The beginning of the working day from 9.00 to 12.00, the end of the working day from 19.00 to 24.00.

It should be noted that the share of enterprises with an average check of more than 500 rubles in 2016 prevailed in the first and third groups.

In the first group of the companies in 2016, the largest share was made up of the companies with an average check of more than 500 rubles. Their share was 80 %. In 2019, the situation has changed in the direction of increasing the share of enterprises with an average check to 500 rubles. Their share reached the level of 50%.

In the third group the opening hours – the beginning of the working day from 7.00 to 8.00, the end of the working day from 23.30 and later" in 2016, the share of the enterprises with an average check of more than 500 rubles was 75 %. In 2019, this figure dropped to 45.45 %.

In general, the share of the enterprises with an average check of more than 500 rubles decreased for all groups of the enterprises selected for the study by the operating mode. The decrease ranges from 15.75 to 30 %. This trend is negative.

Analyzing the enterprises by their location, we define that in general, there is the increase in the number of the enterprises in 2019 compared to 2016. The increase was 43 %. Moreover, this increase is provided mainly by the enterprises situated on the left bank of the city of Krasnoyarsk – 20 enterprises, against 8 enterprises on the right bank of the city. However, it should be noted that the increase in the share of the enterprises with an average check of more than 500 rubles is observed in the coffee shops located on the right bank of the city of Krasnoyarsk.

The analysis of the market structure of the coffee shops by the service was carried out in three groups: the waiter service, the Barista service, and partial self-service. The companies with an average check of more than 500 rubles are represented only in the first group of the "waiter service". The share of such enterprises decreased slightly, less than by 1 % in 2019.

In the coffee shops of the second and the third groups in 2016, the average check of all the places was not more than 500 rubles. This trend continued in 2019.

In general, the number of the places with an average check of more than 500 rubles increased in 2019 compared to 2016, and amounted to 13 enterprises against 11 in 2016, but due to the growth of the total number of the enterprises of this type, their share decreased by 2.94 % in 2019.

Today, the catering establishments offer a wide range of additional services (Chernyakova, Sergacheva, & Batraev, 2018), such as catering, food delivery to home place or work place, table reservations, etc. In this regard, the analysis of the additional services provided by the coffee shops (stage 2.4) is of great importance.

The analysis of the consumer preferences performed at stage 3 of the proposed methodology, together with the results of the analysis of the additional services carried out at stage 2.4, allow identifying the additional services that are chosen by the consumers and are not adequately represented in the coffee shops in the city.

Having studied the consumer preferences in Krasnoyarsk and carried out the marketing research of the additional services provided by the coffee shops in the city of Krasnoyarsk, it is possible to distinguish such types of the additional services chosen by the consumers and offered by the coffee shops as:

1. 11.96 % of respondents choose the option of non-cash payment – 100 % of the surveyed companies provide this service.

2. Parking is considered to be the most important additional service by 10.93 % of respondents. It should be noted that only 70 % of enterprises provide this service.

3. Music is important for 8.87 % of potential coffee shop visitors. However, only 49.46 % of establishments of this type provide this type of service.

4. Wi-Fi is important only for 4.95 % of respondents. It should be noted that this service is provided by almost all places studied, namely 93.3 3%.

5. The survey showed that 3.51 % of people need a smoking area outside the halls. Only 3.33 % of the coffee shops provide this service.

It should be noted that the range of the additional services of the coffee shops in Krasnoyarsk is much wider and the introduction of previously not provided services can be a competitive advantage, which is important to take into account when planning a business.

Conclusion

As the result of the research done there was developed the algorithm of the analysis of the catering market, including the four integrated phases: the analysis of the dynamics of the main indicators of the food service market; the analysis of the structure of the catering market by the types of institutions, the analysis of consumer preferences, the analysis of the main organizational and economic characteristics of the enterprises by the type of institutions.

The first three stages of this algorithm were tested on the example of the catering market of the Krasnoyarsk territory. The testing of the fourth stage was carried out on the example of the coffee shops in the city of Krasnoyarsk.

The proposed algorithm can be used both at the planning stage of opening a business and at the stage of its development.

References

- Borovskikh, N. V. (2017). Regional catering market: Analysis and development prospects. Omsk science bulletin Society Series History. Modernity, 2, 71–75.

- Chernyakova, D. E., Sergacheva, O. M., & Batraev, M. D. (2018). Possible ways to promote food companies in the market of goods and services. Mater. of the IV all-Russ. Sci. and practi. conf. with int. participat. “Problems of development of the market of goods and services: prospects and opportunities of the subjects of the Russian Federation” (pp 297–299). Krasnoyarsk: Siber. Federal Univer..

- Demchenko, S. K., Suslova, J. J., Yamschikov, A. S., Ruyga, I. R., & Melnikova, T. A. (2017). Problems on forming system of indicators to estimate efficiency of social and economic development of the country. Journal of Applied Economic Sciences, 12(1), 194-205.

- Frolov, D. P., & Kim, I. D. (2015). Marketing analysis of the development of the public catering market in Russia: district, regional, and segment aspects. Vestnik Volgogradskogo Gosudarstvennogo Universiteta. Serii︠a︡ 3, Ėkonomika, Ėkologii︠a︡, 3(32), 38–51.

- Krapiva, T. V., Sukhanov, A. A., & Bolshanina, T. Yu. (2017). Analysis of the market of the public catering enterprises in Kemerovo. Mater. of the Russ. Sci. and pract. Conf. with int. participat. “Actual problems of chemistry, biotechnology and services”, 280–286.

- Mayurnikova, L. A., Krapiva, T. V., Davydenko, N. I., & Samoylenko, K. V. (2015). Analysis and prospects for the development of the public catering market in regional conditions. Methods and technol. of food product., 1(36), 141–147.

- Migunova, M. I., & Elgina, E. A. (2013). Problems of tax incentives for innovation in the regional economy. Reg. econ.: theory and pract., 41, 47–52.

- Protasova, L. G., & Tohirien, B. (2013). Market analysis and classification of catering enterprises. Manager, 5(45), 55–57.

- Ruban, N. Y., Reznichenko, I. Yu., & Ustinova, Yu. V. (2019). Analysis of consumer preferences of the residents of Kemerovo towards sports food products. IOP Conf. Ser.: Earth and Environmental Sci. Krasnodar Sci. and Technol. City Hall of the Russ. Union of Sci. and Engineer. Associat., 22025.

- Rudachev, N., & Shcherbakov, P. (2015). Analysis of the fast food industry in the structure of the Russian public catering market. Mater. of the III reg. sci. and pract. Conf. “Actual problems of development of the tourist infrastructure of the Kursk region” (pp. 46–50). Kursk.

- Sandakova, N. Yu., & Wire, T. A. (2019). Analysis of the public catering market of the Republic of Buryatia at the present stage: problems and prospects of development. Coll. of mater. of the sci. and pract. Conf. “Young financiers of the XXI century”, 137–141.

- Shcherbenko, E. V., Suslova, J. J., Ananeva, N. V., & Ivanova, L. V. (2016). Improved Techniques for Estimating Living Standards of the Population: A Case Study of the Siberian Federal District.

- Suslova, J. J., & Satcuk, T. P. (2015). Methodological approaches of assessing population quality of life as a factor determining development of the market infrastructure. European Journal of Science and Theology, 11(1), 233-240.

- Tsimokha, A. E. (2016). Analysis of the public catering market in Tomsk. Selected reports of the 62nd Univer. Sci. and techn. Conf. of students and young sci.,231–236.

- Yakovleva, Ya. V. (2015). Analysis of trends in the Russian coffee market as a segment of the public catering market. Sci. almanac, 11-1(13), 592–595.

- Yenisei Siberia. (2019). Retrieved from: https://ensib.ru/projects/invest

- Zhdanova, R. R., & Nettle, T. V. (2016). Analysis of the catering market in Kemerovo 2015. Mater. of the IV Int. sci. conf. “Food innovations and biotechnologies”, 299–300.

Copyright information

This work is licensed under a Creative Commons Attribution-NonCommercial-NoDerivatives 4.0 International License.

About this article

Publication Date

07 December 2020

Article Doi

eBook ISBN

978-1-80296-095-2

Publisher

European Publisher

Volume

96

Print ISBN (optional)

-

Edition Number

1st Edition

Pages

1-833

Subjects

Management, human resources, resource efficiency, investment, infrastructure, research and development

Cite this article as:

Elgina, E. A., Sergacheva, O. M., Migunova, M. I., Tsyrkunova, T. A., & Bogdanova, L. V. (2020). Analysis Of The Catering Market In Krasnoyarsk. In A. S. Nechaev, V. I. Bunkovsky, G. M. Beregova, P. A. Lontsikh, & A. S. Bovkun (Eds.), Trends and Innovations in Economic Studies, Science on Baikal Session, vol 96. European Proceedings of Social and Behavioural Sciences (pp. 193-205). European Publisher. https://doi.org/10.15405/epsbs.2020.12.26