Abstract

Malaysians have been reported to have poor personal financial management due to low financial literacy which can be seen in high bankruptcy rate. Poor personal financial management among the adults has raised an alarming signal on the importance of having financial knowledge which can help individuals to make good decisions on financial matters. The objective of this study is to determine the current level of financial literacy among the Generation Y in Malaysia. The financial literacy is measured in three ways in these studies namely saving / borrowing, insurance / protection, as well as investment. A survey was carried out among 500 university students using convenience sampling technique. The collected data was descriptively analysed. Generally, the findings showed 65 percent of respondents obtain financial information through social media, followed by official website. Most of the respondents demonstrated low to moderate score in their knowledge of personal financial management and have some grasp of concepts such as time value of money, insurance provider, and types of investment. The study also highlights that higher score is found in certain demographic groups-gender, ethnicity and early exposure on personal finance education. This study also suggests appropriate strategies for education institutions, government and relevant authorities to improve financial knowledge among the younger generation.

Keywords: Intangible assetsvoluntary disclosureresources based viewtechnology sector

Introduction

As the marketplace becomes more globalised and challenging, it is imperative of an individual to handle his or her financial affairs effectively. In order to make a sound financial decision, financial knowledge plays an important role (The Star Online, 2019b). Generally, financial literacy concerns on the knowledge and understanding of how an individual makes, spends, and saves money.

During the launching of Belanjawanku: Expenditure Guide for Malaysian Individuals and Families Programme, Finance Minister Lim Guan Eng mentioned that low financial literacy is the root cause of high bankruptcy rate in Malaysia (The Star Online, 2019a). Bank Negara Malaysia conducted a survey and found out that Malaysian still lack of financial knowledge to handle own financial well-being, including the ability to handle financial shock. For instance, it can be challenging for some individuals to withdraw RM1, 000 cash in the case of emergency. To meet the financial emergency, Malaysians will tend to cut down spending, borrowing from friends and relatives, or worst case by depending of the credit lines. In addition, the survey also mentioned that Malaysians are not able to make rational financial decisions during the time of emergency. Many are involved in financial scams making up to 1,883 cases recorded in the first quarter of 2017, with total loss of RM379mil (The Star Online, 2018).

Financial literacy can be gained through lifelong learning. It is not something to reserve among adults only. Money management is a living skill that people from all walks of life should excel (The Edge Malaysia, 2018). Poor personal financial management among the adults might create anxiety to the younger generation who was currently studying or just started to work. Therefore, it is considered to be valuable to understand the financial literacy level on Gen Y, especially among university students as they are the group of people who will shape the future of society. Gen Y is expected to have live longer than Gen X. Therefore, their financial life spam is longer and it is crucial for them to make the right choice on saving, borrowing, insurance, as well as to invest their money.

Problem Statement

Literature and the mainstream media describe an individual’s financial literacy can be gained through knowledge acquired from financial education by means of both formal and informal classes. Financial literacy is defined as “the ability to make informed judgements and decision regarding the use and management of money” (Widdowson & Hailwood, 2007, p. 37). Financial literacy can also be depicted as the knowledge about managing money in terms of saving, budgeting, insuring, and investing (Hogarth & Hilgert, 2002).

Having a sound financial literacy helps to enhance an individual’s quality of life. A financially literate person possesses better financial decision thereby influence the accumulation of wealth and income. Deuflhard et al. (2018) found out that owning a saving account is partly linked to investor financial literacy. They further added that an individual who has better knowledge in personal financial management would have higher returns from his or her saving account. Financial literacy also helps to promote a sound financial system. An individual who possesses high financial literacy can make good investment plan and strike a balance between risk and return trade off. As a result, it ensures efficient allocation of financial resources in the economy and implies potential economic growth (Widdowson & Hailwood, 2007).

Literature review indicates that financial literacy includes the three main distinct areas:

1. Saving/borrowing (including purchasing power, cost of borrowing, consumer loans and mortgage) (Barbiarz & Robb, 2014; Lusardi & Mitchell, 2011)

2. Insurance/ protection (including medical and life insurance through the use of risk management technique) (Atkinson & Messy, 2012)

3. Investment (including saving the present financial resources for future use by using saving accounts, stocks, bonds, unit trust) (Meyer, 2017).

Chen and Volpe (1998) described an individual not only need to decide on how much to save and spend, they should also manage the need of their own medical and life insurance. Additionally, people must plan for their children’s education and later, their retirement. In personal finance, investment is very important as it is an independent learning process to manage finances in the present and future. According to Pritazahara and Sriwidodo (2015), financial literacy in investment is often associated with knowledge about portfolio diversification, asset allocation, risks and importance of time horizons.

Financial literacy test has been conducted across countries. Most of the findings illustrated the widespread of financial illiteracy among the people. For instance, Hogarth and Hilgert (2002) conducted a telephone survey in U.S, randomly picked on 1,000 households as their respondents. The survey covered a set of 28 true-false questions regarding savings, credit, mortgages, and general financial management topics. The findings showed the consumers are lacking of knowledge on topics such as savings, credit, and general financial management, with average score less than 65 percent. Idris et al. (2017) examined the financial literacy level and its relationship with financial distress among 430 youngsters in Malaysia. The findings showed moderate financial literacy among the respondents and found that an individual with better financial literacy would have lesser financial distress. Past study which examined the level of financial knowledge among the youngsters reported that less than one-third of the respondents have fundamental financial knowledge (Lusardi et al., 2010).

Past studies also revealed on how the demographic profiles are associated with the financial literacy level. Males are found to perform better in financial literacy than females in most studies (Bharucha, 2019; Chen & Volpe, 2002; Kumaran, 2019; Lusardi et al., 2010) while Selvadurai et al. (2018), Stewart (2017) mentioned females have better financial literacy than males. Schubert et al. (1999), Mandell and Klein (2007) are among the few that find no evidence on gender influence the financial literacy level. Certain ethnicity groups proved to have higher financial literacy than others (Jariah et al., 2012; Jeyaram & Mustapha, 2015; Loke, 2015; 2017; Mahathir, 1988).

The role of education also plays a significant role to influence financial literacy. Based on the findings obtained by Lusardi and Mitchell (2011), it demonstrated that the higher the level of education, the better the financial literacy level. In addition, formal education in schools regarding personal financial management is consistently found to be important in improving financial literacy (Hogarth & Hilgert, 2002; Huston, 2010).

Research Questions

Garg and Singh (2018) mentioned that the decisions made by youth is crucial as it impacts their financial well-being in their entire lifespan. Young people need to be given empowerment to handle their own financial affairs (Davies, 2015). In view of financial knowledge is so crucial to youth, hence, this study raises the research question on the level of knowledge in personal financial management, or in short financial literacy, among the university students in Malaysia. Proper decision-making processes can only be implemented by the policy makers after identifying their financial literacy level as well as the vulnerable groups.

Purpose of the Study

The purpose of this study is to determine the financial literacy level among Gen Y in Malaysia.

Research Methods

Research design is “a framework or blueprint for conducting the marketing research project that specifies the procedures necessary to obtain the information needed to structure and / or solve the marketing research problem” (Malhotra, 2007, p. 66). This study applied descriptive research as it aims to describe the financial literacy among Generation Y. This study used cross-sectional design which is s “one-time collection of information from any given sample of population elements” (Malhotra, 2007, p. 73) was used in this study. It is due to less time-consuming and less costly to collect responses from a large sample.

The students in the Multimedia University are regarded as the target population of this study. The sample size is 500 respondents – 250 respondents from each campus in Cyberjaya and Melaka. The respondents are from all levels of programme (Diploma, Foundation, Bachelor, Master, and Doctorate), covering various academic disciplines (Engineering & Technology, Computer Science, Business & Management, Creative Multimedia, Law, and Applied Communication). Convenience sampling was applied in this study.

The survey questionnaire consists of three sections. Section A seeks to understand the respondent’s demographic profile (9 items). Section B assesses their financial literacy on savings and borrowing (6 items), insurance / protection (6 items), and investments (6 items). Section C aims to understand the medium used by the respondents to gain financial information. The content of the survey questionnaire was validated by subject matter experts and the research instruments was refined. Using self-administered questionnaires, the responses were collected from 500 respondents for further analyses. Data collection was conducted in both Cyberjaya and Melaka Campus, Multimedia University from October to December, 2018.

Findings

Once the data is collected, descriptive analysis will be conducted to analyse the central tendency (mean) of the data.

The demographic profile of the respondents is presented in Table

Table

Based on the analysis the average score is categorised into five ratings, namely “very poor (0%-20%), poor (21%-40%), average (41%-60%), good (61%-80%) and very good (81%-100%)”, as suggested by the Asian Institute of Finance (2015). In general, the respondents recorded the highest score in financial literacy on insurance / protection (52.1%; Average), followed by savings and borrowing (47.4%; Average) and investment (37.3%; Poor).

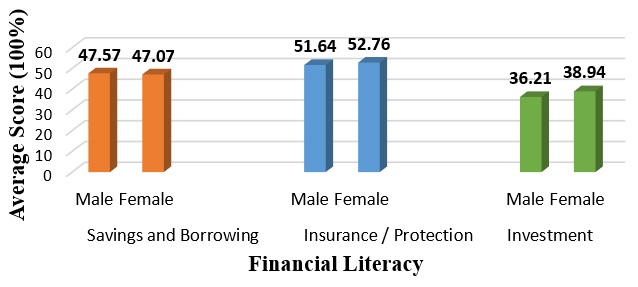

Regarding the tabulation of average score of financial literacy among various demographic groups generally, female respondents recorded higher score in financial literacy than male respondents (Female: 46.26; Male: 45.14). The finding is consistent with past studies which reported females are more family oriented, better organised and self-disciplined in managing matters relating to finances than males (Selvadurai et al., 2018; Stewart, 2017). Nevertheless, the finding is contradicting with past studies (Arrondel et al., 2013; Bucher-Koenen & Lusardi, 2011; Kharchenko, 2011; Luksander et al., 2014) which reported that males can better manage their financial matters.

Figure

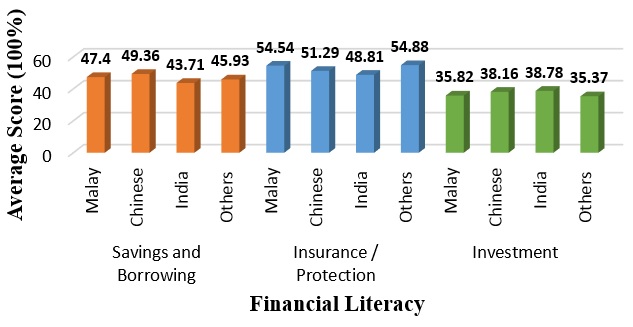

Generally, Chinese respondents recorded higher score in financial literacy than respondents of other ethnicity (Chinese: 46.27; Malay: 45.92; Indian: 43.76). The result is consistent with previous studies which demonstrated that the Chinese have better financial management behaviour, more financially literate and have less debt repayment problems compared to other ethnic groups (Jeyaram & Mustapha, 2015; Loke, 2015 & 2017; Jariah et al., 2012; Mahathir, 1988).

More specifically, Chinese respondents recorded higher score in financial literacy on savings and borrowing (Chinese: 49.36; Malay: 47.40; Indian: 43.71); Malay respondents recorded higher score in financial literacy on insurance/protection (Malay: 54.54; Chinese: 51.29; Indian: 48.81); Indian respondents recorded higher score in financial literacy on investment (Indian: 38.78; Chinese: 38.16; Malay: 35.82) (see Figure

In terms of field of study, business students recorded higher score on financial literacy than non-business students (Business: 47.72; Non-Business: 44.16). Moreover, those who have attended courses related to personal finance management recorded higher score on financial literacy than those who have not (Yes: 46.78; No: 45.18). This finding is consistent with Herawati (2018) who reported that the level of financial literacy for students who have early exposure on financial education is higher than those who have not. This shows the importance of integrating courses related to personal financial management into formal curriculum system in education institutions.

Also, level of financial literacy is found on students who are studying higher level of programme. This can be seen when Doctorate students recorded the highest score in financial literacy than others (Doctorate: 55.56; Bachelor: 47.06; Foundation: 44.49; Diploma: 39.92). This result is consistent with previous empirical study carried out by Lusardi and Mitchell (2011). However, the finding is contradicting with Selvadurai et al. (2018) which reported having the right attitude and mind set is more important than having higher level of education when it comes to financial planning.

Conclusion

In general, the university students in Malaysia have low to moderate financial literacy. To summarise the results, the average scores of financial literacy for both males and females are 45.14% and 46.26%, respectively. Among the three distinct areas of financial literacy, university students are least knowledgeable especially on ‘investment’. Besides, this study also highlights some of the important socio-demographic attributes such as gender, education background, formal financial education do play a significant role to influence financial literacy.

Findings show that financial literacy can be improved through formal education. However, general tertiary education seems insufficient to equip an individual with good financial literacy. Thus, the need of incorporating specific financial courses or programmes into the existing curriculum is crucial. The financial education should focus on the three main areas of financial literacy (saving/borrowing, insurance/protection and investment) as the respondents recorded low to moderate scores in the assessment.

Despite many parties (i.e., The Credit and Debt Management Agency (AKPK), The Malaysian Financial Planning Council (MFPC), Financial Planner Association of Malaysia (FPAM)) are offering roadshows and workshops for the nation regarding financial literacy, most of the youngsters are not aware of such free financial education programmes. We recommend that social media can be used as an effective tool of not only disseminating the information, as well as engaging the audiences together to build a healthy financial freedom society.

Acknowledgments

We are grateful to Multimedia University Mini Fund 2018 (MMUI/180147) that provided financial support to conduct this study.

References

- Arrondel, L., Debbich, M., & Savignac, F. (2013). Financial literacy and financial planning in France. Numeracy, 6(2). https://doi.org/10.5038/1936-4660.6.2.8

- Asian Institute of Finance. (2015). Finance Matters – Understanding Gen Y: Bridging the knowledge gap between the Malaysian’s millennials. Kuala Lumpur, Malaysia.

- Atkinson, A., & Messy, F. (2012). Measuring financial literacy: Results of the OECD/International Network on Financial Education (INFE) pilot study. OECD Working Papers on Finance, Insurance and Private Pensions, No. 15, OECD Publishing. https://doi.org/10.1787/5k9csfs90fr4-en

- Barbiarz, P., & Robb, C. A. (2014). Financial literacy and emergency saving. Journal of Family and Economic Issues, 35(1), 40-50.

- Bharucha, J. P. (2019). Determinants of financial literacy among youth. Dynamic Perspectives on Globalisation and Sustainable Business in Asia (pp. 154-167). ICI Global.

- Bucher-Koenen, T. (2011). Financial literacy, Riester pensions, and other private old age provision in Germany. (MEA Discussion Paper No. 250-11). https://doi.org/10.2139/ssrn.2014170

- Chen, H., & Volpe, R. P. (1998). An analysis of personal financial literacy among college students. Financial services review, 7(2), 107-128.

- Chen, H., & Volpe, R. P. (2002). Gender differences in personal financial literacy among college students. Financial services review, 11(3), 289-307.

- Constantine, G. (2010). Tapping into Generation Y: Nine ways community financial institutions can use technology to capture young customers. A First Data White Paper, 1-10.

- Davies, P. (2015). Towards a framework for financial literacy in the context of democracy. Journal of Curriculum Studies, 47(2), 300-316.

- Deuflhard, F., Georgarakos, D., & Inderst, R. (2018). Financial literacy and savings account returns. Journal of the European Economic Association, 17(1), 131-164.

- Garg, N., & Singh, S. (2018). Financial literacy among youth. International Journal of Social Economics, 45(1), 173-186.

- Herawati, N. T. (2018). Financial Learning: Is it the effective way to improve financial literacy among accounting Students? In SHS Web of Conferences (Vol. 42, p. 00056). EDP Sciences.

- Hogarth, J. M., & Hilgert, M. A. (2002). Financial knowledge, experience and learning preferences: Preliminary results from a new survey on financial literacy. Consumer Interest Annual, 48(1), 1-7.

- Huston, S. J. (2010). Measuring financial literacy. Journal of Consumer Affairs, 44(2), 296-316.

- Idris, F. H., Krishnan, K. S. D., & Azmi, N. (2017). Relationship between financial literacy and financial distress among youths in Malaysia-An empirical study. Geografia-Malaysian Journal of Society and Space, 9(4), 106-117.

- Kharchenko, O. (2011). Financial literacy in Ukraine: Determinants and implications for saving behaviour. (Unpublished Master thesis). Kyiv School of Economics, Ukraine.

- Jariah, M., Husna, S., Tengku Aizan, T. A. H., & Rahimah, I. (2012). Financial practices and problems amongst elderly in Malaysia. Pertanika Journal of Social Sciences and Humanities, 20(4), 1065-1084.

- Jeyaram, S., & Mustapha, M. (2015). Financial literacy and demographic factors. Journal of Technology Management and Business, 2(1), 1-8.

- Kumaran, S. (2019). Assessing financial literacy of employed and business people in AMBO, Ethiopia: Evidence for Policy Makers. Journal of Applied Finance and Banking, 9(1), 41-73.

- Loke, Y. J. (2015). Financial knowledge and behaviour of working adults in Malaysia. The Journal of Applied Economics, 9(1), 18-38.

- Loke, Y. J. (2017). The influence of socio-demographic and financial knowledge factors on financial management practices of Malaysians. International Journal of Business and Society, 18(1), 33-50.

- Luksander, A., Béres, D., Huzdik, K., & Németh, E. (2014). Analysis of the factors that influence the financial literacy of young people studying in higher education. Public Finance Quarterly, 59(2), 220-241.

- Lusardi, A., & Mitchell, O. (2011). Financial literacy and planning: Implications for retirement wellbeing (Working Paper No. 17078). http://www.nber.org/papers/w17078.pdf

- Lusardi, A., Mitchell, O. S., & Curto, V. (2010). Financial literacy among the young. Journal of Consumer Affairs, 44(2), 358-380.

- Mahathir, M. (1988). The Way forward. Weidenfeld & Nicolson.

- Mandell, L., & Klein, L. S. (2007). Motivation and financial literacy. Financial services review, 16(2).

- Malhotra, N. K. (2007). Marketing research: An applied orientation. Pearson Education.

- Meyer, M. (2017). Is financial literacy a determinant of health? The Patient-Patient Centered Research, 10(4), 381-387.

- Pritazahara, R., & Sriwidodo, F. (2015). Influence of financial knowledge and financial experience against investment planning behaviour with self-control as moderating variables. Journal of Economics and Entrepreneurship, 15(1), 28-37.

- Selvadurai, V., Kenayathulla, H. B., & Siraj, S. (2018). Financial literacy education and retirement planning in Malaysia. Malaysian Online Journal of Educational Management, 6(2), 41-66. https://doi.org/10.22452/mojem.vol6no2.3

- Schubert, R., Brown, M., Gysler, M., & Brachinger, H. W. (1999). Gender and economic transaction-Financial decision-making: Are women really more risk-adverse? The American Economic Review, 89(2), 381-385.

- Stewart, B. (2017). How smart women are managing their money in 2017: Rich thinking. http://barbarastewart.ca/RT_WP7-R2017.pdf

- The Edge Malaysia. (2018). Adulting: Making financial education a lifelong endeavour. https://www.theedgemarkets.com/article/adulting-making-financial-education-lifelong-endeavour

- The Star Online. (2019a). Lim: Young Malaysians have low financial literacy. https://www.thestar.com.my/news/nation/2019/03/05/lim-young-malaysians-have-low-financial-literacy/

- The Star Online. (2019b). Need for financial literacy. https://www.thestar.com.my/opinion/letters/ 2019/03/16/need-for-financial-literacy/

- The Star Online. (2018). Sad truth about financial standing. https://www.thestar.com.my/opinion/letters/ 2018/09/12/sad-truth-about-financial-standing/

- Widdowson, D., & Hailwood, K. (2007). Financial literacy and its role in promoting a sound financial system. Reserve Bank of New Zealand Bulletin, 7(2), 37-54.

Copyright information

This work is licensed under a Creative Commons Attribution-NonCommercial-NoDerivatives 4.0 International License.

About this article

Publication Date

30 December 2020

Article Doi

eBook ISBN

978-1-80296-099-0

Publisher

European Publisher

Volume

100

Print ISBN (optional)

-

Edition Number

1st Edition

Pages

1-905

Subjects

Multi-disciplinary, accounting, finance, economics, business, management, marketing, entrepreneurship, social studies

Cite this article as:

Ying, T. L., Chan, C., & Siang, T. G. (2020). Financial Literacy Among Gen Y In Malaysia. In N. S. Othman, A. H. B. Jaaffar, N. H. B. Harun, S. B. Buniamin, N. E. A. B. Mohamad, I. B. M. Ali, N. H. B. A. Razali, & S. L. B. M. Hashim (Eds.), Driving Sustainability through Business-Technology Synergy, vol 100. European Proceedings of Social and Behavioural Sciences (pp. 484-493). European Publisher. https://doi.org/10.15405/epsbs.2020.12.05.52