Abstract

Undergraduates usually don’t have their own income and relied on their family support and education loan to survive during their study. They are limited number of study focusing on undergraduates’ money management behaviour (e.g. conservative, creative, and entrepreneurial) and it relationship with their financial well-being (e.g. Perceived financial well-being and current money management stress). This study has been conducted on 96 undergraduates from business management and accounting background of one of the private university in Malaysia. A self-administered questionnaire were distributed to 150 final year’s undergraduate and 96 questionnaires completed questionnaire were return back. A multiple-regression analysis were performed using IBM SPSS Statistic v26. Results show that undergraduates’ with creative management behaviour tend to have strong perceived financial well-being, while undergraduates’ with conservative management behaviour faced money management stress. Results indicates that undergraduates need to be creative in their money management rather than conservatively manage their money. Given the insignificant relationship found on entrepreneurial money management behaviour, this paper suggest that university need to enhance their entrepreneurial related education to boost student perceived financial wellbeing after they graduated.

Keywords: Money management behaviourfinancial well-beingmoney management stressundergraduates

Introduction

Producing undergraduates with full quality are becoming the high priorities by all higher education institutions. Undergraduates which majority came from Millennials generation cohorts can be regarded as important assets to country like Malaysia since it has been found that undergraduates contribute significantly to the country’s Gross Domestic Product (GDP) (Seuk, 2017). Beside the academic achievement and employability skills, money management competency is becoming important for undergraduate to face the turbulence environment in the job market (Jaaffar et al., 2016). Previous study found that Malaysian undergraduates possessed weak money management skills due to lack of knowledge in handling their financial aspect (Dahlia et al., 2009). Moreover, undergraduates were exposed to bad habits such as pending for the unnecessary things such as smart phone or go to vacation in oversea although they still studying. This kind of bad habits certainly will effected their current financial wellbeing and escalate their money management stress.

Knowledge on money management behaviour is very important to undergraduate as it will spur their saving habits and become independent without too much depending on their educational loans or education scholarship and their parents (Mehwish & Muhammad, 2016). Undergraduates’ negative feeling of their future financial wellbeing and faced money management stress usually have low high quality of work and life (Bamforth & Geursen, 2017). As the situation become worsen, it will effect undergraduates’ confidence and decrease the quality of their money management decision (Howson & Dwyer, 2014). Previous studies revealed that money management behaviour learnt by undergraduates during their university’s life is probably to be carried forward in their later life (Bamforth et al., 2017). Therefore it is very important to understand the current type of undergraduates’ money management behaviour and its implication on their future financial well-being. This kind of behaviour also will be very useful to be understand by the employee along the others undergraduates’ employability related skills (Ibrahim & Jaaffar, 2017).

Problem Statement

Malaysia Economic Monitor Report by World Bank estimates that around 60 percent of the bankrupt individuals in this country were from millennials generation cohort (aged 24 to 44) (Record et al., 2019). The bankruptcy of millennial generation in Malaysia was reported mainly due to their spending habits that exceeding their income. It is very important for millennial in Malaysia to have knowledge and skills related to money management behaviour in order to mitigate this problem. Previous study has revealed that there were many advantages of right money management behaviour including achieved financial security, achieved good physical and mental health, and gain of the money (Topa et al., 2018).

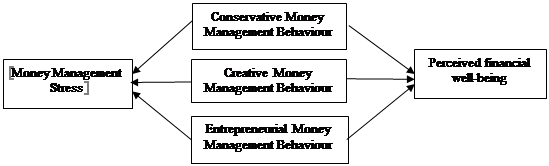

There are several factors that have been found to influence money management behaviour such as economic factors, sociological factors, psychological factors (Bamforth & Geursen, 2017). This factors will influences the type of undergraduate’s management behaviour such creative, conservative, and entrepreneurial money management behaviour (Nga & Yeoh, 2015). The undergraduate’s money management behaviour will determine the current financial well-being and current money management stress of the undergraduate. This study contributes to the body of knowledge related to undergraduates’ financial well-being, and money management behaviour.

Research Questions

The research question for this current study is as follows: What are the effects of undergraduates’ money management behaviour (e.g., conservative, creative, and entrepreneurial) on their financial well-being and money management stress?

Purpose of the Study

The purpose of the present study is to assess the effects of undergraduates’ money management behaviour (e.g. conservative, creative, and entrepreneurial) on their financial well-being and money management stress.

Research Methods

To conduct this study, the conceptual definition and operationalization of undergraduate’s financial well-being, money management stress, and money management behaviour were identified based on previous literature. Financial well-being can be regarded as a “financial freedom where individuals can make their life decision without needing to consider their financial constraint” (Brüggen et al., 2017, p. 3). Money management stress can be defined as “financial anxiety or money worries” (Heo et al., 2020, p. 1). This study conceptualised money management behaviour based on three types including conservative, creative, and entrepreneurial (Bamforth & Geursen, 2017). Conservative money management is the process of the individual to manage the money based on traditional or usual ways people do it, creative money management is the way of individual to do something different or unique to manage the money, while entrepreneurial money management is the risk-taking behaviour by investing the money to achieve the desire outcomes.

The current study gathered 96 completed questionnaires distributed to 150 final years’ undergraduate of business management and accounting undergraduates from one of the private university in Malaysia. All self-administered questionnaires were distributed through drop and pickup technique. The questionnaire consists of two parts. The first part is generally for exogenous and endogenous variables and the second part explains the respondent’s profile. The measurement for financial well-being and money management stress were adopted from (Netemeyer et al., 2018). While, the measurement for money management behaviour were adapted from (Bamforth & Geursen, 2017). Table

In addition, Figure

Findings

Table

Table

Conclusion

The findings reveal that creative money management behaviour has positive significant relationship with perceived financial well-being. This result indicate that undergraduates need to be creative in money management behaviour by spending their money differently and uniquely from their peers. For instance, undergraduate can spend their money in line with their current need, but the same time they need to save their money in the investment channel such as public mutual and so on. Furthermore, it has been found that conservative money management behaviour leads to money management stress. Given the norms of undergraduates that have limited income, they may face stress situation if they feel their current financial cash flow is not enough to cater their present and future need as they may not brave enough to multiply their own money by following the way of creative individual in term of money management behaviour. Surprisingly, the results show that there were not significant result found on entrepreneurial money management behaviour and perceived financial well-being or money management stress. The result indicates the low level entrepreneurial money management knowledge among undergraduates.

This study contributes to the body of knowledge related to financial well-being and money management behaviour among undergraduates. Practically this study shows that university need to provide money management education to undergraduate in order for them to survive when they enter to job market. This study has some limitation as it focus only undergraduates from one private university in Malaysia. Therefore, the results cannot be generalized to entire population of undergraduates in Malaysia. Future study can cover all undergraduates from public and private universities in Malaysia.

Acknowledgment

The authors would like to acknowledge the funding from the Ministry of Education Malaysia in the form of FRGS/1/2018/SS03/UNITEN/02/2.

References

- Bamforth, J., & Geursen, G. (2017). Categorising the money management behaviour of young consumers. Young Consumers, 18(3), 205-222. https://doi.org/10.1108/YC-01-2017-00658

- Bamforth, J., Jebarajakirthy, C., & Geursen, G. (2017). Undergraduates’ responses to factors affecting their money management behaviour: Some new insights from a qualitative study. Young Consumers, 18, 290-311.

- Brüggen, E. C., Hogreve, J., Holmlund, M., Kabadayi, S., & Löfgren, M. (2017). Financial well-being: A conceptualization and research agenda. Journal of Business Research, 79, 228-237. https://doi.org/10.1016/j.jbusres.2017.03.013

- Dahlia, I., Rabitah, H., & Zuraidah, M.I. (2009). A study on financial literacy of Malaysian degree students. Cross-cultural Communication 5(4), 51-59.

- Heo, W., Cho, S., & Lee, P. (2020). APR Financial Stress Scale: Development and Validation of a Multidimensional Measurement. Journal of Financial Therapy, 11(1) 2. https://doi.org/10.4148/1944-9771.1216

- Hodson, R., & Dwyer, R. E. (2014). Financial Behavior, Debt and Early Life Transitions: Insights from the National Longitudinal Survey of Youth, 1997 Cohort, OH State University.

- Ibrahim, H. I., & Jaaffar, A. H. (2017). Employers’ Perspective on Work-Integrated Learning: Evidence from Malaysian Manufacturing and Service Companies. International Journal of Business Management (IJBM), 2(1).

- Jaaffar, A. H., Ibrahim, H. I., Annuar, K., Shah, M., & Zulkafli, A. H. (2016). Work-Integrated Learning and Graduate Employability Skills: The Employers’ Perspective. The Social Sciences, 11(21), 5270-5274.

- Mehwish, Z., & Muhammad, B. (2016). Financial Wellbeing is the Goal of Financial Literacy. Research Journal of Finance and Accounting, 7(11), 94-103.

- Netemeyer, R. G., Warmath, D., Fernandes, D., & Lynch, J. G. Jr. (2018). How am I doing? Perceived financial well-being, its potential antecedents, and its relation to overall well-being. Journal of Consumer Research, 45(1), 68-89.

- Nga, K. H., & Yeoh, K. K. (2015). Affective, social and cognitive antecedents of attitude towards money among undergraduate students: A Malaysian study. Pertanika Journal of Social Sciences & Humanities, 23(1), 161-180.

- Record, R. J. L., Chong, Y. K., Teh Sharifuddin, S. B., Simler, K., Binti Ali Ahmad, Z., Harrison, D. H., & Bandaogo, M. A. S. S. (2019). Malaysia Economic Monitor: Making Ends Meet (No. 144194, pp. 1-104). The World Bank.

- Seuk, W. P. (2017). Education and Economic Growth: A Case Study in Malaysia. https://www.researchgate.net/publication/322222847

- Topa, G., Hernández-Solís, M., & Zappalà, S. (2018). Financial Management behavior among young adults: The role of Need for Cognitive Closure in a three-wave moderated mediation model. Frontiers in Psychology, 9, 2419.

Copyright information

This work is licensed under a Creative Commons Attribution-NonCommercial-NoDerivatives 4.0 International License.

About this article

Publication Date

30 December 2020

Article Doi

eBook ISBN

978-1-80296-099-0

Publisher

European Publisher

Volume

100

Print ISBN (optional)

-

Edition Number

1st Edition

Pages

1-905

Subjects

Multi-disciplinary, accounting, finance, economics, business, management, marketing, entrepreneurship, social studies

Cite this article as:

Jaaffar, A. H. B. (2020). Assessing Money Management Behaviour and Financial Well-Being Among Undergraduates in Malaysia. In N. S. Othman, A. H. B. Jaaffar, N. H. B. Harun, S. B. Buniamin, N. E. A. B. Mohamad, I. B. M. Ali, N. H. B. A. Razali, & S. L. B. M. Hashim (Eds.), Driving Sustainability through Business-Technology Synergy, vol 100. European Proceedings of Social and Behavioural Sciences (pp. 42-47). European Publisher. https://doi.org/10.15405/epsbs.2020.12.05.5