Abstract

On 15 th April 2019, it was announced that FTSE Russell has placed Malaysia on the watch list in reviewing Malaysia position in the FTSE World Government Bond Index (WGBI). This announcement contributes to the current debates on the potential effects pertaining to Malaysia’s future position in the WGBI especially its effect on foreign holdings of Malaysia Government Securities (MGS) as the recent data have shown Malaysia weight in the WGBI is equivalent to MYR 16.2 billion or 11% of foreign holdings of MGS. Hence, this research primarily aims to address these ongoing debates by investigating the direct effect of WGBI towards the level of foreign holdings of MGS in Malaysia. Further, this research will also investigate the effect of domestic or pull factors and the US balance sheet policy on the level of foreign holdings of MGS. This research employs monthly data from January 2008 until April 2018 and Autoregressive Distributed Lag (ARDL) method. The empirical results reveal that the inclusion of Malaysia in the WGBI has no significant effect towards the level of foreign holdings of MGS. Consistent with the literature, this research finds that US balance sheet policy is more significant in influencing the level of foreign holdings of MGS. Further, the positive and significant association between US balance sheet policy and foreign holdings of MGS indicates the need for the government of Malaysia to craft relevant policies to mitigate against the risks in the event of US balance sheet policy reversal.

Keywords: Foreign holdings of Malaysia government securitiesFTSE world government bond indexUS balance sheet policy

Introduction

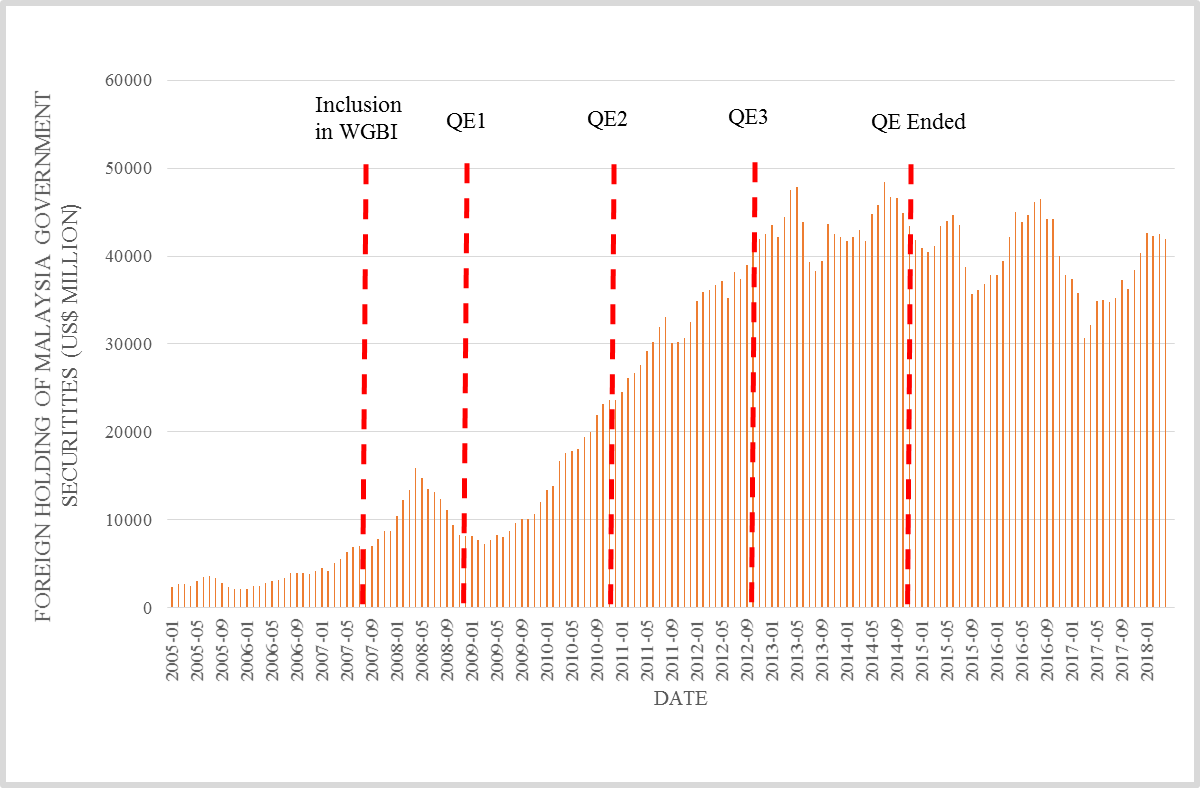

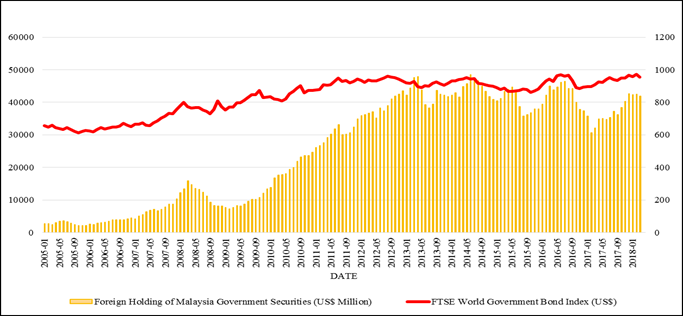

Since July 2007, Malaysia has been included in the FTSE World Government Bond Index (WGBI) ( Citigroup Inc., 2007). Malaysia became the 23 rd country to join this index back in year 2007 which saw the fulfilment of three criteria, which are the absence of barrier, market size of government bonds and minimum credit. WGBI is an index, which assesses the performance of sovereign bonds particularly involving fixed-rate, investment grade sovereign bonds. According to a quarterly bulletin released by the Central Bank of Malaysia during the second quarter of 2017, the inclusion of Malaysia in the WGBI index has been associated with increase in foreign investors’ confidence in Malaysia’s bond market ( Abdullah & Mohamad Razali, 2017). Further, the report revealed that Malaysia is ranked second just behind Indonesia in having the biggest share of foreign bondholding among selected Asian countries such as Indonesia, Thailand, Japan and South Korea. However, it was announced on 15 th April 2019 that FTSE Russell has placed Malaysia on the review list mainly due to bond and FX liquidity concerns for a potential of exclusion from the WGBI where the decision on the review will be discuss on September, 2019. As of March, 2019 Malaysia carried a weight of 0.39% in the WGBI which represented potential foreign holdings of MYR16.2 billion equivalents to 11% of foreign holdings of Malaysia Government Securities (MGS). Hence, the reports on the exclusion of Malaysia from WGBI has contributed to the current debates on the potential effect of the exclusion especially on the foreign holdings of bond in Malaysia.

Based on Figure

Problem Statement

Past studies by ( Hannan, 2017; Koepke, 2018) find both factors which are push and pull to be significant in driving the flows of capital into EMEs. Koepke ( 2018), reveals that both factors are vital in effecting the level of bond flows in EMEs where factors such as inclusion in stock index and United States of America (US) monetary policy expectations should be taken into consideration in examining the drivers of bond flows in EMEs. In addition, ( Ahmed et al., 2017; Ghosh et al., 2014; Horioka et al., 2016; Mishra et al., 2014; Moore et al., 2013; Punzi & Chantapacdepong, 2017; Yoon & Hurlin, 2014) found that the capital inflows into EMEs can be associated with strong macroeconomic fundamentals of the country such as strong GDP growth, deeper financial markets, lower current account deficit and higher government bond yields. In the caveat of foreign investors’ appetite for EMEs assets, Ghosh et al. ( 2014) further argued that foreign investors are more responsive towards global factors whereby in terms of the global market in the event of uncertainty happening it will cause liability flow to surge in EMEs. This particular study highlights that foreign investors are more prone to sell their assets in EMEs in the event of global uncertainty. Other researchers have focused on the impact of inclusion in the WGBI towards capital flows in EMEs ( Moore et al., 2013; Ramírez & González, 2017). Moore et al. ( 2013) found that the inclusion in the WGBI has a significant effect in increasing the flows of capital in EMEs. In contrast, Ramírez and González ( 2017) found that inclusion in the WGBI played no significant role in effecting capital flows into EMEs whereby the study further revealed that the US unconventional monetary policy is more significant than the inclusion in WGBI in driving flows of capital into EMEs. With respect to that, this study contributes to enriching the ongoing debates of factors that can cause capital flows into EMEs where in this study the direct effect on Malaysia will be investigated, assessing the direct effect of Malaysia inclusion in WGBI towards the foreign holdings of MGS and employing the US Federal Reserve total assets as the instrument to represent US balance sheet policy.

Research Questions

-

What is the effect of push and pull factors toward the level of foreign holdings of Malaysia Government Securities (MGS)?

-

Does the FTSE World Government Bond Index (WGBI) has significant effect towards the level of foreign holdings of Malaysia Government Securities (MGS)?

Purpose of the Study

-

To investigate the effect of push and pull factors toward the level of foreign holdings of Malaysia Government Securities (MGS).

-

To investigate the effect of WGBI towards the level of foreign holdings of Malaysia Government Securities (MGS)?

Research Methods

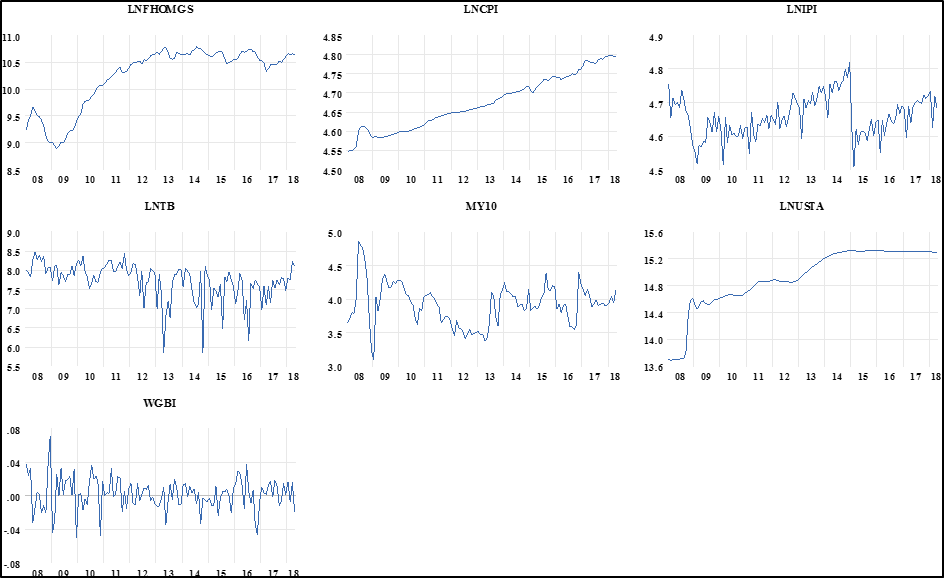

This research employs monthly data from January, 2008 until April, 2018 which involves 124 observations in total. Data for this research are obtained mainly from Bank Negara Malaysia for pull or domestic variables of foreign holding of MGS, industrial production index, trade balance, 10-Year maturity rate of MGS, while data for Malaysia consumer price index is from International Monetary Fund (IMF) databank. As for the push or global variables, the FTSE WGBI is from Bloomberg Terminal while Federal Reserve of Bank of St. Louis is the source for the US total assets. This research has employed Autoregressive Distributed Lag (ARDL) approach to co-integration which was introduced by Pesaran et al. ( 2001) to assess if all the variables long-run relationship. Foreign holdings of Malaysia Government Securities (FHOMGS) acts as the dependent variable for this research, and the independent variables constituting the pull factors are the consumer price index of Malaysia (CPI), industrial production index of Malaysia (IPI), trade balance of Malaysia (TB), and 10-Year maturity rate of MGS (MY10). As for the push factors, changes in FTSE World Government Bond Index (WGBI) and US Total Assets (USTA) are employed in the model. The ARDL is employed due to its advantages of explaining the model in both the short-run and also the long-run association. Whereby, the employed baseline model is specified in equation 5.1:

………………………..…………………(5.1)

Where

is the drift component,

is the natural logarithm of the foreign holdings of Malaysia Government Securities,

represents consumer price index natural logarithm which act as proxy for Malaysia inflation level,

is the natural logarithm of Malaysia industrial production index,

is the natural logarithm of Malaysia trade balance,

represents the natural logarithm of US total assets, while

represents error term or white nose residual. According to Pesaran et al. ( 2001), in examining all the variables long-run association where the model is assesses through bound test approach where the model is tested using F-test through the coefficients of joint significance of lagged level variables. Further, there will be two sets of critical values which are the lower critical bound

Findings

Descriptive statistics

In Figure

Lag order selection

Table

Unit root test

In Table

Autocorrelation test

Table

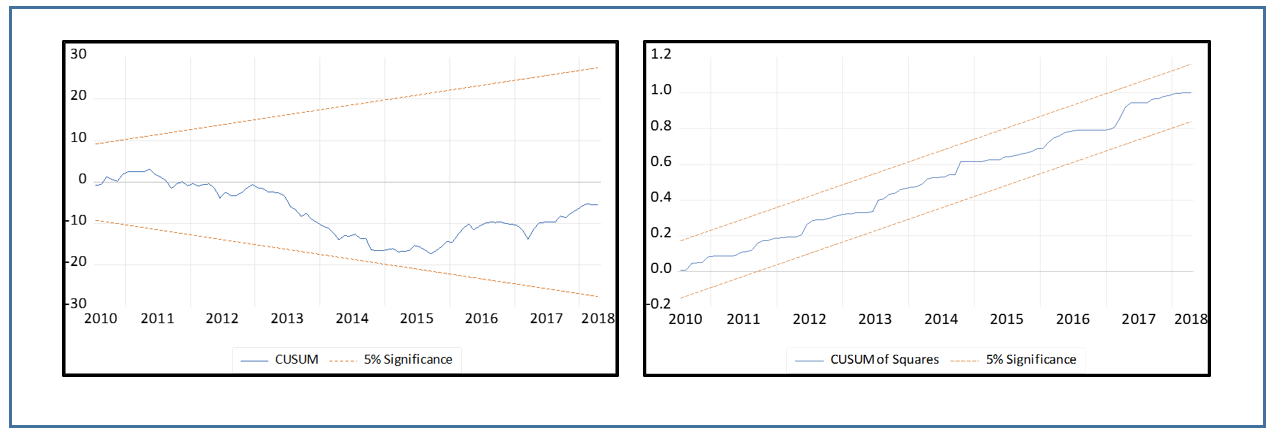

CUSUM and CUSUMSQ tests

In Figure

Bound test approach

In Table

Error Correction Model (ECM)

As reported in Table

Long-run coefficients

The findings in Table

………………………………………………………… (6.1)

Conclusion

In this research, the primary aim was to investigate the effect of WGBI towards the level of foreign holdings of MGS. The findings show that long-run association exist among the foreign holdings of MGS (lnFHOMGS), Malaysia trade balance (lnTB), 10-Year maturity rate of MGS (MY10) and US total assets (lnUSTA). In terms of lnTB, the result revealed that the Malaysia trade balance has a positive and significant effect on foreign holdings of MGS. This notion is in agreement with Burger et al. ( 2015), where they argued that current account balance is positively associated with the inflows of capital into a country. As for MY10, the result indicated that the 10-Year maturity rate of MGS has a negative relationship with foreign holdings of MGS. This result is consistent with those obtained by Bhattarai et al. ( 2018) where they found that when the US raised the total assets in the Zero Lower Bound period, investors seeked for higher yield in EMEs assets which could cause the asset price to face upward pressure and indirectly lead to the fall of the long-term yields in EMEs. Lastly, the result of the lnUSTA in this research is also consistent with that of Bhattarai et al. ( 2018). They showed that during the period of US balance sheet policy there will be spillovers effect causing capital to flow into EMEs.

Based on the results in this research, it can also be seen that the results for the consumer price index of Malaysia (lnCPI) and industrial production index of Malaysia (lnIPI) are statistically insignificant, indicating that both of these variables have no significant effect in influencing the level of foreign holdings of MGS (lnFHOMGS). This result is in line with that of Kim et al. ( 2013) where they found that in terms of looking at domestic factors effect on overall capital flows particularly involving a specific market, the effect of both inflation and gross domestic product are statistically insignificant. Further, these results can be attributed to other pull factors which have more prominent role in effecting the level of foreign holdings of MGS as shown in the results which are Malaysia trade balance and 10-Year maturity rate of MGS. According to Bank Negara Malaysia Annual Report, positive current account balance and sufficient international reserves are important domestic factors for mitigating against the occurrence of reversal in the capital flows of Malaysia financial markets ( Bank Negara Malaysia, 2019). This is in agreement with that of Abdullah et al. ( 2010) where they found that the current account is the prominent factor driving the flows of international capital into Malaysia.

More importantly, this research shows that the inclusion of Malaysia in the WGBI has no significant effect on the foreign holdings of MGS. This indicates that if Malaysia is excluded from the WGBI, the foreign holdings of MGS will not be affected. Further, this research also reveals that the US balance sheet policy plays a more significant role in affecting the level of foreign holdings of MGS. These results further support the findings of Ramírez and González ( 2017) where they argued that the US balance sheet policy is vital for driving the inflows of capital into EMEs. They also revealed that the WGBI inclusion is not a significant driver for the inflows of capital into EMEs. Taken together, this research provides significant implications for the understanding of how the WGBI inclusion and the US balance sheet policy affect the foreign holdings of MGS. Hence, as Malaysia is expected to receive direct adverse effect from the reversal of the US balance sheet policy, Malaysia has to maintain strong macroeconomic fundamentals, positive current account and competitive maturity rate of 10-Year MGS to mitigate against the risks from the normalisation of the US balance sheet or a prolonged low US interest rates.

Acknowledgments

This research is funded by Tun Ismail Ali Chair (TIAC) research grant [grant number: TIACRG2017.28.

References

- Abdullah, A. S., & Mohamad Razali, N. (2017). Factors affecting foreign investors’ bondholding in Malaysia. http://www.bnm.gov.my/files/publication/qb/2017/Q2/p5_ba1.pdf

- Abdullah, M. A., Mansor, S. A., & Puah, C.-H. (2010). Determinants of international capital flows: The case of Malaysia. Global Economy and Finance Journal, 3(1), 31–43.

- Ahmed, S., Coulibaly, B., & Zlate, A. (2017). International financial spillovers to Emerging Market Economies: How important are economic fundamentals? Journal of International Money and Finance, 76, 133–152.

- Bank Negara Malaysia. (2015). Bank Negara Malaysia annual report 2014. http://www.bnm.gov.my/files/publication/ar/en/2014/ar2014_book.pdf

- Bank Negara Malaysia. (2019). Bank Negara Malaysia annual report 2018. http://www.bnm.gov.my/files/publication/ar/en/2018/ar2018_book.pdf

- Bhattarai, S., Chatterjee, A., & Park, W. Y. (2018). Effects of US quantitative easing on emerging market economies. ADBI Working Papers, No.803.

- Burger, J. D., Sengupta, R., Warnock, F. E., & Warnock, V. C. (2015). U.S investment in global bonds: As the Fed pushes, some EMEs pull. Economic Policy, 30(84), 729–766.

- Citigroup Inc. (2007). Malaysia makes it into the Citigroup World Government Bond Index. https://www.citigroup.com/citi/news/2007/070703a.htm

- Ghosh, A. R., Qureshi, M. S., Kim, J. Il, & Zalduendo, J. (2014). Surges. Journal of International Economics, 92(2), 266–285.

- Hannan, S. A. (2017). The drivers of capital flows in Emerging Markets post global financial crisis. Journal of International Commerce, Economics and Policy, 8(02), 1–28.

- Horioka, C. Y., Nomoto, T., & Terada-hagiwara, A. (2016). Explaining foreign holdings of Asia’s debt securities. Asian Economic Journal, 30(1), 3–24.

- Kim, S., Kim, S., & Choi, Y. (2013). Determinants of international capital flows in Korea: push vs. pull factors. Korea and the World Economy, 14(3), 447–474.

- Koepke, R. (2018). Fed policy expectations and portfolio flows to Emerging Markets. Journal of International Financial Markets, Institutions & Money, 55, 170–194.

- Mishra, P., Moriyama, K., N’Diaye, P., & Nguyen, L. (2014). Impact of Fed tapering announcements on Emerging Markets. IMF Working Paper, No. 14/109.

- Moore, J., Nam, S., Suh, M., & Tepper, A. (2013). Estimating the impacts of U.S LSAPs on Emerging Market Economies’ local currency bond markets. Federal Reserve Bank of New York Staff Reports, 595, 1–45.

- Pesaran, M. H., Shin, Y., & Smith, R. J. (2001). Bounds testing approaches to the analysis of level relationships. Journal of Applied Econometrics, 16(3), 289–326.

- Punzi, M. T., & Chantapacdepong, P. (2017). Spillover effects of unconventional monetary policy. ADBI Working Paper, No. 630.

- Ramírez, C., & González, M. (2017). Have quantitative easing programs affected capital flows to Emerging Markets?: A regional analysis. Investigación Conjunta de Bancos Centrales de Las Américas, 155–188.

- Yoon, K., & Hurlin, C. (2014). Cross-country-heterogeneous and time-varying effects of unconventional monetary policies in AEs on portfolio inflows to EMEs. Bank of Korea Working Paper, No. 5.

Copyright information

This work is licensed under a Creative Commons Attribution-NonCommercial-NoDerivatives 4.0 International License.

About this article

Publication Date

06 October 2020

Article Doi

eBook ISBN

978-1-80296-087-7

Publisher

European Publisher

Volume

88

Print ISBN (optional)

-

Edition Number

1st Edition

Pages

1-1099

Subjects

Finance, business, innovation, entrepreneurship, sustainability, environment, green business, environmental issues

Cite this article as:

Evon, Z., Lee, H., & Joe, H. Y. (2020). FTSE WGBI, US Balance Sheet Policy And Foreign Holdings Of Malaysia Government Securities. In Z. Ahmad (Ed.), Progressing Beyond and Better: Leading Businesses for a Sustainable Future, vol 88. European Proceedings of Social and Behavioural Sciences (pp. 88-97). European Publisher. https://doi.org/10.15405/epsbs.2020.10.8