Abstract

This study examined the degree of disclosure of risk information disclosed by companies established in Malaysia. Additionally, this study sought to identify the governance attributes that influenced the practice of risk disclosure among the selected companies in Malaysia. Secondary data gathered from Bursa Malaysia for a range of 10 years (2008-2017) were analysed. Among the governance aspects studied refer to independence of board, board size, independence of auditor, and independence of audit committee (AC). In order to assess the degree of information disclosure, the content analysis approach was adopted. This study applied the descriptive statistical method and fixed effect analysis to measure the degree of information disclosure, as well as to elaborate the interrelationship between disclosure practice in Malaysia and governance attributes. A total of 167 companies were assessed to unravel the degree of information disclosure within the context of Malaysia. Agency and signalling theories were adopted in this study to elucidate the company disclosure practice.

Keywords: Bursa Malaysiacorporate governancecontent analysistotal risk disclosure

Introduction

The expeditious changes that take place in the business realm involving international activities have led many companies to rely more on corporate risk disclosure information, particularly on non-financial information ( Dobler, 2008). In an endeavour to equip users with risk information, several companies have taken the initiative by disclosing more information regarding the type of risks that lurks and future strategies ( Elzahar & Hussainey, 2012). Information disclosed is bound to assist users in estimating rather accurately the impact of current and future risks, thus enabling users to maximise their revenue through plenty of portfolios that they hold ( Abraham & Cox, 2007). Solomon et al. ( 2000) revealed an increase in demand for higher transparency from institutional investors to enhance their portfolio investments decisions. The disclosure practice from companies allows users to identify managerial issues (either threat or opportunities) and to examine the effectiveness of risk management implemented by the management in handling the arising issues ( Lajili & Zéghal, 2005).

An annual report refers to a public document that is drafted during the accounting period (Interim) or at the end of accounting period by the management of the company to obligate with mandatory requirements to ensure that the company indeed fulfils both stewardship and accountability purposes ( Habbash, 2016; Linsley & Shrives, 2006). In the past, Hopwood ( 1996) reported that companies were concerned on how they implied their image through the annual report and encouraged their managers to go the extra mile above the minimum mandatory requirement by purposely disclosing additional corporate information, primarily to enhance their reputation in the market. In the present time, meanwhile, most of the annual reports presented by companies tend to contain image and graphs, apart from narratives and the regular financial information ( Linsley & Shrives, 2006). The additional graphic content offers much information that should be noted by users, which comes in as beneficial to assess the condition of the company.

This study is composed of several sections. The first section of this study discusses the introduction and risk environment in Malaysia and followed by theoretical development. Ensuing, this study denotes the formation of hypotheses, while the third section of this study elaborates the methodology technique. Lastly, study limitations and future recommendations are presented in the final section of this study.

Risk disclosure nature and event

In conjunction with the prominent accounting detractions, as portrayed by Enron, Parmalat, and WorldCom, a significant demand is present in terms of risk information from users, especially on non-financial sections of the annual report ( Cole & Jones, 2005). Abraham and Darby ( 2008) assessed if static risk linked with the company was properly treated as a significant risk and if important events that occurred were properly noted in the annual report amidst UK companies. The study reported that the significant events occurred, regardless of national and global markets; had an impact on share price, hence the clear disclosure of information in the annual report. Thus, this study explored the nature of risks disclosed by listed companies by adhering to the risk framework prescribed by Oliveira et al. ( 2011) and measurement proposed by Abraham and Cox ( 2007) (monetary and non-monetary, forward-looking and backward-looking, beneficial, non-beneficial and neutral, and voluntary and mandatory disclosure).

Board independence

Akhtaruddin et al. ( 2009) discovered mixed empirical results regarding the effect of independent directors. Elshandidy et al. ( 2013) claimed that the proportion of independent directors on the board plays a major role in influencing company disclosure practice. Similarly, Beasley ( 1996) and Elshandidy and Neri ( 2015) found that a higher degree of external directors contributed to lower risk incidents. The number of independent members on the board can determine the degree of annual report complexity, as higher transparency is expected to derive from a board with higher number of independent directors ( Guay et al., 2016). On the contrary, Gul and Leung ( 2004) reported that the number of external directors on the board may not necessarily contribute to improve transparency due to complex board structure. This occurs when independent directors and manager do not see ‘eye to eye’, thus affecting the performance of the company ( Demb & Neubauer, 1992). As such, the following is posited:

H 1: Higher ratio of independent directors on board positively influences risk disclosure practice among listed companies in Malaysia.

Total board size

Board size has an important role to establish the directors’ ability to oversee the managers in improving transparency. The decision to disclose information is weighed in by the directors. Being the top management, the board is responsible to ensure that the company risk policy adheres to regulators requirement and managers practice ( Akhtaruddin et al., 2009). A company with more board members and higher degree of independence can lead to fewer issues, especially when related to internal controls of risk disclosure ( Ji et al., 2015). However, Anderson, Mansi, and Reeb ( 2004) and Jensen ( 1993) highlighted that due to large and complicated board structure, a company may fail to align the objectives of directors, apart from failing to utilise the board function to assist in formulating future strategy and promoting disclosure.

H 2: Larger board size is positively related to the risk disclosure practice among Malaysian listed companies.

Auditor independence

Auditors are obligated to provide truthful opinion about the company condition through issuance of credible audit report. This can be achieved only if the auditor is free from internal and external threats. Stanley and Todd DeZoort ( 2007) revealed that audit fee is a crucial indicator in determining the degree of auditor independence. An auditor may purposely participate in low-balling strategy by charging a lower price than the market average to attract more clients ( Ball et al., 2015; Sankaraguruswamy & Whisenant, 2003). This low-ball tactic may cost the auditors’ independence as this will jeopardise their audit judgment and integrity. On the contrary, Goodwin-Stewart and Kent ( 2006) stated that higher audit fee received by auditors will improve their audit quality and enhance company disclosure practices. Therefore, this study posits that auditor independence induces the transparency practice in Malaysia.

H 3: Higher auditor independence positively affects the practice of risk disclosure among Malaysian companies.

Audit committee independence

Among the audit committee (AC) objectives are to ensure that the audited annual report presented by the company complies with the regulators’ standards, while concurrently disclosing sufficient and beneficial information to the market ( Abdullah et al., 2015). Abdullah et al. (2015) suggested that in order to enhance the function of AC, especially in encouraging disclosure practice, the AC board must consist of a significant number of independent directors. The probability for a company to incur misconduct is higher when the presence of independent AC members on the AC board is lower ( Abbott et al., 2004; Beasley et al., 2000). Salehi and Shirazi ( 2016) documented a positive association of independent and expertise of AC with financial report quality. Hence, the following hypothesis is formulated:

H 4: Independent audit committee positively influences the practice of disclosure among Malaysian listed companies.

Problem Statement

Since the past two or three decades, researchers have put tremendous effort in examining risk information found in annual reports from a variety of aspects ( Linsley & Shrives, 2006). It was noted that the disclosure study trend has shifted from companies established in developed countries, such as the UK ( Elshandidy & Neri, 2015; Linsley & Lawrence, 2007) and the USA ( Kamal Hassan, 2009), to emerging markets, including Malaysia ( Azlan et al., 2009), Nigeria ( Adamu, 2013), and Egypt ( Baroma, 2014). These studies have documented the advantages of disclosing risk information to the public. Among the advantages is, through the risk information disclosed by the company, users are able to determine the company risk appetite, assess the company market value, and carefully observe the company security prices ( Beretta & Bozzolan, 2004; Abraham & Cox, 2007).

Disclosure of information enhances shareholders’ wealth maximisation through improved company performance and hindrance of potential financial failure ( Solomon et al., 2000). On the contrary, ICAEW ( 1997) highlighted that among of the main arguments provided by the company for contemplating to provide risk information is that certain details of the company are competitively sensitive and may lead to competitive disadvantages upon disclosure to contenders. A company also would want to avoid being accountable for any misleading information claimed by investors stemming from risk information disclosed ( Linsley & Shrives, 2005).

Despite the recent bloom in disclosure study, many have only focused on the special features of a company, such as company size, profitability, and company leverage ( Elshandidy, 2011; Linsley et al., 2006; Rajab & Schachler, 2009) in well-regulated risk reporting environments (Jorgensen & Kirschenheiter, 2003, 2007; Linsmeier et al., 2002). As such, this present study investigated the other determinants that may affect risk disclosure. At the best of the researcher’s concern, only a handful of studies have associated corporate governance with risk disclosure ( Elshandidy & Neri, 2015; Oliveira et al., 2011), especially in developing markets ( Ntim et al., 2013; Said Mokhtar & Mellett, 2013). Hence, it would be interesting to evaluate corporate governance that has led to accounting scandals amidst several listed companies in Malaysia (Transmile). In addition, studies that have offered implications for corporate governance and risk disclosure, especially in Malaysia, are in scarcity as prior studies mostly focused on examining company characteristics ( Azlan et al., 2009) or a mix of determinants ( Haniffa & Cooke, 2002).

Research Questions

In relation to the concerns raised in the problem statement, this study puts forward two research questions:

What is the degree of information disclosure practices by non-financial listed companies in Malaysia between 2008 and 2017?

What are the governance determinants that influence the disclosure practices by non-financial listed companies in Malaysia?

Purpose of the Study

This study offers several implications for corporate governance characteristics to company disclosure intention amongst several Malaysian registered companies. Additionally, this study explored the degree of information disclosed by the selected listed companies in Malaysia by using a risk framework developed by Oliveira et al. ( 2011) and semantic properties by Abraham and Cox ( 2007) which divides risk into several relevant categories.

Research Methods

Content analysis technique

In order to specify the degree of risk and the impact of corporate governance on disclosure practice of Malaysian companies, content analysis appears to be the best method. Content analysis is a repetitive approach based on logic interpretation and sound assumptions that derive from coding information ( Krippendorff, 2004). Mohammadi ( 2017) and Smith and Taffler ( 2000) stated that content analysis can be divided into ‘form-oriented’ and ‘meaning-oriented’. In explaining the disclosure practice in Malaysia, the ‘meaning-oriented’ technique was employed. This approach is suitable for this study as this approach could identify the potential themes based on a set of keywords that appeared in the examined sentences. In order to further assess the potential themes, the analysis included the interpretation of positive and negative words that appeared in the sentences. The method is similar to the sentences analysis performed by Azlan et al. ( 2009) and Zadeh et al. ( 2016) in their studies, in which they agreed that this method is precise, accurate, and complete ( Milne & Adler, 1999).

Selected sample size

In order to investigate the degree of risk disclosure among listed companies in Malaysia, all non-financial companies listed in Bursa Malaysia for the past 10 years (2008-2017) were included in this study. This study excluded companies listed in finance, open and close funds, as well as insurance businesses as they are categorised as heavy-regulated industries where they have their own rules and standards issued by the Malaysian Central Bank ( Abdul Aziz et al., 2006; Rahmat & Mohd Iskandar, 2004). Besides, financial and insurance companies have their own format of annual reports that differ from those published by regular non-financial companies ( Mohd Isa, 2006). A total of 940 companies had been listed in 14 industries of Bursa Malaysia for year 2017. However, this study only examined companies with full set of annual reports, which is in line with the study carried out by Zadeh et al. ( 2016). After strict screening process, only 167 companies will be analysed by using simple random sampling employed by ( Al-Arussi et al., 2009) in order to determine the level of risk information and developed the relationship between corporate governance attributes and risk disclosure practice among listed companies in Malaysia.

Measuring the dependent variable

To measure the level of risk information by the companies in Malaysia, this study employed content analysis method to analyse risk information in the respective annual report ( Abraham & Cox, 2007; Beretta & Bozzolan, 2004). To state, there are two main method in content analysis who usually adopted by the researchers, namely as manual method who adopted by ( Beretta & Bozzolan, 2004; Lajili & Zéghal, 2005; Linsley & Shrives, 2006; Said Mokhtar & Mellett, 2013) and automated method ( Elshandidy et al., 2013; Elshandidy & Neri, 2015). Previous studies researchers collectively agreed that automated method in general is far better in capturing risk information as the probability for lower error is higher.

It was stated that both methods, either manual or automated can adopt the word, sentence or line as a unit of measurement. Previous studies of Mohobbot ( 2005), Linsley and Shrives (2006) and Azlan et al. ( 2009) arguably have employed sentences analysis as the unit of measurement as they argued that sentence analysis is more vigorous. This is in agreement with a study conducted by Milne and Adler ( 1999) who found that sentences analysis is more comprehensive and robust as compared to word and line counting.

This study arguably utilised automated method of AntWordProfiler which previously employed by Elshandidy et al. ( 2013), Elshandidy and Neri ( 2015) and Allini et al. ( 2016). In addition, this study also employed sentences analysis as practice by ( Azlan et al., 2009; Linsley & Shrives, 2006) in order to measure the level of risk information among listed companies in Malaysia. Deegan and Rankin ( 1996) stated that, by employing quantitative content analysis, it allows the researcher to identify what type of risk information being disclosed by the company in Malaysia. In addition, by allowing the use of keywords as a tool in sentence analysis, it assists the researchers to conduct a comprehensive analysis due to the ability of software to make logical and robust analysis ( Gray et al., 1995; Milne & Adler, 1999).

Independent variable proxies

This subsection focussed on explaining the measurement of each of the independent variables in this study in order to examine their effect on the disclosure level of companies in Malaysia.

Board independence (BID) is determined by computing the number of independent directors on the board

Board size (BSZE) is determined by computing the number directors sitting on the board

Auditor independence (AUIND) is measured through the audit fee charged, whereby the total audit fee is divided with company total assets.

Audit committee Independence (ACIND) is measured by calculating the number of independent directors sitting on the audit committee board.

Empirical model

To test the posit hypotheses, this study employed empirical model 1 in order to determine the relationship between corporate governance attributes with the risk disclosure.

Model 1

ToRDL = ᾱ 1 + β 0 + β 1BID i,t + β 2BSZe i,t + β 3AUINDi ,t + β 4ACIND i,t + μ i + μ t + Ɛ i,t

The

Findings

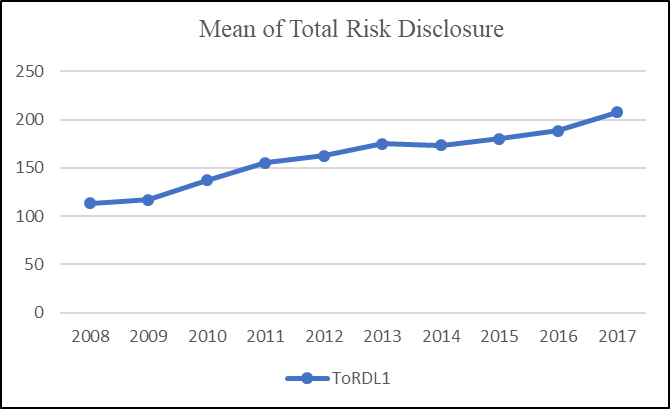

Total disclosure level for overall practices

Figure

Monetary and non-monetary disclosure

By looking on the result of monetary and non-monetary information of the company from Table

Forward-looking and backward-looking information

Based on the observation, it can be said summarise that both of the information backward-looking and forward-looking information is increasing for the last 10 years. The result indicated that, from 2008 until 2012, the amount of forward-looking information and backward-looking information is increasing steadily. However, it is to note that from 2013 until 2014, the amount of each information is diminishing. Therefore, it can be concluded that, companies in Malaysia prefer to disclose forward-looking information than backward-looking information ( 2017 (Forward looking) – 6.049, (backward looking) – 3.531) (Table

Beneficial, non-beneficial and neutral information

By referring to the result in Table

Voluntary and mandatory information

The result suggested (Table

Fixed effect analysis for model 1

To generate robust analysis, this study arguably employed fixed effect and random effect analysis to the present empirical model. However, before deciding either to apply fixed effect of random effect analysis, it is compulsory for the study to run Breusch-Pagan Lagrangian Multiplier (BP-LM) test. This is to ensure either researchers should employ random effect analysis or OLS test. Besides, it also stated that post to BP-LM test, researchers also should run Hausman test to ensure the proper analysis is being applied to the empirical model.

Based on the result of model 1, the F-statistics and Probability F-statistics (F=69.26, p-value < 0.000) indicated that, the company attributes may probably influence the total disclosure level of the company. On the other hand, the R-square score showed that 19.99 percent of this model is explaining through the attributes and disclosure level of the companies. However, it is highlighted that R-square attained is greater than previous studies of Mohammadi ( 2017).

The result of coefficient and p-value of the model 1 is presented in table

The result analysis suggested that, corporate governance attributes such as board independence, auditor independence and audit committee independence in general influence the disclosure practice of the companies in Malaysia. While, board size in different motion stated that, an increase in number of directors sitting on the board will reduce the company transparency.

Conclusion

Overall risk disclosure trend in Malaysia

The analysis of annual report for 167 companies in Malaysia found that, companies in Malaysia, in general are practicing disclosure of information to the market. As observed, it was indicated that, the highest information being disclosed by Malaysian companies in non-financial risk and followed by financial risk and risk management framework information. The result is harmonised with study the of Oliveira et al. ( 2011) who also found that most companies in Portugal preferred to disclose non-financial risk information than risk management information.

It also highlighted that the disclosure of non-beneficial information by companies in Malaysia is rather higher than beneficial and neutral information. The result however is contradicted with the one attained by Oliveira et al. ( 2011) who found that most listed companies in Portugal tend to disclose beneficial news than damaging news. Ball et al. ( 2012) in other stated that, the disclosure of damaging information from different perspectives is considered more credible than the disclosure of beneficial information. The study result is consistent with research conducted by Bamber and McMeeking ( 2010) in the UK who documented that most companies in the UK preferred to disclose non-beneficial information. To concluded, it can be argued that the higher disclosure of non-beneficial information among listed companies in Malaysia is to enhance investor confidence over the company performance.

In other ways around, the disclosure of type of measure information indicated that companies in Malaysia tend to disclose forward looking information in their report. The result in in contrast with the result attained by Oliveira et al. ( 2011) who documented that most companies in Portugal preferred to disclose past information in the report. Beretta and Bozzolan ( 2004) also recorded a similar result which argued that Canadian and Italian bank preferred to disclose past and present information in qualitative characteristics. However, in recent studies conducted by Linsley and Shrives (2006), it was found that most listed companies in the UK preferred to disclose forward looking information.

The result for the type of disclosure (voluntary and mandatory) in this study implied that, mandatory disclosure is the least favourite information disclose by listed companies in Malaysia. This suggested that, companies in Malaysia preferred to disclose voluntary information in their report. This situation can be explained due to the requirement of Bursa Malaysia through their Listing Requirement and also Securities Commisions (SC) who demanded all companies in Malaysia to abide with the guideline proposed by SRMICG (Statement on Risk Management and Internal Control: Guideline for Directors of Listed Issuers). It was stated, this guideline has influenced the companies in Malaysia to enhance their disclosure.

Board independence

The result attained on this study suggested that there is a positive and significant relationship between board independence and total risk disclosure level among listed companies in Malaysia. Therefore, H1 of this study is supported. The result suggested that company with a higher degree of external director tend to promote disclosure practice among the management. This could probably happen when external director actively performs fiduciary role, stressing the importance of higher disclosure on the annual report ( Fama & Jensen, 1983; Zadeh, 2015). In addition, the presence of independent directors arguably reduces agency cost experience by the market by encouraging information exchange. From agency theory view, the presence of an independent director who acts as a monitoring agent significantly increases the company transparency d. ue to their active monitoring activity over management behaviour ( Donnelly & Mulcahy, 2008).

Total board size

Elzahar and Hussainey ( 2012) in their study highlighted that total number of directors play a significant role in enhancing disclosure practice among companies in Malaysia. However, it is to note that the result attained in this study is contradicted with Xie et al. ( 2003) and Ntim et al. ( 2013) where researchers found that an increase in the number of director will reduce the company transparency. Therefore, H2 of this study is rejected. This study result is consistent with a study by Guest ( 2008) and Jensen ( 1993) who found that board size is not influencing the UK listed companies’ disclosure practices. Guest ( 2008) documented that listed companies in the UK preferred to have smaller board size as it is more manageable and able to fully maximise the board function. In addition, it also contends that companies with large board are often associated with poor board flexibility and decision making ( Karamanou & Vafeas, 2005).

Auditor independence

The result of analysis indicated that degree of auditor independence is affecting the company disclosure level. It is extremely important for the auditor to stay independent as it will assist in producing higher quality annual report. The result is also consistent with agency theory who argued that a higher degree of independence from the auditor will enhance the quality of information inside the annual report. As auditor independence is determined through the audit fee ( Stanley & Todd DeZoort, 2007) charged by the audit firm, it is suggested that the amount charged by the audit firm is capable to preserve their independence and consistent with the audit task workload.

Audit committee independence

The result evidence demonstrated that the presence of independent director on the audit committee board will affect risk disclosure practice. Thus, H4 of this study is supported. It was argued by Abdul Rahman and Haneem Mohamed Ali ( 2006) that the need for skillful and competent directors is not limit to the board of directors, but also applied to audit committee as their main purpose is to oversee and review company financial report. The finding also acknowledge past studies result ( Dellaportas et al., 2012; Xie et al., 2003) who found that an independent audit committee increases the ability of company financial control system. In the other study of Elshandidy et al. ( 2013), it was found that when similar individual act as external directors and audit committee member, the individual itself has a higher tendency to promote disclosure among the management of the company.

Summary of the study

The objective of this study is to examine the degree of risk disclosure based on the measurement design by Abraham and Cox ( 2007), apart from evaluating the potential corporate determinants that influenced the risk disclosure practice. Generally, this study focused on examining the narrative part of the annual report as it arguably contained most of the information ( Azlan, 2006).

Based on the result attained, it is suggested that, for the last 10 years, companies in Malaysia are experiencing positive upward trend. It also found that most of the information disclosed are non-financial risk information followed by financial risk information and risk management framework information. The level of voluntary information also found to increase in the last 10 years as compare to mandatory disclosure. The outcome of the study also suggested that most of the corporate governance is influencing the level of risk disclosure among listed companies in Malaysia. However, board size was found to have an inverse relationship with risk disclosure practice in Malaysia.

This study, in reality, comes with several limitations. First, the employed content analysis is arguably subjective, thus may affect the aspect of reliability. Second, this study only focused on non-financial companies in Malaysia, in which the outcomes may not be applied to all companies in Malaysia. Hence, future research may want to extend the samples by including all the listed companies in Malaysia, including finance and insurance institutions;

Acknowledgments

This paper is a revise version of paper who presented at the 13th Asian Academy of Management International conference from 8 th until 10 th October 2019 at Universiti Sains Malaysia, Pulau Pinang, Malaysia.

References

- Abbott, L. J., Parker, S., & Peters, G. F. (2004). Audit committee characteristics and restatements. Auditing, 23(1), 69–87.

- Abdul Aziz, N. H., Mohd Iskandar, T., & Mohd Saleh, N. (2006). Pengurusan Perolehan: Peranan Kualiti Audit Dan Urus Tadbir Korporat. International Journal of Management Studies, 13(Special Issue), 163-188.

- Abdul Rahman, R., & Haneem Mohamed Ali, F. (2006). Board, audit committee, culture and earnings management: Malaysian evidence. Managerial Auditing Journal, 21(7), 783–804.

- Abdullah, M. Abdul Syukor, Z., Mohamed, Z. M., & Ahmad, A. (2015). Risk management disclosure: A study on the effect of voluntary risk management disclosure towards firms value. Journal of Applied Accounting Research, 16(3), 400–432.

- Abdullah, W. A. W., Percy, M., & Stewart, J. (2015). Determinants of voluntary corporate governance disclosure: Evidence from Islamic banks in the Southeast Asian and the Gulf Cooperation Council regions. Journal of Contemporary Accounting and Economics. Elsevier Ltd, 11(3), 262–279.

- Abraham, S., & Cox, P. (2007). Analysing the determinants of narrative risk information in UK FTSE 100 annual reports. British Accounting Review, 39(3), 227–248.

- Abraham, S., & Darby, P. (2008). A Comparison of the Risks Disclosed by UK Companies with Observed Events: Pilot Project. In Proceedings of the British Accounting Association Conference. Dundee.

- Adamu, M. U. (2013). Risk reporting: a study of risk disclosures in the annual reports of listed companies in Nigeria, Research Journal of Finance and Accounting, 4, 140-147.

- Akhtaruddin, M., Hossain, M. A., Hossain, M., & Yao, L. (2009). Corporate governance and voluntary disclosure in corporate annual reports of Malaysian listed firms. Journal of Applied Management Accounting Research, 7(1), 1-20.

- Al-Arussi, A. S., Selamat, M. H., & Mohd Hanefah, M. (2009). Determinants of financial and environmental disclosures through the internet by Malaysian companies. Asian Review of Accounting, 17(1), 59-76.

- Allini, A., Manes Rossi, F., & Hussainey, K. (2016). The board’s role in risk disclosure: an exploratory study of Italian listed state-owned enterprises. Public Money & Management, 36(2), 113–120.

- Anderson, R. C., Mansi, S. A., & Reeb, D. M. (2004). Board characteristics, accounting report integrity, and the cost of debt. Journal of Accounting and Economics, 37(3), 315–342.

- Azlan, A. (2006). Corporate Social Reporting in Malaysia: An Institutional Perspective (Doctoral Dissertation). Universiti Malaya.

- Azlan, A., Rosli, A. M., & Hassan, C. H. M. (2009). Risk reporting : An exploratory study on risk management disclosure in Malaysian annual reports. Managerial Auditing Journal, 24(1), 39–57.

- Ball, F., Tyler, J., & Wells, P. (2015). Is audit quality impacted by auditor relationships? Journal of Contemporary Accounting & Economics, 11(2), 166-181.

- Ball, R., Jayaraman, S., & Shivakumar, L. (2012). Audited financial reporting and voluntary disclosure as complements: A test of the Confirmation Hypothesis. Journal of Accounting and Economics, 53(1–2), 136–166.

- Bamber, M., & McMeeking, K. (2010). An examination of voluntary financial instruments disclosures in excess of mandatory requirements by UK FTSE 100 non‐financial firms. Journal of Applied Accounting Research, 11(2), 133–153.

- Baroma, B. (2014). The association between the level of risk disclosure and corporation characteristics in the annual reports of Egyptian companies. American Journal of Business, Economics and Management, 2(1), 9-16.

- Beasley, M. S. (1996). An empirical analysis of the relation between the board of director composition and financial statement fraud. Accounting Review, 71(4), 443–465.

- Beasley, M. S., Carcello, J. V., Hermanson, D. R., & Lapides, P. D. (2000). Fraudulent financial reporting: Consideration of industry traits and corporate governance mechanisms. Accounting Horizons, 14(4), 441– 454.

- Beretta, S., & Bozzolan, S. (2004). A framework for the analysis of firm risk communication. International Journal of Accounting, 39(3), 265–288.

- Cole, C. J., & Jones, C. L. (2005). Management Discussion and Analysis: A Review and Implications for Future Research. Journal of Accounting Literature, 24, 135-174.

- Deegan, C., & Rankin, M. (1996). Do Australian companies report environmental news objectively? An analysis of environmental disclosures by firms prosecuted successfully by the environmental protection authority. Accounting, Auditing and Accountability Journal, 9, 50-67.

- Dellaportas, S., Leung, P., Cooper, B. J., Lary, A. M., & Taylor, D. W. (2012). Governance characteristics and role effectiveness of audit committees. Managerial Auditing Journal, 27(4), 336–354.

- Demb, A., & Neubauer, F. F. (1992). The corporate board: Confronting the paradoxes. Long range planning, 25(3), 9-20.

- Dobler, M. (2008). Incentives for risk reporting — A discretionary disclosure and cheap talk approach’, The International Journal of Accounting, 43(2), 184–206.

- Donnelly, R., & Mulcahy, M. (2008). Board structure, ownership, and voluntary disclosure in Ireland. Corporate Governance: An International Review, 16(5), 416–429.

- Elshandidy, T. M. (2011). Risk reporting incentives: a cross-country study (Master Thesis). University of Sterling.

- Elshandidy, T., & Neri, L. (2015). Corporate Governance, Risk Disclosure Practices, and Market Liquidity: Comparative Evidence from the UK and Italy. Corporate Governance: An International Review, 23(4), 331–356.

- Elshandidy, T., Fraser, I., & Hussainey, K. (2013). Aggregated, voluntary, and mandatory risk disclosure incentives: Evidence from UK FTSE all-share companies. International Review of Financial Analysis, 30, 320–333.

- Elzahar, H., & Hussainey, K. (2012). Determinants of narrative risk disclosures in UK interim reports. The Journal of Risk Finance, 13(2), 133–147.

- Fama, E. F., & Jensen, M. C. (1983). Separation of Ownership and Control Separation of Ownership and Control. Journal of law and economics, 26(2), 301–325.

- Goodwin‐Stewart, J., & Kent, P. (2006). Relation between external audit fees, audit committee characteristics and internal audit. Accounting and Finance, 46(3), 387 - 404.

- Gray, R., Kouhy, R., Laver, S., Reza, K., Lavers, S., Kouhy, R., & Lavers, S. (1995). Corporate social and environmental reporting : A review of the literature and a longitudinal study of UK disclosure. Accounting, Auditing & Accountability Journal, 8(2), 47–77.

- Guay, W., Samuels, D., & Taylor, D. (2016). Guiding through the Fog: Financial statement complexity and voluntary disclosure. Journal of Accounting and Economics, 62(2–3). 234–269.

- Guest, P. M. (2008). The determinants of board size and composition: Evidence from the UK. Journal of Corporate Finance, 14(1), 51–72.

- Gul, F. A., & Leung, S. (2004). Board leadership, outside directors’ expertise and voluntary corporate disclosures. Journal of Accounting and Public Policy, 23(5), 351–379.

- Habbash, M. (2016). Corporate governance and corporate social responsibility disclosure: evidence from Saudi Arabia. Social Responsibility Journal, 12(4), 740-754.

- Haniffa, R. M., & Cooke, T. E. (2002). Culture, corporate governance and disclosure in Malaysian corporations. Abacus, 38(3), 317–349.

- Hopwood, A. G. (1996). Introduction. Accounting, Organizations and Society, 21(2–3), 217–218.

- ICAEW (1997). Financial Reporting of Risk: Proposals for a Statement of Business Risk, Institute of Chartered Accountants in England and Wales. London.

- Jensen, M. C. (1993). The Modern Industrial Revolution , Exit , and the Failure of Internal Control Systems the Failure of Internal Control Systems. Journal of Finance, 48(3), 831–880.

- Ji, X., Lu, W., & Qu, W. (2015). Determinants and economic consequences of voluntary disclosure of internal control weaknesses in China. Journal of Contemporary Accounting and Economics, 11(1), 1–17.

- Jorgensen, B., & Kirschenheiter, M. (2003). Discretionary risk disclosure. The Accounting Review, 2(78), 449-69.

- Jorgensen, B., & Kirschenheiter, M. (2007). Voluntary disclosure of sensitivity, AAA 2009 Financial Accounting and Reporting Section (FARS). http://ssrn.com/ abstract¼1270977

- Kamal Hassan, M. (2009). UAE corporations‐specific characteristics and level of risk disclosure. Managerial Auditing Journal, 24(7), 668–687.

- Karamanou, I., & Vafeas, N. (2005). The association between corporate boards, audit committees, and management earnings forecasts: An empirical analysis. Journal of Accounting research, 43(3), 453-486.

- Krippendorff, K. (2004). Content Analysis An Introduction to Its Methodology, an introduction to its methodology.http://books.google.com/books?hl=en&lr=&id=q657o3M3C8cC&oi=fnd&pg=PA3&dq=content+analysis+and+introduction+to+its&ots=bK8kw1JfBZ&sig=oZChLqLZbPpLe_MUNDldOt4AvS8%5Cnpapers2://publication/uuid/91E0B6B2-5CD7-491A-AF76-FADCBF51BA9B

- Lajili, K., & Zéghal, D. (2005). A Content Analysis of Risk Management Disclosures in Canadian Annual Reports. Canadian Journal of Administrative Sciences / Revue Canadienne des Sciences de l'Administration, 22, 125–142.

- Linsley, P. M., & Lawrence, M. J. (2007). Risk reporting by the largest UK companies: readability and lack of obfuscation. Accounting, Auditing & Accountability Journal, 20(4), 620–627.

- Linsley, P. M., & Shrives, P. J. (2005). Examining risk reporting in UK public companies. The Journal of Risk Finance, 6(4), 292–305.

- Linsley, P. M., & Shrives, P. J. (2006). Risk reporting: A study of risk disclosures in the annual reports of UK companies. British Accounting Review, 38(4), 387–404.

- Linsley, P. M., Shrives, P. J., & Crumpton, M. (2006). Risk disclosure: An exploratory study of UK and Canadian banks’, Journal of Banking Regulation, 7(3–4), 268–282.

- Linsmeier, T., Thornton, D., Venkatachalam, M., & Welker, M. (2002). The effect of mandated market risk disclosure on trading volume sensitivity to interest rate, exchange rate, and commodity price movements. The Accounting Review, 77(2), 343-77.

- Milda, S. (2012). Effect of IFRS adoption and audit firms’s governance on audit report lag (Master Thesis). Universiti Teknologi Mara.

- Milne, M. J., & Adler, R. W. (1999). Exploring the reliability of social and environmental disclosures content analysis. Accounting, Auditing & Accountability Journal, 12(2), 237–256.

- Mohammadi, M. A. D. (2017). Corporate Governance and Financial Information Disclosure in a Developing Country (Doctoral Dissertation). Universiti Teknologi Malaysia.

- Mohd Isa, R. (2006). Graphical Information in Corporate Annual Report: A Survey of Users and Prepares Perceptions. Journal of Financial Reporting & Accounting, 4(1), 39-60.

- Mohobbot, A. M. (2005). Corporate risk reporting practices in annuals reports of japanese companies. International Journal of Accounting Auditing and Performance Evaluation, 4(3), 263-285.

- Ntim, C. G., Lindop, S., & Thomas, D. A. (2013). Corporate governance and risk reporting in South Africa: A study of corporate risk disclosures in the pre- and post-2007/2008 global financial crisis periods. International Review of Financial Analysis, 30, 363–383.

- Oliveira, J., Rodrigues, L. L., & Russell, C. (2011). Risk-related Disclosures by Non-finance Companies : Portuguese Practices and Discloser Characteristics, Managerial Auditing Journal, 26(9), 817–839.

- Rahmat, M. M., & Mohd Iskandar, T. (2004). Audit fee premiums from brand name, industry specialization and industry leadership: A study of the post Big 6 merger in Malaysia. Asian Review of Accounting, 12(2), 1-24.

- Rajab, B., & Schachler, M. H. (2009). Corporate risk disclosure by UK firms: trends and determinants. World Review of Entrepreneurship, Management and Sustainable Development, 5(3), 224.

- Said Mokhtar, E., & Mellett, H. (2013). Competition, corporate governance, ownership structure and risk reporting’, Managerial Auditing Journal, 28(9), 838–865.

- Saleem, F. (2018). Earning Management and Corporate Governance Attributes among Non-Financial Listed Firms in Pakistan (Doctoral Dissertation). Universiti Teknologi Malaysia.

- Salehi, M., & Shirazi, M. (2016). Audit committee impact on the quality of financial reporting and disclosure: Evidence from the Tehran stock exchange. Management Research Review, 39(12), 1–22.

- Sankaraguruswamy, S., & Whisenant, S. (2003). Pricing Initial Audit Engagements: Empirical Evidence Following Public Disclosure of Audit Fees. SSRN Electronic Journal.

- Smith, M., & Taffler, R. J. (2000). The chairman’s statement ‐ A content analysis of discretionary narrative disclosures. Accounting, Auditing & Accountability Journal, 13(5), 624–647.

- Solomon, J. F. Solomon, A., Norton, S. D., & Joseph, N. L. (2000). A Conceptual Framework for Corporate Risk Disclosure Emerging From the Agenda for Corporate Governance Reform. British Accounting Review, 32, 447–478.

- Stanley, J. D., & Todd DeZoort, F. (2007). Audit firm tenure and financial restatements: An analysis of industry specialization and fee effects. Journal of Accounting and Public Policy, 26(2), 131–159.

- Xie, B., Davidson, W. N., & DaDalt, P. J. (2003). Earnings management and corporate governance: the role of the board and the audit committee. Journal of Corporate Finance, 9(3), 295–316.

- Zadeh, F. O. (2015). Corporate governance, risk disclosure and cost of equity capital in the malaysian public listed firm (Doctoral Dissertation). Universiti Teknologi Malaysia.

- Zadeh, F., O., Rasid, S. Z. A., Basiruddin, R., Zamil, N. A. M., & Vakilbashi, A. (2016). Risk Disclosure Practices among Malaysian Listed Firms’. International Journal of Economics and Financial Issues, 6(3), 1092-1096.

Copyright information

This work is licensed under a Creative Commons Attribution-NonCommercial-NoDerivatives 4.0 International License.

About this article

Publication Date

06 October 2020

Article Doi

eBook ISBN

978-1-80296-087-7

Publisher

European Publisher

Volume

88

Print ISBN (optional)

-

Edition Number

1st Edition

Pages

1-1099

Subjects

Finance, business, innovation, entrepreneurship, sustainability, environment, green business, environmental issues

Cite this article as:

Kiflee, A. K. R. B., & Ali Khan, M. N. A. B. (2020). Risk Disclosure And Corporate Governance Characteristics. In Z. Ahmad (Ed.), Progressing Beyond and Better: Leading Businesses for a Sustainable Future, vol 88. European Proceedings of Social and Behavioural Sciences (pp. 1-15). European Publisher. https://doi.org/10.15405/epsbs.2020.10.1