Abstract

The continuity of activity of any banking institution is the most important principle of its functioning. It implies that it will continue its activities in the nearest future, and it has no intentions and need to liquidate or significantly reduce its activity. The main criterion for ensuring the continuity of bank activity is to maintain its financial stability. The relevance of the research topic is reasoned by the absence of complete and unambiguous definition has not yet been presented in the literature, despite the fact that this term is often used in scientific works and official documents regulating the activities of commercial banks. The more stable the state of a bank will be, the less it will depend on changes in the external environment and crises that occur in Russia quite often. The article gives an integrated assessment of the financial condition of a credit institution using the Fishburn technique. Profitability, liquidity and reliability indicators are calculated; as well as integral coefficients. The results of ranking the coefficients and their weight values are determined. Therefore, in order to assess the financial stability of a bank, a lot of absolute and relative indicators were used that characterize the degree of coverage of stocks with own and equivalent working capital, the ratio of borrowed and own funds, the ratio of receivables and payables, the balance sheet liquidity and solvency of a bank.

Keywords: Bankassessmentstabilitymethodanalysiscoefficient

Introduction

Recently, the crisis in the Russian economy and the tightening of the supervisory policy of the Central Bank of the Russian Federation has attracted more attention to the problem of financial stability of commercial banks.

Ensuring financial stability of both individual banks in particular and the banking system of Russia as a whole is one of the fundamental tasks of the Bank of Russia and state authorities; The financial system of Russia needs a unified development strategy. It also needs a centralized system for the assessment of key indicators of the financial condition of credit institutions, transparent and determinate methods for the analysis of the financial stability of commercial banks, as well as openness and accessibility for end users (individuals and legal entities – bank customers) of information on activities and financial state of banks. The financial stability of a commercial bank is one of the main qualitative characteristics of its financial condition ( Bisultanova, 2015).

Problem Statement

The analysis of financial stability and liquidity of a number of banks, the consequences of the global economic crisis and many other factors makes the problem of the improvement of assessing financial stability particular important.

Research Questions

The subject of the study is to assess the financial stability of a commercial organization by calculating profitability and liquidity ratios.

Purpose of the Study

The purpose of the study is to analyze the financial stability of a banking institution and develop ways to increase it using a specific example.

Research Methods

The recommendation to use the “expert” assessment method ( Bisultanova, Zemlyakova, Razzhivin, Udovik, & Adamenko, 2018), which consists in the determination of the most and least priority indicators of companies, is due to the lack of a developed mechanism for differentiating indicators based on scientific justification.

Under the conditions of the absence of a specific quantitative assessment of the significance of indicators, it makes sense to use the tools used in other scientific studies. One of which is the ranking of criteria according to the Fishburn rule ( Klaas, 2012a; Kretova, 2014).

The main provisions state that the only known information about the ratio of the significance of indicators is the following expression:

ri > ri+1 > ri+2, where ri –the significance of each criterion or the degree of its manifestation.

This provision allows identifying the sequence of relations of the considered indicators in relation to each other. The quantitative characteristic of the i th criterion is determined by the following formula ( Kolmakov et al., 2018):

where i – coefficient rank or serial number after ranking;

ri – specific weight of the i th coefficient;

N – total number of ranks.

A necessary condition for rationing specific weight is as follows ( Gogol & Anikina, 2012):

Findings

In order to develop the methods for integrated assessment of the state of companies, three groups of indicators are proposed for consideration. This system, on the one hand, answers the question of what is the current financial potential, on the other hand, it includes the most significant financial indicators of the state, which together allows the comprehensiveness and completeness of the assessment of the financial condition at a certain point in time.

For the integrated assessment of the financial condition of a bank, we made calculations of profitability, liquidity and reliability. Each rating of indicators was assigned a rank, in accordance with the significance level of the coefficients in the final integrated assessment for this type of enterprise. Each rank was assigned a specific weight in accordance with the Fishburn methodology.

Applying the relation (1) using the identified indicators as an example, the results of ranking the coefficients and their weight values are determined and presented in Table

According to the financial reports of Sberbank, profitability and liquidity ratios were calculated, where C1 is instant liquidity, C2 is current liquidity, C3 is the ratio of highly liquid assets to all assets, as well as reliability indicators. Each coefficient was assigned a rank and, accordingly, a specific weight according to the Fishburn method. As a result of the calculations, a positive change in the dynamics showed only the integrated profitability ratio. The remaining ratios decreased over the reporting period. The overall coefficient, calculated as the sum of three integral indicators of profitability, liquidity and reliability, respectively, showed a decrease (Table

According to Alfa-Bank, as well as according to other banks, the integral coefficients were calculated. The dynamics of changes in the bank indicators turned out to be the same as that of Sberbank. The integral indicator of the assessment of the financial stability of the bank decreased over two years (Table

As a result of the calculation of the integral indicators of VTB, the reverse situation was revealed. All indicators showed growth for the investigated period. The integral coefficient of financial stability of VTB increased by 27.35 % from 0.457 to 0.582 (Table

According to the results of the calculations of Tinkoff Bank a similar dynamics was revealed. The integral coefficient of financial stability of Tinkoff Bank increased by 7.55% from 0.768 to 0.826. All calculated data on banks were presented in Table

As a result of the calculations, the values of the integral indicator were determined taking into account the weights according to the Fishburn method. In order to display graphically the assessment of the financial condition of a company, a Cartesian coordinate system was selected. On the abscissa axis, the data obtained by integral assessment was determined; on the ordinate axis – an estimate obtained without taking into account weights (Table

In order to create a model, the values are calculated according to the groups of indicators without taking into account the relative ratio according to the Fishburn method.

Conclusion

In order to determine the areas characterizing the financial condition, it is necessary to assess the standard values ( Magomadova, Khominich, Savvina, Asyaeva, & Chelukhina, 2019) taking into account the relative ratio and without considering it (Table

The ratios of coefficients were assigned in accordance with the instruction of the Bank of Russia dated 03.12.2012 No. 139-I “On Mandatory Ratios of Banks”.

In the future, these indicators are used to determine the zone of optimality of the financial stability of a bank. The boundaries are set straight, perpendicular to the ordinate axis. The profitability indicator coincides with the Oy axis, since it is enough for a bank to make a profit (Table

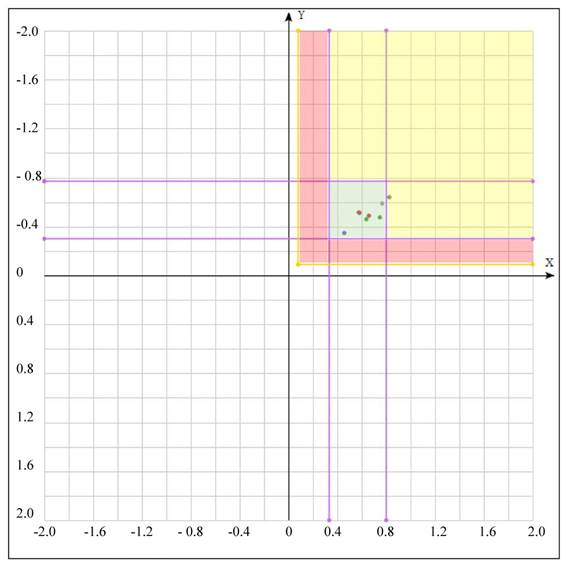

These values were also used in order to determine the optimality zone. Horizontal boundaries were drawn parallel to the abscissa axis according to the values. Thus, the optimal zone of liquidity is limited by y = 0.3 and y = 0.77, reliability is by y = 0.09 and higher, the direct margin of profitability coincides with the axis Ox.

The intersection of direct liquidity formed the optimal liquidity zone characteristic of a banking sector ( Klaas, 2012b; Rats, 2013). The optimal reliability zone is to the right and above the point (0.079; 0.09). The zone of optimal profitability coincides with the first plane of the coordinate system, since the rate of return should be more than zero.

Thus, the study of the financial stability of financial and credit institutions made it possible to determine the optimal zone within which the activities of this kind of institutions meet all the standards of control bodies. The following four coordinates limit the optimal zone: x = 0.334; x = 0.801; y = 0.3; y = 0.77 (Figure

In the framework of the formation of zones of financial stability, a red zone has been defined, which is unacceptable for financial and credit institutions. If financial institutions enter this zone, they risk losing their license to conduct financial activities. The yellow zone is not recommended. Financial and credit institutions falling into it are characterized by irrational management.

The proposed methodology will be useful for commercial enterprises in terms of attracting additional financing. The evaluation using this technique will give a clear idea of the effectiveness of financial and credit institutions, the image and quality of management. This methodology will allow commercial banks controlling their activities taking into account existing restrictions by the central bank and correcting them in a timely manner.

References

- Bisultanova, A. A. (2015). The Russian banking system in the face of continued sanctions. Econ., Entrepreneurship and Law, 4, 209.

- Bisultanova, A. A., Zemlyakova, N. S., Razzhivin, O. A., Udovik, E. E., & Adamenko, A. A. (2018). Modern trends in corporate finance management. Espacios, 31, 467.

- Gogol, D. A., & Anikina, I. D. (2012). Financial stability of a commercial bank: new approaches to valuation. Sci. Bull. of the Volgograd Acad. of Public Administrat. Ser. Econ., 1, 73.

- Klaas, J. A. (2012a). An indicative model for assessing the financial stability of a credit institution and identifying the factors that determine it. Kazan Econ. Bull., 1(1), 68.

- Klaas, J. A. (2012b). Modern approaches to assessing the financial stability of a credit institution. Banking, 8, 64.

- Kolmakov, V., Ekimova, K., Ordov, K., Aliev, A., & Tchuykova, N. (2018). Monetary policy influence on companies' competitiveness through credit channel. Europ. Res. Studies J., 4, 623.

- Kretova, N. A. (2014). Using the method of expert assessments in constructing an integrated measure of the stability of a commercial bank. News of Southwestern State Univer. Ser. Econ. Sociol. Managem, 1, 260.

- Magomadova, M. M., Khominich, I. P., Savvina, O. V., Asyaeva, E. A., & Chelukhina, N. F. (2019). Russian banking system in economic and social development of the country. Proc. the Europ. of Soc. & Behavioral Sci. EpSBS Conf. SCTCGM 2018 – Social and Cultural Transformations in the Context of Modern Globalism (рр. 1000–1006). Great Britain: Publ. by the Future Acad.

- Rats, O. M. (2013). Integral assessment of efficiency of anti-crisis bank management. Issues in Econ., 4, 367.

Copyright information

This work is licensed under a Creative Commons Attribution-NonCommercial-NoDerivatives 4.0 International License.

About this article

Publication Date

31 October 2020

Article Doi

eBook ISBN

978-1-80296-091-4

Publisher

European Publisher

Volume

92

Print ISBN (optional)

-

Edition Number

1st Edition

Pages

1-3929

Subjects

Sociolinguistics, linguistics, semantics, discourse analysis, translation, interpretation

Cite this article as:

Dzhamalovna, U. F., Oglu, A. A. A., Sergeevich, G. M., & Masrur, K. (2020). Integral Assessment Of Financial Stability Of Banks. In D. K. Bataev (Ed.), Social and Cultural Transformations in the Context of Modern Globalism» Dedicated to the 80th Anniversary of Turkayev Hassan Vakhitovich, vol 92. European Proceedings of Social and Behavioural Sciences (pp. 2569-2576). European Publisher. https://doi.org/10.15405/epsbs.2020.10.05.340